UNIT – 3

Corporate Governance

3.1.1 Concept

Corporate governance is the system by which a company is directed and controlled by rules, practices, and processes. Corporate governance essentially involves balancing the interests of a company's many stakeholders, such as shareholders, senior management executives, customers, suppliers, financiers, the government, and the community. Because corporate governance also provides the framework for achieving the goals of a company, it covers virtually every management sphere, from action plans and internal controls to performance measurement and corporate disclosure.

- The structure of rules, practices, and procedures used to direct and manage a business is corporate governance.

- The primary force influencing corporate governance is the board of directors of a company.

- Bad corporate governance can cast doubt on the reliability, integrity, and transparency of a company, which can affect its economic health.

Specifically, governance refers to the set of rules, controls, policies, and resolutions put in place to dictate corporate conduct. Proxy advisors and shareholders are important stakeholders that affect governance indirectly, but they are not examples of governance itself. In governance, the board of directors is pivotal, and it can have major implications for equity valuation.

The corporate governance of a company is important to investors since it demonstrates the direction and integrity of a company. Good corporate governance helps businesses build trust in the community and with investors. As a result, by creating a long-term investment opportunity for market participants, corporate governance helps promote financial viability.

A key component of community and investor relations is the communication of the corporate governance of a firm. For example, the company outlines its corporate leadership, its executive team, its board of directors, and its corporate governance on Apple Inc.'s investor relations site, including its committee charters and governance documents, such as bylaws, stock ownership guidelines and incorporation articles.

Many businesses strive to have a high standard of corporate governance. It is not enough for a business to merely be profitable for many shareholders; it also needs to demonstrate good corporate citizenship through environmental awareness, ethical behavior, and sound corporate governance practices. A transparent set of rules and controls are created by good corporate governance in which shareholders, directors, and officers have aligned incentives.

3.1.2 History of Corporate Governance in India

The idea of good governance in India dates back to the third century B.C. It is very old. Where Chanakya (Vazir of Parliputra) developed a king's fourfold duties, viz. Raksha, Vriddhi, Yogakshema and Palana. The replacement of the King of the State with the CEO of the Company or Board of Directors by the principles of corporate governance refers to the protection of shareholder wealth (Raksha), the improvement of wealth through proper use of assets (Vriddhi), the maintenance of wealth through profitable ventures (Palana) and, above all, the protection of shareholder interests (Yogakshema or safeguard). Corporate governance was not on Indian companies' agenda until the early 1990s, and no one until then would find much reference to this subject in the book of law. In India, system weaknesses such as undesirable stock market practices, boards of directors without adequate fiduciary responsibilities, poor disclosure practices, lack of transparency and chronic capitalism have all been pushing for reforms and enhanced governance. The reform of the Securities and Exchange Board of India was the most important 1992 initiative (SEBI). SEBI's main objective was to supervise and standardize stock trading, but many rules and regulations for corporate governance were gradually created. Initially, the initiative in India was driven by an industry association, the Indian Industry Confederation. CII set up a task force in December 1995 to design a voluntary code of corporate governance. In 1997, the final draft of this code became widely circulated. The code was released in April, 1998. Desirable Corporate Governance, a Code, was called. Over 25 leading companies voluntarily followed the code between 1998 and 2000, including Bajaj Auto, Infosys, BSES, HDFC, ICICI and many others.

In India, in April 1998, the CII took the lead in framing a desirable corporate governance code. This was followed by the corporate governance recommendations of the Kumar Mangalam Birla Committee. SEBI appointed this committee. The recommendations were accepted by SEBI in December 1999 and are now enshrined in Clause 49 of each Indian stock exchange's listing agreement.

The listing agreement deals with complete corporate governance guidelines. To implement effective corporate governance, a company must comply with the provisions below.

1. Independence of the Board: Boards of directors of the companies listed must have a minimum number of independent directors.

2. Audit committees: the companies listed must have board audit committees with at least three directors, two thirds of whom must be independent.

3. Disclosure: In order to ensure transparency, listed companies must periodically make different disclosures regarding financial and other matters.

We are able to compare the 2002 Sarbanes-Oxley Act and Clause 49. Clause 49 is based on the principles set out in the 2002 Sarbanes-Oxley Act. It was created for companies listed on the stock exchanges of the United States. As far as management responsibilities and the number of directors were concerned, they were both the same. They also have the same rules concerning insider trading, rejection of directors' loans, and so on. The important difference between the two is under Sarbanes-Oxley legislation if fraud or annihilation of reports takes place up to 20 years of imprisonment can be charged, but in case of Clause 49, there is no such condition. SEBI can initiate criminal proceedings as the controller of the market. If SEBI chooses to give a serious punishment in the event that it can initiate a criminal proceeding or raise the fine for not agreeing with Clause 49, which automatically de-lists the business.

Amendments to the Companies Act, 1956

India began its programme of economic reforms in the 1990s. Again, a need was felt for a comprehensive review of the Companies Act, 1956, which by this time had become the most bulky and archaic with 781 sections and 25 schedules. Three unsuccessful attempts to rewrite the company law were made in 1993, 1997 and then in 2003. In anticipation of another comprehensive review of the Act, the Government withdrew the Companies (Amendment) Bill, 2003, which contained several important provisions relating to corporate governance. Since 1956, there have been as many as 24 amendments to this Act, of which the 52 amendments related to corporate governance and the development of the corporate sector through the Companies (Amendments) Act, 1999, the Companies (Amendment) Act, 2000 and the Companies (Amendment) Act, 2001.

