Unit 4

International Trade

Ricardo’s theory of comparative cost advantage

Economic theory of comparative advantagewasfirst developed by 19th-century British economist DavidRicardo, that attributed the cause and benefits of international trade to the differences in the relative opportunity costs of producing the same commodities among countries.

David Ricardosupports that the international trade is governed by the comparative cost advantage rather than the absolute cost advantage. A country will specialize in that line of production in which it has a greater comparative advantage in costs than other countries and will depend upon imports from abroad of all such commodities in which it has relative cost disadvantage.

Assumptions

- There is no intervention by the government in economic system

- Both in the commodity and factor market perfect competition exist

- There are static condition in the economy

- Production function is homogenous in the first degree

- Labour is the only factor of production

- Labour is perfectly mobile within the country

- Transport costs are absent so that production cost, measured in terms of labour input alone, determines the cost of producing a given commodity.

- There are only two commodities to be exchanged between the two countries.

- Money is non-existent and prices of different goods are measured by their real cost of production.

- There is full employment of resources in both the countries.

- Trade between two countries takes place on the basis of barter.

For example involving two countries and two goods, if country a has comparative advantage in specializing in the production and export of commodity x while country b will specialize in the production and export of commodity y.

In country a, domestic exchange ratio between x and y is 14 : 10, i.e., 1 unit of x = 14/10 or 1.40 units of y. Alternatively, 1 unit of y= 10/14 or 0.71 units of x.

In country b, the domestic exchange ratio is 16 : 12, i.e., 1 unit of x = 16/12 or 1.33 units of y. Alternatively, 1 unit of y = 16/12 or 0.75 unit of x.

From the above cost ratio, country a has comparative cost advantage in the production of x and b has comparatively lesser cost disadvantages in the production of y.

In algebraic terms, let the cost of labour in country a for producing x commodity is a1 and in country b is a2. For producing y commodity in country a and b labour cost is a3 and a4.

The absolute differences in costs can be measured as:

A1/a2 < 1 < a3/a4

It shows that country a has absolute advantage in producing x and country b has an absolute advantage in commodity y.

The comparative differences in costs can be measured as:

A1/a2 < a3/a4 < 1

Satisfies the condition specified for comparative difference in costs;

A1/a2 < 1 < a3/a4 < 1

14/16 < 10/12 < 1

In case a1/a2 = a3/a4, there are equal differences in costs and there is no possibility of trade between the two countries.

Key takeaways –

- Comparative advantage is an economy's ability to produce a particular good or service at a lower opportunity cost than its trading partners.

- The theory of comparative advantage introduces opportunity cost as a factor for analysis in choosing between different options for production.

The Heckscher – Ohlin theory of factor endowments

The Heckscher-Ohlinmodel is one of the most important models of international trade. This theory states that countries export what they can most efficiently and plentifully produce. It is also known as the h-o model or 2x2x2 model, it's used to evaluate trade and, more specifically, the equilibrium of trade between two countries that have varying specialties and natural resources.

This theory was advocated by Bertil Ohlin. According to him, trade arises due to the differences in the relative prices of different goods in different countries. The difference in commodity price id due to the difference in the cost (factor) price. Factor price differ because capital and labour differ in countries. Thus trade occur based on different countries have different factor endowments.

This theory states that the relatively labor-rich nation exports the relatively labor-intensive commodity and imports the relatively capital-intensive commodity.

Assumptions

- There are two countries involved

- Labour and capital are the factors which each country has

- Each country produce two commodity or goods

- There is a perfect competition in both commodity and factor market

- All production function are homogeneous of the first degree

- Factors are freely mobile within the country

- Two countries differ in factor supply

- Each commodity differ in factor intensity

- There are no transportation cost

- Trade is free i.e. There are no trade restriction in the form of tarrif

- There is full employment of resources in both countries and demand are identical in both countries

- The production function remain the same in different countries for the same commodity.

Understanding the concept of factor abundance

In two countries, two commodities and two factor model, states that the capital rich country will export capital intensive commodity and labour rich country will export labour intensive commodity.

- Price criterion for defining factor abundance

Capital rich country is said to be where capital is relatively cheaper and labour is relatively costly. On the other hand labour rich country is said to be labour is relatively cheaper and capital is relatively costly.

Where,

- P refers to price of the factor

- K refers to capital

- L refers to labour

- E stands for England

- I stands for India

England is capital abundant country as the capital is cheap and India is labour rich country as labour is cheaper.

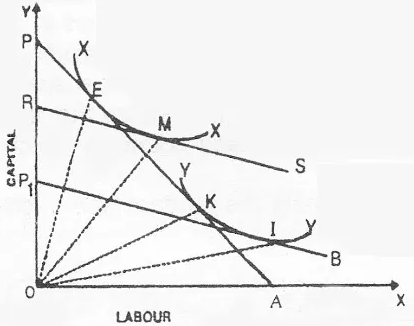

- Diagram

In the above diagram, xx is the isoquant for the commodity x produced in England. Yy is the isoquant for the commodity y produced in India. It shows clearly that xx is relatively capital intensive and yy is relatively labour intensive. Y-axis represent the factor capital and x axis represent the labour capital.

