Unit 1

Introduction to Financial Management

Financial Management is managerial activity which is concerned with the planning and controlling of the firm’s financial resources. Financial management also refers to the effective planning, organising, and controlling of monetary resources. Financial management primarily includes decisions and considerations regarding the size of investments, sources and range of use for capital, and the extent of profit earned from the same. It generally involves applying different management techniques to an enterprise’s financial resources to maximise profits.

Definitions:

Howard and Uptron define Financial Management “as an application of general managerial principles to the area of financial decision-making”.

Weston and Brighem define Financial Management “as an area of financial decision making, harmonizing individual motives and enterprise goal”.

Functions of Financial Management

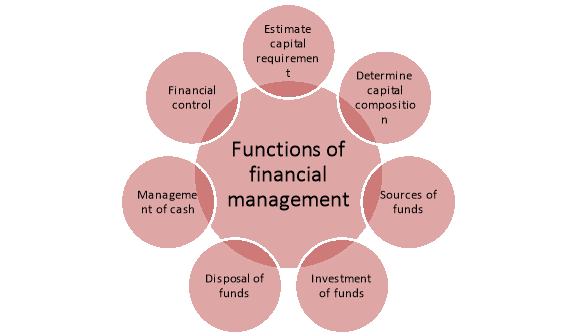

Figure: Functions of financial management

- Estimation of capital requirements: A finance manager has to make estimation with regards to capital requirements of the company. This will depend upon expected costs and profits and future programmes and policies of a concern. Estimations have to be made in an adequate manner which increases earning capacity of enterprise.

- Determination of capital composition: Once the estimation have been made, the capital structure have to be decided. This involves short- term and long- term debt equity analysis. This will depend upon the proportion of equity capital a company is possessing and additional funds which have to be raised from outside parties.

- Choice of sources of funds: For additional funds to be procured, a company has many choices like-

- Issue of shares and debentures

- Loans to be taken from banks and financial institutions

- Public deposits to be drawn like in form of bonds.

Choice of factor will depend on relative merits and demerits of each source and period of financing.

4. Investment of funds: The finance manager has to decide to allocate funds into profitable ventures so that there is safety on investment and regular returns is possible.

5. Disposal of surplus: The net profits decision have to be made by the finance manager. This can be done in two ways:

- Dividend declaration - It includes identifying the rate of dividends and other benefits like bonus.

- Retained profits - The volume has to be decided which will depend upon expansional, innovational, diversification plans of the company.

- Management of cash: Finance manager has to make decisions with regards to cash management. Cash is required for many purposes like payment of wages and salaries, payment of electricity and water bills, payment to creditors, meeting current liabilities, maintainance of enough stock, purchase of raw materials, etc.

- Financial controls: The finance manager has not only to plan, procure and utilize the funds but he also has to exercise control over finances. This can be done through many techniques like ratio analysis, financial forecasting, cost and profit control, etc.

Scope of financial management

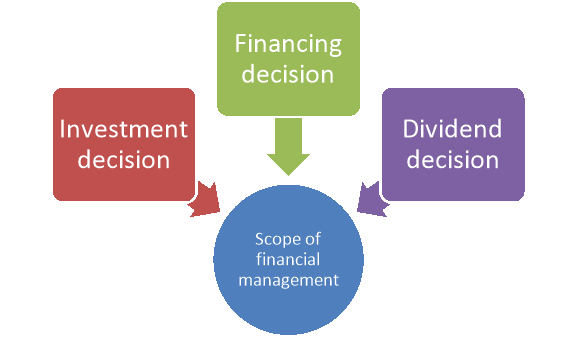

Financial management is applicable in different areas of management that facilitates effective management of fund in the organisation. The scope of financial management are discussed below-

Figure: Scope of financial management

- Investment decision –

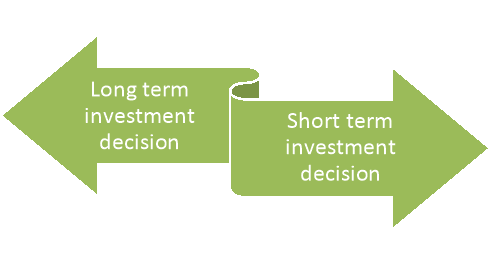

Investment decision is also known as capital budgeting. Investment decisions are related to investment in fixed assets. It may be long term and short term.

