Unit - 4

Foreign Exchange Risk, Appraisal & Tax Management

Introduction to Foreign Exchange Risk Management

Exchange rate volatility is unpredictable since there are so many factors that affect the movement of the exchange rates i.e. economic fundamental, monetary policy, fiscal policy, global economy, speculation, domestic and foreign political issues, market psychology, rumors, and technical factors. The exchange rate volatility poses a risk, called foreign exchange risk or currency risk, to business sector, in particular, the importers and exporters or those ones who associate with international businesses.

Although businesses could not control the fluctuation of the exchange rates but they can manage the risk by using proper hedging tools e.g. Forward, Futures, and Options, in order to manage their revenues and costs more efficiently.

Foreign exchange risk is the most common form of market price risk managed by treasurers – the other common ones being interest rate and commodity risk. Market price risk is one of several groups of risks that businesses must manage within their ERM (Enterprise Risk Management) framework.

Like all risks, Foreign Exchange (FX) risk is managed using the standard risk management process, which looks something like this for FX:

|

Generally, most treasury effort goes into determining the underlying exposures, and then analyzing them. This is because uncertainty within most commercial businesses, combined with often ill-suited reporting systems, makes it difficult to be sure that FX exposure forecasts are accurate.

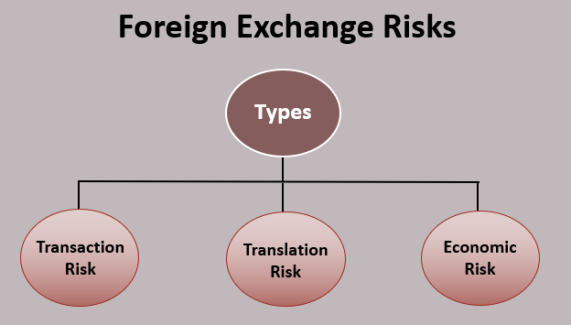

Types of Foreign Exchange Risk

The three types of foreign exchange risk include:

|

a) Transaction risk

Transaction risk is the risk faced by a company when making financial transactions between jurisdictions. The risk is the change in the exchange rate before transaction settlement. Essentially, the time delay between transaction and settlement is the source of transaction risk. Transaction risk can be resolved by using forwards and options.

For example, a Indian company with operations in China is looking to transfer CNY600 in earnings to its Indian account. If the exchange rate at the time of the transaction was 1 Rs for 6 CNY, and the rate subsequently falls to 1 Rs for 7 CNY before settlement, an expected receipt of Rs100 (CNY600/6) would instead of Rs86 (CNY600/7).

b) Economic risk

Economic risk, also known as forecast risk, is the risk that a company’s market value is impacted by unavoidable exposure to exchange rate fluctuations. Such a type of risk is usually created by macroeconomic conditions such as geopolitical instability and/or government regulations.

For example, Indian Company that sells locally face economic risk from automobile importers, especially if the Indian currency unexpectedly strengthens.

c) Translation risk

Translation risk, also known as translation exposure, refers to the risk faced by a company headquartered domestically but conducting business in a foreign jurisdiction, and of which the company’s financial performance is denoted in its domestic currency. Translation risk is higher when a company holds a greater portion of its assets, liabilities, or equities in a foreign currency.

For example, a parent company that reports in USA dollars but oversees a subsidiary based in China faces translation risk, as the subsidiary’s financial performance – which is in Chinese yuan – is translated into USA dollar for reporting purposes.

Examples of Foreign Exchange Risk

A company signs an agreement to buy a consignment at exchange rate 1dollar=Rs45 and promised to pay after 1 week. After 1week exchange rate becomes 1 dollar= Rs 45.5. At this point, there is a risk associated with it…it is the transaction risk as the time delay between transaction and settlement caused Company A to need to pay more, in USA dollars, for the goods.

Question 2: An American company signs a contract to buy 100 cases of irons from a French retailer for €50 per case, or €5,000 total, with payment due at the time of delivery. The American company agrees to this contract at a time when the Euro and the US Dollar are of equal value, so €1 = $1.

But at the time of delivery the exchange rate changed to $1=€0.95 .

Thus this is an example of translation risk. In this case the payer party i.e the American company will gain as they have to pay only €4750 instead of €5,000.

