Unit 4

Overview of financial services industry

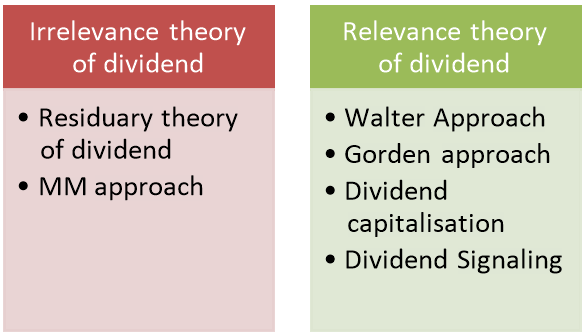

The dividend theories relates with the impact of dividend on the value of the firm. According to one school of thought the dividends are irrelevant and the amount of dividends paid does not affect the value of the firm while the other theory considers that the dividend decision is relevant to the value of the firm.

Thus there are conflicting theories on dividends.

a) Irrelevance Theory of Dividend

b) Relevance Theory of Dividend

Figure: Classification of theories of dividend

a) Irrelevance Theory of Dividend

The advocates of this school of thought argue that the dividends have no impact on the share price or market value of the firm. The argue that the shareholders do not differentiate between the present dividend and the future capital gains and are basically interested in higher returns either earned by the firm by investing the profits in future profitable investments. They believe that the profits are distributed as dividends only if no adequate investment opportunities for investments for the business. Irrelevance theory is of two types-

- Residuals theory of Dividends

The theory is based upon the assumptions that since the external financing has excessive costs and may not be available to the firm. The firm finances its investment by retained earnings or by retaining earnings. The retaining earnings are that portion of profits that is not distributed to the investors. The residual theory of dividend policy is that the firm will only pay dividends from residual earnings, that is, from earnings left over after all suitable (positive NPV) investment opportunities have been financed. With the residual dividend policy, the primary focus of the firm’s management is indeed on investment, not dividends. Thus the firm’s decision to pay the dividends is influenced by:

- The investment opportunities available to the business

- The availability of the internal funds. If the internal funds are excessive and all the investments are finances the residual is paid as dividends.

Thus, the divided policy is totally passive in nature and has no influence on the market price of the firm.

2. Modigliani and Miller (MM) Approach

This theory was proposed by Franco Modigliani and Merton Miller in 1961 who argued that the value of the firm is determined by the basic earning power, the firm’s risk and not by the distribution of earnings. The value of the firm therefore depends on the investment decisions and not the dividend decision. However, their argument was based on some assumptions.

Assumptions of MM hypothesis

- The capital markets are perfect and all the investors behave rationally.

- There are no taxes and flotation costs and if the taxes are there then there is no difference between the dividends tax and capital gains tax.

- No transaction costs associated with share floatation.

- The firm’s investment policy is independent of the dividend policy. The effect of this assumption is that the new investments out of retained earnings will not change and there will not change in the required rate of return of the firm.

- There is perfect certainty by every investor as to future investments and profits of the firm. Thus investors are able to forecast earnings and dividends with certainty.

The MM hypothesis is based upon the arbitrage theory. The arbitrage process involves switching and balancing the operations. Arbitrage leads to entering into two transactions which exactly balance or completely offset the effect of each other. The two transactions are paying of dividends and raising external capital. Since the firm uses retained earnings to finance new investments, the paying of dividends will require the firm to raise the capital externally. The arbitrage theory suggests that the dividend effect will be exactly offset by the effect of raising additional share capital. When the dividends are paid to the shareholders, the market price of share decreases (because of external financing). Thus what is gained by the shareholders as a result of dividends is completely neutralized by the reduction in the market value of the shares.

According to MM, the investors will thus be indifferent between dividends and retained earnings. The market value of the shares will depend entirely on the expected future earnings of the firm.

b) Relevance Theory of Dividend

The relevance theory of dividend argues that dividend decision affects the market value of the firm and therefore dividend matters. This theory suggests that investors are generally risk averse and would rather have dividends today (“bird-in-the-hand”) than possible share appreciation and dividends tomorrow. The relevance theory of dividend proposes that dividend policy affect the share price. Therefore, according to this theory, optimal dividend policy should be determined which will ensure maximization of the wealth of the shareholders. Relevance theory can discussed with following models:

- Walter Approach

The Walter approach was given by James E Walter and is based on a simple argument that where the reinvestment rate, that is, rate of return that the company may earn on retained earnings, is higher than cost of equity (rate of return of the shareholders), then it would be in the interest of the firm to retain the earnings. If the company’s reinvestment rate on retained earnings is the less than shareholders’ rate of return, the company should not retain earnings. If the two rates are the same, then the company should be indifferent between retaining and distributing.

