UNIT 3

Company Law

A company is a legal entity formed by a group of individuals to interact in and operate a business—commercial or industrial—enterprise. A company could also be organized in various ways for tax and financial liability functions counting on the company law of its jurisdiction. The road of business the corporation is in will generally determine which business structure it chooses like a partnership, proprietorship, or corporation. These structures also denote the ownership structure of the company. They will even be distinguished between private and public companies. Both have different ownership structures, regulations, and financial reporting requirements.

A company may be a legal entity formed by a group of individuals to interact during and operate a commercial enterprise in a commercial or industrial capacity. A company's line depends on its structure, which may range from a partnership to a proprietorship, or maybe an organization.

Companies could also be either public or private; the previous issues equity to shareholders on an exchange, while the latter is privately-owned and not regulated. A business enterprise is usually organized to earn a profit from business activities.

Company forms of businesses became immensely popular over the years. Their development has led to the creation of numerous new sorts of companies. Companies are to be classified on the idea of liabilities, members and on the idea of control.

TYPES OF COMPANIES

- Companies on the idea of Liabilities

- When we look at the liabilities of members, companies are often limited by shares, limited by guarantee or just unlimited.

a) Companies Limited by Shares

Sometimes, shareholders of some companies won't pay the whole value of their shares in one go. In these companies, the liabilities of contributors are limited to the extent of the amount not paid by them on their shares.

This ability that just in case of winding up, members will be liable only until they pay the ultimate amount of their shares

b) Companies Limited by Guarantee

In some companies, the memorandum of association mentions amounts of money that some members guarantee to pay.

In case of winding up, they're going to be liable only to pay only the amount so guaranteed. The company or its creditors cannot compel them to pay any greater money.

c) Unlimited Companies

Unlimited companies haven't any limits on their members’ liabilities. Hence, the company can use all personal assets of shareholders to satisfy its debts while winding up. Their liabilities will extend to the company’s entire debt.

COMPANIES ON THE BASIS OF MEMBERS

A) One Person Companies (OPC)

These types of companies have just one member as their sole shareholder. They’re separate from sole proprietorships because OPCs are legal entities awesome from their sole members. Unlike other companies, OPCs don’t have to have any minimum share capital.

b) Private Companies

Private companies are those whose articles of association restrict free transferability of shares. In terms of members, private groups got to have a minimum of two and a maximum of 200. These members encompass present and former employees who also hold shares.

c) Public Companies

In contrast to private companies, public companies allow their members to freely transfer their shares to others. Secondly, they need to have a minimum of seven members, but the maximum quantity of members they will have is unlimited.

COMPANIES ON THE BASIS OF CONTROL OR HOLDING

In terms of control, there are two types of companies.

a) Holding and Subsidiary Companies

In some cases, a company’s shares might be held fully or partly by another company. Here, the company proudly owning these shares becomes the holding or parent company. Likewise, the company whose shares the parent company owns becomes its subsidiary.

Holding companies exercise control over their subsidiaries by dictating the composition of their board of directors. Furthermore, parent companies also exercising control by owning quite 50% of their subsidiary companies’ shares.

b) Associate Companies

Associate organizations are those during which other companies have significant influence. This “significant influence” amounts to ownership of a minimum of 20% shares of the associate company.

The other company’s control can exist in phrases of the associate company’s business decisions under an agreement. Associate companies also can exist under joint venture agreements.

COMPANIES IN TERMS OF ACCESS TO CAPITAL

When we believe the access, a company has got to capital; companies could also be either listed or unlisted.

Unlisted companies, on the other hand, don't list their securities on stock exchanges. Both, public, also as private companies, can come under this category.

OTHER TYPES OF COMPANIES

a) Government Companies

Government companies are those during which more than 50% of share capital is held by either the central government, or by one or more state government, or jointly by the central government and one or more nation government.

b) Foreign Companies

Foreign companies are incorporated outside India. They also conduct business in India employing a place of business either by themselves or with some other company.

c) Charitable Companies (Section 8)

Certain companies have charitable purposes as their objectives. These companies are called Section 8 companies because they're registered under Section 8 of Companies Act, 2013.

Charitable companies have the promotion of arts, science, culture, religion, education, sports, trade, commerce, etc. as their objectives. Since they are doing not earn profits, they additionally don't pay any dividend to their members.

d) Dormant Companies

These companies are generally formed for future projects. They are doing not have significant accounting transactions and don't need to perform all compliances of normal companies.

e) Public Financial Institutions

Life Insurance Corporation, unit trust of India and other such companies are treated as public financial institutions. They’re essentially government companies that conduct functions of public financing.

SALIENT FEATURES OF THE ACT, 2013

Based on the above definitions, given below are the main features of company structure of ownership:

1. Class action suits for Shareholders: the companies Act 2013 has introduced new concept of sophistication action suits with a view of creating shareholders and other stakeholders, more informed and intimate their rights.

2. More power for Shareholders: the companies Act 2013 provides for approvals from shareholders on various significant transactions.

3. Women empowerment within the company sector: the companies Act 2013 stipulate appointment of a minimum of one-woman Director on the Board (for certain class of companies).

4. Corporate Social Responsibility: The Company Act 2013 stipulates certain class of Companies to spend a particular amount of cash per annum on activities/initiatives reflecting Corporate Social Responsibility.

5. National Company Law Tribunal: the companies Act 2013 introduced National Company Law Tribunal and therefore the National Company Law Appellate Tribunal to exchange the company Law Board and Board for Industrial and Financial Reconstruction. They might relieve the Courts of their burden while simultaneously providing specialized justice.

6. Mergers: the companies Act 2013 proposes a quick track and simplified procedure for mergers and amalgamations of certain class of companies like holding and subsidiary, and little companies after obtaining approval of the Indian government.

7. Cross Border Mergers: the companies Act 2013 permits cross border mergers, both ways; a foreign company merging with an India Company and vice versa but with prior permission of RBI.

8. Prohibition on forward dealings and insider trading: the companies Act 2013 prohibits directors and key managerial personnel from purchasing call and put options of shares of the company , if such person is fairly expected to possess access to price-sensitive information.

9. Increase in number of Shareholders: the companies Act 2013 increased the number of maximum shareholders during a private company from 50 to 200.

10. Limit on Maximum Partners: the utmost number of persons/partners in any association/partnership could also be up to such number as could also be prescribed but not exceeding 100. This restriction won't apply to an association or partnership, constituted by professionals like lawyer, chartered accountants, company secretaries, etc. who are governed by their special laws. Under the companies Act 1956, there was a limit of maximum 20 persons/partners and there was no exemption granted to the professionals.

11. One Person Company: the companies Act 2013 provides new sort of private company, i.e., one Person Company. It's going to have just one director and one shareholder. The Companies Act 1956 requires minimum two shareholders and two directors just in case of a private company.

12. Entrenchment in Articles of Association: the companies Act 2013 provides for entrenchment (apply extra legal safeguards) of articles of association are introduced.

13. Electronic Mode: the companies Act 2013 proposed E-Governance for various company processes like maintenance and inspection of documents in electronic form, option of keeping of books of accounts in electronic form, financial statements to be placed on company’s website, etc.

14. Indian Resident as Director: Every company shall have a minimum of one director who has stayed in India for a complete period of not but 182 days within the previous civil year.

