Unit 5

Working Capital Decisions

The term Working Capital also called gross working capital refers to the firm‘s aggregate of current assets and current assets are these assets which can be convertible into cash within an accounting period, generally a year. Accounting Standards Board, The Institute of Chartered Accountants of India defines, “Working capital means the funds available for day-to-day operations of an enterprise. It also represents the excess of current assets over current liabilities including short-term loans.”

Working capital has two concepts:

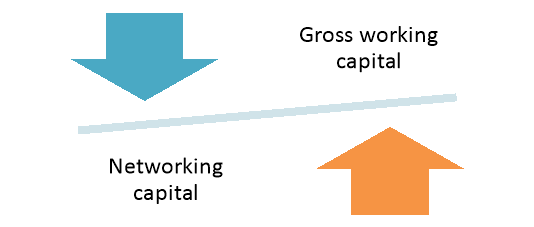

Figure: Concept of working capital

i) Gross working capital

Gross Working capital refers to the total of the current assets. Gross working capital is more helpful to the management in managing each individual current assets for day-to-day operations.

Ii) Net working capital

Net working capital refers to the excess of the current assets over current liabilities. In the long run, it is the net working capital that is useful for the purpose.

There are two types of working capital-

Figure: Working capital classification

(a) Rigid, fixed, regular or permanent working capital

Every business concern has to maintain certain minimum amount of current assets at all times to carry on its activities efficiently and effectively. It is indispensable for any business concern to keep some material as stocks, some in the shape of work-in-progress and some in the form of finished goods. Permanent Working Capital is the irreducible minimum amount of working capital necessary to carry on its activities without any interruptions. It is that minimum amount necessary to outlays its fixed assets effectively.

(b) Variable, seasonal, temporary or flexible working capital

Temporary working capital is that amount of current assets which is not permanent and fluctuating from time to time depending upon the company‘s requirements and it is generally financed out of short term funds, It may also high due to seasonal character of the industry as such it is also called seasonal working capital.

Nature of Working Capital

Working capital is works as breath of the company without which an organisation cannot survive. Some of the features of working capital are-

- It is of two types- gross working capital and net working capital.

- It is permanent and temporary nature. Permanent working capital is needed for long term and short term working capital is needed for short term.

- It is used for purchase of raw materials, payment of wages and expenses.

Iv. It changes form constantly to keep the wheels of business moving.

v. Working capital enhances liquidity, solvency, creditworthiness and reputation of the enterprise.

Vi. It generates the elements of cost namely: Materials, wages and expenses.

Vii. It enables the enterprise to avail the cash discount facilities offered by its suppliers.

Key takeaways

- The term Working Capital also called gross working capital refers to the firm‘s aggregate of current assets and current assets are these assets which can be convertible into cash within an accounting period, generally a year.

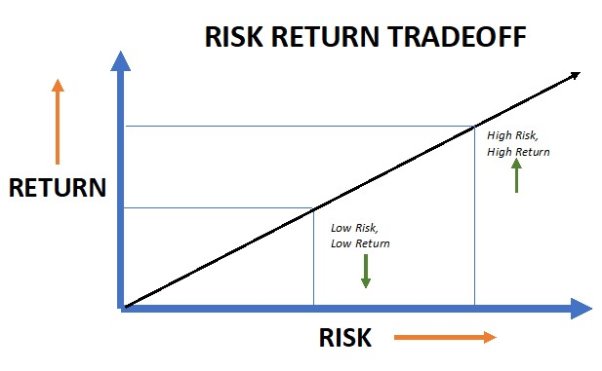

The risk-return trade-off states that the level of return to be earned from an investment should increase as the level of risk goes up. Conversely, this means that investors will be less likely to pay a high price for investments that have a low risk level, such as high-grade corporate or government bonds. Different investors will have different tolerances for the level of risk they are willing to accept, so that some will readily invest in low-return investments because there is a low risk of losing the investment. Others have a higher risk tolerance and so will buy riskier investments in pursuit of a higher return, despite the risk of losing their investments. Some investors develop a portfolio of low-risk, low-return investments and higher-risk, higher-return investments in hopes of achieving a more balanced risk-return trade-off.

