UNIT-4

FINAL ACCOUNTS OF BANKING COMPANIES

The following points highlight the eleven provisions of banking regulation act. They are: (1) Prohibition of Trading (2) Non-Banking Assets (3) Management (4) Minimum Capital and Reserves (5) Capital Structure (6) Payment of Commission, Brokerage etc. (7) Reserve Fund/Statutory Reserve (8) Cash Reserve (9) Liquidity Norms (10) Restrictions on Loans and Advances and (11) Accounts and Audit .

Banking Regulation Act Provision # 1. Prohibition of Trading (Sec. 8):

- According to Sec. 8 of the Banking Regulation Act, a banking company cannot directly or indirectly deal in buying or selling or bartering of goods.

- But it may, however, buy, sell or barter the transactions relating to bills of exchange received for collection or negotiation.

Banking Regulation Act Provision # 2. Non-Banking Assets (Sec. 9):

According to Sec. 9 “A banking company cannot hold any immovable property, howsoever acquired, except for its own use, for any period exceeding seven years from the date of acquisition thereof. The company is permitted, within the period of seven years, to deal or trade in any such property for facilitating its disposal”. Of course, the Reserve Bank of India may, in the interest of depositors, extend the period of seven years by any period not exceeding five years.

Banking Regulation Act Provision # 3. Management (Sec. 10):

Sec. 10(a) states that not less than 51% of the total number of members of the Board of Directors of a banking company shall consist of persons who have special knowledge or practical experience in one or more of the following fields:

(a) Accountancy; (b) Agriculture and Rural Economy; (c) Banking; (d) Cooperation; (e) Economics; (f) Finance; (g) Law; (h) Small Scale Industry.

The Section also states that at least not less than two directors should have special knowledge or practical experience relating to agriculture and rural economy and cooperation. Sec. 10(b)(1) further states that every banking company shall have one of its directors as Chairman of its Board of Directors.

Banking Regulation Act Provision # 4. Minimum Capital and Reserves (Sec. 11)

Sec. 11 of the Banking Regulation Act, 1949, provides that no banking company shall commence or carry on business in India, unless it has minimum paid-up capital and reserve of such aggregate value as is noted below:

(a) Foreign Banking Companies:

In case of banking company incorporated outside India, its paid-up capital and reserve shall not be less than Rs. 15 lakhs and, if it has a place of business in Mumbai or Kolkata or in both, Rs. 20 lakhs. It must deposit and keep with the R.B.I, either in Cash or in unencumbered approved securities (i) the amount as required above, and (ii) after the expiry of each calendar year, an amount equal to 20% of its profits for the year in respect of its Indian business.

(b) Indian Banking Companies:

In case of an Indian banking company, the sum of its paid-up capital and reserves shall not be less than the amount stated below:

(i) If it has places of business in more than one State, Rs. 5 lakhs, and if any such place of business is in Mumbai or Kolkata or in both, Rs. 10 lakhs.

(ii) If it has all its places of business in one State, none of which is in Mumbai or Kolkata, Rs. 1 lakh in respect of its principal place of business plus Rs. 10,000 in respect of each of its other places of business in the same district in which it has its principal place of business plus Rs. 25,000 in respect of each place of business elsewhere in the State. No such banking company shall be required to have paid-up capital and reserves exceeding Rs. 5 lakhs and no such banking company which has only one place of business shall be required to have paid-up capital and reserves exceeding Rs. 50,000.

In case of any such banking company which commences business for the first time after 16th September 1962, the amount of its paid-up capital shall not be less than Rs. 5 lakhs.

(iii) If it has all its places of business in one State, one or more of which are in Mumbai or Kolkata, Rs. 5 lakhs plus Rs. 25,000 in respect of each place of business outside Mumbai or Kolkata. No such banking company shall be required to have paid-up capital and reserve excluding Rs. 10 lakhs.

Banking Regulation Act Provision # 5. Capital Structure (Sec. 12):

According to Sec. 12, no banking company can carry on business in India, unless it satisfies the following conditions:

(a) Its subscribed capital is not less than half of its authorised capital, and its paid-up capital is not less than half of its subscribed capital.

(b) Its capital consists of ordinary shares only or ordinary or equity shares and such preference shares as may have been issued prior to 1st April 1944. This restriction does not apply to a banking company incorporated before 15th January 1937.

(c) The voting right of any shareholder shall not exceed 5% of the total voting right of all the shareholders of the company.