The Walter’s model is based on the following assumptions:

- The firm finances its entire investments by means of retained earnings only.

- Internal rate of return (r) and cost of capital (KE) of the firm remains constant.

- The firms’ earnings are either distributed as dividends or reinvested internally.

- The earnings and dividends of the firm will never change.

- The firm has a very long or infinite life.

Hence, the basis of Walter formula is:

VE = D /KE – g) …………….Eq.

Where,

VE = market value of equity shares

D= initial dividend

KE = costs of equity and

g = expected growth rate of earnings

2. Gordon Approch

Gordon Approch (The Bird-in-the-Hand Theory): The essence of the bird-in-the-hand theory of dividend policy (advanced by John Litner in 1962 and Myron Gordon in 1963) is that shareholders are risk-averse and prefer to receive dividend payments rather than future capital gains. Shareholders consider dividend payments to be more certain that future capital gains- thus a “bird in the hand is worth more than two in the bush”.

Gordon contended that the payment of current dividends “resolves investor uncertainty”. Investors have a preference for a certain level of income now rather that the prospect of a higher, but less certain, income at some time in the future.

The key implication, as argued by Litner and Gordon, is that because of the less risky nature dividends, shareholders and investors will discount the firm’s dividend stream at a lower rate of return, ‘r’, thus increasing the value of the firm’s shares.

Assumptions of Gordon’s Model

The Gordon’s Model is based on the following assumptions:

a) The firm is an all equity firm.

b) There is no outside financing and all investments are financed exclusively by retained earnings.

c) Internal rate of return (R) of the firm remains constant.

d) Cost of capital (KE) of the firm also remains same regardless of the

change in the risk complexion of the firm.

e) The firm derives its earnings in perpetuity

f) The retention ratio (b) once decided upon is constant. Thus the growth rate (g) is also constant (g = br).

g) Corporate tax does not exist.

3. Dividend Capitalization Model

According to Gordon, the market value of a share is equal to the present value of the future streams of dividends. A simple version of Gordon’s model can be presented as below:

P = E (1 – b) / KE – br

Where:

P= Price of a share

E= Earnings per share

b=Retention ratio

1–b=Dividend pay-out ratio

KE = Cost of capital or the capitalization rate

br = Growth rate (rate or return on investment of an all-equity firm)

4. Dividend Signalling Theory

This is a theory which asserts that announcement of increased dividend payments by a company gives strong signals about the bright future prospects of the company. In practice, change in a firm’s dividend policy can be observed to have an effect on its share price- an increase in dividend producing an increasing in share price and a reduction in dividends producing a decrease in share price.

This pattern led many observers to conclude, contrary to M&M’s model, that shareholders do indeed prefer dividends to future capital gains. The change in dividend payment is to be interpreted as a signal to shareholders and investors about the future earnings prospects of the firm.

Generally, a rise in dividend payment is viewed as a positive signal, conveying positive information about a firm’s future earnings prospects resulting in an increase in share price. Conversely a reduction in dividend payment is viewed as negative signal about future earnings prospects, resulting in a decrease in share price.

Key takeaways

- The dividend theories relates with the impact of dividend on the value of the firm. According to one school of thought the dividends are irrelevant and the amount of dividends paid does not affect the value of the firm while the other theory considers that the dividend decision is relevant to the value of the firm.

Dividend refers to the part of company profits that is distributed among its shareholders in proportion to the shares held by them. In simple terms, it is the amount of net earnings that company pay out to its shareholders. It is reward of shareholders for undertaking risks by investing their funds into business for making profits. A dividend is a distribution of a portion of a company's earnings, decided by the board of directors. The purpose of dividends is to return wealth back to the shareholders of a company. There are two main types of dividends: cash and stock.

Figure: Types of dividend

- Cash dividend:

A cash dividend is a payment made by a company out of its earnings to investors in the form of cash (check or electronic transfer). This transfers economic value from the company to the shareholders instead of the company using the money for operations. However, this does cause the company's share price to drop by roughly the same amount as the dividend. For example, if a company issues a cash dividend equal to 5% of the stock price, shareholders will see a resulting loss of 5% in the price of their shares. This is a result of the economic value transfer.

