UNIT 1

Overview of macro economics

Meaning

The term "macro" was first used in economics by Ragnar Frisch in 1933. However, it originated in the 16th and 17th century mercantilists as a methodological approach to economic problems. They were interested in the entire economic system. In the 18th century,

physiocrats adopted it in the table economy, demonstrating a "wealth cycle" (i.e., net production) among the three classes represented by the peasant, landowner, and barren classes.

Malthus, Sismondi and Marx in the 19th century dealt with macroeconomic issues. Walras, Wicksell and Fisher contributed modernly to the development of pre-Keynes macroeconomic analysis.

Certain economists such as Kassel, Marshall, Pigovian, Robertson, Hayek, and Hortley developed the Quantity Theory of Money and General Price Theory in the decade following World War I. But Keynes, who eventually developed the general theory of income, output, and employment in the wake of the Great Depression, has got credit.

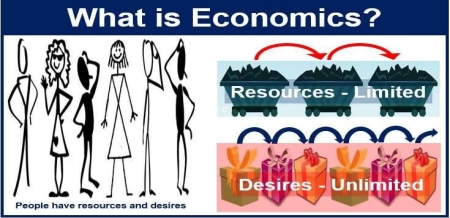

Economics is a science that deals with the production, Exchange and consumption of various goods in the economic system. It is a scarce resource that can lessen the abundance of human welfare. The central focus of Economics lies in the choice between resource scarcity and its alternative uses. The word "economics" is derived from two of the Greek words - oikos (House) and nemein (to manage) which means to manage the household budget "using the limited funds possible.

Scope of Macro Economics

Economics is the subject of dealing with every situation happening all over the world. This subject is used in many stances in our lives. For example, your mom does all the work in your home. From doing all the housework to maintaining a budget for rations to meeting all your needs. Thus, it is one subject that deals with the daily work of our lives. There are two major categories on the same subject: microeconomics and macroeconomics. One deals with individual units of the economy, such as consumers and households. But the latter deals with the whole economy. It deals with research on national income and output. This understanding of science is vast and of varying lengths. However, for simplicity, this article will only focus on the scope and need for macroeconomics.

Microeconomics:

As mentioned above, microeconomics is a branch of economics that deals with individual units of the economy. It includes research areas on individual units such as consumers and homes. The subject deals with issues related to determining the price of goods. These direct or indirect factors affect the supply and demand of goods and the procurement of individual satiety levels. The main purpose of microeconomics is to maximize profits and minimize costs incurred. It is used for future generations to be available and balanced.

Macroeconomics

The term macroeconomics was coined by Ragnar Frisch in 1933. However, the approach to economic problems began in the 16th and 17th centuries. As a result, this originated from mercantilists. It is the field of science that deals with the whole economy or the whole, including macro factors. The hope of macroeconomics does not involve studying individual units of the economy. But the whole economy studies the average National income, total employment, total savings and investment, aggregate supply and demand, and general price levels.

The subject of macroeconomics revolves around income and employment decisions.

Controlling the cycle of inflation and deflation was only possible by choosing current economic policies. These policies were developed at the macro level. Research on individual units has also become impossible. In addition, government participation through financial and fiscal measures in the economy is increasing. Therefore, the use of macro analysis is irrefutable.

Now we know that macroeconomics is a specialty of economics. It focuses on the economy through the sum of the individual units and determines if it will have a significant impact on the country as a whole. All prominent policies and measures are based on this concept. For example, per capita income determines national income. This is nothing but the average of the total income of the people of the whole country.

