Unit 3

Constituents of fiscal policy

Role of a government to provide public goods

- Protection of private property/ national security - The role of the government is to ensure basic law and order, which involves protecting the rights to private property. Through general taxation a government can pay for policing. A similar function of the government is to provide for national defence – paying for an army. The primary cause of the first taxes is military spending. Government raising taxes to pay for his army. Policing and courts are an example of a public good – which usually require government provision.

2. Raising taxes - The government needs to raise tax to provide public goods and public services. They can do this in multiple ways – taxes on goods (customs duties), taxes on income, taxes on people (poll tax) and tax on property and land. The government has to consider the best way of raising taxes. A good tax is efficient; easy to collect; fair.

3. Providing public services - Because of the free rider problem public goods tend to be not provided in a free market. Hence, these goods and services need to be provided by the government. Examples of public goods include street lighting, roads and law and order. There are also public services which are provided fractionally in a free market, like education and healthcare.

4. Regulation of markets - In a free market, firms were often able to create monopoly power and charge excessive prices to consumers. The government needs to regulate monopoly power, e.g. setting price limits in natural monopolies (industries like tap water and railways).

Similarly, firms may develop monopsony power and pay low wages and provide poor working conditions for workers. In this case, the government may need certain regulations on labour markets, such as minimum wages, minimum age of working and provide basic levels of health and safety.

5. Macroeconomic management. Capitalist economies can be subject to economic cycles – economic booms and recession. Recessions may lead to lost output and higher unemployment. In this situation, fiscal policy are used by the government to influence aggregate demand. In addition to trying to solve recessions, the government will also try to avoid inflation. This can involve higher taxes and higher interest rates.

6. Reducing inequality/poverty - We may see a growth in inequality and poverty, in a capitalist economy. This can be due to inherited wealth and opportunity. It can also be due to monopoly power. To ensure everyone has an equal opportunity the government may feel the need for providing education so even poor family have the opportunity to get qualifications. The government also involve in redistributing income from high earners to low-income earners.

Principles of sound and functional finance

Sound finance

According to the classical economists, fiscal policy should have the minimum range of operations and the budget should be balanced annually. They firmly stuck to the doctrine of laissez faire and say’s law of markets.

In such a system, the role of the government was expected to be restricted to traditional areas like defence, law and order, justice, provision of civic amenities and therefore most government spending was expected to be restricted to these areas.

The role of the budget and fiscal policy did not extend beyond raising funds through taxation and spending on traditional functions. The primary belief was that the size of the government’s budget should be small and the budget should balance. These beliefs form the basis of the principle of sound finance.

The following are some of the features of sound finance:

- Say’s law: The principle of sound finance are based on say’s law, that is, “supply creates its own demand.” Thus, one man’s expenditure is another man’s income, aggregate demand will always be equal to aggregate supply. This belief forms the base of the argument on which classical economists argued in favour of sound finance.

2. Full employment: The classical economists argued that there cannot be over-production and under consumption since ad = as. In other words, the economy cannot suffer from fluctuations like unemployment and inflation. The private sector will ensure optimum use of resources and aim at profit motive. Therefore, there will be full employment in the economy. Only voluntary and frictional unemployment may exist.

3. Invisible hand: Driven by profit motive, private owners of factors of production will always achieve maximum level of efficiency in their use of resources. The concept of Adam smith’s ‘invisible hand’ is used to explain how private self interest will result in collective social good.

4. Taxation: According to the classical economist taxes are harmful because they adversely affect willingness and ability to work, save and invest. Taxation was expected to be kept at a minimal limit. High progressive taxation will lead to slow economic progress.

5. Public expenditure: Government spending was expected to be in the traditional areas like defence, law and order, justice, provision of civic amenities. Since budget of the government was not expected to be large in size. Therefore, it was believed that government spending would not have any significant impact on the economy.

6. Balanced budget : In laissez faire capitalism, since all factors of production are normally owned and used by private individuals, the government can make use of such factors only by depriving the private sector. Therefore, there is no justification for the government to expand its expenditure beyond revenue and incur deficit budget. Budget should always balance except during wartime when government will have to expand expenditure to fight war. The state should not take up business activities because the private sector considered to be most efficient.

7. Market efficiency: The market mechanism is assumed to achieve maximum level of efficiency. Market failures are only temporary and the market is fully capable of correcting itself. Therefore there is no justification of any government regulation and restrictions on the market. The use of the budget to correct market failures was not considered.

8. Ricardian equivalence theorem: Budget deficits are uneconomical, harmful and socially undesirable. They lead to inflation and harm economic progress. This belief was based on Ricardian equivalence theorem. Deficits will have to be later met by raising taxes. This is known to the people and they will increase their savings to pay higher taxes later. As their savings increase, they will not increase consumption and therefore, increased public expenditure will not be able to boost demand, production and stimulate growth.

