UNIT – 5

THE NEGOTIABLE INSTRUMENTS (AMMENDED) ACT 2015

Case study (K.Ramalakshmi vs Swarnalatha on 4 November, 2013)

It is brought to the notice of this Court that the learned Judicial Magistrates in some districts take the complaints filed under Section 138 of Negotiable Instruments Act as Calendar Cases while some others take them on file as Summary Trial Cases. In this context, Negotiable Instruments Amendment Act, 2002 has to be taken note of and followed in letter and spirit. Section 143 which has been inserted by the Amendment Act of 2002, stipulates that notwithstanding anything contained in the Code of Criminal Procedure, all offences contained under Chapter XVII of Negotiable Instruments Act dealing with dishonour of cheques for insufficiency etc. of funds in the accounts, shall be tried by a Judicial Magistrate and the provisions of Sections 262 to 265 Cr.P.C, prescribing procedure for summary trials, shall apply to such trials and it shall be lawful for a Magistrate to pass sentence of imprisonment for a term not exceeding one year and an amount of fine exceeding Rs.5,000/- and it is further provided that in the course of a summary trial, if it appears to a Magistrate that the nature of the case requires passing of a sentence of imprisonment, exceeding one year, the Magistrate, after hearing the parties, record an order to that effect and thereafter recall any witness and proceed to hear or rehear the case in the manner provided in Criminal Procedure Code.

A. CONCEPT

According to Section 13 (1) of the Negotiable Instruments Act, 1881, “A negotiable instrument means a promissory note, bill of exchange, or cheque payable either to order or to bearer”. “A negotiable instrument may be made payable to two or more payees jointly, or it may be made payable within the alternative to one of two, or one or some of several payees” [Section 13(2)].

B. CHARACTERTICS/FEATURES OF A NEGOTIABLE INSTRUMENT

The characteristics or features of negotiable instruments are-

1. It may be a written document by which certain rights are created and or/ transferred to a particular person.

2. It must be signed by the maker or the drawer as the case may be.

3. There must exists the unconditional order or promise to pay.

4. There must be a time mentioned for such payment.

5. In particular cases, the drawer’s name should be specifically mentioned.

C. CLASSIFICATION OF NEGOTIABLE INSTRUMENTS

We can study negotiable instruments under the subsequent broad classifications. These classifications depend upon various features like transferability, negotiability, rights of holders, etc.

1. Bearer Instruments

There are two important conditions for negotiable instruments to become payable to bearers. Firstly, parties to the transactions must express it to be so payable. Secondly, the only endorsement for it should be an endorsement in blank. These two requirements basically imply that any holder of such instruments can obtain payment for them. For instance, a bill of exchange is payable to a person who holds it. These bearer instruments include cheque, bills of exchange and promissory notes.

2. Order Instruments

Negotiable instruments can often be payable to order in certain cases. They're payable when the instruments expressly state them to be so. Furthermore, they'll be payable to order only to a selected person. The only requirement is that there should be no prohibition on their transferability.

3. Inland Instruments

Section 11 of the NI Act deals with inland instruments. This provision basically regulates instruments that are drawn and made payable in India. Alternatively, they'll be payable outside India but as long as they're drawn upon by an Indian resident.

4. Foreign Instruments

Every instrument that's not inland automatically becomes a far off instrument. These instruments are drawn during a foreign country but could also be payable within or outside India. They’ll even originate in India but just for payment to an individual who resides abroad.

5. Demand Instruments

Sometimes, an instrument might not specify a time period during which it remains payable. Such instruments are generally payable whenever the bearer demands. Examples of such instruments include promissory notes and bills of exchange.

6. Time Instruments

Unlike demand instruments, time instruments carry a hard and fast future date for payment. For instance, a note may carry a maturity arising after 24 months of its issue. Such instruments may even become payable upon the happening of a selected future event.

7. Ambiguous Instruments

An ambiguous instrument is essentially 0ne which will be either a bill or a note for its holder. Such situations arise in peculiar circumstances only. For instance, sometimes the Drawee could also be a fictitious person or he could also be incompetent to contract.

Under such circumstances, the holder of such instruments may treat them either as bills of exchange or as promissory notes.

8. Incomplete instruments

Incomplete instruments lack certain essential requirements of typical negotiable instruments. In such cases, the holder of the instrument has the authority to complete it up to the amount mentioned therein. This, in turn, leads to the creation of legally binding negotiable instrument payable by law. Not only the first holder but also any subsequent holder who procures such instruments can complete them.

D. MATURITY OF INSTRUMENTS

According to section 22 “Maturity” means the maturity of a promissory note or bill of exchange is that the date at which it falls due.

DAYS OF GRACE

Every promissory note or bill of exchange which isn't expressed to be payable on demand, at sight or on presentment is at maturity on the third day after the day on which it's expressed to be payable.