Pa is the budget line of England. The budget line pa is tangent at e to xx. At k the price line or budget line pa is tangent to yy. The k point helps to find out how much capital and labour is required to produce one unit of y in England.

P1b is the price line of India. The budget line p1b is tangent at me to yy. At m the price line or budget line pib is tangent to xx. The m point helps to find out how much capital and labour is required to produce one unit of x in India.

Under the given situation, England will choose the combination e means more specialization in capital goods. It will not choose combination k as it is labour intensive and less capital intensive.

Thus, using cheap capital, England will specialize in production of goods x and India will produce goods y using cheap labour factor.

Key takeaways

- The basis of internal trade is the difference in commodity prices in the two countries

- A capital rich country specializes in capital intensive goods and export them. While labour rich country specializes in labour intensive goods and export them

Terms of trade - meaning and types

Terms of trade (tot) represent the ratio between a country's export prices and its import prices. The ratio is calculated by dividing the price of the exports by the price of the imports and multiplying the result by 100.

It is expressed as

(index of export price/ index of import price) *100

The country’s tot is less than 100%, when more capital is leaving the country then is entering into the country then the countries. When the tot is greater than 100%, the country is accumulating more capital from exports than it is spending on imports.

The tot is used as an indicator of a country’s economic health. Tot is impacted by the changes in import prices and export prices , and it's important to understand what caused the price to increase or to decrease. Tot measurements are recorded in an index for economic monitoring purposes.The term terms of trade was first coined by the us American economist by frank William in 1927.

Types

- Ccommodity or net barter terms of trade:If one good is considered export good and the other good is supposed import good then “the ratio between prices of exports to price of imports refers to net barter terms of trade”. Then the ratio of price index of exports to price index of imports is called net barer terms of trade.It is expressed as

Tc= px/pm

Where tc - commodity terms of tradepx = index of export pricespm = index of import prices

This principle does not take into consideration the changes in composition of the foreign trade and quality of goods.

2. Income terms of trade:The income terms of trade is the ratio of the prices of exports and index of prices of imports.It is expressed as

Ty= tcqz= pxqx/pm

Where

- Ty = income terms of trade

- Tc = commodity terms of trade

- Qx = index of quantity trade

- Px = index of export prices

- M = index of import prices

It is also called capacity to imports. Because in the long run he value of total export is equal to the value of total imports.This concept does not through lights on profit and loss of international trade.

3. Single factor terms of trade:Single factor terms of trade depends upon the productive efficiency of the factors of production. It shows the amount of imports which can be obtained against the domestic factor employed in export sector. It is obtained by multiplying commodity terms of trade by the index of export productivity.The greatest shortcoming is that it does not take into consideration potential domestic cost of production of input industries of importing country.

4. Double factor terms of trade:Double factorial terms of trade takes into account the productivity of the factors of production in the country’s exports as well as the productivity of the foreign factors of production used in country’s imports.

Td= tc x fx/fm = px/pm x fx/fm (td= px/pm)

Where td=double factorial terms of trade; tc= commodity terms of trade; px= index of prices of exports; fx=index of productivity of export goods industries; pm=index of prices of imports; fm= index of productivity of import goods industries.

Main criticism of the concept of double factorial terms are as under:

- It is very difficult to estimate the index of double factorials terms of trade of a country, because to do so it is necessary to measure the productivity of import goods produced in the country.

- It is not possible to measure gains of international trade by this concept, because no importance is given to the utility of the goods exported and imported.

5. Utility terms of trade:Utility terms of trade is the index of relative utility of import and domestic commodities foregone to produce exports.

Tu= tr x u = px/pm x fx x rx x u

(here, tu=utility terms of trade; tr=real cost terms of trade; px=index of export prices; pm=index of import prices; fx=export productivity; rx= utility foregone to exports.)

Criticism

- It is an unrealistic concept. Utility and disutility cannot be measured precisely. Both concepts are subjective. This concept has no practical significance.

6. Real cost terms of trade- Import and export goods are compared according to their utility. Real cost of both import and export is worked out. Real cost terms of trade is calculated by multiplying the single factorial terms of trade with the index of the amount of disutility per unit of productive resource used in producing exports.

Tr= ts x rx = px/pm x fxx rx (here, tr= real cost terms of trade; ts= single factorial terms of trade; px=index of export prices; pm=index of import prices; fx=index of productivity of export goods industries; rx= sacrifice of utility inherent in export.)

Criticism:

- Main defect of real cost terms of trade is that it is concerned only with the quantity of foreign goods obtained with the real costs inherent in exports

Key takeaways –

- Terms of trade is calculated by dividing the price of the exports by the price of the imports and multiplying the result by 100

Factors determining terms of trade

1. Elasticity of demand - terms of trade is influence by theelasticity of demand for exports and imports of a country. If the demand for a country’s exports is less elastic as compared to her imports, the terms of trade will tend to be favorable because the exports can command higher price than imports.On the other hand, if the demand for imports is less elastic than that for exports, the terms of trade will be unfavorable.

2. Elasticity of supply - The nature of elasticity of supply also significantly influence the country’s terms of trade. If the terms of trade will tend to be favorable when the supply of a country’s exports is more elastic than the imports.

