Unit 4

International Environment

The international environment of business comprises of a country's foreign policy, bilateral relations, international agreements (like WTO), the policies of trading blocs (like European Union, NAFTA ASEAN, etc.), the import export policy, monetary policies etc., other factors like war, civil disturbances, political instability etc. have also an effect on international environment.

Business units engaged in import or export trade or domestic units using imported raw materials, technology or machinery are affected more by a minor change in international environment. Further, business units engaged in export marketing are influenced by depression or boom in international market.

In recent years, the international environment has changed significantly. The developments in transport and communication systems have brought countries closer to each other. Today, global market is emerging out together single market. Under such situations, companies like multinational corporations are likely to dominate the world market.

The present international environment is not favorable for business growth and expansion due to recession in Europe and other countries. Business units particularly connected with import-export should continuously monitor the international environment, identify and make use of opportunities for the betterment of company and country.

The General Agreement on Tariffs and Trade (GATT) has its origin in 1947 at a conference in Genera where negotiations between some 23 nations resulted in an intensive set of bilateral trade concession which were then extended to all participants and incorporated during a General Agreement. GATT was founded at the wake of world war II so as to stop the recurrence of protectionism policies of the then industrialized states which had resulted prolonged recession within the West before the war.

Objectives:

The main objectives with which GATT was founded included:

(a) Raising standard of living;

(b) Ensuring full employment and a large and steadily growing volume of real income and effective demand;

(c) Developing the total use of the resources of the globe and

(d) Expansion of production and international trade.

The negotiating and contracting parties to the general Agreement aim at contributing to the objectives, given above, by stepping into reciprocal and mutually advantageous arrangements directed to the substantial reduction of tariffs and other barriers to trade and to the elimination of discrimination in international trade. Thus the GATT aimed toward fulfilling its objectives through the promotion of free and multilateral trade. at the present, altogether 132 countries including India are the members of GATT.

Fundamental Principle:

The final aim of GATT in to determine a free multilateral trading system and liberalisation of international trade, elimination of discrimination in international trade and also by reducing all kinds of trade barriers. so as to achieve such objective, GATT has adopted certain principles to forbid unfair trade practices and also to set a code of conduct for all the participants of trading activities.

The following are a number of these fundamental principles:

(i) Trade should be conducted on non-discriminatory basis.

(ii) All quantitative restrictions on trade are to be prohibited.

(iii) All trade disputes should be settled through consultations within GATT’s framework.

(iv) Through a series of multilateral negotiations of GATT rounds tariff reductions are to be accomplished.

Rounds of worldwide Trade Talks under GATT:

First Round: Geneva April 1947

In the first round of talks held in Geneva in 1947, 23 countries, which had formed GATT, exchanged tariff concessions on 45,000 products worth 10 billion US dollars of trade every year. This affected 10% of total Global Trade.

Second Round: Annecy Round – 1950

The second round happened in 1949 in Annecy, France. 13 countries took part within the round. The main focus of the talks was more tariff reductions, around 5000 total.

Third Round Torquay Round – 1951

The third round occurred in Torquay, England in 1951. 38 countries took part within the round. 8,700 tariff concessions were made totalling the remaining amount of tariffs to three-fourths of the tariffs which were in effect in 1948. The contemporaneous rejection by the U. S. of the Havana Charter signified the establishment of the GATT as a governing world body.

Fourth Round Geneva Round – 1955-1956

The fourth round returned to Geneva in 1955 and lasted until May 1956. 26 countries took part within the round. $2.5 billion in tariffs were eliminated or reduced.

Fifth Round Geneva (Dillion) Round – 1960-1962

The fifth round occurred another time in Geneva and lasted from 1960 to 1962. The talks were named after U.S. Treasury Secretary and former Under Secretary of State, Douglas Dillon, who first proposed the talks. 26 countries took part within the round. Alongside reducing over $4.9 billion on 4400 items in tariffs, it also yielded discussion concerning the creation of the ecu Economic Community (EEC).

Sixth Round Kennedy Round – 1964-1967

With the formation EEC, the US had been put at a disadvantage. As a reaction to the present, the us congress passed the Trade Expansion Act in October 1962 which authorised the Kennedy administration to form 50 per cent tariff reduction altogether commodities. This paved the way for the opening of the Kennedy round of trade negotiations at Geneva in May 1964, which were to be completed by 30 June 1967.This round had the participation of 62 countries and negotiated tariff reductions of roughly $ 40 billion, covering about four-fifths of the world trade. the major industrial countries during this group applied substantial cuts on their dutiable imports, e.g. as much as 64 per cent cuts within the case of the u. s., 3 per cent in case of England , 30 per cent in case of Japan, 24 per cent in case of Canada. They left the US and European tariff on the manufactured goods within the range of 5 to 15 per cent. However, with reference to agricultural products, the negotiations had lesser success. They agreed on a mean duty reduction of 25 per cent on agricultural items. Non-tariff obstacles too remained untouched and scant attention was paid to the issues of developing countries. In IMF study revealed that weighted average tariff for all industrial products had been reduced to 7.7 per cent, 9.8 per cent on finished manufactured products, 8 per cent on semi-finished products and a couple of per cent on raw materials. Thus trade industrial products after the completion of Kennedy Round was substantially freed from restrictions.

Seventh Round Tokyo Round – 1973-1979

Reduced tariffs and established new regulations aimed toward controlling the proliferation of non-tariff barriers and voluntary export restrictions. 102 countries took part within the round. Concessions were made on $190 billion worth. The Seventh Round of Multilateral Trade Negotiations (MTN) was launched in September 1973 under the auspices of GATT. Its objectives were laid down within the Tokyo Declaration. The Declaration began a far-reaching programme for the negotiations in six areas. These are

- Tariff reduction

- Reduction of elimination of non-tariff barriers

- Coordinated reduction of all trade barriers in selected sectors

- Discussion on the multilateral safeguard system

- Trade liberalisation within the agricultural sector taking under consideration the special characteristics

- Special treatment of tropical products

- It also emphasized that MTN must take under consideration the special, interests and problems of developing countries.

Eighth Round Uruguay Round – 1986-1993

The Eighth Round of GATT negotiations which began at Punta Del Esta in Uruguay in September 1986 need to have been concluded by the end of 1990. But at the ministerial meeting in Brussels in December 1990, an impasse was reached over the area of agriculture and therefore the talks broke down. The talks were restarted in February 1991 and continued till August 1991. On 20 December 1991. Aurthur Dunkel, the then Director-General of GATT tabled a Draft Final Act of the Uruguay Round, referred to as the Dunkel Draft Text. This was a take-it-or-leave-it” document which was hotly discussed at various fora within the member countries through 1992 till July 1993 when the then Director General, Sutherland relaunched the negotiations in Geneva. On 31 August 1993, the Trade Negotiations Committee (TNC) passed a resolution to conclude the Uruguay Round by 15 December. On 15 December 1993 at the ultimate session, Chairman Sutherland declared that seven years of Uruguay Round negotiations had come to an end. Finally, on 15 April 1994, 123 Ministers of member countries ratified the results of the Uruguay Round at Marrakesh (Morocco) and therefore the GATT disappeared and passed into history and it had been absorbed by the world Trade Organization (WTO) on 1 January 1995. The Uruguay Round of trade negotiations undertaken by the GATT since its establishment in 1947 had a wide agenda. The GATT originally covered international trade rules within the goods sector only. Domestic policies were outside the GATT purview and it operated only at international border. Within the Uruguay Round, the GATT extended to 3 new areas, viz. intellectual property rights services and investment. It also covered agriculture and textiles, which were outside the GATT jurisdiction.

