Unit - III

Marginal Costing

Preface

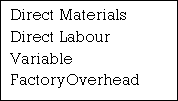

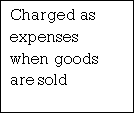

Marginal costs aren't a costing method like costing jobs, batches, or contracts. It's actually a technology costing that only considers variable manufacturing costs when determining cost of products sold. It also can be wont to evaluate inventory. In fact, this system is predicated on the subsequent basic principles. The total costs are often divided into fixed and variable. Although total fixed costs remain constant in the least levels In production, variable costs still change counting on the extent of production. Will increase if there's production When production decreases, it increases and reduces incremental cost method helps supply Relevant information to assist management make decisions in several areas ahead folks .Allocate all manufacturing costs to the merchandise , whether the merchandise is fixed or variable. This approach is Known as Absorption Costing / Total Costing. However, only variable costs are relevant to deciding .This is referred to as marginal / variable cost.

Marginal cost: The term incremental cost refers to the number at a specific production volume. If the assembly volume is modified by 1 unit, the entire costs are going to be charged. Therefore, it is Additional or additional cost of additional output units. Marginal costs show that there's certainly some change in production wherever there's a change. Changes in total cost are associated with fluctuations in variable costs. Fixed costs are treated as a period It costs money and is transferred to the P & L account. This is a costing system that treats only fluctuating manufacturing costs as product costs. Fixed manufacturing overhead is taken into account period cost.

Simple steps to know the above theory:

a) As the output increases, the traditional cost per unit decreases. On the contrary, within the case of output

b) As it decreases, the value per unit increases.

Example: When a factory produces 1000 units at a complete cost of Rs.3,000 and increases production by one the cost goes up to Rs.3,002, and therefore the incremental cost of additional output is Rs.2. (3002-3000). If there are multiple output increases, dividing the entire rise by the entire output increase shows the typical incremental cost per unit.

Example: The output has increased from 1000 units to 1020 units, and therefore the total cost to supply these units is Rs.1,045, average incremental cost per unit is Rs.2.25. (That is, additional cost / additional unit = 45/20 = Rs.2.25)

Assumption:

a) Variable costs change in direct proportion to the extent of activity.

b) Sales unit price remains constant.

c) No change thanks to inventory.

Marginal cost:

Marginal costs are often defined as "confirmation by distinguishing between fixed and variable costs."

Costs, marginal costs, and therefore the impact on profits of changes in production volume or sort of production. "

The costs of the costing procedure are divided into fixed and variable costs. According to J. Batty, the incremental cost is "the costing method is

Cost behavior thanks to changes in production volume. This definition focuses on confirmation. In addition to marginal costs, the impact of changes is in production volume and kinds of production volume on corporate profits.

In other words, incremental costs are often defined as a way for presenting fluctuating cost data. Costs and glued costs are displayed separately for management decisions. got to be clearly understood

The incremental cost isn't a costing method like process costing or job costing. Rather it's just Methods or techniques for analyzing cost information for management guidance

Marginal cost characteristics

(1) All elements of cost are classified into fixed costs and variable costs.

(2) Incremental cost may be a method of cost management and deciding.

(3) Variable costs are billed as manufacturing costs.

(4) Inventories of work-in-process and finished products are evaluated supported variable costs.

(5) Profit is calculated by subtracting fixed costs from contributions. In other words, it's the surplus of the asking price Marginal cost of sales.

(6) Profitability of varied levels of activity is decided by cost volume profit analysis

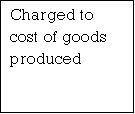

Absorption costing

Absorption costing is also known as total costing or total costing or traditional costing. It's a technique of cost confirmation. With this method, both fixed and variable costs are charged to the product or process operation. Therefore, the cost of a product is determined by considering both fixed and variable costs.

Distinction between Absorption Costing and Marginal Costing

The distinction in these two techniques are illustrated by the following diagrams

Application of marginal cost

Marginal cost is a very useful cost calculation method and has great potential for management in various fields, administrative tasks and decision-making processes regarding the application of marginal costs.