Source: http://www.indianivesh.in

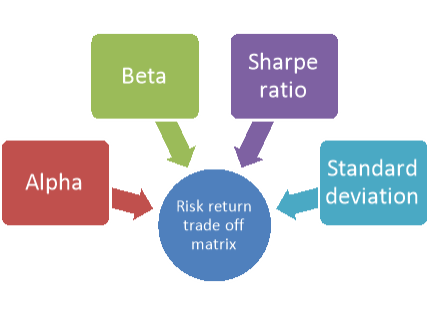

Generally, the risk and return trade-off are calculated with the help of a few metrics. For instance, in the case of mutual funds, investors determine the trade-off with the help of these metrics-

Figure: Risk-return trade off ratio

- Alpha

Alpha measures the risk-adjusted returns of a mutual fund scheme against its underlying benchmark. For instance, if a particular mutual fund follows Nifty 50, the risk-adjusted returns of the fund above or below the performance of the benchmark are considered alpha. For instance, a negative alpha of 1 means that the mutual fund underperformed in comparison to its benchmark by 1%. A positive alpha indicates that the fund outperformed its benchmark. Higher the alpha is, the higher is the returns potential of the mutual fund.

2. Beta

Beta measures the volatility of the fund in line with its underlying benchmark. Higher or positive beta means that the fund you have selected is more volatile as compared to its benchmark. Funds have lower or negative beta if their volatility is lower than the benchmark.

Funds with lower betas are highly recommended to new investors as they are less volatile. But less volatility often leads to lower returns as compared to a fund with higher beta. But higher beta does not guarantee higher returns.

3. Sharpe Ratio

Sharpe Ratio is used for analysing the risk-adjusted returns potential of a mutual fund scheme. In other words, it measures the potential returns of a scheme against each unit of risk the scheme has undertaken. So, Sharpe Ratio of 1 means that the returns potential of a fund is higher than what is expected for an investment at a particular risk level. If the ratio is below 1, it signifies that the returns potential of the fund is lower than the quantum of risk carried by the fund.

4. Standard Deviation

Standard deviation measures the individual returns of an investment over time against its average return for the same period. So, a higher standard deviation of a mutual fund scheme means that the fund is volatile and carries a higher level of risk as compared to a fund with a lower standard deviation. The standard deviation of a fund is compared against the standard deviation of funds from the same category to understand how volatile and risky a particular fund is.

Key takeaways

- The risk-return trade-off states that the level of return to be earned from an investment should increase as the level of risk goes up. Conversely, this means that investors will be less likely to pay a high price for investments that have a low risk level, such as high-grade corporate or government bonds.

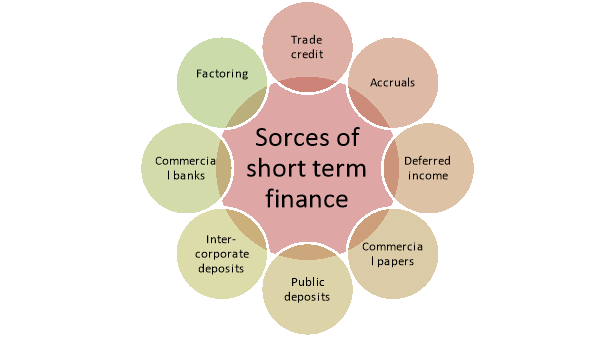

Short-term financing is aimed to meet the demand of current assets and pay the current liabilities of the organization. In other words, it helps in minimizing the gap between current assets and current liabilities. There are different means to raise capital from the market for small duration. Various agencies, such as commercial banks, co-operative banks, financial institutions, and NABARD provide the financial assistance to organizations.

Figure: Sources of short term finance

1. Trade Credit:

Trade credit refers to the credit extended by the supplier of goods or services to his/her customer in the normal course of business. It occupies a very important position in short-term financing due to the competition. Almost all the traders and manufacturers are required to extend credit facility (a portion), without which there is no business. Trade credit is a spontaneous source of finance that arises in the normal business transactions without specific negotiation, (automatic source of finance).

