UNIT 1

Introduction

Meaning

The term "macro" was first used in economics by Ragnar Frisch in 1933. However, it originated in the 16th and 17th century mercantilists as a methodological approach to economic problems. They were interested in the entire economic system. In the 18th century, Physiocrats adopted it in the table economy, demonstrating a "wealth cycle" (i.e., net production) among the three classes represented by the peasant, landowner, and barren classes.

Malthus, Sismondi and Marx in the 19th century dealt with macroeconomic issues. Walras, Wicksell and Fisher contributed modernly to the development of pre-Keynes macroeconomic analysis.

Certain economists such as Kassel, Marshall, Pigovian, Robertson, Hayek, and Hortley developed the Quantity Theory of Money and General Price Theory in the decade following World War I. But Keynes, who eventually developed the general theory of income, output, and employment in the wake of the Great Depression, has credit.

Economics is a science that deals with the production, Exchange and consumption of various goods in the economic system. It is a scarce resource that can lessen the abundance of human welfare. The central focus of Economics lies in the choice between resource scarcity and its alternative uses. The word "economics" is derived from two the Greek words oikos (House) and nemein (to manage) mean to manage the household budget "using the limited funds possible.

Scope of Macro Economics

Economics is the subject of dealing with every situation happening all over the world. This subject is used in many stances in our lives. For example, your mom does all the work in your home. From doing all the housework to maintaining a budget for rations to meeting all your needs. Thus, it is one subject that deals with the daily work of our lives. There are two major categories on the same subject: microeconomics and macroeconomics. One deals with individual units of the economy, such as consumers and households. But the latter deals with the whole economy. It deals with research on national income and output. This understanding of science is vast and of varying lengths. However, for simplicity, this article will only focus on the scope and need for macroeconomics.

Microeconomics:

As mentioned above, microeconomics is a branch of economics that deals with individual units of the economy. It includes research areas on individual units such as consumers and homes. The subject deals with issues related to determining the price of goods. These direct or indirect factors affect the supply and demand of goods and the procurement of individual satiety levels. The main purpose of microeconomics is to maximize profits and minimize costs incurred. It is used for future generations to be available and balanced.

Macroeconomics

The term macroeconomics was coined by Ragnar Frisch in 1933. However, the approach to economic problems began in the 16th and 17th centuries. As a result, this originated from mercantilists. It is the field of science that deals with the whole economy or the whole, including macro factors. The hope of macroeconomics does not involve studying individual units of the economy. But the whole economy studies the whole economy and the average National income, total employment, total savings and investment, aggregate supply and demand, and general price levels.

The subject of macroeconomics revolves around income and employment decisions.

Controlling the cycle of inflation and deflation was only possible by choosing current economic policies. These policies were developed at the macro level. Research on individual units has also become impossible. In addition, government participation through financial and fiscal measures in the economy is increasing. Therefore, the use of macro analysis is irrefutable.

Now we know that macroeconomics is a specialty of economics. Focus on the economy through the sum of the individual units and determine if it will have a significant impact on the country as a whole. All prominent policies and measures are based on this concept. For example, per capita income determines national income. This is nothing but the average of the total income of the people of the whole country.

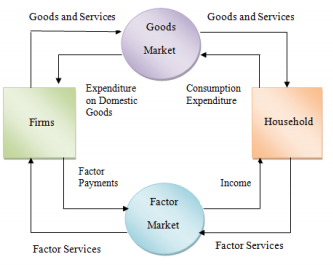

Fig 1

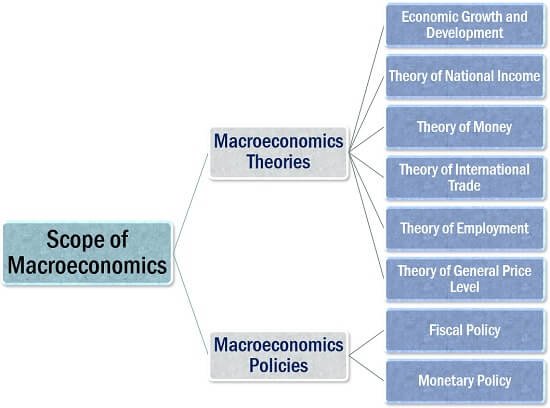

Scope of Macroeconomics:

Governments, financial institutions and researchers analyse the general problems of the people and the economic well-being of the people.