9. Political view: Sound finance is compatible with a political system that supports private ownership and minimizes government’s role. Generally, ideologically the conservative parties believe in the principle of sound finance while the more liberal parties support functional finance. However, in practice most governments have been observed to follow functional finance.

Functional finance

Major economies experienced depression in the 1920s and 1930s in Europe, and in the United States. Many economists during this period started questioning sound finance principles. During depression low profit expectations kept investment spending low, this resulted unemployment to rise. The collapse of economic expectations, resulted in giving up the sound finance principles and using government spending to stimulate the economy

During depression increased government spending would mean running a deficit budget. As private investment was not forthcoming government spending was considered necessary. Increased government expenditure in infrastructure building, job creation and paying social security would increase income. This motivate spending and aggregate demand would rise and ultimately would help pull the economy out of the depression or recession. This was later termed as ‘functional finance’ by Abba P. Lerner.

The concept of functional finance has the following features:

- Market failures: In the form of depression and hyper - inflation market failures can have severe economic consequences. The great depression of 1930s brought the powerful us economy down. In more recent times, the financial crisis of 2007-08 in the USA showed that due to excessive de-regulation, financial markets can fail and become the cause of a severe and long standing recession. Also, due to globalization, this recession has affected the economic prospects of almost every country in the world.

2. Importance of fiscal policy : Taxation, public expenditure and public debt must be adopted according to the needs of the time. While classical economists believed that the main aim of public finance is to raise revenue, modem economists believe that the main objective of public finance is to correct imbalances in the economy. In periods of inflation a policy of surplus budget must be adopted and during depression, deficit budget must be adopted.

3. Aggregate demand : Aggregate demand consists of consumption demand, investment demand, government expenditure and net foreign income. Modern economists believed that it is aggregate demand that determines level of national income and employment. Deficiency in aggregate demand results in unemployment. Government expenditure needs to be increased during such times to boost aggregate demand and to bring the economy out of depression.

4. Budget : Modern economists believe that the government, through public expenditure, taxation, or deficit financing, can maintain full employment. During recession and depression, public expenditure should be increased and the budget should be expanded to increase aggregate demand. A deficit budget is perfectly justifiable to pull the economy out of recession. On the other hand, during inflation, the government may have a surplus budget by raising taxes to control consumption.

5. Income redistribution : According to modem economists, the distribution of national income is as important as its size. A more even distribution of income would increase the average propensity to consume (apc) and would increase the level of investment and employment. Imposing high taxes on the rich and redistributing them to the poor through pension, welfare schemes and allowances. This will improve apc and increase aggregate demand, boosting investment, employment, production and profits.

6. Welfare capitalism : Keynes advocated fiscal measures for controlling capitalism and preventing its collapse. Keynes gave importance to compensatory actions through fiscal measures for improving and maintaining the level of effective demand and thus the level of economic activity in the country. The concept of functional finance forms the basis of welfare capitalism that now exists in most of the advanced economies

7. Social objectives : Public finance has to function in the interest of the entire society and not for the benefit of a select few. Every taxation, expenditure, borrowing policy and ownership and operation of public utilities must be measured on the basis of their effects on the entire society. Objective of taxation should be to redistribute income in the most socially just manner expenditure on social security, poverty eradication, medical care and education will always be justifies as they bring in distributive justice.

Key takeaways –

1. The primary belief was that the size of the government’s budget should be small and the budget should balance

2. Increased government expenditure in infrastructure building, job creation and paying social security would increase income

Fiscal policy: meaning, objectives

Fiscal policy is “a policy under which the government uses its expenditure and revenue programmes to produce desirable effects and avoid undesirable effects on the national income, production and employment.”

Arthur smithies defines fiscal policy as “a policy under which the government uses its expenditure and revenue programmes to produce desirable effects and avoid undesirable effects on the national income, production and employment.”

Fiscal policy consists of the policy relating to taxation, government spending and borrowing programmes to affect macroeconomic variables for stabilization or growth. The main aim of fiscal policy is long run stabilization of the economy.

Objectives of fiscal policy

- Full employment – The first and foremost objective of fiscal policy is to achieve and maintain full employment. If full employment is not achieved, the main motive is to avoid unemployment and to achieve a state of near full employment. The expenditure will help to create more employment opportunities and increase the productive efficiency of the economy. To expand income, output and employment a properly planned investment have a special role to play in a modern state. In rural areas unemployment can be reduced by encouraging domestic industries by providing them training, cheap finance, equipment and marketing facilities.