15. Independent Directors: The Company Act 2013 provides that each one listed company should have a minimum of one-third of the Board as independent directors. Such other class or classes of public companies as even be |is also"> could also be prescribed by the Central Government shall also be required to appoint independent directors. No independent director shall hold office for quite two consecutive terms of 5 years.

16. Serving Notice of Board Meeting: the companies Act 2013 requires a minimum of seven days’ notice to call a board meeting. The notice could also be sent by electronic means to each director at his address registered with the company.

17. Duties of Director defined: Under the companies Act 1956, a director had fiduciary (legal or ethical relationship of trust) duties towards a corporation. However, the companies Act 2013 have defined the duties of a director.

18. Liability on Directors and Officers: the companies Act 2013 don’t restrict an Indian company from indemnifying (compensate for harm or loss) its directors and officers just like the Companies Act 1956.

19. Rotation of Auditors: the companies Act 2013 provides for rotation of auditors and audit firms just in case of publicly traded companies.

20. Prohibits Auditors from performing Non-Audit Services: the companies Act 2013 prohibits Auditors from performing non-audit services to the company where they're auditor to make sure independence and accountability of auditor.

21. Rehabilitation and Liquidation Process: the whole rehabilitation and liquidation process of the companies in financial crisis has been made time bound under Companies Act 2013.

The separate legal entity of a company is one among its most unique features. During this article, we'll check out the famous Corporate Veil Theory and check out to know the scenarios under which lifting or piercing the corporate veil is feasible.

What is the corporate Veil Theory?

The Corporate Veil Theory may be a legal concept which separates the identity of the company from its members. Hence, the members are shielded from the liabilities arising out of the company’s actions.

Therefore, if the company incurs debts or contravenes any laws, then the members aren't responsible for those errors and enjoy corporate insulation. In simpler words, the shareholders are protected from the acts of the company.

Piercing the corporate Veil

Scenarios under which the Courts consider piercing or lifting the corporate veil are as below,

1] To work out the Character of the company

There are cases where the Courts got to understand if the company is an enemy or friend. In such cases, the Courts adopt the test of control. The Courts usually avoid piercing the company veil, unless the general public interest is in jeopardy. However, to determine if a company is an enemy company, the Court might prefer to do so

So, how can a company be an enemy? It doesn't have a mind or consciousness and can't be a friend or foe, right? However, if the affairs of a company are under the control of individuals from an enemy country, then the corporate could be an enemy too. In such cases, the Court may examine the character of the humans who are at the helm of affairs of the company.

2] To guard Revenue or Tax

In matters concerning evasion or circumvention of taxes, duties, etc., the Court might disregard the corporate entity.

Imagine a company that’s wanted to evade tax. In such cases, piercing the corporate veil allows the Court to know the important owner of the income of the company and make the said person liable for legitimate taxes.

3] If trying to avoid a Legal Obligation

Sometimes the members of a company can create another company/subsidiary company to avoid certain legal obligations. In such cases, piercing the corporate veil allows the Courts to know the real transactions.

Imagine a company liable to share 20 percent of its profits with its employees as a bonus. This is often a legal obligation. To avoid this, the company opens an entirely owned subsidiary company and transfers its investment holdings thereto.

The new company formed has no assets of its own and no business income either. It’s completely dependent on the principal company.

By doing so, the principal company reduced the amount of bonus liable to be paid to its employees. The Courts, by piercing the corporate veil, can understand the important intention of the principal company and make sure that it fulfills its legal obligations.

4] Forming Subsidiaries to act as Agents

Sometimes, the idea of the formation of a corporation is to act as an agent or trustee of its members or of another company. In such cases, the corporate loses its individuality in favor of its principal. Also, the principal is responsible for the acts of such a company.

5] A company formed for fraud or improper conduct or to defeat the law

In cases where a company is made for a few illegal or improper purposes like defeating the law, the Courts might plan to lift or pierce the corporate veil.

ONE PERSON COMPANY

The Companies Act, 2013 completely revolutionized corporate laws in India by introducing several new concepts that didn't exist previously. On such game-changer was the introduction of 1 Person Company concept. This led to the popularity of a totally new way of starting businesses that accorded flexibility which a company form of entity offers, while also providing the protection of limited liability that sole proprietorship or partnerships lacked.

Several other countries had already recognized the ability of people forming a corporation before the enactment of the new Companies Act in 2013. These included the likes of China, Singapore, UK, Australia, and therefore the USA.

Definition of 1 Person Company

Section 2(62) of Companies Act defines a one-person company as a company that has just one person on its member. Furthermore, members of a company are nothing but subscribers to its memorandum of association, or its shareholders. So, an OPC is effectively a corporation that has just one shareholder as its member.

Such companies are generally created when there's just one founder/promoter for the business. Entrepreneurs whose businesses lie in early stages like better to create OPCs instead of sole proprietorship business due to the several advantages that OPCs offer.

Difference between OPCs and Sole Proprietorships

A sole proprietorship form of business might sound very similar to one-person companies because they both involve one person owning the business; there are some differences between them.

The main difference between the two is that the nature of the liabilities they carry. Since an OPC may be a separate legal entity distinguished from its promoter, it's its own assets and liabilities. The promoter isn't personally liable to repay the debts of the company.

On the other hand, sole proprietorships and their proprietors is an equivalent person. So, the law allows attachment and sale of promoter’s own assets just in case of non-fulfillment of the business’ liabilities.

Features of a One Person Company

Here are some general features of a one-person company:

- Private company: Section 3(1)(c) of the companies Act says that one person can form a company for any lawful purpose. It further describes OPCs as private companies.

- Single-member: OPCs can have just one member or shareholder, unlike other private companies.

- Nominee: a unique feature of OPCs that separates it from other forms of companies is that the only member of the company has to mention a nominee while registering the company.

- No perpetual succession: Since there's just one member in an OPC, his death will end in the nominee choosing or rejecting to become its sole member. This doesn't happen in other companies as they follow the concept of perpetual succession.

- Minimum one director: OPCs need to have minimum one person (the member) as director. They will have a maximum of 15 directors.

- No minimum paid-up share capital: Companies Act, 2013 has not prescribed any amount as minimum paid-up capital for OPCs

- Special privileges: OPCs enjoy several privileges and exemptions under the companies Act that other forms of companies don't possess.

Formation of one Person Companies

A single person can form an OPC by subscribing his name to the memorandum of association and fulfilling other requirements prescribed by the companies Act, 2013. Such memorandum must state details of a nominee who shall become the company’s sole member just in case the original member dies or becomes incapable of getting into contractual relations

This memorandum and therefore the nominee’s consent to his nomination should be filed to the Registrar of Companies alongside an application of registration. Such nominee can withdraw his name at any point in time by submission of requisite applications to the Registrar. His nomination also can later be canceled by the member.

Membership in One Person Companies

Only natural persons who are Indian citizens and residents are eligible to make a one-person company in India. The same condition applies to nominees of OPCs. Further, such a natural person can't be a member or nominee of quite one OPC at any point in time.

It is important to note that only natural persons can become members of OPCs. This doesn't happen within the case of companies wherein companies themselves can own shares and be members. Further, the law prohibits minors from being members or nominees of OPCs.

Conversion of OPCs into other Companies

Rules regulating the formation of one-person companies expressly restrict the conversion of OPCs into Section 8 companies, i.e. companies that have charitable objectives. OPCs also cannot voluntarily convert into other forms of companies until the expiry of two years from the date of them in company.