The final year embodying the results of the Uruguay Round of Multilateral Trade Negotiations comprises 28 Agreements. It had two components: the WTO Agreement and therefore the Ministerial decisions and declarations. The WTO Agreement covers the formation of the organisation and therefore the rules governing it’s working. Its Annexures contain the Agreements covering trade in goods, services, intellectual property rights, plurilateral trade, GATT Rules 1994, dispute settlement rules and national trading policy review. The Uruguay Round was concerned with two aspects of trade goods and services. the first associated with increasing market access by reducing or eliminating trade barriers. Reductions in tariffs, reductions in non-tariff support in agriculture, the elimination of bilateral quantitative restrictions, and reductions in barriers to trade in services met this. The second associated with increasing the legal security of the new levels of market access by strengthening and expanding rules and procedures and institutions.

The World Trade Organisation (WTO) came into existence on January 1, 1995 replacing GATT, with a membership of 81 countries. The membership has since increased to 164 countries.

- Principles of WTO

The important principles governing the WTO are the following:

1. Non-discrimination: The principle of non-discrimination has two dimensions, that is, the most favoured nation (MFN) and the national treatment.

(a) Most-favoured Nation (MFN): It means treating other people equally. The essence of WTO is a commitment on the part of each signatory to give all other signatories the MFN status. MFN means that each member should treat all the other members equally as the most favoured trading partner. Thus, product made in members' own countries are treated no less favourably than goods originating from any other country. The MFN rule forbids discrimination between the national or other member.

(b) National Treatment: It refers to treating foreigners and locals equally. The national treatment clause forbids discrimination between a member s own nationals and the nationals of other members. Each member should accord to the nationals of other member’s treatment no less favourable than that it gives to its own nationals with respect to copyrights, patents, trademarks, etc. The foreign products should not be treated less favourably than identical domestic products. Thus, it becomes very difficult for a contracting party to prevent foreign products from competing with domestic products.

2. Freer Trade: Lowering trade barriers is one of the most important means of encouraging trade. The WIO agreements allow countries to introduce changes gradually, through "progressive liberalisation". Developing countries are usually given longer time to fulfil their obligations.

3. Predictability: The multilateral trading system is an attempt by governments to make the business environment stable and predictable. The predictability is achieved through binding and transparency. In the WTO, when countries agree to open their markets tor goods and services, they "bind their commitments. For goods, these bindings amount to ceilings on customs tariff rates. A country can change its bindings but only after negotiating with its trading partners, which could mean compensating them for loss of trade.

The system tries to improve predictability and stability by discouraging the use of quotas and other measures used to set limits on quantities of imports, and also by making countries' trading rules as clear and transparent (public) as possible.

4. Promoting Fair Competition: The WTO is sometimes described as a free trade" institutions, but that is not entirely accurate. The system does allow tariffs and, in limited circumstances, other forms of protection. More accurately, WTO is a system of rules dedicated to open, fair and undistorted competition.

5. Encouraging Development and Economic Reforms: WTO system contributes to development and economic reform in the developing countries. The WIO agreements themselves inherit the earlier provisions of GATT that allow for special assistance and trade concessions for developing countries. The WTO has special concern for developing countries, especially least developed countries. They have been given more time to adjust, greater flexibility and special privileges.

- Functions of WTO

1. Administrative Functions: WTO facilitates the implementation, administration, and operation and further the objectives of WTO and Multilateral Trade Agreements and also provides framework for the implementation, administration and operation of Plurilateral Trade Agreements.

2. Platform for negotiations: WTO provides a platform for negotiations among the members concerning their multilateral trade relations in matters dealt under WTO agreements.

3. Execution: WTO has to administer the understanding on Rules and Procedures governing the settlement of Disputes.

4. Administering TPRM: WTO has to administer the Trade Policy Review Mechanism (TPRM).

5. Economic Coherence: WTO works with a view to achieving greater economic coherence in global economic policy making, cooperating as appropriate, with IMF and World Bank.

The Organisation: The WTO is run by its member governments. All major decisions are made by the members as a whole, either by ministers (who meet at least once in every two years) or by their administers or delegates (who meet regularly in Geneva). Decisions are normally taken by consensus. The last Ministerial Conference was held in Buenos Aires, Argentina, 10-13 December, 2017.

Status: WTO is officially defined as "the legal and institutional foundation of the multilateral trading system". Unlike GATT, the WTO is a permanent organisation created by international treaty ratified by the governments and legislatives of member countries.

As the principal international body concerned with solving trade problems between countries and providing a forum for multilateral trade negotiations, it has global status similar to that of the International Monetary Fund and the World Bank. But unlike them it is not a United Nations agency although it has a co-operative relationship with the United Nations.

The WTO is different from the World Bank and the IMF. In the WTO power is not delegated to a board of directors or the organisations head. When WTO rules impose disciplines on countries policies that is the outcome of negotiations among WIO members. Thus, at resent, the WTO is member-driven, consensus-based organisation.

WTO Structure: The WIO is headed by a director general who has four deputies from different member states. The WTOs ruling body is the General Council comprising each member country's permanent envoys. It sits in Geneva on an average of once a month. Its supreme authority is the Ministerial Conference.

The Ministerial Conference is composed of representatives of all WTO members. It is required to be held every two years. The First Ministerial conference was held in Singapore on 9-13 December 1996.It can take decisions on all matters under any of the multilateral trade agreements.

WTO AND ITS IMPLICATIONS ON DEVELOPING NATIONS

Participation in WTO has implications on foreign trade and development of developed as well as developing nations such as India. Although the ultimate goal of WIO is to free world trade in the interest of all nations of the world, yet in reality the WTO agreements have benefited the developed nations more as compared to developing ones. This is because; the developed countries of Europe and America have powerful influence on the WTO agreements.

The impact of WTO on developing countries is explained as follows:

I. NEGATIVE IMPACT:

1. Impact of TRIPs Agreement: The TRIPs Agreement favours the developed countries as compared to developing nations Under TRI's Agreement, protection is given to patents copyrights, etc. The firms from developed nations hold large number of patents Due to huge financial resources, technology and skills, the firm from developed countries develop products and get them patented.

Firms from developing countries have to pay huge royalties or fees to use the patented products. For instance, Indian farmers have to pay high price for BT cotton seeds of Monsanto Chemicals.

2. Impact of TRIMs: Agreement on TRIMs provides for treatment of foreign investment at par with domestic investment. Due to TRIMs Agreement, developing countries including India have withdrawn a number of restrictions on foreign investment.

TRIMs Agreement favours the firms from developed nations. Due to huge financial and technological resources at their disposal, the MNCs from developed countries invest heavily and play a dominant role in developing countries. Besides foreign firms are free to remit profits and royalties to the parent company, thereby, causing foreign exchange drain on developing nations.

3. Impact of GATS: The Uruguay Round included trade in services under WTO. Under the GATS agreement, the member nations have to open up the services sector for foreign companies. The developing countries including India have opened up the services sector in respect of banking, insurance communication, telecom, transport, etc. to foreign firms. The domestic firms of developing countries may find it difficult to compete with giant foreign firms due to lack of resources and professional skills.

4. Impact of Reduction in Tariffs: As per the WTO agreement the developing countries have to reduce the tariff barriers. As a result of this, the developing countries have resorted to reduce tariffs in a phased manner. For instance, India has reduced the peak customs duty on non-agricultural goods to 10% (in 2008).

As the protection to domestic industry gradually disappears, the firms in developing nations have to face increasing competition from foreign goods.

5. Impact on Small Sector: WTO does not discriminate industries on the basis of size. Small sector (micro and small enterprises MSEs) has to compete with large sector. Therefore, as per WTO agreement, India has withdrawn reservation of items for small scale sector in a phased manner since 2000.

