UNIT IV

BUDGETING AND STANDARD COSTING

Budgeting and budgetary control

The term ‘Budget’ appears to have been derived from the French word ‘baguette’ which means ‘little bag' , or a container of documents and accounts. A budget is an accounting plan. It is a formal plan of action expressed in monetary terms. It could be seen as a statement of expected income and expenses under certain anticipated operating conditions. It is a quantified plan for future activities – quantitative blue print for action.

Every organization achieves its purposes by coordinating different activities. For the execution of goals efficient planning of these activities is very important and that is why the management has a crucial role to play in drawing out the plans for its business. Various activities within a company should be synchronized by the preparation of plans of actions for future periods. These comprehensive plans are usually referred to as budgets. Budgeting is a management device used for short‐term planning and control.I t is not just accounting exercise.

Budgetary Control is a method of managing costs through preparation of budgets. Budgeting is thus only a part of the budgetary control. According to CIMA, “Budgetary control is the establishment of budgets relating to the responsibilities of executives of a policy and the continuous comparison of the actual with the budgeted results, either to secure by individual action, the objective of the policy or to provide a basis for its revision.”

The main features of budgetary control are:

Advantages of budgetary control

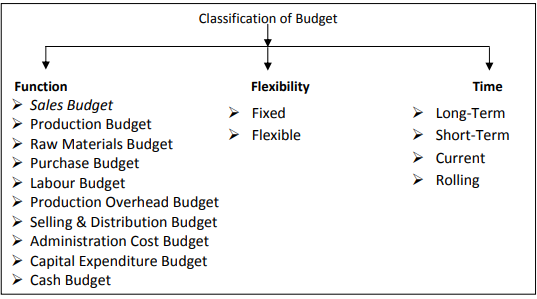

Preparation of different budgets

Functional Classification:

2. PRODUCTION BUDGET: The production budget is prepared on the basis of estimated production for budget period. Usually, the production budget is based on the sales budget. At the time of preparing the budget, the production manager will consider the physical facilities like plant, power, factory space, materials and labour, available for the period. Production budget envisages the production program for achieving the sales target. The budget may be expressed in terms of quantities or money or both. Production may be computed as follows: Units to be produced = Desired closing stock of finished goods + Budgeted sales – Beginning stock of finished goods.

3. PRODUCTION COST BUDGET: This budget shows the estimated cost of production. The production budget demonstrates the capacity of production. These capacities of production are expressed in terms of cost in production cost budget. The cost of production is shown in detail in respect of material cost, labour cost and factory overhead. Thus production cost budget is based upon Production Budget, Material Cost Budget, Labour Cost Budget and Factory overhead.

4. RAW‐MATERIAL BUDGET: Direct Materials budget is prepared with an intention to determine standard material cost per unit and consequently it involves quantities to be used and the rate per unit. This budget shows the estimated quantity of all the raw materials and components needed for production demanded by the production budget.

5. PURCHASE BUDGET: Strategic planning of purchases offers one of the most important areas of reduction cost in many concerns. This will consist of direct and indirect material and services. The purchasing budget may be expressed in terms of quantity or money.

6. LABOUR BUDGET: Human resources are highly expensive item in the operation of an enterprise. Hence, like other factors of production, the management should find out in advance personnel requirements for various jobs in the enterprise. This budget may be classified into labour requirement budget and labour recruitment budget. The labour necessities in the various job categories such as unskilled, semi‐skilled and supervisory are determined with the help of all the head of the departments. The labour employment is made keeping in view the requirement of the job and its qualifications, the degree of skill and experience required and the rate of pay.

7. PRODUCTION OVERHEAD BUDGET: The manufacturing overhead budget includes direct material, direct labour and indirect expenses. The production overhead budget represents the estimate of all the production overhead i.e. fixed, variable, semi‐variable to be incurred during the budget period.

8. SELLING AND DISTRIBUTION COST BUDGET: The Selling and Distribution Cost budget is estimating of the cost of selling, advertising, delivery of goods to customers etc. throughout the budget period. This budget is closely associated to sales budget in the logic that sales forecasts significantly influence the forecasts of these expenses. Nevertheless, all other linked information should also be taken into consideration in the preparation of selling and distribution budget. The sales manager is responsible for selling and distribution cost budget.

9. ADMINISTRATION COST BUDGET: This budget includes the administrative costs for non‐manufacturing business activities like directors fees, managing directors’ salaries, office lightings, heating and air condition etc. Most of these expenses are fixed so they should not be too difficult to forecast. There are semi‐variable expenses which get affected by the expected rise or fall in cost which should be taken into account. Generally, this budget is prepared in the form of fixed budget.

