Unit 2

Money, inflation and monetary policy

Professor Friedman defines the money supply at any moment of time as “literally the number of dollars people are carrying around in their pockets, the number of dollars they have to their credit at banks or dollars they have to their credit at banks in the form of demand deposits, and also commercial bank time deposits.”

Money supply is an important factor for the economic development and priced stability in the economy. Money supply denoted as m1, means demand deposit with commercial bank plus currency with the public.

Money supply has wider definition characterized as M2 and M3. M2 definition includes M1 plus time deposits of commercial banks in the supply of money. M3 includes M2 plus deposits of savings banks, building societies, loan associations, and deposits of other credit and financial institutions.

Determinants of money supply

- The required reserve ratio - The required reserve ratio is also known as the minimum cash reserve ratio or the reserve deposit ratio is an important determinant of the money supply. A rise in the required reserve ratio decreases the supply of money with commercial banks and a decrease in required reserve ratio increases the money supply. The rr1 ratio is determined by law which is the ratio of cash to current and time deposit liabilities. Every commercial banks have to keep certain percentage of these liabilities in the form of deposits with the central bank of the country.

2. The level of bank reserves – Another determinant of money supply is the level of bank reserves. In order to determine the supply of money, it is the central bank of the country that influences the reserves of commercial banks. Required reserves are determined by the required reserve ratio and the level of deposits of a commercial bank. If deposits amount of rs 50 lakhs and required reserve ratio is 20 percent, then the required reserves will be 20% x 50=rs 10 lakhs. If the reserve ratio is reduced to 10 per cent, the required reserves will also be reduced to rs 5 lakhs.

3. Public desire to hold currency and deposits – Another determinant of money supply includes people’s desire to hold currency (or cash) relative to deposits in commercial banks. The money supply will be large if the people are in the habit of keeping less in cash and more in deposits with the commercial banks. Thus bank can create more money with larger deposits. On the other hand the money supply will be lower if people do not have banking habits and prefers to keep their money holdings in cash.

4. High powered money and the money multiplier - The determinants of the money supply in terms of the monetary base or high-powered money. The sum of commercial bank reserves and currency (notes and coins) held by the public refers to high-powered money. High-powered money is the base for the expansion of bank deposits and creation of the money supply.

Factors influencing velocity of circulation of money

- Money supply - Velocity of money depends upon the supply of money in the economy. The velocity of money will increase, if the supply of money in the economy is less than its requirements and vice versa.

2. Value of money – During inflation when the value of money decreases the velocity of money is high because people will like to part with money as soon as possible. During deflation the value of money rises, the velocity of money is low as the people will like to keep money with them.

3. Credit facilities – With the expansion of lending and borrowing facilities in the country, the velocity of money increases. Thus the growth of credit institutions has a good affect on the velocity of money.

4. Volume of trade – The velocity of money increases as the volume of trade increases the number of transaction and the velocity of money decreases as the volume of trade increases.

5. Frequency of transaction – The number of payments and receipts increases with the increase in the frequency of transaction and leads to increase in velocity of money. Similarly, the velocity of money decreases with the decrease in frequency of transaction.

6. Business conditions – During the period of hectic business conditions the velocity of money increases and during slump condition it decreases.

7. Business integration – The velocity of money increases if the business is vertically disintegrated. If the business is vertically integrated, the velocity of money will be less.

8. Payment system – The frequency with which the labour force is paid and the speed with which the bills for goods are settled determines the velocity of money.

9. Regularity of income – The velocity of money increases if the people receives income at regular intervals as they will spend their income freely.

10. Propensity to consume – Other Things remaining the same, greater the tendency of the people to consume, higher will be the velocity of money. Lower the propensity of money, lesser will be the velocity of money.

Key takeaways –

- The velocity of money is important for measuring the rate at which money in circulation is being used for purchasing goods and services.

- Determinants of money supply includes the required reserve ratio, the level of bank reserves, public’s desire to hold currency and deposits, high powered money and the money multiplier.

