Unit 1

Introduction Concepts of financial statements

A financial statement is a collection of data organized according to logical and consistent accounting procedures. Its purpose is to convey an understanding of some financial aspects of a business firm. It may show a position at a moment in time, as in the case of a balance sheet, or may reveal a series of activities over a given period of time, as in the case of an income statement. The term ‘financial statements’ generally refer to the two statements-

i) The position statement or the balance sheet; and

(ii) The income statement or the profit and loss account.

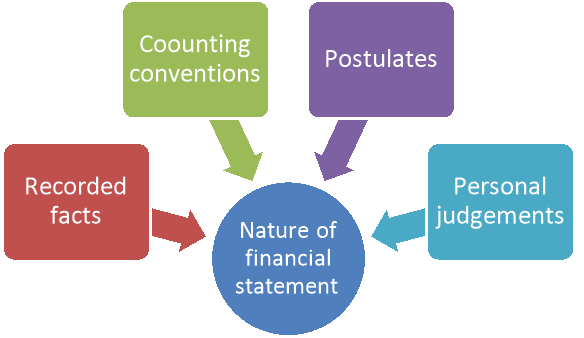

Nature of financial statement

The nature of financial statement is discussed below-

Figure: Nature of financial statement

1. Recorded Facts:

The term ‘recorded facts’ refers to the data taken out from the accounting records. The records are maintained on the basis of actual cost data. The original cost or historical cost is the basis of recording various transactions. The figures of various accounts such as cash in hand, cash in bank, bills receivables, sundry debtors, fixed assets etc. are taken as per the figures recorded in the accounting books. The assets purchased at different times and at different prices are put together and shown at cost prices. As recorded facts are not based on replacement costs, the financial statements do not show current financial condition of the concern.

2. Accounting Conventions:

Certain accounting conventions are followed while preparing financial statements. The convention of valuing inventory at cost or market price, whichever is lower, is followed. The valuing of assets at cost less depreciation principle for balance sheet purposes is followed. The convention of materiality is followed in dealing with small items like pencils, pens, postage stamps, etc. These items are treated as expenditure in the year in which they are purchased even though they are assets in nature. The stationery is valued at cost and not on the principle of cost or market price whichever is less. The use of accounting conventions makes financial statements comparable, simple and realistic.

3. Postulates:

The accountant makes certain assumptions while making accounting records. One of these assumptions is that the enterprise is treated as a going concern. The other alternative to this postulate is that the concern is to be liquidated, this, is untenable if management shows an intention to liquidate the concern. So the assets are shown on a going concern basis. Another important assumption is to presume that the value of money will remain the same in different periods. Though there is a drastic change in purchasing power of money the assets purchased at different times will be shown at the amount paid for them. While preparing profit and loss account, the revenue is treated in the year in which the sale was undertaken even though the sale price may be received in a number of years. The assumption is known as realization postulate.

4. Personal Judgments:

Even though certain standard accounting conventions are followed in preparing financial statements but still personal judgment of the accountant plays an important part. For example, in applying the cost or market value whichever is less to inventory valuation the accountant will have to use his judgment in computing the cost in a particular case. There are a number of methods for valuing stock, viz.; last in first out, first in first out, average cost method, standard cost, base stock method, etc. The accountant will use one of these methods for valuing materials. The selection of depreciation method, to use one of the several methods for estimating uncollectible debts, to determine the period for writing off intangible assets are some of the examples where judgment of the accountant will play an important role in choosing the most appropriate course of action.

KEY TAKEAWAYS

- A FINANCIAL STATEMENT IS A COLLECTION OF DATA ORGANIZED ACCORDING TO LOGICAL AND CONSISTENT ACCOUNTING PROCEDURES. ITS PURPOSE IS TO CONVEY AN UNDERSTANDING OF SOME FINANCIAL ASPECTS OF A BUSINESS FIRM.

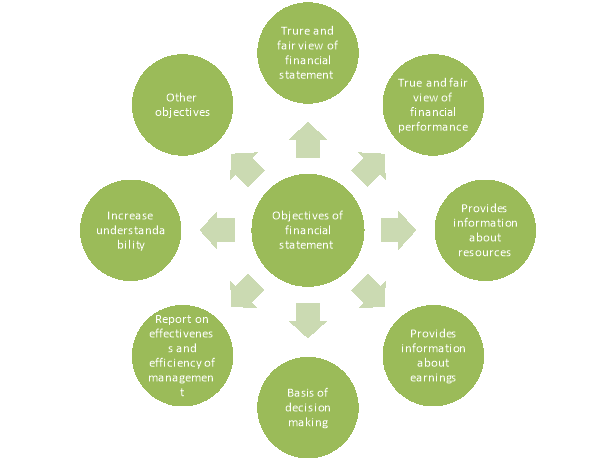

Financial statements are important documents of a company as it provides essential information to the stakeholders. The Accounting Principles Board of America (APB) states the following objectives of financial statements:

(i) To provide reliable financial information about economic resources and obligations of a business firm.

(ii) To provide other needed information about changes in such economic resources and obligations.

(iii) To provide reliable information about changes in net resources (resources less obligations) arising out of business activities.

(iv)To provide financial information that assists in estimating the earning potentials of business.

Some of the general objectives of financial statement are-

Figure: Objectives of financial statement

1. True & Fair view of financial position

- Balance sheet shows the financial position of the business i.e. it enlists the assets and liabilities. The difference between those represents the net worth (i.e. book value of the business). Net worth includes the capital infused by the owners plus the profits earned till date.