It mainly covers the foundations of macroeconomic theory and measure theory, which is macroeconomic policy. Here, macroeconomic theories include theories of economic growth and development, national income, money, international trade, employment, and general price levels. In contrast, macroeconomic policy covers fiscal and monetary policy.

Research on issues such as India's unemployment, general price levels and balance of payments (BOP) issues is part of macroeconomic research as it is relevant to the economy as a whole.

Macroeconomic Theories:

The government is understood to be the national regulator. Consider various aspects that are important and have a direct impact on the lives of citizens. There are six theories within the scope of macroeconomics.

Theory of Economic Growth and Development:

Economic growth is also under the study of macroeconomics. Economic resources and capabilities are assessed based on the scope of macroeconomics. It plans to increase levels of national income, output, and environmental levels. They have a direct impact on the economic development of the economy.

Money theory:

Macroeconomics assesses the impact of reserve banks on the economy, capital inflows and outflows, and its impact on employment rates. Frequent changes in the value of money caused by inflation and deflation have many negative effects on the country's economy. They can be exacerbated by monetary policy, fiscal policy, and direct control of the economy as a whole.

National Income Theory:

This includes various topics related to measuring national income, such as revenue, spending, and budget. As a macroeconomic study, it is essential to assess the overall performance of the economy in terms of national income. At the beginning of the Great Depression of the 1930s, it was essential to investigate the triggers of general overproduction and general unemployment.

This led to the creation of data on national income. Helps predict the level of economic activity. It also helps to understand the income distribution among different classes of citizens.

International Trade Theory:

This is a research area focused on the import and export of products or services. Simply put, it points to the economic impact of cross-border commerce and tariffs.

Employment theory:

This macroeconomic scope helps determine the level of unemployment. It also determines the conditions that lead to such unemployment. Therefore, this affects production supply, consumer demand, consumption, and spending behaviour.

General Price level theory:

The most important of these are research on commodity prices and how inflation or deflation fluctuates a particular price rate.

Macroeconomic policy:

The RBI and the Government of India are working together to imply macroeconomic policies for national improvement and development.

It falls into two sections:

Fiscal policy:

It refers to how spending fills deficit income and describes itself as a form of budgeting under macroeconomics.

Financial policy:

The Reserve Bank is working with the government to establish monetary policy. These policies are measures taken to maintain the stability and growth of a country's economy by regulating various interest rates.

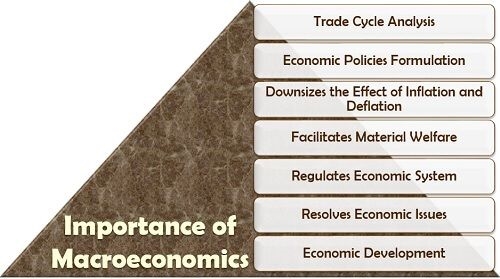

Importance of macroeconomics:

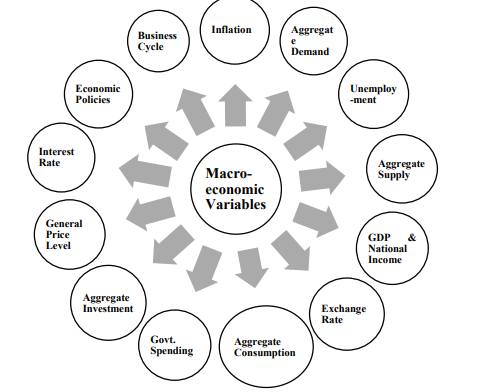

Fig 2

Macroeconomics is an important concept that considers the whole country and works for the welfare of the economy.

1. Business cycle analysis

Timing of economic fluctuations helps prevent or prepare for financial crises and long-term negative situations.

2. Formulation of economic policy

The fiscal and monetary policy system relies entirely on the widespread analysis of macroeconomic conditions in the country.

3. Reduce the effects of inflation and deflation

Macroeconomics is primarily aimed at helping governments and financial institutions prepare for economic stability in a country.

4. Promote material welfare

This stream of economics provides a broader perspective on social or national issues. Those who want to contribute to the welfare of society need to study macroeconomics.

5. Regulate the economic system

It continues to guarantee or check the proper functioning and actual position of the country's economy.

6. Solve economic problems

Macroeconomic theory and problem analysis help economists and governments understand the causes and possible solutions to such macro-level problems.

7. Economic development

By utilizing macroeconomic data to respond to various economic conditions, the door to national growth will be opened.