CALCULATING MATURITY OF BILL OR NOTE PAYABLE NUMEROUS MONTHS AFTER DATE OR SIGHT AS PER SECTION

In calculating the date at which a promissory note or bill of exchange, made payable a stated number of months after date or after sight, or after a particular event, is at maturity, the amount stated shall be held to terminate on the day of the month which corresponds with the day on which the instrument is dated, or presented for acceptance or sight, or noted for non-acceptance, or protested for non-acceptance, or the event happens, or, where the instrument may be a bill of exchange made payable a stated number of months after sight and has been accepted for honor, with the day on which it had been so accepted. If the month during which the amount would terminate has no corresponding day, the amount shall be held to terminate on the last day of such month.

Illustrations

(a) A negotiable instrument, dated 29th January, 1878, it made payable at one month after date. The instrument is at maturity on the third day after the 28th February, 1878.

(b) A negotiable instrument, dated 30th August, 1878, it made payable three months after date. The instrument is at maturity on the 3rd December, 1878.

(c) A promissory note or bill of exchange, dated 31st August, 1878, is formed payable three months after date. The instrument is at maturity on the 3rd December, 1878.

CALCULATING MATURITY OF BILL OR NOTE PAYABLE NUMEROUS DAYS AFTER DATE OR SIGHT (SECTION 24)

In calculating the date at which a note or bill of exchange made payable a particular number of days after date or after sight or after a particular event is at maturity, the day of the date, or of presentment for acceptance or sight, or of protest for non-acceptance, or on which the event happens, shall be excluded.

WHEN DAY OF MATURITY MAY BE A HOLIDAY AS PER SECTION 25

When the day on which a note or bill of exchange may be a t maturity is a public holiday, the instrument shall be deemed to be due on subsequent preceding, business day.

A. CONCEPT

PROMISSORY NOTES

Section 4 of the Act defines, “A promissory note is an instrument in writing (promissory note being a bank-promissory note or a currency promissory note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money to or to the order of a certain person, or to the bearer of the instruments.” The one that makes the promissory note and promises to pay is named the maker. The person to whom the payment is to be made is named the payee.

Examples:

A Signs instruments within the following terms

a) I promise to pay B or order Rs. 500."

b) I promise to pay B Rs. 500 which shall flow from to him.

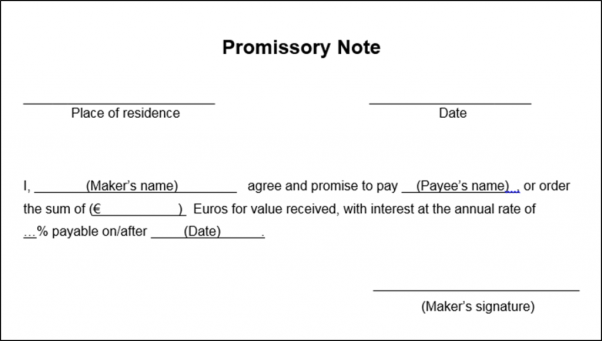

Specimen of promissory note

Source: https://paiementor.com

BILL OF EXCHANGE

According to Section 5 of the act, A bill of exchange is “an instrument in writing containing an unconditional order signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a particular person or to the bearer of the instrument”. It’s also called a Draft.

SPECIAL BENEFITS OF BILL OF EXCHANGE:

• A bill of exchange may be a double secured instrument.

• In case of immediate requirement, a Bill could also be discounted with a bank.

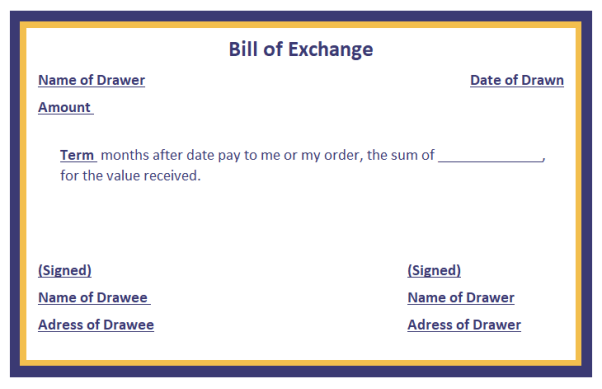

Specimen of bills of exchange

Source: https://tutorstips.com

B. ESSENTIALS OF PROMISSORY NOTE

Promissory notes must contain the following essentials elements;

C. ESSENTIAL FEATURES OF PROMISSORY NOTE AND BILLS OF EXCHANGE

ESSENTIAL FEATURES OF A PROMISSORY NOTE

• It is an Instrument in Writing,

• It may be a Promise to Pay,

• Signed by the Maker,

• Other Formalities,

• Definite and Unconditional Promise,

• Promise to Pay Money Only,

• Maker must be a particular Person,

• Payee must be sure,

• Sum Payable must be sure,

• It could also be Payable on Demand or after a particular Period of time,

• It can't be Made Payable to Bearer on Demand.

ESSENTIAL ELEMENTS OF BILL OF EXCHANGE

• It must be in Writing,

• Order to pay,

• Drawee,

• Signature of the Drawer,

• Unconditional Order,

• Parties,

• Certainty of Amount,

• Payment in a similar way isn't Valid,

• Stamping,

• Cannot be made Payable to Bearer on Demand,

D. KINDS OF PROMISSORY NOTE AND BILLS OF EXCHANGE

TYPES OF PROMISSORY NOTES

Depending upon the kind of promissory loan, notes are of various types. Few are mentioned below.