Corporate Governance provisions in the Companies Act, 2013

The enactment of the companies Act 2013 was major development in corporate governance in 2013. The new Act replaces the Companies Act of 1956 and aims to simplify regulations and increase the interests of minority shareholders by improving corporate governance standards.

1. Junta of Directors (Clause 166)

2. Independent Manager (Clause 149)

3. Transactions relating to related parties (RPT) (Clause 188)

4. Social Corporate Responsibility (CSR) (Clause 135)

5. Auditors (Clause 139)

6. Disclosure and Disclosure (Clause 92)

7. Suits Class Action (Clause 245)

3.1.3 Need for Corporate Governance

(i) Wide Spread of Shareholders:

A company today has a very large number of shareholders spread across the nation and even the world, and most shareholders are unorganized and have an indifferent attitude to corporate affairs. The idea of democracy for shareholders remains confined only to the law and the Articles of Association; this requires practical implementation by means of a corporate governance code of conduct.

(ii) Changing Ownership Structure:

In today's times, the pattern of corporate ownership has significantly changed, with institutional investors (foreign as well as Indian) and mutual funds becoming the largest shareholders in the large private corporate sector. These investors have become corporate management's biggest challenge, forcing the latter to abide by some established corporate governance code to build its image in society.

(iii) Corporate Scams or Scandals:

In recent years, corporate scams (or frauds) have shaken public confidence in corporate management. In the heart and mind of all, the case of the Harshad Mehta scandal, which is perhaps one major scandal, is linked to corporate shareholding or otherwise being educated and socially conscious. Thus, the need for corporate governance is imperative for reviving the trust of investors in the corporate sector in society's economic development.

(iv) Greater Expectations of Society of the Corporate Sector:

Today's society holds higher corporate sector expectations in terms of reasonable prices, better quality, control of pollution, best use of resources, etc. There is a need for a code of corporate governance to meet social expectations, and for the best management of the company in economic and social terms.

(v) Hostile Take-Overs:

In several countries, hostile takeovers of companies have been observed, putting a question mark on the effectiveness of take-over management. The need for corporate governance in the form of an effective code of conduct for corporate management is also highlighted by these factors.

(vi) Huge Increase in Top Management Compensation:

In both developing and developed economies, it has been observed that the monetary payments (compensation) packages of top-level corporate executives have increased greatly. There is no justification for exorbitant payments from corporate funds, which are an asset of shareholders and society, to top ranking managers. This factor requires corporate governance to contain the ill-practices of top company management.

(vii) Globalisation:

Desire of more and more Indian companies to get listed on international stock exchanges also focuses on a need for corporate governance. In fact, in the corporate sector, corporate governance has become a buzzword. There is no doubt that only firms well-managed according to standard corporate governance codes are recognized by the international capital market.

Key Takeaways:

- Corporate governance is the system by which a company is directed and controlled by rules, practices, and processes

- A key component of community and investor relations is the communication of the corporate governance of a firm

- SEBI's main objective was to supervise and standardize stock trading, but many rules and regulations for corporate governance were gradually created. Initially, the initiative in India was driven by an industry association, the Indian Industry Confederation

- These investors have become corporate management's biggest challenge, forcing the latter to abide by some established corporate governance code to build its image in society

Corporate governance is a comprehensive concept that describes the way a business or company is managed and controlled. It lays down a set of rules that assist businesses to integrate and work towards transparency, accountability, honesty and openness. Good corporate governance provides the board and management with appropriate incentives to pursue goals that best serve the interests of the company and its shareholders, while facilitating effective monitoring as well. It is now established that the adoption of best practices for good governance largely determines the sustainability of corporations around the world.

A review of Nigeria's various corporate governance codes and codes in other jurisdictions reveals the respective codes that set out the morally correct and acceptable ways of carrying out corporate activities. Morality prescribes proper conduct in the context of business activities, while ethics is the application of morals in the conduct of the company's business. Corporate governance thus provides the governance of companies with a moral and ethical framework.

Surendra Arjun (Professor of Business and Professional Ethics at the University of West Indies) made a distinction between the use of legal compliance and ethical mechanisms as instruments to ensure good governance, analyzing the importance of ethical compliance mechanisms. According to Arjun, when legal mechanisms are introduced for the purpose of discipline, only the freedom of indifference that cannot necessarily inspire or instill excellence in the letter of law can be promoted. On the other hand, the mechanisms of ethical compliance promote a freedom of excellence that corresponds to the spirit of the law. The real and fundamental issues that inspire ethical conduct may not necessarily be addressed by legal compliance mechanisms.

In any organization, the range and quantity of business ethical problems reflect the interaction of profit maximizing conduct with non-economic concerns or business ethics. Business ethics is critical to any organization's structure and most organizations today encourage their dedication to non-economic values (business ethics) through clearly defined core values, a Code of Business and Ethical Conduct (COBEC) and a Charter of Corporate Social Responsibility (CSR). In Nigeria, the Codes of Corporate Governance all prescribe the adoption by companies of a COBEC and CSR Charter.

A COBEC typically promotes within an organization a culture of ethics and compliance and defines the way and manner in which the company conducts its business in such a way that its core values are reflected. The World Bank defines Corporate Social Responsibility as "the commitment of companies to contribute to sustainable economic development, working in ways that are both good for business and good for development with staff, their families, the local community and society at large to improve the quality of life." A CSR Charter is a carefully articulated policy on how a business seeks to achieve business success in ways that promote ethical values, respect for individuals, communities and the natural environment. In general, the process includes the adoption of responsible business practices for the workplace, the community and the environment.