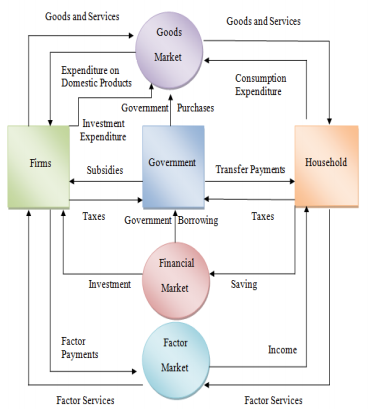

Fig 1

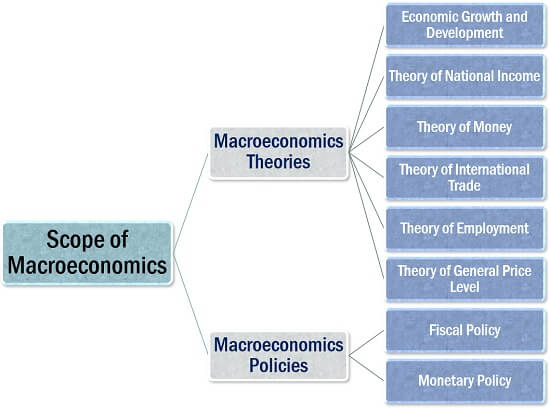

Scope of Macroeconomics:

Governments, financial institutions and researchers analyse the general problems of the people and the economic well-being of the people.

It mainly covers the foundations of macroeconomic theory and measure theory, which is macroeconomic policy. Here, macroeconomic theories include theories of economic growth and development, national income, money, international trade, employment, and general price levels. In contrast, macroeconomic policy covers fiscal and monetary policy.

Research on issues such as India's unemployment, general price levels and balance of payments (BOP) issues is part of macroeconomic research as it is relevant to the economy as a whole.

Macroeconomic Theories:

The government is understood to be the national regulator. Consider various aspects that are important and have a direct impact on the lives of citizens. There are six theories within the scope of macroeconomics.

Theory of Economic Growth and Development:

Economic growth is also under the study of macroeconomics. Economic resources and capabilities are assessed based on the scope of macroeconomics. It plans to increase levels of national income, output, and environmental levels. They have a direct impact on the economic development of the economy.

Money theory:

Macroeconomics assesses the impact of reserve banks on the economy, capital inflows and outflows, and its impact on employment rates. Frequent changes in the value of money caused by inflation and deflation have many negative effects on the country's economy. They can be exacerbated by monetary policy, fiscal policy, and direct control of the economy as a whole.

National Income Theory:

This includes various topics related to measuring national income, such as revenue, spending, and budget. As a macroeconomic study, it is essential to assess the overall performance of the economy in terms of national income. At the beginning of the Great Depression of the 1930s, it was essential to investigate the triggers of general overproduction and general unemployment.

This led to the creation of data on national income. It helps to predict the level of economic activity. It also helps to understand the income distribution among different classes of citizens.

International Trade Theory:

This is a research area focused on the import and export of products or services. Simply put, it points to the economic impact of cross-border commerce and tariffs.

Employment theory:

This macroeconomic scope helps determine the level of unemployment. It also determines the conditions that lead to such unemployment. Therefore, this affects production supply, consumer demand, consumption, and spending behaviour.

General Price level theory:

The most important of these are research on commodity prices and how inflation or deflation fluctuates a particular price rate.

Macroeconomic policy:

The RBI and the Government of India are working together to imply macroeconomic policies for national improvement and development.

It falls into two sections:

Fiscal policy:

It refers to how spending fills deficit income and describes itself as a form of budgeting under macroeconomics.

Financial policy:

The Reserve Bank is working with the government to establish monetary policy. These policies are measures taken to maintain the stability and growth of a country's economy by regulating various interest rates.

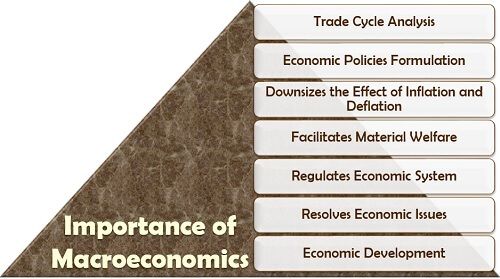

Importance of macroeconomics:

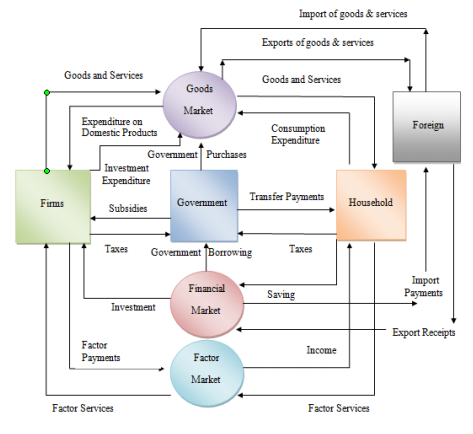

Fig 2

Macroeconomics is an important concept that considers the whole country and works for the welfare of the economy.