The ‘real’ factors of the supply of saving and the demand for investment are the determinants of the equilibrium interest rate in the classical model. Whereas in the Keynesian analysis, determinants of the interest rate are the ‘monetary’ factors alone.

As the determinants of interest rate, Keynes’ analysis concentrates on the demand for and supply of money. According to Keynes, the rate of interest is purely “a monetary phenomenon.” The price paid for borrowed funds is the interest. The rate of interest in the Keynesian theory is determined by the demand for money and supply of money.

Demand for money

The desire for demand for money arises because of three motives:

- Transaction motive

- Precautionary motive

- Speculative motive

- Transaction demand for money: For day to day transaction money is needed. Money is demanded as there is gap between the receipt of income and spending. Income is earned at the end of week or month but individuals income are spent to meet day to day transaction. Throughout the period spending are made but income are received after a period of time. To finance the transaction individual needs active balance in the form of cash. This is known as transaction demand for money. To meet day to day transaction people with higher income keep more liquid money. Transaction demand for money is an increasing function of money income.

Tdm= f (y)

Where,

- Tdm stands for transaction demand for money and

- Y stands for money income.

2. Precautionary demand for money: People keep cash to meet uncertain contingencies, like sickness, death, accidents, danger of unemployment, etc. Under this motive the amount of money held, called ‘idle balance’, also depends on the level of money income of an individual. To meet such unforeseen emergencies people with higher incomes can afford to keep more liquid money. In other words the precautionary demand for money is an increasing function of money income.

Pdm = f (y)

3. Speculative demand for money: The speculative motive refers to the desire to hold one’s assets in liquid form to take advantages of market movements regarding the uncertainty and expectation of future changes in the rate of interest.

Sdm = f (r) where, y is the rate of interest.

4. Total demand for money - The total demand for money (dm) is the sum of all three types of demand for money.

That is, dm = tdm + pdm + sdm.

The demand for money has a negative slope because of the inverse relationship between the speculative demand for money and the rate of interest.

Key takeaways –

1. The desire for demand for money arises because of three motives: Transaction motive, precautionary motive, speculative motive

Quantity theory of money

Definition

Quantity theory of money states that money supply and price level in an economy are in direct proportion to one another. When there is a change in the supply of money, there is a proportional change in the price level and vice-versa.

Quantity theory of money is supported and calculated by using the fisher equation by American economist Irving fisher.

M*v= p*t

Where,

- M = money supply

- V = velocity of money

- P = price level

- T = volume of the transactions

Fisher’s equation of exchange

The transactions version of the quantity theory of money was provided by the American economist Irving fisher in his book- the purchasing power of money (1911). According to fisher, “other things remaining unchanged, as the quantity of money in circulation increases, the price level also increases in direct proportion and the value of money decreases and vice versa”.

Equation

Mv = pt or p = mv/t

The value of money or the price level is also determined by the demand and supply of money.

- Supply of money (mv) –

The supply of money consists of the quantity of money in existence (m) multiplied by the velocity of money (v), i.e., the number of times this money changes hands. In fisher’s equation, v is the transactions velocity of money which means the average number of times a unit of money turns over or changes hands to execute transactions during a period of time.

Thus, the total volume of money in circulation during a period of time refers to mv. Since for transaction purposes money is only to be used, total supply of money also forms the total value of money expenditures in all transactions in the economy during a period of time.

2. Demand for money (pt) –

Money is demanded for transaction purposes, but not for its own sake. The demand for money is equal to the total market value of all goods and services transacted. It is determined by multiplying total amount of things (T) by average price level (P).

Thus, fisher’s equation of exchange represents equality between the supply of money or the total value of money expenditures in all transactions and the demand for money or the total value of all items transacted.

Supply of money = demand for money

MV = PT

Or

P = MV/T

Where,

- M is the quantity of money

- V is the transaction velocity

- P is the price level.

- T is the total goods and services transacted.

The equation states that MV = PT, the fact that the actual total value of all money expenditures (mv) always equals the actual total value of all items sold (pt).