2. Accruals:

Accrued expenses are those expenses which the company owes to the other, but not yet due and not yet paid the amount. Accruals represent a liability that a firm has to pay for the services or goods, it has received. It is spontaneous and interest-free source of financing. Salaries and wages, interest and taxes are the major constituents of accruals. Salaries and wages are usually paid on monthly and weekly base, respectively. The amounts of salaries and wages are owed but not yet paid and shown them as accrued salaries and wages on the balance sheet at the end of the financial year. The longer the time lag in–payment of these expenses, the greater is the amount of funds provided by the employees. Similarly, interest and tax are accruals, as source of short-term finance. Tax will be paid on earnings.

3. Deferred Income:

Deferred income is income received in advance by the firm for supply of goods or services in future period. This income increases the firm’s liquidity and constitutes an important source of short-term finance. These payments are not showed as revenue till the supply of goods or services, but showed in the balance sheet as income received in advance.

Advance payment can be demanded by firms which are having monopoly power, great demand for its products and services and if the firm is manufacturing a special product on a special order.

4. Commercial Papers (CPs):

Commercial paper represents a short-term unsecured promissory note issued by firms that have a fairly high credit (standing) rating. It was first introduced in the USA and it is an important money market instrument. In India, Reserve Bank of India introduced CP on the recommendations of the Vaghul Working Group on Money Market. CP is a source of short-term finance to only large firms with sound financial position.

5. Public Deposits:

Public deposits or term deposits are in the nature of unsecured deposits, are solicited by the firms (both large and small) from general public primarily for the purpose of financing their working capital requirements.

6. Inter-Corporate Deposits (ICDs):

A deposit made by one firm with another firm is known as Inter-Corporate Deposit (ICD). Generally, these deposits are made for a period up to six months.

Such deposits may be of three types:

(a) Call Deposits:

These deposits are those expected to be payable on call/on just one day notice. But, in actual practice, the lender has to wait for at least 2 or 3 days to get back the amount. Inter-corporate deposits generally have 12 per cent interest per annum.

(b) Three Months Deposits:

These deposits are more popular among companies for investing the surplus funds. The borrower takes this type of deposits for meeting short-term cash inadequacy. The interest rate on these types of deposits is around 14 per cent per annum.

(c) Six months Deposits:

Inter-corporate deposits are made for a maximum period of six months. These types of deposits are usually given to ‘A’ category borrowers only and they carry an interest rate of around 16 per cent per annum.

7. Commercial Banks:

Commercial banks are the major source of working capital finance to industries and commerce. Granting loan to business is one of their primary functions. Getting bank loan is not an easy task since the lending bank may ask a number of questions about the prospective borrower’s financial position and its plans for the future.

At the same time the bank will want to monitor borrower’s business progress. But there is a good side to this, that is borrower’s share price tends to rise, because investor knows that convincing banks is very difficult. The different types or forms of loans are:

(i) Loans,

(ii) Overdrafts,

(iii) Cash credits,

(iv) Purchasing or discounting of bills and

(v) Letter of Credit.

8. Factoring:

Factoring is one of the sources of working capital. Banks have been given more freedom of borrowing and lending both internally and externally and facilitated the free functioning in lending and investment operations. From 1994, banks are allowed to enter directly leasing, hire purchasing and factoring services, instead through their subsidiaries. In other words, banks are free to enter or exit in any field depending on their profitability, but subject to some RBI guidelines. Banks provide working capital finance through financing receivables, which is known as “factoring”. A “Factor” is a financial institution, which renders services relating to the management and financing of sundry debtors that arises from credit sales.

Key takeaways

- Short-term financing is aimed to meet the demand of current assets and pay the current liabilities of the organization. In other words, it helps in minimizing the gap between current assets and current liabilities.

Two components of capital are current assets and current liabilities. Estimation of the amount of current and current liabilities to maintain a certain level of operation is not an easy task. The lack of working capital disrupts the smooth production process, and excess working capital increases costs. Here we describe the estimation of working capital in case of trading and manufacturing concerns.

The following procedure should be employed to estimate working capital for manufacturing concerns:

(a) Expected production per week or per month.

(b) Determination of costs for each element, namely material, labour and overhead, as well as profit per unit;

(c) Calculation of the amount blocked for each week/month for each element of cost and profit;

(d) Determination of the operating cycle by estimating the raw material retention period. Processing time, storage period of finished products, debt collection period. The period of payment of creditor it takes time lag in pay and overhead payments.

