UNIT II

Final Accounts

Preface

Accounting is intended to confirm and present the results of the business during the accounting period. To see regular performance, the nature of the transaction needs to be analyzed whether they are the nature of capital or the nature of earnings. Revenue and expense are related to the operation of the business during the accounting period, or the income or expense items earned during that period, and the profits do not extend beyond that period. Capital investment, on the other hand, produces lasting profits and helps generate revenue over multiple accounting periods. Revenue costs must be associated with the physical activity of the entity. Therefore, while production and sales generate revenue in the revenue process, the use of goods and services that support these features is costly. Expenses are recognized in the income statement through a matching principal that informs you when and how much the expense will be charged to your revenue. Part of the expenditure can only be capitalized if the definable flow of future benefits can be traced directly.

The distinction between revenue and equity of a transaction is made for the purpose of placing them in the income statement or balance sheet. Example: Revenue and expenditure appear in the income statement because the profit is for one accounting period. That is, capital expenditures are placed on the asset side of the balance sheet because profits are generated over multiple accounting periods. It is a period and is transferred to the income statement for that year based on the use of that profit in a particular fiscal year. Therefore, both capital expenditures and revenue expenditures are ultimately transferred to the P & L account.

Income and expenditure are transferred to the profit and loss account of the year of expenditure, and capital expenditure is transferred to the profit and loss account of the year in which the profit is used. Therefore, we can conclude that the main determinant for transferring expenses to the income statement is the time factor. Expenses are also recognized in the income statement through a matching concept that indicates when and how much expense is charged against revenue. However, the distinction between capital and income creates considerable difficulty. Often the border between the two is very thin.

Things to consider when checking Capital and Revenue Expenditure

Here are some basic considerations when distinguishing between capital and revenue expenditures:

(A) Nature of business: For furniture traders, the purchase of furniture is a revenue expense, but in other transactions, the purchase of furniture is treated as a capital expense and appears on the balance sheet as an asset. Therefore, the nature of the business is a very important criterion in separating spending between capital and income.

(B) Repetitive nature of spending: If the frequency of spending is very frequent in a fiscal year, it is said to be spending of the nature of income, but non-recurring spending is inherently rare and It does not occur frequently in the fiscal year. Monthly salaries and rents are examples of monthly income and expenditures, but asset purchases are not regular transactions and are classified as capital expenditures unless defined as income and expenditures by materiality criteria.

(C) Purpose of costs: Machine repair costs may be incurred during the normal maintenance process of the asset. Such costs are essentially income. On the other hand, the expenditure incurred to repair assets on a large scale to increase capacity is essentially capital. However, in contrast to the costs that need to be capitalized, determining the costs of maintenance and regular repairs that need to be costly is not always easy.

(D) Impact on the revenue-generating capacity of the business: Revenues / costs that help generate revenues for the period are essentially revenues and must be matched to revenues for the period. On the other hand, when spending helps generate revenue over multiple accounting periods, it is commonly referred to as capital spending.

If expenses are made to improve and repair fixed assets and the expected future profits from fixed assets do not change, the income statement must be charged, and if expected, the book value of fixed assets. Included in. Future profits from the asset will increase.

(E) Importance of the amount involved: The relative proportion of the amount involved is another important consideration in distinguishing between income and equity.

Capital and Revenue Expenditures

Definition and Description of Capital Expenditures:

If the profit of the expenditure spans several trading years, the expenditure is capital expenditure. Capital expenditures may include the following expenditures:

- Expenditures required to acquire fixed assets (tangible or intangible) related to the business for the purpose of profit, not resale of land and buildings, plants and machines, furniture and fixtures, goodwill, patents and copyrights, etc.

- Fixed asset costs include all expenses required before the asset becomes available. For example, the cost of every building you purchase includes the price paid to the seller, legal costs, and broker fees. Similarly, machine costs include purchase prices, freight charges, import taxes, wagons, octroi taxes, construction and installation costs.

- Expenditures to increase the profitability of a business. For example, the expenses incurred to move a business beyond a specific area and the goodwill (the right to use the established name of the originating company) to attract customers of the old company and increase sales and profits. Money.

- Money spent converting, for example, from manual machines to powered machines, to extend the life of existing assets or reduce production costs.

- The cost of expanding and adding existing fixed assets. For example, the cost of adding to buildings, furniture, machinery, cars, etc.

- All expenses incurred to raise capital for a business, such as commissions and intermediaries paid to agents to arrange long-term loans, discounts on the issuance of stocks and bonds.

- Capital investment appears as an asset on the balance sheet.

Example of Capital Investment

The most important items of Capital Investment are as follows:

- Purchase of factories and buildings.

- Purchase of machinery, furniture, automobiles, office equipment, etc.

- Goodwill, trademarks, patents, copyrights, patterns, design costs.

- Costs for installing plants and machinery and other office equipment.

- Add or extend existing fixed assets.

- Structural improvements or changes that improve the life or profitability of fixed assets.

- Reserve fund of limited company.

- Issuance costs for stocks and corporate bonds.

- Legal costs for loans and mortgages.

- Interest on capital during the construction period.

- Development costs for mines and plantations.

Revenue expenditure

Definition and Description of Income and Expenditure:

Expenditure items for which benefits expire within the year are revenue expenditures. Income and expenditure do not increase the efficiency of the company.

Expenditures incurred for the following purposes are treated as revenue expenditures.

- Liquid assets, that is, expenses incurred for resale assets such as commodities, raw materials, and store costs required for the manufacturing process.

- All establishment and other day-to-day expenses related to the implementation and management of the business, including salaries, rent, taxes, postage, stationery, bank charges, insurance and advertising costs.

- Expenditures incurred to keep fixed assets in good working condition, such as repairing, replacing, or renewing buildings, furniture, machinery, etc.