Banking Regulation Act Provision # 6. Payment of Commission, Brokerage etc. (Sec. 13):

According to Sec. 13, a banking company is not permitted to pay directly or indirectly by way of commission, brokerage, discount or remuneration on issues of its shares in excess of 2j% of the paid-up value of such shares.

Payment of Dividend:

According to Sec. 15, no banking company shall pay any dividend on its shares until all its capital expenses (including preliminary expenses, organisation expenses, share selling commission, brokerage, amount of losses incurred and other items of expenditure not represented by tangible assets) have been completely written-off.

But a Banking Company need not:

(a) write-off depreciation in the value of its investments in approved securities in any case where such depreciation has not actually been capitalised or otherwise accounted for a loss;

(b) write-off depreciation in the value of its investments in shares, debentures or bonds (other than approved securities) in any case where adequate provision for such depreciation has been made to the satisfaction of the auditor;

(c) write-off bad debts in any case where adequate provision for such debts has been made to the satisfaction of the auditors of the banking company.

Floating Charges:

A floating charge on the undertaking or any property of a banking company can be created only if RBI certifies in writing that it is not detrimental to the interest of depositors — Sec. 14A. Similarly, any charge created by a banking company on unpaid capital is invalid — Sec. 14.

Banking Regulation Act Provision # 7. Reserve Fund/Statutory Reserve (Sec. 17):

According to Sec. 17, every banking company incorporated in India shall, before declaring a dividend, transfer a sum equal to 20% of the net profits of each year (as disclosed by its Profit and Loss Account) to a reserve fund. The Central Government may, however, on the recommendation of RBI, exempt it from this requirement for a specified period.

The exemption is granted if its existing reserve fund together with Share Premium Account is not less than its paid-up capital. If it appropriates any sum from the reserve fund or the share premium account, it shall, within 21 days from the date of such appropriation, report the fact to the Reserve Bank, explaining the circumstances relating to such appropriation.

Banking Regulation Act Provision # 8. Cash Reserve (Sec. 18):

Under Sec. 18, every banking company (not being a Scheduled Bank) shall, if Indian, maintain in India, by way of a cash reserve in Cash, with itself or in current account with the Reserve Bank or the State Bank of India or any other bank notified by the Central Government in this behalf, a sum equal to at least 3% of its time and demand liabilities in India.

The Reserve Bank has the power to regulate the percentage also between 3% and 15% (in case of Scheduled Banks). Besides the above, they are to maintain a minimum of 25% of its total time and demand liabilities in cash, gold or unencumbered approved securities. But every banking company’s asset in India should not be less than 75% of its time and demand liabilities in India at the close of last Friday of every quarter.

Banking Regulation Act Provision # 9. Liquidity Norms (Sec. 24):

According to Sec. 24 of the Act, banking companies must maintain sufficient liquid assets in the normal course of business. The section states that every banking company has to maintain in cash, gold or unencumbered approved securities, an amount not less than 20% of its demand and time liabilities in India. This percentage may be changed by the RBI from time to time according to economic circumstances of the country. This is in addition to the average daily balance maintained by a bank.

Banking Regulation Act Provision # 10. Restrictions on Loans and Advances (Sec. 20):

After the Amendment of the Act, 1968, a bank cannot:

(i) grant loans or advances on the security of its own shares, and

(i i) grant or agree to grant a loan or advance to or on behalf of:

(a) any of its directors;

(b) any firm in which any of its directors is interested as partner, manager or guarantor;

(c) any company of which any of its directors is a director, manager, employee or guarantor, or in which he holds substantial interest; or

(d) any individual in respect of whom any of its directors is a partner or guarantor.

Banking Regulation Act Provision # 11. Accounts and Audit (Sec. 29 to 34A):