1) Cost Control: One of the key challenges facing management is managing costs. In today's competitive environment, rising selling prices to improve profit margins it is dangerous because it can lead to loss of market share. Another way to improve profits is to reduce costs. Cost management, Cost control aims to ensure that costs do not rise above current levels. Marginal cost techniques help with this task by separating variable and fixed costs. Fixed costs remain Variable costs vary depending on production, regardless of production. Certain fixed cost items cannot be managed at the middle or subordinate level. In these situations, it is advisable to focus on variable costs for cost control purposes. Since then separation of costs between fixed and variable costs is done at marginal costs and concentration. It is a variable cost rather than a fixed cost, which allows unnecessary efforts to manage the fixed cost.

2) Profit Planning: Another important use of marginal costs is in the area of profit planning. A plan, commonly known as a budget or operational plan may be defined as a future plan. Operations to achieve defined profit targets. Marginal costs methods help generate the data you need for profit planning and decision making. For example, calculating profits when there is a change in Impact on profit if there is a change in product composition, selling price, change in profit if there is one of the products Decisions regarding changes in sales structure if there are discontinuances or new product introductions. Some of the areas of profit planning that can generate the information needed by the limits Cost for decision making. Therefore, the separation of fixed and variable costs is very convenient.

3) Key Factor Analysis: Management should consider the following when planning. When various resources are constrained. These constraints are limiting factors or the main budget factors described in the "Budget and Budget Management" topic. These important factors could be raw material availability, skilled worker availability, machine time availability, or market Product demand. Marginal costs help management determine the optimal production plan in the following ways. Use scarce resources in the most profitable way, thereby optimizing your profits. For example

Ingredients are an important factor, their availability is limited to a certain quantity, and the company We manufacture three products, A, B and C. In such cases, the marginal cost method helps prepare a statement indicating the amount of contribution per kg of material. Products with the highest yields Contribution per kg of raw material is prioritized and produced as much as possible. After that, other products are picked up in order of priority. Therefore, the resulting product mix is Best profit in a given situation

4) Decision Making: Management decision making is a very important function of any organization decision .The creation should be based on relevant information. Through the marginal cost method Information on cost behavior is provided in the form of fixed and variable costs. The Separation of costs between fixed and variable helps administrators predict cost behavior in

various options. Therefore, it makes decisions easier. Some decisions

In some decisions, the resulting income is the deciding factor, while the basis for comparative cost analysis. Marginal costs help generate both types of information, so the decision is as follows. It's not intuitive, it's rational and factual. Some of the key areas of decision making is listed below:

5) Decision or purchase decision-

a) Approval or rejection of export proposal.

6) Fluctuations in selling price.

7) Variations in product composition.

8) Changes in sales composition.

9) Key factor analysis.

10) Evaluation of various alternatives for improving profits.

11) Department closure / continuation.

Marginal cost benefits

(1) Cost-volume-profit relationship data required for the purpose of profit planning is Normal accounting statement. Therefore, the administrator does not have to work with two separate data sets. To associate one with the other.

(2) Profit for a certain period of time is not affected by changes in absorption of fixed costs due to the building or reduce inventory. Others remain the same (eg. selling price, cost, selling composition), profits move in the same direction as sales when using direct costing.

(3) Manufacturing costs and income statements in direct cost format follow management's ideas.

Strictly more than the absorption cost form of these statements. Because of this, management finds it Easy to understand and use direct cost reports.

(4) The impact of fixed costs on profits is emphasized in the total amount of fixed costs during that period. It will be displayed on the income statement.

5) Marginal income figures are for products, regions, customer classes, and other segments of the business without obscuring the results due to the allocation of joint fixed costs.

(6) Marginal costs are in effective planning for cost management such as standard costs and flexible budgets.

(7) Marginal costs not only provide a better and more logical basis for fixing selling prices. Bid on contracts when your business is sluggish.

(8) Last but not least, the break-even point can only be determined based on marginal costs.

Marginal cost limit

The marginal cost calculation method has the following restrictions.

(1) In marginal costs, costs are classified into fixed costs and variable costs. Separate costs into fixed and fixed Variables are pretty difficult and can't be done exactly.

(2) Marginal cost is based on the premise that the behavior of cost can be expressed by a straight line. This means fixed costs remain fully fixed for a period of time at various levels, and variable costs vary linearly.