Trade and Exchange Risk

International trade involves exporting and importing of goods or services across foreign borders and, as soon as a firm engages in import and/or export it is exposed to numerous risks. As a result firms operating outside their home country, have to deal with the economic conditions of the foreign country in which it wishes to operate in.

Trading is that branch of the financial business in which firms attempt to make profits by buying and selling. Trading activities may be subdivided into two principal types:

• Market making (also called book running or the “sell” side) consists of making two-way markets by engaging in (nearly) simultaneous buying and selling the same instruments, attempting to keep position holdings to a minimum and to profit primarily through the difference between (nearly) simultaneous buy and sell prices.

• Position taking (also called market using, price taking, speculation, or the “buy” side) consists of deliberately taking positions on one side or the other of a market for substantial time periods, hoping to profit by the market moving in your favor between the time of purchase and the time of sale (Note: time of purchase may be before or after time of sale).

Positions may be taken on behalf of a firm (in which case it is often labeled “proprietary” trading) or on behalf of an individual client, or group of clients, such as a mutual fund, hedge fund, or managed investment account. There is nearly always some time lag between purchase and sale involved in market making. Depending on the length of time and degree of deliberate choice of the resulting positions, these may be labeled position taking aspects of market making. Market making almost always involves risk because you can’t often buy and sell exactly simultaneously. The market maker makes a guess on market direction by its posted price, but bid-asked spread can outweigh even persistent error in directional guess as long as the error is small. And the experience and information gained from seeing so much flow means you most likely will develop ability to be right on direction on average. But the position taker has the advantage over the market maker of not needing to be in the market every day and so can stay away from the market except when possessed of a strong opinion. The market maker can’t do this; staying away from the market would jeopardize the franchise.

Portfolio Management In Foreign Assets

|

A foreign portfolio investment is a grouping of assets such as stocks, bonds, and cash equivalents. Portfolio investments are held directly by an investor or managed by financial professionals. In economics, foreign portfolio investment is the entry of funds into a country where foreigners deposit money in a country's bank or make purchases in the country's stock and bond markets, sometimes for speculation.

An investment portfolio held by a bank or an individual contains various investments that typically include stocks (equity), bonds, loans, financial derivatives (options, futures, etc.), investible commodities such as gold or platinum, real estate, or similar assets of value. The investor is the entity that holds the portfolio and may be a company, a bank, or an individual. Portfolio management involves determining the contents and the structure of the portfolio, monitoring its performance, making any changes, and deciding which assets to acquire and which assets to divest. Portfolio managers weigh both the expected risk and return characteristics of individual assets, the performance of the entire portfolio, and the investor’s financial objectives in order to find an optimal combination of investments that provides the highest level of return for any given level of risk. Banks use several approaches to measure portfolio performance and reduce credit losses. The approaches utilize quantitative assessment tools to predict the likelihood of a default and estimate the impact of the default.

A financial asset is simply a legal claim to a future cash flow. The basic principle

underlying the price of any financial asset is that its price should be determined by the present value of its expected cash flow, by which we mean the expected stream of cash receipts over the life of the asset. Note that we are referring to the expected cash flow, and this may be known with a high degree of certainty both with regard to the timing of payments and their size, or may be highly uncertain, or somewhere between these extremes.

There are a number of factors that will influence the degree of certainty

with which the cash flow is expected.

One is the nature of the financial asset.

In the case of debt security the cash flow is usually more certain with regard to both the timing and amount compared to an equity security (that is, shares). With shares both the timing and size of dividend cash flows will be very much affected by the future performance of the company. Another important factor that will influence the degree of certainty of cash flows is the nature of the issuer of the financial asset; Treasury bonds issued by governments are usually regarded as risk-free in that a government is highly unlikely to renege on its commitments, since it can simply print the money to redeem the bond if need be. The same cannot be said of corporate bonds; a corporation may face financial difficulties that force it to renege on or reschedule part or all of its commitments.

Another important factor is that today many governments and corporations

issue financial assets that are denominated in foreign currencies. In this

case a domestic investor might know what the return is likely to be in the foreign currency, but the unpredictability of exchange rate movements will mean that the value of the payments when converted into the domestic currency is uncertain. The investor thus faces exchange-rate risk.