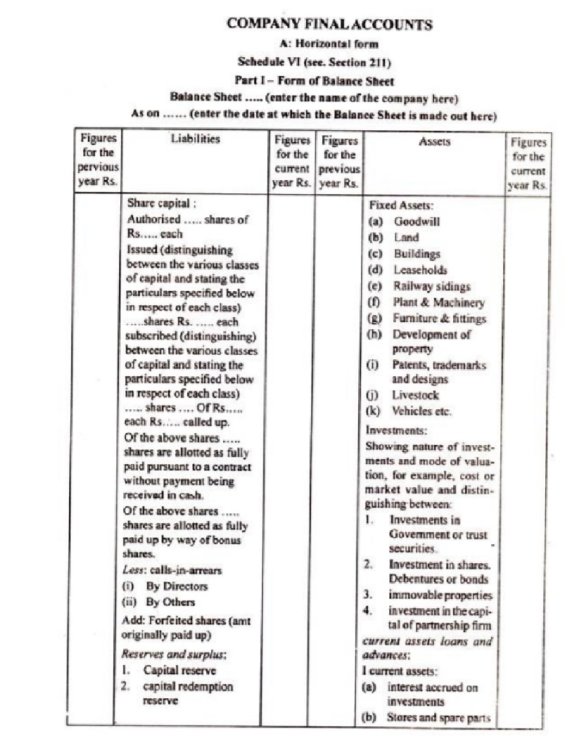

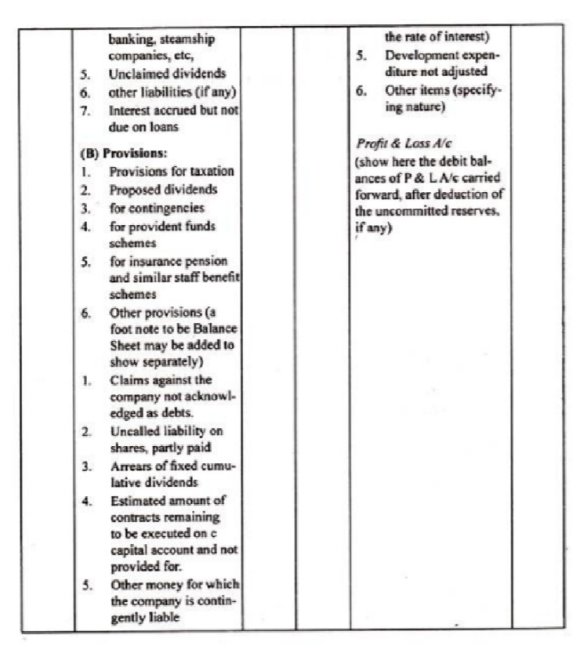

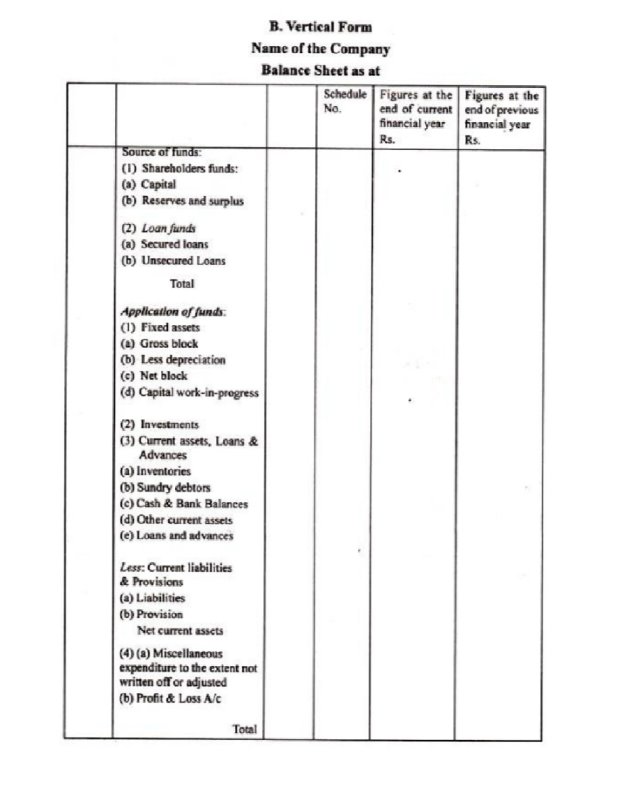

The above Sections of the Banking Regulation Act deal with the accounts and audit. Every banking company, incorporated in India, at the end of financial year expiring a period of 12 months as the Central Government may by notification in the Official Gazette specified, must prepare a Balance Sheet and a Profit and Loss Account as on the last working day of that year or according to the Third Schedule or as circumstances permit.

At the same time, every banking company, which is incorporated outside India, is required to prepare a Balance Sheet and also a Profit and Loss Account relating to its branch in India also. We know that Form A of the Third Schedule deals with form of Balance Sheet and Form B of the Third Schedule deals with form of Profit and Loss Account.