The pattern, or change, is proportional to the change in volume. In real life, fixed costs tend to fluctuate. At various levels of production, especially if additional plants and equipment are introduced, therefore

Variable costs may not change at the same rate as volume

(3) Under the marginal cost method, fixed costs are not included in the value of finished product inventory. And work in process. There are fixed costs, so these also need to be part of the cost of the product. Due to this elimination of fixed costs from finished inventory and work in process, inventory is Modest. This affects the income statement and balance sheet results. Therefore, the profit is contracted unnecessarily.

(4) In the marginal cost system, monthly business reports are not realistic or useful as follows Absorption costing system. This is because this system has different marginal contributions and benefits with changes in sales. If sales occur occasionally, profits will fluctuate from period to period.

(5) Marginal costs do not provide complete information. For example, it could be due to increased production and sales Extensive use of existing machines or expansion of resources or replacement of labor Mechanical force. The small contribution of the P / V ratio cannot derive this reason.

(6) Under the marginal cost system, the difficulties associated with the allocation and calculation below Over absorption of fixed overhead is eliminated, but the problem remains as long as it is below .There are concerns about absorption or over absorption of fluctuating overhead.

(7) Marginal costs may be useful for short-term evaluation of profitability, but long-term profits. It is determined correctly only on a full cost basis.

(8) Marginal cost does not provide a basis for performance evaluation limit

Contribution data do not reveal many of the benefits provided by ANOVA. For example: The difference in efficiency reflects the efficient and inefficient use of plants, machinery and labor and this kind of thing. In the marginal cost analysis, the valuation is insufficient.

(9) Marginal cost analysis assumes that the selling price per unit remains the same at different levels. Production, but these can change in real life and have unrealistic consequences.

(10) What is the impact of fixed costs on products in an era of advances in automation and technology? It is much more than variable costs. As a result, fewer systems do not consider fixed costs. It is effective because it does not take into account a significant portion of the cost.

(11) The selling price according to the marginal cost method is fixed based on the contribution. This may not be the case. This is possible in the case of a "cost plus contract". Therefore, the above restrictions have a fixed cost. It is just as important in certain cases.

Cost Volume Profit Analysis (CVP) is a systematic way to look at the relationships between changes in Total sales, costs, net income production and changes. In other words it is an analysis of the relationships that exist between cost, sales, output, and the resulting profits. It provides information on the following:

a) It helps him predict profits fairly accurately.

b) You can check the cost based on this relationship, which helps you to set a flexible budget. Sales and profits at different levels of activity.

c) It also helps him evaluate performance for business management purposes.

d) Predicting the impact of different price structures will help you develop pricing policy Cost and profit.

e) Helps determine the amount of overhead charged for different levels of operation.

f) Overhead is usually pre-determined based on the production volume selected

Therefore, cost-volume-profit analysis is an important medium for management to gain insights. Impact of fluctuations in costs (both fixed and variable) and sales (both both fixed and variable) on profits Value) and make the right decisions. The following research is essential to understand the relationship between cost, volume, and profit.

(1) Marginal cost calculation formula.

(2) Break-even point analysis.

(3) Profit volume ratio (or) PN ratio.

(4) Profit graph.

(5) Main factors.

(6) Sales composition.

Purpose of cost volume profit analysis:

The key objectives of cost volume profit analysis are:

a) The principle of marginal cost is used .Management can establish what will happen to the financial results at a particular level.

b) The activity or volume fluctuates. It is useful for determining the break-even point and the output level required to obtain the desired profit.

c) The P / V ratio functions as a measure of efficiency for each product, factory, sales area, etc. Management to select the most profitable business.

6. Helps predict the level of sales needed to maintain a constant profit at different levels of the price.

Basic Equation Profit

a) Sales – Total cost Profit = Sales – (Variable cost + Fixed cost

b) Profit = Sales – Variable cost – Fixed cost

c) Profit + Fixed cost = Sales – Variable cost

d) Sales – Variable cost = Fixed cost + profit

e) Sales – Variable cost = Contribution

f) Contribution =Fixed cost + profit

g) Contribution – Fixed cost = Profit

Marginal Cost Equation Contribution is the difference between the sales a marginal cost. Thus, contribution is calculated by the following formula:

a) or, C = S - V………..

(i) Profit = Contribution – Fixed cost

b) or, P = C - F, or, C = F + P……….

(ii) Therefore, contribution may be said to be equal to Fixed Cost-plus Profit (loss).

Contribution contributes towards the recovery of fixed costs and the balance is profit.