- Decreasing in the net worth is bad indicator of growth. This gives the management various hints to improvise the financial position.

- Financial position is presented for current year and previous year. The increase is assets represents growth of the earning capacity and decrease in liabilities represents the repaying capacity of the entity.

- Thus, the utmost objective of true and fairness is very essential here.

2. True & fair view of financial performance

- Income statement shows the financial performance of the entity i.e. its revenue and its expenses. The difference between those represents the profit or loss earned during the period.

- Decrease in revenue has direct impact in decrease in profits. Increase in expense have reverse impact of decrease in profits.

- If the accounting standards are not followed appropriately, it shows that management can play with revenue & expenses figures.

- Thus, the true and fairness is essential objective in preparing the income statement.

3. To provide information about resources

- Another objective behind financial statements is to provide information about the resources available with business (i.e. production capacity, labour hours, cash reserves, inventory, WIP percentage, delivery mechanism, etc.) and its usage parameters. It also gives information about changes in the resources between two periods.

- This information helps in better understanding of the business as changes in the utilisation and acquisition of the resources helps the stakeholders to take financial decisions.

4. To provide Information about the earning potential

- Financial statements should also hint about earning potential of the business. This information is for the top management level of the organisation.

- With the economic assets and liabilities, the management can decide on the expansion levels.

- The three components of financial statements in together should provide information about the earning capacity of the entity.

- Earning potential is also linked with the utilisation of available resources.

5. To form basis for decisions of the stakeholders

- Stakeholders means the owners, directors, customers, suppliers, employees, workman, government, finance providers and the public at large.

- Employees needs to take decision whether to stay employed or not. Customer needs to take decision whether to give more orders. Suppliers needs to think about whether to supply or not. Finance providers also have to take decision whether it is feasible to give loans to the entity. Public at large needs to think whether to invest in the entity. Directors have to decide on the dividend pay-outs, raising finance, employing more staff, acquisition of resources and many other things to keep the business running.

- All such decisions are based primarily on the financial statements.

6. To report on the effectiveness and efficiency of the management

- Owners have no time to attend the daily operations of the business and thus, they appoint the management to look forward for the entity. The strong financials are the picture of the effectiveness and efficiency with which the decisions are taken by the management.

- Effectiveness means whether the purpose is served or not. So, owners can think whether the decision made by them in appointing the management is appropriate or whether it needs any change. It also shows whether the internal policies are strong.

- Efficiency means whether the target is achieved in reasonable time. Owners can think upon their decision by observing the gross profit ratio and the net profit ratios of recent years.

7. To increase the understand ability of the end users.

- End users means the owners, for whom the financial statements are prepared. All the laws, regulations, accounting standards, accounting framework, etc. are here to ensure the understand ability of the end users.

- Financial statements are summaries of the operations during the year and therefore it is required to provide various disclosures to help the owners understand the statements in a better manner.

- If the end users can arrive at correct decision with the help of financial statements, this objective is achieved.

8. Other Objectives

- To help settle disputes arising between various parties.

- To provide information about the credibility of the entity in the finance world.

- To decide on whether it is right time to replace the assets of the firm with new assets having increased capacities

- To decide whether to invest in other entities so to expand the empire.

- To help government with information about payment of taxes, etc.

KEY TAKEAWAYS

- FINANCIAL STATEMENTS ARE IMPORTANT DOCUMENTS OF A COMPANY AS IT PROVIDES ESSENTIAL INFORMATION TO THE STAKEHOLDERS.

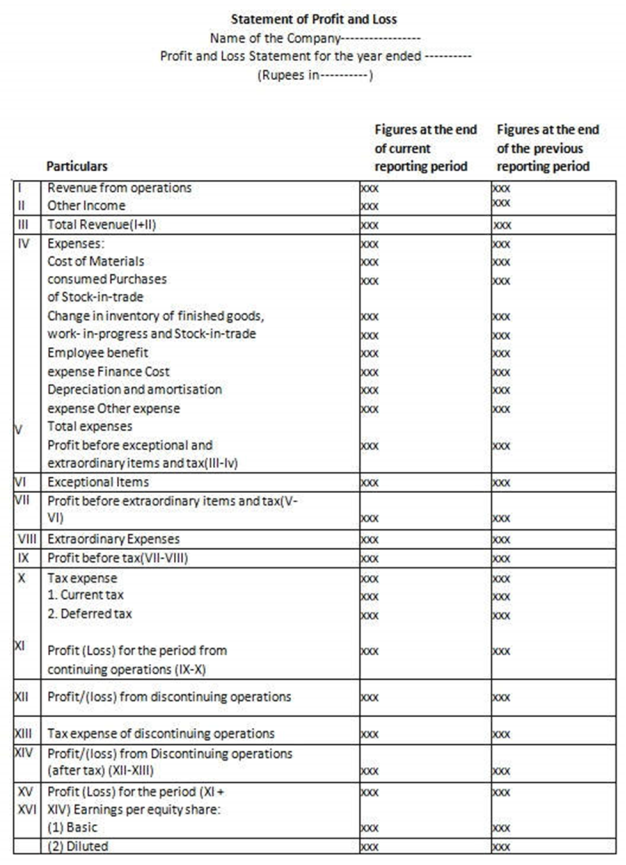

Income statement

Income statement is a financial statement of the company that shows profits/loss of the company for an accounting period. It is also known as profit and loss account which records sales, purchase and all direct and indirect expenses related to the respective accounting period. The specimen format of income statement is depicted below-

The items of statement of profit and loss are discussed as follows:

- Revenue from operations

This includes: (i) Sale of products

(ii) Sale of services

(iii) Other operating revenues.