CLASSIFICATION OF BILL OF EXCHANGE

The classifications of bills of exchange are discussed below

Inland Bill:

• It’s drawn in India on an individual residing in India whether payable in or outside India; or

• It’s drawn in India on an individual residing outside India but payable in India. ◦

Foreign Bill:

• A bill drawn in India on an individual residing outside India and made payable outside India.

• Drawn upon an individual who is that the resident of a distant country.

2. Time and Demand Bills:

Time Bill:

A bill payable after a tough and fast time is termed as a time bill. A bill payable “after date” could also be a time bill.

Demand Bill:

A bill payable at sight or on demand is termed as a requirement bill.

3. Trade and Accommodation Bills:

Trade Bill:

A bill drawn and accepted for a real trade transaction is termed as “trade bill”.

Accommodation Bill:

A bill drawn and accepted not for a real trade transaction but only to provide financial help to some party is termed as an “accommodation bill”.

PARTIES TO A PROMISSORY NOTE

Maker is that the one that promises to pay the quantity stated within the promissory note.

2. Payee:

Payee is that the person to whom the quantity of the promissory note is payable.

3. Holder:

He is either the payee or the person to whom the promissory note may are endorsed.

PARTIES TO A BILL OF EXCHANGE

1. Drawer:

The maker of a bill of exchange is named the drawer.

2. Drawee:

The person directed to pay the money by the drawer is named the drawee.

3. Payee:

The person named within the instrument, to whom or to whose order the money are directed to be paid by the instruments are called the payee.

A CONCEPT

Consistent with Section 6 of the act, A cheque is “a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand”. A cheque is additionally, therefore, a bill of exchange with two additional qualifications:

• It is usually drawn on a specified banker.

• It is usually payable on demand.

ESSENTIAL ELEMENTS OF A CHEQUE

The essential elements of cheque are-

B. TYPES OF CHEQUE

Some of the most common forms of cheque are discussed below-

1. Bearer Cheque

The first among the kinds of Cheques is that the bearer cheque. This cheque is payable to the bearer of the check or whose name the cheque carries within the column meant for the name of the drawee. Ideally, this cheque has “or bearer” printed at the top of the dotted lines, which is supposed to possess the name of the drawee. These cheques are often presented over the counter of the drawee bank and is payable to the one presenting it. It's a transferable instrument and thus are often passed on to a different by mere delivery, there's no got to endorse this kind of cheque.

2. Order Cheque

In this cheque, the printed word “bearer” is canceled thereby making it payable only to the person whose name is written within the place of drawee. Once “bearer” has been canceled on the cheque, it's automatically understood that this is often an order cheque and therefore the bank can only complete the transaction once they need identified, to their satisfaction, the bearer of the cheque to be an equivalent person, as named in it.

3. Crossed Cheque

In a crossed cheque, the drawer makes two parallel transverse lines at the top left corner of the cheque with or without writing “a/c payee”. This makes sure that regardless of who presents the cheque to the drawer bank, the transaction is formed into the account of the person named within the cheque only. The advantage of cross cheque is that it reduces the danger of cash being given to an unauthorized person because this sort of cheque can only be cashed by the drawee’s bank.

4. Open Cheque

It also known sometimes as an uncrossed cheque. Any cheque that's not crossed comes under open cheque category. This cheque is often presented to the drawer’s bank and is payable to the person presenting it. The drawee of this cheque also can transfer it to a different person by writing their name on the cheque and thereby making them the drawee. to form the cheque open, the word OPEN shouldn't be crossed off, and therefore the before the person issuing the cheque must ensure his/her signatures on both the front and the back of the cheque. Otherwise, the payee could also be denied the payment by the bank. The payee is additionally expected to sign at the rear of the cheque while receiving the amount.

5. Post- Dated Cheque

A cheque bearing a later date than the one on which it's actually issued, is named as a post-dated cheque. This cheque maybe presented to the drawee bank at any time after its issuance, but the cash won't be transferred from the account of the payer until the date mentioned on the cheque. The payee also can present the cheque after the date mentioned on the cheque too. It'll still be valid, and therefore the money are going to be transferred to the payee’s account.

6. Stale Cheque

As the name suggests, a stale cheque is one which is past its validity period and may not be enchased. Initially, this era was six months from the date of issue. Now, this era has been reduced to 3 months.

7. Travelers’ Cheque

These could also be equated with a universally accepted currency. A travelers’ cheque is out there almost everywhere and comes in various denominations. This is often an instrument issued by the bank itself to form payments from one place to a different. There's no expiry date of a travelers’ cheque and thus it are often used during your next travel also, or you have the option to encash it once you land back in India.

8. Self Cheque

The drawer usually issues a self-cheque to his or her self. The name column of the drawee has the word “self” written in it. A self-cheque is drawn when the drawer wishes to withdraw money from the bank in cash for his use. This cheque can only be encashed within the account holder’s or the drawer’s bank. This cheque must be used carefully because if it's lost, another person may easily catch on encashed by visiting the drawer’s bank.

