UNIT – 3

SPECIAL CONTRACTS

Case study (Vidya Ratan vs Kota Transport Co. Ltd. on 3 May, 1965)

The admitted position between the parties was that the defendants were common carriers. The preamble of the Act, amongst other things, recites that it was in order to enable common carriers to limit their liability for loss or damage to property delivered to them to be carried that the Act was passed. The preamble thus suggests that prior to the enforcement of this Act, even in British India, there were already extant certain principles of common law about the liability of common carriers under the common law. It seems that the liability of a common carrier under the Common Law was in some respects larger than what was contained in the Carries Act. A common carrier is responsible for the safety of the goods entrusted to him in all events, except when loss or injury arises solely from act of God or the Queen's enemies or from the fault of the consignor or inherent vice in the goods themselves. He was held liable even when the carrier was overwhelmed and robbed by irresistible number of persons (vide Article 382 in Halsbury's Laws of England, Third Edn., Vol. 4, at Page 141). A common carrier was held au insurer of safety of the goods against everything extraneous which may cause loss or injury except the act of God or the Queen's enemies. As in the Indian Carriers Act, so in the corresponding English Carriers Act, the liability of the common carriers could be limited by special contract. Under the head 'Variation of Common Law Duties and Liabilities" and under the Sub-head ''Construction of special contracts" in the volume, already referred to, in the Halsbury's Laws of England ths following passage occurs : --

Such a contract may be express or implied from conduct, but whether it is to be implied or not is a question of fact. Exemptions by special contract to the general liability of a carrier are to be construed strictly, and are not created by the use of subtle implications or ambiguous words. In some cases such a contract must be in writing and signed by the consignor".

Carriers, with certain exceptions, may limit liability by special contract) but any such carrier, not being the owner of a railroad or tramroad constructed under the provisions of Act XXII of 1863 (to provide for taking land lor works of public utility to be constructed by private persons or companies, and for regulating the construction and use of works on land so taken) may, by special contract, signed by the owner of such property so delivered as last aforesaid or by some person duly authorized in that behalf by such owner, limit his liability in respect of the same"

A. CONCEPT

According to section 124 of the Indian Contract act, “Contract of indemnity” is a contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person, is called a “contract of indemnity.” Example: A contracts to indemnify B against the results of any proceedings which C may take against B in respect of a particular sum of 200 rupees. This is often a contract of indemnity.

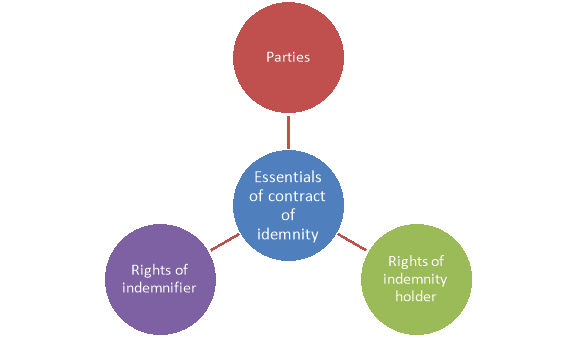

B. ESSENTIAL ELEMENTS OF INDEMNITY CONTRACT:

The essential elements of contract of indemnity are discussed below-

Figure: Essentials of contract of indemnity

i) PARTIES OF CONTRACT OF INDEMNITY:

There are two parties to the contract of indemnity- indemnifier and indemnity holder

1. Indemnity holder:

2. Indemnifier:

ii) RIGHTS OF INDEMNITY HOLDER WHEN SUED AS PER SECTION 125

The promisee in a contract of indemnity, acting within the scope of his authority, is entitled to recover from the promisor

(1) all damages which he may be compelled to pay in any suit in respect of any matter to which the promise to indemnify applies;

(2) all costs which he may be compelled to pay in any such suit if, in bringing or defending it, he did not contravene the orders of the promisor, and acted as it would have been prudent for him to act in the absence of any contract of indemnity, or if the promisor authorized him to bring or defend the suit;

(3) all sums which he may have paid under the terms of any compromise of any such suit, if the compromise was not contrary to the orders of the promisor, and was one which it would have been prudent for the promisee to make in the absence of any contract of indemnity, or if the promisor authorized him to compromise the suit.

iii) RIGHTS OF INDEMNIFIER:

The Indian Contract Act, 1872 is silent for rights of indemnifier. The rights of indemnifier is similar has rights of surety.

C. CONTRACT OF GUARANTEE AS PER SECTION 126

According to section 126 of the Indian Contract Act, a contract of guarantee is a contract to perform the promise, or discharge the liability, of a third person in case of his default. The person who gives the guarantee is called the “surety”; the person in respect of whose default the guarantee is given is called the “principal debtor”, and the person to whom the guarantee is given is called the “creditor”. A guarantee may be either oral or written. For example, B requests A to sell and deliver to him goods on credit. A agrees to do so, provided C will guarantee the payment of the price of the goods. C promises to guarantee the payment in consideration of A‟s promise to deliver the goods. This is a sufficient consideration for C‟s promise.