Examples Of Revenue Expenditure

The following are important items of Revenue Expenditure.

- Rent, salary, wages, manufacturing costs, shipping costs, fees, statutory costs, insurance and advertising, free samples, salaries, shipping costs, and all other costs incurred in normal operations.

- The costs incurred by repairs, renewals, and replacements to keep the business's existing fixed assets healthy.

- The cost of the item purchased for resale.

- Raw materials purchased during the manufacturing process and store costs.

- Wages paid to manufacture products for sale.

- Depreciation of assets used in the business.

- Interest on a loan borrowed for a business.

- Fares and carts paid for purchased items.

- The cost of oil to lubricate the machine.

- Service to the vehicle.

- Expenditures of all kinds incurred to defend proceedings in the sale of goods.

As mentioned earlier, capital investment contributes to the profitability of a business over multiple accounting periods, but revenue costs are incurred to generate revenue for a particular accounting period. Revenue costs are directly related to revenue or are related to accounting periods such as cost of goods sold, salary, and rent. Cost of goods sold is directly related to revenue, while rent is related to a particular accounting period. Therefore, the profits from capital expenditures last for multiple accounting periods, while the profits from revenues and expenses expire in the same accounting period.

Comparison Chart

Basis for comparison | Capital expenditure | Revenue expenditure |

Meaning | The expenditure incurred in acquiring a capital asset or improving the capacity of an existing one, resulting in the extension in its life years. | Expenses incurred in regulating day to day activities of the business. |

Term | Long Term | Short Term |

Capitalization | Yes | No |

Shown in | Income Statement & Balance Sheet | Income Statement |

Outlay | Non-recurring | Recurring |

Benefit | More than one year | Only in current accounting year |

Earning capacity | Seeks to improve earning capacity | Maintain earning capacity |

Matching concept | Not matched with capital receipts | Matched with revenue receipts |

The Main Differences between Capital Spending and Revenue Spending

- Capital investment will generate future economic benefits, but revenue expenditures will only generate profits this year.

- The main difference between the two is that the capital investment is a one-time investment. On the contrary, revenue spending is frequent.

- Capital expenditures appear on the balance sheet, on the asset side, and on the income statement (depreciation), but revenue expenditures only appear on the income statement.

- Capitalized expenditures are capitalized as opposed to uncapitalized revenue expenditures.

- Capital investment is a long-term expenditure. Revenue spending, on the other hand, is short-term spending.

- Capital spending seeks to improve a company's earning power. On the contrary, revenue spending is aimed at maintaining the profitability of the company.

- Capital expenditure does not match capital income. It is different from income expenditure that matches income.

Illustration 1

Please state whether the following statement is "true" or "false" with a reason.

(1) The overhaul cost of the used machine purchased is income expenditure.

(2) The money spent to reduce labor costs is revenue expenditure.

(3) The statutory cost for acquiring real estate is capital expenditure.

(4) The amount spent as attorney's fees to defend a lawsuit alleging that the company's factory premises belong to the plaintiff's land is capital expenditure.

(5) The amount spent on replacing worn parts of the machine is capital expenditure.

(6) The cost of repairing or whitening for the first time when purchasing an old building is income.

(7) The costs associated with obtaining a license to operate a movie theatre are capital expenditures.

(8) The amount of money needed to build the Cinema House and spent on the construction of the temporary hut that was demolished when the Cinema House was ready is capital expenditure.

Solution:

(1) Incorrect: Overhaul costs are incurred in order to bring used machines into operation and generate lasting long-term profits. Therefore, it must be capitalized.

(2) Wrong: The money spent to reduce revenue spending may be reasonably presumed to have brought long-term profits to the enterprise. If it is in the form of technical know-how, it will be part of the property, plant and equipment, and if it is in the form of an additional exchange of any of the existing property, plant and equipment, it will be part of the property, plant and equipment. So this is a capital investment.

(3) Correct: The legal costs paid to acquire an asset are part of the cost of that asset. Ownership of property and thus capital expenditures occur.

(4) Error: The legal cost incurred to defend a lawsuit alleging that the company's factory premises belong to the plaintiff is the maintenance cost of the asset. This cost does not give you a lasting benefit in the future, in addition to what is currently available, and does not increase the capacity of your assets. Maintenance costs associated with assets are income expenditures.

(5) Error: The amount of money spent on replacing worn parts of the machine is a profit cost because it is part of the maintenance cost.

(6) Wrong: For the first time, the cost of repairing and whitening the old building will be incurred to make the old building usable. These are part of the build cost. Therefore, these are capital investments.

(7) Correct: Cinema Hall could not be started without a license. The cost incurred to obtain a license is capitalized preoperative costs. Such costs are amortized over a period of time.

(8) True: The construction cost of the temporary hut required for the construction of the movie theatre is a part of the construction cost of the movie theater. Therefore, such costs are capitalized.

Illustration 2

Please state whether the following is capital expenditure or revenue expenditure, along with the reason.

(1) Costs incurred in connection with the acquisition of a license to start the Rs factory. 10,000.

(2) Rs. 1,000 was paid for the removal of inventory to the new site.

(3) The engine ring and piston were replaced at the cost of Rs. 5,000 to improve fuel economy.

(4) Money paid to Mahan agar Telephone Nigam Ltd. (MTNL) Rs. 8,000 for installing a phone in the office.

(5) The factory hut was built at the cost of Rs. 1,00,000. Total of Rs. 5,000 people were involved in the construction of a temporary hut to store building materials.

Solution:

(1) Rupees paid. 10,000 to get a license to set up a factory is capital expenditure. This is an expense item incurred to acquire the right to continue business.

(2) Rs. The 1,000 paid for removing inventory to a new site is revenue expenditure. It does not bring lasting benefits or increase the value of the asset.