In respect to a finance company, revenue from operational shall include revenue from interest, dividend and income from other financial services. It may be noted that under each of the above heads shall be disclosed separately by way of notes to accounts to the extent applicable.

2. Other income

(i) Interest income (in case of a company other than a finance company),

(ii) Dividend income,

(iii)Net gain/loss on sale of investments,

(i) Other non-operating income (net of expenses directly attributable to such income).

- Expense :

Expenses incurred to earn the income shown under various heads as discussed below:

(a) Cost of Materials: It applies to manufacturing companies. It consists of raw materials and other materials consumed in manufacturing of goods.

(b) Purchase of Stock-in-trade: It means purchases of goods for the purpose of trading.

(c) Changes in inventories: It is the difference between opening inventory (stock) finished goods, WIP and of finished goods, WIP and stock-in-trade and closing stock-in-trade inventory.

(d) Employees benefit expenses: Expenses incurred on employees towards salary, wages, leave encashment, staff welfare, etc., are shown under this head. Employees benefit expenses may be further categorised into direct and indirect expenses.

(e) Finance cost: It is the expenses towards interest charges during the year on the borrowings. Only the interest cost is to be shown under this head. Other financial expenses such as bank charges are shown under “Other Expenses”.

(f) Depreciation: Depreciation is the diminution in the value of fixed assets whereas amortisation is writing off the amount relating to intangible assets.

(g) Other expenses: All other expenses which do not fall in the above categories are shown under other expenses. Other expenses may further be categorised into direct expenses, indirect expenses and non-operating expenses.

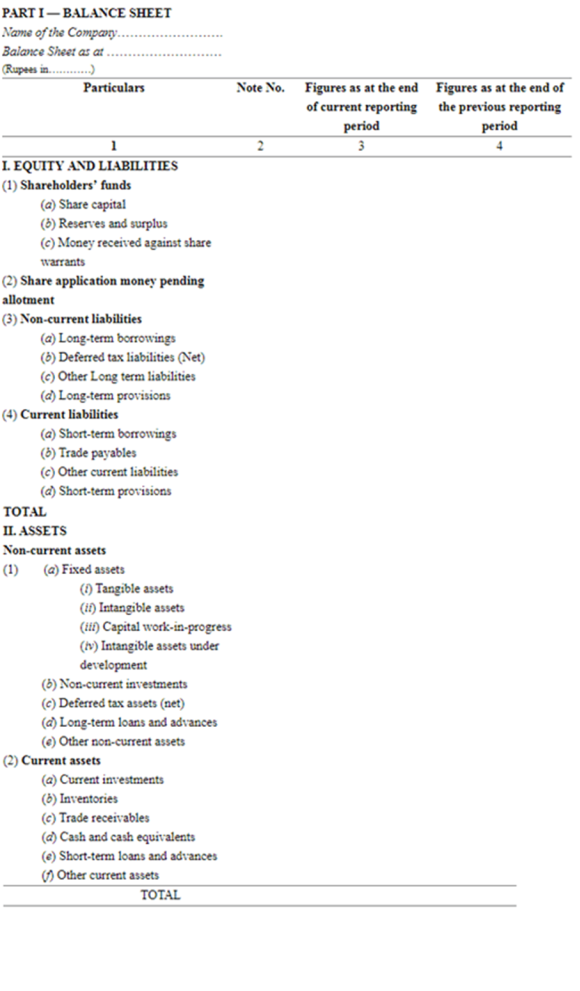

Balance sheet

Balance sheet is a financial statement prepared at the end of the accounting period to know the financial position of the company. The balance provides information about the nature and quality of assets and liabilities of the company. Schedule III of the Companies Act, 2013 deal with the Balance sheet and profit and loss account. The specimen format of the balance sheet is depicted below-

Description of balance sheet items

- Share capital:

a. The number and amount of shares authorized.

b. The number of shares issued, subscribed and fully paid, and subscribed but not fully paid.

c. Par value per share.

d. A reconciliation of the number of shares outstanding at the beginning and at the end of the reporting period.

e. The rights, preferences and restrictions attaching to each class of shares including restrictions on the distribution of dividends and the repayment of capital.

f. Shares in respect of each class in the company held by its holding company or its ultimate holding company including shares held by or by subsidiaries or associates of the holding company or the ultimate holding company in aggregate.

g. Shares in the company held by each shareholder holding more than 5 per cent, shares specifying the number of shares held.

h. Shares reserved for issue under options and contracts/commitments for the sale of shares/disinvestment, including the terms and amounts.

i. For the period of five years immediately preceding the date as at which the Balance Sheet is prepared.

a) Aggregate number and class of shares allotted as fully paid-up pursuant to contract(s) without payment being received in cash.

b) Aggregate number and class of shares allotted as fully paid-up by way of bonus shares.

c) Aggregate number and class of shares bought back.

j. Terms of any securities convertible into equity/preference shares issued along with the earliest date of conversion in descending order starting from the farthest such date.

k. Calls unpaid (showing aggregate value of calls unpaid by directors and officers).

l. Forfeited shares (amount originally paid-up).