(e) Determining the net block period. This is the period during which each element of the cost remains blocked. For example, if the raw material remains in the store for 2 weeks after purchase, the processing time is 2 weeks, the finished product remains in stock, 3 weeks if the credit period extended to the debtor is extended for 4 weeks, and the payment for the material is made for 2 weeks after purchase, the net block period is as follows:[(2+ 2 + 3 + 4) – (2)] = 9 a few weeks.

(f) Obtain the working capital requirements for each element of the cost by multiplying the net block period calculated in step (e) and the amount blocked for each element of the cost according to step (c).

(g) Get the total amount of working capital, if any, by summing up the costs and all the amounts calculated for each element of the desired cash.

Key takeaways

- Estimation of the amount of current and current liabilities to maintain a certain level of operation is not an easy task. The lack of working capital disrupts the smooth production process, and excess working capital increases costs. Here we describe the estimation of working capital in case of trading and manufacturing concerns.

Cash management is the process of collecting and managing cash flows. Cash management can be important for both individuals and companies. In business, it is a key component of a company's financial stability. For individuals, cash is also essential for financial stability while also usually considered as part of a total wealth portfolio. Individuals and businesses have a wide range of offerings available across the financial marketplace to help with all types of cash management needs. Banks are typically a primary financial service provider for the custody of cash assets. There are also many different cash management solutions for individuals and businesses seeking to obtain the best return on cash assets or the most efficient use of cash comprehensively.

Objectives of Cash Management

The objectives of cash management are discussed below-

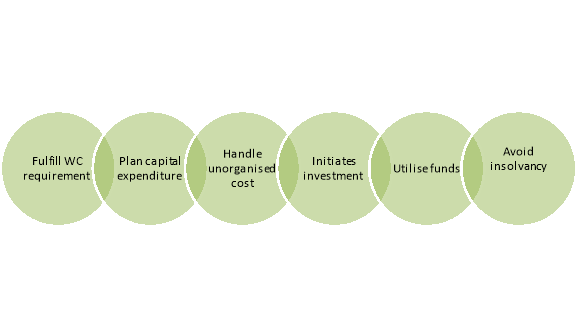

Figure: Objectives of cash management

- Fulfil Working Capital Requirement: The organization needs to maintain ample liquid cash to meet its routine expenses which possible only through effective cash management.

- Planning Capital Expenditure: It helps in planning the capital expenditure and determining the ratio of debt and equity to acquire finance for this purpose.

- Handling Unorganized Costs: There are times when the company encounters unexpected circumstances like the breakdown of machinery. These are unforeseen expenses to cope up with; cash surplus is a lifesaver in such conditions.

- Initiates Investment: The other aim of cash management is to invest the idle funds in the right opportunity and the correct proportion.

- Better Utilization of Funds: It ensures the optimum utilization of the available funds by creating a proper balance between the cash in hand and investment.

- Avoiding Insolvency: If the business does not plan for efficient cash management, the situation of insolvency may arise. It is either due to lack of liquid cash or not making a profit out of the money available.

Factors determining cash needs

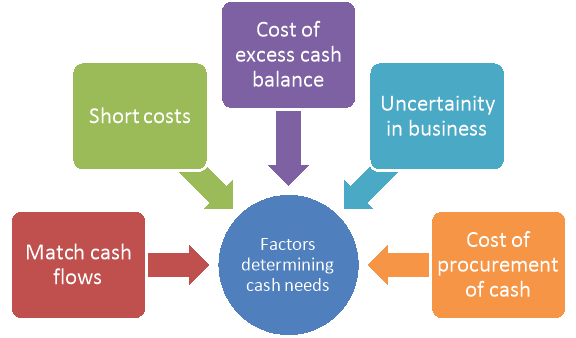

Maintenance of optimum level of cash is the main problem of cash management. The level of cash holding differs from industry to industry, organisation to organisation. The factors determining the cash needs of the industry is explained as follows:

Figure: Factors determining cash needs

- Matching of cash flows:

The first and very important factor determining the level of cash requirement is matching cash inflows with cash outflows. If the receipts and payments are perfectly coincides or balance each other, there would be no need for cash balances. The need for cash management therefore due to the non-synchronisation of cash receipts and disbursements.