Privileges of one Person Companies

OPC enjoy the following privileges and exemptions under the companies Act:

- They do not need to hold annual general meetings.

- Their financial statements needn't include income statements.

- A company secretary isn't required to sign annual returns; directors also can do so.

- Provisions relating to independent directors don't apply to them.

- Their articles can provide for extra grounds for vacation of a director’s office.

- Several provisions concerning meetings and quorum don't apply to them.

- They can pay more remuneration to directors than compared to other companies.

DORMANT COMPANY:

What is Dormant Company?

Dormant Company may be a company which isn't carrying on any business or operation. As per Section 455 of the companies Act, 2013, where a company is made and registered under this Act for a future project or to carry an asset or intellectual property and has no significant accounting transaction, such a company or an inactive company may make an application to the Registrar of Companies for changing its status from active company to dormant company.

“Significant accounting transaction” means any transaction other than:-

- Payment of fees to the Registrar.

- Payments made by it to satisfy the regulatory requirements.

- Allotment of shares.

- Payments made for maintenance of office and records.

Prior Conditions for Dormant Status:-

The company shouldn't be carrying on any business or operation, or not made any significant accounting transaction during the last two financial years or has not filed financial statements and annual returns during the last two financial years.

In case there's any unsecured loan within the Company then consent of the lender should be obtained.

Statement of Assets and Liabilities should be obtained from Statutory Auditors of the company.

No dispute certificate should be obtained from the management or promoters of the company.

The Registrar on consideration of the appliance shall allow the status of a dormant company to the applicant and issue a certificate in such form as could also be prescribed thereto effect. The Registrar shall maintain a register of dormant companies in such form as could also be prescribed. Just in case of a company which has not filed financial statements or annual returns for two financial years consecutively, the Registrar shall issue a notice thereto company and enter the name of such company within the register maintained for dormant companies

Compliance maintained by Dormant Company

A dormant company will need to comply with certain compliance requirements, although these are very minimal. Listed below are the compliance requirements:

A dormant company should file ”Return of Dormant Company” per annum indicating the company financial position duly audited by chartered accountant in practice in Form MSC-3.

A dormant company is required to convene a minimum of one board meeting in every six months.

A dormant company also shall have such minimum number of directors, file such documents and pay such annual fee as could also be prescribed to the Registrar to retain its dormant status within the register and should become an active company on an application made during this behalf accompanied by such documents and fee as could also be prescribed. The Registrar shall strike off the name of a dormant company from the register of dormant companies, which has done not comply with the requirements for maintaining compliance.

Application for obtaining status of dormant company

For the needs of sub-section (1) of section 455, a company may make an application in Form MSC-1 alongside such fee as provided within the Companies (Registration Offices and Fees) Rules, 2014 to the Registrar for obtaining the status of a Dormant Company in accordance with the provisions of section 455 after passing a special resolution to this effect within the general meeting of the company or after issuing a notice to all or any the shareholders of the company for this purpose and obtaining consent of a minimum of 3/4th shareholders (in value):

Provided that a company shall be eligible to apply under this rule only, if-

(i) No inspection, inquiry or investigation has been ordered or taken up or carried out against the company;

(ii) No prosecution has been initiated and pending against the company under any law;

(iii) The company is neither having any public deposits which are outstanding neither is the company in default in payment thereof or interest thereon

(iv)The company isn't having any outstanding loan, whether secured or unsecured:

Provided that if there's any outstanding unsecured loan, the company may apply under this rule after obtaining concurrence of the lender and enclosing the same with Form MSC-1;

(v) There's no dispute within the management or ownership of the company and a certificate during this regard is enclosed with Form MSC-1;

(vi) the company doesn't have any outstanding statutory taxes, dues, duties etc. payable to the Central Government or any government or local authorities etc.;

(vii) The company has not defaulted within the payment of workmen’s dues;

(viii) The securities of the company aren't listed on any stock market within or outside India.

Understanding the concept of Dormant Company

The idea of a dormant company may be a newly introduced concept within the Companies Act 2013, previously absent within the 1956 Act. The Indian legislature seems to possess borrowed it largely from the legal principles of company law applicable within the U.K. However, certain significant differences exist like the duration of dormancy, etc. In line with India’s investor-friendly policies, the supply regarding dormant companies is often seen within the light of promoting and facilitating the procedure of in company and functioning of a company.

Why choose dormant status? What are its benefits?

The immediate question that arises upon understanding the meaning of a dormant company is that this – why would anyone creates a company and registers it only to urge it declared as dormant? The most purpose of obtaining or retaining the dormant status of a company is in order that the company retains its company status despite not carrying out any business.

The benefits derived from such a status could also be summarized under the subsequent heads –

- Protection of the company Name – The intellectual property that the dormant company holds includes trademark of the company name. The name of the company is protected in order that others are prevented from trading under the name of the dormant company.

- Futures Project – a company may be formed in preparation of a future project. This signifies the intention of the promoters to trade and thus retain the name. a good example of this as stated in Ramaiya may be a company that has obtained a lease of land but waiting further approvals before commencing the business. (p. 5755)

- Company History – Although this is often not a really significant benefit, by establishing a company that's initially dormant and later begins business, can claim to be are well-established since it’s in company though it's going to have started its business much later. It helps a company to project a far better image to prospective clients and/or creditors.

ASSOCIATE COMPANY

What is Associate Company?

Before we address the above question, allow us to analyze the definition of Associate Company given in Section 2(6) of Companies Act, 2013

“Associate company”, in reference to another company, means a company during which that other company has a significant influence, but which isn't a subsidiary company of the company having such influence and includes a joint venture company.

As per section 2(27) of Companies Act, 2013 the term control means and shall include:

“Control” shall include the proper to appoint majority of the directors or to regulate the management or policy decisions exercisable by an individual or persons acting individually or together, directly or indirectly, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements or in the other manner.

After understanding the term control and reading the definition and explanation provided in Companies Act, 2013 it's going to be concluded that following conditions must be fulfilled by a company for becoming Associate Company of another Company:

The Company controls twenty percent of total share capital of another Company: If any company controls one-fifth of total share capital of another company by any mean, even if the company directly not holding shareholding in another company but having a control over twenty percent shareholding of another company are going to be an associate company for another company.

Example: allow us to assume 2 companies a private Limited & B Private Limited. Below are assumptive list of shareholders of both the companies.

By analyzing the above list of shareholders of both the companies, the questions arises that which company is an associate company for another company?

The answer is clearly a private Limited is an Associate Company for B Private Limited as B Private Limited is holding 21% Shares of a private Limited.

The Company has a joint venture with another company or both the companies are joint venture companies: International accounting principle 28 (IAS 28) defines a joint venture as “A joint venture may be a joint arrangement whereby the parties that have joint control of the arrangement have rights to the net assets of the arrangement.”

A joint arrangement is an arrangement of which two or more parties have joint control. Joint control is that the contractually agreed sharing of control of an arrangement, which exists only decisions about the relevant activities, requires the unanimous consent of the parties sharing control.

The company controls company decisions of another company under an agreement: when a company has control over company decisions of another company by an oral or written agreement in such a situation that company is an associate company for the company controlling company decisions of another company.