Figure: Types of investment decision

- Long-term investment decisions allow committing funds towards resources like fixed assets. Long-term investment decisions determine the performance of a business and its ability to achieve financial goals over time.

- Short-term investment decisions or working capital financing decisions mean committing funds towards resources like current assets. It occupies funds for a shorter period, including investments in inventory, liquid cash, etc. Short-term investment decisions directly affect the liquidity and performance of an organisation.

- Financing decision –

Financing decision involves the possible sources of raising finances. The financial manager estimates the requirement of funds and accordingly determines the sources of raising the required funds. They are of 2 different types –

Figure: Financial decisions

- Financial planning decisions attempt to estimate the sources and possible application of accumulated funds. A proper financial planning decision is crucial to ensure the availability of funds whenever required.

- Capital structure decisions involve identifying various sources of funds. It involves decisions regarding the combination of owned capital and borrowed capital. It facilitates the selection of the best external sources for short or long-term financial requirements.

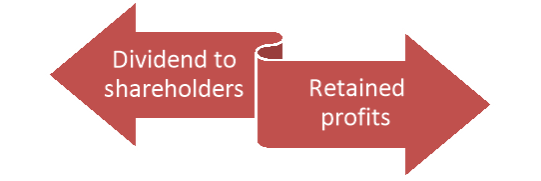

3. Dividend decision –

It involves decisions taken with regards to net profit distribution profits. It involves decisions regarding-

- Dividend for the shareholders.

- Retained profits (usually depends on a particular company’s expansion and diversification plans).

Figure: Dividend decision

Objectives of Financial management

There are mainly two objectives of financial management-

Figure: Objectives of financial management

(1) Profit Maximization:

According to this approach, all activities which increase profits should be undertaken and which decrease profits should be avoided. Profit maximization implies that the financial decision making should be guided by only one test, which is, select those assets, projects and decisions which are profitable and reject those which are not.

The following arguments are advanced in favour of this approach:

(i) Measurement of Performance

Profit is a test of economic efficiency of a business. It is a yardstick by which the economic performance of a business can be judged.

(ii) Efficient Allocation and Utilisation of Resources

Profit maximization leads to efficient allocation and utilisation of scarce resources of the business because sources tend to be directed to uses from less profitable projects to more profitable projects.

(iii) Maximisation of Social Welfare

Profitability is essential for fulfilling the goal of social welfare also. Maximization of profits leads to the maximization of social welfare.

(iv) Source of Incentive

Profit acts as a motivator or incentive which induces a business organisation to work more efficiently. If profit motive is withdrawn the pace of development will be reduced.

(v) Helpful in Facing Adverse Business Conditions

Economic and business conditions go on changing from time to time. There may be adverse business conditions like recession, severe competition etc. Under adverse circumstances a business will be able to survive only if it has some past earnings to rely upon. Hence, a business should maximize its profits when the circumstances are favourable.

(vi) Helpful in the Growth of the Firm

Profits are the major source of finance for the growth of a firm.

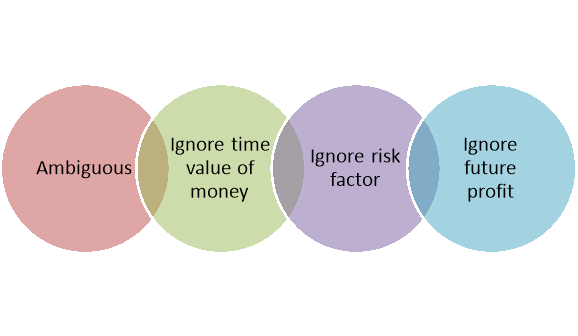

However, the profit maximization approach has been criticised on several grounds:

Figure: Disadvantages of profit maximisation

(i) Ambiguous:

One practical difficulty with this approach is that the term profit is vague and ambiguous. Different people take different meanings of term profit. For example, profit may be short-term or long-term, it may be before tax or after tax, and it may be total profit or rate of profit. Similarly, it may be returned on total capital employed or total assets or shareholders’ funds and so on.

(ii) Ignores the Time Value of Money:

This approach ignores the time value of money, i.e., it does not make a distinction between profits earned over the different years. It ignores the fact that the value of one rupee at present is greater than the value of the same rupees received after one year. Similarly, the value of profit earned in the first year will be more in comparison to the equivalent profits earned in later years.