10. CAPITAL‐ EXPENDITURE BUDGET: This budget stands for the expenditure on all fixed assets for the duration of the budget period. This budget is normally prepared for a longer period than the other functional budgets. It includes such items as new buildings, land, machinery and intangible items like patents, etc. This budget is designed under the observation of the accountant which is supported by the plant engineer and other functional managers.

11. CASH BUDGET: The cash budget is a sketch of the business estimated cash inflows and outflows over a specific period of time. Cash budget is one of the most important and one of the last to be prepared. It is a detailed projection of cash receipts from all sources and cash payments for all purposes and the resultants cash balance during the budget. It is a mechanism for controlling and coordinating the fiscal side of business to ensure solvency and provides the basis for forecasting and financing required to cover up any deficiency in cash. Cash budget thus plays avital role in the financing management of a business undertaken.

FIXED AND FLEXIBLE BUDGET:

2. FLEXIBLE BUDGET: This is a dynamic budget. In comparison with a fixed budget, a flexible budget is one “which is designed to change in relation to the level of activity attained.” The underlying principle of flexibility is that a budget is of little use unless cost and revenue are related to the actual volume of production. The statistics range from the lowest to the highest probable percentages of operating activity in relation to the standard operating performance. Flexible budgets are a part of the feed advance process and as such are a useful part of planning. An equally accurate use of the flexible budgets is for the purposes of control.

TIME BUDGET

(a) Long term Budget: These budgets are prepared on the basis of long‐term projection and portray a long range planning. These budgets generally cover plans for three to ten years. In this regard it is mostly prepared in terms of physical quantities rather than in monetary values.

(b) Short term Budget: In this budget forecasts and plans are given in respect of its operations for a period of about one to five years. They are generally prepared in monetary units and are more specific than long term budgets.

(c) Current Budgets: These budgets cover a very short period, may be a month or a quarter or maximum one year. The preparation of these budgets requires adjustments in short term budgets to current conditions.

(d) Rolling Budgets:A few companies follow the practice of preparing a rolling or progressive budget. In this case companies prepare the budget for a year in advance. A new budget is prepared after the end of each month or quarter for a full year in advance. The figures for the month or quarter which has rolled down are dropped and the statistics for the next month or quarter are added.

MASTER BUDGET

The master budget is a review budget which combines all functional budgets and it may take the form of Financial Statements at the end of budget period. It is also called the operating budget. It embraces the impact of both operating decisions and financing decisions. It provides the necessary plan for operations during the period when all detailed budgets have been completed. A master budget becomes a principal document for the operations of the industry during the period it covers.

What is zero-based budgeting?

Zero-based budgeting (ZBB) is an approach to making a budget from scratch. The budget is not based on previous budgets. Instead, the budget starts at zero.

With zero-based budgeting, you need to justify every expense before adding it to the official budget. The goal of zero-based budgeting is to reduce spending by looking at where costs can be cut.

Your employees might be involved in creating a zero-based budget. You can ask employees what kind of expenses they will have and figure out where you can reduce business expenses. If an expense does not benefit the business, or if it can be done in-house, it is axed from the budget.

Zero-based budgeting process

There are a few different steps in zero-based budgeting to keep in mind. The process of zero-based budgeting follows the same basic steps:

Identify business goals

a) Develop and analyze new ways to achieve goals

b) Discover new ways to fund business processes

c) Prioritize funds

By following these zero-based budgeting steps, you will determine what expenses go toward achieving business goals that directly benefit your company. Then, you can find new ways to spend.

With ZBB, you might find that your budget fluctuates significantly between periods. You might have a budget of $50,000 one year and $35,000 the next, since budgets aren’t based on previous ones.

When to use zero-based budgeting

As a small business owner, you’re busy. You might not have time to make a budget from scratch every few months or even each year.

Some companies might benefit from creating a zero-based budget once every few years and using a traditional budget in the meantime.

Zero-based budgeting vs. traditional budgeting

Unlike traditional budgeting, zero-based budgeting does not look at budgets made in prior years. Traditional budgeting looks at prior-year budgets and adjusts based on the information in those budgets. For example, if you hire one new employee, you would increase your budget since you would add new wages to your payroll expenses.

Zero-based budgeting is more time-consuming than the traditional approach because you need to start from scratch and strategize where your expenses can be cut. You need to know where every dollar is going to implement zero-based budgeting.