To develop the classical quantity theory of money Irving fisher used the equation of exchange i.e., a causal relationship between the money supply and the price level.

The transactions approach to the quantity theory of money maintains that, there exists a direct and proportional relation between m and p; if the quantity of money is doubled, the price level will also be doubled and the value of money halved; if the quantity of money is halved, the price level will also be halved and the value of money doubled.

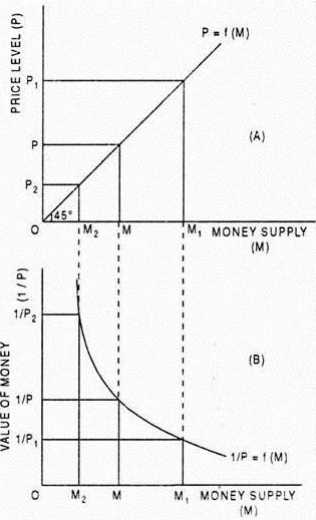

(i) In first figure, when the money supply is doubled from om to om1, the price level is also doubled from op to op1. When the money supply is halved from om to om2, the price level is halved from op to op2. Price curve, p = f(m), is a 45° line showing a direct proportional relationship between the money supply and the price level.

(ii) In second figure, when the money supply is doubled from om to om1; the value of money is halved from o1/p to o1/p1 and when the money supply is halved from om to om2, the value of money is doubled from o1/p to o1/p2. The value of money curve, 1/p = f (m) is a rectangular hyperbola curve showing an inverse proportional relationship between the money supply and the value of money.

Assumptions of the theory

- According to fisher, the velocity of money (v) is constant and is not influenced by the changes in the quantity of money.

- Total volume of trade or transactions (t) is also assumed to be constant and is not affected by changes in the quantity of money.

- P is passive factor in the equation of exchange which is affected by the other factors.

- The quantity theory of money assumed money only as a medium of exchange.

- The theory is based on the assumption of long period. Over a long period of time, v and t are considered constant.

Criticism

- Unrealistic assumption of full employment – In the actual world full employment is a rare phenomenon. Less than full employment and not full employment is a normal feature in a modern capitalist economy. According to Keynes, as long as there is unemployment, every increase in money supply leads to a proportionate increase in output, thus leaving the price level unaffected.

2. Static theory - The quantity theory assumes that the values of vand t remain constant. But, these variables do not remain constant in reality. The assumption of these factors constant makes the theory a static theory and is inapplicable in the dynamic world.

3. Simple truism - The equation of exchange (mv = pt) is a mere truism and proves nothing. It is simply a factual statement which reveals that the amount of money paid in exchange for goods and services (mv) is equal to the market value of goods and services received (pt). The equation does not tell anything about the causal relationship between money and prices.

4. Technical inconsistency – This equation is considered as technically inconsistent by prof. Halm. M in the equation is a stock concept; it refers to the stock of money at a point of time. V, on the other hand, is a flow concept, it refers to velocity of circulation of money over a period of time, m and v are non-comparable factors and cannot be multiplied together.

5. Ignores other determinants of price level - The quantity theory maintains that price level is determined by the factors included in the equation of exchange, i.e. By m, v and t. It ignores the importance of many other determinates of prices, such as income, expenditure, investment, saving, consumption, population, etc.

6. No discussion of velocity of money - The concept of velocity of circulation of money is not discussed in the quantity theory of money, nor does it throw light on the factors influencing it. It regards the velocity of money to be constant and thus ignores the variation in the velocity of money to occur in the long period.

7. One sided theory - Fisher’s transactions approach is one- sided. It assumes the demand for money to be constant and takes into consideration only the supply of money and its effects. It ignores the role of demand for money in causing changes in the value of money.

Key takeaways –

- The general price level in a country is determined by the supply of and the demand for money.

- Given the demand for money, changes in money supply lead to proportional changes in the price level.

- The monetary authorities, by changing the supply of money, can influence and control the price level and the level of economic activity of the country.