SOME IMPORTANT SECTION UNDER THE CONTRACT OF GUARANTEE

CONSIDERATION FOR GUARANTEE AS PER SECTION 127

Anything done, or any promise made, for the advantage of the principal debtor, may be a sufficient consideration to the surety for giving the guarantee. Anything done, or any promise made, for the advantage of the principal debtor, is also a sufficient consideration to the surety for giving the guarantee." Illustrations (a) B requests A to sell and deliver to him goods on credit. A agrees to try and do so, provided C will guarantee the payment of the value of the goods. C promises to ensure the payment in consideration of A’s promise to deliver the goods. this is often a sufficient consideration for C’s promise. (a) B requests A to sell and deliver to him goods on credit. A agrees to try to to so, provided C will guarantee the payment of the value of the goods. C promises to ensure the payment in consideration of A’s promise to deliver the goods. This is often a sufficient consideration for C’s promise."

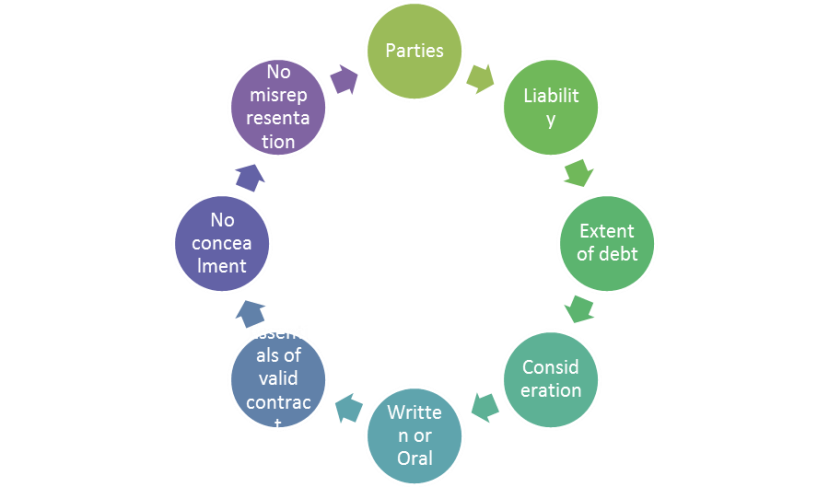

ESSENTIALS ELEMENTS OF A CONTRACT OF GUARANTEE

Some of the important sections of guarantee provided under the Indian Contract Act are-

Figure: Essentials of Guarantee

1. Concurrence of All the Parties

All the three parties namely, the principal debtor, the creditor and therefore the surety must conform to make such a contract.

2. Liability

In a contract of guarantee, liability of the surety is secondary i.e., the creditor must first proceed against the debtor and if the latter doesn't perform his promise, then only he can proceed against the surety.

3. Existence of a Debt

A contract of guarantee pre-supposes the existence of a liability, which is enforceable at law. If no such liability exists, there are often no contract of guarantee. Thus, where the debt, which is sought to be guaranteed is already time barred or void, the surety isn't liable.

4. Consideration

There must be consideration between the creditor and the surety so on make the contract enforceable. The consideration must even be lawful. During a contract of guarantee, the consideration received by the principal debtor is taken to be the sufficient consideration for the surety. Anything done, or any promise made, for the advantage of the principal debtor is also sufficient consideration to the surety for giving the guarantee – Sec. 127 of Indian Contract Act, 1872. Thus, any benefit received by the debtor is adequate consideration to bind the surety. But past consideration is not any consideration for a contract of guarantee. There must be a fresh consideration moving from the creditor.

5. Writing not Necessary

A contract of guarantee may either be oral or written. It's going to be express or implied from the conduct of parties.

Note: A Contract of Guarantee should be in writing under English Law.

6. Essentials of a valid Contract

It must have all the essentials of a valid contract like offer and acceptance, intention to make a legal relationship, capacity to contract, genuine and free consent, lawful object, lawful consideration, certainty and possibility of performance and legal formalities.

7. No Concealment of Facts

The creditor should confide in the surety the facts that are likely to affect the surety’s liability. The guarantee obtained by the concealment of such facts is invalid. Thus, the guarantee is invalid if the creditor obtains it by the concealment of material facts.