Both zero-based and traditional budgeting are important in creating departmental budgets. If you have managers of different departments, you might allocate funds to them for the year. With traditional budgeting, managers are encouraged to spend their allowance so they don’t lose it. Zero-based budgeting is a little more frugal, and you might not see unnecessary spending, since every expense is accounted for.

Key takeaways –

ICMA, London Defines : “Standard Costing is the preparation and use of Standard costs, their comparison with actual costs and analysing of variances to their causes and points of incidence”

Controlling Process in standard Costing :

Formulation of Standard Costs: For all elements of cost viz., Materials, Labour and Expenses, standard costs are fixed very much scientifically by experts based on multiple criteria.

Matching Actuals with Standards: In this step, actual costs are compared with standard costs for the purposes of verifying whether actual cost is more or less than the standard costs.

Variances and Analysis thereof: The difference between actual and the standard is known as variance and this is further analysed to find out whether variance is debit variance (or) Credit variance.

Analysis of causative factors for variances: For all debit (or) unprofitable variances, causative factors (or) reasons responsible are unearthed and then are classified into controllable and uncontrollable reasons.

Corrective Measures: In relation to controllable causes, the people responsible are held up and are instructed to take necessary remedial measures and see that they do not repeat in the time to come.

Reporting to Management: Depending upon the degree of severity of the variances, information by following the principle of “Management by Exception”, will be reported to the concerned management level for necessary cost control measures.

Revising the standards: With regard to uncontrollable variances, an idea of revising the standards watching the changed scenario, may be though of.

Process in setting Standards: The function of setting standards for costs (or) revenues is a rational and professional job. Hence, it is entrusted to a committee called – standards Committee consisting of Production Manager, purchase manager, personnel Manager, Cost Accountants etc. This committee sets standards for each and every element of cost viz., Materials, Labour and expense. Let us see them separately.

Standard for Direct Material Cost: [SMC] This SMC is a product of standard quantity and standard price. So, it is clear that standard quantity and standard price are to be determined first and SMC is obtained by multiplying these two. SMC is briefly called as SC (Standard Cost).

Standard Material Quantity [SMQ]: SMQ is briefly called – Standard Quantity (SQ). Based on input – output relations, normal material losses as per are laboratory tests, SQ is determined.

Standard price [SP]: SP is determined taking multiple criteria into account like : price of material in Stock, materials already contracted, future price trends, discounts etc. So, SC for material is the product of SQ and SP. Therefore SC = SQ x SP

Standard for Direct Labour Cost [SLC] This resembles SMC in that it is a product of standard hours and standard rate. ∴ SLC = SH x SR In this also, SH and SR are to be found out.

Standard Hours: With the help of time and motion studies in a laboratory, work study job analysis, Normal idle time, Therbligs etc. standard time (or) Hours are fixed.

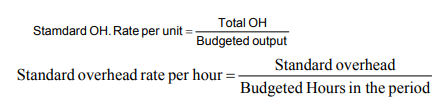

Standard Rate: This is 2nd aspect in finding SLC. It is fixed based on the past, going rates, consultations with Trade union, demand for labour, supply of labour etc. Thus, the product of SH and SR gives SLC. Standard for Expenses : [Overheads] While we fix standards for expenses (or) overheads (OH) we need to go in three steps. (1) Determination of total overhead 2) Determination of production in units (3) Calculation of standard overhead rate.

Sometime, for the entire overhead, a standard rate can be calculated. On the other hand, overhead can see split into fixed and variable overheads and separately, standard Overhead rates can be determined. The following formula can be used to calculate the overhead rate.

This rate can be calculated in hours also.

Variance analysis

This part is the most integral part of standard costing. The purposes of cost Accounting can be achieved by costing through variance analysis in standard costing. Variances are to be calculated for all the elements of cost viz., Materials, Labour and Expenses (or) overhead (OH).

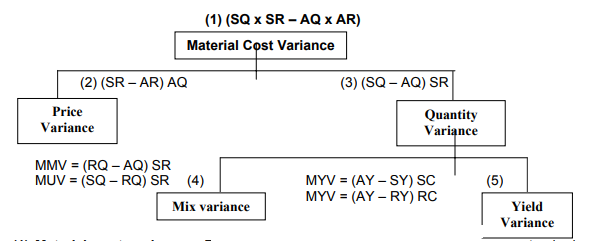

Material variance analysis

(1) Material cost variance: This is the difference between standard cost of standard quantity for Actual output and actual cost of actual Material used for actual output. The formula for this is : MCV = SC – AC = SQ x SR – AQ x AR Where : SC = Standard cost, AC = Actual cost, SQ = SQ for AY, SR = Standard Rate, AQ = Actual Quantity, AR = Actual Rate. Importantly, SQ = SQ for AY Where AY = Actual Yield (or) Actual output.