It is interesting to note that a new set of forms have been prescribed for Balance Sheet and Profit and Loss Account of the banking company and RBI has also issued guidelines to follow the new forms with effect from 31st March 1992.

According to Sec. 30 of the Banking Regulation Act, the Balance Sheet and Profit and Loss Account should be prepared according to Sec. 29 and the same must be audited by a qualified person known as auditor. It is needless to mention here that every banking company must take previous permission from RBI before appointing, re-appointing or removing any auditor.

RBI also can order special audit for public interest of depositors. Moreover, every banking company must have to furnish their copies of accounts and Balance Sheet prepared according to Sec. 29 along with the auditors’ report to the RBI and also the Registrar of Companies within three months from the end of the accounting period.

Banking Regulation Act, 1949

The Banking Regulation Act, 1949 is a legislation in India that regulates all banking firms in India.[1] Passed as the Banking Companies Act 1949, it came into force from 16 March 1949 and changed to Banking Regulation Act 1949 from 1 March 1966. It is applicable in jammu and Kashmir from 1956. Initially, the law was applicable only to banking companies. But, 1965 it was amended to make it applicable to cooperative banks and to introduce other changes.[2] In 2020 it was amended to bring the cooperative banks under the supervision of the Reserve Bank of India.

Important provisions of 1949 Banking Regulation Act

1. Use of words ‘bank’, ‘banker’, ‘banking’ or ‘banking company’ (Sec.7): According to Sec. 7 of the Banking Regulation Act, no company other than a banking company shall use the words ‘bank’, ‘banker’, ‘banking’ or ‘banking company’ and no company shall carry on the business of banking in India, unless it uses the above mentioned words in its name.

2. Prohibition of Trading (Sec. 8): According to Sec. 8 of the Banking Regulation Act, a banking company cannot directly or indirectly deal in buying or selling or bartering of goods. But it may, however, buy, sell or barter the transactions relating to bills of exchange received for collection or negotiation.

3. Disposal of banking assets (Sec. 9): According to Sec. 9 “A banking company cannot hold any immovable property, howsoever acquired, except for its own use, for any period exceeding seven years from the date of acquisition thereof. The company is permitted, within the period of seven years, to deal or trade in any such property for facilitating its disposal”.

4. Management (Sec. 10): Sec. 10 (a) states that not less than 51% of the total number of members of the Board of Directors of a banking company shall consist of persons who have special knowledge or practical experience in one or more of the following fields:

a) Accountancy

b) Agriculture and Rural Economy

c) Banking

d) Cooperative

e) Economics

f) Finance

g) Law

h) Small Scale Industry.

5. Requirements as to minimum paid-up capital and reserves (Sec. 11): Sec. 11 (2) of the Banking Regulation Act, 1949, provides that no banking company shall commence or carry on business in India, unless it has minimum paid-up capital and reserve of such aggregate value as is noted below:

(a) Foreign Banking Companies: In case of banking company incorporated outside India, aggregate value of its paid-up capital and reserve shall not be less than Rs. 15 lakhs and, if it has a place of business in Mumbai or Kolkata or in both, Rs. 20 lakhs. It must deposit and keep with the R.B.I, either in Cash or in unencumbered approved securities:

(i) The amount as required above, and

(ii) After the expiry of each calendar year, an amount equal to 20% of its profits for the year in respect of its Indian business.

(b) Indian Banking Companies: In case of an Indian banking company, the sum of its paid-up capital and reserves shall not be less than the amount stated below:

(i) If it has places of business in more than one State, Rs. 5 lakhs, and if any such place of business is in Mumbai or Kolkata or in both, Rs. 10 lakhs.

(ii) If it has all its places of business in one State, none of which is in Mumbai or Kolkata, Rs. 1 lakh in respect of its principal place of business plus Rs. 10,000 in respect of each of its other places of business in the same district in which it has its principal place of business, plus Rs. 25,000 in respect of each place of business elsewhere in the State.

(iii) If it has all its places of business in one State, one or more of which are in Mumbai or Kolkata, Rs. 5 lakhs plus Rs. 25,000 in respect of each place of business outside Mumbai or Kolkata? No such banking company shall be required to have paid-up capital and reserve excluding Rs. 10 lakhs.

6. Regulation of capital and voting rights of shareholders (Sec. 12): According to Sec. 12, no banking company can carry on business in India, unless it satisfies the following conditions:

(a) Its subscribed capital is not less than half of its authorized capital, and its paid-up capital is not less than half of its subscribed capital.