3. Nature of goods -The term of trade will be unfavorable when country is producing and exporting only primary goods, and importing manufactured goods.

4. Economic development- The economic development has two types of effects: (a) the demand effect: it refers to the demand for imports increases as a result of increase in income associated with economic development, (b) the supply effect: it refers to the supply of import substitutes or import competing goods increases. The net effect of economic development depends upon the extent of these two effects.

5. Rate of exchange- The terms of trade for affected by the changes in the rate of exchange of a country’s currency. , its terms of trade will improve ,if a country’s currency appreciates becausea rise in the value of the currency causes an increase in the export prices and decrease in the import prices.

6. Tariff policy - Tariffs and quotas also influence the terms of trade. These measures, if not retaliated by other countries, improve a country’s terms of trade by restricting imports.

7. Size of population - An overpopulated country will have larger demand for imports. As a result, the terms of trade will tend to be unfavorable in this case relative to the under populated or optimally populated country.

8. Size of country- Ascompared to a smaller country a larger country will tend to have less favorable terms of trade . This is because the smaller country can reap the gains of economies of scale enjoyed by the larger one in the international trade9.degree of competition- in case of its export if a country enjoys monopoly power and there are many alternative sources of supply of its imports, then it will have favorable terms of trade.

Key takeaways –

- Elasticity of demands supply, nature of goods, tariff policy, size of population determines the factors of terms of trade

Gains from trade

The gains from trade are the benefits from trading rather than producing i.e. The benefits that accrue to each country to a transaction over and above the benefits each would have derived from producing the goods or services themselves.

The gains from trade are divided into static and dynamic gains which are discussed as under:

Static gains

- Maximization of production-The gains from trade result from the advantages of division of labour and specialization both at the national and international levels. Given the resources and technology in a country, on the basis of comparative advantage and trading it is specialization in production which enables each country to exchange its goods for the goods of another country. According to Ricardo, “the gain from trade consisted in the saving of cost resulting from obtaining the imported goods through trade instead of domestic production.” Thus trade maximizes production.

2. Increase in welfare -The production of goods increases in the trading country, as a result of international division of labour and specialization. As a result, the consumption of goods increases and as well as the welfare of the people. As perRicardo, “the extension of international trade very powerfully contributes to increase the mass of commodities and, therefore, the sum of enjoyments.”

3. Increase in national income – there is increase in national income when the country gains from international specialization and exchange of goods in trade. Thus it increases the level of output and growth rate of the economy.

4. Vent for surplus – the gain for trade also arises from the existence of idle land, labour and other resources in a country before it enters into international trade.

Dynamic gains

- Efficient employment of resources- The direct dynamic gains from foreign trade are that comparative advantage leads to a more efficient employment of the productive resources of the world.

2. Widens-the market-The major indirect dynamic gain from trade is that it widens the size of the market. International trade makes a greater use of machines, encourages inventions and innovations, raises labour productivity, lowers costs and leads to faster growth, by enlarging the size of the market and scope of specialization.

3. Development of other activities- Other economic activities also develop,when a country starts producing goods for export and importing goods for domestic consumption,. There is expansion of infrastructure facilities in power, and building highways, bridges, fly-overs, etc. The primary sector develops into business sector for export of raw materials and for domestic use. Tertiary sector expands in the form of banks, communications, insurance, etc.

4. Increase in investment -Foreign trade encourages the setting up of new units for assembling and production of variety of goods. Supplementary and ancillary units are established. Production for exports leads to backward and forward linkages in developing other activities referred to above. All these increase autonomous and induced investments in the country.

Key takeaways –

- The gains from trade are the benefits from trading rather than producing. It is divided into static and dynamic

Free trade versus protection

Free trade:

When government put in place policies that allow producers from overseas nations to freely sell their goods in our country (promote trade).

International trade that takes place without barriers such as tariff, quotas and foreign exchange controls is called free trade. Thus, under free trade, goods and services flow between countries freely. In other words, free trade implies absence of governmental intervention on international exchange among different countries of the world.

Arguments for free trade

- Advantages of specialization – Free trade secures all the advantages of international division of labour. Each country will specialise in the production of those goods in which it has a comparative advantage over its trading partners. This will lead to the optimum and efficient utilization of resources and, hence, economy in production.

2. All round prosperity – As there is unrestricted trade, global output increases since specialization, efficiency, etc. Make production large scale. Free trade enables countries to obtain goods at a cheaper price. This result in rise in the standard of living of people of the world. Thus, free trade leads to higher production, higher consumption and higher all-round international prosperity.

3. Competitive spirits prevail – Free trade keeps the spirit of the competition of the economy. Under free trade, there exists the possibility of intense foreign competitiondomestic producers do not want to lose their grounds. Competition enhances efficiency.

4. Accessibility of domestically unavailable goods and raw materials -Free trade enables each country to get commodities which it cannot produce at all or can only produce inefficiently. Commodities and raw materials unavailable domestically can be procured through free movement even at a low price.

5. Greater international cooperation -Free trade safeguards against discrimination. Free trade promote international peace and stability through economic and political cooperation.

Protectionism

When government put in place policies to stop overseas producers freely selling goods in our country (restrict trade).