2. Price stability – For underdeveloped countries, there is a general agreement that economic growth and stability are joint objectives. In developing countries, in the form of inflation economic instability is manifested. Where there is a tendency to the rise in prices due to expanding trend of public expenditure in developing economies, inflation is a permanent phenomena. Fiscal policies try to remove the rigidity which cause imbalance in various sectors of the economy. To achieve the objectives of economic growth and stability fiscal measures as well as monetary measures go side by side

3. To accelerate the rate of economic growth - In a developing economy fiscal policy aims at achieving an accelerated rate of economic growth. Without stability in the economy a high rate of economic growth cannot be achieved and maintained. Fiscal measures such as taxation, public borrowing and deficit financing etc. Should be used properly so that production, consumption and distribution may not adversely affect

4. Optimum allocation of resources - Fiscal measures such as taxation and public expenditure programmes, can greatly affect the allocation of resources in various occupations and sectors. The government can push the growth of social infrastructure through fiscal measures, in order to gear the economy. The industries are attracted towards tax exemptions and tax concessions. On the other hand high taxation may draw away resources in a specific sector.

5. Equitable distribution of income and wealth – Fiscal policy emphasize the significance of equitable distribution of income and wealth in a growing economy. In such countries inequality in wealth persists as in the early stages of growth, it concentrates in few hands. To bridge the gap between the incomes of the different sections of the society, suitable fiscal policy of the government can be devised. The government should invest in those channels which provide benefit to low income groups and help in increasing productivity and technology, in order to reduce inequalities and to do distributive justice.

6. Economic stability – Fiscal measures promotes economic stability. In order to bring economic stability, fiscal measures should incorporate built-in-flexibility in the budgetary system so that income and expenditure of the government may automatically provide compensatory effect on the rise or fall of the nation’s income.

7. Capital formation and growth - In any development activity in a country capital assumes a central place and fiscal policy play an important role for the promotion of the highest possible rate of capital formation. A balanced growth is only feasible with higher rate of capital formation. Prof. Raja j. Chelliah recommends that fiscal policy must aim at the following for attaining rapid economic growth:

- raising the ratio of saving (s) to income (y) by controlling consumption (c);

- Raising the rate of investment:

- Encouraging the flow of spending into productive way;

- Reducing glaring inequalities of income and wealth.

8. To encourage investment - Fiscal policy aims at encouraging of the rate of investment in the public as well as in private sectors of the economy. Fiscal policy encourage investment in public sector which in turn effect to increase the volume of investment in private sector. Fiscal policy should aim at rapid economic development and must encourage investment in those channels which are considered most desirable from the point of view of society. The government in the early stages of economic development must try to build up economic and social overheads such like transport and communication, irrigation, flood control, power, ports, technical training, education, hospital and school facilities, so that external economies try induce investment in industrial and agricultural sectors of the economy.

Contra cyclical fiscal policy and discretionary fiscal policy

Contra cyclical fiscal policy

A counter-cyclical fiscal policy refers to strategy by the government to counter boom or recession through fiscal measures. It works against the ongoing boom or recession trend; thus, trying to stabilize the economy

For example, counter-cyclical fiscal policy actions when the economy is slowing would include increasing government spending or cutting taxes to help stimulate economic recovery.

Countercyclical fiscal policy during recession

The business cycle situation where there is slowing demand and falling growth in the economy refers to recession. Here, by fine-tuning taxation and expenditure policies the government’s responsibility is to generate demand. To create demand and producing upswing in the economy reducing taxes and increasing expenditure will help.

Countercyclical fiscal policy during boom

Economic activities will be on upswing in case of boom. Increase the boom is disastrous as it may create inflation and debt crisis and the government’s responsibility here is to bring down the pace of economic activities. To make the boom mild increasing taxes and reducing public expenditure will help. Thus, during boom, slowing down demand should be the nature of countercyclical fiscal policy.

Discretionary fiscal policy

Discretionary fiscal policy refers to government policy that alters government spending or taxes. Its purpose is to expand or shrink the economy as needed.

For instance, in 2009 when the UK government cut the vat, this was intended to produce a boost in spending.

The level of aggregate demand determines the output so a discretionary fiscal policy can be used to increase aggregate demand and thus also increase the output. This measure would help to close the deflationary gap.

Discretionary fiscal policy is a demand-side policy to influence aggregate demand that uses government spending and taxation policy.

Types of discretionary policy

- Contractionary fiscal policy – This is when the government cuts spending or raises taxes. It slows economic growth. A cut in the spending means less money goes towards government contractors and employees. This leads to reduction in job growth. A contractionary fiscal policy can be used to rein in this inflation to bring it to a more sustainable level. A contractionary discretionary policy will lower government spending and increase taxation. This policy will shift aggregate demand to the left (this denotes a decrease).

