Introduction to Foreign Exchange Markets

As soon as one comes to grips with the actual problems of international monetary

Economics it becomes indispensable to account for the fact that virtually every

Country (or group of countries forming a monetary union) has its own monetary

Unit (currency) and that most international trade is not barter trade but is carried out

By exchanging goods for one or another currency. Besides, there are international

Economic transactions1 of a purely financial character, which, therefore, involve

Different currencies.

From all the above the necessity arises of a foreign exchange market, that is, of

A market where the various national currencies can be exchanged (bought and sold)

For one another. The foreign exchange market, like any other concept of market

Used in economic theory, is not a precise physical place. It is actually formed apart

From institutional characteristics which we shall not go into by banks, brokers and

Other authorized agents (who are linked by telephone, telex, computer, etc.), to

Whom economic agents apply to buy and sell the various currencies; thus it has an

International rather than national dimension.

The foreign exchange market is the market in which individuals, firms, and banks

Buy and sell foreign currencies or foreign exchange. The foreign exchange market

For any currency—say, the U.S. dollar—is comprised of all the locations (such as

London, Paris, Zurich, Frankfurt, Singapore, Hong Kong, Tokyo, and New York)

Where dollars are bought and sold for other currencies. These different monetary

Centers are connected electronically and are in constant contact with one another,

Thus forming a single international foreign exchange market.

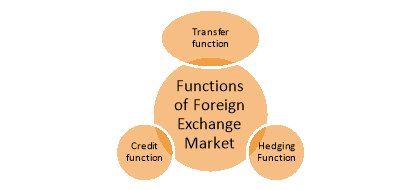

Functions of Foreign Exchange Market

|

1. Transfer Function

The primary function of the foreign exchange market is the transfer of funds from one country to the other. It facilitates the conversion of one currency into another. This accomplishes the transfer of purchasing power between two different countries. This is the primary function of the foreign exchange market. The funds can be transferred through telegraphic transfers, bills of exchange, foreign bills and bank drafts. The foreign exchange market determines the price of one country’s currency relative to another country’s currency.

2. Credit Function

The foreign exchange market performs another function of the financing of trade. It is called as the credit function. Credit is usually required when goods are in transit and also to allow the buyer to resell the goods and make the payment. In general, the exporters allow 90 days to importers to pay. The former generally gets the importers obligations to pay discounted through the commercial banks. This permits the payment to the exporters right away but the commercial banks will eventually collect the payment from the importers when due. Thus the foreign exchange market permits time to the importers in making payment, on the one hand, and permits instant payment to exporters through discounting facility, on the other.

3. Hedging Function

Another function of the foreign exchange market is to furnish facilities for hedging exchange risks. In a free exchange market, the variations in exchange rates result in a gain or loss to the concerned parties. If there is rise in the exchange value of the foreign currency between the time at which obligation arises and the time at which it is discharged, the importer is faced with a risk of loss. To protect himself from such an exchange risk, the importer can avail himself of the hedging facility.

Hedging means covering of an exchange risk, which can be avoided or reduced through a forward contract. It is a contract to buy or sell foreign exchange against another currency at some fixed date in the future at a price agreed upon presently. No money passes at the time of contract. The contract enables the importer to ignore any likely change in exchange rate in during the intervening period which is usually of the duration of 90 days. The existence of a forward market permits hedging against any possible exchange risk.

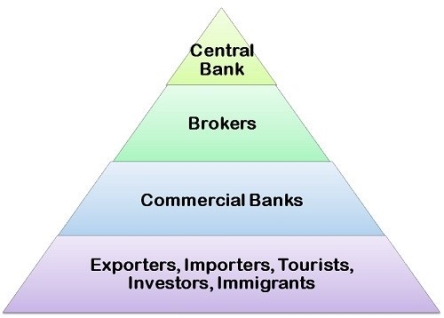

Structure of Foreign Exchange Markets

|

The foreign exchange market consist of Buyers, Commercial banks, Brokers and Central Bank. These are the main players of foreign exchange market. Let us explain the various participants of foreign exchange market

At the bottom of the pyramid are the actual buyers and sellers of foreign currencies- exporters, importers, tourists and investors. They are the prime users of the currencies and approaches to commercial banks to buy them.

Commercial banks

Next player is the commercial banks .The commercial banks account for by far the largest proportion of all trading of both a commercial and speculative nature and operate within what is known as the interbank market. This is essentially a market composed solely of commercial and investments which buy and sell currencies from each other. Strict trading relationships exist between the member banks and lines of credit are established between these banks before they are permitted to trade.

Commercial and investment banks are a fundamental part of the foreign exchange market as they not only trade on their own behalf and for their customers, but also provide the channel through which all other participants must trade. They are in essence the principal sellers within the Forex market

Brokers

Foreign exchange intermediaries are firms that provide an exchanging platform to the currency traders so that they can sell and buy foreign currencies. The currency trading brokers are also known as foreign exchange agent or retail foreign exchange brokers. They handle a little part of the volume of the overall foreign exchange market. To access the 24/7 currency market, money trader utilizes these brokers.

Central banks

Central banks have a unique place in foreign exchange markets. First, unlike the other groups involved in foreign exchange markets, the central banks’ involvement in foreign exchange markets doesn’t have a profit motive.

Second, central banks’ decisions regarding monetary policy are extremely influential on exchange rate determination. Central banks indirectly affect exchange rates through their monetary policy decisions. In every country, central banks are responsible for conducting monetary policy, among their other roles. The main goals of monetary policy are to promote price stability and economic growth.

Basically, a central bank addresses the domestic economy’s problems by changing the quantity of money and interest rates, which leads to changes in the exchange rate as well.

Third, central banks can directly affect exchange rates through interventions into foreign exchange markets. A central bank can use its domestic currency and foreign currency reserves to buy or sell foreign currencies directly in the foreign exchange market.

Types of transactions and settlement dates

Spot transaction

A foreign exchange spot transaction, also known as FX spot, is an agreement between two parties to buy one currency against selling another currency at an agreed price for settlement on the spot date. The exchange rate at which the transaction is done is called the spot exchange rate. As of 2010, the average daily turnover of global FX spot transactions reached nearly 1.5 trillion USD, counting 37.4% of all foreign exchange transactions.

The standard settlement timeframe for foreign exchange spot transactions is T+2; i.e., two business days from the trade date. Notable exceptions are USD/CAD, USD/TRY, USD/PHP, USD/RUB, and offshore USD/KZT and USD/PKR currency pairs, which settle at T+1. Majority of SME FX payments are made through Spot FX, partially because businesses aren't aware of alternatives.

Forward transactions

A forward transaction is a future transaction where the buyer and seller enter into an agreement of sale and purchase of currency after 90 days of the deal at a fixed exchange rate on a definite date in the future. The rate at which the currency is exchanged is called a Forward Exchange Rate. The market in which the deals for the sale and purchase of currency at some future date are made is called a Forward Market.

Forward contracts have one settlement date—they all settle at the end of the contract. These contracts are private agreements between two parties, so they do not trade on an exchange.

Future Transactions

The future transactions are also the forward transactions and deals with the contracts in the same manner as that of normal forward transactions. But however, the transactions made in a future contract differ from the transaction made in the forward contract on the following grounds:

- The forward contracts can be customized on the client’s request, while the future contracts are standardized such as the features, date, and the size of the contracts is standardized.

- The future contracts can only be traded on the organized exchanges, while the forward contracts can be traded anywhere depending on the client’s convenience.

- No margin is required in case of the forward contracts, while the margins are required of all the participants and an initial margin is kept as collateral so as to establish the future position.

The last trading day is the final day that a futures contract can be traded or closed out. Any contracts outstanding at the end of the last day trading day must be settled by delivery of the underlying physical asset, exchange of financial instruments, or by agreeing to a monetary settlement.