(3) Rs. The 5,000 spent to replace engine rings and pistons for fuel efficiency is a capital investment. This is an expense to improve fixed assets. As a result, cost savings improve the profitability of your business.

(4) Money deposited in MTNL for installation Office phone is not an expense. It is treated as an asset and is adjusted over a period of time to the actual telephone charges.

(5) Building construction costs, including temporary hut costs, are capital expenditures. Buildings are fixed assets that bring lasting benefits to your business over multiple accounting periods. The construction of the temporary hut is incidental to this construction. Such costs are also included in construction costs.

Key takeaways:

- Capital expenditures (CapEx) are payments for goods or services recorded or capitalized on the record, instead of being spent on the earnings report.

- Capital investment is vital for companies to take care of their existing assets and equipment and invest in new technologies and other assets for growth.

- If an item features a useful lifetime of but one year, you ought to calculate the value within the earnings report rather than capitalizing it (that is, it's not considered a capital investment).

- Sales, often mentioned as sales, are the income generated from normal business operations and other business activities.

- Operating income is income from normal business operations, like the sale of products and services.

- Non-operating income is rare or non-recurring income from secondary sources of income (such as proceedings in proceedings).

- Capital investment (CAPEX) is that the funds that a corporation uses to accumulate, upgrade, and maintain physical assets like equipment.

- Capital investment is typically a one-time, large-scale purchase of fixed assets won’t to generate long-term revenue.

- Income and expenditure are continuous operating expenses, short-term expenses used for daily business operations.

- Cost of goods sold is directly related to revenue, while rent is related to a particular accounting period.

Receipts: Capital, Revenue

What is a Capital Receipt?

A capital receipt is a receipt that creates a liability or reduces an asset. As mentioned above, receipts for capital are inherently non-recurring. And this kind of receipt is not sometimes received either.

From the above definition, it is clear that a receipt can be called a capital receipt if it complies with at least one of the following conditions:

It must create responsibility. For example, when a company gets a loan from a bank or financial institution, it incurs debt. That's why it's essentially a receipt for capital. However, if one company receives a fee for using the expertise to manufacture a special kind of product for another company, it is not liable and is not called a capital receipt.

It needs to reduce the company's assets. For example, if a company sells its stock to the public, it can help reduce assets and generate more money in the future. In other words, it should be treated as a receipt for capital.

Receiving capital and receiving income are both very important elements of accounting. It is important to distinguish between the two correctly. The classification of these transactions is reflected in the company's final report. Learn more about them.

Receipt of Capital Receipts

A capital receipt is a receipt for a business that has nothing to do with the company's day-to-day business activities. They occur occasionally and benefit over the long term.

Types of Capital

Receipts of Capital can be divided into three types:

- Borrow money

When a company receives a loan from a bank or financial institution, it is called a loan. Borrowing funds from a financial institution is one of three forms of receiving capital.

2. Loan collection

In many cases, a company needs to secure a portion of its assets in order to recover the loan, which reduces the value of the assets. This is the second type of capital income.

3. Receipt of Other Capital

There is a third type of receipt called "Other Capital Receipts". Below this, we include investment cuts and small savings. Withdrawal from investment means selling part of the business. Stopping an investment is called receiving capital because it has reduced the company's assets. Small savings are called capital receipts because they bring debt to the business.

Receiving capital usually appears on the company's balance sheet at realization and usually occurs as a result of the following events:

- Sale of fixed assets.

- Issuance of capital in the form of shares.

- Issuance of debt certificates.

Suppose the QRS complex's annual shareholders meeting approves the issuance of rights shares at a rate of $ 8 per share. QRS allocated shares proportionally to all existing members of the company and received cash in return. The cash received by QRS was a receipt for capital. The company debited from the bank account and credited the stock account to the books.

Other common examples of receiving capital

- Cash received from the sale of fixed assets.

- The amount of loan the company received from the bank.

- Capital invested in the business by a new partner.

- The consideration received by a company by selling a license to manufacture a well-sold drug to another company.

What is a Receipt for Income?

Income receipts are receipts that do not reduce a company's assets or generate liabilities. They are essentially always repetitive and are acquired in the normal course of business.

By definition, it is clear that any type of receipt must meet two conditions called income receipts –

First, don't reduce your company's assets.

Second, it must not cause any liability to the company.

Income Receipt

Revenue receipts are receipts that occur on a regular basis. They are realized by the day-to-day business activities of companies and are needed for every company to survive and strive. Receipts of revenue are usually received through the sale of shares and the provision of services to customers in the normal course of business. The effect of income is usually only visible on the company's income statement.

Suppose the CDE Company manufactures baby diapers and sells them in bulk to wholesalers and retailers. CDE charges the customer when they receive the item and maintains an average collection period of 30 days. CDE records sales / revenue when a customer receives an item. The sales revenue received by the CDE company is a receipt for the revenue.

General Example of Income

- Revenue received from selling goods to customers.

- Revenue from providing services to clients.

- Income received as interest on a savings account.

- Dividend income received from stocks of various companies.

- Rental income received by the company.

- Bad debts collected by the company.

- Cash discount received from the vendor.

- Commission income received by the company.

Summary and Conclusions

The receipt of capital is the influx of economic resources into the company and is essentially non-recurring. Those effects are only communicated to the company's balance sheet

Receiving income is an influx of economic resources into the company and is essentially repetitive. They are essential to keep the company running. Their effects are only shown in the company's income statement.

Do not confuse a receipt for capital with a receipt for income. It can lead to classification errors and incorrect financial summary reports.

Income Characteristics

Income receipts appear to be the opposite of capital receipts, so look at the various features of income receipts so that you can understand the meaning of income receipts and compare them to the characteristics of capital receipts. That makes perfect sense.