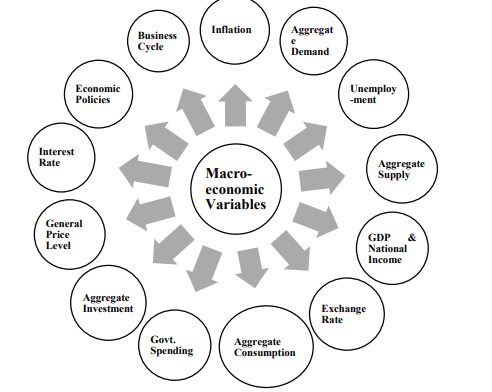

Variables of macro economics

Demand refers to that quantity of goods and services for which consumer is ready to pay and have willingness to purchase that goods and services at different price level over a period of time. But, Aggregate demand refers to the total expenditure incurred on the purchase of all the finished goods and services in the economy during the period of an accounting year. It can be defined as the total monetary expenditure incurred on the purchase of goods and services at a specified price level on a point of time.

II. Aggregate Supply

Supply refers to production of that goods and services which a producer is willing to sell at different prices during a period of time, when all the other factors remain constant. Aggregate supply is the total supply or total production of goods and services in the economy during an accounting period

III. Aggregate Consumption

Total consumption of all goods and services in the economy during an accounting period is known as aggregate consumption.

IV. Aggregate Investment

Investment refers to that asset which results into appreciation of income over a period of time. In economics, it can be defined as expenditure incurred by producers to purchase raw material so that this can be add to their capital in that year. And aggregate investment refers to the total expenditure incurred by all the producers for purchasing raw material in the economy to add their capital during that year.

V. Unemployment

Unemployment occurs when a person wants to do job but he is unable to find a job. Unemployment can be computed on the basis of unemployment rate. It is the rate through which the percentage of the current unemployed labour force and actively seeking employment can be measured. High rate of unemployment leads to unfavorable indicators of macroeconomics. High rate of unemployment leads to maximum number of workforce who is not engaged in any work and job. This represents negative signs for an economy.

VI. General Price level

General Price level refers to index of prices of all goods and services in the economy at the end of a specified period of time.

VII. Exchange Rate

Exchange rate is an important macroeconomic variable as it is helpful for international trade. Import and export among different countries is possible due to exchange rate, as this becomes consideration for exchange of goods and services. Exchange rate refers to that rate at which currency of one country is exchange with the currency of other country. It can provide answer to the question that for one unit of a currency of country A how many units of currency of country B can be obtained.

VIII. Interest Rate

Interest rate refers the cost of borrowed money. This rate is defined by monetary authorities by using various regulations and interventions in the money market. Interest rate is the rate which interest is paid by the borrower for use of money to lender. There is various interest rates prevails in the economy. Interest rates can vary according to variation in the degree of risk.

IX. Government Spending

Government spending refers to the government consumption, government investment and transfer payments. Government spending describes the size of the public sectors in the economy. Government spending can also be described as the expenditure incurred by public sectors in education sector, health sector, transportation, social protection, defense, etc. This spending is based on major two factors i.e. tax collection and borrowing from public.

X. GDP & National Income

Gross domestic product is the total monetary value of the final goods and services produced within national boundaries of a country during an accounting year. GDP is a macroeconomic indicator of health of an economy. High GDP represents the increase in output and this will lead to economic growth. Generally, GDP is also known as measurement of national income. National income provides an idea of purchasing power of people of a country.

XI. Inflation

Inflation refers to hike in general price level of goods and services in an economy over a period of time. Inflation results into loss to value of money as hike in general prices leads to pay more units of money for purchasing goods and services. When demand for goods and services increases consequently their prices also rise and this will lead to inflation. It means consumer is willing to pay high prices for purchasing goods and services they want. Inflation is an important macroeconomic variable as it is interlinked with the other variables of the macroeconomics. Like high rate of unemployment leads to low rate of economic growth which ultimately results into risk of high inflation.

XII. Economic Policies

Economic policies are also defined as the macroeconomic indicators. There are two major economic policies i.e. monetary policy and fiscal policy. Monetary policy is the policy which is formed to control money supply in the economy. Fiscal policy is the policy of government expenditure and revenue. These policies are formed by monetary authority and government of the country.