Swap Transactions

The Swap Transactions involve a simultaneous borrowing and lending of two different currencies between two investors. Here one investor borrows the currency and lends another currency to the second investor. The obligation to repay the currencies is used as collateral, and the amount is repaid at a forward rate. The swap contracts allow the investors to utilize the funds in the currency held by him/her to pay off the obligations denominated in a different currency without suffering a foreign exchange risk.

Swaps are customized contracts, interest payments may be made annually, quarterly, monthly, or at any other interval determined by the parties.

Option Transactions

The foreign exchange option gives an investor the right, but not the obligation to exchange the currency in one denomination to another at an agreed exchange rate on a pre-defined date. An option to buy the currency is called as a Call Option, while the option to sell the currency is called as a Put Option.

Most of the securities like bonds, stocks, mutual funds traded through a broker, municipal securities are settled in 3 days (T + 3).Whereas, government securities and options contracts are settled within a day of trade or the next business day (T+1) after the trade.

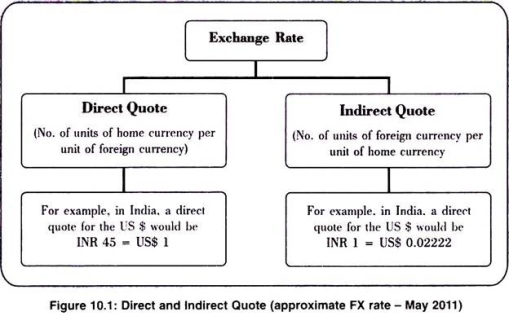

Exchange Rate Quotations and Arbitrage

In financial terms, the exchange rate is the price at which one currency will be exchanged against another currency. The exchange rate can be quoted directly or indirectly.

The quote is direct when the price of one unit of foreign currency is expressed in terms of the domestic currency.

The quote is indirect when the price of one unit of domestic currency is expressed in terms of foreign currency.

|

For example, if the exchange rate between the US dollar and the Chinese Yuan is 0.56 Yuan per US dollar, it is a direct quote for china, as the domestic currency for China is represented per unit of the US dollar (foreign currency).

Similarly, the exact currency quote above is an indirect quote for the USA, as a USD 1.79 per Yuan.

Direct Quote and Indirect Quote – Formula

The direct quote and indirect quote can be expressed in relation to each other, as follows: Direct quote

Arbitrage

An arbitrage is the simultaneous purchase and sale of an asset to profit from a difference in the price. It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms. Arbitrage is described as risk free because participants are not speculating on market movements. Instead, they bet on the mispricing of a share/asset that has happened between two related markets. Therefore, Arbitrage exists as a result of market inefficiencies. Classical theories suggest that the market, assuming it has rational investors and arbitrageurs, take care of the mispricing and brings back the prices of the assets to their fundamental price. But in reality these mispricing do persist from time to time.

As a simple example of arbitrage,

i) The stock of Company X is trading at $25 on the New York Stock Exchange (NYSE) while, at the same moment, it is trading for $25.05 on the London Stock Exchange (LSE). A trader can buy the stock on the NYSE and immediately sell the same shares on the LSE, earning a profit of 5 cents per share. The trader could continue to exploit this arbitrage until the specialists on the NYSE run out of inventory of Company X's stock, or until the specialists on the NYSE or LSE adjust their prices to wipe out the opportunity.

ii) Suppose the market for $ in the UK is: £1 = $1.01

And in Japan £1 = $1.01

If there is a sudden increase in demand for sterling in the UK. The £ would rise in the UK £1=$1.10. If markets are not perfectly competitive there may be a lag effect so that £ are cheaper in Japan (stay at £1 = $2.01). Therefore you could buy £in Japan and then immediately sell them in UK markets. This would give you a small but guaranteed profit. As arbitrageurs do this it will help bring the two markets into line.

Forward Quotations

Forward is a transaction where two different currencies are exchanged between accounts on the prefixed future value date.

The exchange of currencies takes place on the prefixed accounts, on the same value date. The Client is protected from adverse movements in future FX rates, but he also does not benefit from favorable movements.

Foreign Exchange forwards avoid uncertainty and are therefore valid instruments for Clients to mitigate the foreign exchange risk for future transactions denominated in a foreign currency.

The points on a forward rate quote are the differences between the spot exchange rate quote and the forward exchange rate quote. These points are scaled such that they can have a relation to the last decimal in the spot quote. It is of great importance to note that forward quotations are displayed as the number of forward points at each maturity. Swap points also express forward points.

When the forward rate is higher than the spot rate, the points are positive and thus the base currency is said to be trading at a forward premium. Otherwise, the points are negative and said to be trading at a forward discount.

Let us consider the case of an economic agent who has to make a payment at a

Given future date, for example an importer of commodities (the case of the agent

Who is to receive a future payment is a mirror-image of this).Let us also list the

Main opportunities for cover, including the forward cover mentioned above. The

Possibilities are these:

(a) The agent can buy the foreign exchange forward. In this case he will not have

To pay out a single cent now, because the settlement of the forward contract will

Be made at the prescribed future date.

(b) The agent can pay immediately, that is, purchase the foreign exchange spot

And settle his debt in advance. To evaluate this alternative we must examine

Its costs and benefits. On the side of costs we must count the opportunity cost of(domestic) funds, that is, the fact that the economic agent forgoes the domestic interest rate on his funds for the delay granted in payment (if he owns the funds)

Or has to pay the domestic interest rate to borrow the funds now (if he does not

Own the funds). For the sake of simplicity, we ignore the spread between the

Lending and borrowing interest rates, so that the costs are the same whether the

Agent owns the funds or not. On the side of benefits, we have the discount that the

Foreign creditor (like any other creditor) allows because of the advance payment;

This discount will be related to the foreign interest rate (the creditors domestic

Interest rate). For the sake of simplicity, we assume that the percentage discount is equal to the full amount of the foreign interest rate and that the calculation is made by using the exact formula

x[1/(1+if)]

instead of the approximate commercial formula

x - if x = x(1 - if ),

where x is the amount of foreign currency due in the future and if is the foreign interest rate (referring to the given period of time).

(c) The agent can immediately buy the foreign exchange spot, invest it in the foreign

country from now till the maturity of the debt and pay the debt at maturity (spot covering). The costs are the same as in the previous case; on the side of benefits

we must count the interest earned by the agent by investing the foreign exchange abroad.

In practice things do not go so smoothly but at the cost of some simplification

they can be fitted into these three alternatives.

In the case of an agent who is to receive a payment in the future the alternatives

are:

(a) Sell the foreign exchange forward;

(b) Allow a discount to the foreign debtor so as to obtain an advance payment, and immediately sell the foreign exchange spot;

(c) Discount the credit with a bank and immediately sell the foreign exchange spot.

In order to compare these three alternatives, besides the domestic and foreign

interest rates, we must also know the exact amount of the divergence between the

forward exchange rate and the (current) spot exchange rate. For this we need to

define the concept of forward premium and discount.

A forward premium denotes

that the currency under consideration is more expensive (of course in terms of

foreign currency) for future delivery than for immediate delivery, that is, it is more

expensive forward than spot.

A forward discount denotes the opposite situation, i.e. the currency is cheaper forward than spot. The higher or lower value of the currency forward than spot is usually measured in terms of the (absolute or proportional) deviation of the forward exchange rate with respect to the spot exchange rate.

We observe, incidentally, that in the foreign exchange quotations the forward

exchange rates are usually quoted implicitly, that is, by quoting the premium or

discount, either absolute or proportional. When the forward exchange rate is quoted

If the price quotation system is used, the higher value of the currency forward than spot means that the forward exchange rate is lower than the spot exchange rate, and the lower value of a currency forward than spot means that the forward exchange rate is higher than the spot rate. But if the volume quotation system is used the opposite is true: the higher (lower) value of a currency on the forward than on the spot foreign exchange market means that the forward exchange rate is higher (lower, respectively) than the spot rate.

