Unit 4

Capital Budgeting

Case study (Need to grasp SME capital budgeting)

The lifeline of any business is finance. The allocation and usage of funds — technically known as capital budgeting — is one of the most important strategic decisions of any business. But is this decision different for small firms as compared to large ones? The allocation of capital in small enterprises is often more important than in large firms — given their lack of access to capital markets — as the funds necessary to correct a mistake may not be available. Also, big firms allocate capital to numerous projects, so a mistake in one can be offset by success in others. While capital investment is a relevant area for small firms, the majority of studies conducted during the past four decades have focused on the capital budgeting decisions of large enterprises and similar evidence does not exist for small organisations. Therefore, little is known about the capital budgeting practices of small businesses. Given the proportion and importance of small companies in economies the world over and their constant motivation for more efficient use of resources to remain competitive, there is a definite need for information on the methods used by small firms to accumulate and allocate their scarce capital. The Small and Medium Enterprises (SME) sector is the backbone of any growing economy and is recognised as the engine of growth — accounting for about 70 per cent of employment and significantly contributing to the Gross Domestic Product (GDP). The contribution of this sector can be seen from the statistics provided by the Confederation of Indian Industry (CII) which shows that it contributes about 6.11 per cent to the manufacturing GDP and 24.6 per cent to the GDP from services. Further, it has a 45 per cent share in the overall exports from India and provides employment to around 120 million people. It manufactures more than 8,000 diverse products, ranging from low-tech items to technologically-advanced ones. Globally, 99.7 per cent of all enterprises in the world are SMEs and the balance 0.3 per cent are large-scale enterprises. The SME sector in India accounts for 95 per cent of all industrial units. Since this sector is critically important for any economy, proper financial management is of utmost importance for its survival. It is a known fact that financial problems are often a major cause for the failure of small businesses. The two major problems, undercapitalisation and the difficulty in getting external finance support, are often related to poor fiscal management. Poor and in some cases lack of proper financial record-keeping close the avenues of small firms to avail from traditional lending sources as these businesses cannot demonstrate their financial viability.Many SMEs in the start-up phase, underestimate the cost of operating a business and thus fail to manage the cash flow and the amount of operating capital required. Several studies have attempted to establish the existence of the association between SME performance and specific financial practices. The evidence suggests that successful financial performance by SMEs have a positive association with effective management of financial matters, such as planning, maintenance of financial records, obtaining external finance, professional finance advice and other factors. The capital budgeting theory is based on certain assumptions like maximisation of shareholders’ wealth by investing in all positive Net Present Value (NPV) projects and rejecting those with negative NPV; and access to perfect financial markets, allowing it to finance all value-enhancing projects. However, applicability of these assumptions to small firms may be doubtful. The separation principle, that states that investment decisions can be made independent of shareholders’ tastes and preferences, does not hold for closely-held and small businesses. Under the NPV technique, the projects are accepted if the NPV is positive, that is, if the cash outflows are less than the present values of future cash inflows discounted at the firm’s cost of capital. However, since shares of small firms are not readily marketable, market determined discount rates are inappropriate in small businesses. One of the most important differences between capital budgeting for large and small companies is that in the former decisions can be made independently of stockholders’ view but in the latter, it is essential that owners be involved in the decision-making process. Small firms also face difficulty in raising funds from the capital markets. In fact, shortage of equity and long-term funds continue to halt the growth of SMEs in the country. In addition, research shows that small companies are not able to access bank loans because of their information-opaqueness and lack of strong banking relationships. Furthermore, for some small enterprises, it is impossible to raise funds through a public issue and for others it may be prohibitively expensive. The above-mentioned cash constraints encourage the small enterprises to maintain sufficient cash balances to be ready for any potentially attractive investment opportunity. Although the SME sector contributes to the overall economy in a major way, over the past four decades financial research has limited itself to understanding the capital budgeting techniques preferred by large organisations and studied the usage of sophisticated tools like NPV, Internal Rate of Return (IRR) , Profitability Index (PI) and easy tools like payback. In a research conducted on 333 small firms in India, it became evident that small businesses in the country employ less sophisticated methods to analyse potential investments than those recommended by the capital budgeting theory. In particular, survey results show these firms use Discounted Cash Flow (DCF) analysis less frequently than “gut feel”, payback period and accounting rate of return. Although 46 per cent of the respondents have advanced professional degrees, they may not be financially literate and their small management team may not be competent enough to undertake a capital budgeting analysis. Additionally, employing an outside consultant to implement the DCF techniques may prove to be a costly affair for small firms. Since the capital projects are relatively smaller in size, it may not be economical to sustain the cost of analysing them. This suggests that small firms with small projects may be making sense when they depend on less sophisticated techniques or on the owners’ “gut feel”. Since small firms are concerned with basic survival, they tend to be cash-oriented and therefore may emphasise on payback methods. Small business owners are also not comfortable in making forecasts beyond the immediate future since they face greater uncertainty in cash flows and capital budgeting. There exists a gap between education, Government policies and the real business world. The traditional business education mostly focuses on financial management of large firms. However, the major focus has to now shift to financial management of small businesses. In addition, conducive policies have to be framed not only to provide funds to small firms but also to help them in the management of funds.