Foreign trade of a country may be free or restricted. Free trade eliminates tariff and protection trade imposes tariff. Protection trade involves imposing tariff, duties, quota to restrict the inflow of imports. This means government intervenes in trading activities.

Arguments for protection

- Fallacious arguments –Fallacious arguments do not stand after scrutiny. Fallacious argument is to keep the money at home. By restricting trade, a country need not spend money to buy imported articles. If every nation pursues this goal, ultimately global trade will squeeze.

2. Economic arguments –

- Infant industry arguments - The costs will be higher when the industry is first established. It is too immature to reap economies of scale at its infancy. Workers are not only inexperienced but also less efficient. If this infant industry is allowed to grow independently, surely it will be unable to compete effectively with the already established industries of other countries. Thus, an infant industry needs protection of a temporary nature and over time will experience some sort of ‘learning effect’.

b. Diversification arguments -As free trade increases specialization, so protected trade brings in diversified industrial structure. A country minimizes the risk in productionthrough protective means, by setting up newer and variety of industries. Comparative advantage principle dictates narrow specialization in production.

c. Employment argument -Protection can raise the level of employment. Tariffs may reduce import and promotes domestic industry at the expense of foreign industries. The strategy of import-substituting industrialization balance of payment. Thus, employment potential under protective regime is quite favorable.

d. Balance of payment - A deficit in the balance of payments can be cured by curtailing imports. However, imports will decline following a rise in tariff rate provided other trading partners do not retaliate by imposing tariff on a country’s export

e. Strategic trade advantage argument -It is argued that tariffs and other import restrictions create a strategic advantage in producing some new products having potential for generating some net profit. Because of the economies of large scale production there are some large firms who prevent entry of new firms. The large scale economies themselves prevent entry of new firms.

Key takeaways –

- Trade protectionism is national policies restricting international economic trade to alter the balance between imports and goods manufactured domestically through import quotas, tariffs, taxes, anti-dumping legislation, and other limitations.

- International trade that takes place without barriers such as tariff, quotas and foreign exchange controls is called free trade

Foreign portfolio investments

Definition

Foreign portfolio investment (fpi) consists of securities and other financial assets held by investors in another country. It does not provide the investor with direct ownership of a company's assets and is relatively liquid depending on the volatility of the market.

Foreign portfolio investment (fpi) involves an investor purchasing foreign financial assets. The foreign securities transaction generally occurs at an organized formal securities exchange or through an over-the-counter market transaction.

As a means of portfolio diversification foreign portfolio investment is becoming increasingly more common. Fpis consist of securities and alternative foreign financial assets that are passively held by a foreign investor.

Foreign portfolio investment includes stocks, American depositary receipts (adrs), or global depositary receipts of companies headquartered outside the investor's nation. Holding also includes bonds or other debt issued by these companies or foreign governments, mutual funds, or exchange traded funds (etfs) that invest in assets abroad or overseas.

Foreign portfolio investing is popular among several different types of investors.

- Individuals

- Companies

- Foreign governments

Benefits of portfolio cash flows

The primary benefits of foreign portfolio investment are:

1. Portfolio diversification

Foreign portfolio investment provides with an easy opportunity to diversify their portfolio internationally to the investors. An investor would diversify their investment portfolio to achieve a higher risk-adjusted return.

2. International credit

In foreign countries investors may be able to access an increased amount of credit. The investors are allowed to utilize more leverage and generate a higher return on their equity investment.

3. Access to markets with different risk-return characteristics

If investors are seeking out greater returns, they must be willing to take on greater risk. Emerging markets can offer investors a different risk.

4. Increases the liquidity of domestic capital markets

A wider range of investments can be financed as markets become more liquid, they become deeper and broader. Saversif they need access to their savings can invest with the assurance that they will be able to manage their portfolio or sell their financial securities quickly

5. Promotes the development of equity markets

Increased competition for financing will lead to the market rewarding superior performance, prospects, and corporate governance. Equity prices will become value-relevant for investors, as the market’s liquidity and functionality develop, and ultimately driving market efficiency.

Key takeaways

- Foreign portfolio investment (fpi) involves holding financial assets from a country outside of the investor's own.

- Fpi holdings can include stocks, adrs, gdrs, bonds, mutual funds, and exchange traded funds.

- The presence of fpi would mean a significant rise in the depth of the secondary market.

- From the investor’s perspective, it helps an investor add more diversity to their investments and benefit from such a diversification.

- Investors can also gain the benefit of exchange rate changes.

Foreign direct investments

Definition

A foreign direct investment (fdi) is an investment made by a firm or individual in one country into business interests located in another country. Generally, fdi takes place when an investor establishes foreign business operations or acquires foreign business assets in a foreign company.

Foreign direct investment (fdi) is an investmentwith the intention of establishing a lasting interest from a party in one country into a business or corporation in another country. A foreign direct investment can be made by obtaining a lasting interest or by expanding one’s business into a foreign country.

There are various methods for a domestic investor to acquire voting power in a foreign company. Below are some examples:

- Acquiring voting stock in a foreign company

- Mergers and acquisitions

- Joint ventures with foreign corporations

- Starting a subsidiary of a domestic firm in a foreign country

Benefits of foreign direct investment

- Market diversification

- Tax incentives

- Lower labor costs

- Preferential tariffs

- Subsidies

Types of FDI

- Horizontal:Horizontal fdi means a business expands its domestic operations to a foreign country. In this case, in a foreign countries, the business conducts the same activities. For example, McDonald’s opening restaurants in India would be considered horizontal fdi.