2. Expansionary discretionary fiscal policy – It is when the federal government increases spending or decreases taxes. When spending is increased, it leads to create jobs. It happens directly through public works programs or indirectly through contractors. Since, aggregate demand = consumption + investment + government spending + net exports, an expansionary policy will shift aggregate demand to the right. During recession an expansionary discretionary fiscal policy is typically used.

Key takeaways –

- A counter-cyclical fiscal policy refers to strategy by the government to counter boom or recession through fiscal measures.

- Discretionary fiscal policy refers to government policy that alters government spending or taxes

Cannon of taxation

Canons of taxation mean the characteristics or qualities which a good tax system should possess. In fact, canons of taxation are related to the administrative part of a tax. In 1776 Adam smith first devised the principles or canons of taxation .

Even in the 21st century, while imposing and collecting taxes Smithian canons of taxation are applied by the modern governments.

Types of cannon of taxation

- Cannon of equality - According to this canon, public expenditure should be distributed in such a way that it minimizes the inequalities in the distribution of income and wealth. The expenditure pattern of the government should be so incurred to benefit the poorer sections of the community. Rich people are capable of paying more taxes than poor people. Thus, justice demands that a person having greater ability to pay must pay large taxes.

2. Cannon of certainty - The tax which an individual has to pay should be certain and not arbitrary. According to a. Smith, the time of payment, the manner of payment, the quantity to be paid, i.e., tax liability, ought all to be clear and plain to the contributor and to everyone. Thus, canon of certainty embraces a lot of things. It must be certain to the taxpayer as well as to the tax-levying authority.

3. Canon of economy – It states that public money should not be misused and not result in any wastage. It implies that public expenditure should bring maximum benefit and should not produce unfavorable effect on production.

4. Canon of convenience – Tax should be imposed and collected in such a manner that it provides the greatest convenience to the government and the tax payer. In practice it should be trouble free and painless. “Every tax”, stresses a. Smith: “ought to be levied at time or the manner in which it is most likely to be convenient for the contributor to pay it.”

5. Canon of benefit – According to this principle, public money should be spent so as to promote maximum social advantages. Public expenditure benefits includes proper allocation of economic resources, proper distribution of income and wealth in society and stability of price level and growth of economy.

6. Canon of sanction – No money should be spent without sanction of the public authority. In the same way the money must be spent for the purpose it is sanctioned. There may be misuse and misappropriation of public funds in the absence of proper sanction.

7. Canon of elasticity – This implies according to the needs or circumstances there should be scope for varying the expenditure. There should not be any rigidity in public expenditure.

8. Canon of surplus – The aim of the government is at the surplus of income over expenditure. The surplus can be used to meet unavoidable deficit. Surplus can be generated by controlling public expenditure or by increasing current revenue.

9. Canon of neutrality - Canon of neutrality states that public expenditure should have no adverse effect on production and distribution activities of the economy. The result of public expenditure should be in increased production, reduced inequality of income and wealth and increased economic activity.

10. Canon of productivity - This canon states that, public expenditure of the government should encourage production and productive efficiency of the economy. Public expenditure should be always focusing towards enhancing the productive capacity of the economy.

Key takeaways –

- Canons of taxation mean the characteristics or qualities which a good tax system should possess

Factors influencing incidence of taxation

Incidence of the tax is the one who finally bears it. Therefore incidence is on the final consumers. The incidence tax remains on the person who cannot shift the burden to other person.

Impact of taxation is the producer while incidence of tax is the consumer. The impact of tax can be shifted while incidence of tax cannot be shifted.

The main factors determining the incidence and shifting of tax. The factors are: 1. Elasticity of demand 2. Elasticity of supply 3. Price acts an engine of shifting 4. Tax area 5. Time period 6. Coverage of tax 7. Availability of substitutes 8. Nature of demand for commodities 9. Business conditions 10. Types of tax 11. The policy of the government 12. Market conditions.

- Elasticity of demand - Elasticity of demand affects the shifting process. Price cannot be raised at all, if the taxed commodity is having perfectly elastic demand. Hence the incidence will be wholly on the seller. On the other hand, when the demand is perfectly inelastic, the incidence will be wholly on the buyer. The incidence of tax will be shared by the buyer and seller, in between these two extremes.

2. Elasticity of supply - The interaction between demand and supply of a commodity determines the price. Thus when the taxed commodity is having perfectly elastic supply, incidence of a tax will be fully borne by the buyer. Similarly, when the supply of a commodity is perfectly inelastic, the whole incidence will be on the seller.

3. Price acts an engine of shifting - Price act as a media of shifting. If the tax is shifted through a raise in price, it is called forward shifting. If the price cannot be rise, tax cannot be shifted. Therefore the character of price flexibility is the most important factor that determines the shift ability of a tax.