1. Business cycle analysis

Timing of economic fluctuations helps prevent or prepare for financial crises and long-term negative situations.

2. Formulation of economic policy

The fiscal and monetary policy system relies entirely on the widespread analysis of macroeconomic conditions in the country.

3. Reduce the effects of inflation and deflation

Macroeconomics is primarily aimed at helping governments and financial institutions prepare for economic stability in a country.

4. Promote material welfare

This stream of economics provides a broader perspective on social or national issues. Those who want to contribute to the welfare of society need to study macroeconomics.

5. Regulate the economic system

It continues to guarantee or check the proper functioning and actual position of the country's economy.

6. Solve economic problems

Macroeconomic theory and problem analysis help economists and governments understand the causes and possible solutions to such macro-level problems.

7. Economic development

By utilizing macroeconomic data to respond to various economic conditions, the door to national growth will be opened.

Key takeaways

- Microeconomics studies individual and business decisions, while macroeconomics analyzes decisions made by countries and governments.

- Microeconomics has been a bottom-up approach, focusing on supply and demand, and other forces that determine price levels.

- Macroeconomics takes a top-down approach, looks at the economy as a whole, and tries to determine its course and nature.

Circular flow model

Definition

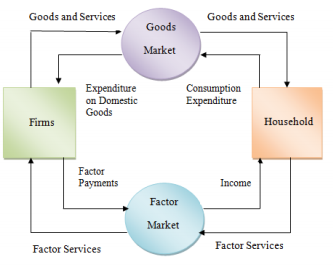

The circular flow model demonstrates how money moves through society. Money flows from producers to workers as wages and flows back to producers as payment for products. In short, an economy is an endless circular flow of money.

Circular flow refers to a simple economic model which states the reciprocal circulation of income between producers and consumers. In the circular flow model, the interdependent entities of producer and consumer are referred to as "firms" and "households" respectively and provide each other with factors in order to facilitate the flow of income. Firms provide consumers with goods and services in exchange for consumer expenditure and "factors of production" from households.

In macroeconomics, we have the economy with 2 sectors, 3 sectors and 4 sectors.

1. Economy with 2 sectors: Household and Firm

2. Economy with 3 sectors: Household, Firm and Government

3. Economy with 4 sectors: Household, Firm, Government and International Trade

The four macro economic sector

- The Household Sector - This sector includes all the individuals in the economy. The primary function of this sector is to provide the factors of production. The factors of production include land, labour, capital and enterprise. The household sectors are the consumers who consume the goods and services produced by the firms and in return make payments for the same.

2. The Firms Sector - This sector includes all the business entities, corporations and partnerships. The primary function of this sector is to produce goods and services for sale in the market and make factor payments to the household sector.

3. The Government Sector - This sector includes the center, state, and local governments. The prime function of this sector is to regulate the functioning of the economy. The government sector incurs both revenue as well as expenditure. The government earns revenue from tax and non-tax sources and incurs expenditure to provide essential public services to the people.

4. The Foreign Sector - This sector includes transactions with the rest of the world. Foreign trade implies net exports (exports minus imports). Exports include goods and services produced domestically and sold to the rest of the world and imports include goods and services produced abroad and sold domestically.

The three markets

- The Goods Market - In this market the goods and services are exchanged among the four macroeconomic sectors. The consumers are the household, government and the foreign sector while the producers are the firms.

2. The Factor Market - The factors of production are traded through this market. For the production of final goods and services, the firms obtain the factor services and make payments in the form of rent, wages and profits for the services to the household sector.