- Vertical:Verticalfdi means a business expands into a foreign country by moving to a different level of the supply chain. In other words, a firm conducts different activities abroad but these activities are still related to the main business. Using the same example, in CanadaMcDonald’s could purchase a large-scale farm to produce meat for their restaurants.

3. Conglomerate:A business acquires an unrelated business in a foreign country. It requires overcoming two barriers to entry: entering a foreign country and entering a new industry or market. An example of this would be if virgin group, which is based in the united kingdom, acquired a clothing line in France.

4. Platform: A business expands into a foreign country but the output from the foreign operations is exported to a third country. This is also referred to as export-platform fdi. This happens commonly in low-cost locations inside free-trade areas. For example, if jaguar purchased manufacturing plants in Ireland with the primary purpose of exporting cars to other countries in the eu.

Key takeaways

- Foreign direct investments (fdi) are investments made by one company into another located in another country.

- Fdis are actively utilized in open markets rather than closed markets for investors.

- Horizontal, vertical, and conglomerate are types of fdi’s.

Merits of foreign direct investment

1. Increased employment and economic growth

The advantage of fdi is creation of jobs. It is the most important reasons why developing, looks to attract fdi. Increased fdi boosts the manufacturing as well as the services sector. This leads in creating jobs, and helps reduce unemployment among the skilled and unskilled labour - in the country. Increased employment translates to increased incomes and this boosts the economy of the country.

2. Human resource development

The advantages of fdi is human resource development. Human capital refers to the knowledge and competence of the workforce. Skills gained and enhanced through training and experience boost the education and human capital quotient of the country. Human capital is mobile, once the skills are developed.

3. Development of backward areas

For a developing country this is one of the most crucial benefits of fdi. Fdi helps the transformation of backward areas in a country into industrial centers. This helps in providing a boost to the social economy of the area.

4. Provision of finance & technology

Fdi helps the businesses get access to latest financing tools, technologies and operational practices from across the world. Local economy over time, get access to the introduction of newer, enhanced technologies and processes, resulting in enhanced efficiency and effectiveness of the industry.

5. Increase in exports

Through fdi not all goods produced are meant for domestic consumption. Many of these products have global markets. The creation of 100% export oriented units and economic zones has further assisted fdi investors in boosting their exports from other countries.

6. Exchange rate stability

The constant flow of fdi into a country translates into a continuous flow of foreign exchange. This helps the country’s central bank to maintain a comfortable reserve of foreign exchange. It ensures stable exchange rates.

7. Improved capital flow

With limited domestic resources inflow of capital is particularly beneficial for countries, as well as for nations with restricted opportunities to raise funds in global capital markets.

8. Creation of a competitive market

Fdi helps create a competitive environment, as well as break domestic monopolies, by facilitating the entry of foreign organizations into the domestic marketplace. A good competitive environment pushes the firms to continuously enhance their processes and product offering. This in turn provides the consumers a wider range of competitively priced products.

Key takeaways -1. Foreign direct investment (fdi) is an investmentwith the intention of establishing a lasting interest from a party in one country into a business or corporation in another country

Role of multinational corporation

Promotion foreign investment:

In the recent years, external assistancehas been declining to developing countries. As the developed countries have not been willing to part with a larger proportion of their GDP as assistance to developing countries. The gap between the requirements of foreign capital for increasing foreign investment in India can be bridge by MNCs.

Since 1991 the liberalized foreign investment pursued, allows MNCs to make investment in India. However,100 per cent export-oriented units (eous) can be set up in some industries. It is seen that, domestic investment, foreign investment has a multiplier effect on income and employment in a country.

2. Non-debt creating capital inflows:

In India during pre-reform period when foreign direct investment by MNCs was discouraged, and relied heavily on external commercial borrowing (ecb) which was of debt-creating capital inflows. This resulted in increasing the burden of external debt.

As direct foreign investment by multinational corporations represents non-debt creating capital inflows, the liability of debt-servicing payments can be avoided.Thus, MNCs can play an important role in reducing stress strains and on India’s balance of payments (bop).

3. Technology transfer:

Another important role of multinational corporations is that it helps raising productivity of working class by transfer high sophisticated technology to developing countries which are essentialand enable the developing countries to start new productive ventures requiring high technology. The multinational firms set up their subsidiary production units which not only import new equipment and machinery but also skills and technical know-how to use the new equipment and machinery.Therefore, MNCs can play an important role in the technological up-gradation of the Indian economy.

4. Promotion of exports:

The lower costs multinationals can play a significant role in promoting exports of a country in which they invest with extensive links all over the world and producing products efficiently. For example, in recent years the rapid expansion in china’s exports is due to the large investment made by multinationals in various fields of Chinese industry.

In Indiaso as to earn foreign exchange government granted the permission subject to the condition that the concerned multinational company would export the product.

5. Investment in infrastructure:

Multinational corporations have large command over financial resources and their superior ability to raise resources could invest in infrastructure such as power projects, modernisation of airports and posts, telecommunication.