Arbitrage and Speculation

Active management or speculation means a company has open interest rate gap or currency gap and tries to obtain higher returns in risky environment. It is possible to speculate on future direction or volatility of price movement. Active strategies rely on forecasts, valuation analysis, credit analysis, yield spread analysis, volatility analysis. Active management includes strategies that attempt to outperform a passive benchmark portfolio. These strategies use derivatives (especially options) as an instrument to increase returns.

Arbitrage is defined as transaction of buying a security at a low price in one market and simultaneously selling in another market (or at the same market but in different time) at a higher price to make a profit. In efficient markets such opportunities cannot exist. For most of firms arbitrage opportunities do not exist. Arbitrage may be compared to money being left on the street .

Arbitrage is a particular type of position taking in which offsetting positions are taken in closely related markets with the intention of generating low risk (but also generally low return) net positions.

Classic example — FX arbitrage between quotations in two different centers. This type of pure informational arbitrage has been largely eliminated by the power of modern technology which gives rapid access to information.

Second example — buy a basket of stocks which mimics an index and sell the future on the index. Depends on capital investment in computers and people to simultaneously purchase a large number of stocks. Might invest in a statistical model to determine a smaller, more manageable basket which closely tracks index, but this introduces some risk.

Key Takeaways

a) Transaction risk b) Economic risk c) Translation risk 3. A foreign portfolio investment is a grouping of assets such as stocks, bonds, and cash equivalents. 4. Active management or speculation means a company has open interest rate gap or currency gap and tries to obtain higher returns in risky environment. |

Meaning of International Tax Environment

International taxation is the study of tax on a person or business subject to the tax laws of different countries or the international aspects of an individual country's tax laws.

Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes the form of a territorial, residence-based, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more.

Objectives Of Taxation

There are mainly Two basic objectives of taxation which is related to the international tax environment. They are:

tax neutrality and tax equity.

Tax neutrality has its foundations in the principles of economic efficiency and equity. Tax neutrality is determined by three criteria-

i) Capital-export neutrality is the criterion that an ideal tax should be effective in raising revenue for the government and not have any negative effects on the economic decision-making process of the taxpayer. That is, a good tax is one that is efficient in raising tax revenue for the government and does not prevent economic resources from being allocated to their most appropriate use no matter where in the world the highest rate of return can be earned. Obviously, capital-export neutrality is based on worldwide economic efficiency.

ii) A second neutrality criterion is national neutrality . That is, taxable income is taxed in the same manner by the taxpayer’s national tax authority regardless of where in the world it is earned. In theory, national tax neutrality is a commendable objective, as it is based on the principle of equality. In practice, it is a difficult concept to apply. In the United States, for example, foreign-source income is taxed at the same rate as U.S.-earned income and a foreign tax credit is given against taxes paid to a foreign government. However, the foreign tax credit is limited to the amount of tax that would be due on that income if it were earned in the United States. Thus, if the tax rate paid on foreign-source income is greater than the U.S. tax rate, part of the credit may go unused. Obviously, if the U.S. tax authority did not limit the foreign tax credit to the equivalent amount of U.S. tax, U.S. taxpayers would end up subsidizing part of the tax liabilities of U.S. MNCs’ foreign earned income.

iii) The third neutrality criterion is capital-import neutrality . To illustrate, this criterion implies that the tax burden a host country imposes on the foreign subsidiary of a MNC should be the same regardless of the country in which the MNC is incorporated and the same as that placed on domestic firms. Implementing capital import neutrality means that if the U.S. tax rate were greater than the tax rate of a foreign country in which a U.S. MNC earned foreign income, additional tax on that income above the amount paid to the foreign tax authority would not be due in the United States. The concept of capital-import neutrality, like national neutrality, is based on the principle of equality, and its implementation provides a level competitive playing field for all participants in a single marketplace, at least with respect to taxation. Nevertheless, implementing capital-import neutrality means that a sovereign government follows the taxation policies of foreign tax authorities on the foreign source income of its resident MNCs and that domestic taxpayers end up paying a larger portion of the total tax burden.

Obviously, the three criteria of tax neutrality are not always consistent with one another.