(b) Its capital consists of ordinary shares only or ordinary or equity shares and such preference shares as may have been issued prior to 1st April 1944.

(c) The voting right of any shareholder shall not exceed 5% of the total voting right of all the shareholders of the company.

7. Restriction on Commission, Brokerage, Discount etc. on sale of shares (Sec. 13): According to Sec. 13, a banking company is not permitted to pay directly or indirectly by way of commission, brokerage, discount or remuneration on issues of its shares in excess of 2½% of the paid-up value of such shares.

8. Prohibition of charges on unpaid capital (Sec. 14): A banking company cannot create any charge upon its unpaid capital and such charges shall be void.

9. Restriction on Payment of Dividend (Sec. 15): According to Sec. 15, no banking company shall pay any dividend on its shares until all its capital expenses (including preliminary expenses, organisation expenses, share selling commission, brokerage, amount of losses incurred and other items of expenditure not represented by tangible assets) have been completely written-off.

10. Reserve Fund/Statutory Reserve (Sec. 17): According to Sec. 17, every banking company incorporated in India shall, before declaring a dividend, transfer a sum equal to 25% of the net profits of each year (as disclosed by its Profit and Loss Account) to a Reserve Fund. The Central Government may, however, on the recommendation of RBI, exempt it from this requirement for a specified period.

11. Cash Reserve (Sec. 18): Under Sec. 18, every banking company (not being a Scheduled Bank) shall, if Indian, maintain in India, by way of a cash reserve in Cash, with itself or in current account with the Reserve Bank or the State Bank of India or any other bank notified by the Central Government in this behalf, a sum equal to at least 3% of its time and demand liabilities in India.

The Reserve Bank has the power to regulate the percentage also between 3% and 15% (in case of Scheduled Banks). Besides the above, they are to maintain a minimum of 25% of its total time and demand liabilities in cash, gold or unencumbered approved securities.

12. Liquidity Norms or Statutory Liquidity Ratio (SLR) (Sec. 24): According to Sec. 24 of the Act, in addition to maintaining CRR, banking companies must maintain sufficient liquid assets in the normal course of business. The section states that every banking company has to maintain in cash, gold or unencumbered approved securities, an amount not less than 25% of its demand and time liabilities in India.

This percentage may be changed by the RBI from time to time according to economic circumstances of the country. This is in addition to the average daily balance maintained by a bank.

13. Restrictions on Loans and Advances (Sec. 20): After the Amendment of the Act in 1968, a bank cannot:

(i) Grant loans or advances on the security of its own shares, and

(ii) Grant or agree to grant a loan or advance to or on behalf of:

a) Any of its directors;

b) Any firm in which any of its directors is interested as partner, manager or guarantor;

c) Any company of which any of its directors is a director, manager, employee or guarantor, or in which he holds substantial interest; or

d) Any individual in respect of whom any of its directors is a partner or guarantor.

14. Accounts and Audit (Sees. 29 to 34A): The above Sections of the Banking Regulation Act deal with the accounts and audit. Every banking company, incorporated in India, at the end of a financial year expiring after a period of 12 months as the Central Government may by notification in the Official Gazette specify, must prepare a Balance Sheet and a Profit and Loss Account as on the last working day of that year, or, according to the Third Schedule, or, as circumstances permit.

In the business of insurance, statutory reserves are those assets an insurance company is legally required to maintain on its balance sheet with respect to the unmatured obligations (i.e., expected future claims) of the company. Statutory reserves are a type of actuarial reserve.

Statutory reserves are intended to ensure that insurance companies are able to meet future obligations created by insurance policies. These reserves must be reported in statements filed with insurance regulatory bodies. They are calculated with a certain level of conservatism in order to protect policyholders and beneficiaries.

There are two types of methods for calculation of statutory reserves. Reserve methodology may be fully prescribed by law, which is often called formula-based reserving. This is in contrast to principles-based reserves, where actuaries are given latitude to use professional judgement in determining methodology and assumptions for reserve calculation.In the United States, where formula-based reserves are used, the National Association of Insurance Commissioners plans to implement principles-based reserves in 2017.

Cash Reserves

Cash Reserve Ratio, or popularly known as CRR is a compulsory reserve that must be maintained with the Reserve Bank of India. Every bank is required to maintain a specific percentage of their net demand and time liabilities as cash balance with the RBI.