(iii) Ignores Risk Factor:

This approach ignores the risk associated with the earnings. If the two firms have the same total expected earnings, but if earnings of one firm fluctuate considerably as compared to the other, it will be more risky.

Investors in general, have a preference for a lower income with less risk in comparison to high income with greater risk. But this approach does not pay any attention to the risk factor.

(iv) Ignores Future Profits:

The business is not solely run with the objective of maximising immediate profits. Some firms place more importance on growth of sales. They are willing to accept lower profits to achieve stability provided by a large volume of sales.

(v) Ignores Social Obligations of Business:

This approach ignores the social obligations of business to various social groups like workers, consumers, society, Government etc. A firm cannot exist for long when interests of social groups are ignored because these groups contribute to its smooth run.

(vi) Neglects the Effects of Dividend Policy on Market Price of the Shares:

Under this approach the firm may not think of paying dividends because retaining profit in the business may satisfy the goal of maximising the earning per share.

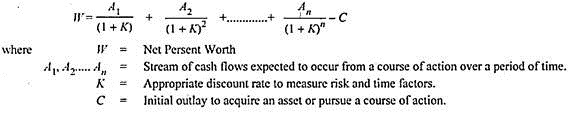

(2) Wealth Maximization:

This approach is now universally accepted as an appropriate criterion for making financial decisions as it removes all the limitations of profit maximization approach. It is also known as net present value (NPV) maximization approach. According to this approach the worth of an asset is measured in terms of benefits received from its use less the cost of its acquisition. Benefits are measured in terms of cash flows received from its use rather than accounting profit which was the basis of measurement of benefits in profit maximization approach. Measuring benefits in terms of cash flow avoids the ambiguity in respect of the meaning of the term profit. Another important feature of this approach is that it also incorporates the time value of money. While measuring the value of future cash flows an allowance is made for time and risk factors by discounting or reducing the cash flows by a certain percentage. This percentage is known as discount rate. The difference between the present value of future cash inflows generated by an asset and its cost is known as net present value (NPV). A financial action (or an asset or a project) which has a positive NPV creates wealth for shareholders and, therefore, is undertaken. On the other hand, a financial action resulting in negative NPV should be rejected since it would reduce shareholder’s wealth. If one out of various projects is to be chosen, the one with the highest NPV is adopted. Hence, the shareholder’s wealth will be maximized if this criterion is followed in making financial decisions.

The NPV can be calculated with the help of the following formula:

It has the following advantages in its favour:

(1) It uses cash flows instead of accounting profits which avoids the ambiguity regarding the exact meaning of the term profit.

(2) It gives due importance to the time value of money by reducing the future cash flows by an appropriate discount or interest rate. If higher risk and longer time period are involved, higher rate of discount or interest will be used to find out the present value of future cash benefits. The discount or interest rate will be lower for the projects which involve low risk.

(3) It gives due importance to payment of regular dividends – In this approach financial decisions are taken in such a way that the shareholders receive the highest combination of dividends and increase in the market price of the shares.

(4) It gives due importance to risk factor and analyses risk and uncertainty so that the best course of action can be selected out of different alternatives.

(5) It gives due importance to social responsibilities of the business.

(6) It takes into consideration long-run survival and growth of the firm.

Key takeaways

- Financial Management is managerial activity which is concerned with the planning and controlling of the firm’s financial resources. Financial management also refers to the effective planning, organising, and controlling of monetary resources.

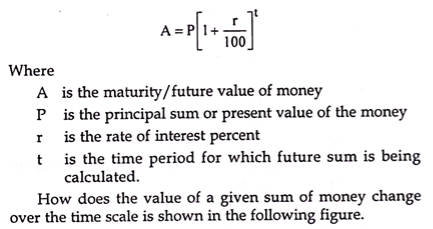

Time value of money is defined as “the value derived from the use of money over time as a result of investment and reinvestment”. Time value of money means that “worth of a rupee received today is different from the worth of rupee to be received in future”. The preference for money now, as compared to future money is known as time preference of money. “Time value of money means that the value of a sum of money received today is more than its value received after some time”, conversely the sum of money received in future is less valuable than it is to-day. The whole set of financial decisions (whether financing decision or investment decision) hinges on the fact that the value of one rupee today is not equal to the value of one rupee at the end of one year or at the end of second year. In other words, we cannot assume that the value of rupee remains the same. This is known as ‘Time Value of Money’.