9. Bankers Cheque

A banker’s cheque, as is self-explanatory here, may be a cheque issued by the bank on behalf of the account holder so as to form payment of a specified sum, by order, to another person within an equivalent city. It's valid just for three months from the date of issue, but if needed, are often re-validated upon fulfilling certain legal obligations.

PARTIES TO A CHEQUE

There are three parties involved in cheque-

Drawer is that the one that draws the cheque.

2. Drawee/Banker:

Drawee is that the drawer’s banker on whom the cheque has been drawn.

3. Payee:

Payee is that the one that is entitled to receive the payment of a cheque.

C. CROSSING OF CHEQUES

Crossing is a direction given by the customer to the banker that payment shouldn't be made across the counter. Crossing means drawing two parallel transverse lines with or without particular abbreviations. A cheque that's not crossed is an open cheque. It is a measure of safety against theft or loss of cheques in transit.

Crossing is of three types-

In special crossing, the cheque bears across its face an addition of the banker’s name, with or without the words ‘not negotiable’. In this case, the paying banker will pay the amount of cheque only to the banker whose name appears in the crossing or to his collecting agent. Thus, the paying banker will honor the cheque only when it is ordered through the bank mentioned in the crossing or its agent bank. However, in special crossing two parallel transverse lines are not essential but the name of the banker is most important.

Source: https://bank.caknowledge.com

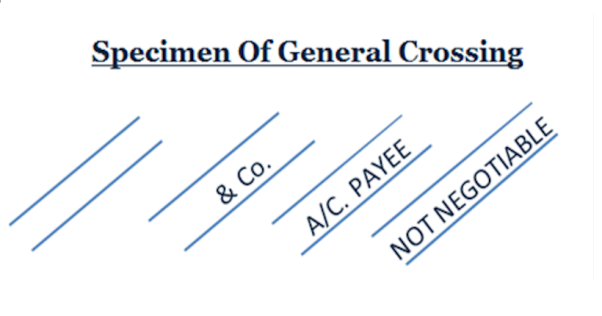

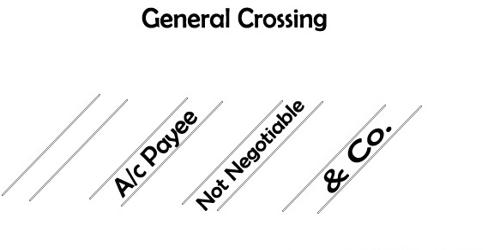

2. General crossing

In general crossing, the cheque bears across its face an addition of two parallel transverse lines and/or the addition of words ‘and Co.’ or ‘not negotiable’ between them. In the case of general crossing on the cheque, the paying banker will pay money to any banker. For the purpose of general crossing two transverse parallel lines at the corner of the cheque are necessary. Thus, in this case, the holder of the cheque or the payee will receive the payment only through a bank account and not over the counter. The words ‘and Co.’ have no significance as such.

Source: https://bank.caknowledge.com

3. Restrictive crossing:

This type of crossing restricts the negotiability of the cheque. It directs the collecting banker that he needs to credit the amount of cheque only to the account of the payee, or the party named or his agent. Where the collecting banker credits the proceeds of a cheque bearing such crossing to any other account, he shall be guilty of negligence.

D. DISHONOUR OF CHEQUE

Section 138 was inserted into the Act vide amendment of 1988. Dishonor of cheque section 138 covers the provision for dishonor of cheque for insufficiency etc. of funds within the account of drawer. The drawer pays off his liability to the payee through cheque and when bank returns the cheque unpaid because of insufficient balance on the account held by the drawer, the liability/debt remains thanks to the drawer and therefore the amount remains unpaid. are often " this is often referred to as the dishonor of cheque The return of cheque can be thanks to insufficient funds within the account or due to exceeding the limit of the amount which was agreed to be paid by the bank. Such a default by a person, creates a liability under the said provision. Prior to 1988, just in case a cheque wasn't honored on presentment, the sole remedy available under the Act was to file a civil suit within the court against the offender. However, this remedy didn't have a desired deterrent effect on offenders and cheque started losing their credibility. Hence, the Act was amended several times to include more stringent provisions to affect dishonor of cheque. The Banking, Public Financial Institutions and Negotiable Instruments Laws (Amendment) Act, 1988 amended the Act to form dishonor of cheque a criminal liability and offenders were liable to be punished by imprisonment for a term which can reach 1 (one) year, or with fine which can reach twice the quantity of the cheque, or with both. The Negotiable Instruments (Amendment and Miscellaneous Provisions) Act, 2002 further extended the term of imprisonment to up to 2 (two) years.

Cheque can be dishonor due to the following reasons-

1. Insufficient Funds

One of the most prevalent reasons for dishonouring of the cheque is lack of funds in the account. If the customer have issued a cheque linked to the account with fewer amounts than the amount he have written in the cheque, then the bank would not find enough money to complete the transaction. This non-availability of requisite balance would stop the payment, and the bank would dishonour the cheque.