By definition, the term “Member” in reference to a company means, one who has agreed to become the member of the company by entering his name into the ‘Register of Members’. Everybody who has agreed in writing to become a part of the company and also holds shares of the company is considered the ‘Member of the Company’ and is claimed to carry membership in a company. The name of the member of the company is entered as ‘Beneficial owner in the record of depository’.

In order to accumulate the membership of the company, the subsequent two elements must be presented:

An Agreement to become a member

Entry of the name of the person so agreeing, in the Register of members of the company

The enlisted person should be in a capable of getting into a contract with the company. But a bearer of share warrant isn't a member of the company. Finally, to become the registered member of the company the person should be satisfactory as an asset to the corporate.

Difference between Member & Shareholder

MATTER | Member | Shareholder |

Meaning | A person whose name is entered in the register of members of a company. | A person who owns the shares of the company. |

Definition | Companies Act, 2013 defines ‘Member’ under section 2(55) | Shareholder is not listed under the Companies Act, 2013 |

Share Warrants | The holder of the share warrant is not a member. | The holder of the share warrant is a Shareholder. |

Company | Every company must have a minimum number of members. | The Company limited by shares can have shareholders |

Memorandum | A person who signs the memorandum of association with the company becomes a member. | After signing the memorandum, a person can become a shareholder only if shares are allotted to him. |

Member Shareholder

Meaning A person whose name is entered in the register of members of a company. An individual who owns the shares of the company.

Definition Companies Act, 2013 defines ‘Member’ under section 2(55) Shareholder isn't listed under the companies Act, 2013

Share warrantsthe holder of the share warrant isn't a member. The holder of the share warrant may be a Shareholder.

Company every company must have a minimum number of members. The company limited by shares can have shareholders

Memorandum A one that signs the memorandum of association with the company becomes a member. After signing the memorandum, an individual can become a shareholder as long as shares are allotted to him.

Modes of Acquiring Membership

Acquiring a membership in a company requires many processes and modes. The subsequent are the modes of acquiring membership in a company:

Subscribing to MOA

If an individual agrees to sign the memorandum and pledge his presence on the board of members, he becomes the member of the company.

Names of the people that have agreed to join the membership of the corporate should be entered in Register of Members.

Along with the agreement, if they’ve agreed to share the company’s shares, they become the Shareholders of the company.

Agreement in Writing

A person would become the member of the company if he ‘agrees in writing’ and gets his name entered within the register of members of the company.

A shareholder would also become a member of the company if he ‘agrees in writing’, and by the subsequent methods:

By transfer of shares

By transmission of shares

By Estoppels (Membership Without sufficient Cause)

Holding Shares

A person becomes a member of the company if his name is entered as a beneficial owner of the records of the depository and also holds equity share capital of the company. In such cases, the person needn’t apply ‘in writing’ to become a member of the company.

Removal of Membership

The term ‘Cessation’ means ‘Termination’ even as there’s a process to add a member of the corporate, there’s a process to terminate that member. Terminating a member of the company may result in removal from the ‘Register of Members’. The subsequent are the modes of removing a member of the company:

Transfer of Membership

Here, the shares of a member are transferred to another person by the corporate in the name of the transferee.

The name of the transferor is eliminated from the Register of Members.

After transferring all the shares from the person to a different person, the person is legally eliminated from the corporate.

Transmission of Membership

On the death of a shareholder/member of the corporate, his/her legal heir or representative becomes a member.

Surrender of Membership

A person is eliminated from the membership once he/she surrenders his shares, which needs ‘Acceptance on part of Board’.

Forfeiture of Membership

On account of Loss or selling of a share, the member is terminated from the corporate.

Share repurchase

The person is terminated from the company if the company buys back its shares.

Liabilities of Members

A ‘Liability’ is a state of being legally liable for something. This term is typically utilized in an organization to emphasize the responsibilities of a member of the company. The subsequent are the liabilities of the member of a company:

- To make shares if he/she is allotted as per the Act.

- To pay call money or pay the due number of shares.

- To abide by the decision of majority once they act ‘bonafide’.

- To contribute to the Asset of the company in case of finishing up and when the shares are partly paid up

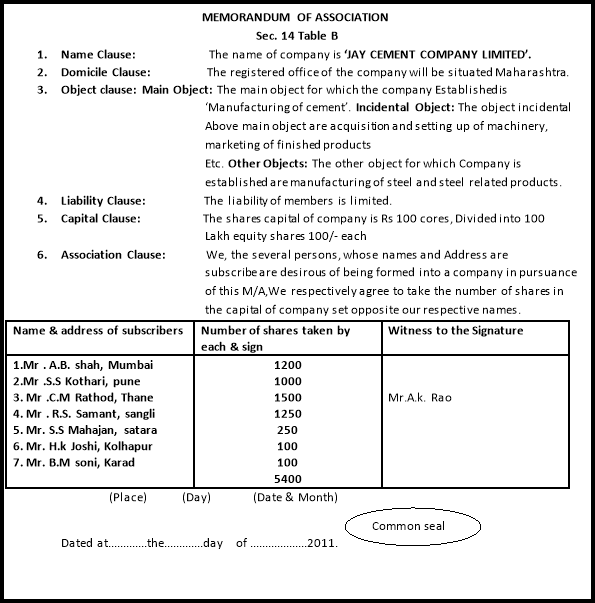

MEANING

The Memorandum of Association or MOA of a company defines the constitution and the scope of powers of the company. In simple words, the MOA is that the foundation on which the company is made.

Object of registering a Memorandum of Association or MOA

The MOA of a company contains the thing that the company is made. It identifies the scope of its operations and determines the boundaries it cannot cross.

It is a public document consistent with Section 399 of the businesses Act, 2013. Hence, a person who enters into a contract with the company is expected to possess knowledge of the MOA.

It contains details about the powers and rights of the company.

Under no circumstance can the corporate depart from the provisions laid out in the memorandum. If it does so, then it might be ultra vires the corporate and void.

Format of Memorandum of Association (MOA)

According to Section 4 of the companies Act, 2013, companies must draw the MOA within the form given in Tables A-E in Schedule I of the Act. Here are the details of the forms:

Table A: Form for the memorandum of association of a company limited by shares.

Table B: Form for the memorandum of association of a company limited by guarantee and not having a share capital.

Table C: Form for the memorandum of association of a company limited by guarantee and having a share capital.

Table D: Form for the memorandum of association of an unlimited company.

Table E: Form for the memorandum of association of an unlimited company and having share capital.

Content of the MOA

The following information is mandatory in an MOA:

1. Name Clause

For a public Ltd. , the name of the company must have the word ‘Limited’ because the last word

For the private Ltd. , the name of the company must have the words ‘Private Limited’ because the last words.

This is not applicable to companies formed under Section 8 of the Act who must include one among the subsequent words, as applicable:

- Foundation

- Forum

- Association

- Federation

- Chambers

- Confederation

- Council

- Electoral Trust, etc.

- Registered Office Clause

It must specify the State during which the registered offices of the company are going to be situated.

2. Object Clause

It must specify the objects that the company is being incorporated. Further, if a corporation changes its activities which aren't reflected in its name, then it can change its name within six months of adjusting its activities. The company must suit all name-change provisions.

3. Liability Clause

- It should specify the liability of the members of the company, whether limited or unlimited. Also,

- For a company limited by shares – it should specify if the liability of its members is restricted to any unpaid amount on the shares that they hold.