If, say, the $ in New York is more expensive forward than spot with respect to the euro, this means that fewer dollars are required to buy the same amount of euros (or, to put it the other way round, that more euros can be bought with the same amount of dollars) on the forward than on the spot exchange market, so that if the USA uses the price quotation system, in New York the $=euro forward exchange rate will be lower than the spot rate, whereas if the USA used the other system, the opposite will be true.

Therefore in the case of the price quotation system the forward premium will

be measured by a negative number (the difference forward minus spot exchange

rate is, in fact, negative) and the forward discount by a positive number. This

apparently counterintuitive numerical definition (intuitively it would seem more

natural to associate premium with a positive number and discount with a negative

one) is presumably due to the fact that this terminology seems to have originated

in England, where the volume quotation system is used, so that by subtracting the

spot from the forward exchange rate one obtains a positive (negative) number in the

case of a premium (discount). Be this as it may, having adopted the price quotation

system and letting r denote the generic spot exchange rate and rF the corresponding

forward rate of a currency, the proportional difference between them,

--------1

--------1

gives a measure of the forward premium (if negative) and discount (if positive).

As there are different maturities for forward contracts, in practice the proportional

difference (1.1) is given on a per annum basis by multiplying it by a suitable factor

(if, for example, we are considering the 3-month forward rate, the approximate

factor is 4) and as a percentage by multiplying by 100.

The reason why the forward margin (a margin is a premium or a discount) is expressed in this proportional form is that, in this way, we give it the dimension of an interest rate and can use it to make comparisons with the (domestic and foreign) interest rates; expression (1.1) is, in fact, sometimes called an implicit interest rate in the forward transaction.

So equipped, we can go back to compare the various alternatives of the agent

who has to make a future payment (the case of the agent who has to receive a

future payment is perfectly symmetric).

We first show that alternatives (b) and (c)

are equivalent. We have already seen that the costs are equivalent; as regards the

benefits, we can assume that the discount made by the foreign creditor for advance

payment (case b) is percentually equal to the interest rate that our debtor might earn

explicitly as a price, it is sometimes called an outright forward exchange rate. We

also observe, as a matter of terminology, that when the spot price of an asset exceeds (falls short of) its forward price, a backwardation (contango, respectively) is said to occur on foreign currency invested in the creditors country (case c).

More precisely, let ih and if be the home and the foreign interest rate respectively, referring to the period considered in the transaction (if, for example, the delay in payment is three months, these rates will refer to a quarter), and x the amount of the debt in foreign currency.

With alternative (b), thanks to the discount allowed by the foreign creditor, it is sufficient to purchase an amount x/(1+if ) of foreign currency now.

The same is true with alternative (c), because by purchasing an amount x/(1+if ) of foreign currency

now and investing it in the creditor’s country for the given period at the interest rate

if , the amount [x/(1+if )](1+if )=x will be obtained at the maturity of the debt.

The purchase of this amount of foreign currency spot requires the immediate outlay

of an amount r [x/(1+if )] of domestic currency.

Therefore, if we consider the opportunity cost of domestic funds (interest

foregone on owned funds, or paid on borrowed funds), referring to the period

considered, the total net cost of the operation in cases (b) and (c), referring to the

maturity date of the debt, is obtained by adding this opportunity cost to the sum

calculated above. Thus we have

-----------(2)

-----------(2)

Let us now consider case (a): the agent under consideration will have to pay out the sum rFx in domestic currency when the debt falls due. It is then obvious that

Alternative

(a) will be better than, the same as, or worse than the other one [since (b)

and (c) are equivalent, there are actually two alternatives] according as

rFx

-------------------- (3)

-------------------- (3)

If we divide through by rx we have

-------------(4)

-------------(4)

whence, by subtracting unity from both sides,

-------------(5)

-------------(5)

On the left-hand side we meet our old friend, the forward margin; the numerator

of the fraction on the right-hand side is the interest (rate) differential between the

domestic and the foreign economy. Formula (5) is often simplified by ignoring

the denominator, but this is legitimate only when if is very small (for a precise

determination of the degree of approximation. The condition of

indifference between the alternatives then occurs when the forward margin equals

the interest rate differential

Key Takeaways

2. Types of transactions and settlement dates

3. The direct quote and indirect quote can be expressed in relation to each other, as follows: Direct quote |

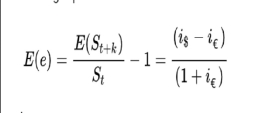

Interest Rate Parity

Interest rate parity is a no-arbitrage condition representing an equilibrium state under which investors interest rates available on bank deposits in two countries. The fact that this condition does not always hold allows for potential opportunities to earn riskless profits from covered interest arbitrage.

Two assumptions central to interest rate parity are capital mobility and perfect substitutability of domestic and foreign assets. Given foreign exchange market equilibrium, the interest rate parity condition implies that the expected return on domestic assets will equal the exchange rate-adjusted expected return on foreign currency assets. Investors then cannot earn arbitrage profits by borrowing in a country with a lower interest rate, exchanging for foreign currency, and investing in a foreign country with a higher interest rate, due to gains or losses from exchanging back to their domestic currency at maturity.

Interest rate parity takes on two distinctive forms: uncovered interest rate parity refers to the parity condition in which exposure to foreign exchange risk (unanticipated changes in exchange rates) is uninhibited, whereas covered interest rate parity refers to the condition in which a forward contract has been used to cover (eliminate exposure to) exchange rate risk. Each form of the parity condition demonstrates a unique relationship with implications for the forecasting of future exchange rates: the forward exchange rate and the future spot exchange rate.

Purchasing Power Parity and Fisher’s Parity

|

Purchasing power parity (PPP) is a measurement of prices in different countries that uses the prices of specific goods to compare the absolute purchasing power of the countries' currencies. In many cases, PPP produces an inflation rate that is equal to the price of the basket of goods at one location divided by the price of the basket of goods at a different location. The PPP inflation and exchange rate may differ from the market exchange rate because of poverty, tariffs, and other transaction costs.

Purchasing power parity is an economic term for measuring prices at different locations. It is based on the law of one price, which says that, if there are no transaction costs nor trade barriers for a particular good, then the price for that good should be the same at every location.[1] Ideally, a computer in New York and in Hong Kong should have the same price. If its price is 500 US dollars in New York and the same computer costs 2000 HK dollars in Hong Kong, PPP theory says the exchange rate should be 4 HK dollars for every 1 US dollar.

Poverty, tariffs, and other frictions prevent trading and purchasing of various goods, so measuring a single good can cause a large error. The PPP term accounts for this by using a basket of goods, that is, many goods with different quantities. PPP then computes an inflation and exchange rate as the ratio of the price of the basket in one location to the price of the basket in the other location. For example, if a basket consisting of 1 computer, 1 ton of rice, and 1 ton of steel was 1800 US dollars in New York and the same goods cost 10800 HK dollars in Hong Kong, the PPP exchange rate would be 6 HK dollars for every 1 US dollar.

The name purchasing power parity comes from the idea that, with the right exchange rate, consumers in every location will have the same purchasing power.

The value of the PPP exchange rate is very dependent on the basket of goods chosen. In general, goods are chosen that might closely obey the law of one price. So, ones traded easily and are commonly available in both locations. Organizations that compute PPP exchange rates use different baskets of goods and can come up with different values.

The PPP exchange rate may not match the market exchange rate. The market rate is more volatile because it reacts to changes in demand at each location. Also, tariffs and difference in the price of labor can contribute to longer term differences between the two rates. One use of PPP is to predict longer term exchange rates.

Because PPP exchange rates are more stable and are less affected by tariffs, they are used for many international comparisons, such as comparing countries' GDPs or other national income statistics. These numbers often come with the label PPP-adjusted.