Equating (i) and (ii), we get, S - V = F + P……..

(iii) Sales – Variable cost = Fixed cost + profit. At Break-even point, there is neither profit nor loss (i.e., Total cost = Total Sales) so that P = 0 (zero)

c) S - V = F + P……..(iii)

d) or, S - V = F + 0 or, S = F + V………

e) (iv) So, Sales = Fixed Cost + Variable Cost (at B.E.P.) or, Sales = Total Cost (at B.E.P.)

The concept of contribution is extremely helpful in the study of Break-even analysis and managerial decision making. Profit Volume Ratio (P/V) Symbolically, P/V Ratio (or, C/S ratio) is expressed as follows:

a) P/V Ratio (or, C/S ratio) =

b) Contribution S𝑎𝑙𝑒𝑠 = C S For determining different requirements, different formulae are available:

(a) P/V Ratio = Sales−Variable Cost S𝑎𝑙𝑒𝑠 = S−V S or, 1- Variable Cost S𝑎𝑙𝑒𝑠 (b) P/V Ratio = Fixed Cost Profit (or loss) S𝑎𝑙𝑒𝑠 = F+P (or L) S (c) P/V Ratio = Change in Contribution Change in S𝑎𝑙𝑒𝑠 (d) P/V Ratio = Change in Profit (or Loss) Change in S𝑎𝑙𝑒

P/V Ratio indicates the rate at which profit is being earned. A high P/V Ratio indicates high profitability and low P/V Ratio indicates low profitability.

Break-even point analysis

Break-even analysis is additionally referred to as cost-volume profit analysis, Break-even point analysis. Relationship between asking price, sales volume, fixed costs, variable costs, and profits at various level activity. Break-even analysis may be a widely used technique for studying the cost-volume-profit relationship narrow

Here, the entire cost is adequate to the entire asking price. The broader interpretation refers to the analytical system. Determines expected profits for all levels of activity. It describes the connection between production costs, Production volume and sales value.

Here, CVP analysis is additionally commonly performed, but it's not accurate, but it's called "break-even point analysis". The difference between the 2 terms is extremely narrow. CVP analysis includes full range Break-even analysis is one among the techniques utilized in this process. But as mentioned the above break-even point analysis techniques are so popular in CVP analysis research that the 2 terms are used as a synonym. For the needs of this investigation, we also these two terms to know the concept of break-even analysis, it's helpful to understand the following specific basic terms listed below application

a) You’ll use break-even analysis to work out your company's break-even point (BEP).

b) The break-even point is that the level of activity where total revenue is adequate to total cost. At this level, the corporate doesn't make a profit

1. Contribution

This is a more than the asking price that exceeds the variable cost. It is also called "gross profit". The amount of profit (loss) is often confirmed by deducting fixed costs from contributions. In other words, it had been fixed Costs and benefits correspond to contributions. It is often expressed by the subsequent formula.

Contribution = Selling Price – Variable Cost or Contribution = Fixed Cost + Profit

Profit = Contribution – Fixed Cost

Profit / Volume ratio (P / V ratio)

This term is important for studying the profitability and profit ratio of operating a business.

Establish a relationship between contribution and sales. The ratio can be displayed in the following format Percentage too. The expression can be expressed as:

This ratio can also be found by comparing changes Contribution to changes in sales or changes in profits due to changes in sales. Increased contribution .Fixed costs are assumed to be constant at all production levels, which mean increased profits.

Therefore,

P/V Ratio (or, C/S ratio) = Contribution S𝑎𝑙𝑒𝑠 = C S or, P/V Ratio = Sales−Variable Cost S𝑎𝑙𝑒𝑠 = S−V S or, 1- Variable Cost S𝑎𝑙𝑒

This ratio is also known as the "contribution / sales" ratio. This ratio can also be found by comparing changes Contribution to changes in sales or changes in profits due to changes in sales increased contribution. Fixed costs are assumed to be constant at all production levels, which mean increased profits.

Therefore, Thus, P/V Ratio = Change in Contribution by Change in S𝑎𝑙𝑒𝑠 Or, P/V Ratio = Change in Profit (or Loss) Change in S𝑎𝑙𝑒

The characteristics of the P / V ratio are as follows.

(I) Helps administrators see the total amount of contribution to a particular sale.