Ii. Short costs:

Short costs are defined as the expenses incurred as a result of shortfall of cash. The short costs includes, transaction costs associated with raising cash to overcome the shortage, borrowing costs associated with borrowing to cover the shortage i.e. interest on loan, loss of trade-discount, penalty rates by banks to meet a shortfall in cash balances and costs associated with deterioration of the firm’s credit rating etc. which is reflected in higher bank charges on loans, decline in sales and profits.

Iii. Cost of excess cash balances:

One of the important factors determining the cash needs is the cost of maintaining cash balances i.e. excess or idle cash balances. The cost of maintaining excess cash balance is called excess cash balance cost.

Iv. Uncertainty in business:

The first requirement of cash management is a precautionary cushion to cope with irregularities in cash flows, unexpected delays in collections and disbursements and defaults. The uncertainty can be overcome through accurate forecasting of tax payments, dividends, capital expenditure etc. and ability of the firm to borrow funds through over draft facility.

v. Cost of procurement and management of cash:

The costs associated with establishing and operating cash management staff and activities determining the cash needs of a business firm. These costs are generally fixed and are accounted for by salary, storage and handling of securities etc. The above factors are considered to determine the cash needs of a business firm

Cash Management Models

Cash management requires a practical approach and a strong base to determine the requirement of cash by the organization to meet its daily expenses. For this purpose, some models were designed to determine the level of money on different parameters.

The two most important models are discussed in detail below:

- The Baumol’s EOQ Model

Based on the Economic Order Quantity (EOQ), in the year 1952, William J. Baumol gave the Baumol’s EOQ model, which influences the cash management of the company. This model emphasizes on maintaining the optimum cash balance in a year to meet the business expenses on the one hand and grab the profitable investment opportunities on the other side. The following formula of the Baumol’s EOQ Model determines the level of cash which is to be maintained by the organization:

Where,

‘C’ is the optimum cash balance;

‘F’ is the fixed transaction cost;

‘T’ is the total cash requirement for that period;

‘i’ is the rate of interest during the period

2. The Miller – Orr’ Model

According to Merton H. Miller and Daniel Orr, Baumol’s model only determines the cash withdrawal; however, cash is the most uncertain element of the business. There may be times when the organization will have surplus cash, thus discouraging withdrawals; instead, it may require to make investments. Therefore, the company needs to decide the return point or the level of money to be maintained, instead of determining the withdrawal amount. This model emphasizes on withdrawing the cash only if the available fund is below the return point of money whereas investing the surplus amount exceeding this level.

Functions of Cash Management

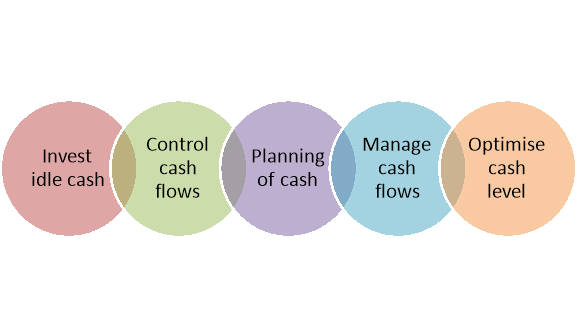

Cash management is required by all kinds of organizations irrespective of their size, type and location. Following are the multiple managerial functions related to cash management:

Figure: Functions of cash management

- Investing Idle Cash: The company needs to look for various short term investment alternatives to utilize surplus funds.

- Controlling Cash Flows: Restricting the cash outflow and accelerating the cash inflow is an essential function of the business.

- Planning of Cash: Cash management is all about planning and decision making in terms of maintaining sufficient cash in hand and making wise investments.

- Managing Cash Flows: Maintaining the proper flow of cash in the organization through cost-cutting and profit generation from investments is necessary to attain a positive cash flow.

- Optimizing Cash Level: The organization should continuously function to maintain the required level of liquidity and cash for business operations.

Key takeaways

- Cash management is the process of collecting and managing cash flows. Cash management can be important for both individuals and companies. In business, it is a key component of a company's financial stability.