The investment in infrastructure will help to boost industrial growth and help in creating income and employment in the economy.

Key takeaways –

- Role of multinational corporation involves promotion of foreign investment, investment in infrastructure, promotion of exports, technology transfer.

Most of exports and imports involve finance i.e. Receipts and payments in money. An account of all receipts and payments is termed as balance of payments (bop)

According to kindle Berger, "the balance of payments of a country is a systematic record of all economic transactions between the residents of the reporting country and residents of foreign countries during a given period of time".

The balance of payment record is maintained in a standard double-entry book-keeping method. International transactions enter in to the record as credit or debit. The payments received from foreign countries enter as credit and payments made to other countries as debit.

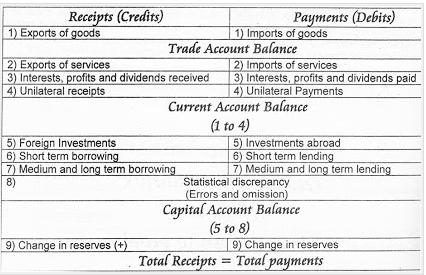

Balance of payment is a record pertaining to a period of time; usually it is all annual statement. All the transactions entering the balance of payments can be grouped under three broad accounts; (1) current account, (2) capital account, and (3) official international reserve account.

Structure of balance of payment (bop)

- Trade account balance

Trade account balance is the difference between exports and imports of goods, usually referred as visible or tangible items. Trade account balance tells as whether a country enjoys a surplus or deficit on that account. An industrial country with its industrial products consists of consumer and capital goods always had an beneficial position. Developing countries suffered from a deficit in their balance of payments with its export of primary goods. Most of the opec countries are in better position on trade account balance.

2. Current account balance

Current account balance is difference between the receipts and payments on account of current account which includes trade balance. The current account includes export of services, interests, profits, dividends and unilateral receipts from abroad, and the import of services, interests, profits, dividends and unilateral payments to abroad. Current account can be either surplus or deficit. When the debits are more than credits then the deficit will take place or when payments are more than receipts and the current account surplus will take place when the credits are more than debits.

3. Capital account balance

Capital account balance is difference between the receipts and payments on account of capital account. The capital account involves inflows and outflows relating to investments, short term borrowings/lending, and medium term to long term borrowing/lending. There can be surplus or deficit in capital account. When the credits are more than debits then the surplus will take place and the deficit will take place when the debits are more than credits.

4. Foreign exchange reserves

Foreign exchange reserves shows the reserves which are held in the form of foreign currencies usually in hard currencies like dollar, pound etc., gold and special drawing rights (sdrs). They increase when the individual has a surplus in his transactions and decrease when he has a deficit. Foreign exchange reserves when a country enjoys a net surplus both in current account & capital account. Whenever current account deficit exceeds the inflow in capital account, foreign exchange from the reserve accounts is used to meet the deficit.

Key takeaways –

- Trade account balance is the difference between exports and imports of goods

- Capital account balance is difference between the receipts and payments on account of capital account

- Current account balance is difference between the receipts and payments on account of current account which includes trade balance

Types of disequilibrium

- Cyclical disequilibrium: It occurs on account of trade cycles. Demand and other forces vary depending upon the different phases of trade cycles like prosperity and depression, causing changes in the terms of trade as well as growth of trade. Thus accordingly a surplus or deficit will result in the balance of payments.

Cyclical disequilibrium in the balance of payments may occur because:

- In different countries trade cycles follow different paths and patterns. In different countries there are no identical timings and periodicity of occurrence of cycles

- No identical stabilization programmes and measures are adopted by different countries.

- Income elasticity of demand for imports in different countries are not identical.

- Price elasticity of demand for imports differ in different countries.

In short, because of cyclical changes in income, employment, output and price variables, cyclical fluctuations cause disequilibrium in the balance of payments. When prices rise during prosperity and fall during a depression, a country which has a highly elastic demand for imports experiences a decline in the value of imports and if it continues its exports further, it will show a surplus in the balance of payments.

2. Structural disequilibrium: It occurs on account of structural changes occurring in some sectors of the economy at home or abroad which may alter the demand or supply relations of exports or imports or both. Suppose the foreign demand for jute products in India declines because of some substitutes, then the resources in the production of jute goods employed by India will have to be shifted to some other commodities of export.

Disequilibrium in the balance of payments will arise when exports may decline whereas with imports remaining the same,. Similarly, in the case of manufactured goods if the supply condition of export items is changed, i.e., supply is reduced due to crop failure in prime commodities or shortage of raw materials or labour strikes, etc., then also exports may decline and structural disequilibrium in the balance of payments will arise.

3. Short-run disequilibrium:A short-run disequilibrium in a country’s balance of payments will be ‘lasting for a short period, which may occur once in a while. When a country borrows or lends internationally, it will have short-run disequilibrium in its balance of payments. Since these loans are usually for a short period or even if they are for a long duration, they are repayable later on; hence the position will be automatically corrected and poses no serious problem. If a country’s imports exceed its exports in a given year a short-run disequilibrium may also emerge.