4. Tax area - The nature of the area in which the tax is levied also affect shifting of a tax. It will be difficult to shift the tax by raising the price, if the tax is imposed on a commodity, having local market. People in such a case can avoid the tax by purchasing a commodity from neighborhood market where it is cheap.

5. Time period - Time factor influence the shift ability of a tax. In the short period supply is inelastic and greater part of tax burden will be borne by the seller.

In the long-run, supply is more elastic and tax burden will be borne by the buyer. Therefore, in the short period, shifting of a tax is difficult, where as in the long period it is easy to do.

6. Coverage of tax – It is easy to shift the burden, if the tax is general in character, falling on wide range of commodities. For example, if the tax levied on tooth paste covering all brands and kinds, it will be readily shifted. If a tax is imposed on one brand of tooth paste, excluding the other brands, it is not possible to shift the tax burden.

7. Availability of substitute - Taxes imposed on a commodity having no close substitutes, can be easily shifted to the buyer. Here the buyer cannot find an alternative product as substitute to satisfy his demand. Thus, he will be ready to purchase the taxed commodity by giving higher prices. On the other hand, shifting the money burden to buyers is difficult, if the taxed product has close substitute.

8. Nature of demand for commodities - The nature of demand is different for different commodities. In the case of necessary goods, demand is inelastic. The burden of tax is higher on the buyer, than on seller. Demand is more elastic, in case of comforts, hence burden of tax will be divided between buyer and seller. In the case of luxuries, demand is elastic, the burden of tax is more on the seller. It cannot be easily shifted to the consumers.

9. Business conditions - By the existing business condition in the economy influence the shifting of tax. Taxes can be shifted more easily, during periods of rising prices and economic prosperity. However, during periods of depression, forward shifting of tax liability is very difficult.

10. Types of tax - Shifting depends upon nature or type of tax levied. Under monopoly or imperfect competition if a tax is imposed on the excess profits of a firm, the incidence will not be shifted. On the other hand, if the tax is levied on the output of the firm, a part of incidence can be shifted on to the consumers.

Key takeaways –

- Iincidence of the tax is the one who finally bears it. Therefore incidence is on the final consumers

Effects of taxation significance of public expenditure

Economic effect of taxation on production

- Effect on the capacity of work, save and invest - When people pay tax their purchasing power reduces and hence it reduces their consumption. This leads to reduction in the overall efficiency to work. Hence, the taxes should aim at increasing the person ability to work and save.

Thus taxes on liquor and tobacco are necessary as it improve person health. While taxes in necessary goods are undesirable as necessities are essential for survival. Lower income is not subject to tax as it affects their ability to work and save.

A person invest depends on the savings available to them. Tax reduces the income and they will be able to save less and hence their capacity to invest also decreases.

2. Effect on desire to work, save and invest – On the basis of the tax imposed, the person may be motivated to work more or demotivated to work less.

If income elasticity of demand is inelastic – a person will work more and earn more to meet his requirements.

If it is elastic – a person may not work hard to increase its income

If it is unity – irrespective of imposition of tax, the desire to work remain same

3. Effect on distribution of economic resources – Production depends on the resources allocated to different sectors, industries, regions, etc. Of an economy. Taxation on liquor and tobacco will discourage production and consumption. Thus tax is desirable to improve human health. While taxes in necessary goods are undesirable as necessities are essential for survival.

Effects of taxation on distribution

Taxation effects the distribution of income and wealth depending upon (a) the nature of tax and tax rate (b) kind of tax

- The nature of tax and tax rate

Under progressive taxation -The rich people beards more burden of taxation than the lower income group. Thus inequalities of income distribution are less.

Under proportional tax – inequalities increases with unproportional increase in income of individuals and remain the same if income of individuals remain the same.

Under regressive taxation – inequalities increase as the tax burden is borne by the poor and less by the rich.

- Kind of taxes –

Direct taxes are progressive in nature , thus, the rich people beards more burden of taxation than the lower income group.

Indirect taxes are regressive in nature, as the tax burden is borne by the poor and less by the rich.

Effects on economic growth

The government allocates income in various sectors like agriculture, industry, transport, communication, education, health, etc to achieve growth of the economy. Government aims at maintaining balanced economic growth. To develop backward region, government allocate more resources. This helps in reducing inequality and balanced economic growth.

Effects on economic stability

Public expenditure acts as a tool to control instability. Economic instability results in depression, recession and inflation. During deflation public expenditure are increased. On the other hand, during inflation public expenditure is reduced. Thus control of money supply brings price stability.

Social security contributions

Social contributions are paid on a compulsory or voluntary basis by employers, employees and self- and non-employed persons.

Under ESA 2010, net social contributions include employers' actual social contributions, households' actual social contributions, imputed social contributions and households' social contribution supplements. Social insurance scheme service charges are deducted from the items above to reach net social contributions.