8. No Misrepresentation

The guarantee shouldn't be obtained by misrepresenting the facts to the surety. Though the contract of guarantee isn't a contract i.e., of absolute good faith, and thus, doesn't require complete disclosure of all the material facts by the principal debtor or creditor to the surety before he enters into a contract. But the facts, that are likely to affect the extent of surety’s responsibility, must be truly represented

PARTIES TO CONTRACT OF GUARANTEE:

The parties to the contract of guarantee are-

For example, when A requests B to lend Rs. 10,000 to C and guarantees that C will repay the amount within the agreed time and that on C falling to do so, he will himself pay to B, there is a contract of guarantee. Here, B is the creditor, C the principal debtor and A the surety.

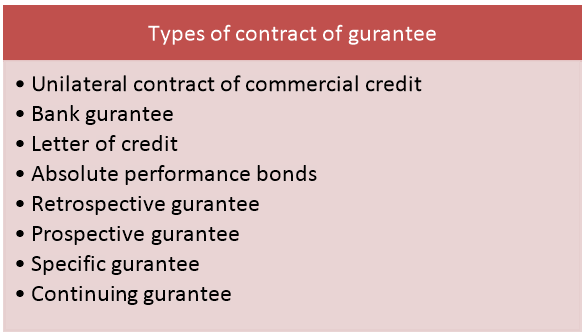

TYPES OF GUARANTEE

Contracts of guarantees may be classified into two types: Specific guarantee and continuing guarantee.

A guarantee is a “specific guarantee”, if it is intended to be applicable to a particular debt and thus comes to an end on its repayment. For example, S is a bookseller who supplies a set of books to P, under the contract that if P does not pay for the books, his friend K would make the payment. This is a contract of specific guarantee and K’s liability would come to an end, the moment the price of the books is paid to S.

A guarantee which extends to a series of transactions is called a “continuing guarantee”. For example, A, in consideration that B will employ C in collecting the rent of B‟s zamindari, promises B to be responsible, to the amount of 5,000 rupees, for the due collection and payment by C of those rents. This is a continuing guarantee.

TYPES OF CONTRACT OF GUARANTEE

Different types of contract of guarantee are discussed below-

Figure: Types of contract of guarantee

It is commonly used in commercial transactions, it is used either between wholesale and retail sellers or between the retail trader and the final customer. This type of agreement implies that the goods are delivered either by the wholesale to the retail seller, or from the retail seller to the customer, with no immediate payment and an agreement for payment at a later date.

2. Bank guarantee(for contract of tender)

It is a type of guarantee issued by a financial institution or a bank, that they will cover any debt a person or an institution attracts if they are no able to do so themselves. This practice helps businesses grow by allowing them to make use of certain goods and services while being able to pay for them at one point in the future, therefore letting a company invest at a higher rate than they would have done without the backing of a bank guarantee.

3. Letter of credit(for international trade)

It is a letter written with the purpose or requesting credit to be given either to the person writing the letter, or to specific entities mentioned in the letter, and it is used most often in international trade.

4. Absolute performance bonds

A straightforward deal in which the surety will pay the sum that's specified in the contract if the person initially attracting the debt is unable to do so.

5. Retrospective guarantee( for existing obligation)

It is a guarantee issued when the debt is already outstanding.

6. Prospective guarantee (for future obligation)

It is given in regard to a future debt.

7. Specific guarantee (for single transaction)

It is also known as a simple guarantee, it's a type that is used when dealing with a single transaction, and therefore a single debt.

8. Continuing guarantee( for more than single debt)

A continuing guarantee is defined under section 129 of the Indian Contract Act, 1872. A continuing guarantee is a type of guarantee which applies to a series of transactions. It applies to all the transactions entered into by the principal debtor until it is revoked by the surety. Therefore Bankers always prefer to have a continuing guarantee so that the guarantor’s liability is not limited to the original advances and would also extend to all subsequent debts. The most important feature of a continuing guarantee is that it applies to a series of separable, distinct transactions. Therefore, when a guarantee is given for an entire consideration, it cannot be termed as a continuing guarantee.

E. DIFFERENCE BETWEEN CONTRACT OF INDEMNITY AND CONTRACT OF GUARANTEE

No. Basis | Contract of Indemnity | Contract of Guarantee |

| There is a contract between two parties for the compensation of loss | There are contracts between three parties for paying liability |

2. Section | Sec.124 & 125 deals with the contract of indemnity. | Sec.126 deals with the contract of gurantee. |

3. No. of parties | It has two parties- indemnity holder and indemnifier. | It have three parties- surety, principal debtor and principal creditor. |

4. No. of contact | It has only one contract i.e, between indemnity holder and indemnifier. | It consist of three contracts i.e, between surety and principal debtor, between surety and principal creditor and between principal debtor and creditor. |