(II) The selling price and the variable cost per unit are constant or constant as long as they are constant. It fluctuates at the same rate.

(III) Not affected by changes in activity level. In other words, the PV ratio of the product. The amount of activity is the same whether it is 1,000 units or 10,000 units.

(IV) Fixed costs are not considered at all, so the ratio is also unaffected by fluctuations in fixed costs while calculating the PV ratio. For multi-product organizations, PV ratios are very important for management to decide which one to find. The product is more profitable. Management is trying to increase the value of this ratio by reducing variable costs or by raising the selling price.

2. Break-even point

It is a point that indicates the level of output or sales by dividing the total cost and sales price evenly. There is no profit or loss, it is considered a break-even point. At this point, business income exactly equal to that spending. If production is boosted beyond this level, profits will be generated in the business. And if it decreases from this level, the loss will be incurred by the business. Here it is appropriate to understand the different concepts of marginal costs and break-even points. Go further. This is explained below.

It's neither a profit nor a loss. Therefore, at the break-even point, the contribution is equal to the fixed cost.

Contribution = Fixed cost (1) Break-even point (in units) = Fixed Cost Contribution per unit (2) Break-even point (in amount) = Fixed Cost Contribution per unit x Selling Price per unit Or, = Fixed Cost Total Contribution x Total Sales Or, = Fixed Cost 1− Variable Cost per unit Selling price per unit = Fixed Cost P/V Ratio

Sales at break-even point = break-even point x selling price per unit

At the break-even point, the desired profit is zero. When calculating production or sales

You need to add a fixed amount of "desired profit" or "target profit" "desired profit" or "target profit"

The cost of the above formula is For example:

(1) No. of units at Desired Profit = Fixed Cost+ Desired Profit Contribution per unit (2) Sales for a Desired Profit = Fixed Cost+ Desired Profit P/V Ratio

(2) Sales at break-even point = break-even point x selling price per unit

(3) At the break-even point, the desired profit is zero. When calculating production or sales

(4) You need to add a fixed amount of "desired profit" or "target profit" "desired profit" or "target profit"

(5) The cost of the above formula. For example:

Break-even point analysis

It is the relationship between selling price, sales volume, fixed costs, variable costs, and profits at various levels activity application.

c) You can use break-even analysis to determine your company's break-even point (BEP).

d) The break-even point is the level of activity where total revenue is equal to total cost.

e) At this level, the company does not make a profit

Break-even point analysis assumptions

f) Related range

g) The relevant range is the range of activities for which fixed costs remain fixed in total.

h) Variable costs per unit remain constant

i) Fixed costs

Total fixed costs are assumed to be constant in total Variable cost

Total variable costs increase because the number of units produced increases Sales

Total revenue increases as the number of units produced increases Safety range

Safety Margin

The safety margin is the difference between actual sales and break-even sales. As we discussed

At the break-even point, there's no profit or loss. Therefore, every company is interested in always being present

It is above the break-even point as much as possible. The safety margin explains exactly this and more.

The better the safety margin, the better for the organization. The safety margin is calculated as follows:

Safety Margin = Actual Sales-Break-even sales. The safety margin also can be expressed as a percentage amount of sales Safety range

j) Shows business health

k) High Safety Margin – BEP is well below actual sales

l) The safety margin is a measure of the amount of sales that a company can lose before it suffers a loss.

m) this will be expressed as variety of units or a percentage of sales

n) Shows business health

o) High Safety Margin – BEP is well below actual sales

p) The safety margin is a measure of the amount of sales that a company can lose before it suffers a loss.

q) this will be expressed as variety of units or a percentage of sales

r) Shows the health of the business

s) High Safety Margin – BEP is well below actual sales

t) The safety margin is a measure of the amount of sales that a company can lose before it suffers a loss.

u) this will be expressed as variety of units or a percentage of sales

You can improve your safety margin in the following ways:

(A) Raise the selling price.

(B) Reduction of variable costs.

(C) Selection of product composition for items with a larger PN ratio.

(D) Reduction of fixed costs.

(E) Increase output.

Formulae:

Margin of safety = Sales – BEP sales

Margin of safety = Sales – fixed cost/ PV ratio

Margin of safety = Sales x PV ratio – Fixed cost / PV ratio

Margin of safety = Contribution – Fixed cost/ PV ratio

Margin of safety = Profit / PV ratio

References-