Account receivables refer to the outstanding invoices or money which is yet to be paid by your customers. Until it is paid, such invoices or money is accounted as accounts receivables. It is also known as bills receivables. Business need cash all the time to keep the business running smoothly and ensuring the accounts receivables are paid on time is essential to manage cash flow efficiently. Management of the accounts receivable is called receivable management. Basically, the entire process of defining the credit policy, setting payment terms, sending payment follow ups and timely collection of the due payments can be defined as receivables management. Management of Receivables is also known as:

2. Payment Collection

3. Collection Management

4. Accounts Receivables

Nature of receivable management

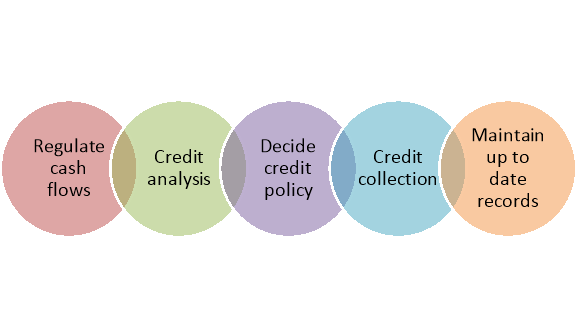

The nature of receivable management are discussed below-

Figure: Nature of receivable management

- Regulate Cash Flow

Receivable management regulates all cash flows in an organization. It controls all inflow and outflow of funds and ensures that an efficient amount of cash is always available. Proper management of receivables enables organizations in efficient functioning at all the times.

2. Credit Analysis

It performs proper analysis of customer credentials for determining their credit ratings. Monitoring and scanning of customers before provide them any credit facility helps in minimizing the credit risk.

3. Decide Credit Policy

Receivable management decides the credit policy and standards as per which credit facility should be extended to customers. A company may have a lenient credit policy where customer credit-worthiness is not at all considered or a stringent policy where credit-worthiness is considered for providing credit.

4. Credit Collection

Receivable management focuses on efficient and timely collection of business payments from its customers. It works towards reducing the time gap in between the moments when bills are raised and payment is collected.

5. Maintain Up-To-Date Records

Receivable management maintains a systematic record of all business transactions on a regular basis. All transactions are maintained fairly in the form of proper billing and invoices which helps in avoiding any confusion or settling of disputes arising later.

Functions of receivable management

The functions of receivable management are discussed below-

- Evaluates Customer Credit Ratings

Receivable management evaluates its customers borrowing capacity and repaying ability for determining their credit ratings. It approves any credit facility to its customers after analysing their information both qualitatively and quantitatively. Proper investigation of client details helps in reducing the credit risk.

2. Minimizes Investment In Receivables

It reduces investment in receivable by ensuring optimum funds are available within organization at all the times. Receivable management decides proper credit limit and credit period for avoiding any bankruptcy situations. Attempts are made to collect account receivable as soon as they become due for payment which reduces the overall investment in receivables.

3. Optimize Sales

Efficient receivable management assist business in raising their sales volume. Business are able to attract more and more customers by providing them credit facilities. They are able to properly decide and monitor credit facilities with the help of a receivable management.

4. Reduce Risk of Bad Debts

It takes all steps to avoid any instances of bad debts. Receivable management notify all customers for the payment as soon as the amount gets due. It charges interest on delay payments and aims at optimum collection of all payment timely.

5. Maintain Efficient Cash

Maintenance of efficient cash is crucial for the survival of every organization. Receivables management properly records all cash inflows and outflows of a business. All credit facilities are extended after analysing the capability of organization and due payments are collected timely. This results in steady cash flow within the organization.

6. Lower Cost of Credit

Receivable management helps business in lowering its cost of credit by limiting the credit amount and credit period for its customers. It performs all processes such as acquiring credit information of clients and collecting all due payments in an efficient way which lower the overall cost associated with credit facilities.

Key takeaways

- Account receivables refer to the outstanding invoices or money which is yet to be paid by your customers. Until it is paid, such invoices or money is accounted as accounts receivables. It is also known as bills receivables.