By February 2008, India has withdrawn reservation for small sector of over 750 items. In April 2015, the remaining 20 items reserved for MSEs are also deserved.

Due to reservation, the small units have to compete with large industries and also from cheaper imports. As a result, several small firms have become weak or sick during the past couple of years.

6. Impact on Agriculture: The developing countries India and China are among the largest producers of agricultural items like vegetables, fruits, food grains, etc. Forever, the agricultural productivity is low as compared to other countries. Due to low productivity, the farmers from developing countries stand to lose in the world markets.

The WTO agreement on agriculture has only in theory favoured the developing countries. But in practice, its implication has affected agricultural exports of developing countries to world markets (as the developed countries provide lot of subsidies to their exporters).

II. POSITIVE IMPLICATIONS:

The positive impacts of WTO on developing countries are viewed from the following aspects:

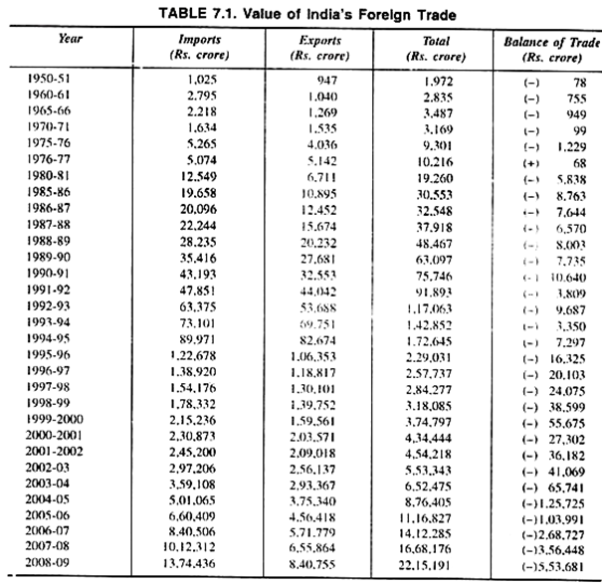

1. Growth in Merchandise Exports: The exports of developing countries like India, China, Brazil, etc. have increased since the setting up of WTO. The increase in exports of developing countries is due to reduction in trade barriers — tariff and non-tariff. For instance, India s merchandise exports have increased since 1995.

India's Merchandise Exports

Year | US $ Billion |

1995-96 | 32 |

2010-11 | 251 |

2014-15 | 316 |

2015-16 | 262 |

2016-17 | 275 |

2. Growth in Services Exports: The WTO has also introduced an agreement on services called GATS. The opening up of trade in services like banking, insurance, telecommunications and shipping to foreign companies is going to impact on the services sector of the developing countries like India in a major way, as the development of services in these sectors in the developed countries far outstrips that in the developing world.

For instance, India's services exports have increased from about 5 billion US $ in 1995 to 160 US $ billion in 2017. The software services accounted for over 50% of the services exports of India in 2017.

3. Foreign Direct Investment: As per the TRIMs agreement restrictions on foreign investment have been withdrawn b member nations of WTO including developing countries Therefore, the developing countries like Brazil, India, China etc. have been benefited by way of foreign direct investment additionally as by Euro equities and portfolio investment. In 2016-17, FDI net inflows (Inflows less Outflows) in India was US $ 38 US $ billion as against 3.3 US $ billion in 2000-01.

4. Textiles and Clothing: It is estimated that the textiles sector would be one of the major beneficiaries of the impact on Uruguay Round. At the Uruguay Round, it was agreed upon by member countries to phase out MFA by 2005, Under MFA, the developed countries like France, USA, UN Canada, etc. used to impose quotas on textile exporting countries. The MFA has been withdrawn w.e.f. 1.1.2005, and thus, it might benefit the developing countries including India by way of increase in export of textiles and clothing.

5. Benefits of TRIPs Agreement: The TRIPs agreement has benefited the developing countries like Brazil. India, China and others. The firms in developing countries have also developed new products and got them patented. Developing countries have also benefited by way of GIS status. For instance, India has obtained GIS for products like Darjeeling Tea, Goa Feni so on.

Conclusion:

It can be concluded that the WTO has created both a positive and negative impact on developing countries. It is expected that the developing countries like Brazil, India. China, South Korea would greatly benefit from WTO agreements in the coming years provided they make efforts to improve efficiency and international competitiveness.

TRIPS TRADE-RELATED ASPECTS OF INTELLECTUAL PROPERTY RIGHTS AGREEMENT

The WTO's Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPs) introduced intellectual property rules into the multilateral trading system for the first time.

Ideas and knowledge are increasingly important part of trade. Mo of the value of new medicines and other high technology product lies in the amount of invention, innovation, research, design and testing involved. Films, music recordings, books, computer software and on-line services are bought and sold because of the information and creativity they contain. Many products that used to be trade as low-technology goods or commodities now contain a higher proportion of invention and design in their value.

The "intellectual property rights" take a number of forms such a copyright, patent, trademarks, geographical indications, industrial design, lay-out designs and so on. Developed countries are mostly the owners of intellectual property while developing countries are mostly the users of intellectual property.

The extent of protection and enforcement of these rights varied widely around the world. The WIOs TRIPs Agreement is an attempt to narrow the gaps in the way these rights are protected around the world, and to bring them under common international rules. Establishes minimum levels of protection that each government has to give to the intellectual property of fellow WTO members

The Agreement on TRIPs provides norms and standards for all area of intellectual property including copyrights and related rights, trade marks, geographical indications, industrial designs, patents, layout designs of integrated circuits and protection of undisclosed information. Patents will be available for any invention whether product or process in all fields of industrial technologies. Patent protection is also extended to microorganisms, non-biological and micro-biological processes and plant varieties. Thus, the entire industrial and agricultural sectors and to some extent the bio technology sector will also be covered under the patent protection.

Each country is required to build adequate procedures and remedies into its domestic laws to ensure the effective enforcement of IPRs Such remedies must be made available to foreign property right holders. Disputes over the TRIPs agreement are to be governed by the WIO dispute settlement procedures.

When the WTO agreements took effect on 1 January 1995, developed countries were given one year to ensure that their laws and practices conform with the TRlP's Agreement. Developing countries were given five years, until 2000. Least developed countries have 11 years, until 2006 which was extended to 2016 for pharmaceutical patents. If a developing country did not provide product patent protection in a particular area of technology when the TRIPs Agreement came into force, it has up to 10 years to introduce the protection.

Impact on Developing Countries: Stricter IPR regime under their TRI's agreement can have the following effects on the developing countries.

(a) It may result in price increases in areas where IPR protection has been strengthened. The impact on prices is likely to be more on pharmaceuticals and chemical products.

(b) Better IPR protection could exert a favourable effect on the supply of innovations.

(c) Developing countries could benefit to the extent that they are actual or potential producers of new technology.

(d) The transfer of technology intensive stages of production to developing countries may have been hindered by weak IPR protection regime. The IPR protection could help the transfer of R&D.

In spite of its possible benefits, it is generally believed that the short run impact of the TRIPs agreement on the developing countries is likely to be negative.

GATS (GENERAL AGREEMENTS ON TRADE SERVICES)

The General Agreement on Trade in Services (GATS) is the first and only set of multilateral rules governing international trade in services. It was incorporated in response to the huge growth of the services economy over the past 30 years and the greater potential for trading services brought about by the communications revolution.

The General Agreement on services has two major across the board requirements. The first is non-discrimination on the basis of the most favoured nation (MFN) and the second is transparency. There is no requirement for an across the board opening up of the services sector. Prior to the Uruguay Round, there was no common set of rules and disciplines governing trade in services.

- Objectives: The agreement has 3 main objectives:

(i) To create a multilateral framework of principles and rules for trade in services, including the elaboration of possible disciplines for individual sectors.