2. Reserves and Surplus

i) Capital Reserves;

Ii) Capital Redemption Reserve;

Iii) Securities Premium Reserve;

Iv)Debenture Redemption Reserve;

v) Revaluation Reserve;

Vi)Share Options Outstanding Account;

Vii) Other Reserves (specify the nature and purpose of each reserve and the amount in respect thereof);

Viii) Surplus i.e., balance in Statement of Profit and Loss disclosing allocations and appropriations such as dividend, bonus snares and transfer to/from reserves, etc.

3. Long-Term Borrowings

i) Bonds/debentures

Ii) Term loans:

(a) from banks.

(b) from other parties

Iii) Deferred payment liabilities;

Iv) Deposits;

v) Loans and advances from related parties;

Vi) Long term maturities of finance lease obligations;

Vii) Other loans and advances (specify nature)

- Other Long-term Liabilities

(i) Trade payables

(ii) Others.

2. Long-term provisions

i) Provision for employee benefits

Ii) Others (specify nature).

3. Short-term borrowings

i) Loans repayable on demand

(a) from banks

(b) from other parties

(c) Loans and advances from related parties

(d) Deposits

(e) Other loans and advances (specify nature).

7. Other current liabilities

i) Current maturities of long-term debt;

Ii) Current maturities of finance lease obligations;

Iii) Interest accrued but not due on borrowings;

Iv) Interest accrued and due on borrowings;

v) Income received in advance;

Vi) Unpaid dividends;

Vii) Application money received for allotment of securities and due for refund and interest accrued thereon. Share application money includes advances towards allotment of share capital. The terms and conditions including the number of shares proposed to be issued, the amount of premium, if any, and the period before which shares shall be allotted shall be disclosed. It shall also be disclosed whether the company has sufficient authorised capital to cover the share capital amount resulting from allotment of shares out of such share application money. Further, the period for which the share application money has been pending beyond the period for allotment as mentioned in the document inviting application for shares along with the reason for such share application money being pending shall be disclosed. Share application money not exceeding the issued capital and to the extent not refundable shall be shown under the head Equity and share application money to the extent refundable, i.e., the amount in excess of subscription or in case the requirements of minimum subscription are not met, shall be separately shown under “Other current liabilities”;

Viii) Unpaid matured deposits and interest accrued thereon;

Ix) Unpaid matured debentures and interest accrued thereon;

x) Other payables (specify nature).

8. Short-term provisions

i) Provision for employee benefits

Ii) Others (specify nature).

9. Tangible assets

i) Land

Ii) Buildings;

Iii) Plant and Equipment;

Iv) Furniture and Fixtures;

v) Vehicles;

Vi) Office equipment;

Vii) Others (specify nature).

10. Intangible assets

i) Goodwill

Ii) Brands /trademarks;

Iii) Computer software;

Iv) Mastheads and publishing titles;

v) Mining rights;

Vi) Copyrights, and patents and other intellectual property rights, services and operating rights;

Vii) Recipes, formulae, models, designs and prototypes;

Vii) Licences and franchise;

Viii) Others (specify nature).

11. Non-current investments

i) Investment property;

Ii) Investments in Equity Instruments;

Iii) Investments in preference shares;

Iv) Investments in Government or trust securities;

v) Investments in debentures or bonds;

Vi) Investments in Mutual Funds;

Vii) Investments in partnership firms;

Viii) Other non-current investments (specify nature). Under each classification, details shall be given of names of the bodies corporate indicating separately whether such bodies are

(a) subsidiaries,

(b) associates,

(c) joint ventures, or

(d) controlled special purpose entities in whom investments have been made and the nature and extent of the investment so made in each such body corporate (showing separately investments which are partly-paid). In regard to investments in the capital of partnership firms, the names of the firms (with the names of all their partners, total capital and the shares of each partner) shall be given.

12. Long-term loans and advances

i) Capital Advances;

Ii) Security Deposits;

Iii) Loans and advances to related parties (giving details thereof);

Iv) Other loans and advances (specify nature).

13.Other non-current assets

i) Long-term Trade Receivables (including trade receivables on deferred credit terms);

Ii) Others (specify nature);

Iii) Long term Trade Receivables, shall be sub-classified as:

(a) Secured, considered good;(b) Unsecured, considered good;

(c) Doubtful

14. Current Investments

i) Investments in Equity Instruments;

Ii) Investment in Preference Shares;

Iii) Investments in Government or trust securities:

Iv) Investments in debentures or bonds;

v) Investments in Mutual Funds;

Vi) Investments in partnership firms;

Vii) Other investments (specify nature).

15. Inventories

i) Raw materials;

Ii) Work-in-progress;

Iii) Finished goods;

Iv) Stock-in-trade (in respect of goods acquired for trading);

v) Stores and spares;

Vi) Loose tools;

Vii) Others (specify nature)

16. Trade Receivables

Aggregate amount of Trade Receivables outstanding for a period exceeding six months from the date they are due for payment

i) Secured, considered good;

Ii) Unsecured, considered good;

Iii) Doubtful.

17. Cash and cash equivalents

i) Balances with banks;

Ii) Cheques, drafts on hand;

Iii) Cash on hand;

Iv) Others (specify nature)

18. Short-term loans and advances

i) Loans and advances to related parties (giving details thereof);

Ii) Others (specify nature).

Sub-categorised as a) Secured, considered good; b) Unsecured, considered good; c) Doubtful.

19. Other current assets (specify nature)

Which incorporates current assets that do not fit into any other asset categories

20. Contingent liabilities

i) Claims against the company not acknowledged as debt

Ii) Guarantees;

Iii) Other money for which the company is contingently liable.