XIII. Business Cycle

Business cycle refers to the upward and downward movements in the gross domestic product. Business cycle defines the fluctuations in the aggregate production, trade and activity in an economy. Business cycles involve the situation of recession and depression. Recession means that period during which aggregate output declines. A prolonged and deep recession is termed as depression. Thus, business cycle is an important indicator of macroeconomics.

Key takeaways-

Income, expenditure and the circular flow

Circular flow model

Definition

The circular flow model demonstrates how money moves through society. Money flows from producers to workers as wages and flows back to producers as payment for products. In short, an economy is an endless circular flow of money.

Circular flow refers to a simple economic model which states the reciprocal circulation of income between producers and consumers. In the circular flow model, the interdependent entities of producer and consumer are referred to as "firms" and "households" respectively and provide each other with factors in order to facilitate the flow of income. Firms provide consumers with goods and services in exchange for consumer expenditure and "factors of production" from households.

In macroeconomics, we have the economy 2 sectors, 3 sectors and 4 sectors.

1. Economy 2 sectors: Household and Firm.

2. Economy 3 sectors: Household, Firm and Government.

3. Economy 4 sectors: Household, Firm, Government and International Trade.

The four macro economics sector.

2. The Firms Sector - This sector includes all the business entities, corporations and partnerships. The primary function of this sector is to produce goods and services for sale in the market and make factor payments to the household sector.

3. The Government Sector - This sector includes the center, state, and local governments. The prime function of this sector is to regulate the functioning of the economy. The government sector incurs both revenue as well as expenditure. The government earns revenue from tax and non-tax sources and incurs expenditure for provide essential public services to the people.

4. The Foreign Sector - This sector includes transactions with the rest of the world. Foreign trade implies net exports (exports minus imports). Exports include goods and services produced domestically and sold to the rest of the world and imports include goods and services produced abroad and sold domestically.

The three markets

2. The Factor Market - The factors of production are traded through this market. For the production of final goods and services, the firms obtain the factor services and make payments in the form of rent, wages and profits for the services to the household sector.

3. The Financial Market - This market consists of financial institutions such as banks and non-bank intermediaries who engage in borrowing (savings from households) and lending of money.

The circular flow of income in a two sector model

In this model, the economy is assumed to be a closed economy and consists of only two sectors, i.e., the household and the firms. A closed economy is an economy that does not participate in international trade. In this model, the household sector is the only buyer of the goods and services produced by the firms and it is also the only supplier of the factors of production. The household sector spends the entire income on the purchase of goods and services produced by the firms implying that there is no saving or investment in the economy. The firms are the only producer of the good and services. The firms generate income by selling the goods and services to the household sector and the latter earns income by selling the factors of production to the former. Thus, the income of the producers is equal to the income of the households is equal to the consumption expenditure of the household. The demand of the economy is equal to the supply.

In this model,

Y = C where, Y is Income and C is Consumption

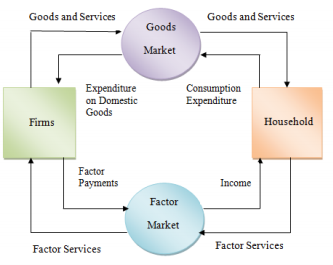

The circular flow of income in a three sector model

The three sector model of circular flow of income highlights the role played by the government sector. This is a more realistic model which includes the economic activities of the government however; we continue to assume the economy to be a closed one. There are no transactions with the rest of the world. The government levies taxes on the households and the firms and it also gives subsidies to the firms and transfer payments to the household sector. Thus, there is income flow from the household and firms to the government via taxes in one direction and there is income outflow from the government to the household and firms in the other direction. If the government revenue falls short of its expenditure, it is also known to borrow through financial markets. This sector adds three key elements to the circular flow model, i.e., taxes, government purchases and government borrowings.

In this model, the equilibrium condition is as follows:

Y = C + I + G

Where, Y = Income; C = Consumption; I = Investment and G = Government Expenditure In a closed economy, aggregate demand is measured by adding consumption, investment and government expenditure. Thus, aggregate demand is defined as the total demand for final goods and services in an economy at a given time and price level and aggregate supply is defined as the total supply of goods and services that the firms are willing to sell in an economy at a given price level.