(ii) To expand trade in services under conditions of transparency and progressive liberalisation.

(iii) To promote the economic growth of all trading partners and the development of developing countries.

- Important Features of Agreement

1. The General Agreement on Trade in Services (GATS) provides a set of multilateral rules which should govern trade in services under conditions of transparency and progressive liberalisation.

2. It spells out certain general obligations such as extension of MFN principles maintenance of transparency and progressive liberalisation.

3. Complete coverage of all service sectors with no service activity being excluded.

4. An obligation to provide national treatment and market access to service suppliers of other members.

5. An obligation not to discriminate between service suppliers of other members (the MFN obligation).

6. Increasing participation in world trade in services for developing countries.

7. Members are free to decide which services will be subject to market access and national treatment commitments in their national schedules.

The Agreement provides flexibility for developing countries to pursue their own development priorities and to open fewer sectors or to liberalize fewer types of transactions in further negotiations.

Narrow Impact: The scope and potential impact of GATS is quite narrow due to the adoption of "positive list" approach to negotiations. Under this approach, countries volunteer the sectors that they wish to open up, as well as the nature of concessions they propose to grant. The positive list approach was favoured by developing countries, since it allowed them to choose the sectorial coverage and extent of liberalisation depending on their development policy objectives.

Countries were required to make binding commitments in terms o market access and national treatment. It is up to each country to decide how far it wishes to go on specific commitments. The initial result of commitments is to introduce transparency, and their binding nature is an assurance that these rules cannot be arbitrarily tightened. All commitments under GATS are non-discriminatory.

There were only limited results achieved by GATS at the Uruguay Round. Therefore, it was decided to continue negotiations in at least three areas i.e., movement of natural persons, financial services and basic telecommunications.

Impact on developing countries: A number of developing countries have taken the opportunity the GATS provides to schedule commitments thereby binding their own domestic reform process. Improvements in the quality of services that will result from liberalization and increased competition will contribute more generally to improved efficiency, consumer welfare and growth in developing countries.

Further, most developing countries have committed themselves to bind or liberalize tourism and travel services, including the liberalisation of foreign investment restrictions for hotel and resort operations. These commitments are likely to improve the supply capacity of this key sector which provides the major source of foreign exchange earnings in a number of island developing countries and least-developed countries.

- Shortcomings: GAIS has several shortcomings. They are:

(1) An important short coming of positive list is that it does not prevent an increase in restrictions on categories that have not been included.

(2) The leeway given to governments to specify different types of restrictions according to modes of supply could create incentives to design restrictions so as to divert investment.

(3) The decision to focus negotiations on specific sectors is a recognition of the inherent difficulty of reaching a broad based agreement given heterogeneous modes of delivery.

TRADE RELATED INVESTMENT MEASURES (TRIMS)

The Trade Related Investment Measures (TRIMs) Agreement applies only to measures that affect trade in goods. Investment measures are crucial for their impact on trade flows. Investment decisions exert indirect influence via the industrialisation policy, trade policy, employment policy, etc. Under TRIMs industrialized countries had been demanding outright prohibition of measures which have a direct and significant impact on trade, such as export obligation, local manufacturing obligations, indigenization, maximum possible equity participation, etc. On the other hand, developing countries contested this demand on the plea that regulations of foreign investment are not trade related, but are based on development considerations. These countries contended that the GATT provisions were adequate to address the trade effects and no additional provisions were necessary in this regard.

The Agreement on TRIMs prohibits investment measures inconsistent with national treatment or prohibition of quantitative restrictions. Other measures such as local equity requirements, participation of local employees in the foreign firm, remittance restrictions on the profits of foreign firms, foreign exchange restrictions, controlling the use of imported inputs, product marketing requirements, technology transfer requirements, use of specific production technology, import restrictions limiting the import of specified products, etc. are equally considered as deterrents from the foreign investors point of view. The TRIMs agreement provides for discretion in its applicability.

In order to promote the expansion and progressive liberalisation of world trade and to facilitate investment across international frontiers so as to increase the economic growth of all trading partners especially developing countries, agreement on TRIMs make the following provisions:

(i) On the grounds of balance of payments the developing countries are permitted to deviate from complying the TRIMs temporarily.

(ii) Each member country is required to eliminate TRIMs within two years from the date of entry into WTO agreement. But this time period is 5 years for developing countries and 7 years for the least developed countries.

(iii) On request, the Council for Trade in Goods may extend the transition period for the elimination of TRIMs for developing countries including least developed countries.

- Criticisms of TRIMs

The Agreement on TRIMs has been criticized from the point of view of developing countries for the following reasons:

(i) There is no provision in the agreement to deal with the restrictive business practices of foreign investors.

(ii) The provisions of the TRIMs agreement, when applied to developing countries are likely undermine the strategy of self-reliant growth based on technology, capital goods, etc.

(iii) While reviewing the implementation of the agreement on TRIMs developed countries are bound to make attempts to extend the frontiers of TRIMs prohibited in the list of the agreement.

The WTO isn't an extension of the GATT but succession to the GATT. It completely replaces GATT and features a very different character. The key differences between the two are:

1. The GATT had no status whereas the WTO features a legal status. it's been created a by international treaty ratified by governments and legislatures of member states.

2. The GATT was a collection of rules and procedures concerning multilateral agreements of selective nature. There have been separate agreements on separate issues, which weren't binding on members. Any member could stay out of the agreement. The agreements, which form a part of the WTO, are permanent and binding on all members.

3. The GATT dispute settlement system was dilatory and not binding on the parties to the dispute. The WTO dispute settlement mechanism is quicker and binding on all parties.

4. GATT was a forum where the member countries met once in a decade to discuss and solve world trade problems. The WTO, on the opposite hand, is a properly established rule based World Trade Organization where decisions on agreement are time bound.

5. The GATT rules applied to trade in goods. Trade in services was included within the Uruguay Round but no agreement was received. The WTO covers both trade in goods and trade in services.

6. The GATT had a small secretariat managed by a Director General. But the WTO contains a large secretariat and a large organizational setup.

Definition of Globalisation:

The aim of globalisation is to secure socio- economic integration and development of all the people of the world through a free flow of products, services, information, knowledge and people across all boundaries.

Globalisation is seen as a conscious and active process of expanding business and trade across the borders of all the states. It stands for expanding cross-border facilities and economic linkages. this is often to be done with a view to secure an integration of economic interests and activities of the people living altogether parts of the world. the objective of creating the world a truly inter-related, inter-dependent, developed global village governs the on-going process of globalisation.

Globalisation is the concept of securing real social economic, political and cultural transformation of the world into a true global community. it's considered to be the essential means for securing sustainable development of all the people of the world.

“Globalisation represents the will to move from national to a global sphere of economic and political activity”. It seeks to transform the present international economic system into a unified system of global economics. within the existing system, national economies are the main players. in the new system, the globalized economic and political activity will ensure sustainable development for the entire world.

“Globalisation is both a lively process of corporate expansion across borders and a structure of cross border facilities and economic linkages that has been steadily growing and changing.” —Edward S.Herman

“Globalisation is that the process whereby social relations acquire relatively distance-less and borderless qualities.” —Baylis and Smith

Nature of Globalisation:

Salient Features of Globalisation:

1. Liberalisation:

It stands for the liberty of the entrepreneurs to establish any industry or trade or business venture, within their own countries or abroad.

2. Free trade:

It stands for free flow of trade relations among all the nations. Each state grants MFN (most favoured nation) status to other states and keeps its business and trade faraway from excessive and hard regulatory and protective regimes.

3. Globalisation of Economic Activity:

Economic activities are be governed both by the domestic market and also the world market. It stands for the method of integrating the domestic economy with world economies.