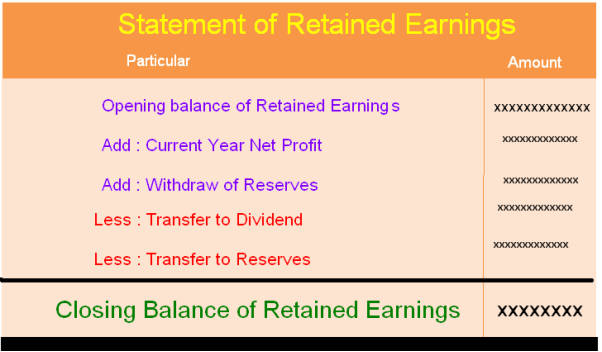

Statement of retained earnings

The statement of retained earnings, also known as the retained earnings statement, is a financial statement that shows the changes in a company’s retained earnings account for a period of time. This statement is used to reconcile the beginning and ending retained earnings for a specified period when it is adjusted with information such as net income and dividends. It is used by analysts to figure out how corporate profits are used by the company. It shares a lot of familiarities with the statement of changes in equity, but it only shows how retained earnings have changed during the period. The statement of retained earnings includes the following basic elements:

- Beginning balance of retained earnings

- Corrections for previous errors along with any tax effect

- Net income

- Dividends or withdrawals by the owner

This statement of retained earnings appears as a separate statement or it can also be included on the balance sheet or an income statement. The statement contains information regarding a company’s retained earnings, also including amounts distributed to shareholders through dividends and net income. An amount is set aside to handle certain obligations other than dividend payments to shareholders, as well as any amount directed to cover any losses. Each statement covers a specified period of time, usually a year, as noted in the statement.

It is calculated as-

Retained Earnings=Beginning Retained Earnings + New Net Income−Dividends

Figure: Specimen of retained earnings

Source: https://www.google.com

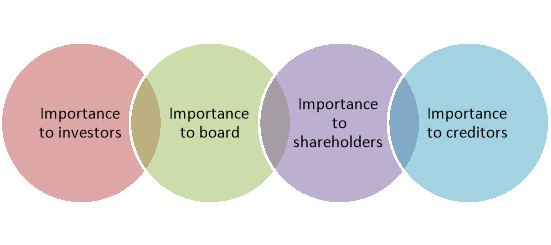

Importance of Retained Earnings Statement

The statement of retained earnings has great importance to investors, shareholders, and the Board of Directors.

Figure: Importance of retained earnings

- Importance to Investors

A company releases its statement of retained earnings to the public to raise market and shareholder confidence. Investors can judge the health of a company by evaluating this statement. The statement is of great importance to individuals within the organization as well. Outside investors can gauge the potential earnings of a company by analysing the statement of retained earnings.

2. Importance to Board

Essentially, a statement of retained earnings is crucial for a company’s growth, as it gives the Board of Directors confidence that the company is well worth the investment in both money and time. The Board of Directors are responsible to shareholders. Ultimately, they have to make the decision to keep the shareholders happy. Retained earnings tell the Board how much money the company has, and enables them to make an informed decision.

3. Importance to Shareholders

Using the retained earnings, shareholders can find out how much equity they hold in the company. Dividing the retained earnings by the no. Of outstanding shares can help a shareholder figure out how much a share is worth.

4. Importance to Creditors

Creditors view this statement as well, as they want to look at several performance measures before they can issue credit to a company. Low or negative retained earnings indicate that the company may have problems repaying its debt. This may result in the creditors choosing not to provide credit to these businesses or charge them a higher interest rate to compensate for the risk.

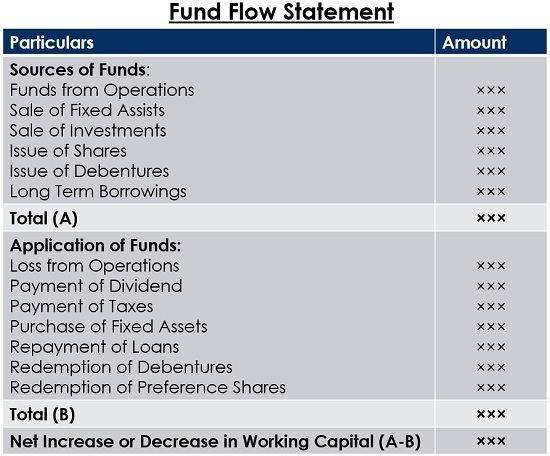

Fund flow statement

A fund flow statement is a statement prepared to analyse the reasons for changes in the financial position of a company between two balance sheets. It portrays the inflow and outflow of funds i.e. sources of funds and applications of funds for a particular period. The fund flow statement is a summary of the source of funds and the application of funds that compares the balance sheets of two different dates and analyse from where company has earned money and where the company has spent money. With the help of fund flow statement format, it becomes a condensed version to analyse the sources and application of fund.

Three Parts of Fund Flow Statement Format are-

Figure: Parts of financial statement

- Statement of Changes in Working Capital: Working capital means the difference between the current assets and current liabilities. If there is an increase in working capital, then it will be an application of funds, and if there is a decrease in working capital, then it will be a source of funds.

2. Funds from Operations: If we earn a profit, then it will be a source of funds, and if there is a loss, then it will be an application of funds.

3.Fund Flow Statement: After preparing the above two requirements, we will prepare the fund flow statement, which will comprise all outflow and inflow of funds.