(2) Material Price Variance: From the above chart, it is understood that 2nd variance is price variance and this will also lead to MCV. This is a part of the MCV and arises due to the difference in standard price set and the actual price paid.

The formula is : MPV = (SR – AR) AQ

where SR = Standard Rate, AR = Actual Rate and AQ = Actual Quantity of material.

(3) Material quantity variance: (MQV) It is also known as usage variance and it is a part of the MCV as per the above chart. This may arise due to any of the reasons viz., workers, quality of Materials, skill and efficiency of workers, changes in product design etc. Mostly, it arises due to the difference in utilisation of raw materials.

Its formula is : MQV = (SQ – AQ) SR

Where SQ = SQ for AY, AQ = Actual Quantity, SR = Standard Rate, AY = Actual Yield.

Key takeaways-

1) Standard Costing discloses the cost of deviations from standards and clarifies these as to their causes, so that management is immediately informed of the sphere of operations in which remedial action is necessary.

Example 1

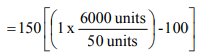

A company produces a product X and operates a system of standard costing. Details of information for the month of July , 2002 are as under :

Standard output from each ton of material : 50 units

Standard price per ton : Rs.150

Actual usage : 100 tons

Actual price per ton : Rs.200

Actual output : 6000 units

Calculate material variances.

Solution

(a) Material Price Variance (MPV) :

Actual Quantity (Standard Price – Actual Price)

= 100 [150 – 200]

= Rs.5,000 (Adverse)

(b) Material Usage Variance (MUV) :

Standard price [Standard quantity – Actual Quantity]

= 150 [120 – 100]

= Rs.3,000 (Favourable)

(c) Material Cost Variance (MCV) :

Standard cost of Material – Actual cost of Material

= [Standard quantity for Actual output x Standard price] – [Actual quantity for Actual output x Actual Price]

= [120 x 150] – [100 x 200]

= 18,000 – 20,000

= Rs.2,000 (Adverse)

Rectification / Verification :

MCV = MPV + MUV

Rs.2,000 (Adverse) = Rs.5,000 (Adverse) + Rs.3,000 (Favourable)

Or, Rs.2,000 (Adverse) = Rs.2,000 (Adverse)

Example 2

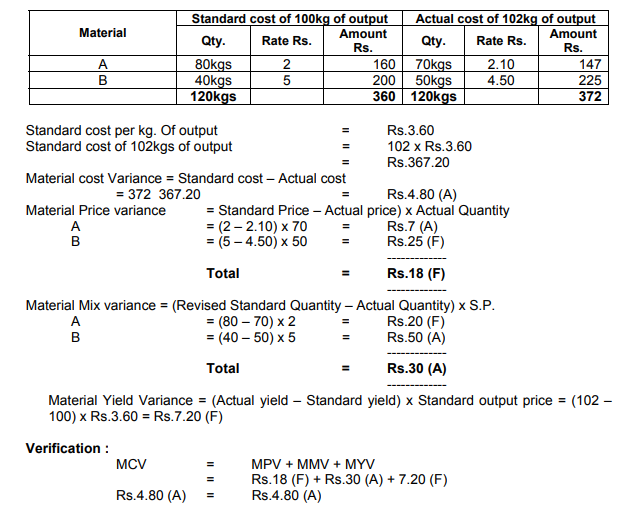

80Kg. of material A at a standard price of Rs.2 per kg and 40kgs.of material B at a standard price of Rs.5 per kg. Were to be used to manufacture 100kgs.of a chemical. During a month, 70kgs.of material A priced at Rs.2.10per kg. And 50kgs.of Material B priced at Rs.4.50per kg. were actually used and the output of the chemical was 102 kgs.

Find out the material variance.