5. Related with | It is related with damage. | It is related with payment of liability. |

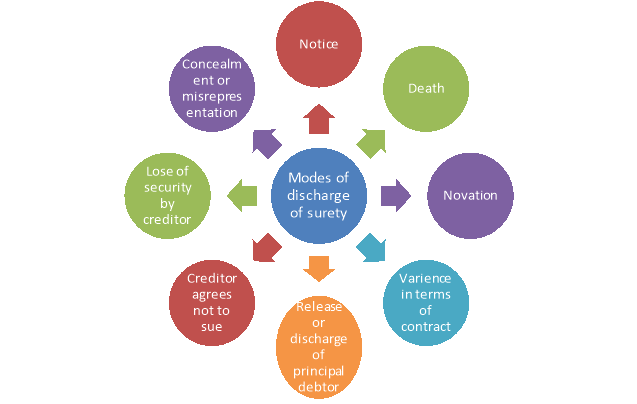

E. MODES OF DISCHARGE OF SURETY

Different modes of discharge of surety provided under the Indian Contract Act are discussed below-

Figure: Modes of discharge of surety

A specific guarantee cannot be revoked by the surety if the liability has already accrued. A continuing guarantee may at any time, be revoked by the surety, as to future transactions, by giving notice to the creditor. But the surety remains liable for transactions already entered into.

2. Revocation by death (sec-131)

The death of the surety operates, in the absence of any contract to the contrary, as a revocation of a continuing guarantee, so far as regards future transactions.. The effect of the death of the surety is that it results in automatic revocation of the guarantee as to future transactions. But such revocation does not affect the transactions which were executed prior to the death of the surety.

3. Novation

Novation, i.e., entering into a fresh contract, either between the same parties or between other parties, constitutes another mode of discharging a surety from the liability. If the parties to a contract (of guarantee) agree to substitute it with a new contract, the original contract need not be performed and so the surety stands discharged with regard to the old contract. For the surety, too, a fresh contract would have to be drafted.

4. Discharge of surety by variance in terms of contract

Section 133 of the Indian Contract Act, 1872 provides for the discharge of the liability of the surety, in case of material alteration or variance in the terms of the contract. Any variance or alteration in the terms of the contract made between the principal debtor and the creditor, without the surety’s consent, discharges the surety as to the transactions taking place subsequent to the variance. For example, A becomes surety to C for payment of rent by B under a lease. Afterwards B and C contract to hike the rent, without informing A. A would hence, be discharged from his liability as a surety for accruing subsequent to the variance in terms of the contract without his consent.

5. Discharge of surety by release or discharge of principal debtor.

The surety is discharged by any contract between the creditor and the principal debtor, by which the principal debtor is released, or by any act or omission of the creditor, the legal consequence of which is the discharge of the principal debtor. The following example explains the point. Example: A contracts with B to build a house for B for a fixed price within a stipulated time, B supplying the necessary timber. C guarantees A’s performance of the contract. B fails to supply the timber. C is thus discharged from his surety.

6. Discharge of surety when creditor compounds with, gives time to, or agrees not to sue, principal debtor

The surety is discharged by any contract between the creditor and the principal debtor, by which the principal debtor is released, or by any act or omission of the creditor, the legal consequence of which is the discharge of the principal debtor. The following example explains the point. Example: A contracts with B to build a house for B for a fixed price within a stipulated time, B supplying the necessary timber. C guarantees A’s performance of the contract. B fails to supply the timber. C is thus discharged from his surety.

7. Discharge of surety by creditor's act or omission impairing surety's eventual remedy.

If the creditor commits any act, which is inconsistent with the rights of the surety, or fails to perform any act that his duty to the surety requires him to do, such that the eventual remedy of the surety himself against the principal debtor is impaired; the surety is discharged.

8. By the creditor losing his security.

If the creditor loses, or without the consent of the surety, parts with such security, the surety is discharged to the extent of the value of the security. It is immaterial whether the surety was or is aware of such security or not. For instance, C advances to B, his tenant. Rs 2,000 on the guarantee of A. C has also a further security for Rs 2,000 by a mortgage of B’s furniture. C, however cancels the mortgage. B becomes insolvent and C sues A on his guarantee. A is discharged from liability to the amount of the value of the furniture.

9. By concealment or misrepresentation.

A surety is also discharged upon invalidation of the contract (i.e., between the creditor and the surety). A contract of guarantee is invalid in the following circumstances.

A. INTRODUCTION

According to Sec 148 of the Contract Act, 1872, ‘A bailment is the delivery of goods by one person to another for some purpose, upon a contract that they shall, when the purpose is accomplished, be returned or otherwise disposed of according to the directions of the person delivering them. The person delivering the goods is called the bailor, the person to whom they are delivered is called the bailee and the transaction is called the bailment. For example, delivery of car to dealer for servicing, delivery of cloths for laundry etc.