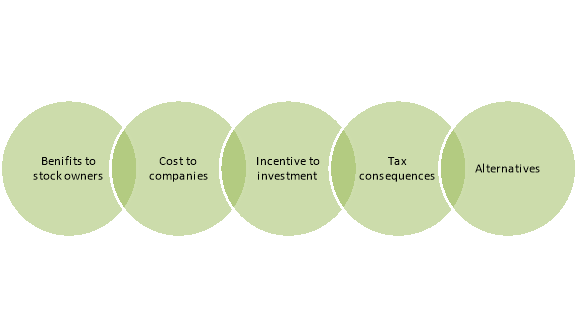

Advantages of cash dividend

The advantages of cash dividend are discussed below-

Figure: Advantages of cost dividend

- Benefit for Stock Owners

Investors who own stock in a company that offers a cash dividend receive several benefits. The cash payment, which is either delivered annually or quarterly, provides additional, steady income that is not directly related to stock performance. Owners who want liquidity can hold shares longer, relying on cash dividends instead while waiting for share prices to rise. Finally, in the event that a stock loses value, cash dividends can help lessen the impact of the loss.

2. Cost to Companies

Companies that offer cash dividends make a substantial financial commitment to their investors. Each share earns a dividend, and large companies can easily spend millions of dollars on dividends. This is money that can't be reinvested in the company or spent elsewhere. Once a company offers a dividend, any decrease to the dividend can cause stockholders and analysts to see the stock as less appealing, and may encourage some stockholders to sell.

3. Incentive to Invest

Dividends offer an incentive for investors to place their money in one company rather than another. Offering a large dividend is one way for a company to raise a large amount of capital, or have greater success with an IPO, or initial public offering, when it first begins to sell stock. Companies may even raise their dividends to combat a downgraded rating and keep investors interested.

4. Tax Consequences

Receiving cash dividends has tax implications for stockholders, who must claim the dividend as investment income. Since cash dividends occur every year, this places an ongoing tax burden on the investor, rather than allowing the investor to choose when to pay taxes by selling the stock at an advantageous time. The tax on cash dividends also reduces the value of the payment and applies to the dividends whether or not the stock itself rises in value.

5. Alternatives

Not every company offers a cash dividend. Some offer no dividend at all, preferring instead to pour resources directly into the company to make share prices rise as much as possible to benefit stockholders in the long term. Others offer a dividend reinvestment program, which automatically reinvests a shareholder's dividends into the company in the form of more stock. This type of dividend has the advantage of growing a stock owner's holdings and curbing losses. It also allows the shareholder to choose when to sell and face the tax consequences of capital gains or losses.

b. Stock dividend:

A stock dividend, on the other hand, is an increase in the number of shares of a company with the new shares being given to shareholders. Companies may decide to distribute this type of dividend to shareholders of record if the company's availability of liquid cash is in short supply. For example, if a company were to issue a 5% stock dividend, it would increase the number of shares by 5% (one share for every 20 owned). If there are one million shares in a company, this would translate into an additional 50,000 shares. If you owned 100 shares in the company, you'd receive five additional shares. For example, consider an investor with Rs.1,000 looking to invest in Stock A or Stock B. Stock A is priced at Rs. 2,000 while Stock B is priced at Rs. 500. Stock A would be deemed “unaffordable” for the investor since he only has Rs.1,000 to invest.

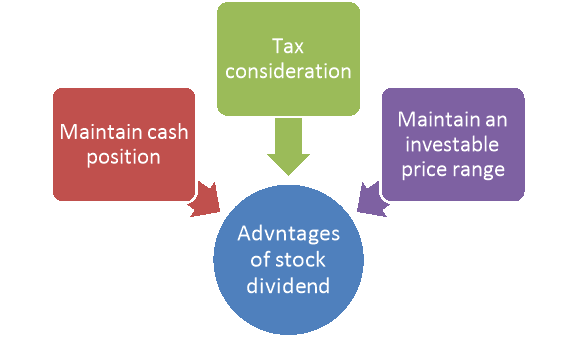

Advantages of a Stock Dividend

The advantages of stock dividend are discussed below-

Figure: Advantages of stock dividend

1. Maintaining cash position

A company that does not have enough cash may choose to pay a stock dividend in lieu of a cash dividend. In other words, a cash dividend allows a company to maintain its current cash position.

2. Tax considerations for a stock dividend

No tax considerations exist for issuing a stock dividend. For this reason, shareholders typically believe that a stock dividend is superior to a cash dividend – a cash dividend is treated as income in the year received and is, therefore, taxed.

3. Maintaining an “investable” price range

As noted above, a stock dividend increases the number of shares while also decreasing the share price. By lowering the share price through a stock dividend, a company’s stock may be more “affordable” to the public.