2. Irregular Signature

Nowadays, people have started using digital banking, and cheques are the few financial instruments relying on signatures. Yet it holds a lot of importance as it is a primary element of cheques. Bank will never accept the cheque if the signature of the issuer does not tally with the specimen signature available with the bank.. If it does not match as per the bank records, then your cheque would not be approved by the bank. Another thing to keep in mind is that you should never sign on the MICR band on the cheque and it also leads to dishonouring of the cheque. Thus it would help if you were very careful while signing on it.

3. Date of Cheque

The date holds a lot of significance in the cheque, and any difference or problem with it can lead to disapproval or dishonouring of the cheque. It is a vital piece of information and thus cannot be taken lightly. Usually, the issue that comes with the date is that it can be disfigured, illegible or has some error or is scribbled; if there is any of this on your cheque, then it can lead your cheque to dishonour. If the date is not definite, then the bank would have no option but to reject it. Also, another reason for cheque bounce can be when the date has expired. There is an order by the Supreme Court that Cheque cannot be cashed after a period of 3 months.

4. Post-Dated Cheque

A post-dated cheque is one on which the date mentioned is yet to come. Post-dated cheques are issued for a future date and cannot be presented in the bank before the date mentioned on the cheque as it gets dishonoured.

5. The difference in the amount in words and numbers

In case if the drawer write incorrect amount as expressed by the difference in words and numbers your cheque would bounce. Also, if there are numbers in words sections or words in the numbers section, then also the bank would not approve your cheque. For example, in words section, you write fifteen thousand only but in the amount in figures you write 1, 50,000. This is a huge difference, and the bank would dishonour your cheque.

6. Damaged Cheque

The bank does not accept any cheque that is damaged or torn or whose condition is not good. Also, if the details on the cheque are not clear, it would get dishonoured. Moreover, if it has too many stains for whatever reasons it would get rejected by the bank, perhaps, it essential for the holder to preserve the cheque properly so that it does not get dishonoured.

7. Scribbling and overwriting on Cheque

If there is any scribbling, correction or overwriting on the cheque, then the bank does not accept the cheque. Because of any reason if you have to make any changes, always issue a fresh cheque so that it does not get dishonoured. Cheques are like notes which should not be overwritten. As scribbled or overwritten cheques appear scrupulous and are not accepted by the bank.

8. When payment is stopped

This happens when the drawer asks the bank to stop the cheque and do not clear the payment, in such a situation the cheque would bounce, and the payee would not receive the amount mentioned in the cheque. These are some of the primary reasons why the cheque gets rejected by the bank, and it is paramount to know them well so that you can stay away from any unwanted hassle.

FILING A COMPLAINT UNDER SECTION 138 OF THE ACT

For filing a complaint, the complainant must follow these steps;

1. Dishonor of Cheque(s):

The complainant should have deposited the cheque drawn in his/its favour, which cheque(s) has been returned unpaid or has been dishonored due to:

• Insufficiency of fund within the account of the drawer;

• Issuance of order instructions by the drawer to the drawer bank;

• Amount of cheque exceeding the arrangement with the drawer bank.

2. Notice asking for payment of dues:

A legal notice for cheque dishonor is necessary before any action. This Act provides that, once the cheque has been dishonored, a notice must be issued (by registered A.D.) to the drawer within 30 days of the receipt of memo from drawee bank that the cheque is dishonored.

3. Filing complaint:

Where on the receipt of notice, if the drawer after the dishonor of cheque remains silent or refuses to pay the cash within 15 days from the date of receipt of notice, then a criminal complaint should be filed against the drawer (“Accused”) within next 30 days from the expiry of time period provided to the drawer.

4. Place of filing the complaint:

The place for filing the complaint shall be determined based on any of the following;

• Place of the bank on which the cheque is drawn;

• Place where cheque is presented to the bank and therefore the same is dishonoured;

• Place of residence/business of the complainant;

• Place of residence/business of Accused;

• Place from where the notice is sent to the drawer of the cheque demanding the cheque amount.

5. Contents of criminal complaint:

A complaint should contain complete details about the complainant, Accused, details of the transaction, details of the notice sent to Accused, jurisdiction clause, limitation clause, prayers posing for compensation and punishment for the Accused. The complaint should even be accompanied with all the important attachments i.e. the list of witnesses, list of all original documents and copies, board resolution giving authority to an individual to file complaint on behalf of the company (if applicable) etc.

6. Issuance of summons:

Upon filing of complaint and completion of all procedural aspects, the Magistrate before whom the complaint is filed shall verify the documents and upon subsequent verification, shall issue summons against the Accused.

7. Post – Issuance of summons:

On issuance of summons, the Accused may appear or might not appear. On appearance of the Accused; the plea of the Accused shall be recorded and therefore the proceedings shall be conducted as per Section 262 and 265 of CrPC. Where Accused fails to appear, a bailable warrant shall be issued against the Accused. Even after this, where the Accused fails to appear, a non-bailable warrant are going to be issued. If the Accused appears, the procedure are going to be an equivalent as within the case of issuance of summons. However, If the Accused fails to secure his attendance, then by courts order, Accused shall be declared absconding and a notice shall be issued in local newspaper in respect of an equivalent. Properties of the Accused are going to be attached and can be sold by public auction. Complainant can recover his dues out of the sale proceeds.