4. Liberalisation of Import-Export System:

It stands for liberating the import- export activity and securing a free flow of products and services across borders.

5. Privatisation:

Keeping the state away from ownership of means of production and distribution and letting the free flow of commercial, trade and economic activity across borders

6. Increased Collaborations:

Encouraging the method of collaborations among the entrepreneurs with a view to secure rapid modernisation, development and technological advancement

7. Economic Reforms:

Encouraging fiscal and financial reforms with a view to offer strength to Free World trade, free enterprise, and market forces

Globalisation accepts and advocates the value of Free World trade, freedom of access to world markets and a free flow of investments across borders. It stands for integration and democratization of the world’s culture, economy and infrastructure through global investments.

Four Stages of Globalization

Domestic stage:

- Market potential is restricted to the home country

- Production and marketing facilities located at home

International stage:

- Exports increase

- Company usually adopts a multi-domestic approach

Multinational stage:

- Marketing and production facilities located in many countries

- Over 1/3 of its sales outside the home country

Global (or stateless) stage:

- Making sales and acquiring resources in whatever country offers the most effective deal

- Ownership, control, and top management tend to be dispersed

Global growth strategies are categorized according to whether the corporate was relying for growth on existing or new products in existing or new markets. The results of this would be to determine four general approaches to growth.

The same framework is used to examine multinational growth alternatives except that:

(a) Rather than markets, we'll refer to countries, and

(b) Rather than existing or new products, we'll refer to a narrow versus a broad international product mix.

This leads to a model that presents four general growth strategies—market concentration, market extension, product extension and diversification.

1. Market concentration:

Many companies direct single products to one or a couple of markets. A general food company sells chewing gum in France, ice-cream in Brazil, and pasta in Italy. None of those businesses is large enough to justify sales on a worldwide basis. Therefore, market concentration may be a logical strategy if a product are often sold profitably in a limited market.

Another motive for pursuing a strategy of market concentration is that the belief that the product appeals to a reasonably homogeneous group in a few countries. Playtex markets its hair care line in industrialized countries where women’s hair care needs are relatively homogeneous. the corporate may feel that extending the line to other markets is simply too risky.

2. Market extension:

The strategy of market extension is suitable for companies with unique product lines which will appeal to the requirements of different customers in several countries. Such a technique requires a company to own a competitive advantage that allows it to sell a narrow product line on a worldwide basis. Coca-Cola and Pepsi are two ideal examples.

These companies enjoy a competitive advantage that permits their line to be considered superior on a worldwide basis. the Japanese company Honda has successfully pursued a technique of market extension by developing inexpensive and reliable motorcycles.

Before Honda established a mass market, motorcycles were considered an expensive product. A worldwide message and a superior distributor network permitted Honda to outdo its major competitors and expand rapidly in foreign markets.

3. Product extension:

This involves selling a broad product mix during a limited number of foreign markets. This strategy is logical if the multinational firm:

- Is well entrenched in these markets and views further expansion as risky, and

- Can achieve economies of scale in advertising and distribution.

Economies of scale in advertising might involve a family brand strategy during which many brands are advertised under the company name. The general electric company uses a family brand advertising strategy within the international market also as the domestic American market.

Economies of scale also can be achieved in distribution. By marketing a broad product mix in a few countries, a corporation can distribute many of its products through the same intermediaries, achieving economies in transport, storage and direct sales. Chevrolet Captiva of General Motors is an effort by the second largest car manufacturer in the world to form an impact in the second fastest growing car market in the world

4. Diversification:

This is an aggressive growth strategy which involves expansion of both the product mix and foreign markets. Such a technique is often employed by companies with sufficient resources to accomplish fast entry into many markets on a multi-product basis. The strategy also requires a broader product mix to appeal to several segments in several markets.

A company that's currently pursuing a diversification strategy is Johnson & Johnson. the company markets a broad range of household and personal care products in foreign markets. It currently sells in over 40 countries and is expanding its operations by about two countries per annum.

Proactive Decision-Making

Proactive decision-making is a strategy where decisions are made before an incident happens. Should a corporation prefer to go this route, it'll take tons of time and investment to come up with different possible scenarios and solutions before they happen. But if there's a great deal of interest in your company globally, your decisions will already be made for you. you won't need to wait to make a decision. If a good opportunity arises quickly, you'll take benefit of it.

Let's say Whisker Bikes chooses a proactive approach to going global. the company decides to brainstorm decisions before time and discuss potential decisions should things arise. What happens if there's an excess demand for the newest model of powered bicycles? Whisker Bikes would have already worked through a proactive decision-making process. The steps of this process would look something like this:

1. Foresee the problem. It's possible that there'll be excess demand from Tokyo due to huge traffic and pollution problems there.

2. Determine the alternatives. Options might include contingency contracts with suppliers that include a requirement to satisfy fluctuations in demand.

3. Evaluate the choices. The choices are to meet the demand or not meet it.

4. Choose situational resolutions. Whisker Bikes might decide that not meeting demand quickly would hinder the company's growth plans. the corporate could plan to provide suppliers with contingency contracts that need them to extend their production should demand for Whisker Bike's products increase.

5. Prepare for a changing landscape. Reviewing marketing, electronic, and growth analytics in real-time can help Whisker Bikes prepare for changes in demand as they're happening. it is vital that the company give key personnel the tools to make good decisions when the time comes.

Now, let's check out how Whisker Bikes would approach this if using reactive decision-making.

Before you start tapping into new overseas markets, consider these 11 things to incorporate in global expansion strategy:

OPERATIONAL LOGISTICS

What will it take to operate your business overseas?

A physical location

Equipment

Materials

Shipping and logistics

If your business goes to exist beyond e-commerce, you’ll got to create an idea for procuring the resources you’ll need at your new location.

In addition, you’ll need to believe how you’ll take care of basic operational necessities like setting up Wi-Fi and a phone number and paying utilities bills. To avoid the time and cost of setting up your day-to-day operational tasks, you'll start your expansion process by using a co-working space instead of renting your own office from the start. This may help you focus less on logistics and more on growing your business.

MARKET RESEARCH

You may have your sights set on a specific area, but that doesn’t mean the people there are looking back at you. You’ve got to form sure your ideal customers exist in your chosen market. Determine if there's enough need for your product or service, and the way likely the people will be to purchase it.

LOCAL FLAVOR

Venturing into a new country requires learning about the cultures within and how they could perceive your brand. If you want your expansion to achieve success, you’ll got to appeal to the people you'll be serving.

Find out everything you'll about local traditions, values, religions, holidays, and other cultural differences you’ll get to adapt to. Research income data to know how to price your product for better sales learning everything you'll about your chosen market can offer you a good indication on whether your business can succeed there.

KEY CONTACTS

In business, it’s not almost about what you know, but also about who you know. Make contacts with relevant industry leaders in your countries of interest. they will help answer your questions, provide helpful resources, and introduce you to others who can influence your success.

Co-working spaces can connect you to future clients and key industry stakeholders, helping you enter the proper network as you expand abroad. They will also facilitate the networking process by offering their members access to events and meet ups with local partners.

CURRENCY

If you'll be selling in a different currency, you’ll need some knowledge about the way to appropriately price your products and services. you should also check out banking options which will assist you manage your new sort of money. Converting other currency into USD isn’t free and may easily cut into your profit margins. Ensure that your account for conversion costs when creating your pricing strategy.

HUMAN TALENT

Unless your businesses are going to be run by robots, consider how you plan to staff your new location. Take under consideration the education levels and capabilities of the local market, also because the potential of relocating talent from your home country to figure overseas. There’s often a multitude of compliance requirements and considerations when hiring employees, including worker’s compensation, benefits, wages, cultural norms, and other details worth knowing.