Disadvantages of a Stock Dividend

1. Market signaling and asymmetric information

The market may perceive a stock dividend as a shortage of cash, signaling financial problems. Market participants may believe the company is financially distressed, as they do not know the actual reason for management issuing a stock dividend. This can put selling pressure on the stock and depress its price.

2. Risky projects

Issuing a stock dividend instead of a cash dividend may signal that the company is using its cash to invest in risky projects. The practice can cast doubt on the company’s management and subsequently depress its stock price.

Key takeaways

- Dividend refers to the part of company profits that is distributed among its shareholders in proportion to the shares held by them. In simple terms, it is the amount of net earnings that company pay out to its shareholders.

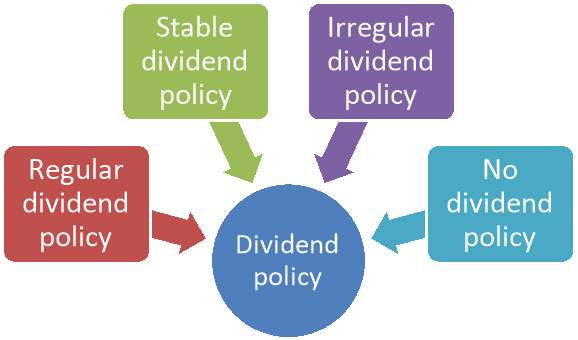

A dividend policy is the policy a company uses to structure its dividend pay-out to shareholders. Different dividend policies are discussed below-

Figure: Types of dividend policy

1. Regular dividend policy

Under the regular dividend policy, the company pays out dividends to its shareholders every year. If the company makes abnormal profits (very high profits), the excess profits will not be distributed to the shareholders but are withheld by the company as retained earnings. If the company makes a loss, the shareholders will still be paid a dividend under the policy. The regular dividend policy is used by companies with a steady cash flow and stable earnings. Companies that pay out dividends this way are considered low-risk investments because while the dividend payments are regular, they may not be very high.

2. Stable dividend policy

Under the stable dividend policy, the percentage of profits paid out as dividends is fixed. For example, if a company sets the pay-out rate at 6%, it is the percentage of profits that will be paid out regardless of the amount of profits earned for the financial year. Whether a company makes $1 million or $100,000, a fixed dividend will be paid out. Investing in a company that follows such a policy is risky for investors as the amount of dividends fluctuates with the level of profits. Shareholders face a lot of uncertainty as they are not sure of the exact dividend they will receive.

3. Irregular dividend policy

Under the irregular dividend policy, the company is under no obligation to pay its shareholders and the board of directors can decide what to do with the profits. If they a make an abnormal profit in a certain year, they can decide to distribute it to the shareholders or not pay out any dividends at all and instead keep the profits for business expansion and future projects. The irregular dividend policy is used by companies that do not enjoy a steady cash flow or lack liquidity. Investors who invest in a company that follows the policy face very high risks as there is a possibility of not receiving any dividends during the financial year.

4. No dividend policy

Under the no dividend policy, the company doesn’t distribute dividends to shareholders. It is because any profits earned is retained and reinvested into the business for future growth. Companies that don’t give out dividends are constantly growing and expanding, and shareholders invest in them because the value of the company stock appreciates. For the investor, the share price appreciation is more valuable than a dividend pay-out.

Key takeaways

- A dividend policy is the policy a company uses to structure its dividend pay-out to shareholders

References

1. Bhalla V.K – Financial Management – S.Chand.

2. Horne, J.C. Van and Wackowich. Fundamentals of Financial Management. 9thed. New Delhi Prentice Hall of India.

3. Johnson, R.W. Financial Management. Boston Allyn and Bacon.

4. Joy, O.M. Introduction to Financial Management. Homewood: Irwin.

5. Khan and Jain. Financial Management text and problems. 2nd ed. Tata McGraw Hill New Delhi.

6. Pandey, I.M. Financial Management. Vikas Publications.

7. Chandra, P. Financial Management- Theory and Practice. (Tata McGraw Hill).

8. Rustagi, R.P. Fundamentals of Financial Management. Taxmann Publication Pvt. Ltd.

8. Singh, J.K. Financial Management- text and Problems. 2nd Ed. DhanpatRai and Company, Delhi.

9. Singh, Surender and Kaur, Rajeev. Fundamentals of Financial Management. Book Bank International.

10. Brigham and Houston, Fundamentals of Financial Management, 13th Ed., Cengage Learning