3. The Financial Market - This market consists of financial institutions such as banks and non-bank intermediaries who engage in borrowing (savings from households) and lending of money.

The circular flow of income in a two sector model

In this model, the economy is assumed to be a closed economy and consists of only two sectors, i.e., the household and the firms. A closed economy is an economy that does not participate in international trade. In this model, the household sector is the only buyer of the goods and services produced by the firms and it is also the only supplier of the factors of production. The household sector spends the entire income on the purchase of goods and services produced by the firms implying that there is no saving or investment in the economy. The firms are the only producer of the good and services. The firms generate income by selling the goods and services to the household sector and the later earned income by selling the factors of production to the former. Thus, the income of the producers is equal to the income of the households is equal to the consumption expenditure of the household. The demand of the economy is equal to the supply.

In this model,

Y = C where, Y is Income and C is Consumption

The circular flow of income in a three sector model

The three sector model of circular flow of income highlights the role played by the government sector. This is a more realistic model which includes the economic activities of the government however we continue to assume the economy to be a closed one. There are no transactions with the rest of the world. The government levies taxes on the households and the firms and it also gives subsidies to the firms and transfer payments to the household sector. Thus, there is income flow from the household and firms to the government via taxes in one direction and there is income outflow from the government to the household and firms in the other direction. If the government revenue falls short of its expenditure, it is also known to borrow through financial markets. This sector adds three key elements to the circular flow model, i.e., taxes, government purchases and government borrowings.

In this model, the equilibrium condition is as follows:

Y = C + I + G

Where, Y = Income; C = Consumption; I = Investment and G = Government Expenditure. In a closed economy, aggregate demand is measured by adding consumption, investment and government expenditure. Thus, aggregate demand is defined as the total demand for final goods and services in an economy at a given time and price level and aggregate supply is defined as the total supply of goods and services that the firms are willing to sell in an economy at a given price level.

The circular flow of income in a four sector model

This is the complete model of the circular flow of income that incorporates all the four macroeconomic sectors. Along with the above three sectors it considers the effect of foreign trade on the circular flow. With the inclusion of this sector the economy now becomes an ‘open economy’. Foreign trade includes two transactions, i.e., exports and imports. Goods and services are exported from one country to the other countries and imports come to a country from different countries in the goods market. There is inflow of income to the firms and government in the form of payments for the exports and there is outflow of income when the firms and governments make payments abroad for the imports. The import payments and export receipts transactions are done in the financial market

In this model, the equilibrium condition is as follows:

Y = C + I + G + NX

NX = Net Exports = Exports (X) – Imports (M)

Where, Y = Income; C = Consumption; I = Investment; G = Government Expenditure; X = Exports and M = Imports.

Key takeaways –

- Circular flow refers to a simple economic model which states the reciprocal circulation of income between producers and consumers.

National income: Meaning and Definition:

What is saved each year is consumed as regularly as it is spent every year and almost at the same time. But that is consumed by another person. That part of him the income that rich people spend each year is almost always consumed by an idle guest that part he consumes every year immediately for savings, profits employed as capital and consumed at the same manners but by other people ", Adam Smith

Fisher ' s definition:

Fisher adopted "consumption" as the standard for national income, while Marshall and Pigou considered it production. "

It's a flaw:

- However, from a practical point of view, this definition is less useful, because there are certain difficulties in measuring goods and services in terms of money. First, it is much more difficult to estimate the monetary value of net consumption than to estimate the monetary value of net production.

- In a country, there are several people who consume specific goods in different places, so it is difficult to estimate their total consumption. Secondly, some consumer goods are durable and can be used for many years.

- If we consider the example of a piano or coat given by Fisher, then only the services they provide within a year will be included in the income. If the coat costs Rs. 100 and lasting ten years, Fisher will consider only rupees 100 as a year's national income, while Marshall and pigou will include rupees. 100 in the year of national income, when it is made.

- In addition, it is not safe to say that this coat can only be used for ten years. It may last longer or for a shorter period of time. Third, durable goods are often constantly changing, resulting in changes in ownership and value as well.