Solution

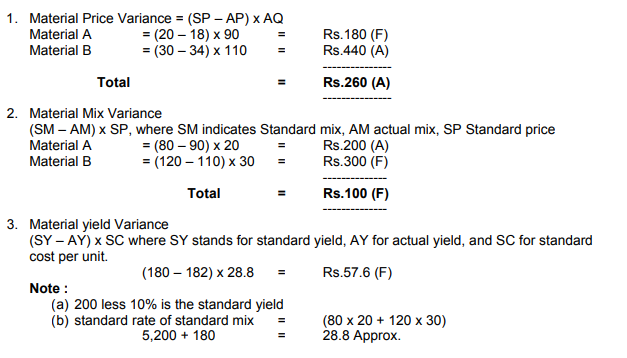

Example 3

The standard cost of a chemical mixture is :

40% material A at Rs.20 per kg.

60% material B at Rs.30 per kg.

A standard loss of 10% expected in production. During a period there is used:

90kgs material A at cost of Rs.18 per kg

110kgs material B at cost of Rs.24 per kg.

The weight produced is 182kgs of good product.

Calculate :

1. Material price variance.

2. Material mix variance.

3. Material yield variance

4. Material cost variance.

Solution

Materials Cost Variance = Materials price Variance + Materials Mix Variance + Material

Yield Variance

Rs.102.40 (A) = Rs.260 (A) + Rs.100 (F) + Rs.57.60 (F) = Rs.102.40.

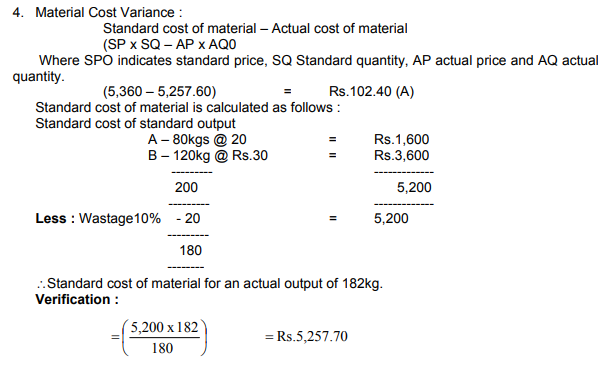

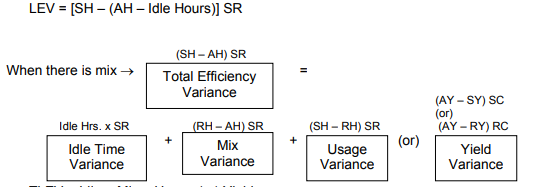

Direct labour cost variance

These variances are about the 2nd element of cost, i.e. Labour. We get reminded of all material variance formula when we look at Labour variances. There is a lot of similarity. The first variance is Direct Labour Cost Variance (DLCV). This is difference between standard cost of labour and actual cost of labur. This is like MCV. It’s formula is:

DLCV = SC – AC = SH * SR – AH * AR

Labour Rate Variance [LRV]:

This is just like Material Price Variance. This is part of the DLCV which is due to difference between standard wage rate and actual wage rate paid. Formula is:

LRV = (SR – AR) AH,

Where: SR = Standard Rate

AR = Actual Rate,

AH = Actual Hours.

Labour Time (or) Total Efficiency Variance : (LTV (or) LEV)

This is again like material quantity variance. This is post of DLCV which is due to difference in standard Hours for Actual output and Actual Hours. The relevant formula is:

LTV (or) LEV : (SH – AH) SR where:

SH = Standard Hours,

AH = Actual Hours,

SR = Standard Rate

Labour Efficiency variance : (LEV) :

(1) Idle Time Variance: As per the chart of labour variances, it is portion of the Labour Efficiency (or) Time variance. As there is material loss in the case of materials, there is problem of idle time is the case of Labour. This idle time is due to abnormal reasons viz., non – availability of raw materials, of special kind of labour, break down of Plant & Machinery etc. Formula is:

ITV = Abnormal Idle Hours x SR

Note: This is always adverse variance.

(2) Labour Mix variance: This is similar to material mix variance and all the formula of material mix variance can be used by using SH in the place of SQ and RSH (Revised standard hours) in the place of RSQ (or) RQ the relevant formula are :

From the above it can be understood that the total Labour Efficiency (or) Time variance is a sum of (1) Idle Time variance, (2) Mix variance and (3) usage variance. When LUV is calculated in Labour time variance, there is no need to specially calculate Labour yield variance as it is very much equal to LYU.

(3) Labour yield variance: This is very much similar to MYV. The formula are :

Labour Efficiency Variance: [LEV] As per the chart, this is part of Total Efficiency variance. When we seek to calculate the real efficiency variance, from out of total Hrs. actually worked, Idle Hours lost due to abnormal condition shall be set a side and with these actual hours, efficiency variance is to be calculated. The formula is :

TLEV = Idle + Mix + Usage (or) Yield

• Denotes Total Actual Hours worked including idle Time Hours.