The circular flow of income in a four sector model

This is the complete model of the circular flow of income that incorporates all the four macroeconomic sectors. Along with the above three sectors it considers the effect of foreign trade on the circular flow. With the inclusion of this sector the economy now becomes an ‘open economy’. Foreign trade includes two transactions, i.e., exports and imports. Goods and services are exported from one country to the other countries and imports come to a country from different countries in the goods market. There is inflow of income to the firms and government in the form of payments for the exports and there is outflow of income when the firms and governments make payments abroad for the imports. The import payments and export receipts transactions are done in the financial market

In this model, the equilibrium condition is as follows:

Y = C + I + G + NX

NX = Net Exports = Exports (X) – Imports (M)

Where, Y = Income; C = Consumption; I = Investment; G = Government Expenditure; X = Exports and M = Imports.

National income

National income or national product is defined as the total market value of all the final goods and services produced in an economy in a given period of time. There are many concepts of national income which are used by different economists and all of which are inter-related.

The total net value of all goods and services produced within a nation over a specified period of time, representing the sum of wages, profits, rents, interest, and pension payments to residents of the nation.

It includes income from all the productive sectors such as Agricultural, Industrial and Service Industry.

Final Goods: Final goods are those goods which have crossed the boundary line of production, and are ready for use by their final users. Final users may be consumers and any firm. Final goods as used by the producers are called capital goods.

Intermediate Goods: These are those goods which are not out of the boundary line of production and are yet not ready for use by their final users. These used are largely used as raw material.

Depreciation: A reduction in the value of an asset with the passage of time, due in particular to wear and tear. Depreciation is a non-cash expense that reduces the value of an asset over time.

Assets depreciate for two reasons: Wear and tear.

Net factor income from abroad (NFIA): Factor income earned by our residents from abroad Factor income earned by non residents within our country.

Transfer Payment: A payment made or income received in which no goods or services are being paid for, such as a benefit payment or subsidy.

A no compensatory government payment to individuals, as for welfare or social security benefits is transfer payment. People sometimes get income without any productive activity.

Ex: Unemployment benefits, old age pensions etc.

Change in Stock: It is measured as the difference between “Closing Stock” of the accounting year and “Opening stock” of the accounting year.

Change in Stock = Closing Stock – Opening Stock

GDPMP: GDPMP refers to the market value of final goods and services produced within the domestic territory of a country during an accounting year.

GDPMP is the sum total of value added by all producing units within the domestic territory of a country during the period of an accounting year.

GNPMP: Gross National Product is the total market value of all final goods and services produced annually in a country plus net factor income from abroad.

GNP=GDP+NFIA (Net Factor Income from Abroad)

NNPMP: Net National Product is the market value of all final goods and services after allowing for depreciation. It is also called National Income at market price. When charges for depreciation are deducted from the gross national product, we get it. Thus,

NNP=GNP-Depreciation

Personal Income (PI): Personal Income i s the total money income received by individuals and households of a country from all possible sources before direct taxes. Therefore, personal income can be expressed as follows: PI = NI - Corporate Income Taxes - Undistributed Corporate Profits - Social Security Contribution + Transfer Payments

Disposable Income (DI) : The income left after the payment of direct taxes from personal income is called Disposable Income. Disposable income means actual income which can be spent on consumption by individuals and families. Thus, it can be expressed as:

DI=PI-Direct Taxes

Per Capita Income (PCI): Per Capita Income of a country is derived by dividing the national income of the country by the total population of a country. Thus,

PCI=Total National Income/Total National Population.

Components of expenditure

There are four types of expenditures: consumption, investment, government purchases and net exports. Each of these expenditure types represent the market value of goods and services. The expenditure approach to calculating gross domestic product for the nation, or GDP, uses these four expenditure categories as a measure of economic growth and activity

Consumption

Generally the largest portion of GDP, accounting for as much as two-thirds of the total, consumption is primarily made up of services, and is calculated by adding durable and non-durable goods to expenditures for services. Consumption activity is driven by changes in interest rates. As your customers begin to save money due to higher interest rates improving return on their money, they also begin to consume less because of higher interest rates on credit, which decreases the amount they purchase from your store or service. Conversely, when rates fall, your customers tend to have more discretionary money or credit, and the amount they spend on your business increases.

Investments

Investments are considered purchases in assets that are expected to provide a value over time. Small businesses and individuals can invest in a wide range of assets, from commodities to foreign currencies. The formula for total investment, nationally, is fixed investment, plus inventory investment, plus residential investment. Fixed investment for small businesses includes purchases of capital goods, such as equipment, facilities, or even robotic systems to improve manufacturing. Inventory investment includes the change in business inventories over a given period.