- Therefore, from a consumption point of view, it is difficult to measure the value of the services of these goods in money. For example, the owner of the Maruti car sells it at a price higher than its actual price, and the purchaser sells it further at the actual price after using it for several years.

- The question now is, Should we consider its price, whether real or black market price, and then when it moves from one person to another, its value should be included in national income according to its average age?

- But the definition proposed by Marshall, Pigou and Fisher is not entirely flawless. However, Marshallian and Pigovian definitions tell us what affects economic well-being, while Fisher's definition helps us compare economic well-being over different years.

Modern definition:

From a modern point of view, Simon Kuznets defines national income as"the net output of goods and services that flow from the national production system into the hands of the end consumer in a year."”

On the other hand, in a United Nations report, national income is determined on the basis of a system of estimates of national income, as a net national product, as a supplement to the share of different factors, and as a country & apos; net national expenditure over a period of one year. In fact, while estimating national income, any of these three definitions could be used, because if different items were correctly included in the estimate, the same national income could be derived

Net income accounting

Definition

National income accounting refers to the government bookkeeping system that measures the health of an economy, projected growth, economic activity, and development during a certain period of time. It helps in assessing the performance of an economy and the flow of money in an economy. The double entry system principle of accounting is used to prepare the national income accounts.

Where,

- Y – National income

- C – Personal consumption expenditure

- I – Private investment

- G – Government spending

- X – Exports

- M – Imports

Importance of net income accounting

- National income accounting provides statistics can be used to simplify the procedures and techniques used to measure the aggregate input and output of an economy.

- The national income accounting provides data which is used to frame government economic policies

- National income accounting provides information on the trend of economic activity level.

- The national income accounting statistics is used by the central bank to vary the rate of interest and set or revise the monetary policy.

- The government use data on GDP, investments, and expenditures to frame or modify policies regarding infrastructure spending and tax rates.

- The national income accounting data shows the contribution of different sectors towards economic growth.

Green GNP and NNP concepts

Green GNP is defined as “ GNP which is indicator of a sustainable use of natural environment and equitable distribution of benefits of development”.

The following characteristics involves

- Sustainable economic development means development does not cause environmental degradation and depletion of natural resources.

- Equitable distribution of benefits of its development

- Promotes economic welfare for a long period of time

Equation

Green GNP = GNP – net fall in stock of national capital

NNP concept

Definition

Net national product (NNP) is the monetary value of finished goods and services produced by a country's citizens, overseas and domestically, in a given period. It is the equivalent of gross national product (GNP), the total value of a nation's annual output, minus the amount of GNP required to purchase new goods to maintain existing stock, otherwise known as depreciation.

Net national product is also obtained by subtracting depreciation from the gross national product (GNP)

NNP= GNP – Depreciation

Or,

NNP= GDP+ income from abroad- depreciation

National income and economic welfare

Welfare is a happy and satisfied state of human mind. Pigou regards individual welfare as the sum total of all satisfactions experienced by an individual and social welfare as the sum total of individual welfares. Economic Welfare is that part of social welfare which can directly or indirectly be measured in money.

Relation between Economic Welfare and National Income

In terms of money there is a close relationship between economic income and national welfare. When national income increases, total welfare also increases and vice versa.

The effect of national income on economic welfare can be studied in two ways:

- By change in the size of national income – The change in the size of national income may be positive or negative. The positive change in the national income increases its volume which leads to more consumption of goods and services, as a result leads to increase in the economic welfare.

While the negative change in national income results in reduction of its volume. As a result people get lesser goods and services for consumption which leads to decrease in economic welfare. But this relationship depends on a number of factors such as changes in price, working conditions, percapita income and methods of spending.

- Changes in price – it is difficult to measure real change in economic welfare, if the change in national income is due to change in prices. When the national income increases as a result of increase in prices. It is more likely that the economic welfare would decline

b. Working conditions- the increase in national income is due to exploitation of labour e.g., increase in production by workers working for longer hours, by paying them lesser wages than the minimum. Then the economic welfare cannot be said to be increased.

c. Per capita income - if per capita income is not kept in mind, national income cannot be a reliable index of economic welfare.

d. Method of spending - If with the increase in income, people spend on such necessities and facilities as milk, ghee, eggs, fans, etc. which increase efficiency, the economic welfare will increase. On the other hand, the expenditure on drinking, gambling etc. will result in decreasing the economic welfare.