The international Fisher effect (sometimes referred to as Fisher's open hypothesis) is a hypothesis in international finance that suggests differences in nominal interest rates reflect expected changes in the spot exchange rate between countries. The hypothesis specifically states that a spot exchange rate is expected to change equally in the opposite direction of the interest rate differential; thus, the currency of the country with the higher nominal interest rate is expected to depreciate against the currency of the country with the lower nominal interest rate, as higher nominal interest rates reflect an expectation of inflation.

Relation to interest rate parity

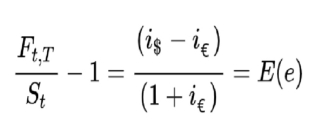

Combining the international Fisher effect with uncovered interest rate parity yields the following equation:

|

Where

E (St+k) is the expected future spot exchange rate

St is the spot exchange rate

Combining the International Fisher effect with covered interest rate parity yields the equation for unbiasedness hypothesis, where the forward exchange rate is an unbiased predictor of the future spot exchange rate.

|

where

Ft,T is the forward exchange rate.

Forecasting Exchange Rates

Forecasting Exchange Rates International transactions are usually settled in the near future. Exchange rate forecasts are necessary to evaluate the foreign denominated cash flows involved in international transactions. Thus, exchange rate forecasting is very important to evaluate the benefits and risks attached to the international business environment. A forecast represents an expectation about a future value or values of a variable.

The expectation is constructed using an information set selected by the forecaster. Based on the information set used by the forecaster, there are two pure approaches to forecasting foreign exchange rates: (1) The fundamental approach. (2) The technical approach.

The Importance of Exchange Rate Forecasting Exchange rate forecasts plays a fundamental role in nearly all aspects of international financial management.

- Short-term hedging or cash management decisions often rely on a forecast of expected exchange rate movements. –

To evaluate foreign borrowing or investment opportunities, forecasts of future spot exchange rates are necessary to convert expected foreign currency cash flows into their expected domestic currencies.

- For long-term strategic decisions, such as whether to build or acquire productive resources in a particular country, the firm needs forecasts of exchange rates to measure the competitiveness of alternative location choices.

Exchange rate forecasts also enter into the firm’s operating and strategic decisions, such as where in the world to source inputs and sell final products.

Efficient market approach

Financial markets are said to be efficient if the current asset prices fully reflect all the available and relevant information (efficient market hypothesis).-Suppose that foreign exchange markets are efficient. This means that the current exchange rate has already reflected all relevant information, such as money supply, inflation rates, balance of trade, and output growth. The exchange rate will then change only when the market receives new information.

News is unpredictable, the exchange rate will change randomly over time.-Incremental changes in the exchange rate will be independent of the past history of the exchange rate. If the exchange rate indeed follows a random walk, the future exchange rate is expected to be the same as the current exchange rate.-Random walk hypothesis suggests that today's exchange rate is the best predictor of tomorrow's exchange rate.-Those who subscribe to the efficient market hypothesis may predict the future exchange rate using either the current spot exchange rate or the current forward exchange rate

Advantages-Forecasting Exchange Rates through efficient market approach

Since the efficient market approach is based on market-determined prices, it is costless to generate forecasts. Both the current spot and forward exchange rates are public information. Everyone has free access to it.

Given the efficiency of foreign exchange markets, it is difficult to outperform the market-based forecasts unless the forecaster has access to private information that is not yet reflected in the current exchange rate.

Fundamental Approach

The fundamental approach is based on a wide range of data regarded as fundamental economic variables that determine exchange rates. These fundamental economic variables are taken from economic models. Usually included variables are GNP, consumption, trade balance, inflation rates, interest rates, unemployment, productivity indexes, etc. In general, the fundamental forecast is based on structural (equilibrium) models. These structural models are then modified to take into account statistical characteristics of the data and the experience of the forecasters.

The fundamental approach starts with a model, which produces a forecasting equation. This model can be based on theory, say PPP, a combination of theories or on the ad-hoc experience of a practitioner. Based on this first step, a forecaster collects data to estimate the forecasting equation. The estimated forecasting equation will be evaluated using different statistics or measures. If the forecaster is happy with the model, she will move to the next step, the generation of forecasts. The final step is the evaluation of the forecast

A forecast represents an expectation about a future value or values of a variable. Suppose we have forecasted a future value of the exchange rate, St+T. The expectation is constructed using an information set selected by the forecaster. The information set should be available at time t.

The notation used for forecasts of St+T is Et[St+T]

Where Et[.] represent an expectation taken at time t.

Advantages of Fundamental Approach

- Fundamental Forecasting is based on the fundamental relationships between economic variables and exchange rates

- A forecast may arise simply from a subjective assessment of the factors that affect exchange rates.

- A forecast may be based on quantitative measurements using the regression models and sensitivity analysis.

Technical Approach

The technical approach (TA) focuses on a smaller subset of the available data. In general, it is based on price information. The analysis is "technical" in the sense that it does not rely on a fundamental analysis of the underlying economic determinants of exchange rates or asset prices, but only on extrapolations of past price trends. Technical analysis looks for the repetition of specific price patterns.

Computer models attempt to detect both major trends and critical, or turning, points. These turning points are used to generate trading signals: buy or sell signals.

The most popular TA models are simple and rely on moving averages (MA), filters, or momentum indicators.

Advantages Of Technical Approach

- Technical forecasting involves the use of historical data to predict future values. It includes statistical analysis and time series models.

- Speculators may find the models useful for predicting day-to-day movements.

- Limited use of MNCs.

Key takeaways |

|

2. Does not use the key economic variables such as money supplies or trade balances for the purpose of forecasting. |

Performance of the Forecasters

Business forecasting is an essential part of running a successful, sustainable business. Being able to predict (with as much certainty as possible) and prepare for whatever is coming around the next corner ensures that your business has the maximum chance of success. Without forecasting, you leave a great deal more to chance.

Fundamentals of Forecasting are-

To run a successful business you need to match demand and supply. In order to understand and prepare for future demand, businesses must create forecasts.

Demand forecasting – the process of estimating the future demand of a product in terms of a unit or monetary value – is a fundamental part of supply chain management.

If you run a seasonal business, understanding the peaks and troughs of previous demand and incorporating them into your current business forecast allows your business to better manage its inventory. With an informed forecast, you can assess what amounts of stock should be maintained, what raw materials are likely to be required, and also what workforce you’ll need to fulfil orders.

Forecasting helps you to fully understand expected costs, revenue and profits, which in turn impacts process management across the entire business.

- Your business forecast should mirror your business plan

Business forecasting is concerned with understanding what could realistically happen based upon your historical performance.

Business plans include the growth aspirations of the business, and are arranged around a set of goals. They describe what the business wants to achieve, based on a set of assumptions. They provide the vision for the business, and shape all decisions moving forwards.

Having a business plan with clear targets is key to developing a relevant business forecast. Your business plan should inform your business forecast methods, assumptions and relevant data points.

Your forecast findings should then help to inform your business plans.

Business forecasting methods and process

The basic process of forecasting is essentially the same

- Whatever the methods employed

- Relevant data points are chosen – what variables and how to collect them

- Assumptions are made to simplify the process and cut down on time and data

- A forecasting model is chosen that is suitable for the above points

- The data is analyzed and the forecast is drawn up

- The forecast is verified through comparison to actual events and performance

There are two main methods of forecasting: qualitative and quantitative.

Quantitative

Quantitative forecasting is concerned with data.

Qualitative

Qualitative business forecasting models are generally used for short-term predictions, or for when data is scarce – for example, when a new product is first introduced to market.

Due to the nature of forecasting, the goal is not to be able to create a 100% accurate prediction of future performance and events. It’s simply to formulate the best guess or estimate based upon the available relevant information.

Aiming to paint as realistic and informed a picture of how the next week, month, year, and even decade will play out, however, comes up against inherent limitations.

Data quality

Due to the historical nature of the data used in qualitative forecasting methods, it is always old. If your data is not used regularly, the quality of it can decay.