CRR is the percentage of total deposits, which a commercial bank has to keep as reserves in the form of cash with the RBI. The banks are not allowed to use that money, kept with RBI, for economic and commercial purposes. It is a tool used by the apex bank to regulate the liquidity in the economy and control the flow of money in the country.

Therefore, if the RBI wants to increase the money supply in the economy, it will reduce the rate of CRR while, if RBI seeks to decrease the money supply in the market then it will increase the rate of CRR.

On the other hand, Statutory Liquidity Ratio, shortly called as SLR also an obligatory reserve to be kept by the banks, as prescribed securities, based on a certain percentage of net demand and time liabilities.

Statutory Liquidity Ratio

SLR is a percentage of Net Time and Demand Liabilities kept by the bank in the form of liquid assets. It is used to maintain the stability of banks by limiting the credit facility offered to its customers. The banks hold more than the required SLR and the purpose of maintaining the SLR is to hold a certain amount of money in the form of liquid assets, so as to fulfill the demand of the depositors when arises.

Here, Time Liabilities mean the amount of money which is made payable to the customer after a period of time while the demand liabilities means the amount of money which is made payable to the customer at the time when it is demanded.

The liquidity of the country is regulated by CRR while SLR governs the credit growth of the country.

The RBI is required to keep the supply of money in the economy and for this purpose, it uses tools, like Bank Rate, Repo Rate, Reverse Repo Rate, CRR, and SLR.

CRR and SLR are the form of reserves, in which the money is blocked in the economy and is not used for further lending and investment purposes.

The terms ‘invoice discounting’ or ‘bills discounting’ or ‘purchase of bills’ are all same. Invoice discounting is a source of working capital finance for the seller of goods on credit. Bill discounting is an arrangement whereby the seller recovers an amount of sales bill from the financial intermediaries before it is due. Such intermediaries charge a fee for the service. From the other side, it is a business vertical for all types of financial intermediaries such as banks, financial institutions, NBFCs, etc.

Invoice discounting can be technically defined as the selling of bill to invoice discounting company before the due date of payment at a value which is less than the invoice amount. The difference between the bill amount and the amount paid is the fee of the invoice discounting to the company. The fee will depend on the period left before payment date, amount and the perceived risk.

The bills or invoices under bill discounting are legally the ‘bill of exchange’. A bill of exchange is a negotiable instrument which is negotiable mere by endorsing the name. For example our currency is an example of bill of exchange. Currency provides value written over it to the bearer of the instrument. In the case of bill discounting, such bills can be either payable to the bearer or payable to order. Therefore, after discounting a bill, a bank can further get the bill discounted from other banks in case of cash flow requirement.

Unique Features of Bill Discounting

- Credit Evaluation

A bank will look at the reputation of the seller as well as the past payment records of the buyer who needs to pay to the bank.

- Banking Partner Preferred

The buyer should have a good bank as well which can work in your favor if it endorses the bill of exchange. This will ensure your bank that the paying party is reliable and two such signatures of reputable companies or banks are required for discounting usually.

- Usance Bill

The bill has to be valid within the date of time permitted by customs for the bill date and its payment. This time period can vary from two weeks to two months. This time is called as “Usance Period”. Hence the bill should be a usance bill.

- Bank to Bank Dealing

The transaction happens between banks where the confirming bank or the buyers’ bank does not intimate the seller of the reimbursement instruction but deals with his bank directly to determine the discounting terms.

Methods of Presenting Invoice

There are two methods to present the bills to the buyer’s bank – with recourse and without recourse.

With Recourse

Along with recourse the seller’s bank checks all documents and terms of the discount and send it across to the buyer’s bank. This bank doesn’t need to recheck everything and can later claim refunds in case of any issues which crop up.

Without Recourse

Without recourse bill of exchange is presented when there are no checks done by the seller’s bank and request for payment is done. The buyer’s bank will need to check all details. This is usually done when both banks have tie-ups for payment, acceptance, and negotiation from each other or the buyer’s bank has already confirmed on the discount terms.

Bill Discounting or Invoice Discounting Process/Procedure

- The process of bill discounting is simple and logical.

- The seller sells the goods on credit and raises invoice on the buyer.

- The buyer accepts the invoice. By accepting, the buyer acknowledges paying on the due date.

- Seller approaches the financing company to discount it.

- The financing company assures itself of the legitimacy of the bill and creditworthiness of the buyer.

- The financing company avails the fund to the seller after deducting appropriate margin, discount and fee as per the norms.