The whole process can be explained as follows:

Suppose the rate of interest is 10 percent per annum.

If we receive a sum of Rs. 500 now, it will earn an interest of Rs. 50 in one year and will become equal to Rs. 550 after 1 year. The same sum will earn an interest of Rs. 55 in the second year and will become equal to Rs. 605 after two years. How this money grows at different points of time can be calculated by the following compound interest formula?

In the above figure, different values are given at different time periods. These are all values of the same Rs. 500 at different points of time, assuming the rate of interest to be 10 per cent per annum. The amount of Rs. 500 becomes Rs. 550 after one year, 605 after two years and 805.26 after 5 years. In terms of valuation all sums have equal value.

All these values have been calculated by the above mentioned compound interest formula. This, well known compound interest formula, can be modified a little to make our working more convenient. Instead of using ‘r’ as rate per cent, we use the symbol ‘i’ to indicate rate per rupee.

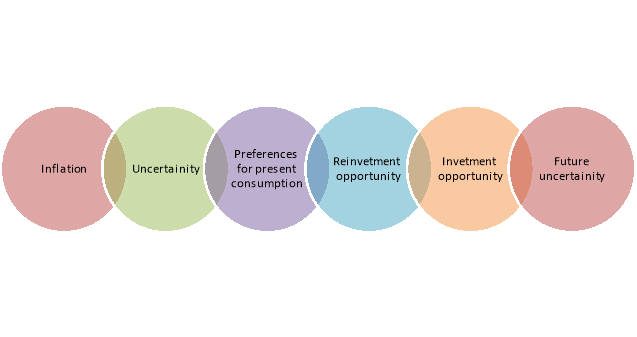

Importance of time value of money

The importance of time value of money is discussed below-

Figure: Importance of time value of money

(i) Inflation

Because of inflationary conditions, the rupee today has a higher purchasing power than rupee in future. As a result, those who have to receive the money prefer to receive the same as early as possible, while those who have to pay the money try to delay the payment.

(ii) Uncertainty

Since the future is characterised by uncertainty, individuals/business concerns prefer to have current income rather than having the same payment at a later date. They have an apprehension that the party making the payment may default due to insolvency or other reasons.

(iii) Preference for Present Consumption

Both due to uncertainty and inflationary conditions, individuals prefer the consumption to future consumption. They do not wish to save for the future by curtailing current consumption.

(iv) Opportunities for reinvestment

Money can be employed to generate real returns. Individual’s business concerns reinvest the money at a certain rate so as to have some yield on it.

v) Preference for Consumption:

Most people have preference for present consumption over future consumption of goods and services either because of the urgency of their present wants or because of the risk of not being in a position to enjoy future consumption that may be caused by illness or death, or because of inflation.

Vi) Investment Opportunities:

Most individuals prefer present cash to future cash because of the available investment opportunities to which they can put present cash to earn additional cash.

Vii) Future Uncertainties:

One of the reasons for preference of current money is that there is a certainty about it whereas the future money has an uncertainty. There may be chances that the other party (the creditor) may become insolvent.