Cambridge cash balance approach

As an alternative to fisher’s quantity theory of money, Marshall, Pigou, Robertson, Keynes, etc. At the Cambridge university formulated the Cambridge cash-balance approach. Fisher’s transactions approach emphasized the medium of exchange functions of money. On the other hand, the Cambridge cash-balance approach was based on the store of value function of money.

According to cash-balance approach, the value of money is determined by the demand for money and supply of money. This approach, considers the demand for money and supply of money at a particular moment of time. Since, at a particular moment the supply of money is fixed, it is the demand for money which largely accounts for the changes in the price level. As such, the cash-balance approach is also called the demand theory of money.

Robertson wrote in this connection: “money is only one of the many economic things. Its value, therefore, is primarily determined by exactly nomic things. Its value, therefore, is primarily determined by exactly the same two factors as determine the value of any other thing, namely, the conditions of demand for it, and the quantity of it available.”

The supply of money is determined at a point of time by the banking system. On the other hand the demand for money is the demand to hold cash balance for transactions and precautionary motives. Thus the cash balances approach considers the demand for money as a store of value and not as a medium of exchange

The Cambridge equations show that given the supply of money at a point of time, the value of money is determined by the demand for cash balances.

When the demand for money increases, people in order to have larger cash holdings will reduce their expenditures on goods and services. Reduced demand for goods and services will bring down the price level and raise the value of money. On the contrary, fall in the demand for money will raise the price level and lower the value of money.

The Cambridge cash balances equations of Marshall, Pigou, Robertson and Keynes are discussed as under:

Marshall’s equation

Mv = kpy or p = m/ky

Where,

- M is the supply of money (currency plus demand deposits)

- P is the price level

- Y is aggregate real income; and

- K is the fraction of the real income which the people desire to hold in the form of money.

The price level (p) is directly proportional to the money supply (m)

The price level (p) is indirectly proportional to the aggregate real income (y) and the proportion of the real income which people desire to keep in the form of money (k)

m and y being constant, with the increase in k price level (p) falls and with the decreases in k price level (p) rises

K and y remaining unchanged, if supply of money (m) increases, price level (p) rises and if supply of money (m) decreases, price level (p) falls.

Pigou’s equation

P = m/kr

Where

- P is the purchasing power of money or the value of money

- K is the proportion of total real resources or income (r) which people wish to hold in the form of titles to legal tender,

- R is the total resources or real income, and

- M refers to the number of actual units of legal tender money.

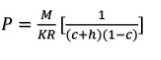

Since money is held by the community in the form of cash and in the form of bank deposits. In order to include bank notes and bank balances in the demand for money, Pigou modifies his equation as

Where

- C =the proportion of cash which people keep with them

- 1–c =the proportion of bank balances held by the people

- H =the proportion of cash reserves to deposits held by the banks.

According to Pigou, k was more significant than m in explaining changes in the purchasing power of money (value of money). This means that the value of money depends upon the demand of the people to hold money. Moreover, assuming k and r (and also c and h in the modified equation) to be constant, the relationship between money supply (m) and price level (p) is direct and proportional.

Robertson’s equation

M = kpt or p = m/kt

Where,

- P = the price level;

- M = the money supply;

- T = the total amount of goods and services to be purchased during a year.

- K = the proportion of t which people wish to hold in the form cash.

According to Robertson’s cash balance equation, p changes directly with m and inversely with k and t.

Keynes' Equation

N = PK or P = N/K

Where

- N = the cash held by the general public;

- P = the price level of consumer goods;

- K = the real balance or the proportion of consumer goods over which cash is kept.

Assuming k to be constant, a change in ‘n’ causes a direct and proportional change in ‘p’. In other words, if the quantity of money in circulation is doubled the price level will also be doubled, provided k remains constant.

This equation can be expanded by taking into account bank deposits.

N = p (k+ rk’)

Where, r is the cash reserve ratio of the banks; k’ is the real balance held in the form of bank money

Again, if k, k’ and r are constant, p will change in exact proportion to the change in n.