Government

Government spending is often used as a lever by the U.S. Federal Reserve to manipulate money supply in the the economy for various reasons. When government spending goes up, some small businesses will have more money because of government contracts or subcontracts, or because their customers have more money to spend on goods and services. When government spending goes down, some small businesses will have less money because of losing contracts, or because customers in the community have less money to spend.

Net Exports

Many small businesses export goods to other nations. Likewise, many small businesses import goods from other countries for resell. Exports are goods and services that are sent out of the U.S. for other countries to purchase. Exports are added to GDP. Imports includes goods and services that businesses in the U.S., both large and small, buy from other countries. Imports are subtracted from GDP.

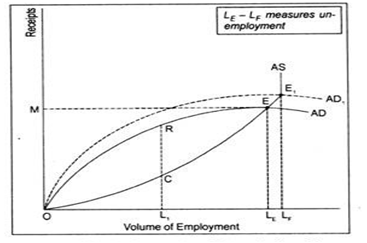

Keynes’ theory of employment is based on the principle of effective demand. In other words, level of employment in a capitalist economy depends on the extent of effective demand. Thus, unemployment is attributed to the deficiency of effective demand and to cure it requires the increasing of the level of effective demand.

By ‘effective’ demand, Keynes meant the entire demand for goods and services in an economy at various levels of employment. Total demand for goods and services by the people is that the sum total of all demand meant for consumption and investment. In other words, the sum of consumption expenditures and investment expenditures constitute effective demand in a two-sector economy.

In order to satisfy such demand, people are employed to produce all types of goods, both consumption goods and investment goods. However, to finish our discussion on effective demand, we need another component of effective demand—the component of government expenditure. Thus, effective demand could also be defined as the total of all expenditures, i.e.,

C + 1 +G

Where C stands for consumption expenditure,

I stands for investment expenditure, and

G stands for government expenditure.

Here we ignore government expenditure as a component of effective demand. Consistent with Keynes, the level of employment is decided by the effective demand which, in turn, is decided by aggregate demand function or aggregate demand price and aggregate supply function or aggregate supply price. In Keynes’ words; “The value of D (Aggregate Demand) at the point of Aggregate Demand function, where it's intersected by the aggregate Supply function, are going to be called the effective demand.”

Aggregate Demand (AD):

“The aggregate demand price for the output of any given amount of employment is the total sum of money or proceeds, which is expected from the sale of the output produced when that amount of labour is employed.”

Thus the aggregate demand price is the amount of money which the entrepreneurs expect to get by selling the output produced by the number of men employed. In other words, it refers to the expected revenue from the sale of output produced at a particular level of employment. Different aggregate demand prices relate to different levels of employment in the economy.

A statement showing the various aggregate demand prices at different levels of employment is called the aggregate demand price schedule or aggregate demand function. “The aggregate demand function,” according to Keynes, “relates any given level of employment to the expected proceeds from that level of employment.” Table I shows the aggregate demand schedule.

Table 1

Level of employment (N) (in lakhs) | Aggregate demand price (D) (Rs crores) |

20 | 230 |

25 | 240 |

30 | 250 |

35 | 260 |

40 | 270 |

45 | 280 |

50 | 290 |

The table reveals that with the increase in the level of employment proceeds expected rise and at lower levels of employment decline. When 45 lakh people are provided employment the aggregate demand price is Rs 280 crores and when 25 lakh people are provided jobs, it is Rs 240 crores. According to Keynes, the aggregate demand function is an increasing function of the level of employment and is expressed as D = F (AO, where D is the proceeds which entrepreneurs expect from the employment of N men.

The aggregate demand curve can be drawn on the basis of the above schedule. It slopes upward from left to right because as the level of employment increases aggregate demand price also rises, shown as AD curve in bellow figure.

Aggregate Supply (AS):

When an entrepreneur gives employment to certain amount of labour, it requires certain quantities of co-operant factors like land, capital, raw materials, etc. which will be paid remuneration along with labour. Thus each level of employment involves certain money costs of production including normal profits which the entrepreneur must cover.

“At any given level of employment of labour aggregate supply price is the total amount of money which all the entrepreneurs in the economy, taken together, must expect to receive from the sale of the output produced by that given number of men, if it is to be just worth employing them.”

In brief, the aggregate supply price refers to the proceeds necessary from the sale of output at a particular level of employment. Thus each level of employment in the economy is related to a particular aggregate supply price and there are different aggregate supply prices for different levels of employment.