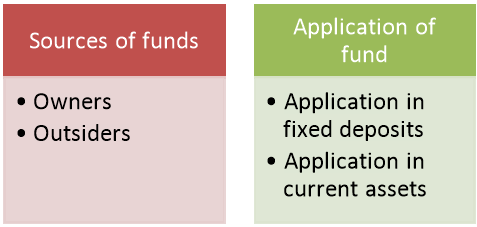

Components of a fund flow statement

A fund flow statement comprises of:

Figure: Components of financial statement

- Sources of funds: It talks about the extent of funds availed from

Owners

Outsiders.

- Application of funds: It talks about how the funds have been utilized

Funds deployed in Fixed assets

Funds deployed in Current assets

Figure: Specimen of fund flow statement

Benefits of Funds Flow Statement

A statement of the business’s funds flow is an essential financial tool to monitor and regulate working capital. Below are some benefits of Funds Flow Statement that financial analysts and managers opt for.

Figure: Benefits of fund flow statement

- Analytical importance in financial operations

Even though financial statements show the resources and their utilisations, it doesn’t reveal the reasons for such changes in the Balance Sheet. The statement thus provides an analytical view of the differences between current assets and current liabilities. Hence, it also explains how these changes take place in the context of the funds of a concerned company. In some cases, even if the company runs on profit, scenarios of cash shortage may arise. In such circumstances, this statement provides a clear picture of the profit earned by an organization.

2. Helps to form effective dividend policy

Sometimes a firm possesses substantial available profit to be distributed as a dividend but finds it difficult to do so due to a lack of sufficient liquidity. A Funds Flow Statement thus helps identify liquidity blockage and assists in planning an effective dividend policy.

3. Works as a financial guide

This statement also serves as a financial guide for a company. It brings out the financial issues that a concerned company could face in the near future. The management can thus chalk out an appropriate strategy to protect the company from any significant future financial loss.

4. Helps to determine the creditworthiness of an organization

Institutions lending finances often opt to evaluate this statement for a series of years to assess the creditworthiness of an applicant company before approving a loan. Hence, it also portrays the credibility of a firm in terms of fund management.

Limitations of Funds Flow Statement

In spite of several essential utilities, financial analysts encounter some Funds Flow Statement problems indicating at the limitations to its use.

- This statement cannot portray financial parameters represented in a Balance Sheet or Income Statement. It only focuses on the movement of funds during a specific timeline and does not quantify other essential items.

- The statement doesn’t add any new numerical value to a company’s financial standing. It only re-arranges the available information to identify issues with fund management.

- Due to its historical nature, this statement can’t conclude with accuracy the present-day financial standing of a business.

- Working capital plays an essential role in business finance. However, the movement of cash is more important for a promising financial future of a business. Thus, the flow of funds does not serve as an effective barometer for the purpose.

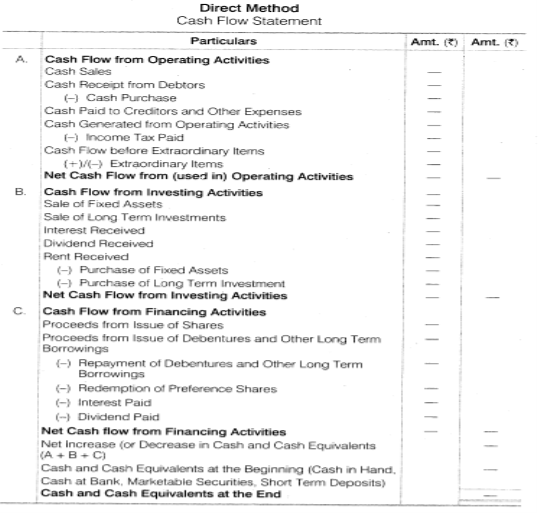

Cash flow statement

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.

How Cash Flow Statements Work

The cash flow statement is an important document that helps open a wind interested parties insight into all the transactions that go through a company. The cash flows from different categories are grouped under three heads which are discussed below-

Figure: Sources of cash flows

- Cash Flows from Operations

This is the first section of the cash flow statement covers cash flows from operating activities (CFO) and includes transactions from all operational business activities. The cash flows from operations section begins with net income, then reconciles all noncash items to cash items involving operational activities. This section reports cash flows and outflows that stem directly from a company's main business activities. These activities may include

Buying and selling inventory and supplies, along with paying its employees their salaries.

Any other forms of in and outflows such as investments, debts, and dividends are not included.

Companies are able to generate sufficient positive cash flow for operational growth. If there is not enough generated, they may need to secure financing for external growth in order to expand. The cash flows from the operations section can also include accounts payable, depreciation, amortization, and numerous prepaid items booked as revenue or expenses, but with no associated cash flow.

2. Cash Flows From Investing

This is the second section of the cash flow statement looks at cash flows from investing (CFI) and is the result of investment gains and losses. This section also includes cash spent on property, plant, and equipment. This section is where analysts look to find changes in capital expenditures. When capital expenditure increases, it generally means there is a reduction in cash flow. But that's not always a bad thing, as it may indicate that a company is making investment into its future operations. Companies with high capital expenditure tend to be those that are growing. While positive cash flows within this section can be considered good, investors would prefer companies that generate cash flow from business operations—not through investing and financing activities. Companies can generate cash flow within this section by selling equipment or property.