B. ESSENTIALS OF BAILMENT

Some of the essentials of contract of bailment are discussed below-

The delivery to the bailee may be made by doing anything which has the effect of putting the goods in the possession of the intended bailee or of any person authorized to hold them on his behalf.

2. Bailor’s duty to disclose faults in goods bailed (section 150)

The bailor is bound to disclose to the bailee faults in the goods bailed, of which the bailor is aware, and which materially interfere with the use of them, or expose the bailee to extraordinary risks; and if he does not make such disclosure, he is responsible for damage arising to the bailee directly from such faults.

3. Care to be taken by bailee (sec 151)

In all cases of bailment the bailee is bound to take as much care of the goods bailed to him as a man of ordinary prudence would, under similar circumstances, take of his own goods of the same bulk, quality and value as the goods bailed.

4. Bailee when not liable for loss, etc., of thing bailed (sec 152)

The bailee, in the absence of any special contract, is not responsible for the loss, destruction or deterioration of the thing bailed, if he has taken the amount of care of it described in section 151.

5. Termination of bailment by bailee’s act inconsistent with conditions (sec 153)

A contract of bailment is avoidable at the option of the bailor, if the bailee does any act with regard to the goods bailed, inconsistent with the conditions of the bailment.

6. Liability of bailee making unauthorized use of goods bailed (sec 154)

If the bailee makes any use of the goods bailed which is not according to the conditions of the bailment, he is liable to make compensation to the bailor for any damage arising to the goods from or during such use of them.

7. Effect of mixture, with bailor’s consent, of his goods with bailee’s (sec 155)

If the bailee, with the consent of the bailor, mixes the goods of the bailor with his own goods, the bailor and the bailee shall have an interest, in proportion to their respective shares, in the mixture thus produced.

8. Effect of mixture without bailor’s consent, when the goods can be separated (sec 156)

If the bailee, without the consent of the bailor, mixes the goods of the bailor with his own goods, and the goods can be separated or divided, the property in the goods remains in the parties respectively; but the bailee is bound to bear the expense of separation or division, and any damage arising from the mixture.

9. Effect of mixture, without bailor’s consent, when the goods cannot be separated (sec 157)

If the bailee, without the consent of the bailor, mixes the goods of the bailor with his own goods, in such a manner that it is impossible to separate the goods bailed from the other goods, and deliver them back, the bailor is entitled to be compensated by the bailee for the loss of the goods.

10. Repayment, by bailor, of necessary expenses (sec 158)

Where, by the conditions of the bailment, the goods are to be kept or to be carried, or to have work done upon them by the bailee for the bailor, and the bailee is to receive no remuneration, the bailor shall repay to the bailee the necessary expenses incurred by him for the purpose of the bailment.

C. KINDS OF BAILMENT

There are five sorts of Bailment are as under

1) Gratuitous Bailment

A Bailment made with none Consideration for the benefit of the bailor or for the benefit of the bailee is named Gratuitous Bailment. In simple words A bailment with no consideration is Gratuitous bailment.

2) Non-Gratuitous Bailment:

Non Gratuitous may be a bailment for reward. It's for the advantage of both the bailor and bailee.

3) Bailment for the benefit of the Bailor:

During this case the bailor delivers his goods to a bailee for a secure custody with none benefit/ reward. It's called the bailment for the advantage of the bailor".

4) Bailment for the exclusive advantage of the Bailee

In this case Bailor delivers his goods to a bailee with none benefit for his use, it's called "the bailment for the exclusive benefit of the bailee"

5) Bailment for the benefit of the Bailor and Bailee:

In this case goods are delivered for consideration, both the bailor and bailee get benefit and hence it's called the bailment for the advantage of the bailor and bailee.

D. DUTIES AND RIGHTS OF BAILOR AND BAILEE

DUTIES OF THE BAILEE

The bailee must take reasonable care of the goods bailed to him, as if they were his own. If he does so, he will not liable for any loss, destruction or deterioration of the goods bailed.

2. Duty not to make unauthorized use of goods entrusted to him [ sec 154]

It is the duty of the bailee not to make any unauthorised use of the goods bailed to him.

3. Duty not to mix goods bailed with his own goods [ Sec 155]

It is the duty of the bailee not to mix the bailed goods with his own goods, without the consent of the bailor. If he does so, the bailee will have to bear the expenses incurred due to such mixture.

4. Duty to return the goods [ Sec 165]

It is the duty of the bailee to return the goods according to the bailor’s directions, as soon as the time for which they were bailed has expired, or the purpose for which they were bailed has been accomplished.

5. Duty to deliver any accretion to the goods [Sec 163]

It is the duty of the bailee to deliver to the bailor any natural increase or profit accruing from the goods bailed, unless there is a contract to the contrary.