There are two types of social contributions- actual and imputed, paid by the employer for the benefit of their employees:

Employers' actual social contributions consist of payments made by employers for the benefit of their employees to insurers (social security funds, general government and private funded schemes). In respect of insurance against social risks or needs, these payments cover statutory, conventional, contractual and voluntary contributions;

Employers’ imputed social contributions represent the counterpart to unfunded social benefits paid directly by employers to their employees or former employees and other eligible persons without involving an insurance enterprise or autonomous pension fund, and without creating a special fund or segregated reserve for the purpose.

Key takeaways –

- social contributions are paid on a compulsory or voluntary basis by employers, employees and self- and non-employed persons.

Low income support and social insurance programmes

Definition

Social insurance is a concept where the government intervenes in the insurance market to ensure that a group of individuals are insured or protected against the risk of any emergencies that lead to financial problems.

This is done through a process where individuals' claims are partly dependent on their contributions, which can be considered as insurance premium to create a common fund out of which the individuals are then paid benefits in the future. Thus, social insurance is also a concept based inherently on the work done by the individual over his life and how they will ultimately benefit from this.

Examples of social insurance include:

- Medicare, Medicaid

- Social security

- Unemployment insurance

Public debt – types

Public debt is the total amount borrowed by the government of a country to meet its operational and development expenditure. It is also referred as total liability of the government which the public income fails to meet. The different form of borrowing includes market loans, special bearer bonds, treasury bills and special loans and securities issued by the reserve bank. It also includes external debt. In the Indian context, public debt includes the total liabilities of the union government that have to be paid from the consolidated fund of India.

The state borrows to meet the following expenditures

- To meet budget deficit

- To meet the expenses of war and other extraordinary situations

- To finance development activity

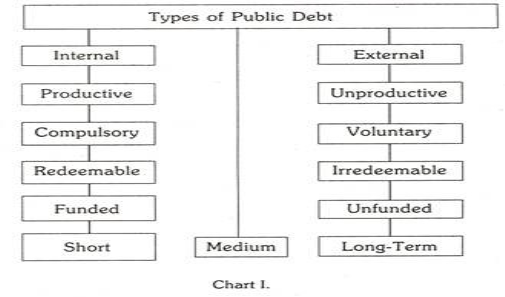

Types of public debt

Public debt is classified into various categories:-

- Internal and external debt

- Short term and long term loans

- Funded and unfunded debt

- Voluntary and compulsory loans

- Redeemable and irredeemable loans

- Productive and unproductive debt

|

Internal and external debt

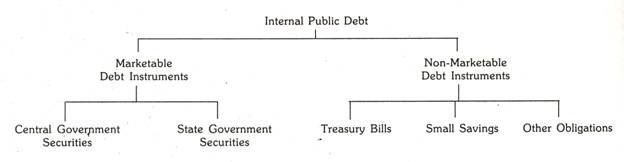

Money owed to the citizens and institutions are called internal debt. Government loans floated within the country are referred as internal debt. Such debt is borrowed by individuals and institutions within the country. Internal debt has no direct money burden as the government collects from interest payment on debt and imposition of taxation which is transfer of resources from one to another group. Sum borrowed from internal debt are spent on development activities.

Internal debts are classified as follows

|

- Marketable debt instruments – These are securities held for longer than one year. This includes central government securities and state government securities.

- Dated loans issued by the government to reserve bank of India in exchange of treasury bills outstanding.

- Treasury bills are issued for short term by the government. Tenure of such issue are 90 to 180 days

- Small savings are post office savings bank deposits, cumulative time deposits, post office recurring deposits, national defence certificates, 15-year annuity certificates, national savings certificates, national savings annuity scheme, national development banks, national savings account, Indira Visas Patra, Kisan Vikas Patra.

Money owned to foreigners is called external debt. Government loan floated outside the country market ie. Foreign capital market is referred as external debt. Such debts are borrowed from foreign nationals, foreign governments, and international financial institutions. External debt has direct money burden as the government has to pay interest as well as principal amount for a given period of time to the external creditors.

Short term and long term loans

According to their duration, loans are classified as short term, medium term and long term. Short term loan mature within 3 to 9 months. Short term loans are treasury bills which mature with 90 days. Interest rate for short term debt is very less.

Long term loans mature after a long period exceeding five years or more. Government comes to the public for long term loans. Long term loans bear high rate of interest. Long term debt are raised for development purpose

Medium term loans mature with 1 to 5 years. It falls between short term and long term loans bearing intermediate interest rate. Such loans are raised during war, relief work, etc.

Funded and unfunded debt

Funded debts are long term debt which is repayable after the duration of at least a year. For repayment of such debt government maintains a separate fund called funded debt. The securities of funded debt are marketable on the stock exchange.