- For a company limited by guarantee – it should specify the quantity undertaken by each member to contribute to:

- The assets of the company when it winds-up. This is often as long as he's a member of the company when it winds-up or the winding-up happens within one year of him ceasing to be a member. In the latter case, the debts and liabilities considered would be those contracted before he ceases to be a member.

- The costs, charges, and expenses of winding up and therefore the adjustment of the rights of the contributors among themselves.

4. Capital Clause

This is valid just for companies having share capital. These companies must specify the quantity of Authorized capital divided into shares of fixed amounts. Further, it must state the names of every member and therefore the number of shares against their names.

5. Association Clause

The MOA must clearly specify the will of the subscriber to make a company. This is often the last clause.

For One-Person-Company

The MOA must specify the name of the one that becomes a member of the company within the event of the death of the subscriber.

FORM OF MEMORANDUM OF ASSOCIATION

Keep in mind the subsequent aspects before submitting the MOA:

- Print the MOA

- Divide it into paragraphs

- Number the pages in sequence

- Ensure that a minimum of seven people sign it (2 within the case of a personal Ltd. And one just in case of a 1 Person company).

- Have a minimum of one witness to attest the signatures

- Enter particulars about the signatories and witnesses like address, description, occupation, etc.

- A few things to recollect

- A company can subscribe an MOA through its agent

- A minor cannot sign an MOA. However, the guardian of a minor, who subscribes to the MOA on his behalf, are going to be deemed to possess subscribed in his personal capacity.

- Companies can attach additional provisions as needed aside from the mandatory ones mentioned above.

ALTERATION OF MEMORANDUM

(1) Save as provided in section 61, a company may, by a special resolution and after complying with the procedure laid out in this section; alter the provisions of its memorandum.

(2) Any change within the name of a company shall be subject to the provisions of subsections (2) and (3) of section 4 and shall not have effect except with the approval of the Central Government in writing:

Provided that no such approval shall be necessary where the sole change within the name of the company is that the deletion there from, or addition thereto, of the word Private‖, consequent on the conversion of anybody class of companies to a different class in accordance with the provisions of this Act.

(3) When any change within the name of a company is formed under sub-section (2), the Registrar shall enter the new name within the register of companies in situ of the old name and issue a fresh certificate of incorporation with the new name and therefore the change within the name shall be complete and effective only on the difficulty of such a certificate.

(4) The alteration of the memorandum relating to the place of the registered office from one State to a different shall not have any effect unless it's approved by the Central Government on an application in such form and manner as could also be prescribed.

(5) The Central Government shall eliminate the appliance under sub-section (4) within a period of sixty days and before passing its order may satisfy itself that the alteration has the consent of the creditors, debenture-holders and other persons concerned with the company or that the sufficient provision has been made by the company either for the due discharge of all its debts and obligations or that adequate security has been provided for such discharge.

(6) Save as provided in section 64, a company shall, in reference to any alteration of its memorandum, file with the Registrar—

(a) The special resolution gone by the company under sub-section (1);

(b) The approval of the Central Government under sub-section (2), if the alteration involves any change within the name of the company.

(7) Where an alteration of the memorandum leads to the transfer of the registered office of a company from one State to a different , a licensed copy of the order of the Central Government approving the alteration shall be filed by the company with the Registrar of every of the States within such time and in such manner as could also be prescribed, who shall register an equivalent , and therefore the Registrar of the State where the registered office is being shifted to, shall issue a fresh certificate of incorporation indicating the alteration.

(8) a company, which has raised money from public through prospectus and still has any unutilized amount out of the cash so raised, shall not change its objects that it raised the cash through prospectus unless a special resolution is gone by the company and—

(i) the small print, as could also be prescribed, in respect of such resolution shall even be published within the newspapers (one in English and one in vernacular language) which is in circulation at the place where the registered office of the company is situated and shall even be placed on the web site of the company, if any, indicating there in the justification for such change;

(ii) The dissenting shareholders shall tend a chance to exit by the promoters and shareholders having control in accordance with regulations to be specified by the Securities and Exchange Board.

(9) The Registrar shall register any alteration of the memorandum with reference to the objects of the company and certify the registration within a period of thirty days from the date of filing of the special resolution in accordance with clause (a) of sub-section (6) of this section.

(10) No alteration made under this section shall have any effect until it's been registered in accordance with the provisions of this section 32

(11) Any alteration of the memorandum, within the case of a company limited by guarantee and not having a share capital, purporting to offer a person a right to participate within the divisible profits of the corporate otherwise than as a member, shall be void.

Every company needs a group of rules and regulations to manage its internal affairs. There are two important business documents of a company, namely, Memorandum of Association (MOA) and Articles of Association (AOA). The AOA specifies the internal regulations of the company. During this post, we'll check out the Articles of Association (AOA) in detail.

The AOA contains the bye-laws of the company. Therefore, the director and other members must perform their functions as regards the management of the company, its accounts, and audits in accordance with the AOA.

Content and Model of Articles of Association (AOA)

According to Section 5 of the companies Act, 2013, the AOA must have the subsequent components:

- Regulations

- The AOA must contain the regulations for the management of the company.

- Inclusion of matters

- The Articles must specify all matters, in accordance with the rules. Furthermore, a company can include additional matters deemed necessary for its management.

- Provisions for entrenchment

- Entrenchment means fortification or protection.

The AOA can contain provisions for entrenchment for specific provisions. The provisions for entrenchment can make sure that the required provisions are altered as long as certain conditions or procedures are met or complied with. These conditions are usually more restrictive than those applicable for a special resolution.

The inclusion of the provisions for entrenchment is possible:

On the formation of the company

By amending the Articles approvingly from all members of the corporate. Further, within the case of a public limited company, with a special resolution.

Regardless of whether the provisions for entrenchment are added on the formation or after an amendment, the company must provide a notice to the Registrar of an equivalent.

Forms of AOA

Schedule I of the companies Act, 2013 provides forms for AOA in tables F, G, H, I and J for various sorts of companies. Further, the articles must be within the respective form.

Model Articles

- A company can adopt all or any of the regulations lay out in the model articles.

- Company registered after the commencement of the Act

- If The registered articles of such a company don't exclude or modify the regulations contained within the model articles applicable to such company

- Those regulations are the regulations of that company as if they were contained within the duly registered articles of the company.

Parameter | MOA | AOA |

Objectives | It defines and delimits the objectives of a company. Further, it specifies the condition of incorporation | It lays down the rules and regulations for the internal management of the company. Hence, it also contains the bye – law of the company |

Relationship | It defines the relationship of the company with the outside world | It defines the relationship between the company and its members |

Alteration | It can be altered only under special circumstances. Also, it usually requires the permission of the Regional Director to the Tribunal | It can be altered by passing a special resolution |

Ultra vires | Acts beyond the scope of the MOA are ultra vires and void. Furthermore, even unanimous consent of all shareholders cannot ratify it | Acts which are ultra vires the AOA can be ratified by a special resolution of the shareholders. However, such acts should not be ultra vires the MOA |

ALTERATION OF ARTICLES OF ASSOCIATION

1) Subject to the provisions of this Act and the conditions contained in its memorandum, if any, a company may, by a special resolution, alter its articles including alterations having the effect of conversion of—

(a) a private company into a public company; or

(b) a public company into a private company:

Provided that where a company being a private company alters its articles in such a manner that they not include the restrictions and limitations which are required to be included within the articles of a private company under this Act, the company shall, as from the date of such alteration, cease to be a private company:

Provided further that any alteration having the effect of conversion of a public company into a personal company shall not be valid unless it's approved by an order of the Central Government on an application made in such form and manner as could also be prescribed:

Provided also that any application pending before the Tribunal, as on the date of commencement of the companies (Amendment) Ordinance,[2019], shall be disposed of by the Tribunal in accordance with the provisions applicable thereto before such commencement.