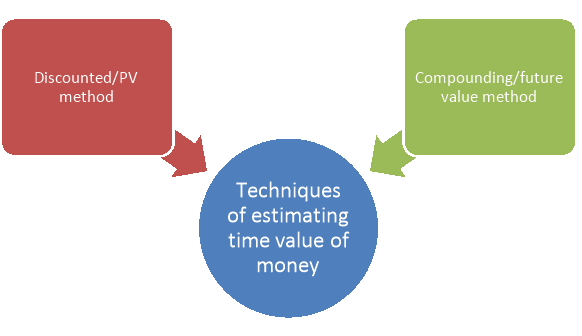

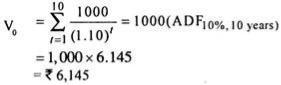

There are two techniques of estimating time value of money

The techniques of estimating time value of money is discussed below-

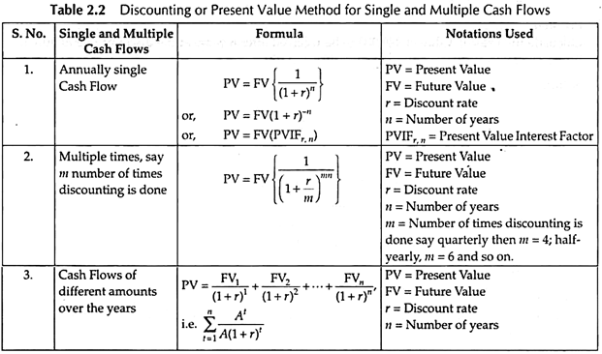

1. Discounting or Present Value Method:

The current value of an expected amount of money to be received at a future date is known as Present Value. If we expect a certain sum of money after some years at a specific interest rate, then by discounting the Future Value we can calculate the amount to be invested today, i.e., the current or Present Value.

Hence, Discounting Technique is the method that converts Future Value into Present Value. The amount calculated by Discounting Technique is the Present Value and the rate of interest is the discount rate.

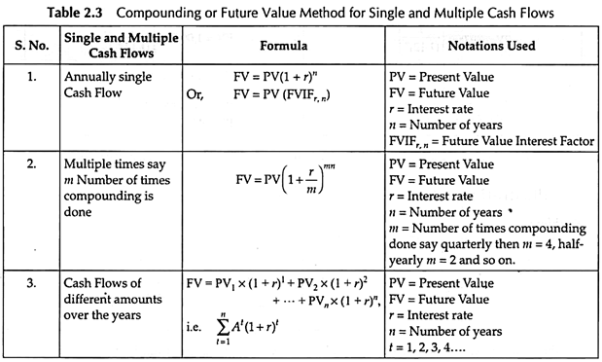

2. Compounding or Future Value Method:

Compounding is just the opposite of discounting. The process of converting Present Value into Future Value is known as compounding.

Future Value of a sum of money is the expected value of that sum of money invested after n number of years at a specific compound rate of interest.

Time Value of Money – Formula for Calculating Present and Future Value of Money

A. Present Value:

i. Present Value of a Future Sum:

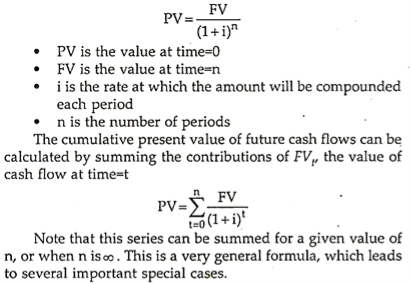

The present value formula is the core formula for the time value of money; each of the other formulae is derived from this formula.

For example- the annuity formula is the sum of a series of present value calculations.

The Present Value (PV) formula has four variables, each of which can be solved for

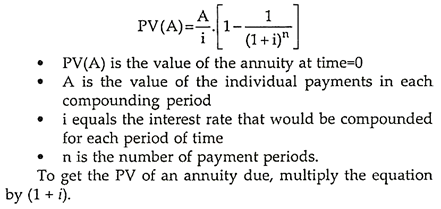

Ii. Present Value of an Annuity for n Payment Periods:

In this case the cash flow values remain the same throughout the n periods. The present value of an annuity formula has four variables, each of which can be solved for –

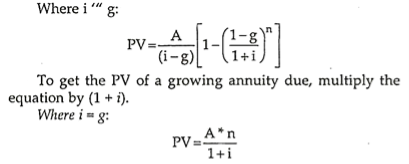

Iii. Present Value of a Growing Annuity:

In this case each cash flow grows by a factor of (1+g). Similar to the formula for an annuity, the present value of a growing annuity (PVGA) uses the same variables with the addition of g as the rate of growth of the annuity (A is the annuity payment in the first period). This is a calculation that is rarely provided for on financial calculators.

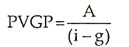

Iv. Present Value of a Growing Perpetuity:

When the perpetual annuity payment grows at a fixed rate (g) the value is theoretically determined just as to the following formula. In practice, there are few securities with precise characteristics, and the application of this valuation approach is subject to various qualifications and modifications.

Most importantly, it is rare to find a growing perpetual annuity with fixed rates of growth and true perpetual cash flow generation. Despite these qualifications, the general approach may be used in valuations of real estate, equities, and other assets.

This is the well-known Gordon Growth model used for stock valuation.