On the other hand unfunded debt are for short duration and repayable within a year. To meet the current needs unfunded debt are raised. Repayment of such debt is made by public revenue; no separate fund is maintained by the government. It’s also referred as floating debt.

Voluntary and compulsory loans

Loans borrowed by the government using coercive methods are referred as compulsory loans. In case of emergency such as war, natural calamities, etc government force the people to lend money. Tax payers have to pay tax, in case of default then they are punishable.

Loan given by the nationals on their own will and ability are called voluntary loans. Government Issue securities to the public. Based on their wish they purchase securities subscribed by the government from institution like commercial banks. Public debt is voluntary in nature.

Redeemable and irredeemable debt

Based on the maturity, public debt is classified into redeemable and irredeemable debt. Redeemable debt referred to loans which the government promises to pay off at some future date. After the maturity, government pays the interest and principal to the lenders. It is also called terminable loans. This is mostly preferred by the creditors.

Under irredeemable debt, government does not make any promise to pay the principal amount. No maturity date is fixed. The government only agrees to pay interest regularly. Such debts are issued for long duration and the society are burden with the consequence of perpetual debt.

Productive and unproductive debt

Based on purpose of loan, public debt is classified into productive and unproductive debt. Productive debt are referred as loan rose by the government which are invested in productive assets such as railways, irrigation, multipurpose projects etc., it is also called reproductive debt. This leads to increasing the income of the government to pay the interest as well as principal amount. This helps in increasing the productive capacity of the economy. Productive debt is self liquidating in nature

Unproductive debts are also called as deadweight debt. It refers to loan borrowed by government for unproductive purpose such as relief work, financing war, etc. Unproductive loans do not add to the productive capacity of the economy. Unproductive debt adds burden to the community as to repay the loan government will impose additional taxation.

Public debt and fiscal solvency

Public debt is the total amount borrowed by the government of a country to meet its operational and development expenditure. It is also referred as total liability of the government which the public income fails to meet. The different form of borrowing includes market loans, special bearer bonds, treasury bills and special loans and securities issued by the reserve bank. It also includes external debt. In the Indian context, public debt includes the total liabilities of the union government that have to be paid from the consolidated fund of India.

The state borrows to meet the following expenditures

- To meet budget deficit

- To meet the expenses of war and other extraordinary situations

- To finance development activity

Fiscal solvency

Definition

Financial solvency is defined as the ability of a person, business or organization to pay their debts and have cash to pay for future needs.

Burden of debt finance

Public debt constitutes the financial obligation or liabilities of the government. Debt burden is measured as ratio of outstanding debt to GNP

• Debt= outstanding debt/ GNP

Burden of public debt consist of the sacrifice that tax payer have to make for financial repayment of principle and interest.

Burden of internal debt - since the interest payment on debt and the imposition of taxation to pay interest to the lenders is simply a transfer of purchasing power from one to another, thus internal debt has no direct money burden. In case of internal debt, money is borrowed from individuals and institutions within the country.

Burden of external debt - during a given period, the direct money burden of external debt is the interest payment as well as the principal repayment (i.e., debt servicing) to external creditors. The direct real burden of such external borrowing is measured by the sacrifice of goods and services which these payments involve to the members of the debtor country.

There is also indirect money burden of external debt. Loan repayment by the debtor country implies more exports of goods and services to the creditor country. Thus a debtor country experiences a fall in welfare of the community.

Measurement of burden debt

- Income – debt ratio –

It is estimated as: size of public debt/national income = d/y

If y remains at a very high level, the burden of debt, d, will be insignificant. However, if the ratio becomes high, debt then poses a great burden.

2. Debt- service ratio – the ratio is defined as

Annual interest payments of borrowing/national income = I/y

Increase in y means lower debt-service ratio. However, taxes are collected for the repayment of public debt. Thus, this ratio indicates the necessity of imposing higher taxes.

3. Debt service – tax revenue ratio - it is worked out as:

Annual interest payments/aggregate tax revenue = I/t

An increase of this ratio indicates the financial weaknesses of the government.

Key takeaways –

- Public debt constitutes the financial obligation or liabilities of the government. Debt burden is measured as ratio of outstanding debt to GNP

Union budget - structure

Definition

According to article 112 of the Indian constitution, the union budget of a year, also referred to as the annual financial statement, is a statement of the estimated receipts and expenditure of the government for that particular year.

Union budget keeps the account of the government's finances for the fiscal year that runs from 1st April to 31st march. Union budget is classified into revenue budget and capital budget.

Revenue budget includes the government's revenue receipts and expenditure. There are two kinds of revenue receipts - tax and non-tax revenue. Revenue expenditure is the expenditure occurred on day to day functioning of the government and on various services offered to citizens. The government incurs a revenue deficit, if revenue expenditure exceeds revenue receipts.