The underlying principle of tax equity is that all similarly situated taxpayers should participate in the cost of operating the government according to the same rules. Operationally, this means that regardless of the country in which an affiliate of a MNC earns taxable income, the same tax rate and tax due date apply. A dollar earned by a foreign affiliate is taxed under the same rules as a dollar earned by a domestic affiliate of the MNC. The principle of tax equity is difficult to apply; as we will see in a later section, the organizational form of a MNC can affect the timing of a tax liability.

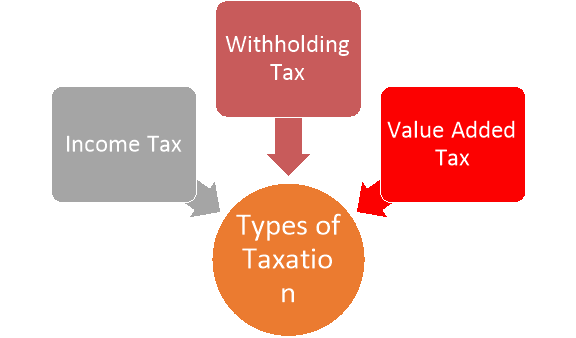

Types of Taxation

There are three basic taxes. They are:

|

Income Tax

Many countries in the world obtain a significant portion of their tax revenue from imposing an income tax on personal and corporate income. An income tax is a direct tax , that is, one that is paid directly by the taxpayer on whom it is levied. The tax is levied on active income , that is, income that results from production by the firm or individual or from services that have been provided.

Withholding Tax

A withholding tax is a tax generally levied on passive income earned by an individual or corporation of one country within the tax jurisdiction of another country. Passive income includes dividends and interest income, and income from royalties, patents, or copyrights paid to the taxpayer by a corporation. A withholding tax is an indirect tax that is borne by a taxpayer who did not directly generate the income. The tax is withheld from payments the corporation makes to the taxpayer and turned over to the local tax authority. The withholding tax assures the local tax authority that it will receive the tax due on the passive income earned within its tax jurisdiction.

Value Added Tax

A value-added tax (VAT) is an indirect national tax levied on the value added in the production of a good (or service) as it moves through the various stages of production. There are several ways to implement a VAT. The “subtraction method” is frequently followed in practice.

In many European countries (especially the EU) and also Latin American countries, VAT has become a major source of taxation on private citizens. Many economists prefer a VAT in place of a personal income tax because the latter is a disincentive to work, whereas a VAT discourages unnecessary consumption. A VAT fosters national saving, whereas an income tax is a disincentive to save because the returns from savings are taxed. Moreover, national tax authorities find that a VAT is easier to collect than an income tax because tax evasion is more difficult. Under a VAT, each stage in the production process has an incentive to obtain documentation from the previous stage that the VAT was paid in order to get the greatest tax credit possible

Benefits Towards Parties doing Business Internationally

a) Increased revenues

One of the top advantages of international trade is that one may be able to increase the number of potential clients. Each country that have been added can open up a new pathway to business growth and increased revenues.

b). Decreased competition

The product and services may have to compete in a crowded market domestically but it may find better access and less competition in other countries.

c) Longer product lifespan

Sales can dip for certain products domestically, as domestic consumers stop buying them or move to upgraded versions over time.

d) Easier cash-flow management

Getting paid upfront may be one of the hidden advantages of international trade.

When trading internationally, it may be a general practice to ask for payment upfront, whereas at home we may have to be more creative in managing cash flow while waiting to be paid. Expanding business overseas could help businesspersons to manage cash flow better.

e) Better risk management

One of the significant advantages of doing business internationally is market diversification. Focusing only on the domestic market may expose to increased risk from downturns in the economy, political factors, environmental events and other risk factors. Becoming less dependent on a single market may help businesspersons to mitigate potential risks in their core market.

f) Benefiting from currency exchange

Those who add international trade to their portfolio may also benefit from currency fluctuations. For example, when the U.S. dollar is down, you may be able to export more as foreign customers benefit from the favorable currency exchange rate.

g) Access to export financing

Another one of the advantages of international trade is that one may be able to leverage export financing.

The Export-Import Bank s (EXIM) of respective countries and may be places to explore for export financing options.

h) Disposal of surplus goods

One of the advantages of international trade is that businessperson may have an outlet to dispose of surplus goods that domestic businessperson are unable to sell in the home market.

i) Enhanced reputation

Doing business in other countries can boost company's reputation. Successes in one country can influence success in other adjacent countries, which can raise a company's profile in domestic market niche. It can also help increase the company's credibility, both abroad and at home. This is one of the advantages of international trade that may be difficult to quantify and, therefore, easy to ignore.

j) Opportunity to specialize

International markets can open up avenues for a new line of service or products. It can also give an opportunity to specialize in a different area to serve that market.

Being exposed to the realities of the world outside home base may even spark innovations, upgrades and efficiencies for domestic products and services. We never know what happens when we open our minds to ideas, feedback and experiences that come from outside the boundaries of our own country.

Tax Heavens

A tax haven is a country or place with very low "effective" rates of taxation for foreign investors.

In some traditional definitions, a tax haven also offers financial secrecy. However, while countries with high levels of secrecy but also high rates of taxation (e.g. the United States and Germany in the Financial Secrecy Index can feature in some tax haven lists, they are not universally considered as tax havens. In contrast, countries with lower levels of secrecy but also low "effective" rates of taxation (e.g. Ireland in the FSI rankings), appear in most § Tax haven lists.

Three main types of tax haven lists have been produced to date:

- Governmental, Qualitative: these lists are qualitative and political; they never list members (or each other), and are largely disregarded by academic research; the OECD had one country on its 2017 list, Trinidad & Tobago; the EU had 17 countries on its 2017 list, none of which were OECD or EU countries, or § Top 10 tax havens.

- Non–governmental, Qualitative: these follow a subjective scoring system based on various attributes (e.g. type of tax structures available in the haven); the best known are Oxfam's Corporate Tax Havens list, and the Financial Secrecy Index (although the FSI is a list of "financial secrecy jurisdictions", and not specifically tax havens).

- Non–governmental, Quantitative: by following an objective quantitative approach, they can rank the relative scale of individual havens.

Criteria for Tax Havens

In 1998, the Organization for Economic Cooperation and Development (OECD) gave a number of factors to identify tax havens. Some of the most common factors are given below:

- No, or nominal, tax on relevant income

- Lack of effective exchange of information

- Lack of transparency

- No substantial activities

Top Tax Havens in the World

- Bermuda – Declared the world’s worst (or best if you’re looking to avoid taxation) corporate tax haven in 2016 by Oxfam with a zero percent tax rate and no personal income tax.

- Netherlands – Most popular tax haven among the world’s Fortune 500. The government uses tax incentives to attract businesses to invest in their country. One such tax incentive cost an estimated 1.2 billion euros in 2016 to the Netherlands.

- Luxembourg – It gives benefits such as tax incentives and zero percent withholding taxes.

- Cayman Islands – No personal income taxes, no capital gains taxes, no payroll taxes, no corporate taxes, and the country does not withhold taxes on foreign entities.

- Singapore – Charges reasonable nominal corporate taxes. Reasonable corporate tax rates are provided through tax incentives, lack of withholding taxes, and what appears to be substantial profit shifting.

- The Channel Islands – No capital gains taxes, no council taxes, and no value-added taxes.

- Isle of Man – No capital gains tax, turnover tax, or capital transfer tax. It also imposes a low income tax, with the highest rates at 20%.

- Mauritius – Low corporate tax rate and no withholding tax.

- Switzerland – Full or partial tax exemptions, depending on the bank used.

- Ireland – Referred to as a tax haven despite officials asserting that it is not. Apple discovered that two of the company’s Irish subsidiaries were not classified as tax residents in the United States or Ireland, despite being incorporated in the latter country.

Tax Liabilities

Tax liability is the amount of money that a person owe to tax authorities or government of the nation. When one person have a tax liability, he has a legally binding debt to creditor. Both individuals and businesses can have tax liabilities.

The government uses tax payments to fund social programs and administrative roles. For example, funding in various govt prescribed programmes, constructing/investing in public goods.

Tax liabilities are current liabilities. Current liabilities are short-term debts must pay within a year. Generally, it is incurred by short-term liabilities from normal business operations. It has been reported in the balance sheets of a company or individual .

Failing to pay a tax liability can result in back taxes, a tax lien, penalties, interest, and even jail time.

Here are some tax liabilities which are generally incurred by small business enterprises

a) Income tax liability

Working individuals are generally required to pay income tax, and possibly state and local income taxes, on their earnings. This is generally based upon the principle of Ability to pay .

Employers withhold income tax liabilities from employee wages. But in case of a small business owner, there won’t any payment of wages (unless one is incorporated). And when one don’t receive wages, do not have income taxes withheld from his earnings.

b) Business tax liability

The business holder/player is required to pay taxes on its profits. However, if the structure of business as a sole proprietorship, partnership, S corporation, or LLC (not taxed as a corporation), then one can enjoy pass-through taxation. Pass-through taxation means the business taxes pass through your business and on the person, which is why you include the business income tax liability as income on his personal income tax return.

c) Self-employment tax liability

Working individuals must pay Social Security and Medicare taxes on their earnings. For employees, these taxes are withheld from their wages in the form of FICA tax, which is an employer and employee tax. Self-employed individuals pay these taxes in the form of self-employment tax.

As a small business owner, one has a self-employment tax liability unless his business is incorporated. Self-employment tax essentially covers both the employer and employee portions of Social Security and Medicare taxes.

An individual’s self-employment tax liability is (approx)15.3% of you’re his earnings.

d) Payroll tax liability

If one has employees, then he will be responsible for withholding, filing, and remitting payroll taxes. And also the individual must pay employer taxes. The money which is withhold from employees, as well as the money spend as the employer, make up his payroll tax liability.

Together, income, unemployment, and FICA taxes make up the payroll tax liability. One must deposit these taxes with the IRS according to his depositing schedule.

e) Sales tax liability

sales tax occurs when someone sales some goods or services. After collecting the sales tax from the customers; constitutes a sales tax liability. One must remit the sales tax to the state or local government.

Sales tax is a percentage of a customer’s total bill. The sales tax rate differs based on businesses physical presence.

f) Capital gains tax liability

When an individual or a firm sell an investment or another type of asset for a profit it incurred Capital gains tax. Capital gain taxes are taxes you pay on the gain. Your gain is the difference between what you purchased the asset for minus what you sold it for.

g) Property tax liability

Property tax liability incurred when business holds its real estates(e.g., buildings, land, etc). Property tax is a tax that property owners pay to their local governments.

Property tax rates vary on the basis of differences in property as tax liability is based on the value of the property. Generally, the government will reassess the tax rate per year. Multiply your tax rate by the market value of individual/firm’s property to calculate the property tax liability.

Key Takeaways

a) Income Tax b) Withholding Tax c) Value Added Tax 3. A tax haven is a country or place with very low "effective" rates of taxation for foreign investors. 4. In 1998, the Organization for Economic Cooperation and Development (OECD) gave a number of factors to identify tax havens. 5. Tax liability is the amount of money that a person owe to tax authorities or government of the nation. |

Meaning of International Project Appraisal

Project appraisal is concerned the motive to answer the questions : whether or not to put the money in the project. At a very basic level it means comparing return on investment with the cost of the funds i.e the business or project will fruitful or not if someone put efforts on it. Only if the return is higher than the cost of funds, it would make sense to put the money in a project. This presumes, of course, that the purpose and rationale for undertaking a project is to generate a surplus. A literature survey on the motivation factors for undertaking FDI may highlight diverse strategic. behavioural and economic factors viz. follow the leader, bandwagon effect., market seekers, follow the customers, raw material seekers. efficiency seekers. cutting cost, that is. taking advantage of lower labour or input cost in other countries. pre-emption of competition, international diversification. However, to the extent that maximization of shareholders wealth is a ' consensus objective of business, in financial terms. project appraisal means assessing the possibilities of generating a financial return higher than the cost of funds. This is so because the only way to maximise shareholders "wealth is to maximise risk adjusted rate of return that is the spread between return and cost of ti~ntls. suitably modified for business risks.

Techniques of Project Appraisal

There are generally two techniques of project appraisal.

NonDCF and DCF are the two broad groups.

DCF means Discounted Cash Flow. The main difference between non-DCF and DCF techniques is that while non-DCF techniques use undiscounted or unadjusted for time value of money cash flow data, the DCF techniques use discounted or adjusted for time value of money cash flows.. The time value of money is a very critical concept in project appraisal. Time value of money means a rupee today 1s worth more than a rupee tomorrow. Or, you may say a rupee tomorrow is worth less than a rupee today. This is true as long as there is inflation in the economy. Inflation causes loss of purchasing power of currencies.

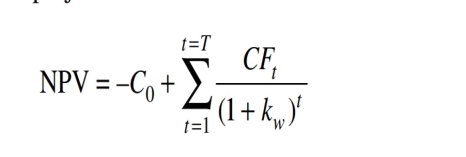

A Review Of The NPV Approach

Consider the well-known Net Present Value (NPV) formula widely used in evaluating domestic investment projects

|

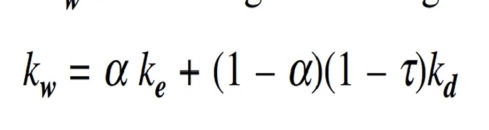

Here, C0 is the initial capital cost of the project incurred at t = 0 and CFt is the net cash flow from the project at the end of period t. Each cash flow CFt is discounted by the discount factor (1+ kw)t where kw is the weighted average cost of capital defined by

|

In this equation, ke is the cost of equity capital, kd is the pre-tax cost of debt, t is the corporate tax rate and a is the proportion of equity finance for the project.

Keep in mind that the cash flows in the numerator of equation (1) must be incremental cash flows attibutable to the project. This means among other things that (1) Any change in the cash flows from some of the existing activities of the firm which arise on account of the project must be attributed to the project

(2) Only net increase in overheads which would be on account of this

project should be charged to the project.

The virtue of the simple formula (2) is that it captures in a single parameter, viz. kw all the financing considerations allowing the project evaluator to focus on cash flows associated with the project.

The problem is, there are two implicit assumptions. One is that the project being appraised has the same business risk as the portfolio of the firm’s current activities and the other is that the debt : equity proportion in financing the project is same as the firm’s existing debt : equity ratio. If either assumption is not true, the firm’s cost of equity capital, ke changes and the above convenient formula gives no clue as to how it changes. Thus, even in a purely domestic context, the standard NPV approach has limitations.

The Adjusted Present Value (APV) approach seeks to disentangle the effects of particular financing arrangements of the project from the NPV of the project viewed as an all-equity financed investment.

Options Approach to Project Appraisal

In many situations, the project sponsors have the freedom to alter various features of the project in the light of developments in input and output markets, competitive pressures and changes in government policies. Among these flexibilities are:

a) The start of the project may be delayed till more information about variables such as demand, costs, exchange rates, etc. is obtained. For instance, starting a foreign plant may be postponed till the foreign currency stabilizes, Development of an oil field may be delayed till oil prices harden. For instance, consider a project to develop an steel field. The current steel price is $15 a

ton and the project NPV is $10 million. In one year’s time, the steel price may rise to $30 or fall to $10. The NPV of the project then would be either $18 million or –$10 million. By delaying the start of the project, the firm can add greater shareholder value avoid getting locked into an unprofitable project.

b) The project may be abandoned if demand or price forecasts turn out to be over optimistic or operating costs shoot up. It may even be temporarily closed down and re-started again when market conditions improve, e.g. a copper mine can be closed down when copper prices are low and operations re-started when prices rise. Some exit and re-entry costs may of course be involved.

c) The operational scale of the project may be expanded or contracted depending upon whether demand turns out to be more or less than initially envisioned.

d) The input and output mix may be changed or a different technology may be employed.

In recent years, the theory of option pricing has been applied to project appraisal to take account of these operational flexibilities. For instance, the option to abandon a project can be viewed as a put option – the option to sell the project assets – with a “strike” price equal to the liquidation value of the project. The option to start the project at a later date can be viewed as a call option on the PV of project cash

flows with a strike price equal to the initial investment required for the project. Similarly, the option to expand capacity, if demand turns out to be higher than expected can be viewed as a call option on the incremental present value with the strike price being equal to the additional investment required to expand capacity.

Key Takeaways

|

There are some challenges which differntiates a foreign project from a domestic project; They are-

- Exchange Risk and Capital Market Segmentation

Cash flows from a foreign project are in a foreign currency and therefore subject to exchange risk from the parent’s point of view. How to incorporate this risk in project evaluation? And also what is the appropriate cost of capital when the host and home country capital markets are not integrated? Are the main areas of concern.

- Political or “Country” Risk

Assets located abroad are subject to risks of appropriation or nationalisation (without adequate compensation) by the host country government. Also, there maybe changes in applicable withholding taxes, restrictions on remmittances by the subsidiary to the parent, etc. How should we incorporate these risks in evaluating the project?

- International Taxation

In addition to the taxes the subsidiary pays to the host government, there will generally be withholding taxes on dividends and other income remitted to the parent. In addition, the home country government may tax this income in the hands of the parent. If double taxation avoidance treaty is in place, the parent may obtain some credit for the taxes paid abroad. The specific provisions of the tax code in the host and home countries will affect the kinds of financial arrangements between the parent and the subsidiary. There is also the related issue of transfer pricing which may enable the parent to further reduce the overall tax burden.

- Blocked Funds

Sometimes, a foreign project can become an attractive proposal because the parent has some funds accumulated in a foreign country which cannot be taken out (or can be taken out only with heavy penalties in the form of taxes). Investing these funds locally in a subsidiary or a joint venture may then represent a better use of such blocked funds.

In addition, like in domestic projects, we must be careful to take account of any interactions between the new project and some existing activities of the firm, e.g. local production will usually mean loss of export sales.

As in the case of domestic projects, we will adopt a step-wise approach to the evaluation of foreign projects. They are as follows:

a) First treat the project as a branch operation of the parent company. All the cash flows generated by the project belong by definition to the parent since the project has no distinct identity. This allows us to focus on the pure economics of the project.

b) Next, consider the project as a fully equity financed, wholly owned subsidiary of the parent, incorporated under the host country laws, having a distinct legal identity. Now we focus on the various financial arrangements between the parent and the subsidiary and consider what means are available to the parent to increase the cash flow transfers between the subsidiary and the parent and minimise the overall tax burden.

c) Finally, as in the case of a domestic project, incorporate the effects of external financing such as the interest tax shield.

The reasons we consider intra-corporate financing separately from external financing are:

- Firstly ,their effects can be estimated more precisely than those of external financing;

- Secondly , the nature of internal financing arrangements is sensitive to the particular features of the tax law in the host and home countries;

- Thirdly , it always forces us to keep in mind that any change in the nature of

intra-corporate financial relationships impinges only on the allocation of profits between the parent and the subsidiary and not a net gain or loss.

Practice of Investment Appraisal

The practices of Investment appraisals are surveyed by various financialists and economist from time to time. Some of them are- Keck, Levengood and Longfield (1998) have reported the results of a survey of practitioners

pertaining to the methodologies they employ to estimate cost of capital for international investments.

Their findings can be broadly summarized as follows:

a) A large majority of practitioners employ DCF as at least one of the methods for valuation.

b) Most practitioners are de facto multi-factor model adherents. More segmented the market under consideration, greater is the number of additional factors used in valuation. Even those who claimed to use the single factor CAPM include more than one risk factor proxies.

c) The use of local market portfolio as the sole risk factor is less frequent when the evaluator is dealing with countries which are not well integrated into the global capital markets. However, they then add other risk factors rather than using the global market portfolio. For integrated markets such as the US or the UK, global market portfolio is used more frequently.

d) In the case of less integrated markets like Sri Lanka or Mexico, exchange risk, political risk (e.g. expropriation), sovereign risk (e.g. Government defaulting on its obligations) and unexpected inflation are considered to be important risk factors in addition to market risk.

e) Most practitioners adjust for these added risks by adding ad-hoc risk premia to discount rates derived from some asset pricing model rather than incorporating them in estimates of cashflows. This goes against the spirit of asset pricing models which are found on the premise that only non-diversifiable risks should be incorporated in the discount rate.

Key Takeaways

a) Exchange Risk and Capital Market Segmentation b) Political or “Country” Risk c) International Taxation d) Blocked Funds 3. The practices of Investment appraisals are surveyed by various financialists and economist from time to time. Some of them are- Keck, Levengood and Longfield. |

REFERENCE BOOKS

- International Financial Management 7th edition by Cheol S. Eun Bruce G. Resnick

- INTERNATIONAL TAX ENVIRONMENT AND TRANSFER PRICING- Research paper

- Finance and Financial Markets by Keith Pilbeam

- Guide to Financial Management by John Tennent