DUTIES OF THE BAILOR

The bailor must disclose all the known faults in the goods and if he fails to do so, he will be liable for any damage resulting directly from facts.

2. Duty to repay necessary expenses in case of gratuitous Bailment [Sec 158]

When goods are delivered to any bailee without paying remuneration, it is the duty of the bailor to pay any extraordinary expenses incurred by the bailee in respect of such goods.

3. Duty to indemnify bailee [Sec 164]

The bailor is bound to indemnify the bailee for any cost which the bailee may incur because of the defective title of the bailor for the goods bailed.

RIGHTS OF BAILEE

The duties of the bailor are the rights of the bailee. Thus the bailee has the right to-

When goods have been bailed by several joint owners, the bailee has a right to deliver the goods to one of the several joint owner without the consent of all, in the absence of any agreement to the contrary.

If the bailor has no title to the goods, and the bailee delivers them back to the bailor in good faith, the bailee is not responsible to the true owner in respect of such delivery.

The bailee has a right to claim his lawful charges and if they are not paid, he is given the right to retain the goods until the charges due in respect of them are paid.

If a third party wrongfully deprives bailee of the use or possession of the goods bailed, he has a right of action against such third party in the same manner as the true owner has against the third person.

RIGHTS OF THE BAILOR

A. INTRODUCTION

According to Sec 172, Contract Act, 1872, ‘The bailment of goods for repayment of a debt or performance of a promise is called ‘pledge’. The Bailor in this case is called the pawnor, the bailee is called the Pawnee. In other words, bailment of goods for security purpose is known as pledge. For example, delivery of property documents to banks against mortgage.

Differences between pledge and bailment are

Basis of difference | Pledge | Bailment |

| Pledge is the bailment for a specific purpose i.e. to provide security for a debt or for fulfillment of object | Bailment is for a purpose a specific purpose i.e. to other than two under provide security for a pledge i.e. for repairs, safe debt or for fulfillment of custody etc. object. |

2. Right to sale | The pledgee has right to sale on default after giving notice thereof to the pledger | The Bailee may either retain the goods or for non-payment of the dues. He has no right to sale. |

3. Right to use | The pledgee has no right to use the goods. | There is no restriction on use of goods. |

4. Remedy for default | The pledgee can sale the goods after giving notice to the pledger. | The bailor can either retain the goods or return the goods. |

5. Consideration | It is necessary in pledge. | It may or may not be present in bailment. |

B. ESSENTIAL FEATURES OF A VALID PLEDGE

There must be a bailment of goods as defined in section 148 of the Contract Act that is delivery of goods. The delivery of possession may be actual or constructive. If the Pledger has goods in his physical possession he could effects the pledge by actual delivery.

2. Delivery should be upon a contract

The bailment must be by way of security. The goods are delivered as security for the payment of a debt or performance of a promise.

3. Delivery should be for the purpose of security

The delivery of goods should only for the purpose of security against loan. Otherwise it is not considered as pledge.

4. Delivery should be upon condition to return

To constitute Pledge the subject matter of property must be a movable property. It can be valuable documents, goods, chattels etc.

C. LIEN

A lien is that the right to retain the lawful possession of another person's piece of property until the owner fulfills a duty to the person holding the property, like the payment of lawful charges for work done on the property. A mortgage may be a common lien. In its most general meaning, this term includes every case during which real or personal estate is charged with the payment of any debt or duty. During a more limited sense it's defined to be a right of detaining the property of another until some claim is satisfied. The proper of lien generally arises by operation of law, but in some cases it's created by express contract.

Two kinds of Liens

There are two sorts of liens:

D. DIFFERENCE BETWEEN THE PLEDGE AND LIEN

Basis of difference | Pledge | Lien |

| The bailment of goods for repayment of a debt or performance of a promise is called ‘pledge’ | A lien is that the right to retain the lawful possession of another person's piece of property until the owner fulfills a duty to the person holding the property, like the payment of lawful charges for work done on the property. |

2. Nature | It is created by a contract. | No contract is required for lien. |

3. Right to sue | The pledgee has the right to sue, right to sale and right of lien. | The lien holder has only the right to retain. |

E. RIGHTS AND DUTIES OF PAWNOR AND PAWNEE

DUTIES OF A PAWNOR

DUTIES OF A PAWNEE

RIGHT OF PAWNOR

1. Right to get back the goods pledged: The pawnor is entitled to get back the commodities pledged on the repayment of the debt or performance of the promise.

2. Rights to redeem the debt: The pawnor has a right to redeem the debt at any time for which the pledge is made. (Sec. 177)

3. Right to check the condition of goods: The pawnor has a right to check that the pawnee, like bailee, preserves the goods pledged and properly maintains them.