Organizations are the most important nucleus of modern economic activity and, although they are formed for economic purposes, they have a duty to ensure that these objectives are pursued and achieved in an ethical and sustainable way. A moral commitment at a subjective and a collective level is required for this responsibility. While it can be argued that cultural and individual relativism is subject to determining what is right or wrong and that what is considered ethical is a product of the moral perspective of an individual, the failure or collapse of organizations in recent times indicates that the absence of business ethics in economic activities, regardless of our relative ideas about the concepts of morality and ethics.

3.2.1 Principles of Corporate Governance

(i) Transparency:

Transparency means the quality of something which enables one to understand the truth easily. It implies an accurate, adequate and timely disclosure to stakeholders of relevant information about the operating results etc. of the corporate enterprise in the context of corporate governance.

Indeed, transparency is the cornerstone of corporate governance, helping to build a high level of public trust in the corporate sector. A company should publish relevant information on corporate affairs in leading newspapers, for example, on a quarterly or half-yearly or annual basis, to ensure transparency in corporate governance.

(ii) Accountability:

Accountability is a responsibility to clarify the outcomes of one's choices made in the interest of others. In the context of corporate governance, accountability, in the best interest of the company and its stakeholders, implies the responsibility of the Chairman, the Board of Directors and the Chief Executive for the use of the resources of the company (over which they have authority).

(iii) Independence:

Good corporate governance requires independence on the part of the corporation's top management, i.e. the Board of Directors must be a strong non-partisan body so that all corporate decisions can be taken on the basis of business prudence. Without the company's top management being independent, good corporate governance is merely a dream.

3.2.2 Benefits of Good Governance

Increases trust - In a vacuum, companies do not exist. Organizations that are aware of the role they play in wider society will typically seek to behave in a transparent way by regularly providing their stakeholders with clear and accurate information. This leads to increased levels of trust when all stakeholders feel able to rely on the data provided by companies, and organizations are able to develop stronger, long-standing relationships with their stakeholders. There are numerous and diverse benefits that can be reaped - from favorable credit terms to repeat business.

Enhances sustainability - A business committed to good governance can quickly identify and resolve any systemic problems, thereby reducing the likelihood of expensive corporate crises and scandals. Of course, issues may arise that an organization is unable to anticipate, but an organization can respond quickly with a governance system in place that is aimed at managing such eventualities in order to safeguard its reputation and future.

Encourages positive behaviours - Significant focus has been put on the role that culture plays in an organization's success. Clearly defined policies and procedures and a board of directors and executive managers who are interested in and accountable for such matters can help prevent future failures while setting cultural expectations for organizations. The organization's tone is set at the top' is said to mean that the chairman and CEO are protagonists of the organizational culture. Therefore, it is essential that all members of the board take an active interest in the company's activities and ensure clear lines of communication and reactivity to deal with any move away from the positive culture they seek to imbue throughout the organization.

Lowers the cost of capital - Implementation of good governance practices may lead to a reduction in the cost of capital of a company in today's volatile environment. An organization that is seen to be stable, reliable and capable of mitigating potential risks can borrow funds at a lower rate than those with no or weak governance systems. Companies with debt or equity investors may find that, knowing that the company has a sound governance framework, their investors pay a premium for the comfort they obtain.

Minimises waste, risks, corruption and mismanagement - It is likely that companies committed to the implementation and maintenance of good governance practices will find that certain risks are drastically minimized. This is because strong governance practices typically increase transparency, confidence and integrity levels, all of which create an environment conducive to risk reduction, corruption opportunities and any source of mismanagement.

|

- Integrity at all levels, both external and internal, in appointments

- In all the places where they are needed, strong leadership and management skills

- Processes in place to monitor the quality of teaching and learning and within institutions to improve that performance with the appropriate participation of students

- Processes in place to improve the quality of research (assuming that there is significant research activity)

- Lean and skilled administration

- Robust and transparent financial systems, particularly for procurement, as well as strong internal and external audits.

- Effective and transparent mechanisms at all levels for determining remuneration

- Strong human resources procedures, such as evaluation, development and poor performance management,

- Effective arrangements for student aid

- Student involvement at all levels in management and governance

- Contribution to better accreditation performance

- Awareness of institutional outputs, particularly increased employability, is focused.

3.2.3 Issues in Corporate Governance

1. Getting the Board Right

On board, enough and its role as the cornerstone of good corporate governance have been stated. To this end, the legislation requires a healthy mix of executive and non-executive directors and at least one female diversity director to be appointed. There is no doubt that, to a large extent, an able, diverse and active board would improve a company's governance standards. The challenge is to integrate governance into corporate cultures so that "in spirit" compliance is improved. In India, most companies tend to comply only on paper; board appointments are still recommended by "word of mouth" or fellow board member recommendations. It is common for promoters' friends and family (a uniquely Indian term for founders and controlling shareholders) and management to be appointed as members of the board. The need for the hour is innovative solutions - for example, rating board diversity and governance practices and publishing these findings or using performance assessment as a minimum benchmark for director appointment.