Verifications:

(1) LCV = Rate + Total Time (or) Total Efficiency.

(2) Total Efficiency Variance = Idle Time + Effeciency.

(3) Total Efficiency Variance = Idle + Mix + usage (or) Yield.

(4) Usage = Yield.

Example 1

With the help of the following data, calculate :

(i) Labour Cost Variance,

(ii) Labour Rate Variance,

(iii) Labour Efficiency Variance

Standard hours : 40 @ Rs.3 per hour

Actual hour : 50 @ Rs.4 per hour

Solution

(i) Labour Cost Variance [LCV] :

[Standard Time x Standard Rate] – [Actual Time x Actual Rate]

= [40 x 3] – [50 x 4]

= 120 – 200

= Rs.80 (Adverse)

(ii) Labour Rate Variance [LRV] :

Actual Time [Standard Rate – Actual Rate]

= 50 [3 – 4]

= Rs.50 (Adverse)

(iii) Labour Efficiency Variance [LEV] :

Standard Rate [Standard Time – Actual Time]

= Rs.3 [40 – 50]

= Rs.30 (Adverse)

Reconciliation / Check :

LCV = LRV + LEV

Rs.80 (Adverse) = Rs.50 (Adverse) + Rs.30 (Adverse)

Example 2

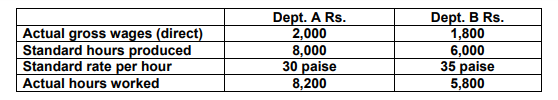

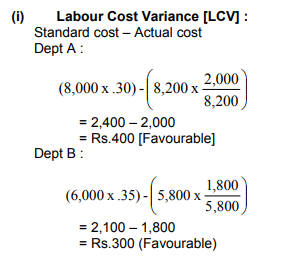

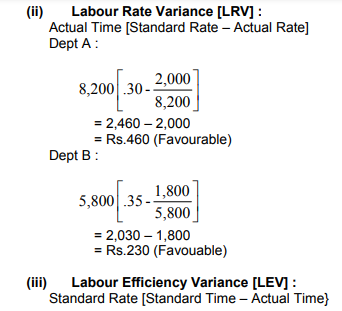

From the data given below, calculate labour variances for the two departments

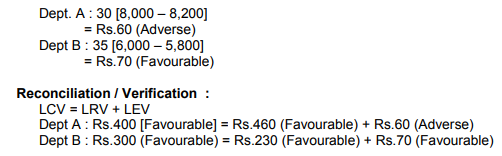

Solution

Example 3

Calculate Labour variances from the following data:

Gross Direct wages Rs.30,000

Standard hours 1,600

Standard rate per hour Rs.15

Actual hours paid 1,500

Actual hours paid include hours not worked (abnormal idle time) : 50

Solution :

(i) Labour Cost Variance [LCV]:

[Standard Time x Standard Rate] – [Actual Time x Actual Rate]

= [1,600 x 15] – [1,500 x 20]

= 24,000 – 30,000

= Rs.6,000 (Adverse)

(ii) Labour Rate Variance [LRV] :

Actual Time [Standard Rate – Actual Rate]

= 1,500 [15 – 20]

= Rs.7,500 (Adverse)

(iii) Labour Efficiency Variances [LEV]:

Standard Rate [Standard Time – Actual Time]

= 15 [1,600 – 1,450]

= Rs.2,250 (Favourable)

(iv) Labour Idle time Variance [LITV]:

Standard Rate x Abnormal Idle Time

= 15 x 50

= Rs.750 (Adverse)

Reconciliation / Check:

LCV = LRV + LEV + LITV

Rs.6,000 (Adverse) = Rs.7,500 (Adverse) + Rs.2,250 (Favourable) + Rs.750 (Adverse)