Capital Budgeting is one of the appraising techniques of investment decisions. Capital Budgeting is defined as the firm‘s decision to invest its current funds most efficiently in long term activities in anticipation of an expected flow of future benefits over a series of years.

Charles. T. Horngreen defined capital budgeting as ―”Long term planning for making and financing proposed capital out lay”.

According to Keller and Ferrara, ―”Capital Budgeting represents the plans for the appropriation and expenditure for fixed asset during the budget period”.

Robert N. Anthony defined as ―”Capital Budget is essentially a list of what management believes to be worthwhile projects for the acquisition of new capital assets together with the estimated cost of each product.”

Significance of capital budgeting decisions

Capital Budgeting decisions are considered important for a variety of reasons. Some of them are the following:

1) Crucial decisions: Capital budgeting decisions are crucial, affecting all the departments of the firm. So the capital budgeting decisions should be taken very carefully.

2) Long-run decisions: The implications of capital budgeting decisions extend to a longer period in the future. The consequences of a wrong decision will be disastrous for the survival of the firm.

3) Large amount of funds: Capital budgeting decisions involve spending large amount of funds. As such proper care should be exercised to see that these funds are invested in productive purchases.

4) Rigid: Capital budgeting decision cannot be altered easily to suit the purpose. Because of this reason, when once funds are committed in a project, they are to be continued till the end, loss or profit no matter.

Need of capital budgeting decision

Capital budgeting decisions may be generally needed for the following purposes:

a) Expansion: The firm requires additional funds to invest in fixed assets when it intends to expand the production facilities in view of the increase in demand for their product in near future. Accordingly the current assets will increase. In case of expansion the existing infrastructure – like plant, machinery and other fixed assets is inadequate, to carry out the increased production volume. Thus the firm needs funds for such project. This will include not only expenditure on fixed assets (infrastructure) but also an increase in working capital (current assets).

b) Replacement: The machines and equipment used in production may either wear out or may be rendered obsolete due to new technology. The productive capacity and competitive ability of the firm may be adversely affected. The firm needs funds or modernisation of a certain machines or for renovation of the entire plant etc., to make them more efficient and productive. Modernization and renovation will be a substitute for total replacement, where renovation or modernization is not desirable or feasible, funds will be needed for replacement.

c) Diversification: If the management of the firm decided to diversify its production into other lines by adding a new line to its original line, the process of diversification would require large funds for long-term investment. For example ITC and Philips company for their diversification.

d) Buy or Lease: This is a most important decision area in Financial Management whether the firm acquire the desired equipment and building on lease or buy it‖. If the asset is acquired on lease, there have to be made a series of annual or monthly rental payments. If the asset is purchased, there will be a large initial commitment of funds, but not further payments. The decision – making area is which course of action will be better to follow? The costs and benefits of the two alternative methods should be matched and compared to arrive at a conclusion.

e) Research and Development: The existing production and operations can be improved by the application of new and more sophisticated production and operations management techniques. New technology can be borrowed or developed in the laboratories. There is a greater need of funds for continuous research and development of new technology for future benefits or returns from such investments.

The capital budgeting projects implies long term investment. The classification of capital budgeting projects are-

- Replacement projects: These are among the easier capital budgeting decisions. If a piece of equipment breaks down or wears out, whether to replace it may not require careful analysis. If the expenditure is modest and if not investing has significant implications for production, operations, or sales, it would be a waste of resources to over-analyze the decision. Other replacement decisions involve replacing existing equipment with newer, more efficient equipment, or perhaps choosing one type of equipment over another. These replacement decisions are often amenable to very detailed analysis, and you might have a lot of confidence in the final decision.