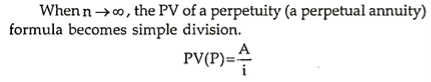

Present Value of Perpetuity:

B. Future Value:

i. Future Value of a Present Sum:

The Future Value (FV) formula is similar and uses the same variables.

FV = PV. (1 + i)n

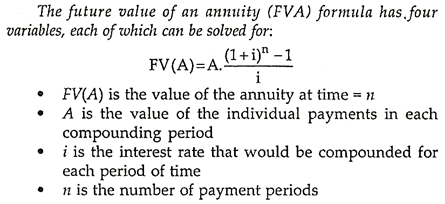

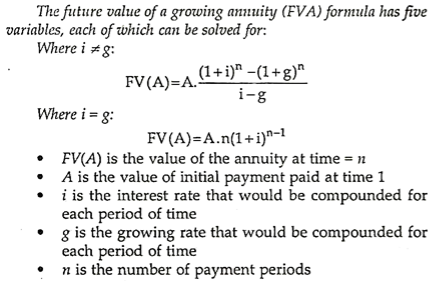

Ii. Future Value of an Annuity:

Iii. Future Value of a Growing Annuity:

Key takeaways

- Time value of money is defined as “the value derived from the use of money over time as a result of investment and reinvestment”. Time value of money means that “worth of a rupee received today is different from the worth of rupee to be received in future”.

Risk is the variability in the expected return from a project. In other words, it is the degree of deviation from expected return. Risk is associated with the possibility that realized returns will be less than the returns that were expected. So, when realizations correspond to expectations exactly, there would be no risk.

i. Elements of Risk:

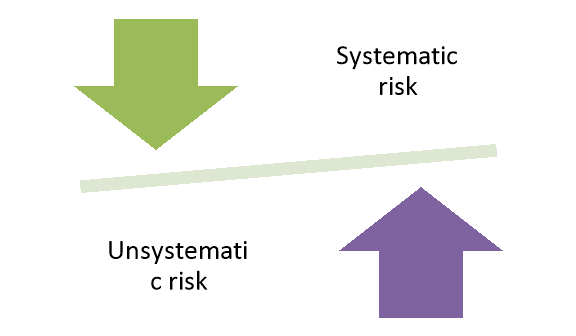

Various components cause the variability in expected returns, which are known as elements of risk. There are broadly two groups of elements classified as systematic risk and unsystematic risk.

Figure: Types of risk

a) Systematic Risk:

Business organizations are part of society that is dynamic. Various changes occur in a society like economic, political and social systems that have influence on the performance of companies and thereby on their expected returns. These changes affect all organizations to varying degrees. Hence the impact of these changes is system-wide and the portion of total variability in returns caused by such across the board factors is referred to as systematic risk. These risks are further subdivided into interest rate risk, market risk, and purchasing power risk.

b) Unsystematic Risk:

The returns of a company may vary due to certain factors that affect only that company. Examples of such factors are raw material scarcity, labour strike, management inefficiency, etc. When the variability in returns occurs due to such firm-specific factors it is known as unsystematic risk. This risk is unique or peculiar to a specific organization and affects it in addition to the systematic risk. These risks are subdivided into business risk and financial risk.

Ii. Measurement of Risk:

Quantification of risk is known as measurement of risk.

Two approaches are followed in measurement of risk:

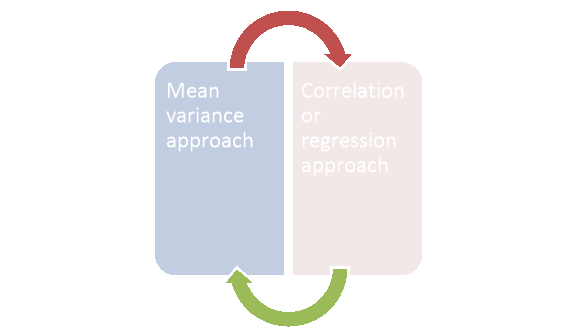

Figure: Risk measurement approach

(i) Mean-variance approach, and

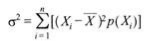

Mean-variance approach is used to measure the total risk, i.e. sum of systematic and unsystematic risks. Under this approach the variance and standard deviation measure the extent of variability of possible returns from the expected return and is calculated as:

Where, Xi = Possible return,

P = Probability of return, and

n = Number of possible returns.

