UNIT-3

World Financial Markets & Institutional & Risks

Introduction to Euro Currency Markets

The market for Euro currency is the money market for currency outside the country where it is a legal tender. Banks, MNC's, mutual funds, and hedge funds make use of the Eurocurrency market. They want to avoid regulatory standards, tax rules, and interest rate limits that are commonly present in domestic banking.

The term Euro currency is a eurodollar generalisation, and should not be confused with the euro, the EU currency. The demand for Euro currency operates in many financial centres around the world, not only in Europe.

Origin of Euro Currency Market

The eurocurrency market originated as a consequence of World War II when a flood of dollars was sent overseas by the Marshall Plan to rebuild Europe. The market first developed in London, as banks needed a dollar-deposit market outside the USA. The dollars held outside the United States are referred to as Eurodollars even if they are held outside Europe. They can hold them in markets, such as Singapore or the Cayman Islands.

The emergence of Eurocurrency is closely tied to the origins of the Eurodollar as it was the first type of Eurocurrency. Eurodollars began from large quantities of US dollar-denominated deposits being held in European, namely London, banks during the 1950s. Over several decades, economists have produced several explanations of how eurocurrency came about, why it occurred in London , and how London managed to maintain a competitive advantage in the market as eurocurrency expanded globally. Environmental and political factors commonly underpin most theories, influencing the decisions of nations during this period known as the Bretton Woods Era.

The Bretton Woods Era spanned from 1944 to 1973 and saw national policymakers, notably those of Britain and the US, agree to a fixed or pegged exchange rate system. Under this system, national currencies were "pegged" against the US dollar which itself was now convertible into gold. This was done to promote freer world trade in response to a sharp decline in imports and exports after the 1930s financial crises and World War 2 (WW2). As a result, national governments had raised their barriers to trade in an attempt to boost their domestic performance, causing major declines in world trade

The eurocurrency market includes other currencies, such as the Japanese yen and the British pound, each time they trade outside their home markets. The eurodollar market still remains the largest.

Euro Bond Market

|

A Eurobond is a debt capital market instrument issued in a “Eurocurrency” through a syndicate of issuing banks and securities houses, and distributed internationally when issued, that is sold in more than one country of issue and subsequently traded by market participants in several international financial centres. The Eurobond market is divided into sectors depending on the currency in which the issue is denominated. For example US dollar Eurobonds are often referred to as Eurodollar bonds, similar sterling issues are called Eurosterling bonds. The prefix “Euro” was first used to refer to deposits of US dollars in continental Europe in the 1960s.

Borrowers

The range of borrowers in the Euromarkets is very diverse. From virtually the inception of the market, borrowers representing corporates, sovereign and local governments, nationalised corporations, supranational institutions, and financial institutions have raised finance in the international markets. The majority of borrowing has been by governments, regional governments and public agencies of developed countries, although the Eurobond market is increasingly a source of finance for developing country governments and corporates. Governments and institutions access the Euromarkets for a number of reasons. Under certain circumstances it is more advantageous for a borrower to raise funds outside its domestic market, due to the effects of tax or regulatory rules. The international markets are very competitive in terms of using intermediaries, and a borrower may well be able to raise cheaper funds in the international markets.

Other reasons why borrowers access Eurobond markets include:

■ A desire to diversify sources of long-term funding. A bond issue is often placed with a wide range of institutional and private investors, rather than the more restricted investor base that may prevail in a domestic market. This gives the borrower access to a wider range of lenders, and for corporate borrowers this also enhances the international profile of the company;

■ For both corporates and emerging country governments, the prestige associated with an issue of bonds in the international market;

■ The flexibility of a Eurobond issue compared to a domestic bond issue or bank loan, illustrated by the different types of Eurobond instruments available.

An Issue of Eurobonds:

The issue of Eurobonds is normally undertaken by a consortium of international banks. A record of the transaction called a “Tombstone” is subsequently published in the financial press. Those banks whose names appear at the top of the tombstone have agreed to subscribe to the issue. At a second level, a much larger underwriting syndicate mentioned.

The banks in the managing syndicate will have made arrangements with a worldwide group of underwriters, mainly banks and security dealers. After arranging the participation of several underwriters, the managing syndicate will have made a firm offer to the borrower, which obtains the funds from the loan immediately. At a third level, the underwriting group usually arranges for the sale of the issue through an even larger selling group of banks, brokers, and dealers.

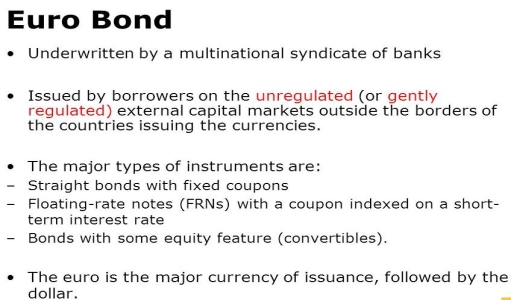

Types of Eurobonds:

There are three types of Eurobonds, of which two are international bonds. A domestic bond is a bond issue in a country by a resident of that country.

|

- Straight Bond: Bond is one having a specified interest coupon and a specified maturity date. Straight bonds may issue with a floating rate of interest. Such bonds may have their interest rate fixed at six-month intervals of a stated margin over the LIBOR for deposits in the currency of the bond. So, in the case of a Eurodollar bond, the interest rate may base upon LIBOR for Eurodollar deposits.

- Convertible Eurobond: The Eurobond is a bond having a specified interest coupon and maturity date. But, it includes an option for the hold to convert its bonds into an equity share of the company at a conversion price set at the time of issue.

- Medium-term Eurobond: Medium-term Euro notes are shorter-term Eurobonds with maturities ranging from three to eight years. Their issuing procedure is less formal than for large bonds. Interest rates on Euro notes can fix or variable. Medium-term Euro-notes are similar to medium-term roll-over Eurodollar credits. The difference is that in the Eurodollar market lenders hold a claim on a bank and not directly on the borrower.