Bias

Forecasts, as with any predictions, are often biased to some degree.

Unexpected events

Forecasting generally assumes overall economic stability and no significant changes in the industry or market. However, there is no guarantee that conditions in the past will carry over into the future.

Methodology

Forecasting is, by its nature, never totally accurate, and always evolving.

A well-constructed forecast should be simple to understand and provide information relevant to the strategy of the business. They should also be easy to adjust. The more simple the methodology used, the easier it is to understand, analyze, and figure out why, should anything go wrong. If a method is too complex, it can obscure key assumptions and reasons for failure.

Global Financial Markets and Interest Rates

The global financial markets include the market for foreign exchange, the Eurocurrency and related money markets, the international capital markets, notably the Eurobond and global equity markets, the commodity market and last but not least, the markets for forward contracts, options, swaps and other derivatives.

Domestic Market

A domestic market, also referred to as an internal market or domestic trading, is the supply and demand of goods, services, and securities within a single country. In domestic trading, a firm faces only one set of competitive, economic, and market issues and essentially must deal with only one set of customers, although the company may have several segments in a market.

The term is also used to refer to the customers of a single business who live in the country where the business operates.

Here we will discuss about our domestic i.e Indian Financial markets:-

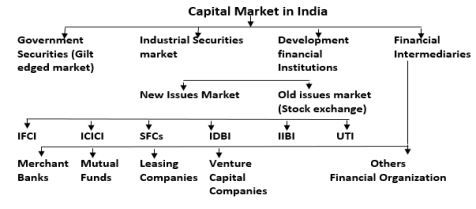

Capital market

Capital market is the market where investment instruments like bonds, equities and mortgages are traded. It is a market which deals in long-term loans. It supplies industry with fixed and working capital and finances medium-term and long-term borrowings of the central, state and local governments. Major function of this market is to make investment from stockholders who have excess funds to the ones who are running a scarcity. The capital market provides both long term and overnight funds.

Various types of financial instruments that are traded in the capital markets are as under:

- Equity instruments

- Credit market instruments

- Insurance instruments

- Foreign exchange instruments

- Hybrid instruments

- Derivative instruments

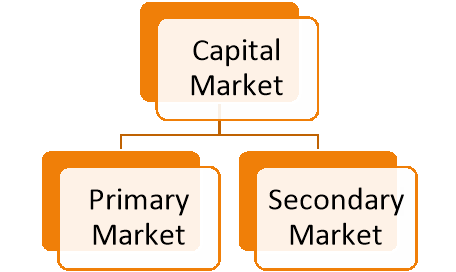

There are two types of capital market which include Primary market and Secondary market.

|

Primary Market: Primary Market is that market in which shares, debentures and other securities are sold for the first time to collect long-term capital. This market is concerned with new issues. Therefore, the primary market is also called new issue market.

Actions in the Primary Market:

- Appointment of merchant bankers

- Pricing of securities being issued

- Communication/ Marketing of the issue

- Information on credit risk

- Making public issues

- Collection of money

- Minimum subscription

- Listing on the stock exchange(s)

- Allotment of securities in demat / physical mode

- Record keeping

Secondary market: The secondary market is that market in which the buying and selling of the formerly issued securities is done. The transactions of the secondary market are usually done through the medium of stock exchange. The main aim of the secondary market is to create liquidity in securities.

Activities in the Secondary Market:

- Trading of securities

- Risk management

- Clearing and settlement of trades

- Delivery of securities and funds

In Indian capital market, there are following members which smoothly operate functions of market:

- India Capital Markets Pvt. Ltd.- Members NSE, BSE and NSDL,

- ICM Commodities Pvt Ltd. � Members MCX, NCDEX

- SEBI Registered PMS

|

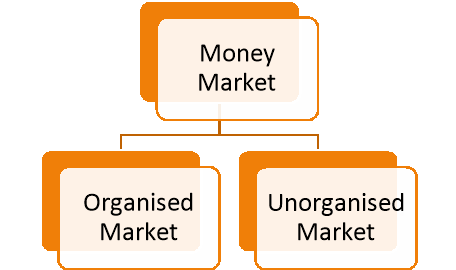

Money Market

Money market is a tool that manage the lending of short term funds (less than one year). It is a subdivision of the financial market in which financial instrument with high liquidity and very short maturities are traded.

Classification of money market

|

Unorganized sector include chit funds, money lenders and indigenous banks.

Organized sector include commercial banks in India both public sector and private sector and foreign banks In money market, main players are Government, RBI, DFHI (Discount and finance House of India) Banks, Mutual Funds, Corporate Investors, Provident Funds, PSUs (Public Sector Undertakings), NBFCs (Non-Banking Finance Companies).

Major functions of money market:

- It furnishes to the short-term financial needs of the economy.

- It helps the RBI in effective implementation of monetary policy.

- It provides mechanism to achieve equilibrium between demand and supply of short term funds.

- It helps in allocation of short term funds through inter-bank transactions and money market Instruments.

- It also provides funds in non-inflationary way to the government to meet its deficits.

- It expedites economic growth.

Offshore Market

The offshore market is a market where funds are moved actively by market participants (surplus and deficits units) in an offshore financial centre having specific and unique characteristics. Generally, an offshore financial center is a location or jurisdiction where financial products and services are offered by offshore companies that meet the needs of financial market participants in a low tax regime and moderately or lightly regulated jurisdictions.

Some of the general characteristics, and benefits, of an offshore financial center are as follows:

- Low tax environment that give opportunities for offshore companies, including offshore banks to generate higher profits and a stable operating base

- Minimum exchange control requirements that enable the offshore banks to mobilize funds among market participants with a greater degree of flexibility even in a volatile market conditions

- Large number of financial institutions offering numerous products and services to meet the specific needs of the market

- Maximum confidentiality through the appointment of nominee owners and directors that provides high degree of secrecy on information of the banking clients

- Excellent physical infrastructure and communication networks that enable providers and users of the products and services to enjoy excellent services

- In the case of the Malaysian financial system the activities of offshore financial markets are based in Labuan. Labuan has all of the above features and besides that companies operating in Labuan (offshore companies) are able to operate in a competitive cost and politically and economically stable environment.

Business and financial activities are done by offshore companies. What is an ‘offshore company’? An offshore company is company established by either residents or non-residents and registered or incorporated under the Offshore Companies Act 1990 through a licensed Trust Company in Labuan and all dealings are in currencies except Malaysian ringgit. The company can be either (i) an Offshore Trading Company or (ii) Offshore Non-trading Company.

An Offshore Trading Company is a company that typically generates profits by buying and selling products or services to customers in international markets. These include companies dealing in banking, insurance, trading, management, licensing and any other activity which is not an Offshore Non-trading activity.

An Offshore Non-trading company is a company whose activity is related to the holding of investments in securities, stocks, shares, loans, deposits and immovable properties on its own behalf.

The various business and financial activities in Labuan are under the control of the Labuan Financial Services Authority (Labuan FSA) and operate within the Labuan International Business and Financial Center (Labuan IBFC).

Interest Rates

The linkages between interest rates in the domestic and offshore markets and between interest rates for different currencies in the offshore market

• The spectrum of interest rates existing in an economy at any point of time is the result of the complex interaction between several forces.

In domestic market it is provided by the short term money market and in case of Interbank deposit market, the benchmark is provided by the interbank borrowing and lending rates in the Eurocurrency market e.g. LONDON INTER-BANK OFFER RATE abbreviated LIBOR

• The relationship between interest rates in the domestic and euro segments of the money market Arbitrage by borrowers and investors with access to both the markets should serve to keep the rates close together .The rates not identical due to Demand side and supply side factors • Linkages between interest rates for different currencies in the euro market.

• Forward contract: Under this contract, a depositor agrees to deliver a particular currency six months later in return for another currency, at an exchange rate specified now. This is the forward exchange rate.