(ii) Correlation or regression approach

Correlation or regression method is used to measure the systematic risk. Systematic risk is expressed by β and is calculated by the following formula:

Where, rim = Correlation coefficient between the returns of stock i and the return of the market index,

σm = Standard deviation of returns of the market index, and

σi = Standard deviation of returns of stock i.

Using regression method we may measure the systematic risk.

The form of the regression equation is as follows:

Where, n = Number of items,

Y = Mean value of the company’s return,

X = Mean value of return of the market index,

α = Estimated return of the security when the market is stationary, and

β = Change in the return of the individual security in response to unit change in the return of the market index.

Concept of Return:

Return can be defined as the actual income from a project as well as appreciation in the value of capital. Thus there are two components in return—the basic component or the periodic cash flows from the investment, either in the form of interest or dividends; and the change in the price of the asset, commonly called as the capital gain or loss. The term yield is often used in connection to return, which refers to the income component in relation to some price for the asset. The total return of an asset for the holding period relates to all the cash flows received by an investor during any designated time period to the amount of money invested in the asset. It is measured as:

Total Return = Cash payments received + Price change in assets over the period /Purchase price of the asset. In connection with return we use two terms—realized return and expected or predicted return. Realized return is the return that was earned by the firm, so it is historic. Expected or predicted return is the return the firm anticipates to earn from an asset over some future period.

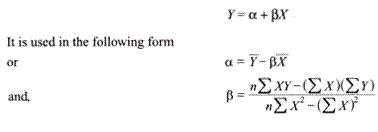

Security valuation is important to decide on the portfolio of an investor. All investment decisions are to be made on a scientific analysis of the right price of a share. Hence, an understanding of the valuation of securities is essential. Investors should buy under-priced shares and sell overpriced shares. Share pricing is thus an important aspect of trading. The valuation models are discussed below-

Figure: Valuation of securities

(i) Book Value:

Book value of a security is an accounting concept. The book value of an equity share is equal to the net worth of the firm divided by the number of equity shares, where the net worth is equal to equity capital plus free reserves. The market value may fluctuate around the book value but may be higher if the future prospects are good.

(ii) Liquidating Value (Breakdown Value):

If the assets are valued at their breakdown value in the market and take net fixed assets plus current assets minus current liabilities as if the company is liquidated, then divide this by the number of shares, the resultant value is the liquidating value per share. This is also an accounting concept.

(iii) Intrinsic Value:

Market value of a security is the price at which the security is traded in the market and it is generally hovering around its intrinsic value. There are different schools of thought regarding the relationship of intrinsic value to the market price. Market prices are those which rule in the market, resulting from the demand and supply forces. Intrinsic price is the true value of the share, which depends on its earning capacity and its true worth. According to the fundamentalist approach to security valuation, the value of the security must be equal to the discounted value of the future income stream. The investor buys the securities when the market price is below this value.

(iv) Replacement Value:

When the company is liquidated and its assets are to be replaced by new ones, their prices being higher, the replacement value of a share will be different from the Breakdown value. Some analysts take this replacement value to compare with the market price.

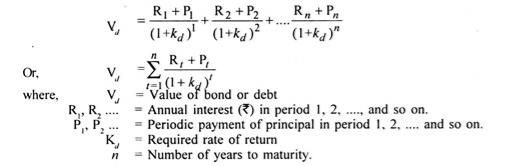

Debenture Valuation:

A bond is an instrument of debt issued by a business house or a government unit. The bonds may be issued at par, premium or discount. The par value is the amount stated on the face of the bond. It states the amount the firm borrows and promises to repay at the time of maturity. The bonds carry a fixed rate of interest payable at fixed intervals of time. The interest is calculated by multiplying the value of bonds with the rate of interest. Bond valuation is, generally, called debt valuation because the features that distinguish bonds from other debts are primarily non-financial in nature. Since bonds have a promised payment stream, they are less risky as compared to the shares. But it does not mean that they are totally risk free. Therefore, the required rate of return on a firm’s bond will exceed the risk free interest rate but will be less than the required rate of return on shares. The differences in required rates of return among bonds of different companies are caused by differences in ‘default risk’. The value of the bond depends upon the discount rate. It will decrease with every increase in the discount rate. For the purpose of valuation, bonds may be classified into two categories

- Bonds with a maturity period

When the bonds have a definite maturity period, its valuation is determined by considering the annual interest payments plus its maturity value. The following formula can be used to determine the value of a bond:

Where, Vd = Value of bond or debt

R1, R2……. =Annual interest (Rs.) in period 1, 2, …, and so on

Kd = Required rate of return

M = Maturity value of bond

n = Number of years to maturity.