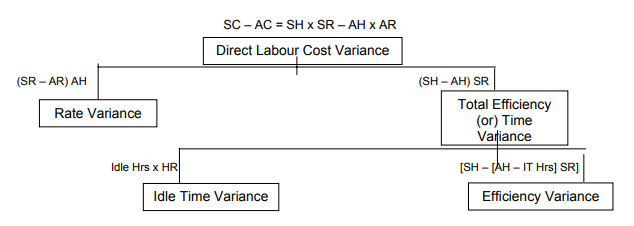

Overhead variance-

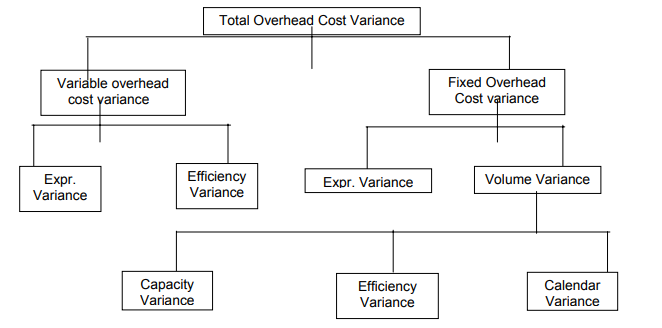

Overhead is the aggregate of all indirect costs viz., indirect material, indirect labour and indirect expenses. Under cost Accounting, and in standard costing overheads are absorbed (or) recovered from cost units on same suitable basis. Overhead rates of absorption are predetermined in terms of both labour hrs.(or) Machine hrs. and production units. So, the actual output (or) hours worked are multiplied by the predetermined rates of OH absorption in order to find out standard overhead for actual production (or) hours worked and it is compared to actual overheads incurred to find out the variance between standard overhead and actual overhead. Thus, overhead variance analysis is made. Total overhead cost variances can be conveniently divided into:

(1) Variable overhead variance and

(2) Fixed overhead variance.

Variable Overhead Variance is further divided into (a) Expenditure variance and (b) Efficiency variance. Similarly, Fixed overhead variance is further divided into (a) Expenditure variance and (b) Volume variance and volume variance is further broken into (i) Capacity Variance (ii) Efficiency Variance and (iii) Calendar Variance. Total overhead cost variance is the difference between Standard overhead and Actual overhead. The whole of this is analysed as under.

Total overhead cost variance = Standard overhead – Actual overhead

Variable Overhead Cost Variances:

1. Variable overhead Expenditure Variance: This is the difference between Budgeted Variable overheads for actual output and actual overheads for actual output. The formula is :

Variable Overhead Expenditure Variance = AH (Standard OH Rate – Actual OH Rate)

= (Standard OH – Actual OH)

2. Variable Overhead Efficiency variance: (Standard time for Actual production – Actual hours) Standard rate per unit

= (Budget overhead – Standard overhead)

This is the difference between Standard Hours for Actual production and actual hours taken, multiplied by Standard Rate per unit.

Fixed overhead cost variances:

Fixed overheads are those costs which do not very with the level of activity but which remain cost and for any level. The following are various variances in this category.

(a) Fixed Overhead Expenditure variance : It is that part of the Fixed overhead variance that is due to the difference between budgeted expenditure and actual expenditure.

Fixed Expenditure variance = Budgeted Fixed Overhead – Actual Fixed overhead.

(b) Volume Variance : Fixed Overhead variance may be caused as a result of changes in volume of activity, as per the chart given above. It is the difference between standard overhead and Budgeted overhead. The formula is:

Volume Variance = Standard overhead – Budgeted overhead.

(or)

Recovered Overhead – Budgeted overhead.

(i) Capacity Variance: It is a part of volume variance which is due to under (or) over utilisation of plant and machinery. In terms, formula, it is:

Capacity variance = SR ph (AH – Budgetary Hours)

= SR pu (Standard output – Budgetary Output)

(ii) Efficiency Variance: This variance is again another portion of volume variance. It arises due to increased (or) decreased output due to efficiency (or) in efficiency. The relevant formula is :

Efficiency Variance = SR ph (Standard hours for actual production – Actual hours)

= SR ph (SH – AH)

(iii) Calendar variance: This is also a part of volume variance. This arises due to the difference in Budgeted working days in the budgeted period and actual days in the same budgeted period. The formula is :

Calendar Variance = SR ph/pd x Excess (or) deficit hours / days worked

Checking / Verifications:

Example 1

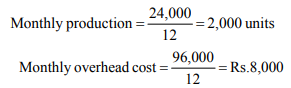

A factory has estimated its overheads for one year at Rs.96,000. The factory runs for 300 days in a year. It works for 8 hours a day. The total budgeted production for the year is 24,000 articles.

Actual data are also given to you as under for the month of April.

Actual overhead Rs.8,500

Output 2,100 articles

Idle time 4 hours

Calculate: (1) Overhead cost variance, (2) Overhead budget variance, (3) Overhead efficiency variance, (4) Idle Time variance.