2. By change in the distribution of national income.

- By Transfer of Wealth from the Poor to the Rich: - transfer of wealth from poor to rich result in decrease in economic welfare. This happens when the government gives more benefits to the richer sections and imposes regressive taxes on the poor.

b. Transfer of wealth from rich to poor - When the distribution of income takes place in favour of the poor through the methods such as fixing a minimum wage rate, by increasing the production of goods used by the poor, by fixing the prices of such goods, by granting financial assistance to the producers of these goods, by the distribution of goods through co-operative stores, the economic welfare increases.

Key takeaways –

- National income accounting refers to the government bookkeeping system that measures the health of an economy, projected growth, economic activity, and development during a certain period of time.

- When national income increases, total welfare also increases and vice versa.

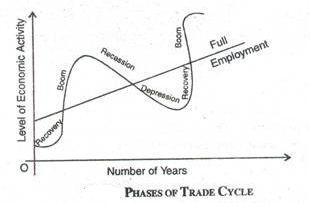

A trade cycle refers to fluctuations in economic activities such as employment, output and income, prices, profits, etc.

Definition

According to Keynes, “A trade cycle is composed of periods of good trade characterised by rising prices and low unemployment percentages altering with periods of bad trade characterised by falling prices and high unemployment percentages”.

According to Mitchell, “Business cycles are of fluctuations in the economic activities of organized communities. The adjective ‘business’ restricts the concept of fluctuations in activities which are systematically conducted on commercial basis.

Features of a trade cycle

- A business cycle is synchronic which involves cyclical fluctuations start in one sector it spreads to other sectors.

- The trade cycle is a wave like movement which involves a period of prosperity is followed by a period of depression.

- Business cycle is recurrent and rhythmic; prosperity is followed by depression and vice versa.

- A trade cycle is cumulative which involves each phase feeds on itself and creates further movement in the same direction.

- A trade cycle is asymmetrical which results in prosperity phase is slow and gradual and the phase of depression is rapid.

- The impact of a trade cycle is differential. It affects different industries in different ways.

- A trade cycle is international in character. Booms and depressions in one country are passed to other countries, through international trade.

Phase of a trade cycle

- Recovery - entrepreneurs increase the level of investment which in turn increases employment and income, in the early period of recovery. The purchasing power increases through employment which leads to increase in demand for consumer goods. The demand for consumer goods encourages the demand for producer’s goods. Depending upon the gestation period of investment the prices rises. The rise in price shall bring change in the distribution of income.

2. Boom – the rate of investment increases further which wave of optimism in business, the level of production increases and the boom gathers momentum. During a period of boom, the economy surpasses the level of full employment and enters a stage of over full employment.

3. Recession - on the onset of a recession, the orders of raw material are reduced. In producers’ goods industries and housing construction the rate of investment declines. The price falls, liquidity preference rises in society and owing to a contraction of money supply.

4. Depression - The main characteristic of a depression is a general fall in economic activity. Under this stage production, employment and income decline. The prices fall and the fall in the price is due to fall in the purchasing power.

Key takeaways –

- A trade cycle refers to fluctuations in economic activities such as employment, output and income, prices, profits, etc.

- Phase of trade cycle refers to recession, boom, depression, recovery

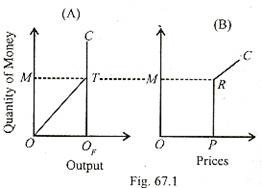

Keynes does not agree with the old quantity theorists that there is a direct and proportional relationship between the amount of money and the price. According to him, the impact of changes in the amount on the price is indirect and non-proportional.

This dichotomy between the relative price level (determined by the supply and demand of goods) and the absolute price level (determined by the supply and demand of money) arises from the failure of classical financial economists to integrate value theory and money theory. Thus, changes in the money supply affect only the absolute price level, but not the relative price level.