Innovation in The Euro Bond Markets

The first Eurobond issues were in the form of ‘straights’ that is borrowing at a fixed rate of interest but the Eurobond market has since developed so that many issues now have innovative features. These days a good proportion of Eurobond issues are at floating rates of interest and are called floating rate notes, while another major innovation is that a higher percentage of issues are in the euro. Such bonds are attractive to international investors that wish to diversify away from the US dollar.

Other innovations include the issue of convertible Eurobonds whereby the investor has the right to convert the bond into shares in the company at a predetermined price; some Eurobonds are issued with warrants attached which can be traded separately giving the holder the right to buy shares at a predetermined price; and many Eurobond issues also have a 'call-back' feature which enables the issuer to buy back the issue should it wish to do so. More recently, in some Eurobond issues the principal to be returned to the investor is linked to movements in a broad market index such as the Nikkei. An even more recent innovation are asset-backed Eurobonds, in which illiquid assets such as the outstanding loans of a bank are sold in the form of a Eurobond promising to pay a given coupon based on the income from the outstanding loans. Such bonds can still have a AAA rating because the bond will typically be over- collaterized, that is backed up by loans with a face value considerably higher than that of the bond so even if allowance is made for default on some of the outstanding loans the Eurobond investor can expect to receive full payment.

In recent years, the Eurobond market has been opened up to governments from so-called emerging markets such as Argentina, Mexico, Venezuela, South-Africa, China, Poland and South Korea. Some high-risk countries such as Argentina and Mexico were paying in 1996 as much as 500 to 600 basis points above the equivalent US Treasury bond rates; while other emerging countries such as China, Poland and South Africa can get away with borrowing at a spread of 150 basis points or less.

In many ways the Eurobond market has the potential to provide a valuable source of funding for emerging-market governments, although such borrowers are of a higher risk than traditional Eurobond borrowers. All of these innovative features, as well as the fact that interest is paid once a year and the lower liquidity of Eurobonds compared to Treasury bonds, make it quite difficult to compare the yields on Eurobonds with standard Treasury and corporate bonds. Nonetheless, a typical Eurobond offers a premium over the standard Treasury bond of between 20 to 150 basis points depending on the credit rating of the issuer. More importantly, from the viewpoint of the issuer the typical cost savings of a Eurobond issue compared to a domestic bond issue can range from 25 to 200 basis points.

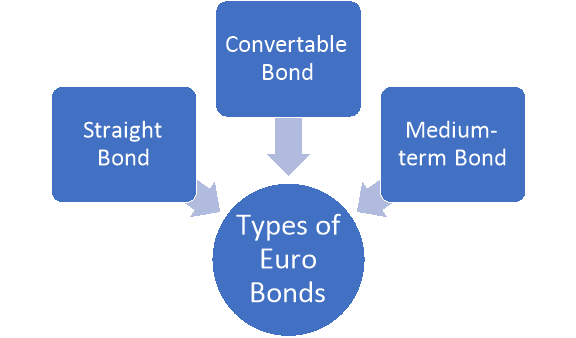

Competitive Advantage Of Euro Banks

The Eurobanks pay a higher rate on deposits and charge lower rate for loans than US banks for similar facilities. The reasons: Unlike domestic banks Eurobanks are free of regulatory control Eurobanks benefit from economies of scale Eurobanks avoid much of the personnel expense, administration costs The Eurobanks business is highly competitive internationally with relatively easy entrance requirements compared to domestic ones this drives up deposit rates and drives down loan rates Eurobanks do not have to pay deposit insurance whereas US banks have to deposit their insurance with Federal Deposit Insurance Corporation(FDIC) Eurobank lending is almost exlusively to high quality customers with a negligible default rate.

The main reason for the continuing success of Eurobanking despite the relaxation of regulation on US banks is that they are able to offer higher deposit rates and lower loan rates than US banks. It is this competitive edge which is the fundamental reason for their continued popularity and growth. The competitive advantage of Eurobanks is illustrated in the following figure

|

The Eurobanks are generally able to pay a higher rate on deposits and charge a lower rate for loans than US banks can for similar facilities. This implies that the interest rate spread, that is the difference between the rate paid on deposits and charged for loans, is lower for the Eurobanks than US banks. The usual domestic interest rate used for the purposes of comparison with the Euro-interest rate is the interest on certificates of deposit. The difference between deposit rates on certificates of deposit and those on Eurodeposits fluctuates but usually ranges between 10-40 basis points. The lower Euro-interest spread can be accounted for by a number of factors:

1. Eurobanks, unlike domestic banks, are free of regulatory control and in particular they are not required to hold reserve assets. This gives them a competitive advantage over domestic banks which are required to hold part of their assets in zero or low-interest liquid funds to meet official reserve requirements. Since Eurobanks are not subject to reserve requirements, they are able to hold less money in the form of low-interest reserves enabling them to pay a higher interest rate on deposits and charge a lower rate on loans.

2. Eurobanks benefit from economies of scale, the average size of their deposits and loans (hundreds of thousands and millions of dollars) is considerably greater than those of domestic banks (tens, hundreds and thousands of dollars). This makes the operating cost associated with each deposit and loan smaller in relation to the size of the transaction.

3. Eurobanks avoid much of the personnel, administration costs and delays associated with complying with domestic banking regulations.

4. The Eurobanking business is highly competitive internationally with relatively easy entrance requirements as compared to domestic banking activity, this encourages greater efficiency and more competitive pricing on the part of Eurobanks.

5. Eurobanks do not have to pay deposit insurance whereas US banks have to insure their deposit base with the Federal Deposit Insurance Corporation (FDIC).

6. Eurobank lending is almost exclusively to high-quality customers with a virtually negligible default rate, and this contrasts with the relatively high default rate faced by domestic banks that have to charge an appropriate default-risk premium in their lending rates.