Inventory constitutes an important item in the working capital of many business concerns. Net working capital is the difference between current assets and current liabilities. Inventory is a major item of current assets. The term inventory refers to the stocks of the product a firm is offering for sale and the components that make up the product. Inventory is stores of goods and stocks. This includes raw materials, work-in-process and finished goods. Raw materials consist of those units or input which are used to manufacture goods that require further processing to become finished goods. Finished goods are products ready for sale. The classification of inventory and the levels of the components vary from organisation to organisation depending upon the nature of business. For example steel is a finished product for a steel industry, but raw material for an automobile manufacturer. Thus, inventory may be defined as “Stock of goods that is held for future use”. Since inventory constitute about 50 to 60 percent of current assets, the management of inventories is crucial to successful Working Capital Management. Working capital requirements are influenced by inventory holding. Hence, there is a need for effective and efficient management of inventory A good inventory management is important to the successful operations of the most of the organizations, unfortunately the importance of inventory is not always appreciated by top management. This may be due to a failure to recognize the link between inventory and achievement of organisational goals or due to ignorance of the impact that inventory can have on costs and profits. Inventory management refers to an optimum investment in inventory. It should neither be too low to effect the production adversely nor too high to block the funds unnecessarily. Excess investment in inventory is unprofitable for the business. Both excess and inadequate investment in inventory is not desirable. The firm should operate within the two danger points. The purpose of inventory management is to determine and maintain the optimum level of inventory investment. Techniques and Tools of Inventory Control:

Figure: Techniques of inventory control

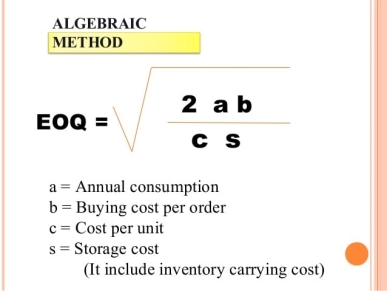

- Economic Order Quantity

The economic order quantity (EOQ) refers to the ideal order quantity a company should purchase in order to minimize its inventory costs, such as holding costs, shortage costs, and order costs. EOQ is necessarily used in inventory management, which is the oversight of the ordering, storing, and use of a company's inventory. Inventory management is tasked with calculating the number of units a company should add to its inventory with each batch order to reduce the total costs of its inventory.

Formula for EOQ

Source: https://image.slidesharecdn.com

2. Fixing Levels of Material.

(a) Minimum Level

This represents the quantity which must be maintained in hand at all times. If stocks are less than the minimum level, then the work will stop due to shortage of materials. Following factors are taken into account while deciding minimum stock level:

(i) Lead Time:

A purchasing firm requires some time to process the order and time is also required by the supplier/vendor to execute the order. The time taken in processing the order and then executing it is known as lead time. It is essential to maintain some inventory during this period to meet production requirements.

(ii) Rate of Consumption:

It is the average consumption of materials items in the industry. The rate of consumption will be decided on the basis of past experience and production plans.

(iii) Nature of Material:

The nature of material also affects the minimum level. If a material is required only against special orders of the customer then minimum stock will not be required for such materials. Wheldon has given the following formula for calculating minimum stock level:

Minimum stock Level = Re-ordering Level – (Normal Consumption x Normal Reorder Period)

(iv) Re-ordering Level:

When the quantity of materials reaches a certain level then fresh order is sent to procure materials again. The order is sent before the materials reach minimum stock level.

(b) Maximum Level

It is the quantity of materials beyond which a firm should not exceed its stocks. If the quantity exceeds maximum level limit then it will be termed as overstocking. A firm avoids overstocking because it will result in high material costs. Overstocking will lead to the requirement of more capital, more space for storing the materials, and more charges of losses from obsolescence. Maximum stock level will depend upon the following factors:

1. The availability of capital for the purchase of materials in the firm.

2. The maximum requirements of materials at any point of time.

3. The availability of space for storing the materials as inventory.

4. The rate of consumption of materials during lead time.

5. The cost of maintaining the stores.

6. The possibility of fluctuations in prices of various materials.

7. The nature of materials. If the materials are perishable in nature, then they cannot be stored for long periods.

8. Availability of materials. If the materials are available only during seasons then they will have to be stored for the future period.

9. Restrictions imposed by the government. Sometimes, government fixes the maximum quantity of materials which a concern can store. The limit fixed by the government will become the deciding factor and maximum level cannot be fixed more than that limit.

10. The possibility of changes in fashions will also affect the maximum level.

It is calculated as-

Maximum Stock Level = Reordering Level + Reordering Quantity – (Minimum Consumption x Minimum Reordering period)

(c) Danger Level

It is the level below which stocks should not fall in any case. If danger level approaches then immediate steps should taken to replenish the stocks even if more cost is incurred in arranging the materials. Danger level can be determined with the following formula:

Danger Level = Average Consumption x Maximum reorder period for emergency purchases.