TRANSLATION SERVICES

No challenge to your global expansion strategy is sort of as daunting as language barriers. If you don’t speak the native language, it’s in your best interest to hire translators. Hunt down a company that gives comprehensive translation services, including website localization and in-person interactions, for best results.

MARKETING

Chevy’s Nova probably didn’t sell well in Mexico, since the name, in Spanish, directly translates into “No Go.” Gerber sold baby food in Ethiopia with images of babies on the jars, not realizing that, due to Ethiopia’s low literacy rate, food typically shows images of what’s inside the package.

Small nuances like these can have a major impact on how well your product sells (or doesn’t). It’s invaluable to make sure you’re tailoring your marketing to the local audience – what works in one country isn’t always successful in another.

TAX COMPLIANCE

Other countries have their own tax system you’ll got to abide by, and it's going to look vastly different than the native one you’re used to. This is often where it’s helpful to possess translators which will assist you navigate financial challenges and banking details to make sure you’re in compliance with the law.

SHIPPING REQUIREMENTS

Things like postage and packing requirements can vary from country to country. If you've got a presence in multiple countries, you would like to research the shipping requirements for each. Details like customs information and the way the foreign address is written can affect the transit of your goods, and will be included in your shipping strategy.

BUSINESS LICENSES AND OTHER REQUIREMENTS

What will it take to open your doors for business? Here in the US, a business license may be a must, because it is in other countries. You may got to acquire additional licenses or pay fees so as to officially start. You’ll ask the International Trade Association or your market’s local government for more information.

WRAPPING UP

Deciding to expand your business globally isn’t a choice to require lightly. If you haven’t crafted a meticulous global expansion strategy, you’re sabotaging your chances for successful growth. However, if done correctly, you would possibly find your new venture exceeds even your own expectations.

Questions to ask before going global

1. Where to go Global?

2. Which Market to Enter?

3. The way to enter the Market?

4. The way to handle Differences?

5. The way to adjust the management process?

6. Which managerial approach should adopt?

7. Which Organization structure should follow?

Strategies to Enter in a Foreign Market

1 – Franchising your brand

Kicking off the list at 1 is franchising. In case you’re not familiar with franchising, it works like this:

1. You create a successful brand (e.g. a restaurant)

2. You permit business owners to open their own branches of your restaurant, aka franchises

3. The franchisees pay you a precise fee and sometimes a cut of the profits annually, and then they keep the rest

The good thing about franchising is that it’s one among the better ways to break into new markets. All you've got to do is take your existing, successful business model, find a franchisee in your target market, build out the franchise, and open your doors.

2 – Direct Exporting

Direct exporting is the commonest of the eight strategies on this list. It’s pretty simple – you sell on to the market that you’re trying to break into. For instance, if you would like to sell to Japan, you get your product into the suitable Japanese stores and see how it does.

Your friends in direct exporting are your agents and distributors. These people are the branch between you and therefore the stores. Trying to get an edge with a major Japanese store as a foreigner is a lost cause, but with a reliable agent/distributor (and translation services company) on your side, it’s not! Actually, it’s easy… your agent/distributor have most of the contacts you would like to succeed.

Of course, you’ll need to work out shipping logistics and everything else of that nature – but on the surface, direct exporting is very much similar to selling products in your domestic market.

3 – Partnering up

Partnering is a relatively vague term. It can be anything, really – you'll get a partner in a foreign country to easily help with marketing (and receive a cut of profits), or, you'll get a partner in a foreign country who is simply as invested in all facets of your business as you’re.

But if you'll get a decent partner, you’ll be able to get a grip on your new market way more easily – he or she will know everything that you simply don’t about the new market.

(In some areas of the world, a partnership is a borderline necessity. for instance, in many Asian countries, you merely won't be able to break ground if you’re a foreigner – you would like a partner in each particular country to assist you get by regulations and such.)

4 – Joint Ventures

A JV (joint venture) is a partnership between two companies or people. They join up and become invested in some kind of business project – the investment is nearly always an equal 50/50, and profits are split accordingly.

Usually, the 2 companies stay separate from one another, but work together on one particular venture to undertake and succeed.

5 – Just buying a company

Buying a company in a foreign land is by far the simplest way to enter a new market.

• You immediately claim market share

• You have an existing customer base and brand image

• Even if the Govt... Has regulations on the industry for newcomers, you'll bypass them with relative ease (and these rules and regulations will actually assist you by keeping competition low)

• Governments will still treat you as a local firm in most cases with regard to licensing and such

Of course, there are downsides.

• You’re not one company, and your foreign operations therein particular market will be somewhat separate from the rest of your brand’s image

• It’s very expensive, especially if the business you want to buy is thriving

• Due diligence on a far off company – especially one in a more obscure country – is far harder than on a domestic company

6 – Turnkey solutions or products

Do you build something? Maybe your business is in construction or engineering. If you do, it’s worth trying to seek out turnkey projects in foreign countries to bid on.

“Turnkey” is a pretty apt name – a “turnkey product” is where you build something from the ground up, and whoever you turn the product over to just has to “turn the key” before he or she is ready to go.

These are some of the best contracts to get because they almost always come from governments. On the flip side, everyone knows that these are a number of the best contracts to get, and you’ll often be competing with other foreign and domestic firms for the contract.

7 – Piggyback

In order to piggyback, you need to already be selling product to other domestic companies.

If those domestic companies have international presences, all you have to do is give them a ring and ask the following:

“Hi, can you take my products to your international agencies too?”

Of course, phrase it a bit better than that – but you get the point. You’re jumping on the back of your existing business relationship and trying to make it into international markets that way.

8 – Licensing

Licensing is somewhat similar to piggybacking, except instead of talking to domestic firms and asking them to carry the product; you discuss with foreign firms and ask them to temporarily own the product.

So for instance, if you've got a great widget that you feel fits in perfectly with a company’s inventory in your new market, all you’d need to do is contact that company and ask.

We consider licensing to be one among the simplest ways to get started, but it’s not necessarily an “easy process” overall. you initially need to convince the firm that your product is right for them. Then, you would like to convince them that it'll sell. Then, you would like to deal with governments and lawyers to iron out all of the legal aspects of the “sale” of the license.

You don’t lose control of your product – it’s not an equivalent as selling the rights to your product. You’re merely licensing the rights to your product to a foreign company for a limited amount of time.

Key Take Away

INTERNATIONAL ENVIRONMENT The international environment of business comprises of a country's foreign policy, bilateral relations, international agreements (like WTO), the policies of trading blocs (like European Union, NAFTA ASEAN, etc.), the import export policy, monetary policies etc., other factors like war, civil disturbances, political instability etc. have also an effect on international environment. GATT

The General Agreement on Tariffs and Trade (GATT) has its origin in 1947 at a conference in Genera where negotiations between some 23 nations resulted in an intensive set of bilateral trade concession which were then extended to all participants and incorporated during a General Agreement. GATT was founded at the wake of world war II so as to stop the recurrence of protectionism policies of the then industrialized states which had resulted prolonged recession within the West before the war.

WTO

The World Trade Organisation (WTO) came into existence on January 1, 1995 replacing GATT, with a membership of 81 countries. The membership has since increased to 164 countries. he important principles governing the WTO are the following: Non-discrimination: The

TRIPS TRADE-RELATED ASPECTS OF INTELLECTUAL PROPERTY RIGHTS AGREEMENT

The WTO's Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPs) introduced intellectual property rules into the multilateral trading system for the first time.

Ideas and knowledge are increasingly important part of trade. Mo of the value of new medicines and other high technology product lies in the amount of invention, innovation, research, design and testing involved. Films, music recordings, books, computer software and on-line services are bought and sold because of the information and creativity they contain. Many products that used to be trade as low-technology goods or commodities now contain a higher proportion of invention and design in their value.