3. Cash Flows From Financing

Cash flows from financing (CFF) is the last section of the cash flow statement. The section provides an overview of cash used in business financing. It measures cash flow between a company and its owners and its creditors, and its source is normally from debt or equity. These figures are generally reported annually on a company's 10-K report to shareholders. Analysts use the cash flows from financing section to determine how much money the company has paid out via dividends or share buybacks. It is also useful to help determine how a company raises cash for operational growth. Cash obtained or paid back from capital fundraising efforts, such as equity or debt, is listed here, as are loans taken out or paid back. When the cash flow from financing is a positive number, it means there is more money coming into the company than flowing out. When the number is negative, it may mean the company is paying off debt, or is making dividend payments and/or stock buybacks.

Figure: Specimen of cash flow statement

Benefits of cash flow statement

Some of the advantages of Cash flow statement

- Verifying Profitability and Liquidity Positions

Cash Flow Statement helps the management to ascertain the liquidity and profitability position of businesses. Liquidity refers to one’s ability to pay the obligation as soon as it becomes due. Since Cash Flow Statement presents the cash position of a firm at the time of making payment it directly helps to verify the liquidity position, the same is applicable for profitability.

2. Verifying Capital Cash Balance

Cash Flow Statement also helps to verify the capital cash balance of businesses. It is possible for businesses to verify the idle and/or excess and/or shortage of cash position, if capital cash balance is determined. After verifying the cash position, the management can invest the excess cash, if any, or borrow funds from outside sources accordingly to reach the cash loss.

3. Cash Management

If the Cash Flow Statement is properly prepared, it becomes easy for you to manage the cash. The management can prepare an estimate about the multiple inflows of cash and outflows of cash so that it becomes very helpful for them to make future plans.

4. Planning and Coordination

Cash Flow Statement is planned on an estimated basis meant for the successive year. This helps the management to understand how much funds are needed and for what purposes, how much cash is generated from internal sources, how much cash can be procured from outside the business. It also helps to prepare cash budgets. Thus, the management can coordinate various activities and prepare plans with the help of this statement.

5. Superiority over Accrual Basis of Accounting

As a number of technical adjustments are made in the latter case, Cash Flow Statement is more reliable or dependable than collecting basis of accounting.

Schedules

In accounting, a schedule is defined as the supporting report or document which constitutes detailed information, explaining the elements of the chief financial report. It serves as a kind of proof to all the data that is presented in the financial report, with answers to all the numbers mentioned in the report. In other words, accounting schedules provide all the financial accounting in detail which cannot be illustrated within the chief report. For example, if we talk about the schedule of the balance sheet, not only the liabilities, assets, and equities of a company will be presented, but a breakdown of each category will be shared as a sub-category or a sub-schedule. A schedule is a supporting document that provides additional details or proof for the information stated in a primary document. In business, schedules are needed to provide proof for the ending balances stated in the general ledger, as well as to provide additional detail for contracts. Examples of schedules are:

A list of the aged accounts payable

A list of the aged accounts receivable

An itemization of all fixed assets and their associated accumulated depreciation

An itemization of all inventory and their associated costs

A schedule is also a timeline for a project. For example, a schedule shows the activities required to complete a construction project, along with task assignments, expected task durations, and milestones reached.

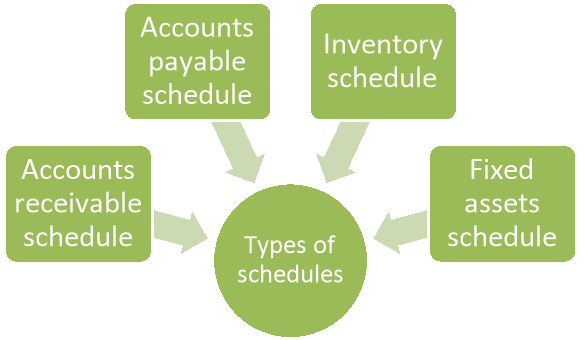

Types of Accounting Schedules

The accounting world constitutes a lot of financial terms which have different meanings and executions. These terms together lay the foundation for financial reporting and serve as the basis for the various types of accounting schedules discussed herein.

Figure: Types of schedules

- Accounts Receivable Schedule

The accounts receivable schedule lets you know about the payments which others have to pay to your company in exchange for your products and services which were consumed by them. This easily lets you know which customers have outstanding invoices as the invoices are collaboratively assigned to every single customer. With this report, you will know if you need to schedule a collection call or reduce the ‘credit extended’ in case a customer has not paid you yet for your services. For example, businesses can generate payment notices to the customers with unpaid invoices after simply cross-verifying the list of such customers with the help of this schedule.

2. Accounts Payable Schedule

The accounts payable schedule lists the number of vendors to whom your company have payments pending. If your business buys services and raw materials from a lot of different companies, there is a good amount of possibility that your business gets offered terms, with cash not forming the only source of payments. For example, the debts which are outstanding are actually a liability on a business which must be paid as soon as possible. This schedule precisely tells you about how much money is to be paid and to whom. In other words, it is one of the best ways to arrive at the accounts payable solutions.