2) Every alteration of the articles under this section and a copy of the order of the [Central Governmentapproving the alteration as per sub-section (1) shall be filed with the Registrar, alongside a printed copy of the altered articles, within a period of fifteen days in such manner as could also be prescribed, who shall register the same.

3) Any alteration of the articles registered under sub-section (2) shall, subject to the provisions of this Act, be valid as if it were originally within the articles.

DOCTRINE OF INDOOR MANAGEMENT

Section 399 of the companies Act, 2013, specifies the rules and regulations governing the inspection, production, and evidence of documents with the Registrar. During this article, we'll check out the doctrine of constructive notice, the doctrine of indoor management, and exceptions to the indoor management rule.

Doctrine of Constructive Notice

Section 399 allows any person to electronically inspect, make a record, or get copy/extracts of any document of any company which the Registrar maintains. There’s a fee applicable for the same. The documents include the certificate of incorporation of the company.

By now we know that the Memorandum and Articles of Association are public documents. This section confers the proper of inspection to all or any

Before any person deals with a company, he must inspect its documents and establish conformity with the provisions. However, albeit an individual fails to read them, the law assumes that he's aware of the contents of the documents. Such an implied or presumed notice is called Constructive Notice.

In simpler words, if an individual enters into a contract which is beyond the powers of a corporation, then he has no right under the said contract against the company. The Memorandum of Association defines the powers of the corporate. Also, if the contract is beyond the authority of the administrators as defined within the Articles, the person has no rights.

The doctrine of indoor management is an exception to the earlier doctrine of constructive notice. It’s important to note that the doctrine of constructive notice doesn't allow outsiders to possess notice of the interior affairs of the company.

Hence, if an act is permitted by the Memorandum or Articles of Association, then the outsider can assume that each one detailed formality are observed in doing the act. This is often the Doctrine of Indoor Management or the Turquand Rule. This is often based on the landmark case between The Royal British Bank and Turquand. In simple words, the doctrine of indoor management means a company’s indoor affairs are the company’s problem.

Therefore, this rule of indoor management is vital to people handling a company through its directors or other persons. They will assume that the members of the company are performing their acts within the scope of their apparent authority. Hence, if an act which is valid under the Articles is completed during a particular manner, then the outsider handling the corporate can assume that the director/other officers have worked within their authority.

EXCEPTIONS TO THE DOCTRINE OF INDOOR MANAGEMENT

The Turquand rule or the law of indoor management isn't applicable to the subsequent cases:

The outsider has actual or constructive knowledge of an irregularity

In such cases, the rule of indoor management doesn't offer protection to the outsider handling the said company.

The outsider behaves negligently

The rule of Indoor management doesn't protect an individual handling a company if he doesn't initiate an inquiry despite suspecting an irregularity. Further, this rule doesn't offer protection if the circumstances surrounding the contract are suspicious. For example, the outsider should get suspicious if an officer purports to act during a manner outside the scope of his authority.

Forgery

The doctrine of indoor management is applicable to irregularities that affect a transaction apart from forgery. Just in case of a forgery, the transaction is deemed null and void.

The 2013 Act has introduced a new section [section 23] to explicitly provide the ways during which a public company or private company may issue securities. This section explains that a public company may issue securities in any of the following manners:

• To public through prospectus. ▫

• Through private placement

• Through rights offering or a bonus issue.

For private companies, this section provides that it's going to issue securities through private placement, by way of rights offering or bonus issue.

Section 23 also provides that compliance with provisions of part I of chapter III is required for the difficulty of securities to public through prospectus. For private placement compliance, with the provisions of part II of chapter III are required.

The 2013 Act also introduces certain changes with reference to prospectus and public offers aimed toward enhancing disclosure requirements also as streamlining the method of issuance of securities.

1. Issue of Prospectus:

Currently, the matters and therefore the reports to be included within the prospectus are laid out in the parts I & II of the Schedule of the 1956 Act. Within the 2013 Act, the matters are included within the section 26 of the act. The act mandates certain additional disclosures:

• Any litigation or action pending or taken by a department or a statutory body during the last five years immediately preceding the year of the difficulty of prospectus against the promoter of the company.

• Sources of Promoter’s Contribution.

The 2013 Act has also relaxed the disclosure requirements in some areas. Examples of certain which aren't included within the 2013 Act are as follows. Particulars regarding the company and other listed companies under an equivalent management, which made any capital issues during the last 3 years. - Export possibilities and export obligations. - Details regarding collaboration.

The 2013 act states that report by the auditors on the assets & liabilities of business shall not be before 180 days before the difficulty of the prospectus.[section 26 (1) (b) (iii) of 2013 Act ].

The 1956 currently requires that report won't be 120 days before the difficulty of the prospectus.

2. Variation in terms of contracts and obligation:

The 2013 Act requires Special resolution to be passed to vary the terms of the contract and obligations mentioned within the prospectus or objects that the prospectus was issued. [Section 27 (1) of 2013 Act].

The 1956 Act requires the approval within the general meeting by way of a standard resolution.

The 2013 Act also requires the dissenting shareholders to tend exit offer by promoters or controlling shareholders.

3. Offer of sale of shares by certain members of the company:

The Act 2013 includes a new section under which members of a company, in consultation with the BOD, may offer a part of their holdings to the general public.

The document by which the offer purchasable shall be made to the public shall be considered because the prospectus. The members shall reimburse all the expenses to the company incurred by it.

4. Shelf Prospectus:

The 2013 Act has extended the facility of the shelf prospectus by enabling SEBI to prescribe the classes of companies which will file a shelf prospectus. The Act 1956 currently limits the power of shelf prospectus to the public financial institutions, public sector banks or scheduled banks. [Section 31 (1) of 2013 Act]

5. GDRs:

The 2013 Act includes a new section to enable the difficulty of depository receipts in any foreign country subject to the prescribed conditions [section 41 of 2013 Act].

Currently the supply of section 81 of the 1956 Act concerning the further issue of shares are getting used in conjunction with requirements mandated by SEBI for the issuance of depository receipts.

In several aspects across the 2013 Act, it appears that the 2013 act supplements the powers of SEBI by incorporating requirements already mandated by the SEBI.

6. Private Placement:

The 2013 Act requires that certain specified conditions are complied with so as to form a suggestion or invitation of offer by way of personal placement or through the difficulty of a prospectus.

The offer of securities or invitation to subscribe securities during a fiscal year shall be made to such number of persons not exceeding 50 or such higher number as could also be prescribed {excluding qualified institutional buyers, and employees of the company being offered securities under a scheme of employees option during a fiscal year and on such conditions (including the shape and manner of private placement) as could also be prescribed}. This provision of the 2013 Act is in line with the prevailing provision of the 1956 Act.

The allotments with reference to any earlier offer or invitation may are completed.

All the money payable towards the subscription of securities shall be paid through cheque, demand draft or the other banking channels but not by cash.