It must be observed from the above equation that as n becomes large, it becomes difficult to calculate (1 + kd)n.

Symbolically:

Vd =(R)(ADFi, n) + (M)(DFi, n)

2. Bonds Redeemable in Instalment:

A company may issue a bond or debenture to be redeemed periodically. In such a case, principal amount is repaid partially each period instead of a lump sum at maturity and hence cash outflows each period include interest and principal. The amount of interest goes on decreasing each period as it is calculated on the outstanding amount of bond/debenture.

The value of such a bond can be calculated as below:

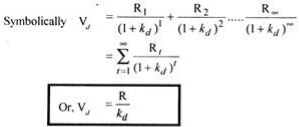

3. Bonds in Perpetuity:

Perpetuity bonds are the bonds which never mature or have infinitive maturity period. Value of such bonds is simply the discounted value of infinite streams of interest (cash) flows.

Where, Vd = Value or bond or debt

Kd = Required rate of return

R1 = Interest at period 1

R2 = Interest at period 2

R = Annual Interest (as interest is constant)

Valuation of Zero Coupon/Deep Discount Bonds (DDBs/ZCBs):

The deep discount bond does not carry any interest but it is sold by the issuer company at deep discount from its eventual maturity (nominal) value. The Industrial Development Bank of India (IDBI) issued such DDBs for the first time in the Indian capital market at a price of Rs. 2700 against the nominal value of Rs. 1,00,000 payable after 25 years. Since there is no intermediate payment of interest between the date of issue and the maturity date, these DDBs may also be called zero coupon bonds (ZBBs). The valuation of a deep discount bond can also be made in the same manner as that of the ordinary bond or debenture. The only point to remember is that there shall be only one cash flow at the time of maturity in case of a deep discount bond. Thus, the value of a DDB may be taken as equal to the present value of this future cash flow discounted at the required rate of return of the investor for number of years equal to the life of the bond.

The following formula can be used to determine the value of a DDB:

Vddb = FV/(1+rn)

Where Vddb = Value of a deep discount bond

FV = Face value of DDB payable at maturity

r = Required rate of return

n = Number of years to maturity/Life of DDB.

We can also make use of the present value tables to simplify our calculations.

Symbolically:

Vddb = (FV) x (DFi,n)

Equity Share Valuation:

The valuation of common stock or equity shares is relatively difficult as compared to the bonds or preferred stock. The cash flows of the latter are certain because the rate of interest on bonds and the rate of dividend on preference shares are known. The cash flows expected by investors on common stock are uncertain. The earnings and dividends on equity shares are expected to grow.

However, we can determine the value of equity shares:

(i) By developing certain models based on capitalisation of dividend, and

(ii) Capitalisation of earnings. Dividend capitalisation models are the basic valuation models.

References-

1. Bhalla V.K – Financial Management – S.Chand.

2. Horne, J.C. Van and Wackowich. Fundamentals of Financial Management. 9thed. New Delhi Prentice Hall of India.

3. Johnson, R.W. Financial Management. Boston Allyn and Bacon.

4. Joy, O.M. Introduction to Financial Management. Homewood: Irwin.

5. Khan and Jain. Financial Management text and problems. 2nd ed. Tata McGraw Hill New Delhi.

6. Pandey, I.M. Financial Management. Vikas Publications.

7. Chandra, P. Financial Management- Theory and Practice. (Tata McGraw Hill).

8. Rustagi, R.P. Fundamentals of Financial Management. Taxmann Publication Pvt. Ltd.

8. Singh, J.K. Financial Management- text and Problems. 2nd Ed. DhanpatRai and Company, Delhi.

9. Singh, Surender and Kaur, Rajeev. Fundamentals of Financial Management. Book Bank International.

10. Brigham and Houston, Fundamentals of Financial Management, 13th Ed., Cengage Learning