Control & Regulation of Euro Banks

Eurobonds are generally exempt from the rules and regulations that govern the issue of foreign bonds in the country; for example, the need to issue very detailed prospectuses and withholding taxes (taxes on non-residents which are deducted at source). However, Eurobond issues and trading do have to meet certain regulatory requirements, and a self-regulatory body known as the Association of International Bond Dealers sets rules and standards. Most Eurobonds are issued in bearer form which means that holders are able to avoid open registration of their ownership. Despite the fact that the Eurobond market is by definition outside the legal jurisdiction of the country of the currency of issue, this does not mean that the national authorities of the currency in question are unable to exert significant influence on the Eurobond market.

National governments have always exerted control on national capital markets for a number of reasons; the most important is that they are usually huge borrowers themselves, they are also keen to encourage scarce domestic capital to be invested in domestic bond issues, and they are also concerned about possible tax avoidance and excessive outflows of capital on the value of the currency.

Governments still have a number of means of controlling the issue of Eurobonds in their national currencies. Firstly, most clearance of funds in Eurobonds is done through the clearing system of the domestic banking system of the currency in question giving the central bank of that currency the ability to prohibit issues if it so wishes. Secondly, governments can exert pressure on both domestic investment banks and foreign investment banks not to participate in Eurobond issues with the implicit threat of losing government business and even, ultimately, their licence to operate in their country.

The Swiss authorities have effectively prevented Eurobond issues in Swiss francs requiring all Swiss franc issues to be done in Switzerland, and the Japanese have managed to exert strong control over Eurobond issues in yen.

The US authorities have generally had a concerned but tolerant attitude to

the Eurobond market. The main concern has been that because Eurobonds are

issued in bearer form then the possibility of tax avoidance is high. The other concern is to protect US investors from investment risk due to the looser regulatory and disclosure requirement. For these reasons, the US authorities prohibit the sale of Eurobonds by investment banks to US citizens, with the Stock Exchange Commission requiring US investment banks to take measures 'reasonably designed to preclude distribution or redistribution of the securities, within, or to nationals of, the United States'. However, there is currently no law preventing US citizens of their own initiative purchasing Eurobonds although they would clearly be expected to reveal any coupon earnings in their tax declaration. The private-placements rule 144A permits sophisticated US financial institutions to hold Eurobonds in their investment portfolio so long as they are held demonstrably for investment purposes.

Key Takeaways

a) Straight Bond b) Convertible Eurobond c) Medium-term Eurobond 4. The Eurobanks are generally able to pay a higher rate on deposits and charge a lower rate for loans than US banks can for similar facilities. |

Introduction to International Equity Market

An equity market is a hub in which shares of companies are issued and traded. The market comes in the form of an exchange – which facilitates the trade between buyers and sellers – or over-the-counter (OTC) in which buyers and sellers find each other.

The equity market is also referred to as the stock market and is one of the most important leading indicators of the market economy. It also plays a pivotal role in supporting a market-based economy since it is the bridge between providing capital to companies who require it and providing investments for investors who are seeking a return on their investment.

International equity market has developed through cross listing of shares in different stock exchanges. Cross listing indicates that a company lists its shares in foreign stock exchanges besides listing its shares in domestic exchanges. For example, investors from US can invest in Infosys equity shares as Infosys shares are listed in NASDAQ. Cross listing of shares normally happens through depository receipts (DRs) or registered shares. Depository receipts can be ADRs (American Depository Receipts) or GDRs (Global Depository Receipts) or for that matter any country specific depository receipts can be issued. GDRs are primarily issued and traded in London or Luxembourg stock exchanges. ADRs by default issued in USD.

All most all GDRs are also denominated in USD. But GDRs can be issued in EURO. Similarly like ADRs/GDRs, If a foreign company lists its shares in Chinese Stock exchange, then these will be known CDRs (Chinese Depository Receipts). A foreign company can list its IDRs (Indian Depository Receipts) in any Indian stock exchanges. These depository receipts are negotiable receipts of securities issued by foreign companies but listed and traded in domestic stock exchanges denominated in the home currency of the domestic country. Each depository receipt has specific number of company’s shares as underlying. For example, HDFC Bank ADR has three shares representing one ADR. This ratio is known as DR/Underlying share ratio. There is no hard and fast rule regarding the number of underlying shares representing one depository receipt. In a DR, the company declares the dividend in its home currency. This dividend is converted to the home currency of the DR investor. In other words, the DR investors receive the dividend in their home currency. For all practical purpose, these depository receipts behave like domestic securities.

International Equity Market Benchmarks

A benchmark is an unmanaged group of securities which are considered as a 'benchmark' to measure a fund's/stock's performance. Benchmarks are generally broad market indices like BSE Sensex, CNX Nifty of the Indian stock market with which mutual fund returns are compared.

If a fund returned 59% in a particular year, but the benchmark Sensex returned 70%, this infers the fund underperformed compared to the Sensex benchmark.

A benchmark indicates directly the fund manager's performance.

Over the years, the use of benchmarks has expanded far beyond their original role as a general indicator of market sentiment and direction. They have become central to investment management, with an impact on active management, asset allocation, and performance measurement and reward as well as passive indexing.

In India, the NSE Nifty the BSE Sensex act as the benchmark indices. They are believed to indicate the performance of the entire stock market. In the same manner, an index which is made up of pharma stocks is assumed to portray the average price of stocks of companies operating in the pharmaceutical industry.

Benchmark Indices: S&P BSE Sensex, a collection of 30 best-performing stocks and Nifty 50, a collection of 50 best-performing stocks are indicators of BSE and NSE respectively. They are considered benchmark indices because they are the most concise, use the best practices to regulate the companies they pick and hence are the best points of reference for how the markets are doing in general.

Risk & Return from Foreign Equity Investments

Two of the chief reasons why people invest in international investments and investments with international exposure are:

- Diversification. International investing may help U.S. investors to spread their investment risk among foreign companies and markets in addition to U.S. companies and markets.

- Growth. International investing takes advantage of the potential for growth in some foreign economies, particularly in emerging markets.

But there are special risks of international investing, including:

- Access to different information. Many companies outside the U.S. do not provide investors with the same type of information as U.S. public companies, and the information may not be available in English.

- Costs of international investments. International investing can be more expensive than investing in U.S. companies.