Effective interest rate

• Covered Interest Arbitrage

The relationship between the domestic and offshore market interest rates for a currency are governed by risk premia, reserve requirements and other regulations that apply to domestic deposits and the presence of capital controls

• The differences in interest rates between currencies in the euro market are explained by the differences in the spot-forward margins.

• In equilibrium, effective returns on all currencies would be equal

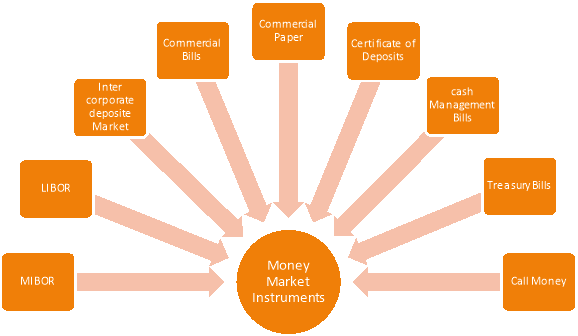

Money Market Instruments

There are several money market instruments---

|

Call Money

- Interbank market where funds are borrowed and lent for 1 day or less.

- If >1 day and up to 14 days, it is called notice money.

- Mutual funds, scheduled commercial & cooperative banks act as both borrowers and lenders.

- LIC, GIC, NABARD, IDBI act only as lenders.

Treasury Bills

- Issued by RBI on behalf of govt.

- Govt uses them to meet their short-term liquidity crunch.

- T-bills are sovereign zero risk instruments.

- At present, 3 types of T-bills are there : 91-day, 182-day, 364-day.

- State govt can not issue T-bills.

- They are issued by Market Stabilization Scheme (MSS).

- Available for a minimum amount of Rs 25000 or in multiples of that.

Cash Management Bills (CMBs)

- It's a comparatively new short-term instrument issued by RBI on behalf of Govt.

- Issued to meet temporary mismatches in cash flow of Govt.

- They resemble T-bills in character but are issued for less than 91 days only.

- Issued by scheduled commercial banks and other financial institutions.

- RRBs and local area banks can not issue CDs.

- Issued at a discount to face value, the discount rate is negotiated between issuer and investor.

- Minimum amount to be Rs 1 lac.

- CDs issued by banks have a maturity period: 15 days to 1 year.

- CDs issued by selected FIs have maturity period: 1 year to 3 years.

- Can be issued to individuals or firms.

Commercial Paper (CP)

- These are unsecured promissory* notes issued by large corporates, primary dealers, satellite dealers and all India FIs.

- Maturity period is between 7 days up to 1 year from date of issue.

- Minimum amount to be invested is Rs 5 lacs or multiples of that.

- The net worth for a corporate to be able to issue it is 4 crore.

- CPs need to have a credit rating from a credit rating agency.

Commercial Bills (CBs)

- Negotiable instruments which are issued by all India FIs, NBFCs, SCBs, Merchant banks & Mutual funds.

- Drawn by seller on the buyer (buyer gives seller), hence also called trade bills.

Inter Corporate Deposit Market

- This is a market where corporates extend the unsecured loan to each other.

- Majorly used by low rated corporates for managing their funds.

LIBOR

- Developed and launched by British Bankers Association in the 1980s

- It is the average interest rate at which leading banks borrow or lend, estimated in London.

- It reflects market conditions for international funds.

- Approximately $350 trillion funds are tied to LIBOR as per estimates.

MIBOR

- Developed and launched by NSE in 1998.

- It is the weighted average interest rate at which banks/institutions in Mumbai lend in the call money market.

Key takeaways

|

Introduction to Currency Options

Options are financial instruments that confer upon the option buyer the right to execute a particular transaction, but without the obligation to do so. More specifically, an option is a financial contract in which the buyer of the option has the right to buy or sell an asset, at a pre-specified price, on or up to a specified date if he chooses to do so; however, there is no obligation for him to do so. In other words, the option buyer can simply let his right lapse by not exercising his option. The seller of the option has an obligation to take the other side of the transaction, if the buyer wishes to exercise his option. The closest analogy is an insurance contract – you want to save or make money, if nature moves in your favour but want protection if nature moves against you. For such contracts you have to pay an insurance premium. Along the same lines, the option buyer has to pay the option seller a fee – a premium – for receiving such a privilege.

An option on spot foreign exchange gives the option buyer the right to buy or sell a specified amount of a currency say US dollars at a stated price in terms of another currency say Swiss francs. If the option is exercised, the option seller must deliver US dollars against Swiss francs or take delivery of dollars against francs at the exchange rate agreed upon in the option contract. Options on spot exchange are traded in the over-the-counter markets as well as a number of organised exchanges including the United Currency Options Market (UCOM) of the Philadelphia Stock Exchange (PHLX), the London Stock Exchange (LSE) and the Chicago Board Options Exchange (CBOE) .

Exchange-traded options can be both standardised as to amounts of underlying currency and maturity dates as well as customised. For instance, PHLX trades both standardised and customised options. Over-the-counter options are customised by banks.

An option on currency futures gives the option buyer the right to establish a long or a short position in a currency futures contract at a specified price. If the option is exercised, the seller must take the opposite position in the relevant futures contract.

For instance, suppose you hold an option to buy a December CHF contract on the IMM at a price of $0.58/CHF. You exercise the option when December futures are trading at 0.5895. You can close out your position at this price and take a profit of $0.0095 per CHF or, meet futures margin requirements and carry the long position with $0.0095 per CHF being immediately credited to your margin account. The option seller automatically gets a short position in December futures.

Futures-style options are a little bit more complicated. Like futures contracts, they represent a bet on a price. The price being betted on is the price of an option on spot foreign exchange. It’s like a situation that a buyer of an option has to pay a fee to the seller. This fee is the price of the option. In a futures style option you are betting on changes in this price which, in turn, as we will see below, depends on several factors including the spot exchange rate of the currency involved.

Options on currency futures are traded at the Chicago Mercantile Exchange (CME) among others. Futures-style options are traded at the LIFFE.

Futures Contract

In finance, a futures contract (sometimes called futures) is a standardized legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price the parties agree to buy and sell the asset for is known as the forward price. The specified time in the future—which is when delivery and payment occur—is known as the delivery date. Because it is a function of an underlying asset, a futures contract is a derivative product.

Contracts are negotiated at futures exchanges, which act as a marketplace between buyers and sellers.

The buyer of a contract is said to be the long position holder, and the selling party is said to be the short position holder. As both parties risk their counter-party walking away if the price goes against them, the contract may involve both parties lodging a margin of the value of the contract with a mutually trusted third party.

For example, in gold futures trading, the margin varies between 2% and 20% depending on the volatility of the spot market.

We describe a futures contract with delivery of item J at the time T:

- There exists in the market a quoted price F(t,T), which is known as the futures price at time t for delivery of J at time T.

- The price of entering a futures contract is equal to zero.

- During any time interval [t, s ], the holder receives the amount F(s,T)- F(t, T) (this reflects instantaneous marking to market)

- At time T, the holder pays F(T,T) and is entitled to receive J. Note that F(T,T) should be the spot price of J at time T.

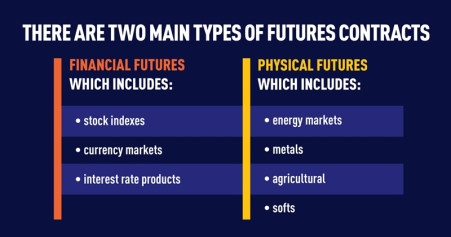

Types of Futures Contract

There are many different kinds of futures contracts, reflecting the many different kinds of "tradable" assets about which the contract may be based such as commodities, securities (such as single-stock futures), currencies or intangibles such as interest rates and indexes.

|

Financial Futures Contracts

Financial Futures contracts tend to be paper assets. These products allow a trader/investor to participate in products closely related to Equity markets while having some advantages in doing so. Financial Futures allows 23-hour trading, reducing the daily gap risk that many Equity traders experience because Equities only trade for approximately 7 hours per day. Financial Futures also require less capital to trade than Equity products. Using margin in Futures, a trader only has to deposit approximately 5-10% of the contract value compared to 50% in the Equity market when using margin. The Financial Futures market, though, will be affected by news/economic reports in the same way that the Equity markets are.