Let's see:

Means to Survive: Companies start their businesses because they expect to receive money as a result of servicing their customers. They can sell a lot of products or provide services. No matter what they do, without a receipt for income, they cannot survive long because the receipt for income is collected from the direct operation of the business.

Short-term application: Income receipts are money received in a short period of time. The benefits of receiving revenue can only be enjoyed for one fiscal year and no more.

Periodic: Revenue receipts need to be regular, as revenue receipts bring profits in a short period of time. If the revenue receipt is not repeated, the business It can't last long.

Affect Profit / Loss: Receiving revenue has a direct impact on your business's profit / loss. When you receive revenue, you either increase your profits or decrease your losses.

Small Volume: The number of income receipts is usually small compared to capital receipts. That doesn't mean that all income is low. For example, if a company sells his one million products in a particular year, the income can be huge, more than the annual capital income.

Capital Receipts Vs. Revenue Receipts (Comparison Table)

Basis for Comparison – Capital Receipts vs. Revenue Receipts | Capital Receipts | Revenue Receipts |

1. Inherent meaning | Capital Receipts are receipts that don’t affect the profit or loss of business. | Revenue Receipts are receipts that affect the profit or loss of business. |

2. Source | Capital Receipts stem from non-operational sources. | Revenue Receipts stem from operational sources. |

3. Nature | Capital Receipts are non-recurring. | Revenue Receipts are recurring in nature. |

4. Reserve funds | Capital Receipts can’t be saved for creating reserve funds. | Revenue Receipts can be saved for creating reserve funds. |

5. Distribution | Not available for distribution of profits. | Available for distribution of profits. |

6. Loans – Capital Receipts vs. Revenue Receipts | Capital Receipts can be loans raised from banks/financial institutions. | Revenue Receipts are not loans, but the amount received from operations. |

7. Found in | Balance Sheet. | Income Statement. |

8. Example – Capital Receipts vs. Revenue Receipts | Sales of fixed assets. | Sale of products of the business; |

Capital Receipts and Revenue Receipts-Main Differences

There are many differences between receipts of capital and receipts of income. Let's take a look at the most famous ones –

- Receiving capital is inherently non-recurring. Income receipts, on the other hand, are inherently repetitive.

- Without a receipt for capital, the business can survive, but without a receipt for income, the business cannot last.

- Receipts of capital cannot be used as a profit share. Income receipts can be distributed after deducting the costs incurred to earn income.

- Receipts of capital can be found on the balance sheet. The receipt of income can be found on the income statement.

- Receiving capital reduces the company's assets or creates company responsibility. Income receipts are the opposite. They do not hold the company accountable or reduce the company's assets.

- Receipts of capital are atypical. Income receipts are routine.

- Capital receipts are sources from non-operational sources. Income receipts, on the other hand, come from operational sources.

Conclusion

A receipt for capital and a receipt for income are the opposite, even if they are both receipts.

Investors need to understand the difference between receiving capital and receiving income so that they can carefully determine when a transaction will occur.

Understanding these two concepts also helps investors make careful choices about whether to invest in a company. If your company has low income and high capital, you need to think twice before investing. And if the company has high income and low capital income (generated rather than generated), the company is above the level of survival and can take risks.

Just as you would like to form a transparent distinction between capital expenditures and revenue expenditures, you would like to differentiate between capital income and revenue income.

Receipts obtained within the course of normal business activities are income receipts (e.g., receipts from the sale of products and services, interest income, etc.). Receipts that aren't essentially income, on the opposite hand, are receipts for capital (for example, receipts from the sale of fixed assets or investments, secured or unsecured loans, owner donations, etc.). Revenue and receipt of capital are recognized on an accounting as soon because the entitlement is established. The income receipt shouldn't be an equivalent because the actual cash receipt. Revenue receipts are credited to the P & L account.

Capital receipts, on the opposite hand, aren't credited on to the earnings report. For instance, if a hard and fast asset is sold for rupees. 92,000 (cost Rs. 90,000), capital income Rs. 92,000 won't be credited to the earnings report. Gains and losses on sales of fixed assets are calculated and credited to the P & L account as follows:

Sale price Rs. 92,000

Less: Cost rupee. 90,000

Profit Rs. 2,000

Illustration 3

Good Pictures Co., Ltd. Will build a cinema house within the first year until March 31, 2016 and can bear the subsequent costs.

1. Used furniture like rupees. 9,000 are purchased. Rs are going to be applied to repaint the furniture. 1,000. The furniture was installed by their workers, the wage for this is often rupees. 200.

2. Expenses associated with obtaining a license to work a movies like rupees. 20,000. During the year, the movie company was fined Rs. 1,000 for violating rules. Renewal fee Rs. I paid 2,000 next year.

3. Insurance, Rs. On October 1, 2015, 1,000 were purchased one year.

4. The temporary hut was built at the value of Rs. 1,200. They were needed to create a movie. They were demolished when the cinema was ready.

Please means the way to classify the above items.

Solution:

1. The entire cost of furniture should be treated as Rs. You've got to capitalize 10,200, that is, all the amounts listed, because you cannot use furniture without such spending. For Rs. Rs 1,000, 200 is debited to the repair and wage accounts, respectively, and these accounts are credited to the furniture account.

2. You would like a license to run a cinema house, so you would like to capitalize the value. But Rs fine. 1,000 is revenue expenditure. Subsequent year's renewal fee is additionally a revenue expense, but it's associated with subsequent year. Therefore, it's a prepaid cost.

3. Half the premium is said to the year starting April 1, 2016. Therefore, such amounts should be treated as prepaid expenses. The remaining amount is that the revenue and expenses for the present year.

4. The development required a short-lived hut, which must be capitalized additionally to the value of the cinema.

Illustration 4

Please explain why you'd wish to classify the subsequent spending items.