- Expansion projects: Instead of merely maintaining a company’s existing business activities, expansion projects increase the size of the business. These expansion decisions may involve more uncertainties than replacement decisions, and these decisions may be more carefully considered.

- New products and services: These investments expose the company to even more uncertainties than expansion projects. These decisions are more complex and will involve more people in the decision-making process.

- Regulatory, safety, and environmental projects: These projects are frequently required by a governmental agency, an insurance company, or some other external party. They may generate no revenue and might not be undertaken by a company maximizing its own private interests. Often, the company will accept the required investment and continue to operate. Occasionally, however, the cost of the project is sufficiently high that the company would do better to cease operating altogether or to shut down any part of the business that is related to the project.

- Other: The projects above are all susceptible to capital budgeting analysis, and tl1ey can be accepted or rejected using tl1e net present value (NPV) or some other criterion. Some projects escape such analysis. These are either pet projects of someone in the company (such as the CEO buying a new aircraft) or so risky that they are difficult to analyze by the usual methods (such as some research and development decisions).

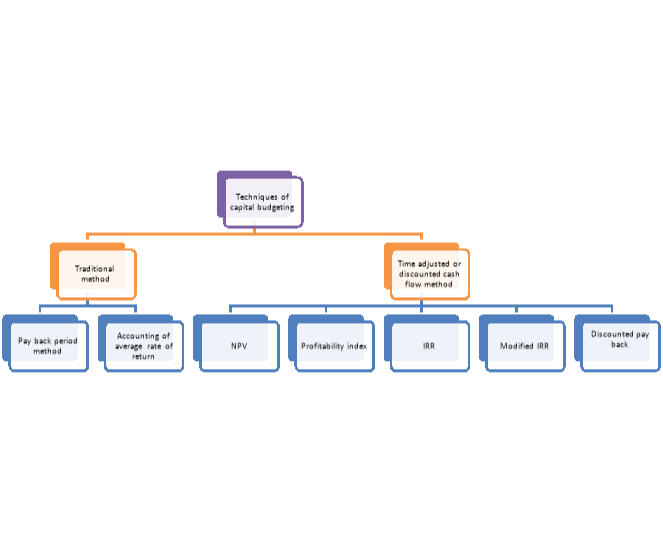

The capital budgeting appraisal methods or techniques for evaluation of investment proposals will help the company to decide the desirability of an investment proposal, depending upon their relative income generating capacity and rank them in order if their desirability. These methods provide the company a set of normal method should enable to measure the real worth of the investment proposal. The appraisal methods should possess several good characteristics, which are mentioned as under. The capital budgeting techniques are highlighted in figure 1

Figure 1: Capital budgeting techniques

Payback Period

It is the most popular and widely recognized traditional methods of evaluating the investment proposals. It can be defined as the number of years to recover the original capital invested in a project. The payback period can be used as an accept or reject criterion as well as a method of ranking projects. The payback period is the number of years to recover the investment made in a project. If the payback period calculated for a project is less than the maximum payback period set-up by the company, it can be accepted. As a ranking method it gives the highest rank to a project which has the lowest payback period, and the lowest rank to a project with the highest payback period. Whenever a company faces the problem of choosing among two or more mutually exclusive projects, it can select a project on the basis of payback period, which has shorter period than the other projects.

The following are the merits of the payback period method:

(i) Easy to calculate: It is one of the easiest methods of evaluating the investment projects. It is simple to understand and easy to compute.

(ii) Knowledge: The knowledge of payback period is useful in decision-making, the shorter the period better the project.

(iii) Protection from loss due to obsolescence: This method is very suitable to such industries where mechanical and technical changes are routine practice and hence, shorter payback period practice avoids such losses.

(iv) Easily availability of information: It can be computed on the basis of accounting information, what is available from the books.

The payback period method has certain demerits:

(i) Failure in taking cash flows after payback period: This methods is not taking into account the cash flows received by the company after the payback period.

(ii) Not considering the time value of money: It does not take into account the time value of money.

(iii) Non-considering of interest factor: It does not take into account the interest factor involved in the capital outlay.

(iv) Maximisation of market value not possible: It is not consistent with the objective of maximizing the market value of share.