2. Performance Evaluation of Directors

While performance evaluation of directors has been part of India's existing legal framework, it has recently caught the attention of the regulator. A 'Guidance Note on Board Evaluation' was released by SEBI, India's capital markets regulator, in January 2017. This note elaborated on the various aspects of performance evaluation by setting out the means by which the objectives, the different criteria and the evaluation method could be identified. There is often a call for the results of such evaluation to be made public for performance assessment to achieve the desired results on governance practices. That said, assessment is always a sensitive topic, and public disclosures can be counter-productive. In a peer review situation, negative feedback may not be shared in order to avoid public scrutiny. The role of independent directors in performance evaluation is key to negating this behaviour.

3. True Independence of Directors

The appointment of independent directors was supposed to be the biggest reform in corporate governance. Nevertheless, 15 years down the line, independent directors were hardly able to have the desired effect. Over and over again, the regulator has tightened the standards: introduced a comprehensive definition of independent directors, defined the role of the audit committee, etc. However, a tick-the-box way out of the regulatory requirements is designed by most Indian promoters. The independence of the independent directors appointed by the promoter is questionable because it is unlikely that they will stand up against the promoter in favor of minority interests. The regulator is still found wanting despite all the governance reforms. Perhaps, in matters relating to independent directors, the focus needs to shift to limiting the powers of promoters.

4. Removal of Independent Directors

While independent directors have generally been criticized for playing a passive role on the board, instances of independent directors not siding with the decisions of the promoter have not been taken well - promoters have removed them from their position. Under the legislation, promoters or majority shareholders can easily remove an independent director. This inherent conflict has a direct effect on autonomy. In fact, even the International Advisory Board of SEBI proposed earlier this year an increase in transparency with regard to the appointment and removal of directors. In order to safeguard independent directors from vendetta action and grant them greater freedom of action, it is imperative to provide for additional controls in the removal process, requiring the approval of the majority of public shareholders, for example.

5. Accountability to Stakeholders

The empowerment of independent directors must be complemented by higher responsibilities for directors and accountability. In this regard, Indian company law, revamped in 2013, requires directors not only to owe responsibilities to the company and shareholders, but also to employees, the community and environmental protection. Although all directors have been given these general duties, directors, including independent directors, have been complacent because of the lack of enforcement action. It may be a good idea to require the entire board to be present at general meetings in order to increase accountability, to give stakeholders an opportunity to interact with the board and pose questions.

6. Executive Compensation

Executive compensation, especially when subject to shareholder accountability, is a contentious issue. To attract talent, companies have to offer competitive compensation. Such executive compensation, however, needs to stand the test of scrutiny by stakeholders. Currently, under Indian law, a policy on remuneration of key staff is required by the Nomination and Remuneration Committee (a committee of the board comprising a majority of independent directors). It is also required to make public the annual remuneration paid to key executives. Is there enough of this? Companies may consider framing remuneration policies that are transparent and require shareholder approval in order to retain and nurture a trustworthy relationship between the shareholders and the executive.

7. Founders' Control and Succession Planning

In India, the ability of founders to control company affairs has the potential to derail the entire system of corporate governance. In India, unlike developed economies, the identity of the founder and the company is often mixed. Regardless of their legal position, the founders continue to exercise substantial influence over the key business decisions of companies and do not recognize the need for succession planning. From the perspective of governance and business continuity, it is best if founders chalk out and execute a succession plan. Indian family-owned businesses suffer from an inherent inhibition of letting go of control. As PE and other institutional investors pump in capital, founders are forced to think about a succession plan and step away with dignity. The best way to deal with this is to broaden the shareholder base.

8. Risk Management

Large enterprises are currently exposed to real-time monitoring by business media and national media houses. Given that the board only plays a supervisory role in a company's affairs, it is essential to frame and implement a risk management policy. In this context, Indian company law requires the board to include a statement indicating the development and implementation of the company's risk management policy in its report to the shareholders. The independent directors have the mandate to evaluate the company's risk management systems. A robust risk management policy that outlines key guiding principles and practices for mitigating risks in day-to-day activities is imperative for a governance model to be effective.

9. Privacy and Data Protection

An important governance issue is privacy and data protection as a key aspect of risk management. A sound understanding of the fundamentals of cyber security must be expected from every director in this era of digitalisation. Only if executives are able to engage and understand the specialists in their company will good governance be achieved. The board must evaluate the potential risk of data handling and take steps to ensure that such data is protected against potential misuse. In order to ensure the goal of data protection is achieved, the board must invest a reasonable amount of time and money.

10. Board's Approach to Corporate Social Responsibility (CSR)

India is one of the few countries that has adopted CSR legislation. Companies meeting specified thresholds are required from within the board to constitute a CSR committee. This committee then sets up a CSR policy and recommends spending on such policy-based CSR activities. Companies are required to spend at least 2% of the previous three financial years' average net earnings. For companies that fail to meet the CSR expenditure, the boards of such companies are required in the board's report to disclose reasons for such failure. Companies that did not comply received notices from the Ministry of Corporate Affairs during the last year asking why they did not incur CSR spending and, in some cases, questioning the reasons for not spending. In these situations, it is necessary to increase the board's effort and seriousness towards CSR. CSR projects should be managed with as much interest and vigor from the board as any other company business project.

Key Takeaways:

- Good corporate governance provides the board and management with appropriate incentives to pursue goals that best serve the interests of the company and its shareholders, while facilitating effective monitoring as well.

- Transparency is the cornerstone of corporate governance, helping to build a high level of public trust in the corporate sector

- Executive compensation, especially when subject to shareholder accountability, is a contentious issue

- The board must evaluate the potential risk of data handling and take steps to ensure that such data is protected against potential misuse.