RIGHT OF PAWNEE

The rights enjoyed by a pawnee may be enumerated as follows:

2. Right of retainer for subsequent advances: When the Pawnee borrows money to the same pawnor after the time of the pledge, it is assumed that the right of retainer over the pledge of goods extends to subsequent advances also. (Sec174).

3. Rights to extraordinary express: The Pawnee is to receive from the pawnor extraordinary expenses incurred by him for the preservation of the goods pledged but he has no right to retain the goods. (Sec. 175)

4. Right against true owner, when the pawnor’s title is defective: When the pawnor obtained possession of the goods pledged by him under a voidable contract i.e. (by fraud, undue influence, coercion) but the contract has not been rescinded at the time of the pledge, the Pawnee acquires a good title to the commodities (Sec178-A)

5. Pawnee’s right’s where pawnor makes default: Where the pawnor fails to pay debt or performance of the promise, the Pawnee may exercise the following rights:

According to section 182, of the contract act, “An agent is a person employed to do any act for another or to represent another in dealing with third persons. The person for whom such act is done or who is so represented is called the principal”.

WHO MAY EMPLOY AGENT (SECTION 183)

Any person who is of the age of majority according to the law to which he is subject, and who is of sound mind, may employ an agent.

WHO MAY BE AN AGENT ( SECTION 184)

As between the principal and third person any person may become an agent, but no person who is not of the age of majority and of sound mind can become an agent, so as to be responsible to his principle according to the provisions in that behalf herein contained. —As between the principal and third person any person may become an agent, but no person who is not of the age of majority and of sound mind can become an agent, so as to be responsible to his principle according to the provisions in that behalf herein contained."

FEATURES OF THE CONTRACT OF AGENCY

TEST OF AGENCY

A person does not become an agent on behalf of another merely because he gives him advice in matters of business. Every person who acts for another cannot be agent. Cobbler mending shoes of a man, servant rendering services for us – are not agents.

To test whether a person is or not an agent

CLASSIFICATION OF AGENTS

3. Universal Agent – is one who is employed to all such act which a principal can lawfully do & can delegate. Agent has unlimited authority.

4. Factors – is a mercantile agent to whom the possession of goods are given for the purpose of selling them. He usually sells the goods in own name. He can exercise a general right of lien on the goods delivered to him for balance of payment if any.

5. Auctioneer – is an agent who is appointed by the principal to sell the goods on his behalf at a public auction for a reward in form of commission. Eg reserve price

6. Broker – is an agent appointed by the principal for the purpose of selling or buying goods on his behalf. He do not have possession of goods nor he can contract in his own name. He bring seller & buyer together to bargain. He gets commission (brokerage ).

7. Commission Agent – is a mercantile agent who is employed to buy & sell goods for his principal on best possible terms. He transact in his own name. He is entitled to commission. He may or may not have possession.

8. Del credere Agent – is one who guarantees to his principal, the performance of the financial obligation by party with whom he enters into a contract on principal behalf, in consideration of an extra commission. He becomes surety & become liable on the default of third party.

9. Banker – act as a mercantile agent on behalf of his customer when he collects cheques, drafts, bills & pay insurance premium & buy or sell securities.

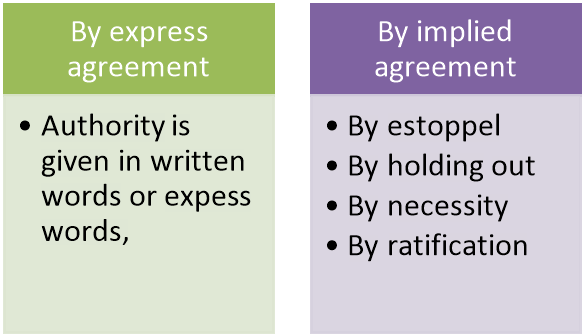

B. MODES OF CREATION OF AGENCY

The modes of creation of agency are discussed below-

Figure: Modes of creation of agency

a) By express agreement – Authority is given to agent in written or by words of mouth. He can bind the principal to the third parties by his acts to the extent he is delegated with the authority.

b) By implied agreement

1. Agency by Estoppel – Where a person permit another to act on his behalf. Principal is estopped from denying his agent’s authority. E.g. A tell B in the presence of P that A is the agent of P. P does not contradict the statement. B enter into the contract with P on the belief that A is P’s agent. In such case P would be bound by the contract. He is not the agent. He ceases to be an agent

2. Agency by holding out – Some positive conduct of the principal indicates that a particular person is his agent.

P sends A to buy goods on credit from C. A buys goods on credit for himself & refuses to pay. C sue P. P cannot plead that A had no authority.

3. Agency by necessity – When an agency is created by the circumstances. The impossibility of getting the instructions from the principal is the basis of creation of agency by necessity.