1. Rupee overhaul cost. 25,000 for car engines to urge better fuel efficiency.

2. Rupee inauguration fee. Rs 250,000 was incurred when opening a replacement manufacturing unit in an existing business.

3. Rs compensation. Workers who chose to retire voluntarily were paid Rs 250 million.

Solution:

1. Car engine overhaul costs are going to be incurred to enhance fuel economy. These costs reduce future running costs; therefore, the benefits are within the sort of lasting long-term benefits. Therefore, this expenditure must be capitalized.

2. The opening costs incurred when opening a replacement unit may help to succeed in more customers. This expenditure has the character of revenue expenditure because it's going to not bring lasting benefits to the business over multiple accounting periods.

3. The quantity paid to workers for voluntary retirement has the character of revenue expenditure. The quantity of paying is so important that it's going to be better to postpone it within the future.

Illustration 5

Classify the subsequent expenditures and receipts as capital or income.

(i) Rs. 10,000 was spent on travel expenses for directors traveling abroad to get capital assets.

(ii) The quantity received from assets during the year.

(iii) The quantity of cash spent on the demolition of a building to create an outsized building on an equivalent site.

(iv) Claims received for a machine damaged by a fireplace.

Solution:

(i) Capital investment.

(ii) Receipt of income.

(iii) Capital investment.

(iv) Receipt of capital.

Illustration 6

Is the next spending essentially capital?

(i) M / s ABC & Co. Runs a restaurant. They refurbish a number of the old cabins. This refurbishment freed up some space and increased the number of cabins from 10 to 13. The entire expenditure was rupees. 20,000.

(ii) M / s New Delhi Financing Co. Was sold Certain products on an installment basis. Five customers didn't pay in instalments. The corporate spent rupees to recover such unpaid instalments. 10,000 for statutory costs.

(iii) M / s Ballav & Co in Delhi. Is Ahmedabad's M / s Shah & Co. I bought a machine from. M / s Ballav & Co. Is Rs. 40,000 for the transportation of such machines. The top of the year is New Year's Eve, 2015.

Solution:

(i) The number of cabins has increased thanks to the renovation of the cabins. This may affect your business's ability to get revenue within the future. Therefore, refurbishment costs are essentially capital investments.

(ii) The prices incurred to gather instalments from customers don't improve future revenue-generating capabilities. This is often the traditional recurring cost of a business. Therefore, the legal costs incurred during this case are essentially revenue expenditures.

(iii) The prices incurred for the transportation of fixed assets are essentially capital expenditures.

Key takeaways:

- A capital receipt is a receipt that creates a liability or reduces an asset. As mentioned above, receipts for capital are inherently non-recurring.

- For example, if a company sells its stock to the public, it can help reduce assets and generate more money in the future.

- A capital receipt is a receipt for a business that has nothing to do with the company's day-to-day business activities.

- Income receipts are receipts that do not reduce a company's assets or generate liabilities.

- They are essentially always repetitive and are acquired in the normal course of business.

- Revenue receipts are receipts that occur on a regular basis.

- They are realized by the day-to-day business activities of companies and are needed for every company to survive and strive.

- The receipt of capital is the influx of economic resources into the company and is essentially non-recurring.

- Income receipts appear to be the opposite of capital receipts, so look at the various features of income receipts so that you can understand the meaning of income receipts and compare them to the characteristics of capital receipts.

- Receipts obtained within the course of normal business activities are income receipts (e.g., receipts from the sale of products and services, interest income, etc.).

Meaning And Necessity of Adjustment Entry

After creating the trial balance and before creating the final account, you may find that some commercial transactions are recorded completely or partially omitted or entered incorrectly. In addition to this, there are some income or expenses related to the following year, but received or paid during the year. You must make adjustments to these accounts before you can create trading and profit and loss accounts.

Transactions omitted in connection with this year must be entered in the books. If the transaction entered is not fully or partially related to the current year, then that portion of income or expense should be excluded. This process is done through the adjustment entry in the books. Without the necessary adjustments, the trading, P & L accounts will not show true profit or loss, and as a result, the balance sheet will not be able to represent the true financial position of the business. This situation defeats the very purpose of the final account. Therefore, reconciliation entries play an important role in displaying the correct image for your account.

Final Account Adjustment

The final account is usually prepared for the entire period. It should be kept in mind that the costs and income of the relevant accounting period will be taken when preparing the final accounting. If expenses are incurred but not paid during the period, you will need to create a liability for the unpaid amount before you can review the performance and financial position of concern. In order to create the final account of the commercial accounting system, all expenses and income related to the period, whether incurred or received, must be booked. To do this, you need to be concerned about passing certain entries at the end of the year to adjust various items of income and expenses. Such entries are called reconciliation entries.

Accounting: Transactions and profit and loss and balance sheets are collectively referred to as final accounts. Items that appear in the trial balance are either debited or credited and appear only once in the final account. The reconciliation entry requires two postings of the same amount, debit and credit. The important point is that students need to post (debit and credit) to the relevant accounts at the same time. Care must be taken to ensure that the total amount of debits and credits is the same.

The following is a summary of important adjustments that are typically made at the end of the accounting period.