8. Orders:

Upon hearing the parties, the court may pass any of the subsequent orders;

• The Accused could also be acquitted of all the charges; or

• The Accused could also be held guilty of the offence committed under Dishonor of cheque Section 138 of the Act and shall be penalized as follows;

• Imprisonment up to 2 years; or

• Monetary fine which can extend to twice the amount of cheque; or

• Both imprisonment and fine; or

• paying off the dishonored cheque amount to the complainant.

E. PENALTIES

LIABILITY OF A DRAWER OF A DISHONOURED CHEQUE

Civil liability

Where a cheque is dishonored, the legal position of the drawer of the cheque becomes that of a principal debtor to the holder. The holder can bring civil suit a bit like any creditor to recover the quantity from the drawer making him liable as principal debtor.

Criminal liability

A drawer of a cheque is deemed to possess committed a criminal offence when the cheque drawn by him is dishonoured by the drawee on account of insufficiency of funds.

The criminal liability of a drawer just in case of dishonour of cheque is dealt in section 138 to Section 142 of legal document Act 1881.

MAXIMUM PUNISHMENT

The maximum punishment for such an offence is imprisonment upto 2 years or fine upto twice the amount of cheque or both. Where the cheque is drawn by a company, a firm, or association of individuals, the punishment are often awarded to each one that was in-charge of and was liable for its conduct of business and also to the company.

F. DISTINGUISH BETWEEN BILLS OF EXCHANGE AND CHEQUES

Basis of difference | Bills of exchange | Cheque |

| A bill of exchange usually drawn on some person or firm | A cheque is always drawn on bank |

2. Acceptance | It is essential that a bill of exchange must be accepted before its payment can be claimed | A cheque does not require any such acceptance |

3. Payable on demand | The B.O.E. may be drawn payable on demand | A cheque can only be drawer payable on demand |

4. Grace of days | Three days are allowed in case of B.O.E. | In case cheque no grace of days are allowed |

5. Notice of dishonor | It is necessary in B.O.E. | No. such notice is required |

6. Crossing | No crossing of bills of exchange | A cheque may be crossed |

7. Stamp | It must be properly stamped | No stamp is required |

A. CONCEPT

HOLDER

According to sec. 8, Holder of a negotiable instrument is that the person:

In case the instrument (promissory note, bill or cheque) is lost or destroyed, the one that has entitled in his own name to the possession of it or to receive or recover the quantity due thereon from the parties thereto is that the holder of.

Who are often a Holder?

• Payee:

The payee is typically the first holder of an instrument. He remains holder till he endorses the instrument.

• Endorsee:

The person to whom an instrument is endorsed becomes holder of in situ of the endorser. An instrument, when endorsed and delivered, the endorsee becomes the holder.

• Bearer:

In the case of a bearer instrument, the person to whom the instrument is delivered becomes the holder. But every bearer of an instrument cannot become the holder.

Example: a thief or a finder of a bearer instrument or a servant possessing an instrument on behalf of his employer cannot become holder.

• Legal representative or heir- a legal representative or heir of a deceased person can become holder by operation of law albeit he's not the payee or the bearer or the endorsee of the instrument.

B. HOLDER IN DUE COURSE:

Holder in due course may be a one that came into possession of the instrument on payment of consideration and without knowledge of the very fact that the erstwhile owner had a defective title. The holder in due course features a better title than the holder. Therefore, consistent with sec. 9 of the negotiable instrument Act, holder in due course mans a person who for consideration became the possessor of a note, bill of exchange or cheque if payable to bearer, or the payee or endorsee thereof, if payable to order before the quantity mentioned in it became payable, and without having sufficient cause to believe that any defect existed within the title of the person from whom he derived his title. [sec. 9].

C. RIGHTS OF HOLDER IN DUE COURSE

The rights of a holder in due course of a negotiable instrument are qualitatively, as matters of law, superior to those provided by ordinary species of contracts:

PRIVILEGES OF A HOLDER IN DUE COURSE

D. PAYMENT IN DUE COURSE AS PER SECTION 10

"Payment in due course" means payment in accordance with the apparent tenor of the instrument in good faith and without negligence to a person in possession thereof under circumstances which don't afford an inexpensive ground for believing that he's not entitled to receive payment of the amount therein mentioned.

E. NOTING UNDER SECTION 99

When a note or bill of exchange has been dishonored by non-acceptance or non-payment, the holder may cause such dishonor to be noted by a notary public upon the instrument, or upon a paper attached thereto, or partly upon each. Such note must be made within a reasonable time after dishonor, and must specify the date of dishonor, the rationale, if any, assigned for such dishonor, or, if the instrument has not been expressly dishonored, the reason why the holder treats it as dishonored, and therefore the notary's charges.

F. PROTEST UNDER SECTION 100

When a note or bill of exchange has been dishonoured by non-acceptance or non-payment, the holder may, within an inexpensive time, cause such dishonour to be noted and authorized by a notary public. Such certificate is named a protest.