E.G. X sent some horses to Y through a railway company. But Y did not take the delivery of the horses at the destination with the result the railway company had to feed the horses. Held, the railway co. was an agent of necessity & could recover the amount spent on feeding the horses.

4. Agency by ratification – Ratification means subsequent adoption or acceptance by a person of an unauthorized act done by another on his behalf without any authority. X buys 5 bags of wheat on behalf of Y without his knowledge or authority. Y would be bound by the contract, if he ratify or accept the same. It can be expressed or implied.

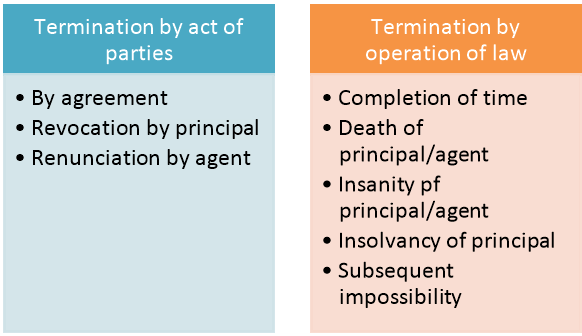

C. MODES OF TERMINATION OF AGENCY

Different modes of termination of agency are discussed below-

Figure: Modes of termination of agency

1. By the Act of the Parties:

The agency can be terminated by the act of the Principal or agent by any of the following mode:

(A) By agreement: - By mutual agreement between Principal and Agent the agency can be terminated at any time or any stage.

(B) Revocation by the Principal:- Agency can be terminated by the Principal revoking the Agent's authority. The Principal can revoke only his agent's authority when it has not been exercised by the Agent Reasonable notice must be given for such revocation. Revocation may be express or complied. For example – A empowers B to let A's house. Afterwards A lets it himself. This is an implied revocation of B's authority.

(i) Where Authority has been partly exercise Principal cannot revoke his Agent's authority: - [S.204]- The principal cannot revoke the authority given to his agent after the authority has been partly exercised, so far as regards such acts and obligations as arise from acts already done in the agency. Examples: (a) A authorizes B to buy 1,000 bales of cotton on account of A, and to pay for it out of A's moneys remaining in B's hands. B buys 1,000 bales of cotton in his own name, so as to make himself personally liable for the price. A cannot revoke B's authority so far as regards payment for the cotton.

(b) A authorizes B to buy 1,000 bales of cotton on account of A, and to pay

for it out of A's moneys remaining in B's hands. B buys 1,000 bales of cotton in A's name, and so as not to render himself personally liable for the price. A can revoke B's authority to pay for the cotton’

(ii) Termination of agency where agent has an interest in subject- matter [S.202]- Where the agent has himself an interest in the property which forms the subject-matter of the agency, the agency cannot, in the absence of an express contract, be terminated to the prejudice of such interest. Such type of agency is called agency coupled with interest or irrevocable agency.

Example: A gives authority to B to sell A's land, and to pay himself, out of the proceeds, the debts due to him from A. A cannot revoke this authority, nor can it be terminated by his insanity or death.

(C) Renunciation by Agent- Agency can be renunciated by the agent is the same manner in which the principal can revoke the agent's authority.

Compensation for revocation by principal, or renunciation by agent [S.205]- Where there is an express or implied contract that the agency should be continued for any period of time, the principal must make compensation to the agent, or the agent to the principal, as the case may be, for any previous revocation or renunciation of the agency without sufficient cause.

Notice of revocation or renunciation[S.206]- Reasonable notice must be given of such revocation or renunciation otherwise the damage thereby resulting to the principal or the agent, as the case may be, must be made good to the one by the other.

3. Revocation Agency of Operation of Law

(A) Completion of Business or Expiry of time: - When the business of agency is completed, the relationship between Principal and agent also comes to an end automatically. Similarly, where the agency has been created for a fixed time the Agency is automatically terminated on the expiry of that time.

(B) Death of the Principal or Agent:- When either the principal or the agent dies, the agency relationship is automatically terminated.

(C) Insanity of Principal or agent- When either the principal or his agent becomes unsound mind, the agency relationship is automatically terminated.

(D) Insolvency of the Principal-When the Principal is declared as an insolvent, the agency relationship is terminated.

(E) Subsequent impossibility- Agency is also terminated when after the creation of the agency.

i) the subject matter of the agency business is destroyed:

(ii) Business of the agency becomes lawful.

Duties of agent

Rights of an agent

Rights of the Principal

The duties of the agent are the rights of the principal, such as:

Duties of Principal

The duties of the principal are the rights of the agent, such as:

References-

1. Kappoor, N.D. (2019). Business Law, New Delhi, Sultan Chand & Sons (P) Ltd.

2. Tulsiam, P.C. (2019). Business Law, 4th edition), New Delhi, McGraw Hill Education (MGH).