Sr No | Adjustment | Effect 1 | Effect 2 |

1 | Closing Stock- Raw Materials | Less from RC- MFG A/c | BS- Asset Side |

| Closing Stock- Work in Progress | MFG A/c- Cr Side | BS- Asset Side |

| Closing Stock- Finished Goods | Trading A/c- Cr Side | BS- Asset Side |

2 | Outstanding Expenses or Payable | Add to Expense | BS- Liability Side |

3 | Prepaid Expense | Less from Expenses | BS- Asset Side |

4 | Outstanding Income or Receivable | Add to Income | BS- Asset Side |

5 | Income received in Advance | Less from Income | BS- Liability Side |

6 | Depreciation on Assets used in MFG | Less from Asset in BS | MFG A/c Dr Side |

| Depreciation on Office Assets | Less from Asset in BS | P/L A/c Dr Side |

7 | Interest on Capital | P & L A/c Dr Side | Add to Capital in BS |

8 | Interest on Drawings | P & L A/c Cr Side | Less from Capital in BS |

9 | Bad or Doubtful Debts | P & L Dr Side (Formula) | Less From Debtors |

10 | Provision/Reserve for Doubtful Debts (RDD) | P & L Dr Side (Formula) | Less From Debtors |

11 | Provision for Discount on Debtors | Add to Discount (P & L Dr Side) | Less From Debtors |

12 | Provision for Discount on Creditors | Add to Discount (P & L Cr Side) | Less From Creditors |

13 | Unrecorded Sales | Add to Debtors | Add to Sales |

14 | Unrecorded Purchases | Add to Creditors | Add to Purchases |

15 | Uninsured Goods lost by Fire/theft | P & L Dr Side | Trading A/c Cr Side |

16 | Insured Goods lost by Fire/theft | P & L Dr Side- Actual Loss Amount

BS Asset Side - Insurance Claim Receivable | Trading A/c Cr Side- Amount of Goods Lost |

17 | Goods Distributed as Free Samples | P & L Dr Side | Trading A/c Cr Side |

18 | Goods taken for Personal use by proprietor | Add to Drawings | Trading A/c Cr Side |

19 | Bills Receivable Dishonored | Less from Bills Receivable | Add to Debtors |

20 | Bills Payable Dishonored | Less from Bills Payable | Add to Creditors |

21 | Interest on Loan Payable | Add to Loan Liability Side | P & L Dr Side |

22 | Interest on Investment Receivable | Add to Investment Asset Side | P & L Cr Side |

Key takeaways:

- After creating the trial balance and before creating the final account, you may find that some commercial transactions are recorded completely or partially omitted or entered incorrectly.

- The final account is usually prepared for the entire period. It should be kept in mind that the costs and income of the relevant accounting period will be taken when preparing the final accounting.

- Transactions and profit and loss and balance sheets are collectively referred to as final accounts.

Closing Entries

"Closing entry" is indispensable to confirm the correct operation result. In order to determine operating income, we will settle expenses and profits. Therefore, the balances of the expense and profit and loss accounts must be transferred to the manufacturing, trading, and profit and loss accounts. The process of closing expense and revenue accounts is done by closing the entry.

Tips if the Balance Sheet is not calculated

“I made all the adjustments correctly, but the balance sheet isn't aggregated.” – This is a common statement from students coming out of the exam venue.

Follow the steps below for tips on how to avoid this situation.

- The entries displayed in the trial balance search for a location in only one place, debit or credit.

- While reading the trial balance, provide special identification information for entries that need adjustment (see the adjustment number in question). You will not forget to make adjustments as the symbol will remind you to make adjustments! This is also "time management".

- All adjustment entries must be made in two places for the same amount. Students will be able to enter at their own convenience. This is the wrong approach. After debiting, credit the same amount at the same time. Students know the adjustment entry, but do not make both adjustments (changes) at the same time.

- After making adjustments, double-check that the same number of adjustments have been made in both locations before moving on to the next entry.

- Remember to make sure that the debit and credit amounts are the same.

With great care, the balance sheet is always aggregated.

Key takeaways:

- The process of closing expense and revenue accounts is done by closing the entry.

- Closing entry" is indispensable to confirm the correct operation result. In order to determine operating income, we will settle expenses and profits.

Meaning of Final Account

The term "final account" is a broader term. The following four financial statements have been prepared for the preparation of the final accounting for the manufacturer.

1. Manufacturing Account: Shows the manufacturing cost.

2. Trading Account: Shows the gross profit / loss of the business.

3. Income Statement: Shows the net profit / loss of the business.

4. Balance Sheet: Shows the financial position of the business.

If the first of the above four statements is created, the manufacturing account, transaction, and profit and loss account are created together, and the balance sheet is created separately. It's important to remember that these accounts aren't created in a ledger, not on regular sheets or paper. These treatises will be submitted for future reference. The way you set up these accounts is different from other accounts like personal, real, nominal accounts.

As mentioned above, the term "final account" refers to manufacturing accounts, trading accounts, profit and loss accounts, and balance sheets. The balance sheet is a statement, but it is still included in the final account. Now, the question arises as to why they are called final accounts.

Ultimately, every businessman is interested in knowing the end result of his business. These are called final accounts because they are the last accounts created at the end of the year. They serve the ultimate purpose of holding an account. Their purpose is to analyze the impact of various income and expenditures of the year, and the resulting profits or losses.

Manufacturing, transactions, income statements, and balance sheets are all collectively called the final account. The final result of the manufacturing account is transferred to the trading account. The final result of the transaction can be found through the income statement. The financial position is reflected on the balance sheet. These are usually created at the end of the year and are therefore known as final accounts.

Final Account Preparation

The final balances of all the accounts in the ledger are transferred to the trial balance. From the trial balance, the expense and income accounts are transferred to the manufacturing, transaction, and profit and loss accounts.

Accounts with balances carried forward to the next year are displayed on the balance sheet. The balance sheet comprises the final stage of accounting.

The final account should be prepared for every business each year. After all accounts are completely written and the trial balance is extracted, the final account is created. Before creating the final accounting, you need to find out if all expenses and income for the year in which the accounting was created are properly provided and included in the accounting. Situations and items that are adjusted at the end of the accounting period are common. These items do not cost cash and are not recorded until the end of the year.

Final Accounting Format: There is a standard final accounting format only for limited liability companies. For proprietary concerns and partnerships, there is no fixed and prescribed form of financial accounting.