In addition, Keynes criticizes the classical static equilibrium theory, in which money is considered neutral and does not affect the real equilibrium of the economy with respect to relative prices. According to him, the problems of the real world are related to the theory of shifting equilibrium, while money enters as a “link between the present and the future".

Keynes reformulated quantity of money theory:

Keynes ' reformulated theory of quantities is based as follows:

Assumption:

1. All factors of production are in a completely elastic supply as long as there is unemployment.

2. All unemployed factors are homogeneous, completely divisible and interchangeable.

3. There is a constant return on the scale, because this price will rise or fall and the output will increase.

4. As long as there are unemployed resources, the effective demand and the amount will change at the same rate.

Given these assumptions, the Keynesian chain of causal relationships between changes in the amount of money and the price is indirect through the rate of interest. Therefore, as the amount of money increases, its first impact is on the rate of interest, which tends to fall. Given the marginal efficiency of a person], a decrease in the rate of interest will increase the amount of investment.

Increased investment raises effective demand through the multiplier effect, thereby increasing income, production and employment. Wage and non-wage factors are available at a certain compensation rate, since the supply curve of production factors is completely elastic in the situation of unemployment. There is a constant return to the scale; prices will not rise with an increase in output, as long as there is any unemployment.

Under such circumstances, production and employment will increase at the same rate as effective demand, and effective demand will increase at the same rate as the amount of money. Depending on the change in supply, which was infinite as long as unemployment was, the elasticity of the supply of output falls to zero. The whole effect of the change in the supply of money is exerted on the price, which rises exactly in proportion to the increase in effective demand. So, as long as there is unemployment, the output will change at the same rate as the amount of money, there will be no change in the price, and if there is full employment, the price will change at the same rate as the amount of money. Thus, the reformulated volume theory of money emphasizes that with an increase in the volume of money, the price rises only when the level of full employment is reached, and not before this.

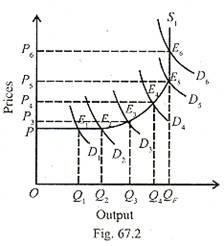

This reformulated monetary quantity theory is shown in figures 67.1(A)and(B).OTC is the output curve for money volume and PRC is the price curve for money volume. Panel A in the figure shows that as the amount of money increases from Σ to M, the output level also increases along the Σ part of the otc curve. As the amount of money reaches OM level, full employment output OQF is being produced. But after Point T, a further increase in the amount of money cannot raise the output beyond the full employment level OQF, so the output curve will be vertical. The figure panel ① shows the relationship between the amount of money and the price. As long as there is unemployment, the price will remain constant whatever the increase in the amount of money. Prices begin to rise only after the level of full employment is reached.

However, an increase in the amount above the OM will raise the price by the same percentage as the amount. This is indicated by the RC part of the price curve PRC.

Keynes himself noted that the real world is very complex, and simplified assumptions, on which the theory of reformulated quantities is based, do not hold. According to him, the following possible complications will qualify the statement that, as long as there is unemployment, employment will change at the same rate as the amount of money, and when there is full employment, prices will change at the same rate as the amount of money.”

- Because resources are not interchangeable, some goods reach a state of inelastic supply while there are still unemployed resources available for the production of other goods.

- Wage units tend to rise before they reach full employment.

- Compensation for factors that fall into the marginal cost does not all change at the same rate."Taking into account these complications, it is clear that the reformulated amount of money theory does not hold.

- The increase in effective demand will not change exactly in proportion to the amount of money, but in part it will be spent on an increase in output and an increase in price levels. As long as there are unemployed resources, the general price level will not rise much as output increases.

- But a sharp significant increase in aggregate demand will run into bottlenecks when resources are still unemployed.

It may be that the supply of some factors becomes inelastic or others are scarce and are not replaceable. This may lead to marginal costs and price increases. Thus, the price is above the average unit price, the profit increases rapidly, and due to the pressure of trade unions there is a tendency to raise wages. Diminishing returns may also set in. When full employment is reached, the elasticity of the supply of production decreases to zero, and the price increases in proportion to the increase in the amount.