The offers shall be made only to such persons whose names are recorded by the company before the invitation to subscribe, which such persons shall receive the offer by name. • the company offering securities shall not release any advertisements or utilize any media, marketing or distribution channels or agents to tell the general public at large about such an offer [section 42 of 2013 Act].

Contents in prospectus

(1) Every prospectus issued by or on behalf of a public company either with regard to its formation or subsequently, or by or on behalf of any person who is or has been engaged or interested in the formation of a public company, shall be dated and signed and shall—

(a) State the following information, namely:—

(i) Names and addresses of the registered office of the company, company secretary, Chief financial officer, auditors, legal advisers, bankers, trustees, if any, underwriters and such other persons as could also be prescribed;

(ii) Dates of the opening and shutting of the issue, and declaration about the issue of allotment letters and refunds within the prescribed time;

(iii) A press release by the Board of Directors about the separate checking account where all monies received out of the issue are to be transferred and disclosure of details of all monies including utilized and unutilized monies out of the previous issue within the prescribed manner;

(iv) Details about underwriting of the issue;

(v) Consent of the administrators, auditors, bankers to the issue, expert‘s opinion, if any, and of such other persons, as could also be prescribed;

(vi)The authority for the issue and therefore the details of the resolution passed therefore;

(vii) Procedure and time schedule for allotment and issue of securities;

(viii) Capital structure of the company within the prescribed manner;

(ix) Main objects of public offer, terms of this issue and such other particulars as could also be prescribed;

(x) Main objects and present business of the company and its location, schedule of implementation of the project;

(xi) Particulars relating to—

(A) Management perception of risk factors specific to the project;

(B) Gestation period of the project;

(C) Extent of progress made within the project;

(D) Deadlines for completion of the project; and

(E) Any litigation or action pending or taken by a government department or a statutory body during the last five years immediately preceding the year of the issue of prospectus against the promoter of the company;

(xii) Minimum subscription, amount payable by way of premium, issue of shares otherwise than on cash;

(xiii) Details of directors including their appointments and remuneration, and such particulars of the character and extent of their interests within the company as may be prescribed;

(xiv) Disclosures in such manner as could also be prescribed about sources of promoter‘s contribution;

(b) Set out the following reports for the needs of the financial information, namely:—

(i) Reports by the auditors of the company with reference to its profits and losses and assets and liabilities and such other matters as could also be prescribed;

(ii) Reports relating to profits and losses for every of the five financial years immediately preceding the fiscal year of the issue of prospectus including such reports of its subsidiaries and in such manner as could also be prescribed:

Provided that just in case of a company with reference to which a period of 5 years has not elapsed from the date of incorporation, the prospectus shall begin in such manner as could also be prescribed, the reports concerning profits and losses for every of the fiscal year’s immediately preceding the financial year of the issue of prospectus including such reports of its subsidiaries;

(iii) Reports made within the prescribed manner by the auditors upon the profits and losses of the business of the company for every of the five financial years immediately preceding issue and assets and liabilities of its business on the last date to which the accounts of the business were made up, being a date less than 100 and eighty days before the difficulty of the prospectus:

Provided that just in case of a company with reference to which a period of 5 years has not elapsed from the date of incorporation, the prospectus shall began within the prescribed manner, the reports made by the auditors upon the profits and losses of the business of the company for all financial years from the date of its incorporation, and assets and liabilities of its business on the last date before the issue of prospectus; and

(iv) reports about the business or transaction to which the proceeds of the securities are to be applied directly or indirectly;

(c) make a declaration about the compliance of the provisions of this Act and a statement to the effect that nothing within the prospectus is contrary to the provisions of this Act, the Securities Contracts (Regulation) Act, 1956 (42 of 1956) and therefore the Securities and Exchange Board of India Act, 1992 (15 of 1992) and therefore the rules and regulations made there under; and

(d) State such other matters and began such other reports, as could also be prescribed.

(2) Nothing in sub-section (1) shall apply—

(a) to the issue to existing members or debenture-holders of a company, of a prospectus or sort of application concerning shares in or debentures of the company, whether an applicant features a right to renounce the shares or not under sub-clause (ii) of clause (a) of sub-section (1) of section 62 in favor of the other person; or

(b) To the difficulty of a prospectus or sort of application relating to shares or debentures which are, or are to be, altogether respects uniform with shares or debentures previously issued and for the nonce dealt in or quoted on a recognized stock exchange.

(3) Subject to sub-section (2), the provisions of sub-section (1) shall apply to a prospectus or a sort of application, whether issued on or with regard to the formation of a company or subsequently.

Explanation.—the date indicated within the prospectus shall be deemed to be the date of its publication.

(4) No prospectus shall be issued by or on behalf of a company or in relation to an intended company unless on or before the date of its publication, there has been delivered to the Registrar for registration, a replica thereof signed by everyone who is known as therein as a director or proposed director of the company or by his duly authorized attorney.

(5) A prospectus issued under sub-section (1) shall not include a statement purporting to be made by an expert unless the expert may be a one that isn't , and has not been, engaged or curious about the formation or promotion or management, of the company and has given his written consent to the difficulty of the prospectus and has not withdrawn such consent before the delivery of a replica of the prospectus to the Registrar for registration and a press release thereto effect shall be included within the prospectus.

(6) Every prospectus issued under sub-section (1) shall, on the face of it,—

(a) State that a replica has been delivered for registration to the Registrar as needed under subsection

(b) Specify any documents required by this section to be attached to the copy so delivered or ask statements included within the prospectus which specify these documents.

(7) The Registrar shall not register a prospectus unless the wants of this section with reference to its registration are complied with and therefore the prospectus is amid the consent in writing of all the persons named within the prospectus.

(8) No prospectus shall be valid if it's issued quite ninety days after the date on which a replica thereof is delivered to the Registrar under sub-section (4).

(9) If a prospectus is issued in contravention of the provisions of this section, the company shall be punishable with fine which shall not be but fifty thousand rupees but which can reach three lakh rupees and each one that is knowingly a party to the issue of such prospectus shall be punishable with imprisonment for a term which can reach three years or with fine which shall not be but fifty thousand rupees but which can reach three lakh rupees, or with both.

ABRIDGED PROSPECTUS

The following shall be applicable with reference to the abridged prospectus annexed to the application form:

(a) The abridged prospectus shall be printed in A4 size sheets. The information shall be provided under the abridged prospectus as given at Annexure-C hereto.

(b) The Abridged Prospectus shall be printed:

• In Times New Roman font,

• In a font size of not less than 10,

• With a line spacing not less than 1.00 lines

• And normal character spacing with 100% scale and no condensation.

(c) A larger font size could also be used, if required, for various heads of data. All major heads shall be in uppercase and bold and in boxes. The primary level subheads shall be in bold and in boxes. The other levels of sub-heads shall be bold and underlined.

(d) The numbering shall be either continuous or with different types of numbering for various heads/ sub-heads.

(e) The appliance form shall be so positioned that on the tearing-off of the application form, not a part of the information given within the abridged prospectus is mutilated.

(f) The order of the contents within the abridged prospectus shall not be changed.

(g) Tabular formats and pointers could also be used wherever possible for efficient understanding. Instructions for filling up the shape , payment instructions and risk factors shall be in pointers and each pointer shall be during a new line.

(h) The top of each page within the abridged prospectus shall have a colored strap in bold letters incorporating the statement

In the nature of form 2a – memorandum containing salient features of the prospectus“

(i) Under the sections ‘any other information’, any information which is vital for the investor but has not been included within the other heads could also be included.