(v) Failure in taking magnitude and timing of cash inflows: It fails to consider the pattern of cash inflows i.e. the magnitude and timing of cash inflows.

Accounting Rate of Return

This technique uses the accounting information revealed by the financial statements to measure the profitability of an investment proposal. It can be determined by dividing the average income after taxes by the average investment. According to Soloman, Accounting Rate of Return can be calculated as the ratio, of average net income to the initial investment. On the basis of this method, the company can select all those projects whose ARR is higher than the minimum rate established by the company. It can reject the projects with an ARR lower than the expected rate of return. This method also helps the management to rank the proposal on the basis of ARR.

Accounting Rate of Return (ARR) = Original Investment Average Net Income

OR

Accounting Rate of Return (ARR) = Average Investment Average Net Income

The following are the merits of ARR method:

(i) It is very simple to understand and calculate;

(ii) It can be readily computed with the help of the available accounting data;

(iii) It uses the entire stream of earnings to calculate the ARR.

This method has the following demerits:

(i) It is not based on cash flows generated by a project;

(ii) This method does not consider the objective of wealth maximization;

(iii) It ignores the length of the projects useful life;

(iv) If does not take into account the fact that the profile can be re-invested; and

(v) It ignores the time value of money.

Net Present Value

The net present value method is a classic method of evaluating the investment proposals. It is one of the methods of discounted cash flow techniques, which recognizes the importance of time value of money. It correctly postulates that cash flows arising at time periods differ in value and are comparable only with their equivalents i.e. present values. It is a method of calculating the present value of cash flows (inflows and outflows) of an investment proposal using the cost of capital as an appropriate discounting rate. The net present value will be arrived at by subtracting the present value of cash outflows from the present value of cash inflows. Steps to compute net present value:

(i) Estimation of future cash inflows.

(ii) An appropriate rate of interest should be selected to discount the cash flows. Generally, this will be the ―cost of capital‖ of the company, or required rate of return.

(iii) The present value of inflows and outflows of an investment proposal has to be computed by discounting them with an appropriate cost of capital.

(iv) The net value is the difference between the present value of cash inflows and the present value of cash outflows.

The formula for the net present value can be written as:

NPV= C1 /(1+k)1 + C2 / (1+K)2 +C3 /(1+k)3 +…………. Cn /(1+K)n – I

Where,

C = Annual Cash inflows,

Cn = Cash inflow in the year n

K = Cost of Capital

I = Initial Investment

The following are the merits of the net present value (NPV) methods:

(i) Consideration to total Cash Inflows: The NPV methods considers the total cash inflows of investment opportunities over the entire life-time of the projects unlike the payback period methods.

(ii) Recognition to the Time Value of Money: This methods explicitly recognizes the time value of money, which is investable for making meaningful financial decisions.

(iii) Changing Discount Rate: Due to change in the risk pattern of the investor different discount rates can be used.

(iv) Best decision criteria for Mutually Exclusive Projects: This Method is particularly useful for the selection of mutually exclusive projects. It serves as the best decision criteria for mutually exclusive choice proposals.

(v) Maximisation of the Shareholders Wealth: Finally, the NPV method is instrumental in achieving the objective of the maximization of the shareholders’ wealth. This method is logically consistent with the company‘s objective of maximizing shareholders‘ wealth in terms of maximizing market value of shares, and theoretically correct for the selections of investment proposals.

The following are the demerits of the net present value method:

(i) It is difficult to understand and use.

(ii) The NPV is calculated by using the cost of capital as a discount rate. But the concept of cost of capital itself is difficult to understand and determine.

(iii) It does not give solutions when the comparable projects are involved in different amounts of investment.

(iv) It does not give correct answer to a question when alternative projects of limited funds are available, with unequal lives.

The Profitability Index

This method is also known as Benefit Cost Ratio‘. According to Van Horne, the profitability Index of a project is ―the ratio of the present value of future net cash inflows to the present value of cash outflows. If the Profitability Index is greater than or equal to one, the project should be accepted otherwise reject. It can be calculated as follows-

Profitability Index = Present value of cash inflows/Present value of cash outflows

The merits of this method are:

(i) It takes into account the time value of money.

(ii) It helps to accept / reject investment proposal on the basis of value of the index.

(iii) It is useful to rank the proposals on the basis of the highest /lowest value of the index.