The complex model of Keynesian theory of money and prices is shown graphically in Figure 67.2 in terms of the total supply and demand (D) curves. Price levels are measured on the vertical axis and output on the horizontal axis. According to Keynes, an increase in the amount of money increases the demand for total money for investments as a result of a decrease in the rate of interest. This initially increases production and employment, but does not increase the price level. In the figure, the increase in total monetary demand from D1 to D2 increases the output from OQ1 to OQ2, but the price level at Op remains constant, as the total monetary demand from D2 to D3 increases further, oq2 to OQ3, and the price level also increases to OP3.

This is because costs rise as bottlenecks develop due to immobility of resources. Dwindling returns have been set, and less efficient labour and capital have been employed. The output increases at a slower rate than the given increase in the total monetary demand, which leads to higher prices. As full employment approaches, bottlenecks increase. Further-the more, the increase in prices leads to an increase in demand, especially for stocks. Thus, prices rise at an increasing rate. This is shown throughout the figure. However, when the economy reaches the level of full employment of production, a further increase in the demand for total gold leads to a proportional increase in the price level, but production remains unchanged at that level. This is shown in the figure when the demand curve D5 shifts upwards to d6, the price level rises from OP5 to OP6, and the output level remains constant in oqf.

The superiority of Keynesian theory over traditional monetary theory:

Reasons

Keynes's reformulated quantity-quantity theory is better than the traditional approach in that he discards the old view that the relationship between the amount of money and the price is directly proportional.

In establishing such relationships, Keynes led to the transition from pure price theory to currency theory of production and employment. In doing so, he integrates currency theory and Value Theory. He integrates the theory of interest rates with the theory of value, and also with the theory of production and employment through the rate of interest.

In fact, the integration of money theory and Value Theory takes place through the output theory, where the rate of interest plays an important role. As the amount of money increases, the rate of interest decreases, thereby increasing the amount of investment and aggregate demand that raises output and employment. In this way, money theory is integrated with the theory of production and employment.

As production and employment increase, the demand for production factors increases even more. As a result, certain bottlenecks emerge that raise marginal costs, including the money wage rate. Thus the price begins to rise. Money theory is thus integrated with Value Theory.

So, as long as there is unemployment, production and employment will change at the same rate as the amount of money, but there will be no change in prices. Thus, the Keynesian analysis is better than the traditional analysis, as it studies the relationship between the amount of money and price under both unemployment and full employment conditions.

Furthermore, Keynesian theory is superior to traditional quantum gold theory in that it emphasizes important policy implications. Traditional theory believes that every increase in the amount of money leads to inflation.

Keynes, on the other hand, has established that as long as there is unemployment, the rise in prices will be moderate and there will be no risk of inflation. Only when the economy reaches the level of full employment, the increase in prices becomes inflation with each increase in the amount of money.

Criticism of Keynesian money and price theory:

Keynes ' views on money and prices have been criticized by monetarists for the following reasons:

1. Direct relationships:

Keynes accidentally took the price as fixed, so the effect of money appears in his analysis, rather than in terms of the amount of goods traded than their average price. Therefore, Keynes adopted an indirect mechanism through investment of bond prices, interest rates, and the impact of financial fluctuations on economic activity. However, the impact of real financial fluctuations is direct, not indirect.

2. Stable money demand:

Keynes assumed that changes in money would be absorbed primarily by changes in demand for money. But Friedman, based on his empirical research, shows that the demand for money is very stable.

3. The nature of money:

Keynes could not understand the essence of money. He believed that money could only be exchanged for bonds.

4. Money effect:

Keynes wrote during the recession, so this led him to conclude that money had little effect on income. According to Friedman, it was the contraction of money that caused the depression. Therefore, it was wrong on Keynes's side to argue that money has little effect on income. Money affects national income.

Reference

- Business economics by H.L Ahuja

- Business economics application and analysis by Dr. Raj kumar

- Business economics by T Aryamala

- Business economics by SK Agarwal