Criticisms of the cash balance approach:

- Truism: The cash balances equations are truisms, like the transaction equation. Take any Cambridge equation: Marshall’s p=m/ky or Pigou’s p=kr/m or Robertson’s p=m/kt or Keynes’s p=n/k, it establishes a proportionate relation between quantity of money and price level.”

- More importance to total deposit - Another defect of the Cambridge equation “lies in its applying to the total deposits considerations which are primarily relevant only to the income-deposits.” And the importance attached to k “is misleading when it is extended beyond the income deposits.”

3. Neglect other factors - The cash balances equation does not tell about changes in the price level due to changes in the of income, business and savings purposes.

4. Neglect of savings investment effect – Cash balance approach fails to analyse variations in the price level due to saving-investment inequality in the economy.

5. K and y are not constant – This equation assumes k and y as constant like transaction equation. This is unrealistic because during short period it is not essential that the cash balances (k) and the income of the people (y) should remain constant.

6. Neglects interest rate – The cash balance approach ignores interest rate that have significant influence upon the price level. The theory fails to integrate rate of interest, investment, output, employment and income with the theory of vale and output.

Key takeaways –

- Cash-balance approach states that the value of money depends upon the demand for money and the demand for money arises on account of its being a store of value

Demand pull inflation

Definition

Demand-pull inflation exists when aggregate demand for a good or service exceeds aggregate supply. It starts with an increase in consumer demand. Sellers meet such an increase with more supply. But when additional supply is unavailable, sellers raise their prices. That results in demand-pull inflation.

When there is excess demand in the economy, producers are able to raise prices and achieve bigger profit margins because they know that demand is running ahead of supply. Typically, demand-pull inflation becomes a threat when an economy has experienced a strong boom with gdp rising faster than the long run trend growth of potential gdp.

Causes of demand pull inflation

- Growing economy – When the families spend more instead of savings and feel confident to take more debt. They expect better jobs and rise. This leads to a steady increase in demand, which means higher prices.

2. Expectation of inflation – Once people expect inflation in future, they tend to buy more to avoid higher prices. This leads to increase in demand and creates demand-pull inflation. It’s difficult to eradicate once the expectation of inflation sets in.

3. Over expansion of the money supply – This happens when too much money chasing too few goods. An expansion of the money supply with too few goods to buy makes prices increase.

4. Discretionary fiscal policy - According to Keynesian economic theory, government spending drives up demand. Demand increases when government lowers taxes. When consumers have more discretionary income to spend on goods and services it creates inflation.

5. Strong brand - Marketing can create high demand for certain products, a form of asset inflation. This leads to charge high prices

6. Technological innovation – A company owns the market when it creates new technology until other companies figure out how to copy it. People demand new technology that creates real improvement in their daily lives.

Cost push inflation

Cost-push inflation occurs when supply costs rise or supply levels fall. As long as demand remains the same either will drive up prices. Cost push inflation is created by shortages or cost increases in labor, raw materials, and capital goods.

Definition

Cost-push inflation occurs when firms respond to rising costs by increasing prices in order to protect their profit margins.

Causes of cost push inflation

- Monopoly- Cost-push inflation are created by companies that achieve a monopoly over an industry. A monopoly reduces supply to meet its profit goal.

2. Wage inflation - Wage inflation is created when workers have enough leverage to force through wage increases. When people expect higher inflation wage may increase in order to protect their real incomes.

3. Component cost – It involves increase in the prices of raw materials and other components. This is due to the rise in commodity prices such as oil, copper and agricultural products used in food processing.

4. Higher indirect taxes – Government regulation and taxation may reduce the supply of many other products such as rise in the duty on alcohol, fuels and cigarettes, or a rise in value added tax.

5. Exchange rates - Higher import prices happens when any country that allows the value of its currency to fall. The foreign supplier does not want the value of its product to drop along with that of the currency. It can raise the price and keep its profit margin intact, if demand is inelastic.