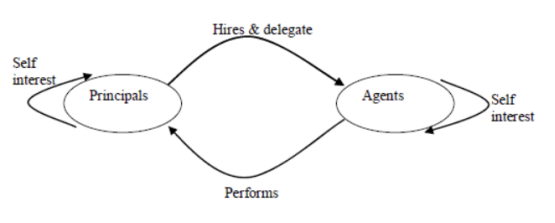

3.3.1 Agency Theory

The theory of the agency is a principle used in the relationship between business principals and their agents to explain and resolve problems. This relationship is most commonly the one between shareholders, as principals, and executives of companies, as agents.

- Agency theory attempts to explain and resolve disputes between principals and their agents over priorities.

- Principals rely on agents to carry out certain transactions, especially financial ones, resulting in a difference in priorities and methods agreed upon.

- The difference between agents and principals in priorities and interests is known as the issue of principal-agent.

- It is called "reducing agency loss." to resolve the differences in expectations.

- One way that is used to achieve a balance between principal and agent is performance-based compensation.

- In agency theory, common principal-agent relationships include shareholders and management, financial planners and their customers, and lessees and lessors.

|

3.3.2 Shareholder Theory

Shareholder primacy is a form of corporate governance centered on shareholders that focuses on maximizing shareholder value before taking into account the interests of other stakeholders, such as society, the community, consumers, and employees.

The debate has been going on for a long time between a shareholder approach and an approach to stakeholders. Shareholder approach advocates stress that corporations should focus on maximizing shareholder wealth, while stakeholder approach proponents highlight the importance of corporations as employment resources, consumers' sources of higher-quality products, and improvements in social responsibility within the general community.

Although shareholder primacy may be favored by most, a shareholder-centric corporate approach has many limitations and disadvantages. The following include some key issues:

Corporate decisions and strategies can transition to short-term objectives, leading to hasty decision-making and decisions characterized by short-term incentives and bonuses to achieve certain objectives.

The lack of willingness to take risks and invest in new technologies may limit corporate growth and the potential for better products to enhance overall well-being.

Instead of using the cash generated to make more and better strategic investment decisions, e.g. research and development, more dividends paid by corporations to provide income to shareholders.

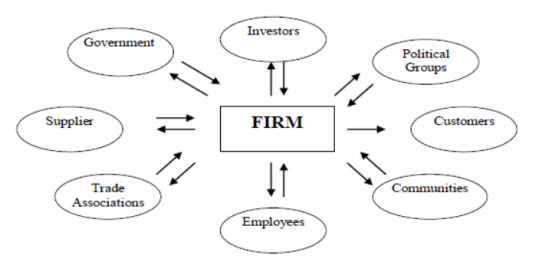

3.3.3 Stakeholder Theory

A stakeholder is defined as any person/group that can influence or be impacted by a company's actions. It involves staff, clients, suppliers, creditors and even the wider community and rivals.

An important component of Corporate Social Responsibility (CSR), a concept that recognizes today's corporate responsibilities in the world, be they economic, legal, ethical or even philanthropic. Some of the largest corporations in the world today claim to have CSR at the center of their corporate strategy. While there are many real cases of "conscientious" companies, many others use CSR as a good PR tool to enhance their image and reputation, but ultimately fail to put their words into action.

Like that of the shareholder approach, the point of the stakeholder approach is to maximize the economic benefit of the operations of the business. It simply takes a different perspective on how this should be done:

Firstly, the potential reduction in external costs imposed by the company on stakeholders is present. Instead of treating as many of its costs as possible as externalities and disclaiming responsibility for them, leading to conflict in the form of strikes, lawsuits, and controls and regulations imposed by the government, the stakeholder company seeks to manage these costs through internal negotiation with its stakeholders.

Secondly, the approach of stakeholders promotes a better transfer of information between the different elements of the company. A company's competitiveness will often be affected by whether stakeholders (such as banks, subcontractors, or workers) are able to enter into agreements with managers that require information sharing and mutual engagement. Obviously, in generating these types of long-term relationships, or 'implicit contracts,' between stakeholders, a governance structure that promotes information disclosure will be vital.

|

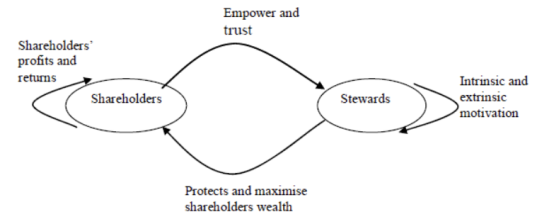

3.3.4 Stewardship Theory

The theory of the steward states that through firm performance, a steward protects and maximizes shareholder wealth. Stewards are business managers and managers working for shareholders, protecting shareholders and making profits. When organizational success is obtained, the stewards are satisfied and motivated. It stresses the position of employees or executives to act more independently in order to maximize the returns of shareholders. Employees take ownership of their jobs and diligently work for them.

|

Key Takeaways:

- The theory of the agency is a principle used in the relationship between business principals and their agents to explain and resolve problems

- Shareholder primacy is a form of corporate governance centered on shareholders that focuses on maximizing shareholder value before taking into account the interests of other stakeholders, such as society, the community, consumers, and employees.

- A stakeholder is defined as any person/group that can influence or be impacted by a company's actions. It involves staff, clients, suppliers, creditors and even the wider community and rivals.