- The seller gets the funds and uses it for further business.

- On the due date of payment, the financial intermediary or the seller collects the money from the buyer. ‘Who will collect the money’ depends on the agreement between the seller and financing company.

Advantages of Bill / Invoice Discounting

The business gets the cash instantaneously giving business cycle a better momentum. It allows an entrepreneur to do business without funds. This works like a bank overdraft, the borrower pays the interest only on the amount of money utilized. There is a tough competition in the market to extend such credit and hence there are a plenty of different products to suit the needs of the client. There are borrowers who even cover the risk of bad debt along with the service. Obviously, the charge may be little more.

Disadvantages of Bill / Invoice Discounting

It can be an expensive form of financing compared to other modes of financing such as bank overdraft etc. In many countries like India, where the central bank encouraged the scheme of bill discounting and allowed a lower percentage of interest. But, it was not successful due to various misuses by financing brokers, banks etc.

Rebate on Bills Discounted is also known as Discount Received in Advance, or, Unexpired Discount or, Discount Received but not earned.

Its treatment is same as we do in the case of Interest Received in Advance.

Thus:

(i) If it is given only in the Trial Balance:

— the same will be shown as a liability and will appear in the liability side of the Balance Sheet.

(ii) If it is given in adjustment:

— In that case, the same is deducted from the Income from Interest and Discount in Profit and Loss Account and the same also will appear in the liability side of the Balance Sheet.

Method of Computation of Rebate on Bills Discounted:

For example, a customer discounts a bill of Rs. 20,000 for 3 months at 12% on 1st March 2000, it will be calculated as under:

Bank will earn discount @ 12% for 92 days i.e., = Rs. 20,000 x 12/100 x 92/365 = Rs. 604.9

But this amount of discount is meant for March, April and May. As accounts are prepared on 31st March each year, discount received for 61 days (30 + 31) for April and May is not actually earned. Thus, discount of 61 days i.e., Rs. 401 is called Rebate on Bill Discounted. So, actual income is Rs. 203.9 (i.e., 604.9 – Rs. 401).

Final accounts are those accounts that are prepared by a joint stock company at the end of a fiscal year. The purpose of creating final accounts is to provide a clear picture of the financial position of the organisation to its management, owners, or any other users of such accounting information.

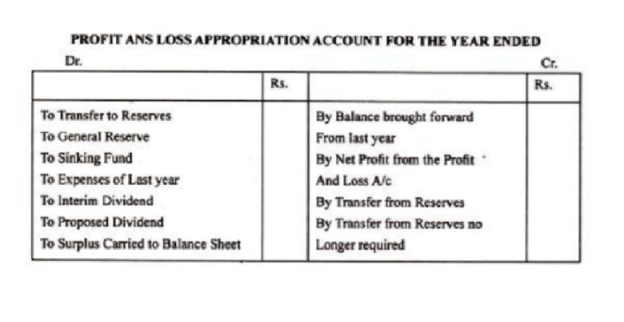

Final account preparation involves preparing a set of accounts and statements at the end of an accounting year. The final account consists of the following accounts:

- Trading and Profit and Loss Account

- Balance Sheet

- Profit and Loss Appropriation account

Objectives of Final Account preparation

Final accounts are prepared with the following objectives:

- To determine profit or loss incurred by a company in a given financial period

- To determine the financial position of the company

- To act as a source of information to convey the users of accounting information (owners, creditors, investors and other stakeholders) about the solvency of the company.

The format of a final account is represented as follows:

|

|

|

A non performing asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

Banks are required to classify NPAs further into Substandard, Doubtful and Loss assets.

1. Substandard assets: Assets which has remained NPA for a period less than or equal to 12 months.

2. Doubtful assets: An asset would be classified as doubtful if it has remained in the substandard category for a period of 12 months.

3. Loss assets: As per RBI, “Loss asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted, although there may be some salvage or recovery value.”

Sub-Classifications for Non-Performing Assets (NPAs)

Lenders usually provide a grace period before classifying an asset as non-performing. Afterward, the lender or bank will categorize the NPA into one of the following sub-categories:

1. Standard Assets

They are NPAs that have been past due for anywhere from 90 days to 12 months, with a normal risk level.

2. Sub-Standard Assets

They are NPAs that have been past due for more than 12 months. They have a significantly higher risk level, combined with a borrower that has less than ideal credit. Banks usually assign a haircut (reduction in market value) to such NPAs because they are less certain that the borrower will eventually repay the full amount.