Solution:

(1) Overhead Cost Variance:

Formula:

Standard overhead cost of actual output – Actual overhead cost

= Rs.8,400 – Rs.8,500 = Rs.100 (A)

(2) Overhead budget variance or expenditure variance

Budget overheads – Actual overheads

= Rs.8,000 – Rs.8,500 = Rs.500 (A)

(3) Overhead efficiency variance

(i) Where standard overhead rate per unit is given

(Actual production – Standard production in actual hours) x Standard overhead rate per unit

= (2,100 – 1,960) x Rs.4 = Rs.560 (F)

(ii) Where standard overhead rate per hour is given

(Actual Hours – Standard hours for actual production) x Standard overhead rate per hour

= (196 – 210) x Rs.40 = Rs.560 (F)

(4) Idle Time variance:

(i) Where standard overhead rate per unit is given

Formula:

Production lost in idle time x overhead standard rate per unit

= 40 x Rs.4 = Rs.160 (A)

(ii) Where standard overhead rate per hour is given

Formula:

Idle Time x overhead standard rate per hour

= 4 x Rs.40 = Rs.160 (A)

Check:

Overhead efficiency variance + Overhead idle time variance = Overhead volume variance

Rs.560 (F) + Rs.160 (A) = Rs.400 (F)

Overhead volume variance + Overhead budget variance = Overhead cost variance

Rs.400 (F) + Rs.500 (A) = Rs.100 (A)

Working Notes:

(i) Standard overhead cost of actual output

If monthly production is 2,000 units, overhead cost is Rs.8,000

If monthly production is 2,100 units, overhead cost is

8,000 / 2,000 x 2,100 = Rs.8,400

(ii) Standard production in actual hours

Yearly hours 300 days x 8 = 2,400 hours

Monthly hours = 2,400 / 12 = 200 hours

∴Actual hours worked = 200 – 4 = 196 hours

If factory runs 200 hours standard production is 2,000 units

If factory runs 196 hours standard production 2,000 / 200 x 196 = 1,960 units

(iii) Standard overhead rate per hour

Monthly overhead cost Rs.8,000

Standard hours in a month 200

∴Rate per hour = 8,000 / 200 = Rs.40 per hour.

(iv) Standard overhead rate per unit

Standard units 2,000

Overhead cost Rs.8,000

∴Rate per unit 8,000 / 2,000 = Rs.4 per unit

Example 2

A manufacturing company operates a costing system and showed the following data in respect of the month of November.

Actual No. of working days 22

Actual man hours worked during the month 4,300

Number of products produced 425

Actual overhead incurred (Rs.) 1,800

Relevant information from the company’s budget and standard cost data are as follows :

Budgeted number of working days per month 20

Budgeted man hours per month 4,000

Standard man hours per product 10

Standard overhead rate per man hour Rs.0.50

You are required to calculate for the month of November.

(a) the overhead variance.

(b) The calendar variance

(c) The volume variance.

Solution

(a) Overhead cost variance

Standard overhead cost of actual production – Actual overhead cost

Rs.2,125 – Rs.1,800 = Rs.325 (F)

(b) Overhead calendar variance

(i) where standard overhead rate per unit is given

(Revised budgeted quantity, i.e., budgeted quantity on the basis of actual no. of working days – Budgeted quantity) x Standard rate per unit

(440 – 400) x Rs.5 = Rs.200 (F)

(ii) where standard rate per hour is given

(Budgeted No. of hours for actual working days – Budgeted hours) x Standard overhead rate per hour

(4,400 – 4,000) x Re.0.50 = Rs.200 (F)

(c) Overhead volume variance

(i) Where standard rate per unit is given

(Actual production – Budgeted production) x Standard overhead rate per unit

(425 – 400) x Rs.5 = Rs.125 (F)

(ii) Where standard rate per hour is given

(Standard hours for Actual production – Budgeted hours) x Standard overhead rate per hour

(4,250 – 4,000) x Re.0.50 = Rs.125 (F)

Working Notes :

(1) Standard cost per unit

Re.0.50P x 10 hours = Rs.5 per unit

(2) Standard overhead cost of actual production

425 units x Rs.5 per unit = Rs.2,125

(3) Revised budgeted quantity

If 20 are the working days, standard production 400 units

If 22 are the working days, standard production 400/20 x 22 = 440 units

(4) Budgeted hours for actual working days

In 20 working days, the standard hours are 4,000

∴ In 22 working days, the standard hours are 4,000 / 20 x 22 = 4,400 hours

(5) Standard hours for actual production

Actual production x Standard hours per unit = 425 x 10 = 4,250 hours

References-