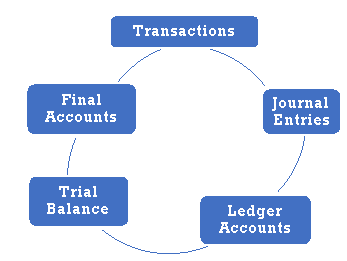

Cycle of Final Accounts

Format of Final Account

1. Manufacturing Account

Manufacturing entities typically create separate manufacturing accounts as part of their final accounts, in addition to trading accounts, profit and loss accounts, and balance sheets. The purpose of creating a manufacturing account is to determine the manufacturing cost of the finished product in order to evaluate the cost-effectiveness of the manufacturing activity. The manufacturing cost of the finished product is then transferred from the manufacturing account to the trading account.

Purpose: The manufacturing account serves the following functions:

1. Show the total cost of manufacturing the finished product and detail the components of such cost, along with the appropriate classification. Therefore, material costs, manufacturing wages, and costs incurred directly or indirectly during manufacturing are debited.

2. Provides factory cost details, facilitates matching of financial books and cost records, and also serves as the basis for comparison of annual manufacturing operations.

3. The manufacturing account can also be used for various other purposes. For example, if the output is brought to the trading account at the market price, the manufacturing gain or loss is disclosed. Similarly, if such a scheme is in place, it can also be used to fix the production of profit-sharing bonuses

Manufacturing costs are classified into: + Raw Material Consumed + Direct Manufacturing Wages + Direct Manufacturing Expenses + Direct Manufacturing Cost + Indirect Manufacturing expenses or + Manufacturing Overhead Total Manufacturing Cost |

Raw Material consumed is arrived at after adjustment of opening and closing Inventory of raw materials:

Raw Material Consumed = Opening inventory of Raw Materials + Purchases – Closing inventory of Raw Materials |

If there are unfinished products left at the beginning and end of the accounting period, the cost of such unfinished products (also known as work in process) appears in the manufacturing account –

The starting stock of work in process is posted to the manufacturing account debit, and the ending stock of work in process is credited to the manufacturing account.

Direct Manufacturing Cost

Direct manufacturing costs are costs incurred for a particular product or service available for sale, other than material costs or wages.

Examples Of Direct Manufacturing Costs are (i) loyalty to use licenses or technologies based on produced units, (ii) based on produced units, of plants and machinery used for employment. There are employment fees and so on.

If royalties or employment fees are based on the units produced, these costs are directly dependent on production.

Indirect Manufacturing Costs or Overheads

These are also called manufacturing overheads, production overheads, work overheads, and so on. Overhead is defined as the total cost of indirect materials, overhead wages, and overhead costs.

These are also called manufacturing overheads, production overheads, work overheads, and so on. Overhead is defined as the total cost of indirect materials, overhead wages, and overhead costs.

Indirect materials are materials that cannot be directly linked to the units produced, such as stores, small tools, fuels, and lubricants that are consumed for repair and maintenance work.

Indirect wages are wages that are not directly linked to production units, such as maintenance work and owned wages.

Overhead costs are those that cannot be directly linked to the units produced, such as training costs, plant and machine depreciation, factory shed depreciation, plant and machine insurance premiums, and factory sheds.

Therefore, indirect manufacturing costs consist of indirect material costs, indirect wages, and overhead costs of the manufacturing department.

By-Product

In most manufacturing operations, the production of the main product involves the production of secondary products that are worth selling. For example, the production of hardened vegetable oil involves the production of oxygen gas, and the production of steel produces scrap. By-products are called by-products because their production results from the production of the main product rather than consciously. It is usually very difficult to determine the cost of a product. In addition, its value usually accounts for a very small percentage of the major products.

By-Products are by-products. It is manufactured from the same raw materials used to manufacture the main product and does not incur additional costs from the same manufacturing process in which the main product is manufactured. Here are some examples of By-Products.

(i) Molasses is a By-Product of Sugar Production.

(ii) Buttermilk is a By-Product of dairy products that produce butter and cheese.

By-Products generally have insignificant value compared to the value of the main product. If their costs cannot be identified individually, they are usually valued at their net realizable value. Often treated as "miscellaneous income", the correct treatment is to credit the sales amount of the by-product to the manufacturing account and reduce the manufacturing cost of the main product to that extent.

Format of Manufacturing Account

Particulars | Units | Amount Rs. | Particulars | Units | Amount Rs. |

To Opening Work-in-process To Raw Material Consumed: Opening inventory Add: Purchases Less: Closing inventory To Direct Wages To Direct expenses: Prime cost To Factory overheads: Royalty Hire charges To Indirect expenses: Repairs & Maintenance Depreciation Factory cost |

|

| By Sale of Scrap By-products at net realizable value By Closing Work-in- Process By Trading A/c (Cost of production) |

|

|

You can follow the General Rules below:

a. The production account requires columns that show quantities and values. In many cases, not all quantities are shown and you need to calculate the quantity applicable to one or more items. For example, if your question does not list the total number of items sold, you can calculate the quantity by adding the starting inventory and manufacturing units and subtracting the ending inventory. Therefore, it is useful to include a quantity column in your account so that you can see that both are balanced.

b. The manufacturing account shows the quantity of raw materials in stock at the beginning and end of the year and the purchase price for the year. For finished products, only the production quantity is displayed, and for work in progress, only the start and end amounts are displayed.

c. The trading account shows the quantity of finished products manufactured and sold, as well as the starting and ending stock. The amount of raw materials and work in process are not displayed.

d. To determine the value of the closing inventory, it is assumed that the sale was made on a "first-in, first-out" basis, that is, the closing inventory consists of the products produced as much as possible, unless otherwise specified. Is needed. The opening inventory was sold out during the year.