- Working with a broker or investment adviser. If investors are working with a broker or investment adviser, they should make sure the investment professional is registered with the SEC or (for some investment advisers) with the appropriate state regulatory entity. It is generally against the law for a broker, foreign or domestic, to contact a U.S. investor and solicit an investment unless the broker is registered with the SEC. If U.S. investors directly contact and work with a foreign broker not registered with the SEC, they may not have the same protections as they would if the broker were registered with the SEC and subject to the laws of the United States. Investment advisers advising U.S. persons on investments in securities must register in the U.S. or must be eligible for an exemption to registration.

- Changes in currency exchange rates and currency controls. When the exchange rate between the U.S. dollar and the currency of an international investment changes, it can increase or reduce your investment return. In addition, some countries may impose foreign currency controls that restrict or delay investors or the company invested in from moving currency out of a country.

- Changes in market value. All securities markets, including those outside the U.S., can experience dramatic changes in value.

- Political, economic, and social events. It is difficult for investors to understand all the political, economic, and social factors that influence markets, especially those abroad.

- Different levels of liquidity. Markets outside the U.S. may have lower trading volumes and fewer listed companies than U.S. markets. They may only be open a few hours a day. Some countries restrict the amount or type of stocks that foreign investors may purchase.

- Legal Remedies. If U.S. investors have a problem with their investment, they may not be able to seek certain legal remedies in U.S. courts as private plaintiffs. Even if they sue successfully in a U.S. court, they may not be able to collect on a U.S. judgment against a non-U.S. company. They may have to rely on legal remedies that are available in the company’s home country, if any.

- Different market operations. Foreign markets may operate differently from the major U.S. trading markets.

Equity Financing in the International Markets

For international equity financing, there are euro-equity and cross listing. It can be done through private and public placement or cross list in different forms directly onto a foreign market or through an intermediary creating a vehicle like an American Depository Receipts in the United States or the used of retained earnings. Euro equity is a company issue underwritten equity across foreign equity market, a market created by financial institution. A euro-currency deposit is created by a financial institution and Over the counter , it means that dealing with an institution. Even with private offerings, someone will facilitate the trade. Therefore, It is necessary to have a financial institution to be involved as equity offerings are too big for a cash deal. Cross listing means a company listings its share in a foreign stock exchange Direct Cross Listing such as Yankee stock offerings while ADR is a certificates representing a bundle of stocks which can be traded through Over-the-market, exchange traded, private and public offering and existing and new capital.

Equity financing refers to raising capital by selling shares of stock. The stock market refers to the organized trading of securities through exchanges. An individual or entity can purchase partial ownership in a corporation, buying shares of stock in the company. The global equity market refers to all stock exchanges worldwide where firms can buy and sell stock for financing an investment.

The largest exchanges in the world include the New York Stock Exchange (NYSE) Euronext, the Tokyo Stock Exchange, NASDAQ (National Association of Securities Dealers Automated Quotations) stock exchange, and the London Stock Exchange. The advantage of raising capital in equity markets is that the firm doesn’t have to repay the money at a specific time or at a specific interest rate, as it does with bank loans. The disadvantage is that each time a firm offers stock, the firm’s management loses some control of the company because shareholders can now vote to approve or disallow management actions.

Depository Receipts

Depositary receipts allow investors to invest in companies in foreign countries while trading in a local stock exchange in the investor’s home country. It is advantageous to investors since shares are not allowed to leave the home country that they trade in. Depositary receipts were created to minimize the complications of investing in foreign securities.

Previously, if investors wanted to buy shares in a foreign company, they would need to exchange their money into foreign currency and open a foreign brokerage account. Then, they would be able to purchase shares through the brokerage account on a foreign stock exchange.

The creation of depositary receipts eliminates the entire process and makes it simpler and more convenient for investors to invest in international companies

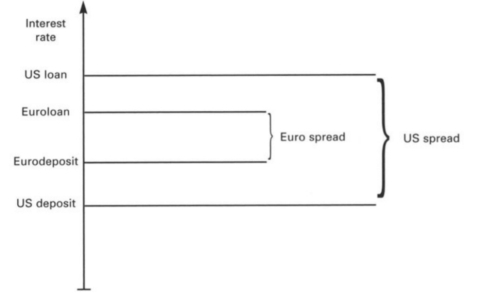

Types of Depositary Receipts

|

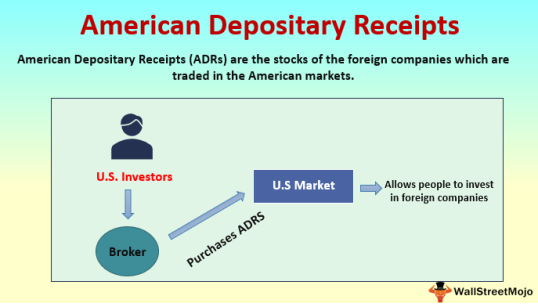

a. American Depositary Receipt (ADR)

It is listed only on American stock exchanges (i.e., NYSE, AMEX, NASDAQ) and can only be traded in the U.S. They pay investors dividends in U.S. dollars and are issued by a bank in the U.S.

An American depositary receipt (ADR, and sometimes spelled depository) is a negotiable security that represents securities of a foreign company and allows that company's shares to trade in the U.S. financial markets.

Shares of many non-U.S. companies trade on U.S. stock exchanges through ADRs, which are denominated and pay dividends in U.S. dollars, and may be traded like regular shares of stock. ADRs are also traded during U.S. trading hours, through U.S. broker-dealers. ADRs simplify investing in foreign securities by having the depositary bank "manage all custody, currency and local taxes issues".

The first ADR was introduced by J.P. Morgan in 1927 for the British retailer Selfridges on the New York Curb Exchange, the American Stock Exchange's precursor.

They are the U.S. equivalent of a global depository receipt (GDR). Securities of a foreign company that are represented by an ADR are called American depositary shares (ADSs).

ADRs are categorized into sponsored and unsponsored, which are then grouped into one of three levels.

|

Features of ADR

i) Trade in US Markets

The first and foremost feature of American depository receipt is that they trade in American markets only and not any other stock markets of the world, hence an investor can only buy and sell ADR in US markets only.

ii) Pivotal Role of Banks

In case of American depository receipt, the banks of US plays a key role because any company thinking of listing its shares in the form of ADR will have to contact US banks who in turn will buy shares from the company and keep it as security before offering the ADRs to the investors through US stock exchange.

iii) Currency Factor

Currency plays an important part because the return of the investor of ADR are dependent on foreign exchange fluctuations.

iv) International Diversification

If US investors want to diversify their portfolio internationally than ADR is a good option because through American depository receipt an investor can easily benefit from the growth of companies that are located in emerging markets where growth rate is more than developed markets like the USA.

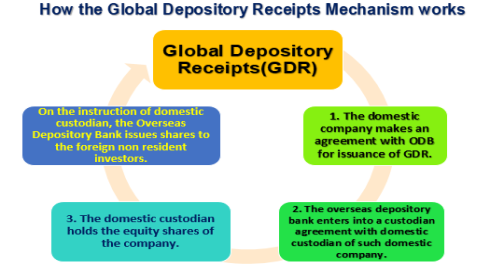

b. Global Depositary Receipt (GDR)

It is a general term for a depositary receipt that consists of shares from a foreign company. Therefore, any depositary receipt that did not originate from your home country is called a GDR.

Many other countries around the world, such as India, Russia, the Philippines, and Singapore also offer depositary receipts.

The GDR or Global Depository Receipt is a negotiable instrument or certificate in form of depository receipt issued by an Overseas Depository Bank outside India against shares or Foreign Currency Convertible Bonds of an Indian company. Most importantly the GDR is represented in US dollar currency. GDRs help the domestic company to get exposure to the global equity markets by raising foreign currency capital or equity.

|

The ODB is authorized by the domestic company to issue the securities only after the instructions of the custodian domestic bank of the domestic company. Generally, the shares and foreign currency convertible bonds are handed over to the domestic custodian bank of the domestic company. This custodian bank then issues instructions to the ODB for issuance of GDR securities to non-residents against the shares or bonds held by it.

Global Depository Receipts may be enlisted in any Overseas Stock Exchanges and are transacted Over The Counter (OTC) or Otc market or even among the Qualified Institutional Buyers(QIB) or Institutional investors. They are freely tradable like other dollar expressed securities and transferrable certificate or Debt instruments and can be bought by non-resident investors only. The features of GDR are given below.

- Nature- A GDR is a negotiable instrument in exchange of shares or Foreign Currency Convertible Bonds for raising capital in foreign currency;

- Denomination- GDRs are expressed in US Dollar currency;

- Tradability- GDR is a freely tradable in Capital markets and a transferrable certificate in the form of depository receipts;

- Listing- Global Depository Receipts are listed on Overseas Stock exchanges like American stock exchanges and is traded over the counter( Financial markets ) and among the Qualified Institutional Buyers;

- Underlying Asset- A GDR is issued against the underlying asset or underlying shares which is Common stock or Equities or bonds of the domestic company as held by the Domestic custodian bank. Further, this share can be one or more than one share as the underlying asset of the GDR;

- Redemption- A non-resident GDR investor can exchange his GDR against the equivalent shares or bonds only after 45 days of its allotment;

- Buyer/Investor- Generally, the non-resident investors are permitted to buy GDR;

- Raising of capital- A GDR is primarily issued by the domestic company for raising capital in foreign currency ;

- Return- The holders of the GDR receive dividends from the company in local currency after converting it into American dollars( Foreign currency ) at the going rate of exchange.

- Foreign Direct Investment(F.D.I)- The shares and Foreign Currency Convertible Bonds issued against the GDR is treated as the Foreign Direct Investment in the issuing company. However, this foreign direct investment in the form of GDR is permissible up to 51% of the issued and subscribed capital of the issuing company;

- Prior permission- The issuer of GDR has to obtain the prior permission of the Government of the respective domestic country.

AID

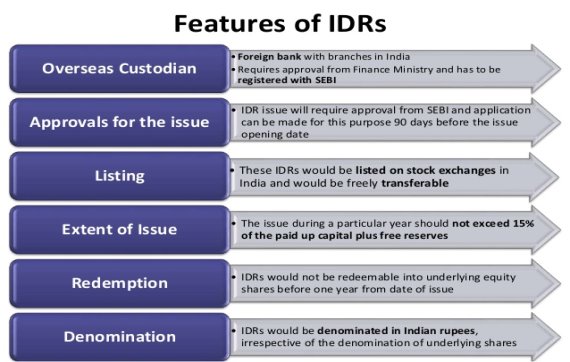

c. Indian Depositary Receipt (IDR)

An IDR is in Indian rupees and is created by a domestic depository (custodian of securities registered with SEBI (Securities and Exchange Board of India). It is issued against the underlying equity of the company to enable foreign companies to raise funds from the Indian securities Markets. As foreign companies are not allowed to list on Indian equity markets, IDR is a way to own shares of those companies. These IDRs could be listed on the Indian stock exchanges. Through the IDRs, you could directly invest money into international companies.

These are foreign companies that have subsidiaries working in India. Since these offshoots are not listed, the firms offer shares to Indian investors. Standard Chartered Plc is the first company to come out with an IDR issue.

Indian Depository Receipts are based on American Depository Receipts introduced in 1927. Securities and Exchange Board of India (SEBI) first operationalised the rules of IDRs. The Reserve Bank of India (RBI) issued operations under the Foreign Exchange Management Act.

The Indian depository receipts had their inception on the BSE and the NSE on June 11, 2011

|

Key Takeaways

a) American Depositary Receipt (ADR) b) Global Depositary Receipt (GDR) c) Indian Depositary Receipt (IDR) |

Meaning Of International Foregin Exchange Market

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.[1]

The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: US$1 is worth X CAD, or CHF, or JPY, etc.

The foreign exchange market is unique because of the following characteristics:

- its huge trading volume, representing the largest asset class in the world leading to high liquidity;

- its geographical dispersion;

- its continuous operation: 24 hours a day except for weekends, i.e., trading from 22:00 GMT on Sunday (Sydney) until 22:00 GMT Friday (New York);

- the variety of factors that affect exchange rates;

- the low margins of relative profit compared with other markets of fixed income; and

- the use of leverage to enhance profit and loss margins and with respect to account size.

FERA vs FEMA

FERA was mainly formulated to deal with deep crunch of foreign exchange post world war II and hence was a rigid piece of legislation which have left all the businesspeople and Indian citizens at the mercy of Enforcement Directorate as violence of FERA was considered a criminal act and there were major penalties associated with it.

FEMA or Foreign Exchange Management Act was introduced in the year 1999 to replace FERA (Foreign Exchange Regulations Act). FEMA came into act on 1st of June 2000. The Scope and Objective of FEMA was mainly to amend the laws related to foreign exchangeto facilitate external trade and payments and to develop the foreign exchange market in India.

FEMA was a liberal from of its prior version (FERA). It extends to whole of the country. It introduced resident ship in place of citizenship. FEMA is more human and natural in nature and removed all kinds of restrictions on withdrawal of foreign exchange. FEMA also introduced RFC (Resident foreign currency account). It specifically deals with possession and retention of foreign currency and includes all kinds of foreign securities and immovable property.

|

Major Differences between FERA vs FEMA are:

Foreign Exchange Regulation Act (FERA) | Foreign Exchange Management Act (FEMA) |

|

|

ii. FERA came into force from January 1, 1974. | ii. FEMA came into force from June 2000. |

iii. FERA was repealed in 1998 by Vajpayee Government | iii. FEMA succeeded FERA |

iv. FERA has 81 sections | iv. FEMA has 49 sections |

v. FERA was conceived with the notion that Foreign Exchange is a scarce resource. | v. FEMA was conceived with the notion that Foreign Exchange is an asset. |

vi. FERA rules regulated foreign payments. | vi. FEMA focused on increasing the foreign exchange reserves of India, focused on promoting foreign payments and foreign trade. |

vii. The objective of FERA was conservation of Foreign Exchange | vii. The objective of FEMA is Management of Foreign Exchange |

Scope & Significance Of Foreign Exchange Market

The Scope or subject matter of Forex Market is comprised of all the working of its participants. The Participants in Foreign exchange market can be categorized into five major groups, viz.; commercial banks, Foreign exchange brokers, Central bank, MNCs and Individuals and Small businesses.

a. Commercial Banks:

The major participants in the foreign exchange market are the large Commercial banks who provide the core of market. As many as 100 to 200 banks across the globe actively “make the market” in the foreign exchange. These banks serve their retail clients, the bank customers, in conducting foreign commerce or making international investment in financial assets that require foreign exchange.

b. Foreign Exchange Brokers:

Foreign exchange brokers also operate in the international currency market. They act as agents who facilitate trading between dealers. Unlike the banks, brokers serve merely as matchmakers and do not put their own money at risk.

They actively and constantly monitor exchange rates offered by the major international banks through computerized systems such as Reuters and are able to find quickly an opposite party for a client without revealing the identity of either party until a transaction has been agreed upon. This is why inter-bank traders use a broker primarily to disseminate as quickly as possible a currency quote to many other dealers.

c. Central banks:

Another important player in the foreign market is Central bank of the various countries. Central banks frequently intervene in the market to maintain the exchange rates of their currencies within a desired range and to smooth fluctuations within that range. The level of the bank’s intervention will depend upon the exchange rate regime flowed by the given country’s Central bank.

d. MNCs:

MNCs are the major non-bank participants in the forward market as they exchange cash flows associated with their multinational operations. MNCs often contract to either pay or receive fixed amounts in foreign currencies at future dates, so they are exposed to foreign currency risk. This is why they often hedge these future cash flows through the inter-bank forward exchange market.

e. Individuals and Small Businesses:

Individuals and small businesses also use foreign exchange market to facilitate execution of commercial or investment transactions. The foreign needs of these players are usually small and account for only a fraction of all foreign exchange transactions. Even then they are very important participants in the market. Some of these participants use the market to hedge foreign exchange risk.

The Significance of Foreign Exchange Market

The main significance of foreign exchange market is to get the best market value of a business.

Foreign Exchange Market is a type of financial institution which performs following functions:

|

a. Transfer Function:

The basic and the most visible function of foreign exchange market is the transfer of funds (foreign currency) from one country to another for the settlement of payments. It basically includes the conversion of one currency to another, wherein the role of FOREX is to transfer the purchasing power from one country to another.

For example, If the exporter of India import goods from the USA and the payment is to be made in dollars, then the conversion of the rupee to the dollar will be facilitated by FOREX. The transfer function is performed through a use of credit instruments, such as bank drafts, bills of foreign exchange, and telephone transfers.

b. Credit Function

FOREX provides a short-term credit to the importers so as to facilitate the smooth flow of goods and services from country to country. An importer can use credit to finance the foreign purchases. Such as an Indian company wants to purchase the machinery from the USA, can pay for the purchase by issuing a bill of exchange in the foreign exchange market, essentially with a three-month maturity.

c. Hedging Function

The third function of a foreign exchange market is to hedge foreign exchange risks. The parties to the foreign exchange are often afraid of the fluctuations in the exchange rates, i.e., the price of one currency in terms of another. The change in the exchange rate may result in a gain or loss to the party concerned.

Thus, due to this reason the FOREX provides the services for hedging the anticipated or actual claims/liabilities in exchange for the forward contracts. A forward contract is usually a three month contract to buy or sell the foreign exchange for another currency at a fixed date in the future at a price agreed upon today. Thus, no money is exchanged at the time of the contract.

Role of Forex Manager

There are many people who are confused with the responsibilities of a foreign exchange manager; therefore, with giving an outline of Foreign Exchange Manager Job Description, you and other people are sure to understand its significance:

•Manage trading functions in order to meet corporate goals financially.

•Be up to date with all of the latest financial developments, not only with the country’s economy, but also with other countries.

•Monitor a large scale of foreign exchange functions and operations within the banking environment. This will include all transactions and remittances in the field.

•Manage the research on both foreign and domestic markets, with the use of fundamental and technical analysis. Must also be able to provide appropriate solutions or recommendations for all clients that they can handle.

•Review reconciliation sheets and ensure that all sheets are balanced accordingly to the regulations and laws of the industry and bank.

•Maintain the relationship between international or counterpart financial institutions.

These are the key responsibilities that a foreign exchange manager has. Being able to show these responsibilities are sure to make people understand the significance of the position for foreign exchange firms.

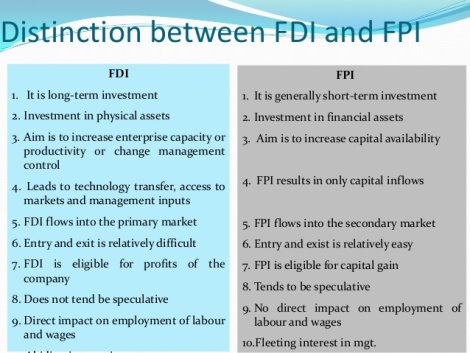

FDI vs FPI

Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) are the two important forms of foreign capital. The real difference between the two is thatwhile FDI aims to take control of the company in which investment is made, FPI aims to reap profits by investing in shares and bonds of the invested entity without controlling the company.

|

Role of FEDAI in Foreign Exchange Market

Established in 1958, FEDAI (Foreign Exchange Dealers' Association of India) is a group of banks that deals in foreign exchange in India as a self regulatory body under the Section 25 of the Indian Company Act (1956).The role and responsibilities of FEDAI are as follows:

Formulations of FEDAI guidelines and FEDAI rules for Forex business.

Training of bank personnel in the areas of Foreign Exchange Business.

Accreditation of Forex Brokers.

Advising/Assisting member banks in settling issues/matters in their dealings.

Represent member banks on Government/Reserve Bank of India and other bodies.

Rules of FEDAI also include announcement of daily and periodical rates to its member banks.

FEDAI guidelines play an important role in the functioning of the markets and work in close coordination with Reserve Bank of India (RBI), other organizations like Fixed Income Money Market and Derivatives Association (FIMMDA), the Forex Association of India and various other market participants. FEDAI also maximizes the benefits derived from synergies of member banks through innovation in areas like new customized products, bench marking against international standards on accounting, market practices, risk management systems, etc.

Key takeaways

a) Transfer Function b) Credit Function c) Hedging Function |

Meaning Of Capital Budgeting

Capital budgeting is a method of analyzing and comparing substantial future investments and expenditures to determine which ones are most worthwhile. In other words, it’s a process that company management uses to identify what capital projects will create the biggest return compared with the funds invested in the project. Each project is ranked by its potential future return, so the company management can choose which one to invest in first.

Most business’ future goals include expanding their operations. This is difficult to do if the company doesn’t have enough capital or fixed assets. That is where capital budgeting comes into play.

Capital budgets or capital expenditure budgets are a way for a company’s management to plan fixed asset sales and purchases. Usually these budgets help management analyze different long-term strategies that the company can take to achieve its expansion goals. In other words, the management can decide what assets it might need to sell or buy in order to expand the company. To make this decision, management typically uses these three main analyzes in the budgeting process: throughput analysis, discounted cash flows analysis, and payback analysis.

Example

Obviously, capital budgeting involves difficult decisions. In most cases buying fixed assets is expensive and cannot be easily undone. The management has to decide to spend cash in the bank, take out a loan, or sell existing assets to pay for the new ones. Each one of these decisions comes with the eternal question: will they receive the proper return on investment? Because when you think about it, buying new fixed assets is no different than putting money any other investment. The company is buying equipment hoping that is will pay off in the future.

Capital Budgeting Decisions

capital budgeting includes the process of generating, evaluating, selecting and following- up on capital expenditure alternatives, allocation of financial resources should be made by the firm to its new investment projects in the most efficient manner.

A firm may adopt three types of capital budgeting decisions:

(i) Mutually Exclusive Projects:

It means if a firm accepts one project, it may rule out the necessity for others i.e., the alternatives are mutually exclusive and only one is to be chosen.

For example, if there is a need to transport supplies from a loading dock to the warehouse, the firm may adopt two proposals, viz., (a) fork lifts to pick up the goods and move them, or, (b) a conveyor belt may be connected between the dock and the warehouse. If one proposal is accepted it will eliminate the other.

(ii) Accept-Reject Decisions or Acceptance Rule:

The proposals which yield a higher rate of return in comparison with a certain rate of return or cost of capital are accepted and, naturally, the others are rejected. For example, if the minimum acceptable return from a project is, say, 20%, after tax, and an investment proposal which shows a return of 22% may be accepted and another project which gives a return of 18% only may be rejected.

iii) Capital Rationing Decision:

Capital rationing is normally applied to situations where the supply of funds to the firm is limited in some way. As such, the term encompasses many different situations ranging from that where the borrowing and lending rates faced by the firm differ, to that where the funds available for investments are strictly limited.

In other words, it occurs when a firm has more acceptable proposals than it can finance. At this point, the firm ranks the projects from highest to lowest priority and, as such, a cut-off point is considered.

Incremental Cash Flows

Incremental cash flow refers to cash flow that a company acquires when it takes on a new project. If you have a positive incremental cash flow, it means that your company’s cash flow will increase after you accept it. That’s a good indicator that it’s worth investing in a project. On the other hand, a negative incremental cash flow indicates that your cash flow will decrease, which means that it may not be the best option.

The relevant cash inflows over a project’s expected life involve the incremental after-tax cash flows resulting from increased revenues and/or savings in cash operating costs. Cash flows are not the same as accounting income, which is not usually available for paying the firms’ bills. The differences between accounting income and cash flows are such noncash charges as depreciation expense and amortization expense.

The computation of relevant or incremental cash inflows after taxes involves the following two steps:

1. Compute the after-tax cash flows of each proposal by adding back any noncash charges, which are deducted as expenses on the firm’s income statement, to net profits (earnings) after taxes;

that is:

After-tax cash inflows =net profits (or earnings)after taxes + depreciation

2. Subtract the cash inflows after taxes resulting from use of the old asset from the cash inflows generated by the new asset to obtain the relevant (incremental) cash inflows after taxes.

After-tax incremental cash inflows= (increase in revenues) (1-tax rate)-(increase in cash changes)(1- tax rate) +(increase in depreciation expenses) (tax rate)

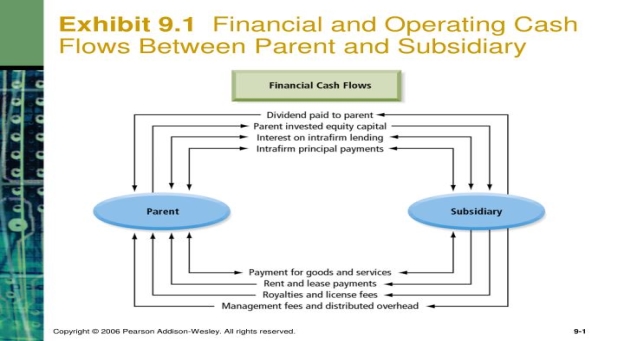

Cash Flows At Subsidiary and Parent Company

When one company controls another, this is known as a parent company subsidiary relationship. Typically, a parent company is created when a company purchases a controlling amount of voting stock in another company. Usually, a parent company is a large company that owns a smaller company. The subsidiary company can be in the same industry as the parent company or can be in a related industry. A parent company may own a variety of small subsidiary companies.

Parent companies can be directly involved in the operations of the subsidiary company, or they can take a completely hands-off approach. For instance, the parent company can allow the subsidiary company to retain its managerial control. Subsidiary companies can be wholly or partially owned by a parent company, but a parent company is required to own over half of the voting stock in the subsidiary company.

Cash flows at subsidiary and parent company could be described by following picture

|

Repatriation of Profits

Profit repatriation is the ability of a firm to send foreign‐earned profits or financial assets back to the firm's home country in hard currency such as US$, Euro, and Pound, after meeting host nation's tax obligations. Profit repatriation has both pros and cons. Proponents argue that it encourages foreign direct investments (FDIs) and thus leading to higher quality of life through employment and income, whereas opponents argue that profit repatriation boosts another country's economy, and thus boosting their local demand. Therefore, different countries impose different restrictions for profit repatriation.

Companies with profits made in foreign countries under a different currency periodically repatriate their profits into the company home currency.

Operating in more countries means access to more customers and thus, greater sales and profits. However, without correct management of exchange rate risk, these profits can quickly dwindle.

Example of “repatriation of profits”

The Japanese carmaker, Nissan, repatriates profits made across the globe into Japanese yen. As the carmaker sells its cars all over the world, they are very much exposed to FX market risk.

In May 2015, Nissan reported record fiscal year profits, which came in large part as a reversal of the yen’s appreciation against theU.S. dollar the previous fiscal year. Japan’s second biggest carmaker earned $3.8 billion in the fiscal year to March 2014.

There are five methods for repatriation of profits:

financing structure, parallel loans, reinvoicing centers, royalty payments, and transfer pricing.

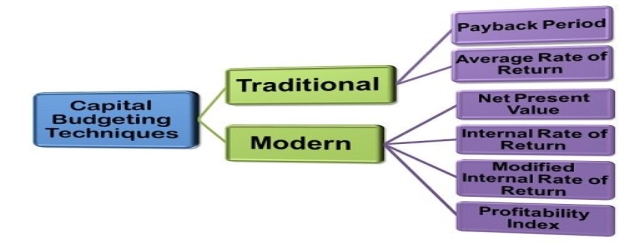

Capital Budgeting Techniques

The Capital Budgeting Techniques are employed to evaluate the viability of long-term investments. The capital budgeting decisions are one of the critical financial decisions that relate to the selection of investment proposal or the course of action that will yield benefits in the future over the lifetime of the project.

|

Traditional methods

The traditional methods comprise of the following evaluation techniques:

ModernMethods

The modern methods comprise of the following evaluation techniques:

Here we will discuss about Net Present Value Method of Capital Budgetting.

The Net Present Value or NPV is a discounting technique of capital budgeting wherein the profitability of investment is measured through the difference between the cash inflows generated out of the cash outflows or the investments made in the project.

The formula to calculate the Net Present value is:

Net present value = n∑t=1 Ct / (1+r)t – C0

Where, Ct = cash inflow at the end of year t

n= life of the project

r= discount rate or the cost of capital

Co= cash outflow

Accept/Reject Criteria: If the NPV is positive, the project is accepted.

Merits of Net Present Value

- It takes into consideration the Time Value of Money.

- It measures the profitability of the entire project by considering the profits throughout its life.

- It is easy to alter the discount rate, by just changing the value of the denominator.

- This method is particularly suitable for the mutually exclusive projects.

- It is consistent with the objective of maximizing the net wealth of the company.

Demerits of Net Present Value

- The forecasting of cash flows is difficult because of several uncertainties involved in the operations of the firm.

- It is difficult to compute the discount rate precisely. And this is one of the crucial factors in the computation of net present value as with the change in the discount factor the NPV results also changes.

- Another problem is that it is an absolute measure, it accepts or rejects the projects only on the basis of its higher value irrespective of the cost of initial outlay.

Thus, to compute the Net Present value, a firm should determine the cash inflows and the outflows along with the discount rate or a rate of return that firm desires during the lifetime of the project.

Key Takeaways

a) Mutually Exclusive Projects b) Accept-Reject Decisions or Acceptance Rule c) iii) Capital Rationing Decision 3. Incremental cash flow refers to cash flow that a company acquires when it takes on a new project. 4. The Capital Budgeting Techniques are employed to evaluate the viability of long-term investments. |

Reference books

- Schaums Outline of Financial Management by Jae Shim, Joel Siegel

- International financial management by P G Apte

- International Economics by Dominick Salvatore.

- International Finance and Open Economy Macroeconomics by Giancarlo Gandolfo