4. Long-run disequilibrium:The long-term disequilibrium refers to a deep- rooted, persistent deficit or surplus in the balance of payments of a country. In the balance of payment a long-term deficit of a country tends to deplete its foreign exchange reserves and during a period of persistent deficits the country may also not be able to raise any more loans from foreigners. It is caused by changes in dynamic forces/factors such as capital formation, population growth, territorial expansion, technological advancement, innovations, etc.

Key takeaways –

- Disequilibrium can be cyclic disequilibrium, structural disequilibrium, short term disequilibrium, long term disequilibrium

Causes of disequilibrium

- Economic factors:

- Imbalance between exports and imports.

- Large scale development expenditure which causes large imports,

- High domestic prices which lead to imports,

- Cyclical fluctuations (like recession or depression) in general business activity,

- New sources of supply and new substitutes.

2. Political factors: political instability and disturbances cause large capital outflows and hinder inflows of foreign capital.

3. Social factors:

- Changes in fashions, tastes and preferences of the people bring disequilibrium in bop by influencing imports and exports;

- High growth in population in poor countries adversely affects their bop because it increases the needs of the countries for imports and decreases their capacity to export.

Measures of disequilibrium

- Export promotion: Exports should be encouraged by granting various bounties to manufacturers and exporters. At the same time, by undertaking import substitution and imposing reasonable tariffs imports should be discouraged.

2. Import: Other measures of correcting disequilibrium are restrictions and import substitution.

3. Reducing inflation: Inflation occurs with continuous rise in prices discourages exports and encourages imports. Hence, government should check inflation and lower the prices in the country.

4. Exchange control:Government should control foreign exchange by ordering all exporters to surrender their foreign exchange to the central bank and then ration out among licensed importers.

5. Devaluation of domestic currency: It means fall in the external or exchange value of domestic currency in terms of a unit of foreign exchange which makes domestic goods cheaper for the foreigners. When a country has adopted a fixed exchange rate system devaluation is done by a government order.

6. Depreciation:Depreciation leads to fall in external purchasing power of home currency like devaluation. Depreciation occurs in a free market system wherein demand for foreign exchange far exceeds the supply of foreign exchange in foreign exchange market of a country.

Key takeaways –

- Measures of disequilibrium are exchange control, devaluation of domestic currency, depreciation, import, export promotion

What is the foreign exchange market?

Definition

The foreign exchange market also referred as forex, fx, or the currency market is an over-the-counter (otc) global marketplace that determines the exchange rate for currencies around the world. Participants are able to buy, sell, exchange, and speculate on currencies.

Foreign exchange markets are made up of banks, forex dealers, commercial companies, central banks, investment management firms, hedge funds, retail forex dealers, and investors.

On the basis of the period of transaction carried out foreign exchange markets are classified into spot market and forward market.

- Spot market:

If the operation is of daily nature, it is called spot market or current market. It takes care only spot transactions or current transactions in foreign exchange.

At prevailing rate of exchange at that point of time transactions are affected and instantly delivery of foreign exchange is affected. The exchange rate that prevails in the spot market for foreign exchange is called spot rate. Spot rate of exchange refers to the rate at which foreign currency is available on the spot.

For instance,at the point of time if one us dollar can be purchased for rs 50 in the foreign exchange market, it will be called spot rate of foreign exchange. For current transactions spot rate of foreign exchange is very useful.

2. Forward market:

A market in which foreign exchange is bought and sold for future delivery is known as forward market. It deals with sale and purchase of foreign exchange transactions which are contracted today but implemented sometimes in future. Exchange rate that prevails in a forward contract for purchase or sale of foreign exchange is called forward rate. Thus, forward rate is the rate at which a future contract for foreign currency is made.

The forward rate is quoted at a premium or discount over the spot rate. Forward market for foreign exchange covers transactions which occur at a future date. Forward exchange rate helps both the parties involved.

A forward contract is entered into for two reasons:

(i) To minimise risk of loss due to adverse change in exchange rate and

(ii) to make a profit (i.e., speculation).

Hedging, speculation and arbitrage

Hedging refers to covering risk involved in fluctuating exchange rates. Hedgers are traders who undertake foreign exchange trading because they have assets or liabilities in foreign currency. The change in the exchange rates involves the element of risk. Both exporters and importers try to cover the risk through an institutional arrangement called the forward exchange market. The ‘forward exchange market’ is a market arrangement where buyers and sellers of foreign exchange come to a mutual agreement to exchange currencies at a given rate on a future date.

Thus, a forward contract helps to hedge or cover the risk involved in fluctuating exchange rates. For instance, suppose an Indian exporter to Usa is expecting a payment of $ 20,000 three months hence from a us importer. The Indian exporter can fix the rupee value of his dollar receivables amounting to $ 20,000 three months forward at a rupee-dollar conversion rate agreed upon today. Similarly, an importer can fix the home currency value of payables by buying foreign exchange forward. Banks offer forward contracts to individual importers and exporters per the amount and maturity.

Arbitrage refers to the act of buying foreign exchange cheap and selling at a higher price. For instance, in the Zurich foreign exchange market, $ one buys five Swiss francs, five Swiss francs buy three marks and three marks buy $ 1.50. Arbitrageurs will simultaneously sell francs for marks and sell marks for dollars.