Capital budget includes capital receipts and payments of the government. The government's capital receipts includes loans from public, foreign governments and RBI . Capital expenditure is the expenditure on development of machinery, equipment, building, health facilities, education etc. When the government's total expenditure exceeds its total revenue fiscal deficit is incurred.

Deficit concept

Deficit is the amount by which the spends done in a budget exceed the earnings. The government deficit is the amount of money in the budget set by which the government spending exceeds the revenue earned by the government. It represents a picture of the financial health of the economy. To minimize the deficit the government may reduce a few expenditures and also rise revenue.

There are several measures that capture government deficit such as :

- Revenue deficit

- Fiscal deficit

- Primary deficit

Revenue deficit

The revenue deficit refers to the surplus of government’s revenue expenditure over the revenue receipts.

Revenue deficit = revenue expenditure – revenue receipts

This deficit only includes current income and current expenses. A high degree of deficit means that the government should reduce its expenditure. The government raises its revenue receipts by rising income tax. Another corrective measure to minimize revenue deficit is disinvestment is selling off assets.

Fiscal deficit

Fiscal deficit is the difference between the government’s total expenditure and its total receipts, and this excludes borrowing.

Gross fiscal deficit = total expenditure – (revenue receipts + non-debt creating capital receipts)

Through borrowing the fiscal deficit has to be financed. Hence, it indicates the total borrowing necessities of the government from all the possible sources.

Gross fiscal deficit = net borrowing at home + borrowing from RBI + borrowing from abroad

Primary deficit

A primary deficit is the amount of money that the government requires to borrow apart from the interest payments on the formerly borrowed loans.

The aim of computing the primary deficit is to concentrate on current fiscal imbalances. To attain an approximate of borrowing on account of current expenditure overreaching revenues known as the primary deficit.

Gross primary deficit = gross fiscal deficit – net interest liabilities

Net interest liabilities comprise of interest payments – interest receipts by the government on net domestic lending.

Fiscal responsibility and budget management act

In revised estimates 2019-20 fiscal deficit is estimated of 3.8% and 3.5% for budget estimates (be) 2020-21. Finance had set a fiscal deficit target of 3.3 percent for the fiscal (fy 2019-20) year.

In the year 2000 by Atal Bihari Vajpayee government introduced the fiscal responsibility and budget management (frbm) bill in the parliament of India for providing legal backing to the fiscal discipline to be institutionalized in the country.

Subsequently, the frbm act was passed in the year 2003. It is an act of the parliament that set targets for the government of India to establish financial discipline, improve the management of public funds, strengthen fiscal prudence, and reduce its fiscal deficits.

Latest changes in frbm act with interim budget 2019-20

On Feb. 1, 2019 the interim budget for the financial year 2019-20 was presented, in the parliament.

The following changes have been incorporated, as per the latest data:

- Fiscal deficit fix at 3.4% of GDP for 2019-20.

- In 2019-20, total expenditure rises by 13.30% over 2018-19 re.

- 35.6% increase in allocation for welfare of scs, 28% for sts.

- Disinvestment target of rs. 90,000 crore set for 2019-20

The elimination of revenue deficit and bringing down the fiscal deficit was the primary objective of this act.

The other objectives included:

- Within the country introduction of a transparent system of fiscal management

- Over the years ensuring equitable distribution of debt

- Ensuring fiscal stability in the long run

The act for managing inflation in India given the required flexibility to the central bank.

- The act mandated that the following must be placed along with the budget documents annually in the parliament:

- Macroeconomic framework statement

- Medium term fiscal policy statement and

- Fiscal policy strategy statement

- It was proposed that the four fiscal indicators i.e, revenue deficit as a percentage of GDP, fiscal deficit as a percentage of GDP, tax revenue as a percentage of GDP, and total outstanding liabilities as a percentage of GDP be projected in the medium-term fiscal policy statement.

Targets and fiscal indicators as per the FRBM act

After the enactment of the frbma, the central government agreed to the following fiscal indicators and targets,

- Revenue deficit to be eliminated by the 31st of march 2009. A minimum annual reduction of 0.5% of GDP.

- Fiscal deficit to be brought down to at least 3% of GDP by 31st of march 2008. A minimum annual reduction – 0.3% of GDP.

- Total debt to be reduced to 9% of the GDP. An annual reduction of – 1% of GDP.

- The purchase of government bonds by RBI must cease from 1 April 2006.

Key takeaways –

- It is an act of the parliament that set targets for the government of India to establish financial discipline, improve the management of public funds, strengthen fiscal prudence, and reduce its fiscal deficits.

Reference

- Business economics by H.L Ahuja

- Business economics application and analysis by Dr. Raj Kumar

- Business economics by T Aryamala

- Business economics by SK Agarwal