GATS (GENERAL AGREEMENTS ON TRADE SERVICES) The General Agreement on Trade in Services (GATS) is the first and only set of multilateral rules governing international trade in services. It was incorporated in response to the huge growth of the services economy over the past 30 years and the greater potential for trading services brought about by the communications revolution

TRADE RELATED INVESTMENT MEASURES (TRIMS)

The Trade Related Investment Measures (TRIMs) Agreement applies only to measures that affect trade in goods. Investment measures are crucial for their impact on trade flows. Investment decisions exert indirect influence via the industrialisation policy, trade policy, employment policy, etc. Under TRIMs industrialized countries had been demanding outright prohibition of measures which have a direct and significant impact on trade, such as export obligation, local manufacturing obligations, indigenization, maximum possible equity participation, etc.

GLOBALIZATION

The aim of globalisation is to secure socio- economic integration and development of all the people of the world through a free flow of products, services, information, knowledge and people across all boundaries.

Nature of Globalisation: 1. Liberalisation: 2. Free trade: 3. Globalisation of Economic Activity: 4. Liberalisation of Import-Export System: 5. Privatisation: 6. Increased Collaborations: 7. Economic Reforms:

Four Stages of Globalization

FOREIGN MARKET ENTRY STRATEGIES

– Direct Exporting

|

Liberalization, Privatisation and Globalisation

Economic environment is additionally called business environment and are used interchangeably. So as to solve the economic problem of our country, the Govt. has taken several steps including control by the State of certain industries, central planning and reduced importance of the private sector.

Accordingly, the most objectives of India’s development plans set were to:

a. Initiate rapid economic growth to lift the standard of living, reduce the widespread unemployment and poverty stalking the land;

b. Become self-reliant and established a strong industrial base with emphasis on heavy and basic industries;

c. Achieve balanced regional development by establishing industries across the country;

d. Reduce inequalities of income and wealth;

e. Adopt a socialist pattern of development — based on equality and stop exploitation of man by man.

With the above objectives in view, the Govt. of India as a part of economic reforms announced a new industrial policy in July 1991.

The broad features of this policy were as follows:

1. The Govt. reduced the amount of industries under compulsory licensing to 6 only.

2. Disinvestment was administered in case of the many public sector industrial enterprises.

3. Policy towards foreign capital was liberalized. The share of foreign equity participation was increased and in many activities 100 per cent Foreign Direct Investment (FDI) was permitted.

4. Automatic permission was now granted for technology agreements with foreign companies.

5. Foreign Investment Promotion Board (FIPB) was set up to market and channelize foreign investment in India.

There were three major initiatives taken by the Govt. of India to introduce the much debated and discussed economic reforms to transform Indian economy from closed to open market economy. These are generally abbreviated as LPG, i.e. Liberalization, Privatization and Globalization.

Liberalization:

Liberalization of the Indian economy contained the subsequent features:

a. The economic reforms that were introduced were aimed toward liberalizing the Indian business and industry from all unnecessary controls and restrictions.

b. They indicate the end of the license-permit-quota raj.

c. Liberalization of the Indian industry has taken place with respect to:

(i) Abolishing licensing requirement in most of the industries except a brief list,

(ii) Freedom choose the scale of business activities i.e., no restrictions on expansion or contraction of business activities,

(iii) Removal of restrictions on the movement of products and services,

(iv) Freedom in fixing the prices of products and services,

(v) Reduction in tax rates and lifting of unnecessary controls over the economy,

(vi) Simplifying procedures for imports and exports, and

(vii) Making it easier to draw in foreign capital and technology to India.

Privatisation:

Privatization was characterized by the subsequent features:

a. The new set of economic reforms aimed toward giving greater role to the private sector in the nation building process and a reduced role to the public sector.

b. to attain this, the Govt. redefined the role of the public sector within the New Industrial Policy of 1991.

c. the aim of the same, according to the Govt. , was mainly to enhance financial discipline and facilitate modernization.

d. it was also observed that non-public capital and managerial capabilities might be effectively utilized to enhance the performance of the PSUs.

e. the Govt. has also made attempts to enhance the efficiency of PSUs by giving them autonomy in taking managerial decisions.

Globalisation:

Globalisation of the Indian economy contained the subsequent characteristics:

a. Globalization is the outcome of the policies of liberalisation and privatization already initiated by the Govt.

b. Globalisation is generally understood to mean integration of the economy of the country with the world economy. it's a complex phenomenon to understand and apply into practice.

c. it's an outcome of the set of varied policies that are aimed toward transforming the world towards greater interdependence and integration.

d. It involves creation of networks and activities transcending economic, social and geographical boundaries.

e. Globalisation involves an increased level of interaction and interdependence among the varied nations of the global economy.

f. Physical geographical gap or political boundaries no longer remain barriers for a business enterprise to serve a customer during a distant geographical market across the world.

• As the word also suggests, MNC is a company that owns or controls production in more than one nation.

• MNCs establish its offices and factories for production in regions where they will get cheap labour and other resources.

• MNCs choose such multi nation location so on avail low cost of production thus earning greater profits.

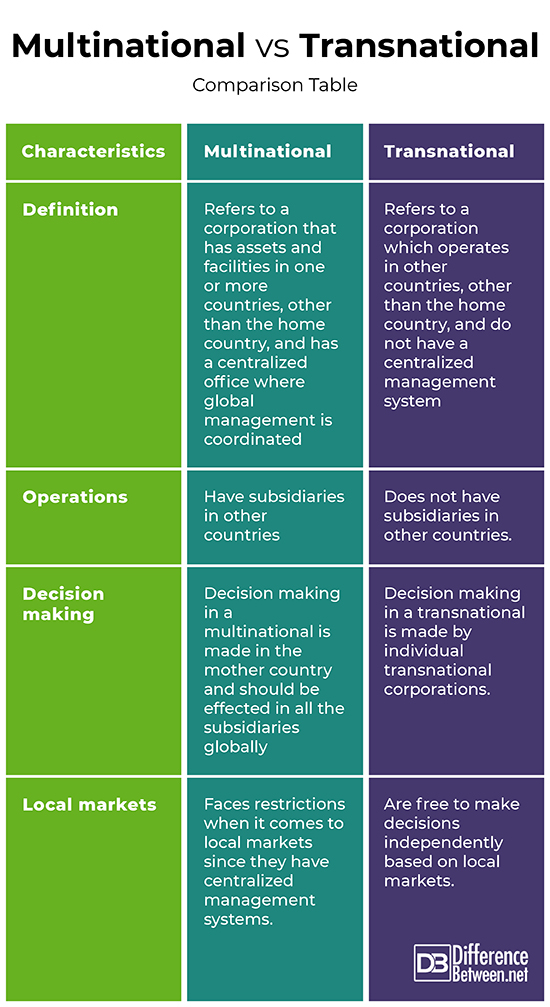

A “multinational corporation” is additionally named as an international, transactional or global corporation. For enlarging the business organisation, multinational is a beginning step, because it helps you become transnational thus leading you to go global.

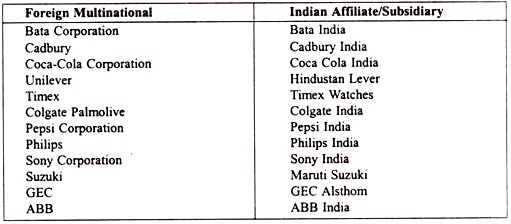

Some popular samples of multinationals are given below:

|

Features of MNCs

Following are the main features of MNCs:

• Location – MNCs have their headquarters in home countries and have their operational division spread across foreign countries to reduce the cost.