Protest for better security:

When the acceptor of a bill of exchange has become insolvent, or his credit has been publicly impeached, before the maturity of the bill, the holder may, within a reasonable time, cause a notary public to demand better security of the acceptor, and on its being refused may, within a reasonable time, cause such facts to be noted and authorized as aforesaid. Such certificate is called a protest for better security.

CONTENTS OF PROTEST AS PER SECTION 101

A protest under section 100 must contain

(a) either the instrument itself, or a literal transcript of the instrument and of everything written or printed thereupon;

(b) the name of the person for whom and against whom the instrument has been protested;

(c) a press release that payment or acceptance, or better security, because the case could also be , has been demanded of such person by the notary public; the terms of his answer, if any, or a press release that he gave no answer or that he couldn't be found;

(d) When the note or bill has been dishonored, the place and time of dishonor, and, when better security has been refused, the place and time of refusal;

(e) The subscription of the notary public making the protest;

(f) within the event of an acceptance for honor or of a payment for honor, the name of the person by whom, of the person for whom, and therefore the manner during which , such acceptance or payment was offered and effected.

NOTICE OF PROTEST AS PER SECTION 102

When a note or bill of exchange is required by law to be protested, notice of such protest must tend rather than notice of dishonor, within the same manner and subject to equivalent conditions; but the notice could also be given by the notary who makes the protest.

PRESUMPTIONS ON NEGOTIABLE INSTRUMENTS AS PER SECTION 118

Until the contrary is proved, the subsequent presumptions shall be made:

(a) Of consideration:—that every negotiable instrument was made or drawn for consideration, which every such instrument, when it's been accepted, indorsed, negotiated or transferred, was accepted, indorsed, negotiated or transferred for consideration;

(b) On date:—that every negotiable instrument bearing a date was made or drawn on such date;

(c) On time of acceptance:—that every accepted bill of exchange was accepted within a reasonable time after its date and before its maturity;

(d) On time of transfer:—that every transfer of a negotiable instrument was made before its maturity;

(e) On order of endorsements:—that the endorsements appearing upon a negotiable instrument were made within the order during which they seem then on;

(f) On stamp: — that a lost note, bill of exchange or cheque was duly stamped;

(g) that holder may be a holder in due course:— that the holder of a negotiable instrument may be a holder in due course : as long as , where the instrument has been obtained from its lawful owner, or from a person in lawful custody thereof, by means of an offence or fraud, or has been obtained from the maker or acceptor thereof by means of an offence or fraud, or for unlawful consideration, the burden of proving that the holder may be a holder in due course lies upon him.

PRESUMPTION ON PROOF OF PROTEST AS PER SECTION 119

In a suit upon an instrument which has been dishonoured, the Court shall, on proof of the protest, presume the very fact of dishonour, unless and until such fact is disproved.

Estoppel Against Denying Original Validity Of Instrument as Per Section 120

No maker of a promissory note and no drawer of a bill of exchange or cheque, and no acceptor of a bill of exchange for the honour of the drawer shall, during a suit thereon by a holder in due course, be permitted to deny the validity of the instrument as originally made or drawn.

ESTOPPEL AGAINST DENYING CAPACITY OF PAYEE TO INDORSE AS PER SECTION 121

No maker of a note and no acceptor of a bill of exchange [payable to order] shall, in a suit thereon by a holder in due course, be permitted to deny the payee's capacity, at the date of the note or bill, to indorse an equivalent .

ESTOPPEL AGAINST DENYING SIGNATURE OR CAPACITY OF PRIOR PARTY AS PER SECTION 122

No endorser of a negotiable instrument shall, during a suit thereon by a subsequent holder, be permitted to deny the signature or capacity to contract of any prior party to the instrument.

LAW GOVERNING LIABILITY OF MAKER, ACCEPTOR OR INDORSER OF FOREIGN INSTRUMENT AS PER SECTION 134

In the absence of a contract to the contrary, the liability of the maker or drawer of a far off promissory note, bill of exchange or cheque is regulated altogether essential matters by the law of the place where he made the instrument, and therefore the respective liabilities of the acceptor and indorser by the law of the place where the instrument is formed payable.

LAW OF PLACE OF PAYMENT GOVERNS DISHONOR AS PER SECTION 135

Where a note, bill of exchange or cheque is formed payable during a different place from that during which it's made or indorsed, the law of the place where it's made payable determines what constitutes dishonour and what notice of dishonour is sufficient.

INSTRUMENT MADE, ETC., OUT OF INDIA, BUT IN ACCORDANCE WITH THE LAW OF INDIA AS PER SECTION 136

If a legal document is formed , drawn, accepted or indorsed 2 [outside India], but in accordance with the three [law of India], the circumstances that any agreement evidenced by such instrument is invalid consistent with the law of the country wherein it had been entered into doesn't invalidate any subsequent acceptance or endorsement made thereon 4 [within India].

PRESUMPTION AS TO FOREIGN LAW AS PER SECTION 137

The law of any foreign country regarding promissory notes, bills of exchange and Cheques shall be presumed to be the same as that of 6 [India], unless and until the contrary is proved.