Forces That Drive Financial Futures Prices

- Stock index Prices

- Currency market Prices

- Interest rate Prices

Physical Futures markets are a little more advanced. These markets are typically for items extracted from the Earth and produced or processed before being sent out to end users. There are many factors that can impact these markets causing price changes. Factors like weather, geo-politics (tariffs, labor strikes, etc.), seasonality, disruptions to supply/demand (such as transportation issues) and even diseases that impact crops and livestock can be all be relevant with respect to price.

Users of Futures Contract

Futures traders are traditionally placed in one of two groups:

Hedgers, who have an interest in the underlying asset (which could include an intangible such as an index or interest rate) and are seeking to hedge out the risk of price changes;

and speculators, who seek to make a profit by predicting market moves and opening a derivative contract related to the asset "on paper", while they have no practical use for or intent to actually take or make delivery of the underlying asset. In other words, the investor is seeking exposure to the asset in a long futures or the opposite effect via a short futures contract.

Futures Market and trading process

A futures market is an auction market in which participants buy and sell commodity and futures contracts for delivery on a specified future date. Futures are exchange-traded derivatives contracts that lock in future delivery of a commodity or security at a price set today.

Futures contracts are derivative financial instruments that have their value determined by an underlying asset. Each futures contract is an agreement between 2 parties to buy or sell an asset at a certain price by a set future date. Futures are commonly traded on assets like stock indices, currency pairs and commodities like grains and precious metals.

While futures contracts imply a forthcoming transaction will take place, most futures trades are for hedging and speculation and are rarely used to take delivery of an asset. The majority of futures contracts are either offset in the market before the delivery date or rolled into later months.

Trading in Futures

|

Futures contracts are traded by a system of open outcry on the trading floor (also called the trading pit) of a centralized and regulated exchange. Increasingly, trading with electronic screens is becoming the preferred mode in many exchanges around the world. All traders represent exchange members.

Those who trade for their own account are called floor traders while those who trade on behalf of others are floor brokers. Some do both and are called dual traders .

The variables to be negotiated in any deal are the price and the number of contracts. A buyer of futures acquires a long position while the seller acquires a short position. As we know, when two traders agree on a deal, it is entered as a short and a long both vis-à-vis the clearinghouse.

When a position is opened, the trader (both the long and the short) must post an initial margin. As prices change, the contract is marked to market with gains credited to the margin account and losses debited from the account. These are called “variation margins”. If, as a result of losses, the amount in the margin account falls below a certain level known as maintenance margin, the trader receives a margin call and must make up the amount to the level of the initial margin in a specified time. This is called “paying the variation margin”. If the trader fails to do so, his or her position is liquidated immediately. Thus, daily marking to market coupled with margins, limit the loss the clearinghouse or a broker may have to incur to at most a couple of days’ price change.

There are various kinds of orders given to floor traders and brokers.

A client may ask his or her broker to buy or sell a certain number of contracts at the best available price (Market Orders) or may specify upper price limit for buy orders and lower limit for sell orders (Limit Orders). An order can become a market order, if a specified price limit is touched though it may not get executed at the limit price or better (Market If Touched or MIT orders). A trader with a long (short) position may wish to limit his losses by instructing his broker to liquidate the position, if the price falls (rises) to or below (above) a specified level below (above) the current market price (stop-loss orders). Stop orders can be combined with limit orders by stating that execution is restricted to the specified limit price or better (stop limit orders). Some traders may wish their orders to be executed during specified intervals of time – e.g. first half an hour of trading (time of day orders).

For every contract, the exchange specifies a “last trading day”. Those who have not liquidated their contracts at the end of this day are obliged to make or accept delivery as the case may be. For some contracts, there is no physical delivery of the underlying asset, but only a cash settlement from losers to the gainers (like in a non-deliverable forward contract). Where physical delivery is involved, the exchange specifies the mechanism of delivery.

Futures markets also have market-makers and bid-ask spreads. Floor traders who perform this service are known as scalpers. The rules of futures trading ensure that a single market price is produced at each instant based on competing bids and offers. All bids and offers have to be announced publicly. The highest bid takes precedence over all bids and the lowest offer takes precedence over

all offers. This ensures that a sale takes place at the highest bid price currently available and a purchase takes place at the lowest offer price available. As a consequence, one does not see a spectrum of prices in futures markets as in, for instance, the inter-bank forward market in foreign exchange. Since most major banks also participate in currency futures markets, the single price at any time conveys information that helps banks set prices in the inter-bank over the counter market for currencies.

Simple steps to trade in futures

Step 1: Learn about Commodities and Futures.

Step 2: Get a Reliable Internet Connection.

Step 3: Choose a Reputable Futures Broker.

Step 4: Open and Fund a Live Account.

Advantages of Trading Futures

Futures trading has several significant advantages over trading physical commodities as detailed further below.

(i)Leverage

Although it acts as a two-edged sword, one of the biggest advantages of trading futures is the leverage that gives the trader increased market exposure given the size of their trading capital put on deposit as margin. For example, if you have $11,500 and would like to take a position in the gold market, you could buy 6.05 troy ounces of gold at $1,900 that would cost $11,495.

Another way to speculate on gold would be to purchase shares of a gold exchange-traded fund (ETF) where each share is worth 1/10 of the current price of gold. You could buy 121 gold ETF shares costing $190 with a 2:1 leverage ratio for $11,495 so that you can control 12.1 ounces of gold.

The 3rd option would be to buy a gold futures contract on 100 ounces of gold that has a maintenance margin amount of $11,500, so you could buy 1 futures contract and control 100 ounces of gold at $1,900 per troy ounce. This means that for $11,500, you could control $190,000 worth of gold.

(ii)Hedging

Hedging is defined as a strategy used to reduce financial risk. A hedge can be used to lock in profits or limit losses. For example, you can hedge an asset by taking an offsetting position in a parallel or equivalent market to the asset you hold, such as the futures or options market.

A hedger is generally an individual or corporation involved in a business related to the commodity they want to protect against adverse price moves in. For example, a gold producer might want to hedge their future mining production by selling gold futures, or an electronics company might hedge against a rise in the price of gold they use in their products by buying gold futures.

Keep in mind that while losses can be hedged against using futures, potential profits are also limited by using futures as a hedging strategy.

(iii) Diversification and Flexibility

Futures are traded on a wide variety of assets, which gives traders a broad spectrum of asset types to operate in.

Disadvantages of Trading Futures

Futures trading also has disadvantages, which in the case of leverage is also one of the advantages of futures trading. Other issues with futures include time, since you are trading a contract on an asset in the future, a certain time value is added to the futures price. This time value includes storage and interest costs depending on the asset you’re trading.

(i)Potentially Unlimited Liability

The biggest risk to a futures trader is losing more than their initial margin deposit on a trade. This can happen if the asset they’re trading has an unusually sharp adverse move. A recent example of this would be the Swiss Shock of January 2015 when the Swiss National Bank announced it would no longer support a fixed exchange rate for the Swiss franc versus the EU’s euro.

The market in EUR/CHF collapsed on this news, and those long Euro/Swiss franc futures could not sell them due to a “limit down” market. During such a disaster, a futures exchange will generally cap upside and downside market moves at specific levels with limit-up and limit-down parameters. If the market is limit up, you can only sell contracts, while if the market is limit down, you can only buy.

The Swiss shock put several large online forex brokers out of business at the time, and it stands as an extreme example of how holding a futures position can expose a trader to potentially unlimited liability. In contrast, many online forex brokers offer clients negative balance protection when trading through them that avoids this issue by automatically closing out positions and limiting losses to your available margin.