Effect of inflation

- Effects on distribution of income and wealth - Within the national economy, the impact of inflation is felt unevenly by the different groups of individuals

- Creditors and debtors - During inflation creditors lose as they receive the repayments during a period of low prices. On other hand, debtors during inflation gain, since they repay their debts in currency that has lost its value

- Producers and workers - Producers gain during inflation as they get higher prices and leads to earn more profits from the sale of their products. Producers can earn more during inflation, as the rise in prices is usually higher than the increase in costs. But, workers lose because there is a fall in their real wages as their money wages do not usually rise proportionately with the increase in prices.

- Fixed income earners – During inflation, fixed income earners suffer greatly because inflation reduces the value of their earnings.

- Investors – In equity shares investor gains s they get dividends at higher rates. But the bondholders lose because they get a fixed interest on the real value of which has already fallen

- Farmers – Farmers gains during inflation as rise in the price of agricultural products is higher than the rise in the price of other goods

2. Effects on production - The production of all goods—both of consumption and of capital goods is stimulated by rising prices. As producers get more and more profit, they try to produce more and more by utilizing all the available resources at their disposal. The production cannot increase after the stage of full employment as all the resources are fully employed.

3. Effects on income and employment - On account of larger spending and greater production inflation tend to increase the aggregate money income (i.e., national income) of the community as a whole. Similarly, under the impact of increased production the volume of employment increases. Whereas people real income of the fails to increase proportionately due to a fall in the purchasing power of money.

4. Effects on business and trade – During inflation due to higher income, greater productivity and larger spending the aggregate volume of internal trade tend to increase. On account of rise in the price of domestic goods export trade is likely to suffer. Profit soar during inflation as cost do not rise as fast as price.

5. Effects on the government finance - During inflation, the government revenue increases as it gets more revenue from income tax, sales tax, excise duties, etc. In the same way, public expenditure increases as the government is required to spend more and more for administrative and other purposes. But the real burden of public debt is reduced due to rising prices because a fix sum has to be paid in installment per period.

6. Effects on growth - A mild inflation promotes economic growth, but a increase in inflation hinder the economic growth as it raises cost of development projects. Although in a developing economy mild dose of inflation is inevitable and desirable, a high rate of inflation tends to lower the growth rate by slowing down the rate of capital formation and creating uncertainty.

Nature of inflation in a developing economy

Developing countries have often found themselves in the grip of inflation in their bid to raise the standards of living of their people through development plans.

But the nature of inflation in developing economies is quite different from that found in developed countries. True inflation starts after the level of full-employment is attained in developed countries. But in developing countries like India huge unemployment and inflation exist side by side. This is because during times of depression the nature of unemployment in developing countries differs from that which prevails in developed countries.

The governments in advanced countries take various steps to increase the level of investment in order to get the economy out of depression. Increase in investment and effective demand helps a great deal in removing depression and unemployment which are caused by the lack of effective demand. Thus, when the supply of output can be increased easily so as to match increase in effective demand, there need be no inflationary pressures.

The situation in developing countries is different. Unemployment in under-developed economics is not due to lack of effective demand hut due to the lack of real capital. In these countries, by accumulating more real capital level of national income can be increased and the unemployment can be removed. Increase in the capital formation requires stepping up the level of investment.

Now, developing countries are making huge investment expenditure to increase the rate of capital formation and thus to obtain rapid economic growth.

Key takeaways –

- Demand-pull inflation exists when aggregate demand for a good or service exceeds aggregate supply.

- Cost-push inflation occurs when supply costs rise or supply levels fall. As long as demand remains the same either will drive up prices

Meaning

Monetary policy is the process of drafting, announcing, and implementing the plan of actions taken by the central bank, currency board, or other competent monetary authority of a country that controls the quantity of money in an economy and the channels by which new money is supplied.