• Capital Assets – Major portion of the capital assets of the parent company is owned by the citizens of the company’s home country.

• Board of Directors – Majority of the members of the Board of Directors are citizens of the house country.

• MNCs are large-sized corporation and exercise an excellent degree of economic dominance.

We all are quite conscious of the bottom line of any business. Every business has the ultimate goal of creating profit. Businesses always seek to sell more products and services so on bring in more revenue and generate profits for its owners.

Advantages of MNCs

• Access to Consumers – Access to consumers is one among the primary advantages that the MNCs enjoy over companies with operations limited to smaller region. Increasing accessibility to wider countries allows the MNCs to possess a larger pool of potential customers and help them in expanding, growing at a faster pace as compared to others.

• Accesses to Labour – MNCs enjoy access to cheap labour, which is a great advantage over other companies. A firm having operations spread across different geographical areas can have its production unit created in countries with cheap labour. a number of the countries where cheap labour is accessible is China, India, Pakistan etc.

• Taxes and Other Costs – Taxes are one among the areas where every MNC can benefit. Many countries offer reduced taxes on exports and imports so as to increase their foreign exposure and international trade. Also countries impose lower excise and custom duty which ends up in high margin of profit for MNCs. Thus taxes are one of the area of creating money but it again depends on the country of operation.

• Overall Development – The investment level, employment level, and income level of the country increases because of the operation of MNC’s. Level of commercial and economic development increases because of the growth of MNCs

• Technology – The industry gets latest technology from foreign countries through MNCs which help them improve on their technological parameter.

• R&D – MNCs help in improving the R&D for the economy.

• Exports & Imports – MNC operations also help in improving the Balance of payment. This will be achieved by the rise in exports and reduce in the imports.

• MNCs help in breaking protectionism and also help in curbing local monopolies, if at all it exists in the country.

Disadvantages of MNCs for the Host Country

• Laws – one of the main disadvantages is that the strict and stringent laws applicable in the country. MNCs are subject to more laws and regulations than other companies. it's seen that certain countries don't allow companies to run its operations because it has been doing in other countries, which end in a conflict within the country and leads to problems in the organization.

• Intellectual Property – Multinational companies also face issues concerning the intellectual property that's not always applicable in case of purely domestic firms

• Political Risks – as the operations of the MNCs is wide spread across national boundaries of several countries they'll end in a threat to the economic and political sovereignty of host countries.

• Loss to Local Businesses – MNCs products sometimes cause the killing of the domestic company operations. The MNCs establishes their monopoly in the country where they operate thus killing the local businesses which exists in the country.

• Loss of Natural Resources – MNCs use natural resources of the house country in order to create huge profit which ends up in the depletion of the resources thus causing a loss of natural resources for the economy

• Money flows – As MNCs operate in several countries a large sum of money flows to foreign countries as payment towards profit which ends up in less efficiency for the host country where the MNCs operations are based.

• Transfer of capital takes place from the house country to the foreign ground which is unfavourable for the economy.

TRANSNATIONAL CORPORATION

Operations become more complex within transnational companies. They combine domestic and global strategies, employing a central control structure to manage all operating units as an integrated global company. as an example, an operating unit in China may be responsible for manufacturing, while one in the u. s. handles global marketing, and another in Germany leads research and development.

The result's a commercial enterprise that runs several facilities and conducts business in multiple countries. While some transnational companies recognize a home country, many don’t consider any nation as a base or headquarters. a well-known example of a transnational company is Nestle.

The advantages

One of the foremost distinctive benefits of operating a transnational company is that the ability to retort to the local markets where it maintains facilities. This flexibility leads some transnational businesses to create custom products or provide varied services for strategic distribution across target audiences. Plus, by establishing facilities in multiple locations, transnational business owners can cash in of lower labour costs and favourable taxation.

The disadvantages

Transnational companies can choose where manufacturing occurs, often selecting countries with low wages and minimal restrictions for cost-saving purposes. However, transnational companies often face criticisms once they avoid higher tax rates, form monopolies, and cause smaller businesses within the region to suffer. As such, management must determine strategic ways to create a profit while maintaining a decent reputation.

The Advantages and disadvantages

Multi-national or Trans-national companies are ones which locate their factories throughout the globe. This provides them many benefits, like access to the world market, cheap labour, cheaper production costs, and thus greater profits. The headquarters of the corporate remains in its original country, usually one among the most developed countries in the world, like the United Kingdom or USA. They then have factories throughout the planet, which either makes parts or entire finished products for the corporate to sell on the world market.

Most of the largest multi-national companies are oil companies like BP and Exxon (Esso), also car companies (for example, Ford, Toyota, Nissan and Volkswagen). Other well-known companies like Coca-Cola, IBM and Sony also are defined as being multi-national.

Multi-national companies locate round the world for their own benefit - in other words - to form as much money as possible. They carry with them both advantages and disadvantages for the country that plays host to them.

How do multi-national companies affect their host country?

Investment:

Advantages: the businesses bring much needed money into the country. Although most of their profits do return to the company’s country of origin, the local economy does benefit.

Disadvantages: The wages paid to local workers are often low and a few companies are accused of exploiting the local workforce instead of benefiting it. There are often tax incentives for these companies to locate in countries in the Developing World. This added to the fact that they take most of their profits out of the country; means the actual economic benefit to the country could be minimal.

Technology:

Advantages: the businesses help the development of the country by bringing in technology and knowledge that the host country doesn't possess.

Disadvantages: Unless the corporate actively participates in a program to educate local companies in the new technologies, the country’s industry won't really benefit. Multi-national companies could be worried by sharing an excessive amount of information, as they might find themselves with increased competition from local companies.

Transport:

Advantages: The new companies often help to enhance transport links around the area.

Disadvantages: The transport links that do receive financial help from the multi-nationals often only serve the direct routes and needs of that company, not the wider area also.

Employment:

Advantages: They create jobs for the local population.

Disadvantages: Often the jobs are highly skilled then the corporate brings in their own people to do them. Also, the technological nature of the many of those companies means that there aren’t as many jobs as there might have been.

Growth poles:

Advantages: The new multi-national companies act as growth poles for other similar companies. They might encourage more companies to locate therein country once they see the advantages that it brings.

Disadvantages: Only a limited range of companies find that moving to a Developing World location is useful. They’re going to only move there if it makes economic sense for the country. They do not consider the potential benefits to the host country.

Environment/Safety:

Advantages: Companies bring with them the technology and expertise to reduce harmful pollution and make a secure working environment.

Disadvantages: Many multi-national companies have very poor records on pollution and worker safety. They have been accused of trying to chop corners with both safety and pollution so as to keep costs down.

|

When an investment is done by an investor in physical assets of the foreign country it's termed as Foreign Direct Investment (FDI), subject to the internal control being retained by the investor. Foreign portfolio investments (FPI) indicate the investments are made in financial securities of the foreign country.

Foreign Portfolio investments differ from foreign direct investments in two ways: First, FDI is made in physical assets and not in financial assets; while in case of FPI investments are made in financial assets. Secondly, FDI has complete managerial control over the firm during which investments are made.

FDI is also in type of investments in plants and machineries, equipment’s, lands and buildings, etc. in the case of FPI investments are made in the financial securities like shares, debentures, bonds, etc., of a company in other country.

FDI is done in many ways; few of these commonly used are as follows:

1. Setting up a new corporate in the foreign country either as a branch or a subsidiary. The subsidiary could also be established either in its own capacity, or through some kind of agreement viz. joint venture; or

2. To make further investment in the foreign branch or subsidiary; or

3. By acquiring an existing business in the foreign country.

Reasons for FDI:

Firms and corporate are making investment in foreign physical assets on account of following few illustrative reasons:

1. Economies of Scale: