Unit 2

Ratio Analysis and Interpretation

Case Analysis

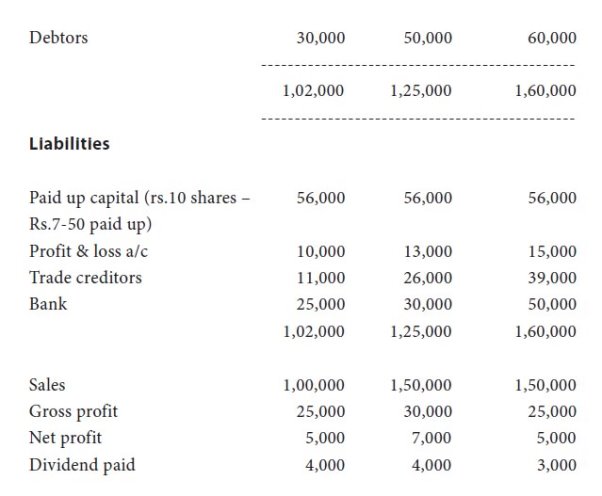

The following figures are extracted from the balance sheets of a Company:

The opening stock at the beginning of the year 2002-03 was rs.4,000. As a financial analyst comment on the comparative short-term, activity, solvency, profitability and financial position of the company during the three year period.

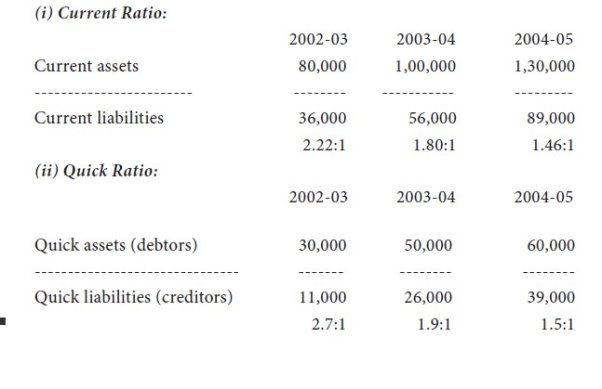

Solution: To test the short-term solvency the following ratios are calculated for three years:

I. Current ratio and

Ii. Quick ratio.

As the standard for current ratio is 2:1 the working capital position of the company has weakened in the 2nd year and 3rd year. However the quick ratio for all the three years is well above the standard of 1:1. Thus it can be said that the short term solvency position of the company shows a mixed trend.

As the standard for current ratio is 2:1 the working capital position of the company has weakened in the 2nd year and 3rd year. However the quick ratio for all the three years is well above the standard of 1:1. Thus it can be said that the short term solvency position of the company shows a mixed trend.

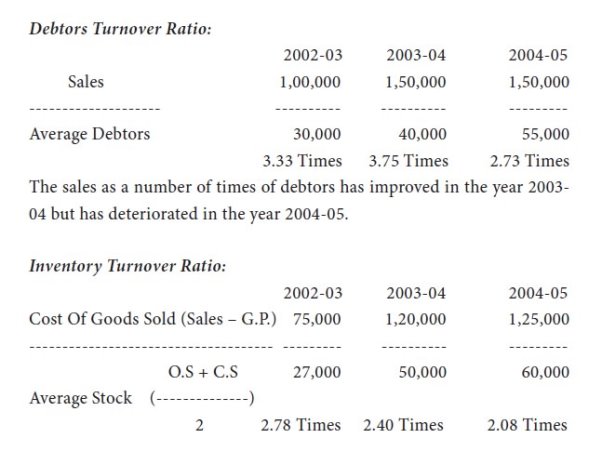

Activity Ratios:

To test the operational efficiency of the company the following ratios are calculated. Debtors turnover ratio and inventory turnover ratio.

Though there is no standard for inventory turnover ratio, higher the ratio, better is the activity level of the concern. From this angle the ratio has come down gradually during the three year period indicating slow moving of stock.

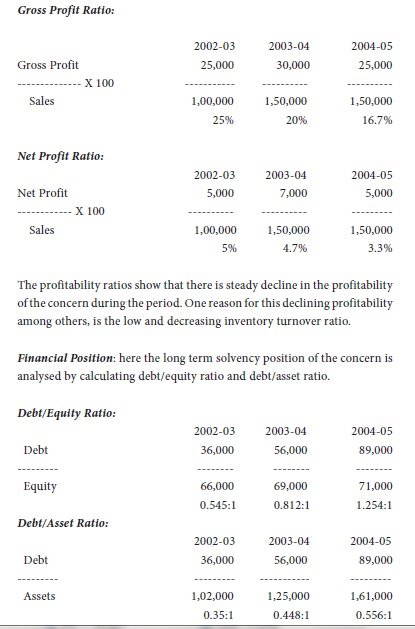

Profitability Ratios:

To analyse the profitability position of the company, gross profit ratio and net profit ratio are calculated.

Debt equity ratio expresses the existence of debt for every re.1 of equity. From this standpoint the share of debt in comparison to equity is increasing year after year and in the last year the debt is even more than equity. Debt asset ratio gives how much of assets have been acquired using debt funds. The calculation of this ratio reveals that in the 1st year 35% of assets were purchased using debt funds which has increased to 44.8% in the 2nd year and 55.6% in the 3rd year. Thus both the ratios reveal that the debt component in the capital structure is increasing which has far reaching consequences.

Ratio analysis is used to evaluate relationships among financial statement items. The ratios are used to identify trends over time for one organisation or to compare two or more organisations at one point in time. Ratio analysis focuses on three key aspects of a business: liquidity, profitability, and solvency. Ratio Analysis is an important tool for any business organisation. The computation of ratios facilitates the comparison of firms which differ in size. Ratios can be used to compare a firm's financial performance with industry averages. In addition, ratios can be used in a form of trend analysis to identify areas where performance has improved or deteriorated over time.

It deals with relationship between two items appearing in the balance sheet, e.g., current assets to current liability or current ratio. These ratios are also known as financial position ratios since they reflect the financial position of the business.

i) Current Ratio

Current ratio also known as the working capital ratio, is the most widely used ratio. It is the ratio of total current assets to current liabilities and is calculated by dividing the current assets by current liabilities. Current assets are those assets which can be converted into cash in the short-run or within one year. Likewise, current liabilities are those which are to be paid off in the short run. Current assets normally include cash in hand or at bank, inventories, sundry debtors, loans and advances, marketable securities, pre-paid expenses, etc. while current liabilities consist of sundry creditors, bills payable, outstanding and accrued expenses, provisions for taxation, proposed and un-claimed dividend, bank overdraft etc. Current ratio indicates the firms’ commitment to meet its short-term obligations. It is a measure of testing short-term solvency or in other words, it is an index of the short-term financial stability of an enterprise because it shows the margin available after paying off current liabilities. It is calculated as-

Ii) Liquid Ratio

This ratio is also known as Quick Ratio or Acid Test Ratio. This ratio is calculated by relating liquid or quick assets to current liabilities. Liquid assets mean those assets which are immediately converted into cash without much loss. All current assets except inventories and prepaid expenses are categorised as liquid assets. This ratio is an indicator of the liquid position of an enterprise. Generally, a liquid ratio of 1:1 is considered as ideal as the firm can easily meet all current liabilities.

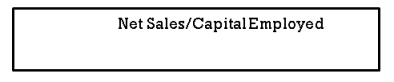

Iii) Stock Working Capital Ratio

This ratio shows the number of times working capital is turned-over in a stated period. It indicates to what extent the working capital funds have been employed in the business towards sales. This ratio is calculated as:

Iv) Proprietary Ratio

This ratio is a variant of debt-equity ratio which establishes the relationship between shareholders funds and total assets. Shareholders’ fund means, share capital both equity and preference and reserves and surplus less losses. This ratio indicates the extent to which shareholders’ funds have been invested in the assets. This ratio is worked out as follows:

v) Debt Equity Ratio

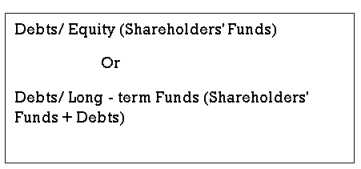

Debt-equity ratio is the relation between borrowed funds and owners’ capital in a firm, it is also known as external-internal equity ratio. The debt-equity ratio is used to ascertain the soundness of long-term financial policies of the business. Debt means long-term loans i.e. debentures or long-term loans from financial institutions. Equity means shareholders’ funds i.e., preference share capital, equity share capital, reserves less loss and fictitious assets like preliminary expenses. It is calculated in the following ways:

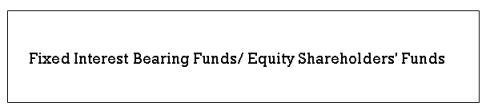

Vi) Capital Gearing Ratio

The proportion between fixed interest or dividend bearing funds and non-fixed interest or dividend bearing funds in the total capital employed in the business is termed as capital gearing ratio. Debentures, long-term loans and preference share capital belong to the category of fixed interest/dividend bearing funds. Equity share capital, reserves and surplus constitute non-fixed interest or dividend bearing funds. In case the fixed income bearing funds are more than the equity shareholders’ funds, the company is said to be highly geared. A low capital gearing implies that equity funds are more than the amount of fixed interest bearing securities. This ratio indicates the extra residual benefits accruing to equity shareholders. This ratio is calculated as follows:

Key takeaways-

- Balance sheet ratios deals with relationship between two items appearing in the balance sheet, e.g., current assets to current liability or current ratio.

These ratios express the relationship between two individual or group of items appearing in the income or profit and loss statement. Since they reflect the operating conditions of a business, they are also known as operating ratios, e.g., gross profit to sales, cost of goods sold to sales, etc.

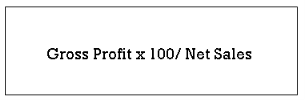

i) Gross Profit Ratio

Gross profit ratio expresses the relationship of gross profit to net sales or turnover. Gross profit is the excess of the proceeds of goods sold and services rendered during a period over their cost, before taking into account administration, selling and distribution and financing charges. This ratio is important to determine general profitability since it is expected that the ratio would be quite high so as to cover not only the remaining costs but also to allow proper returns to owners. It is calculated as-

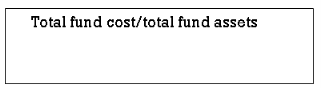

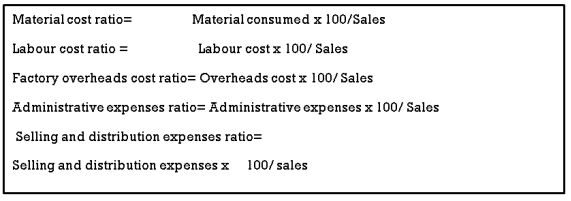

Ii) Expenses Ratio

It measures how much of a fund’s assets are used for administrative and other operating expenses. It is determined by dividing a fund’s operating expenses by average value of its assets. It is calculated as-

Iii) Operating Ratio

The ratio of all operating expenses (i.e., materials used, labour, factory overheads, office and selling expenses) to sales is the operating ratio. A comparison of the operating ratio would indicate whether the cost content is high or low in the figure of sales. If the annual comparison shows that the sales has increased, the management would be naturally interested and concerned to know as to which element of the cost has gone up. The major components of cost are: material, labour and overheads. Therefore, it is worthwhile to classify the cost ratio as:

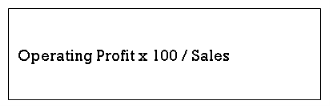

Iv) Net Profit Ratio

One of the components of return on capital employed is the net profit ratio (or the margin on sales). It indicates the net margin earned in a sale of 100. Net profit is arrived at from gross profit after deducting administration, selling and distribution expenses; non-operating incomes, such as dividends received and non-operating expenses are ignored, since they do not affect efficiency of operations. It is calculated as-

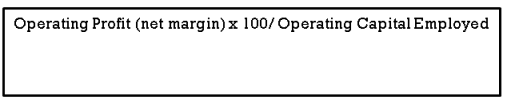

v) Net Operating Profit Ratio

A measure of ‘profitability’ is the overall measure of efficiency. In general terms efficiency of business is measured by the input-output analysis. By measuring the output as a proportion of the input, and comparing result of similar other firms or periods the relative change in its profitability can be established. Profitability ratio can be determined on the basis of either investments or sales. Profitability in relation to investments is measured by return on capital employed, return on shareholders’ funds and return on assets. The profitability in relation to sales are profit margin (gross and net) and expenses ratio or operating ratio. It is calculated as-

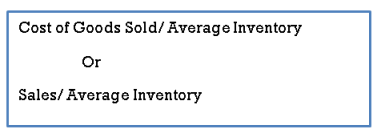

Vi) Stock Turnover Ratio

This ratio is an indicator of the efficiency of the use of investment in stock. It is calculated as-

Key takeaways-

- Revenue statement ratios express the relationship between two individual or group of items appearing in the income or profit and loss statement.

These ratios express the relationship between two items, each appearing in different statements, i.e., one appearing in balance sheet while the other in income statement, e.g., return on investment (net profit to capital employed); Assets turnover (sales) ratio, etc. Since both the statements are involved in the calculation of each of these ratios, they are also known as inter statement ratios.

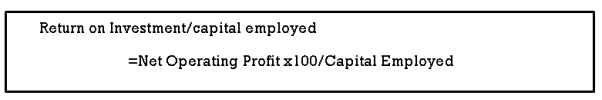

i) Return on capital employed (Including Long Term Borrowings)

This ratio is also known as overall profitability ratio or return on capital employed. The income (output) as compared to the capital employed (input) indicates the return on investment. It shows how much the company is earning on its investment. This ratio is calculated as follows:

Where, Operating profit= Profit before interest and tax

Capital employed= Share Capital + Reserve and Surplus + Long term

Loans − Non-Operating Assets − Fictitious Assets

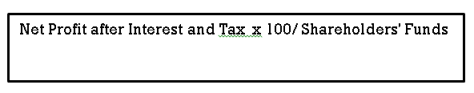

Ii) Return on proprietor's Fund (Shareholders Fund and Preference Capital)

It is also referred to as return on net worth. In this case it is desired to work out the profitability of the company from the shareholders’ point of view. This ratio would reflect the profitability for the shareholders. To extend the idea further, the profitability from equity shareholders’ point of view can also be worked out by taking the profits after preference dividend and comparing against capital employed after deducting both long-term loans and preference capital.

Iii) Return on Equity Capital

This ratio shows the efficiency of capital employed in the business. The higher the ratio the greater are the profits. It is calculated as-

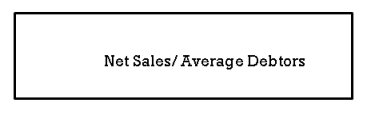

Iv) Debtors Turnover

This ratio measures the net credit sales of a firm to the recorded trade debtors thereby indicating the rate at which cash is generated by turnover of receivable or debtors. This ratio is calculated as:

Average debtors= opening debtors + closing debtors/2

While calculating debtors turnover, it is important to note that provision for bad and doubtful debts are not deducted from total debtors in order to avoid the impression that a larger amount of receivables have been collected.

v) Creditors Turnover

Like debtors’ turnover ratio, this ratio indicates the speed at which the payments for credit purchases are made to creditors. The term ‘creditors’ include, trade creditors and bills payable. In case the details regarding credit purchases, opening and closing balances of creditors are not available, then instead of credit purchases, total purchases may be taken and in place of average creditors, the balance available may be substituted. This ratio is computed as follows:

Vi) Debt Service Ratio

This ratio is also known as Fixed Charges Cover or Interest Cover. This ratio measures the debt servicing capacity of a firm in so far as fixed interest on long-term loan is concerned. It is determined by dividing the net profit before interest and taxes by the fixed charges on loans. This ratio is expressed as ‘number of times’ to indicate that profit is number of times the interest charges. It is also a measure of profitability. Since higher the ratio, higher the profitability. The ideal ratio should be 6 to 7 times. It is calculated as-

Vii) Dividend Payout Ratio

This ratio establishes the relationship between the market price and the dividend paid per share. It is expressed as a percentage and gives the rate of return on the market value of the shares and helps in the decision of investors who are more concerned about returns on their investment rather than its capital appreciation. Since dividends are declared on paid-up value of shares, they do not reflect the actual rate of earning if the shares are purchased at market price, which is generally different from paid-up value. This ratio removes this ambiguity by relating the dividends to the market value of shares. This ratio is calculated as under-

Key takeaways-

- Combined ratios express the relationship between two items, each appearing in different statements, i.e., one appearing in balance sheet while the other in income statement, e.g., return on investment (net profit to capital employed); Assets turnover (sales) ratio, etc.

Practical problems

Q.1 The following Trading and Profit and Loss Account of Fantasy Ltd. For the year 31‐3‐2000 is given below

Particular | Rs. | Particular | Rs. |

To Opening Stock Purchases Carriage and Freight Wages Gross Profit b/d

To Administration expenses To Selling and Dist. Expenses To Non‐operating expenses To Financial Expenses To Net Profit c/d | 76,250 3,15,250 2,000 5,000 2,00,000 5,98,500

1,01,000 12,000 2,000 7,000 84,000 2,06,000 | By Sales By Closing stock

By Gross Profit b/d Non‐operating incomes By Interest on Securities By Dividend on shares By Profit on sale of shares | 5,00,000 98,500

5,98,500 2,00,000

1,500 3,750 750 2,06,000 |

Calculate:

1. Gross Profit Ratio.

2. Expenses Ratio.

3. Operating Ratio.

4. Net Profit Ratio.

5. Stock Turnover Ratio.

Solution

- Gross Profit Ratio = Gross Profit/Sales x 100

= 2,00,000/5,00,000 x 100

= 40%

2. Expense Ratio = Operating expenses/Sales x 100

= (1,01,000+12,000)/5,00,000 x 100

= 22.60%

3. Operating Ratio = (COGS + Operating expenses)/Sales x 100

= (3,00,000+1,13,000)/5,00,000 x 100

= 82.60%

COGS = Op. Stock + purchases + carriage and Freight + wages – Closing Stock

= 76,250 + 3,15,250 + 2,000 + 5,000 - 98,500

= Rs 3,00,000

4. Net Profit Ratio = Net Profit/Sales x 100

= 84,000/5,00,000 x 100

= 16.8%

5. Stock Turnover Ratio = COGS/ Average Stock

= 3,00,000/87,375

= 3.43 times

Average Stock = Opening Stock + Closing Stock / 2

= (76,250+98,500)/2

= 87,375

Q.2 The Balance Sheet of Punjab Auto Limited as on 31‐12‐2002 was as follows:

Particulars | Rs. | Particulars | Rs. |

Equity Share Capital Capital Reserve 8% Loan on Mortgage Creditors Bank overdraft Taxation: Current Future Profit and Loss A/c | 40,000 8,000 32,000 16,000 4,000

4,000 4,000 12,000 1,20,000 | Plant and Machinery Land and Buildings Furniture & Fixtures Stock Debtors Investments (Short‐term) Cash in hand | 24,000 40,000 16,000 12,000 12,000 4,000 12,000

1,20,000 |

From the above, compute (a) the Current Ratio, (b) Quick Ratio, (c) Debt‐Equity Ratio

Solution.

- Current Ratio= Current Assets/Current Liabilities

= 40,000/28,000

= 1.43:1

Current Assets = Stock + debtors + Investments (short term) + Cash In hand

= 12,000+12,000+4,000+12,000

= Rs 40,000

Current Liabilities = Creditors + bank overdraft + Provision for Taxation (current & Future)

= 16,000+4,000+4,000+4,000

= Rs 28,000

2. Quick Ratio = Quick Assets/Quick Liabilities

= 28,000/20,000

= 1.40:1

Quick Assets = Current Assets ‐ Stock

= 40,000 - 12,000

= Rs 28,000

Quick Liabilities = Current Liabilities – (BOD + PFT future)

= 28,000 – (4,000 + 4,000)

= 20,000

3. Debt Equity Ratio= Debt/Equity

= 32,000/60,000

= 0.53:1

Debt = Debentures + long term loans

= Rs 32,000

Equity = Eq. Sh. Cap. + Reserves & Surplus + Preference Sh. Cap. – Fictitious Assets

= 40,000+8,000+12,000

= Rs 60,000

Q.3

The details of Shreenath Company are as under:

Sales (40% cash sales) |

| 15,00,000 |

Less: Cost of sales |

| 7,50,000 |

| Gross Profit: | 7,50,000 |

Less: Office Exp. (including int. On debentures) 1,25,000 | ||

Selling Exp. | 1,25,000 | 2,50,000 |

| Profit before Taxes: | 5,00,000 |

Less: Taxes |

| 2,50,000 |

| Net Profit: | 2,50,000 |

Particular | Rs. | Particular | Rs. |

Equity share capital 10% Preference share capital Reserves 10% Debentures Creditors Bank‐overdraft Bills payable Outstanding expenses | 20,00,000

20,00,000 11,00,000 10,00,000 1,00,000 1,50,000 45,000 5,000 64,00,000 | Fixed Assets Stock Debtors Bills receivable Cash Fictitious Assets | 55,00,000 1,75,000 3,50,000 50,000 2,25,000 1,00,000

64,00,000 |

Besides the details mentioned above, the opening stock was of Rs. 3,25,000 & Opening Debtors was Rs 3,00,000, Opening Bills Receivable was Rs 1,00,000. Calculate the following ratios; also discuss the position of the company:

(1) Gross profit ratio. (2) Stock turnover ratio. (3) Current ratio. (4) Liquid ratio. (5) Debtors Turnover Ratio

Solution:

- Gross Profit Ratio = Gross Profit/Sales x 100

= 7,50,000/15,00,000 x 100

= 50%

2. Stock Turnover Ratio = COGS/ Average Stock

= 7,50,000/2,50,000

= 3 times

Average Stock = Opening Stock + Closing Stock / 2

= (3,25,000+1,75,000)/2

= 2,50,000

COGS = Sales – GP

= 15,00,000 – 7,50,000

= 7,50,000

3. Current Ratio = Current Assets / Current Liabilities

= 8,00,000/3,00,000

= 2.67:1

Current Assets= Stock + debtors + Bills receivable + Cash

= 1,75,000 + 3,50,000 + 50,000 + 2,25,000

= Rs 8,00,000

Current Liabilities = Creditors + bank overdraft + Bills payable + O/s Expenses

= 1,00,000 + 1,50,000 + 45,000 + 5,000

= Rs 3,00,000

4. Quick Ratio/

Liquid Ratio = Quick Assets/Quick Liabilities

= 6,25,000/1,50,000

= 4.17:1

(Liquid) Quick Assets = Current Assets ‐ Stock

= 8,00,000 – 1,75,000

= Rs 6,25,000

(Liquid) Quick Liabilities = Current Liabilities – BOD

= 3,00,000-1,50,000

= Rs 1,50,000

5. Debtors Turnover Ratio = Net Credit Sales/Average Debtors

= (15,00,000 x 60%)/4,00,000

= 9,00,000/4,00,000

= 2.25 times

Average Debtors = (Op Debtors+Op B/R+ Cl Debtors+Cl B/R) / 2

= (3,00,000+1,00,000+3,50,000+50,000)/2

= Rs 4,00,000

Q.4

From the data calculate:

(i) Gross Profit Ratio, (ii) Net Profit Ratio, (iii) Inventory Turnover, (iv) Current Ratio (v) Debt-Equity Ratio

Sales 25,20,000 Other Current Assets 7,60,000

Cost of sale 19,20,000 Fixed Assets 14,40,000

Net profit 3,60,000 Equity & Reserves 15,00,000

Closing Inventory 8,00,000 Debt. 9,00,000

Current Liabilities 6,00,000 Opening Inventory 7,00,000

Solution:

- Gross Profit Ratio= Gross Profit/Sales x 100

= 6,00,000/25,20,000 x 100

= 23.81%

Gross Profit = Sales – COGS

= 25,20,000 – 19,20,000

= 6,00,000

2. Net Profit Ratio = Net Profit / Sales x 100

= 3,60,000/25,20,000 x 100

= 14.29%

3. Inventory Turnover Ratio = COGS/ Average Inventory

= 19,20,000/ 7,50,000

= 2.56 times

Average Inventory = (Opening Inventory + Closing inventory) / 2

= (7,00,000+8,00,000) / 2

= Rs 7,50,000

4. Current Ratio = Current Assets/ Current Liabilities

= 7,60,000/6,00,000

= 1.27:1

5. Debt Equity Ratio= Debt/Equity

= 9,00,000/15,00,000

= 0.60:1

Q.5

Calculate stock turnover ratio from the following information:

Opening stock 8,000

Purchases 4,84,000

Sales 6,40,000

Gross Profit Rate – 25% on Sales.

Solution:

Stock Turnover Ratio = Cost of Goods Sold / Average Stock

Cost of Goods Sold = Sales- G.P

= 6,40,000 – 1,60,000 = 4,80,000

Stock Turnover Ratio= 4,80,000 /58000

= 8.27 times

Here, there is no closing stock. So there is no need to calculate the average stock.

Q.6

Calculate the operating Ratio from the following figures.

Items ($ in Lakhs)

Sales 17874

Sales Returns 4

Other Incomes 53

Cost of Sales 15440

Administration and Selling Exp. 1843

Depreciation 63

Interest Expenses (Non- operating 456

Solution:

Operating Ratio = (Cost of Goods Sold + Operating Expenses x 100) / Sales

= ((15,440 + 1,843)/ 17,870)x100

= 97%

Q.7

The following is the Trading and Profit and loss account of Mathan Bros Private Limited for the year ended June 30,2001.

To Stock in hand 76250 By Sales 500000

To Purchases 315250 By Stock in hand 98500

To Carriage and Freight 2000

To Wages 5000

To Gross Profit 200000

598500 598500

To Administration

Expenses 1,01,000 By Gross profit 2,00,000

To Finance Expenses. : By Non-operating Incomes

Interest 1200 Interest on Securities 1,500

Discount 2400 Dividend on Shares 3, 750

Bad Debts 3400 7000 Profit on Sale of Shares 750 6,000

To Selling Distribution

Expenses 12000

To Non-operating expenses

Loss on sale of securities 350

Provision for legal suit 1,650 2000

To Net profit 84000

206000 206000

You are required to calculate:

(i) Gross profit Ratio (ii) Net profit Ratio

(iii) Operating Ratio (iv) Stock turnover Ratio

Solution:

- Gross Profit Ratio =Gross Profit/ Sales x 100

= 2,00,000 / 500000 x 100

= 40%

2. Net Profit Ratio = Net Profit/ Sales x100

= 84000/ 500000 x100

= 16.8%

3. Operating Ratio = ( Cost of Goods Sold + Operating Expenses)/Sales x 100

= (3,00,000 + 1,20,000)/ 500000 x 100

= 84%

Cost of Goods Sold = Sales – Gross profit

= 5,00,000 – 2,00,000

= Rs 3,00,000

Operating Expenses

All Expenses Debited in the Profit & Loss A/c Except Non-Operating Expenses

[including Finance expense] = 1,01,000 + 7,000 + 12,000 = 1,20,000

4. Stock Turnover Ratio = Cost of Goods Sold / Average Stock

= 3,00,000/87,375

= 3.43 times

Average Stock = (Opening Stock + Closing Stock)/2

= (76,250 + 98,500) / 2

= 87,375

References-

1. Cost and Management Accounting - Colinn Dury 7th Edition

2. Cost and Management Accounting- Dbarshi Bhattacharyya pearson Publications 2013 edition

3. Management Accounting - M.Y.Khan

4. Management Accounting - I.M.pandey.

5. Www.icai.in