3. Inventory Schedule

The inventory schedule lets you know about the raw materials that are available for use for manufacturing and the number of ready-to-sale products to the customers. The complete costs of all these things form the inventory, which is considered as an asset to the company. Any revenues that come as a result of incurred costs while providing a service also come under the inventory. The distribution details of the inventories will be shown in this schedule. In a nutshell, inventory accounting is comprised of the following:

Raw Materials- Materials available for the finished goods manufacturing

Working Materials-Materials that are presently in use for goods manufacturing

Finished Goods-Finished goods that are ready for sale to the customers

4. Fixed Asset Schedule

The fixed asset schedule comprises of the fixed assets listing in detail, which is mentioned in the general ledger. In exact terms, this schedule will let you know about the particular asset number, gross cost, description, and accumulated depreciation. Accumulated depreciation is defined as the complete fixed asset depreciation, which is ‘expense charged’ owing to its acquisition and availability for use. The accumulated depreciation account is an account for the assets which are having a credit balance i.e. it appears as a deduction from the total fixed assets amount reported on the balance sheet.

KEY TAKEAWAYS

- INCOME STATEMENT IS A FINANCIAL STATEMENT OF THE COMPANY THAT SHOWS PROFITS/LOSS OF THE COMPANY FOR AN ACCOUNTING PERIOD. IT IS ALSO KNOWN AS PROFIT AND LOSS ACCOUNTS WHICH RECORDS SALES, PURCHASE AND ALL DIRECT AND INDIRECT EXPENSES RELATED TO THE RESPECTIVE ACCOUNTING PERIOD.

- BALANCE SHEET IS A FINANCIAL STATEMENT PREPARED AT THE END OF THE ACCOUNTING PERIOD TO KNOW THE FINANCIAL POSITION OF THE COMPANY.

The limitations of financial statements are discussed below-

- Historical Costs

Financial reports depend on historical costs. All the transactions record at historical costs; The value of the assets purchased by the Company and the liabilities it owes changes with time and depends on market factors; The financial statements do not provide the current value of such assets and liabilities. Thus, if a large number of items available in the financial statements based on historical costs and the Company has not re-valued them, the statements can be misleading.

2. Inflation Adjustments

The assets and liabilities of the Company are not inflation-adjusted. If the inflation is very high, the items in the reports will be recorded at lower costs and hence, not giving much information to the readers.

3.Personal Judgments

The financial statements are based on personal judgments. The value of assets and liabilities depends on the accounting standard used by the person or group of persons preparing them. The depreciation methods, amortization of assets, etc. are prone to the personal judgment of the person using those assets. All such methods cannot be stated in the financial reports and are, therefore, a limitation.

4.Specific Time Period Reporting

The financial statements based on a specific time period; they can have an effect of seasonality or sudden spike/dull in the sales of the Company. One period cannot be compared to other periods very easily as many parameters affect the performance of the Company, and that reported in the financial reports. A reader of the reports can make mistakes while analyzing based on only one period of reporting. Looking at reports from various periods and analyzing them prudently can give a better view of the performance of the Company.

5. Intangible Assets

The intangible assets of the Company are not recorded on the balance sheet. Intangible assets include brand value, the reputation of the Company earned over a while, which helps it generate more sales, is not included in the balance sheet. However, if the Company has done any expense on intangible assets, it is recorded on the financial statements. It is, in general, a problem for start-ups which, based on the domain knowledge, creates a huge intellectual property, but since they have not been in business for long could not generate enough sales. Hence, their intangible assets are not recorded on the financial statements and neither reflected in the sales.

6. Comparability

While it is a common practice for analysts and investors to compare the performance of the Company with other companies in the same sector, but they are not usually comparable. Due to various factors like the accounting practices used, valuation, personal judgments made by the different people in different Companies, comparability can be a difficult task.

7. Fraudulent Practices

The financial statements are subject to fraud. There are many motives behind having fraudulent practices and thereby skewing the financial results of the Company. If the management is to receive a bonus or the promoters would like to raise the price of the share, they tend to show good results of the Company’s performance by using fraudulent accounting practices, creating fraud sales, etc. The analysts can catch these if the Company’s performance exceeds the industry norms.

8. No Discussion on Non-Financial Issues

Financial statements do not discuss non-financial issues like the environment, social and governance concerns, and the steps taken by the Company to improve the same. These issues are becoming more relevant in the current generation, and there is an increased awareness amongst the Companies and the government. However, the financial reports do not provide such information/discussion.

9. It May Not be Verified

An auditor should audit the financial statements; however, if they are not, they are of minimal use to the readers. If no one has verified the accounting practices of the Company, operations, and general controls of the Company, there will be no audit opinion. An audit opinion that accompanies the financial statements highlights various financial issues (if any) in the reports.

10. Future Prediction

Although many financial statements have a comment that these contain the forward-looking statement, however, no prediction about the business could be made using these statements. The financial statements provide the historical performance of the Company; many analysts use this information and predict the sales and profit of the Company in future quarters. However, it is prone to many assumptions. Thus, financial statements as a standalone cannot provide any prediction on the future performance of the Company.

KEY TAKEAWAYS

- THE LIMITATIONS OF FINANCIAL STATEMENTS ARE IT IGNORES HISTORICAL COST, FUTURE PREDICTION, VERIFICATION, INFLATION JUDGEMENT ETC.

References

- Foster, G.: Financial Statement Analysis, Englewood Cliffs, NJ, Prentice Hall.

- Sahaf M.A – Management Accounting – Principles & Practice – Vikash Publication

- Foulke, R.A.: Practical Financial Statement Analysis, New York, McGraw-Hill.

- Hendriksen, E.S.: Accounting Theory, New Delhi, Khosla Publishing House.

- Kaveri, V.S.: Financial Ratios as Predictors of Borrowers’ Health, New Delhi, Sultan Chand.

- Lev, B.: Financial Statement Analysis – A New Approach, Englewood Cliffs, NJ, Prentice Hall.