- The theory of the steward states that through firm performance, a steward protects and maximizes shareholder wealth.

Some progressive and transparent processes have been introduced by the Indian Companies Act of 2013 that benefit stakeholders, directors as well as business management. Investment advisory services and proxy firms provide shareholders with concise information about these newly introduced processes and regulations aimed at improving India's corporate governance.

Corporate advisory services are provided by advisory firms to effectively manage company activities in order to ensure business stability and growth, maintain customer and customer reputation and reliability. The top management that consists of the board of directors is responsible for governance. In the interest of the company and minority investors, they must have effective control over the company's affairs. In the continually changing business scenario in India, corporate governance ensures strict and efficient application of management practices along with legal compliance.

Before the Companies Act of 2013 was introduced, corporate governance was guided by Clause 49 of the Listing Agreement. In accordance with the new provision, certain amendments to the Listing Agreement have also been approved by SEBI in order to improve the transparency of the transactions of the listed companies and to give minority stakeholders a greater say in influencing management decisions. These amendments have become effective from 1st October 2014.

A business that has good corporate governance among the shareholders associated with that business has a much higher level of trust. Active and independent directors contribute to the company's positive financial market outlook, influencing share prices positively. For foreign institutional investors, corporate governance is one of the important criteria for deciding which company to invest in.

The corporate practices in India emphasize the functions of audit and finances that have legal, moral and ethical implications for the business and its impact on the shareholders. Innovative measures were introduced by the Indian Companies Act of 2013 to adequately balance legislative and regulatory reforms for enterprise growth and to increase foreign investment, taking into account international practices. Rules and regulations are measures that increase shareholder participation in decision-making and introduce transparency in corporate governance, thereby ultimately safeguarding the company's and shareholders' interests.

Corporate governance safeguards not only the leadership but also the interests of the stakeholders and promotes India's economic progress in the world's roaring economies.

SEBI (the primary regulator of the Indian securities market and listed companies) and the MCA are the primary Indian implementation entities for corporate governance initiatives.

Other entities in charge of enforcing corporate governance issues include:

Under the Companies Act, the National Company Law Tribunal (the Tribunal) has quasi-judicial powers under the Companies Act to decide certain matters, including the protection of minority shareholders from majority shareholder oppression and mismanagement, and its appeal authority, the National Company Law Appellate Tribunal (the Appellate Tribunal);

The Registrar of Companies (ROC), which is generally present in every Indian state and primarily guarantees a company's compliance with the Companies Act's filings and disclosures;

The Regional Director (RD), to whom certain powers have been delegated from the central government. In India, there are seven RDs, each with its own territorial jurisdiction, in which, inter alia, they oversee the operation of the relevant ROCs; and

The Competition Commission of India (CCI) was established under the aegis of the Competition Act 2002, which deals with antitrust issues where the action of a company may have a negative impact on competition in the relevant Indian market.

There are also other regulatory authorities, such as the Insurance Regulatory and Development Authority (for the insurance sector) and the Telecom Regulatory Authority of India that regulate companies operating in specific sectors (for the telecom sector).

In India, the notion of shareholder activist groups or proxy advisory companies is emerging. A 'proxy adviser' is defined by the SEBI (Research Analysts) Regulations, 2014 (the Analyst Regulations) as any person who provides advice, by any means, to an institutional investor or shareholder of a company, in relation to the exercise of their rights in the company, including public offer recommendations or agenda item voting recommendations. Prominent proxy consulting firms operating in India are Institutional Investor Advisory Services India Limited and In Govern, both established in 2010. Stakeholders Empowerment Services, a research and advisory corporate governance firm, claims to be the first company to have registered under the Analyst Regulations as a 'proxy adviser'; however, prior to the enactment of corporate governance initiatives, these companies are not formally consulted by the authorities. Usually, committee recommendations and proposed regulatory norms are put up for public comment by concerned authorities in order to ensure large-scale participation. In association with the Confederation of Indian Industry, the Institute of Chartered Accountants of India and the Institute of Company Secretaries of India (ICSI), the National Foundation for Corporate Governance, set up by the MCA as a non-profit trust, also provides a platform to raise awareness of corporate governance issues.

3.4.1 Emerging Trends in Corporate Governance

Better Investor Stewardship: Since the last financial crisis, there has been a push for more investor accountability in how they use their influence and votes to sway the direction of investment companies. In 2017, $8.2 trillion of equity investments were controlled by the top five global asset managers. Many of the largest institutional investors focus more on expanding investor companies and proxy voting commitments.

Board Quality & Composition: The key indicators of board quality for institutional investors are likely to remain as gender diversity, board abilities and experiences, composition refreshment, and the appointment of directors who have enough time to dedicate themselves to the business. Boards and committees in certain markets should expect to see more votes against directors in cases where fewer than two women are on the board.

Compensation: Investors are seeking additional commitment and/or disclosure about total composition and the effect it has on long-term strategic goals and business performance. On incentive compensation schemes and if they achieve the desired employee behavior, boards should expect more inquiries.

Activist Investing: By competing demands, many boards feel trapped. Institutional investors are interested in the creation of long-term value, while activist investors usually want to improve value in the short term. The boards that will succeed are the ones that are willing to have a meaningful dialogue to reach a resolution with activists.

Environmental, Social, & Governance Risks: Climate change and sustainability are now seen by investors as mainstream priorities. The Task Force of the Financial Stability Board provided guidance on climate-related financial disclosures that will increase investor focus on recommendations such as the use of the two-degree planning scenario to achieve the goal of the Paris Agreement.