THE NEW AMENDED ACT, 2015 OF NEGOTIABLE INSTRUMENTS

The President of India has promulgated the Negotiable Instruments (Amendment) Ordinance, 2015 (6 of 2015) on 15th June 2015. The amendments to the Negotiable Instruments Act, 1881 (“The NI Act”) are focused on clarifying the jurisdiction related issues for filing cases for offence committed u/s 138 of the NI Act.

A three Judge Bench of the Hon’ble Supreme Court in Dashrath Rupsingh Rathod vs. State of Maharashtra held that a Complaint of dishonor of cheque are often filed only to the Court within whose local jurisdiction where the cheque is dishonored by the bank on which it's drawn. This judgment overruled the sooner two Judge Bench Judgment of the Hon’ble Supreme Court in K. Bhaskaran v. Sankaran Vaidhyan Balan.

The Hon’ble Supreme Court within the matter of Dashrath, directed that the complaints u/s 138 NI Act should be returned to the Complainant to presented within 30 days from the date of such return before the Court having jurisdiction where the cheque is dishonored by the bank on which it's drawn.

The amendment of 2015 inserted Section 142(2) within the Principal Act. The amendment reads as follows:

(2) The offence under Section 138 shall be inquired into and tried only by a court within whose local jurisdiction

(a) If the cheque is delivered for collection through an account, the branch of the bank where the payee or holder in due course, because the case could also be, maintains the account, is situated; or

(b) If the cheque is presented for payment by the payee or holder in due course otherwise through his account, the branch of the drawee bank where the drawer maintains the account is situating.

Explanation – For the aim of clause (a), where the cheque is delivered for collection at any branch of the bank of the payee or holder in due course, then, the cheque shall be deemed to possess been delivered to the branch of the bank during which the payee or holder in due course, because the case could also be, maintains the account.”

To cite examples to know the jurisdiction as per the amendment:

1. A holds and account with Fort Branch, Mumbai of XYZ Bank, issues a cheque payable at par in favor of B. B holds an account with M.G. Road Branch, Pune of PQR Bank, deposits the said cheque at Nagpur Branch of PQR Bank and therefore the cheque is dishonored. The Complaint will have been filed before the Court having local jurisdiction where M.G. Road Branch, Pune of PQR Bank is situated.

2. A holds an account with Fort Branch, Mumbai of XYZ Bank, issues a cheque payable at par in favor of B. B presents the said cheque at Nagpur Branch of XYZ Bank, (but B doesn't hold account in any branch of XYZ Bank) and therefore the cheque is dishonored. The Complaint will have been filed before the Court having local jurisdiction where Fort Branch, Mumbai of XYZ Bank is situated.

Therefore, to summarize, firstly, when the cheque is delivered for collection through an account the complaint is to be filed before the Court where the branch of the bank is situated, where the payee or the holder in due course maintains his account and secondly when the cheque is presented for payment over the counter the complaint is to be filed before the Court where the drawer maintains his account.

In addition to the aforesaid amendment, Section 142A is inserted which reads as follows:

(1) Notwithstanding anything contained within the Code of Criminal Procedure, 1973 or any judgment, decree, order or directions of any court, all cases arising out of section 138 which were pending in any court, whether filed before it, or transferred thereto , before the commencement of the Negotiable Instruments (Amendment) Act, 2015, shall be transferred to the court having jurisdiction under sub-section (2) of section 142 as if that sub-section had been effective in the least material times.

(2) Notwithstanding anything contained in sub-section (2) of section 142 or sub-section (1), where the payee or the holder in due course, because the case could also be , has filed a complaint against the drawer of a cheque within the court having jurisdiction under sub-section (2) of section 142 or the case has been transferred thereto court under sub-section (1), all subsequent complaints arising out of section 138 against an equivalent drawer shall be filed before an equivalent court regardless of whether those Cheques were presented for payment within the territorial jurisdiction of that court.

(3) If, on the date of commencement of the Negotiable Instruments (Amendment) Act, 2015, quite one prosecution filed by the same person against the same drawer of Cheques is pending before different courts, upon the said fact having been delivered to the notice of the court, such court shall transfer the case to the court having jurisdiction under sub-section 142(2) before which the primary case was filed as if that sub-section had been effective in the least material times.”

Sec. 142A is often summed up as under:

• All cases pending before any Court, whether filed before it or transferred thereto pending before 15th June 2015 shall be transferred to the Court having jurisdiction as per Sec. 142 (2).

• If a complaint is filed by the payee or the holder in due course against a drawer before the Court having jurisdiction u/s 142(2), all further complaints against that drawer shall be filed before the same Court where the primary complaint is filed, regardless of whether the cheque is presented or delivered for collection to the bank/ branch within the local limits of Court having jurisdiction where that bank/branch is situated.

• If on 15th June 2015, there are quite one cases u/s 138 NI Act pending between the same parties in several Courts, then the cases should be transferred to the Court having jurisdiction u/s 142 (2) and every one subsequent complaints between the same parties should be filed before the same Court.

In view of this amendment, all cases transferred pursuant to the judgment within the matter of Dashrath and every one other pending case would need to be transferred as per Sec. 142A

References-