Arbitrageurs will continue to buy and sell in this manner until marks fall in value so that three marks purchase only one dollar. This is known as a threeway transaction. Similarly, if the dollar is cheaper relative to the mark in London then it is in Hamburg, arbitrageurs will simultaneously buy dollars for marks; in London and sell them in Hamburg. This will bring their prices back into line on the two exchanges. The possibility of arbitrage keeps exchange rates in line around the world because huge amount of money can be mobilized in response to a small gain.

Speculation is involved in buying and selling of foreign currencies. The existence of the forward and swap transactions in the foreign exchange market points to the activities of speculators. Both hedgers and arbitrageurs are speculators in the foreign exchange market. Their activities contribute to fluctuation exchange rates in the foreign exchange market. Foreign exchange traders and brokers, commercial banks, hedge funds, and other financial companies represent the speculators in the foreign exchange market. Speculators in foreign exchange markets want to make profit from buying currency at a lower price and selling it a higher price. Speculators make a profit from fluctuations in exchange rates. The interbank foreign exchange market consists of large commercial banks and financial firms. These are the major speculators in the foreign exchange markets.

The interbank market helps to determine the bid (buy) and ask (sell) price of currencies. This market has no trading floor, but banks can trade with each other directly or via electronic brokerage systems that connect market participants. Multinational companies are also involved in speculation because they make or receive payments denominated in various currencies to and from firms around the world. These currencies fluctuate on a daily basis.

Key takeaways –

- Hedging refers to covering risk involved in fluctuating exchange rates

- Arbitrage refers to the act of buying foreign exchange cheap and selling at a higher price

- Speculation is involved in buying and selling of foreign currencies

Fixed and flexible exchange rates

Fixed exchange rate

- The fixed exchange rate is officially fixed by the government or a competent authority, not by the market forces.

- Under this the government and central bank attempts to keep the value of the currency is fixed against the value of other currencies.

- According to the gold value of currencies that have to be exchanged the value of each currency was set in terms of gold and exchange rate was fixed.

- The central bank undertakes to buy and sell foreign exchange and the private purchase and sales are postponed, once the rate determined.

- An apex bank changes the exchange rate if needed.

Flexible exchange rate

- A flexible exchange rate is also known as a floating exchange rate.

- In a flexible exchange according to the demand and supply of market forces rate, a rate is set.

- A country's economic situation will determine the market demand and supply of its currency.

- It is particularly determined concerning other currency it means higher the demand of particular currency, the higher its exchange rate.

- The government has no control over the flexible exchange rate.If an economy is strong the flexible exchange rate is higher and vice a versa.

- According to the demand and supply of international exchange a value of the currency is fluctuated.

Basis | Fixed exchange rate | Flexible exchange rate |

Meaning | A fixed exchange rate is a rate which is maintained and controlled by the central government. | A flexible exchange rate is a rate which is determined by the market force. |

Controlled by | A fixed exchange rate is controlled by an apex bank or a monetary authority. | A flexible exchange rate is controlled by the demand and supply forces. |

How it affects currency | A fixed exchange rate has a devaluation and evaluation in a currency. | A flexible exchange rate can depreciate and appreciate the value of a currency. |

Hedging | If the country is using fixed exchange rate there is no hedging risk | Hedging is used to reduce the currency risks in the flexible exchange rate. |

Key takeaways

- The fixed exchange rate is officially fixed by the government or a competent authority, not by the market forces

- A flexible exchange rate is a rate which is determined by the market force.

Managed flexibility

Definition

A managed floating exchange rate is a regime that allows an issuing central bank to intervene regularly in fx markets in order to change the direction of the currency’s float and shore up its balance of payments in excessively volatile periods. This regime is also known as a “dirty float”.

A managed flexible exchange rate is a combination of fixed and flexible exchange rate policy. It recognizes the benefits of a flexible exchange rate automatically adjusting to equilibrium in response to foreign exchange market disruptions. However, it also recognizes that the resulting exchange rate might not always generate desired international trade patterns and that government might need to step in to fix the rate temporarily.

The policy players

Central banks: the primary players in most managed exchange rate policies are one or both of the governments issuing the currency being exchanged. The central bank are usuallyspecify policy decision makers of the countries. Independently or in cooperation a central bank might operate with the central bank of another nation. For example, the federal reserve system keeps an eye on exchange rates between the u.s. Dollar and the currencies of other nations, taking actions when deemed necessary. However, it works with the bank of England, the bank of Japan, and other central banks to keep the dollar-pound, dollar-yen, and other exchange rates under control.

International agencies: other major players managing exchange rates are international agencies, especially the international monetary fund (imf). The imf is an agency chartered by the united nations specifically charged with monitoring and stabilizing foreign exchange rates. It has stockpiles of the currencies of member nations (over 150) that it uses when needed to manage exchange rates.

Key takeaways –

- A managed flexible exchange rate is a combination of two other exchange rate policies - fixed and flexible.

- Managed flexibility – is an exchange rate system where the exchange rate is determined by the interaction of the market forces like demand and supply, but wide fluctuations are corrected by central bank’s intervention.

Reference

- Business economics by H.L Abuja

- Business economics application and analysis by Dr. Raj Kumar

- Business economics by T Aryamala

- Business economics by SK Agarwal