Monetary policy aims at meeting macroeconomics objectives such as controlling inflation, consumption, growth, and liquidity which consist of the management of money supply and interest rates. This is achieved by actions such as modifying the interest rate, buying or selling government bonds, regulating foreign exchange (forex) rates, and changing the amount of money banks are required to maintain as reserves.

Definition

Monetary policy, the demand side of economic policy, refers to the actions undertaken by a nation's central bank to control money supply and achieve macroeconomic goals that promote sustainable economic growth.

Johnson defines monetary policy “as policy employing central bank’s control of the supply of money as an instrument for achieving the objectives of general economic policy.”

G.k. Shaw defines it as “any conscious action undertaken by the monetary authorities to change the quantity, availability or cost of money.”

Objectives

- Full employment - The foremost objectives of monetary policy is full employment. It is an important goal not only because unemployment leads to wastage of potential output, but also because of the loss of social standing and self-respect.

2. Price stability – One of the objectives of monetary policy is to stabilize the price level. This policy is favored because fluctuations in prices bring uncertainty and instability to the economy.

3. Economic growth – In the recent years the most important objectives of monetary policy has been the rapid economic growth of an economy. Economic growth is defined as “the process whereby the real per capita income of a country increases over a long period of time.”

4. Balance of payment – Another important objective is to maintain equilibrium in the balance of payments.

Instruments of monetary policy

- Bank rate policy – The minimum lending rate is the bank rate of the central bank at which it rediscounts first class bills of exchange and government securities held by the commercial banks. Central banks raise the bank rate when it finds that inflationary pressures have started emerging within the economy. Commercial bank borrows less as borrowing from central bank become costly. In turn, commercial banks raise their lending rate to the business community and the borrowers borrow less from commercial bank.

On the other hand central banks lower the bank rate when prices are depressed. On the part of commercial bank it is cheap to borrow from the central bank. The commercial bank lowers their lending rate and encourages business men to borrow more.

2. Open market operation – Open market operations refer to sale and purchase of securities in the money market by the central bank. The central bank sells securities, when prices are rising and there is need to control them. The reserves of commercial banks are reduced and they are not in a position to lend more to the business community.

On the contrary, the central bank buys securities, when recessionary forces start in the economy. The commercial bank reserves are raised and they lend more to the business community.

3. Changes in reserves ratio – Every bank is required to keep certain percentage of its total deposits with the central bank. The central bank raise the reserve ratio when prices are rising. Banks are required to keep more with the central bank. Their reserves are reduced and they lend less. In the opposite case, the reserves of commercial banks are raised, when the reserve ratio is lowered. They lend more and the economic activity is favorably affected.

4. Selective credit controls - For particular purposes selective credit controls are used to influence specific types of credit. The central bank raises the margin requirement when there is brisk speculative activity in the economy or in particular sectors in certain commodities and prices start rising. The result is that the borrowers are given less money in loans against specified securities. In case of recession in a particular sector, the central bank encourages borrowing by lowering margin requirements.

Inflation targeting

Definition

Inflation targeting is a central banking policy that revolves around adjusting monetary policy to achieve a specified annual rate of inflation. The principle of inflation targeting is based on the belief that long-term economic growth is best achieved by maintaining price stability, and price stability is achieved by controlling inflation.

Based on above-target or under-target inflation an inflation-targeting central bank can boost or lower interest rates, respectively. The ideology is that rising interest rates typically cools the economy to hold during inflation; lowering interest rates generally speeds up the economy and thus increases inflation.

Inflation targeting allows central banks to respond to shocks to the domestic economy and focus on domestic considerations. Stable inflation reduces investor uncertainty, allows investors to predict changes in interest rates, and anchors inflation expectations. If the target is published, inflation targeting also allows for greater transparency in monetary policy.

Key takeaways –

- Inflation targeting is a central bank strategy of specifying an inflation rate as a goal and adjusting monetary policy to achieve that rate.

Reference

- Business economics by H.L Ahuja

- Business economics application and analysis by dr. Raj Kumar

- Business economics by t Aryamala

- Business economics by SK Agarwal