(ii)Large Standard Transaction Size

For smaller traders or those who like to fine-tune the size of their positions, standard futures contracts may be too large in size. Also, the amount of minimum and maintenance margin needed to trade these larger contracts may exceed your budget. Some futures contracts like the CME Group’s E-mini contracts do come in smaller denominations, which can give smaller retail traders the opportunity to trade in markets otherwise not available due to large standard contract sizes.

Hedging &Speculation with Interest Rate Futures

Hedging with Interest Rate Futures

In an environment of volatile interest rates, both borrowers and investors may wish to reduce or completely eliminate interest rate risk. Borrowers may wish to ensure that their borrowing cost does not exceed some ceiling rate while investors may want to lock-in a minimum rate of return on their investments. Banks may wish to reduce the risk arising out of maturity mismatch – borrowing short term and lending long term – and hedge their positions in OTC products like FRAs.

Interest rate futures can be used to reduce the risk though not eliminate it except in rare cases.

Borrower’s Hedge

Hedging a Commercial Paper Issue

In January a corporation finalizes its plans to make an issue of $50 million 90-day commercial paper around mid may Paper of comparable quality is now yielding 6.10 per cent, a cost which the company finds acceptable. At this yield, the company hopes to realize $49,237,50037. To protect itself against the possibility that interest rates may rise before it makes the issue, it decides to use Eurodollar futures.

June 90-day Eurodollar futures are trading at 95.25 implying a yield of 5.75 per cent.

January 15:

Company plans to issue $50 million of 90-day commercial paper in four months. Company’s position will be adversely affected, if interest rates rise between now and mid-May. Hence, in futures market, it must take a position which yield positive profit, if rates rise. As seen above, Eurodollar futures prices fall as rates rise. Hence, it must take a short position in these contracts. Sells 50 Eurodollar June contracts

at 95.25.

May 15:

Yields have risen. The company must issue its paper at a yield of 6.50 per cent. It will realize $49,187,500 from the issue, a shortfall of $50000. June T-bill futures are trading at 94.95. The company buys 50 contracts for a profit of 30 ticks on each contract, each tick being worth $25. Total futures profit: $(30 ¥ 25 ¥ 50) = $37,500.

The gain on futures partially recoups the shortfall on the CP issue.

This example illustrates a cross-hedge. Since no futures contracts are available in commercial paper, the firm chooses a closely related instrument. The hedge is imperfect because of basis risk,

viz. the difference between CP yield and Eurodollar interest rate does not remain constant. In the example, the difference widened from 35 basis points to 45 basis points with CP yield rising more than the Eurodollar interest rate.

An Investor’s Hedge

Corporate treasurers from time to time have to invest short-term surplus funds in money market instruments. Portfolio managers invest funds on behalf of clients. These and other investors must plan in advance how they are going to deploy their funds. There is often a time gap between their deciding on an investment strategy and the actual execution of the transaction.

If interest rates fall in the meanwhile, return on the investment is adversely affected. Futures can be used as partial protection against this risk.

In the case of a borrower, protection is required against a rise in interest rates. As we have seen, futures prices fall when interest rates rise and hence borrowers must take short positions in futures. Conversely, investors must take long positions to guard against a fall in interest rates.

The following example illustrates a simple hedge for a bond investment.

A Simple Investment Hedge

It is late February 2010. A bond portfolio manager is planning to buy in late May, $5 million face value of 7.5 per cent coupon T-bonds maturing in November 2030 on behalf of an institutional client. The bonds are currently available at a price of 94-25, i.e. $94781.25 per bond or $4,7,39,062.50 for the total purchase. At this price the YTM is 7.99 per cent. The price is equivalent to 100-04 for the CBT notional T bond. To guard against a fall in yields between now and May, the manager is considering T-bond futures. June futures are being quoted at 98-21. The conversion factor for the bond to be purchased is 0.9466.

The number of contracts to be purchased:

(5000000/100000) ¥ 0.9466 = 47.33

The manager buys 47 CBT T-bond contracts at 98-21.

The basis is 47 ticks (= 100 – 04 minus 98 – 21)

May 15:

The bond to be bought is now quoted at 98-20, i.e. $98,625.00 per bond. Fifty bonds will now cost $4,9,31,250, an extra expenditure of $1,92,187.50. The equivalent notional T-bond price is 104-06.

June T-bond futures are quoted at 102-20. The manager sells 47 contracts making profit of 127 ticks (= 102-20 minus 98-21) per contract.

His total futures gain is: $(127 ¥ 31.25 ¥ 47) = $1,86,531.25

The futures gain almost compensates for the loss in the cash market. The small discrepancy is due to the widening of the basis from 47 ticks to 50 ticks (= 104-06 minus 102-20).

Note that for simplicity, we have ignored the accrued interest which will have to be paid.

It does not change the conclusion significantly.

A near-perfect hedge was possible in this case because the asset which the portfolio manager wanted to acquire had futures available on it. If he had wanted to invest in say high grade corporate bonds, he could still hedge using T-bond futures but in that case the price correlation would be much weaker and the hedge efficiency would decrease.

Speculation with Interest Rate Futures

Like currency futures, interest futures can be used to speculate on absolute and relative interest rate movements.

Strategies used by speculators

Long position; purchase futures contracts

Strategy to use if speculator anticipates interest rates will decrease and bond prices will increase. Buy a futures contract and if rates drop the contract’s price rises above what it cost to purchase and exchange adds gain with daily settlement to investor’s account. If interest rates rise instead of fall, futures contract price drops and investor’s account is reduced by daily loss

Short position: sell futures contracts Strategy to use if speculator anticipates interest rates will rise and contract prices drop. Sell (short) a futures contract and close the position by buying a contract to offset short. If rates rise, the price to buy the contract and close the position is less than the price received for the initial sale of the contract. Speculator loses money if rates drop

SPECULATION WITH INTEREST RATE FUTURES

Open Position Trading -On September 1, December Eurodollar futures on the IMM is trading at A trader believes that short term interest rates are going to fall very soon. He buys a December contract at On subsequent days, the prices and consequent losses/gains are

:Day 1: (+$250)

Day 2: (-$75)

Day 3: (+$325)

Day 4: (+$50)

Day 5: (-$50)

Day 6: (+$125)

Liquidates position

Total gain: $625 minus brokerage commissions.

Currency Options In India

In January 1994, the RBI started permitting Indian banks to write “cross-currency” options including barrier options and other innovations. They were required to cover themselves on a back-to-back basis.

Currency options between the Indian rupee and foreign currencies were launched with effect from July 7, 2003. Only banks are allowed to write currency options.

Corporates can only buy options and that too only for hedging, underlying exposures. They cannot write options; more correctly, they cannot receive premium in any structured deal.

After an initial period of low activity due to unfamiliarity with the product on the part of corporate treasurers, the market has now picked up and trading volumes are reasonably high. The daily turnover ranges between equivalent of US dollar 50 to 150 million. The following table illustrates some rupee-dollar one-month and three-month option quotes on July 13, 2005, given as bid/offer implied volatilities for an at-the-money-forward straddle:

|

On July 30, 2010, RBI issued a circular informing the market that recognized stock exchanges will be permitted to trade USD-INR currency options on their currency derivatives segment.

Standardised exchange traded currency options shall have the following features:

(a) The underlying for the currency option shall be US Dollar-Indian Rupee (USDINR) spot rate.

(b) The options shall be premium styled European call and put options.

(c) The size of each contract shall be USD 1000.

(d) The premium shall be quoted in Rupee terms. The outstanding position shall be in USD.

(e) The maturity of the contracts shall not exceed twelve months.

(f) The contracts shall be settled in cash in Indian Rupees.

(g) The settlement price shall be the Reserve Bank’s Reference Rate on the date of expiry of the contracts.