Cybersecurity: Due to security breaches, cyber hazards continue to be an area of concern. Institution investors will use 2018 to shape their cyber-risk policies and what the boards' role will be.

Human Capital: Institution investors will focus on effective succession planning, the impact of corporate culture on performance, and gender pay disparity at the C-suite level and beyond.

3.4.2 Models of Corporate Governance

1. Canadian Model:

Canada has a history of colonization by France and Britain. Those cultures were inherited by industries. In these industries, the cultural background has affected subsequent developments. French merchanism has a large influence on the country.

The Canadian industry was controlled by rich families in the 19th century. Over the last five decades, wealthy Canadian families have sold their stocks during periods of stock boom. Canada now resembles the United States in the structure of industry.

Since last four decades there is change in industries in Canada in the areas:

i. Family-owned businesses are increasingly on the rise.

ii. Utilization of new technologies

iii. More activities for entrepreneurship

iv. Early entrance into corporate governance initiation

v. Ownership diffuse from earlier colonial masters.

2. UK and American Model:

The U.S. in July 2002 The Sarbanes Oxley Act (SOX), particularly designed to make US companies more transparent and accountable to their stakeholders, was passed by Congress.

The Act seeks to restore investor trust by providing good corporate governance practices to prevent corporate fraud and fraud in corporations, to enhance the accuracy and transparency of listed companies' financial reporting, accounting services, corporate accountability and independent auditing.

The applicability of the Act is not limited to US companies which are publicly owned, but also extends to other units which are registered with the Securities Exchange Commission. There is a common thread running between them, however, i.e., that governance matters. Effective governance can not be achieved unless corporate governance is integrated with strategic planning and shareholders are willing to bear the additional required expenses.

The above events encouraged the development of the current situation in which various aspects of the Sarbanes Oxley Act are discussed and limitations are discussed and their effects.

3. German Model:

Since the beginning of the 19th century, Germany has been famous for industrialisation. For the last five decades, Germany has been exporting sophisticated machinery on a large scale. Wealthy German families, small shareholders, banks and foreign investors finance the industries. The large private bankers who invested in industry had a bigger say in running those industries and hence performance was not up to the mark.

Since the second half of the 19th century, Germany has been considering proper steps towards corporate governance. In Germany, the company law of 1870 established a dual board structure to look after small investors and the public. In 1884, the company law made data and openness the main theme. At the first shareholders' meeting of any company, the legislation also mandated minimum attendance.

By dismantling the wealthy, World War I saw considerable changes in industries in Germany. Germany has a large number of family-owned companies as of today. Smaller businesses are regulated by banks. In Germany, proxy voting by small investors was introduced in 1884.

4. Italian Model:

Family holdings also controlled the Italian business. By the middle of the 20th century, business groups and families were powerful. During the second half of the 20th century, the stock market slowly gained importance. The Italian government did not intervene in the management or the operation of the company.

In 1931, after the Italian collapse of all investment banks, the Fascist government in Italy took over industrial shares and imposed a legal separation of investment from commercial banking. In order to have a direct role in the economy, the Second World War brought a shift from the government side, helping weak companies and using corporate governance to enhance these companies. This has helped Italy's economic growth, especially in capital-intensive industries.

Industrial policies have been introduced since World War II. The policy had no need for the protection of investors. This led investors not to invest in company shares, but to purchase government bonds. The Italian industry's growth was due to the small specialized industries that remained unlisted in the stock markets.

Families controlled the tiny firms. Bureaucrats or wealthy families were in the hands of corporate governance. The activities of corporate governance and trust in stock markets have begun to develop over the last two decades. Italian investors are aware that corporate governance and the protection of rights are important.

5. France Model:

Religion has traditionally regulated the French financial system. The techniques of controlling, borrowing, and lending with the principal borrower being the state. The interest was somewhat prohibited by religion. The lending was based mainly on real estate mortgages. The French public took to hoarding gold and silver in the early 19th century.

Composed coins measure part of the money transactions over that period. Conservative in its outlook was the French industry. The company used one company's retained profits to build other business areas and businesses.

The company was managed by wealthy families who financed these business groups. From generation to generation, the company's control continued. In France, along with economic development activities, the corporate government was introduced stage wise. This resulted in wealthy families controlling the corporate sector coming under the state's watchful guidance.

6. Japanese Model:

Japan was a profoundly conservative nation where the system of hereditary castes was important. Business families were at the end of the era, i.e., under priests, warriors, peasants, and artisans. The company stagnated because of the lack of funds at the lowest level of the pyramid.

Goods and services were required by the country's large population and prominent mercantile families such as Mitsui and Sumitomo were given importance. The Second World War brought a sea change in business, trade and industry and opened up American traders to the Japanese markets. The young Japanese began to study higher education in Europe and America, learning foreign technology and business administration.

These have led to the creation of a new culture in Japan's industry, commerce and economic outlook. The government has also begun to set up state-owned companies. These firms ended up with losses and enormous debts. Most of these businesses were mass privatized by the government to get out of the problem. Many of them were sold to the families of Mitsui and Sumitomo.

Mitsubishi, meanwhile, gained prominence. The three groups of companies were called Zaibatsu, "meaning controlled by listed corporate pyramids." A mix of private and state capitalism is the growth of Japanese industry. Meanwhile, large companies such as Nissan and Suzuki have developed in the automotive region. The Suzuki business was the property of the Suzuki family.