A statement showing the various aggregate supply prices at different levels of employment is called the aggregate supply price schedule or aggregate supply function. In the words of Prof. Dillard, “The aggregate supply function is a schedule of the minimum amounts of proceeds required to induce varying quantities of employment.” Table II shows the aggregate supply schedule

Level of employment (N) (in lakhs) | Aggregate supply price (D) (Rs crores) |

20 | 215 |

25 | 230 |

30 | 245 |

35 | 260 |

40 | 275 |

45 | 290 |

50 | 305 |

The above table reveals that the aggregate supply price rises with the increase in the level of employment. If entrepreneurs are to provide employment to 20 lakh workers, they must receive Rs 215 crores from the sale of the output produced by them.

It is only when they expect to receive the minimum amounts of proceeds (Rs 230 crores, Rs 245 crores and Rs 260 crores) that they will provide employment to more workers (25 lakhs, 30 lakhs and 35 lakhs respectively).

But when the economy reaches the level of full employment (at 40 lakh workers) the aggregate supply price (Rs 275,290 and 305 crores) continues to increase but there is no further increase in employment. According to Keynes, the aggregate supply function is an increasing function of the level of employment and is expressed as Z = фN, where Z is aggregate supply price of the output from employing N men.

The aggregate supply curve can be drawn on the basis of the schedule. It slopes upward from left to right because as the necessary expected proceeds increase, the level of employment also rises. But when the economy reaches the level of full employment, the aggregate supply curve becomes vertical. Even with the increase in the aggregate supply price, it is not possible to provide more employment as the economy has attained the level of full employment.

Equilibrium Level of Employment— the point of Effective Demand:

We have studied separately aggregate demand and aggregate supply as the two determinants of effective demand. Now we'll describe how equilibrium level of employment is determined in an economy by using the concept of effective demand.

The level of employment in an economy is determined at that point where the aggregate supply price equals the aggregate demand price. In other words, the intersection of the aggregate supply function with the aggregate demand function determines the volume of income and employment in an economy.

It is, thus, clear that so long as expected sales receipts of the entrepreneur (i.e., aggregate demand schedule) exceed costs (i.e., aggregate supply schedule), the level of employment should be increasing and therefore the process will continue until expected receipts equal costs or aggregate demand curve intersects aggregate supply curve.

Note that the AS curve starts from the origin. If aggregate receipts (i.e., GNP) are zero, entrepreneurs wouldn't hire workers. Likewise, AD curve also starts from the origin. The equilibrium level of employment is deter-mined by the intersection of the AS and AD curves. this is often the point of effective demand— point E in the below figure. Like this point, OLE workers are employed. At the OL1 level of employment, expected receipts exceed necessary costs by the quantity RC. Entrepreneurs will now go on hiring more labour till OLE level of employment is reached.

At this level of employment, entrepreneurs’ expectations of profits are maximised. Employment beyond OLE is unprofitable because costs exceed revenue. Thus, actual employment (OLE) falls short of full employment (OLF). Keynesian system shows two kinds of equilibrium—actual employment equilibrium determined by AD and AS curves and underemployment equilibrium.

Keynes made little emphasis to the aggregate supply function since its determinants (such as technology, supply or availability of raw materials, etc.,) don't change in the short run. Keynes was examining the possibility of unemployment in a capitalistic economy against the backdrop of Great Depression of the 1930s.

After diagnosing the matter, Keynes recommended policy prescription so on create more employment in the economy. Indeed, for curing unemployment problem, he did not subscribe the classical ideas—the supply-oriented policies. Keynes attached great importance to demand-stimulating policies to cure unemployment. In other words, Keynes paid emphasis on the aggregate demand function. That is why Keynes’ theory is known as a ‘theory of aggregate demand’.

Key takeaways –

Sources-

1. Ahuja H.L – Macro Economics – S.Chand.

2. Mankiw, N. Gregory. Principles Macroeconomics.Cengage Learning.

3. Dornbusch, Rudiger, and Stanley. Fischer, Macroeconomics. McGraw-Hill.

4. Dornbusch, Rudiger., Stanley. Fischer and Richard Startz, Macroeconomics. Irwin/McGraw-Hill.

5. Deepashree, Macro Economics, Scholar Tech. New Delhi.

6. Barro, Robert, J. Macroeconomics, MIT Press, Cambridge MA.