(j) Risk factors shall be so as long as they convey the risks related to the issue briefly.

(k) A reference could also be made to the prospectus wherever necessary.

The issuer and every one the concerned intermediaries are directed to suits the instructions contained during this circular effective from 30 days to the date of this circular.

This circular is issued in exercise of powers conferred under Section 11(1) and section 11A of the Securities and Exchange Board of India Act, 1992 read with Regulation 31(1) of SEBI (Issue and Listing of Debt Securities) Regulations, 2008.

This circular is out there on SEBI.

STATUTORY REQUIREMENTS IN relation to PROSPECTUS – DEEMED PROSPECTUS

(1) Where accompany allots or agrees to all or any of any securities of the corporate with a view to all or any of these securities being offered for sale to the public, any document by which the offer for sale to the public is formed shall, for all purposes, be deemed to be a prospectus issued by the company; and every one enactments and rules of law on the contents of prospectus and on liability in respect of mis-statements, in an omissions from, prospectus, or otherwise relating to prospectus, shall apply with the modifications laid out in subsections (3) and (4) and shall have effect accordingly, as if the securities had been offered to the public for subscription and as if persons accepting the offer in respect of any securities were subscribers for those securities, but without prejudice to the liability, if any, of the persons by whom the offer is formed in respect of mis-statements contained within the document or otherwise in respect thereof.

(2) For the needs of this Act, it shall, unless the contrary is proved, be evidence that an allotment of, or an agreement to allot, securities was made with a view to the securities being offered for sale to the public if it's shown—

(a) That an offer of the securities or of any of them for sale to the public was made within six months after the allotment or agreement to allot; or

(b) That at the date when the offer was made, the entire consideration to be received by the company in respect of the securities had not been received by it.

(3) Section 26 as applied by this section shall have effect as if —

(i) It required a prospectus to state additionally to the matters required by that section to be stated during a prospectus—

(a) The net amount of the consideration received or to be received by the company in respect of the securities to which the offer relates; and

(b) The time and place at which the contract where under the said securities are or are to be allotted could also be inspected;

(ii) The persons making the offer were persons named during a prospectus as directors of a company.

(4) Where an individual making an offer to which this section relates may be a company or a firm, it shall be sufficient if the document mentioned in sub-section (1) is signed on behalf of the company or firm by two directors of the company or by not but one-half of the partners within the firm, because the case could also be.

STATUTORY REQUIREMENTS IN RELATION TO PROSPECTUS – SHELF PROSPECTUS

(1) Any class or classes of companies, as the Securities and Exchange Board may provide by regulations during this behalf, may file a shelf prospectus with the Registrar at the stage of the primary offer of securities included therein which shall indicate a period not exceeding one year because the period of validity of such prospectus which shall commence from the date of opening of the primary offer of securities there under prospectus, and in respect of a second or subsequent offer of such securities issued during the amount of validity of that prospectus, no further prospectus is required.

(2) a company filing a shelf prospectus shall be required to file an information memorandum containing all material facts concerning new charges created, changes within the financial position of the company as have occurred between the primary offer of securities or the previous offer of securities and therefore the succeeding offer of securities and such other changes as could also be prescribed, with the Registrar within the prescribed time, before the difficulty of a second or subsequent offer of securities under the shelf prospectus:

Provided that where a company or any other person has received applications for the allotment of securities alongside advance payments of subscription before the making of any such change, the company or other person shall intimate the changes to such applicants and if they express a desire to withdraw their application, the company or other person shall refund all the monies received as subscription within fifteen days thereof.

(3) Where an information memorandum is filed, whenever an offer of securities is formed under subsection (2), such memorandum alongside the shelf prospectus shall be deemed to be a prospectus.

Explanation.—for the needs of this section, the expression "shelf prospectus" means a prospectus in respect of which the securities or class of securities included therein are issued for subscription in one or more issues over a particular period without the difficulty of an extra prospectus.

STATEMENT IN LIEU OF PROSPECTUS

The statement in lieu of prospectus may be a document issued by the company when it doesn't offer its securities for public subscription. The Statement in Lieu of Prospectus may be a document filed with the Registrar of the companies (ROC) when the company has not issued prospectus to the general public for inviting them to subscribe for shares. Its objective is to be filed with the registrar if the company doesn't issue prospectus.

It is mandatory for the public limited company to distribute the Prospectus but its not compulsory altogether aspects. It’s also possible to adopt an alternate to the prospectus. It’s not necessary to distribute prospectus for the corporate if the directors are ready to raise the specified funds by selling the shares and debentures to their friends and relatives. If the company used the choice of the prospectus, it'll be necessary to submit that replicate to the registrar. It's called substitute prospectus or substitute circular. This substitute holds all the things that are being required within the original prospectus and it must be signed or attested by the directors.

A statement in lieu of prospectus contains the subsequent information

• Name of company

• Account of capital

• Explanation of the business

• Names, addresses, and occupations of directors

• Probable preliminary expenses

• Names of vendors and information of property

• Substance contracts

• Director’s interests

• Least subscription

LIABILITIES FOR MIS-STATEMENT

A prospectus is issued either by or on behalf of a public company on its formation or subsequently or on behalf of a person engaged in formation of a public company.

For the aim of monetary information following reports are issued alongside prospectus:

1. Reports by auditors of the company regarding its assets and liabilities and profit and losses.

2. Reports regarding profit and losses for five preceding financial years including report of subsidiaries in such manner as could also be prescribed.

3. Reports about the securities or transaction to which proceeds of securities are to be applied directly or indirectly.

Considering the reporting liabilities of auditor, the companies Act, 2013 has also taken appropriate steps for safeguarding the mechanism by including criminal and civil liabilities.

THE SECTION FOR CRIMINAL LIABILITIES READ AS FOLLOWS

“Where a prospectus, issued, circulated or distributed under this Chapter, includes any statement which is untrue or misleading in form or context during which it's included or where any inclusion or omission of any matter is probably going to mislead, everyone who authorizes the issue of such prospectus shall be liable under section 447.

Provided that nothing during this section shall apply to a person if he proves that such statement or omission was immaterial or that he had reasonable grounds to believe, and did up to the time of issue of the prospectus believe, that the statement was true or the inclusion or omission was necessary. “

Section 447 is stringent in its way. The section provides for the punishment for fraud.

This hereby implies that any misstatement in prospectus will cause fraud and can attract section 447.

Section 447 states that without giving effect to any liability under the other law for the nonce in force any person who is guilty of fraud shall be punishable with imprisonment for a term not but six months but which can reach 10 years and shall be liable to fine not but the amount involved in fraud but may reach 3 times the fraud amount.

However, if the fraud involves public interest the term of imprisonment shall not be but 3 years.

THE SECTION FOR CIVIL LIABILITIES READ AS FOLLOWS

“Notwithstanding anything contained during this section, where it's proved that a prospectus has been issued with intent to defraud the applicants for the securities of a company or the other person or for any fraudulent purpose, every one mentioned in subsection (1) shall be personally responsible, with none limitation of liability, for all or any of the losses or damages which will are incurred by a person who subscribed to the securities on the idea of such prospectus”

In accordance with the above section the civil liabilities are going to be imposed on director of the company, issuer of prospectus, promoter of the company, one that has authorized issue of prospectus, expert mentioned in section 26.