(iv) It takes into consideration the entire stream of cash flows generated during the life of the asset.

This technique suffers from the following limitations:

(i) It is somewhat difficult to compute.

(ii) It is difficult to understand the analytical of the decision on the basis of profitability index.

Discounted Payback

Under this method the discounted cash inflows are calculated and where the discounted cash flows are equal to original investment then the period which is required is called discounting payback period. While calculating discounting cash inflows the firm‘s cost of capital has been used. It is calculated as-

Discounted payback period (DPP) = Investment/Discounted Annual cash in flow

Practical problems

Q.1. (Pay-Back Period- Fixed cash inflows)

A project requires an initial investment of Rs. 2,00,000 and the annual cash inflows of Rs 50,000 for next 5 years. Calculate the payback period.

Solution:

Initial Investment (cash outflow) = Rs 2,00,000

Cash inflow = Rs 50,000

Pay-back Period = Initial Investment (Cash outflows)/Annual Cash Inflow

= 2,00,000/50,000

= 4 years

Q.2. (Pay-Back Period- Variable cash inflows)

A project requires an initial investment of Rs. 2,00,000 and the annual cash inflows for 5 years are Rs. 60,000, Rs. 80,000, Rs. 50,000, Rs. 40,000 and Rs. 30,000 respectively. Calculate the payback period.

Solution:

Year | Cash Outflow (Rs) | Cash Inflows (Rs) | Cumulative Cash Inflows (Rs.) |

0 | 2,00,000 |

|

|

1 |

| 60,000 | 60,000 |

2 |

| 80,000 | 1,40,000 |

3 |

| 50,000 | 1,90,000 |

4 |

| 40,000 | 2,30,000 |

5 |

| 30,000 | 2,60,000 |

Solution

Payback Period = 3 + 10,000

40,000

=3 + 0.25 years

= 3.25 years

For understanding: Cash outflow of Rs. 2,00,000 is recovered in between year 3 and 4(see cumulative cash flows). Till Year 3, Rs. 1,90,000 was recovered, so Rs 10,000 was yet to be recovered in Year 4. But Rs 40,000 was total cash flow of Year 4. We need time taken to recover Rs 10,000 which comes to 0.25 year.

Q.3. (ARR)

A machine is available for purchase at a cost of Rs. 8,00,000. It is expected to have a life of 5 years and have a scrap value of Rs. 1,00,000 at the end of five years period. The machine will generate the following profits over its life as under:-

Year | Amount (Rs.) |

1 | 2,00,000 |

2 | 3,00,000 |

3 | 4,00,000 |

4 | 1,50,000 |

5 | 50,000 |

The above estimates are profits before depreciation. You are required to calculate the accounting rate of return.

Solution:

Total profit before depreciation over the life of machine = 2+3+4+1.50+0.50

= Rs. 11 lakhs

Average Profit = 11 lakhs / 5 = Rs 2,20,000

Total Depreciation over the life of asset = Cost – Scrap Value

= 8,00,000-1,00,000

= Rs 7,00,000

Average Depreciation = 7,00,000/5

= Rs 1,40,000

Average Annual profit after depreciation = 2,20,000-1,40,000

= Rs 80,000

Original Investment = Rs 8,00,000

Salvage = Rs 1,00,000

Average Investment = 8,00,000 + 1,00,000

2

= Rs 4,50,000

Average Rate of Return = 80,000 x 100

4,50,000

= 17.78%

Q.4. (Net Present Value)

An investment project costs Rs.1,00,000 initially. It is expected to generate cash flow as follows:

Year | Cash inflows (Rs.) |

1 | 50,000 |

2 | 40,000 |

3 | 30,000 |

4 | 20,000 |

(a) What is the net present value of the project assuming a 10 % risk-free rate? Should the project be accepted?

(b) If the project is risky and it is decided to use a higher rate to allow for the perceived risk. Assuming that rate is 15%, what will be the net present value of the project? Should the project be accepted?