3. Doubtful Debts

Non-performing assets in the doubtful debts category have been past due for at least 18 months. Banks generally have serious doubts that the borrower will ever repay the full loan. This class of NPA seriously affects the bank’s own risk profile

4. Loss Assets

These are non-performing assets with an extended period of non-payment. With this class, banks are forced to accept that the loan will never be repaid, and must record a loss on their balance sheet. The entire amount of the loan must be written off completely.

Working of NPA

Loans, as addressed above, are not switched into the NPA category until a considerable period of non-payment has passed. Lenders consider all of the factors that may make a borrower late on making interest and principal payments and extend a grace period.

After a month or so, banks typically consider a loan overdue. It is not until the end of the grace period (typically, 90 days of non-payment) that the loan then becomes a non-performing asset.

Banks may attempt to collect the outstanding debt by foreclosing on whatever property or asset has been used to secure the loan. For example, if an individual takes out a second mortgage and that loan becomes an NPA, the bank will generally send notice of foreclosure on the home because it is being used as collateral for the loan.

Significance of NPAs

- It is important for both the borrower and the lender to be aware of performing versus non-performing assets. For the borrower, if the asset is non-performing and interest payments are not made, it can negatively affect their credit and growth possibilities. It will then hamper their ability to obtain future borrowing.

- For the bank or lender, interest earned on loans acts as a main source of income. Therefore, non-performing assets will negatively affect their ability to generate adequate income and thus, their overall profitability. It is important for banks to keep track of their non-performing assets because too many NPAs will adversely affect their liquidity and growth abilities.

- Non-performing assets can be manageable, but it depends on how many there are and how far they are past due. In the short term, most banks can take on a fair amount of NPAs. However, if the volume of NPAs continues to build over a period of time, it threatens the financial health and future success of the lender.

- A nonperforming asset (NPA) is a debt instrument where the borrower has not made any previously agreed upon interest and principal repayments to the designated lender for an extended period of time. The nonperforming asset is, therefore, not yielding any income to the lender in the form of interest payments.

he banks have to classify their advances as follows in order to arrive at the amount of the provision to be made against them, into the following groups:- 1. Standard Assets 2. Sub-Standard Assets 3. Doubtful Assets and 4. Loss Assets.

(1) Standard Assets:

Standard assets are those which do not pose any problems and which do not carry more than normal risk attached to the business. They are non-performing assets (NPA). No provision is required to be made against them. However, banks have been asked to make provision at the rate of 0.25% on their standard advances also from the year ending 31st March, 2000.

(2) Sub-Standard Assets:

Sub-standard assets are those which have been classified as NPA for a period not exceeding 18 months. In such cases, the security available to the bank is inadequate and there is a distinct possibility that the bank will suffer some loss, if deficiencies are not corrected. Provision has to be made at the rate of 10% of the total outstanding amount of substandard assets.

However, in respect of accounts where there are potential threats of recovery on account of erosion in the value of security or non-availability of security and existence of other factors, such as frauds committed by borrowers, it will not be prudent for banks to classify them first as substandard and then as doubtful after expiry of two years from the date the account has become NPA. Such accounts should straightaway be classified as doubtful assets, or loss asset, as appropriate, irrespective of the period for which it has remained as NPA.

(3) Doubtful Assets:

Doubtful assets are those which have remained NPA for a period exceeding 18 months. This period of two years is being reduced to 18 months by 31st March, 2001. These assets are so weak that their collection or liquidation in full is considered highly improbable. A loan classified as doubtful has all the weaknesses inherent in the classified as substandard with the added characteristic that the weaknesses make collection or liquidation in full, high questionable and improbable, on the basis of currently known facts, condition and values.

In order to arrive at the amount provision to be made against doubtful assets, the unsecured portions and the secured portions of these assets have to be considered separately. The unsecured portion has to be fully provided for, i.e., provision has to be made equal to 100% of the amount by which the advance is not covered by the realisable value of the security.

(4) Loss Assets:

Loss assets are those where loss has been identified by the bank or internal or external auditors or RBI inspectors but the amount has not been written off wholly or partly. These assets are uncollectible and, therefore, they must be written off even though there may be a remote possibility of recovery of some amount.

Provision of 100% of the outstanding balance should be made.

References

- https://www.researchgate.net/

- https://www.economicsdiscussion.net/