The period of depression in the 1930s brought economic stagnation and eroded the appreciation of family companies by the Japanese public. Family companies have always maintained their family rights in front of their shareholders and in the public interest. The private company resorted to short-term gains and was not concerned with long-term investments or long-term gestation projects.

The big companies in Japan had their own banks as well. The American occupied the Japanese economy in 1945 and took over that changed the face of Japanese industry and economy. The large Japanese companies were free-standing by the beginning of the 1950s and widely held similar to the United Kingdom and the United States.

The businesses that were poorly governed were the targets for large businesses to take over. The banks controlled the big sectors of industry known as Keiretsu. Even today, the Keiretsu system is in place. Large businesses also have a major influence on the government. In Japan, corporate governance has evolved in the last 2 decades.

7. Indian Model:

East India Co. (EIC) had malpractices in its trade.

Current practice in enterprises since 400 years of industrialisation.

Classic instances are environmental and global trade.

India is 2500 years old with a long history of commercial activity.

(a) System of the Managing Agency, 1850-19555

(b) The 1956-1991 Promoter System

(c) From 1992 onwards, the Anglo American System

The Securities and Exchange Board of India (SEBI):

In Jan. 1992, the SEBI Act was introduced and gave statutory powers and introduced 2 problems.

(a) Protection of investors, and

(b) Market Evolution.

SEBI is part of the Company Affairs Department of Govt. About India.

SEBI has shifted from a system of control to prudential regulation.

It is entitled to control the operation of stock exchanges and their players, including all of us listed.

SEBI plays a key role in India's corporate governance.

Such innovations in the U.K. had significant influence on India. A National Task Force headed by Rahul Bajaj, who submitted a 'Desirable Corporate Governance in India-a Code' in April 1998 containing 17 recommendations, was appointed by the Confederation of Indian Industries (CII).

The Securities and Exchange Board of India (SEBI) subsequently appointed a committee to be chaired by Kumar Mangalam Birla. This committee submitted its report, containing 19 mandatory recommendations and 6 non-mandatory ones, on 7 May 1999. By requiring the Stock Exchanges to introduce a separate clause 49 in the Listing Agreements, SEBI implemented the report.

A Ganguly Committee report on the improvement of corporate governance in banks and financial institutions was produced in April 2002. Under the chairmanship of Mr. Naresh Chandra on Corporate Audit and Governance, the Central Government (Ministry of Finance and Company Affairs) appointed a Committee. This committee submitted its report on 23 December 2002.

Finally, under the chairmanship of N.R., SEBI appointed another Corporate Governance committee. Murthy Narayan. On 8 Feb. 2003, the committee presented its report to SEBI. SEBI subsequently revised clause 49 of the Listing Agreement, which came into force on 1 January 2006.

Legal recognition was given to some of the recommendations of these various committees by amending the Companies Act in 1999, 2000 and twice in 2002. In December 2004, the Central Government (Ministry of Enterprise Affairs) appointed an Expert Committee under the chairmanship of Dr. Jamshed J. Irani in view of the gear company law for competition with enterprises in developed countries.

Insider Trading

Insider trading involves trading in the stock of a public company by someone who, for any reason, has non-public, material information about that stock. Insider trading, depending on when the insider makes the trade, can be either illegal or legal. When the material data is still non-public, it is illegal, and this kind of insider trading has harsh consequences.

- Insider trading is the purchase or sale of the stock of a publicly traded company by someone with material information about that stock that is not public.

- Material non-public information is any information that could significantly affect the decision of an investor to purchase or sell the security that was not made available to the public.

- This type of insider trading is illegal and includes severe penalties, including both possible fines and time in jail.

- Insider trading can be legal if it conforms to the rules set forth by the SEC.

Material information is any data that could have a significant impact on the choice of an investor to purchase or sell the security. Information that is not legally available to the public is non-public information.

The legality issue stems from the attempt of the SEC to maintain a fair marketplace. An individual who has access to insider data would have an unfair advantage over other investors who do not have the same access and could possibly make more unfair profits than their fellow investors.

Illegal insider trading involves tipping others if you have any type of non-public material information. Legal insider trading occurs when company directors buy or sell shares, but their transactions are legally disclosed. In order to protect investments from the effects of insider trading, the Securities and Exchange Commission has rules. It does not matter how the non-public material information was received or if the company employs the individual. Suppose, for example, someone learns from a family member about non-public material information and shares it with a friend. If this insider information is used by the friend to profit from the stock market, then all three of the people involved could be prosecuted.

The best way to stay out of legal trouble is to avoid sharing or using non-public material information, even if you have accidentally overheard it.

Key Takeaways:

- Investment advisory services and proxy firms provide shareholders with concise information about these newly introduced processes and regulations aimed at improving India's corporate governance.

- Prominent proxy consulting firms operating in India are Institutional Investor Advisory Services India Limited and In Govern, both established in 2010.

- The Task Force of the Financial Stability Board provided guidance on climate-related financial disclosures that will increase investor focus on recommendations such as the use of the two-degree planning scenario to achieve the goal of the Paris Agreement

- Illegal insider trading involves tipping others if you have any type of non-public material information. Legal insider trading occurs when company directors buy or sell shares, but their transactions are legally disclosed.

Reference books:

- Dr.A.K. Gavai, Business Ethics, Himalaya Publishing House, 2008

- S.K. Mandal, Ethics is Business and Corporate Governance, McGraw Hill, 2010