The discounted factor @10% is:

Year | 1 | 2 | 3 | 4 |

Discount factor | 0.9091 | 0.8254 | 0.7513 | 0.6830 |

The discounted factor @15% is:

Year | 1 | 2 | 3 | 4 |

Discount factor | 0.8696 | 0.7561 | 0.6575 | 0.5718 |

Solution:

Net Present Value at 10% discounting rate | |||

Year | Cash inflows (Rs) | Discount factor at 10% | Present value (Rs.) |

1 | 50000 | 0.9091 | 45455 |

2 | 40000 | 0.8254 | 33056 |

3 | 30000 | 0.7513 | 22539 |

4 | 20000 | 0.6830 | 13660 |

Present value of cash inflows

Less: Present value of cash outflow

Net present value | 114710 | ||

100000 | |||

14700 | |||

The project should be accepted at risk free rate of 10% because net present value is positive.

Net Present Value at 15% discounting rate | |||

Year | Cash inflows (Rs) | Discount factor at 15% | Present value (Rs.) |

1 | 50000 | 0.8696 | 43480 |

2 | 40000 | 0.7561 | 30244 |

3 | 30000 | 0.6575 | 19725 |

4 | 20000 | 0.5718 | 11436 |

Present value of cash inflows

Less: Present value of cash outflow

Net present value | 104885 | ||

100000 | |||

4885 | |||

The project can be accepted at 15% because net present value is positive.

Q.5. (Profitability Index)

X Ltd is considering purchase of a machine in replacement of an old one. Two models viz. ‘modern’ and ‘sky’ are offered at price of Rs. 22.5 lakhs and Rs. 30 lakhs respectively. Further particulars regarding these models are given below:

Particulars | Modern | Sky |

(I) Economic life in years | 5 | 6 |

(II) After tax annual cash inflows | ||

Years | Rs. Lakhs | Rs. Lakhs |

1 | 5.00 | 6.00 |

2 | 7.50 | 8.00 |

3 | 10.00 | 10.00 |

4 | 9.00 | 12.00 |

5 | 8.50 | 10.50 |

6 | - | 9.50 |

(III) Present value factors at 12% per annuam are as follows | ||

Years | P.V.Factor | |

1 | 0.893 | |

2 | 0.797 | |

3 | 0.712 | |

4 | 0.636 | |

5 | 0.567 | |

6 | 0.507 | |

Evaluate the two proposals.

Which model would you recommend any why?

Solution:

Years | P.V.Factor | Modern | Sky | ||

CFAT | PV | CFAT | PV | ||

1 | 0.893 | 5.00 | 4.465 | 6.00 | 5.358 |

2 | 0.797 | 7.50 | 5.977 | 8.00 | 6.376 |

3 | 0.712 | 10.00 | 7.120 | 10.00 | 7.120 |

4 | 0.636 | 9.00 | 5.724 | 12.00 | 7.632 |

5 | 0.567 | 8.50 | 5.954 | 10.50 | 5.953 |

6 | 0.507 | - |

| 9.50 | 6.084 |

|

|

|

| 2.50 |

|

Less | Present Value of Cash inflows | 29,240 |

| 38,523 | |

| Present value of cash outflows | 22,500 |

| 30,000 | |

| Net present value | 6.740 |

| 8.523 | |

Considering net present value method, both the models have positive net present value and their initial investments are different. Hence, the decision will be based on Profitability Index which is calculated as follows:-

Profitability Index = PVCI PVCO | Modern | Sky |

29,240 22,500 | 38,523 30,000 | |

= 1.299 | = 1.284 |

As the profitability index of model ‘Modern’ is higher, it is recommended.

Q.6. (Discounted Pay Back Period)

ABC Ltd. Is considering a given project. Below are some selected data from the discounted cash flow model created by the company’s financial analysts:

The initial investment is Rs 75,000/-

Year | Discounted Cash inflows Rs. |

1 | 10,000 |

2 | 15,000 |

3 | 20,000 |

4 | 30,000 |

5 | 30,000 |

Solution:

Year | Discounted Cash Outflow (Rs) | Cash Inflows (Rs) | Cumulative Cash Inflows (Rs.) |

0 | 75,000 |

|

|

1 |

| 10,000 | 10,000 |

2 |

| 15,000 | 25,000 |

3 |

| 20,000 | 45,000 |

4 |

| 30,000 | 75,000 |

5 |

| 30,000 | 1,05,000 |

References-

1. Cost and Management Accounting - Colinn Dury 7th Edition

2. Cost and Management Accounting- Dbarshi Bhattacharyya pearson Publications 2013 edition

3. Management Accounting - M.Y.Khan

4. Management Accounting - I.M.pandey.

5. Www.icai.in