It can be mentioned here that today, manufacturing entities do not create manufacturing accounts as part of their final account. Even items in the manufacturing account appear in either the transaction account (for non-corporate) or the income statement (for corporate).

The procedures for creating trading accounts, income statements and balance sheets have already been studied by students of the 11th Criterion. Students should see the same to try the problem based on the preparation of a complete set of sole proprietorship final accounts.

Meaning and Necessity of Adjustment Entry

After creating the trial balance and before creating the final account, you may find that some commercial transactions are recorded completely or partially omitted or entered incorrectly. In addition to this, there are some income or expenses related to the following year, but received or paid during the year. You must make adjustments to these accounts before you can create trading and profit and loss accounts.

Transactions omitted in connection with this year must be entered in the books. If the transaction entered is not fully or partially related to the current year, then that portion of income or expense should be excluded. This process is done through the adjustment entry in the books. Without the necessary adjustments, the trading, P & L accounts will not show true profit or loss, and as a result, the balance sheet will not be able to represent the true financial position of the business. This situation defeats the very purpose of the final account. Therefore, reconciliation entries play an important role in displaying the correct image for your account.

- Trading Account

Particulars | Amount | Particulars | Amount |

To Opening Stock Finished Goods |

| By Sales |

|

To Purchases |

| Less : Return Inward |

|

Less : Return Outward |

| By Goods distributed as free samples |

|

To Carriage Inward |

| By Goods lost by fire |

|

To Freight |

| By Goods lost in Accident |

|

To Dock Charges |

| By Goods lost by theft |

|

To Custom Duty |

| By Goods withdrawn by Proprietor |

|

To Wages Productive |

| By Closing Stock Finished Goods |

|

To Manufacturing Wages |

| By Gross Loss c/d |

|

To Wages & Salaries |

|

|

|

To Import Duty |

|

|

|

To Coal/Coke/Gas/ Motive Power/Oil/ Water /Grease |

|

|

|

To Royalty on Purchase/Production |

|

|

|

To Factory Rent & Rates |

|

|

|

To Factory Insurance |

|

|

|

To Works Manager's Salary |

|

|

|

To Primary Packaging |

|

|

|

To Gross Profit c/d |

|

|

|

Total |

| Total |

|

2. Profit & Loss Account

Particulars | Amount | Particulars | Amount |

To Salaries To Salaries & Wages To Rent & Rates To Insurance To Electricity/Lighting To Telephone, Postage To Printing & Stationery To Travelling Expenses of Salesman To Depreciation on Assets To Loading Charges To Audit Fees To Entertainment Exp. To Repairs / Renewals / Maintenance |

| By Gross Profit b/d By Commission Received By Discount Received/ Earned By Interest Received By Dividend Received By Rent Received By Sundry/Miscellaneous Receipts By Profit on Sale of an Asset By Net Loss transferred to Balance Sheet

|

|

To Interest on Loan To Sundry/Miscellaneous Expenses To Conveyance To Loss by Fire To Loss by Theft To Loss in Accident To Goods distributed as free sample To Commission Allowed/ Given To Discount allowed To Allowances To Advertisement To Carriage Outward To Sale Charges To Bad Debts To Export Duty To Taxes To General Expenses To Trade Expenses To Legal Charges To Professional Charges To Bank Charges To Solicitor's Fees To Secondary Packing Charges To Loss on sale of Fixed Assets To Net Profit transferred to Balance Sheet |

|

|

|

|

|

|

|

Total |

| Total |

|

3. Balance Sheet

Particulars | Amount | Particulars | Amount |

Capital Bank Loan |

| Goodwill |

|

Loan from Relatives |

| Patents |

|

Bills Payable |

| Copyrights |

|

Bank Overdraft |

| Trade Marks |

|

Sundry Creditors |

| Furniture & Fittings |

|

Less: Provision for Discount on Creditors |

| Less: Depreciation |

|

Outstanding Expenses |

| Plant & Machinery |

|

Income received in Advance |

| Less: Depreciation |

|

Provision for Taxes |

| Land & Building |

|

|

| Less: Depreciation |

|

|

| Premises |

|

|

| Less: Depreciation |

|

|

| Equipment |

|

|

| Less: Depreciation |

|

|

| Delivery/Motor Van |

|

|

| Less: Depreciation |

|

|

| Loose Tools/Spare Parts |

|

|

| Less: Depreciation |

|

|

| Investments |

|

|

| Sundry Debtors |

|

|

| Less: Bad Debts |

|

|

| Less: R.D. D |

|

|

| Less: Provision for Discount on Debtors |

|

|

| Bills Receivable |

|

|

| Cash In Hand |

|

|

| Cash at Bank |

|

|

| Loans & Advances |

|

|

| Prepaid Expenses |

|

|

| Income Receivable |

|

|

| Closing Stock |

|

|

|

|

|

Total |

| Total |

|

Key takeaways:

- The main purpose of accounting is to organize your accounting data so that you can see the amount of profit or loss.

- It will be created for a certain period of time. For this purpose, we will prepare a final account.

- A non-manufacturing entity or a trading entity makes a profitable purchase and sale of goods without changing the form of the goods.

- In addition to transaction accounts, profit and loss accounts, and balance sheets, manufacturing entities typically create separate manufacturing accounts as part of their final account.

- The main purpose of creating a manufacturing account is to determine the manufacturing cost of the finished product.

- It helps improve the cost-effectiveness of manufacturing activities.

- The cost of the finished product is then transferred from this account to your trading account.

References:

Text Books:

- Gupta R.L. And Radha swamy. M, Sultan Chand & Sons, New Delhi.

- Shukla M. C. Grewal T. S and Gupta S.C., S. Chand & Sons. New Delhi.

- Shukla S. M., Sahitya Bhawan Publication, Agra.