3. ABC Inventory Control

ABC method of inventory control involves a system that controls inventory and is used for materials and throughout the distribution management. It is also known as selective inventory control or SIC. ABC analysis is a method in which inventory is divided into three categories, i.e. A, B, and C in descending value. The items in the A category have the highest value, B category items are of lower value than A, and C category items have the lowest value.

Need for Prioritizing Inventory

Item A:

In the ABC model of inventory control, items categorized under A are goods that register the highest value in terms of annual consumption. It is interesting to note that the top 70 to 80 per cent of the yearly consumption value of the company comes from only about 10 to 20 per cent of the total inventory items. Hence, it is crucial to prioritize these items.

Item B:

These are items that have a medium consumption value. These amounts to about 30 percent of the total inventory in a company which accounts for about 15 to 20 percent of annual consumption value.

Item C:

The items placed in this category have the lowest consumption value and account for less than 5 percent of the annual consumption value that comes from about 50 percent of the total inventory items.

4. Perpetual Inventory System

A perpetual inventory system is an inventory management method that records when stock is sold or received in real-time through the use of an inventory management system that automates the process. A perpetual inventory system will record changes in inventory at the time of the transaction. A perpetual inventory system works by updating inventory counts continuously as goods are bought and sold. This inventory accounting method provides a more accurate and efficient way to account for inventory than a periodic inventory system. Here is a step-by-step overview of how this type of inventory system works.

5. VED classification.

VED analysis is an inventory management technique that classifies inventory based on its functional importance. It categorizes stock under three heads based on its importance and necessity for an organization for production or any of its other activities. VED analysis stands for Vital, Essential, and Desirable.

- V-Vital category

As the name suggests, the category “Vital” includes inventory, which is necessary for production or any other process in an organization. The shortage of items under this category can severely hamper or disrupt the proper functioning of operations. Hence, continuous checking, evaluation, and replenishment happen for such stocks. If any of such inventories are unavailable, the entire production chain may stop. Also, a missing essential component may be of need at the time of a breakdown. Therefore, order for such inventory should be before-hand. Proper checks should be put in place by the management to ensure the continuous availability of items under the “vital” category.

- E- Essential category

The essential category includes inventory, which is next to being vital. These, too, are very important for any organization because they may lead to a stoppage of production or hamper some other process. But the loss due to their unavailability may be temporary, or it might be possible to repair the stock item or part.

The management should ensure optimum availability and maintenance of inventory under the “Essential” category too. The unavailability of inventory under this category should not cause any stoppage or delays.

2. D- Desirable category

The desirable category of inventory is the least important among the three, and their unavailability may result in minor stoppages in production or other processes. Moreover, the easy replenishment of such shortages is possible in a short duration of time.

6. Just-In-Time

Just in time is a form of inventory management that requires working closely with suppliers so that raw materials arrive as production is scheduled to begin, but no sooner. The goal is to have the minimum amount of inventory on hand to meet demand.

7. FSN Analysis

FSN stands for fast-moving, slow-moving and non-moving items. The basis of FSN analysis is to derive vital data to help guide inventory management decisions. These may include where products should be placed in the warehouse. For example, fast-moving items could be placed in a location that is easily accessible.

3. Fast-moving inventory

Fast-moving inventory comprises of inventory, which moves in and out of stock fastest and most often. Therefore these goods have the highest replenishment rate. Items in this category generally comprise less than 20% of the total inventory.

4. Slow-moving inventory

Items in this category move slower, and hence, their replenishment is also slower. This category comprises of around 35% of the total inventory in an organization.

5. Non- moving inventory

The last category of this analysis is the least moving portion of the inventory and also includes the dead stock. Replenishment of such inventory may or may not take place at all after utilization. This category can go as high as 55%-60% of the total inventory in organizations.

8. Inventory Turnover Ratio

Inventory turnover is a financial ratio showing how many times a company has sold and replaced inventory during a given period. A company can then divide the days in the period by the inventory turnover formula to calculate the days it takes to sell the inventory on hand. Calculating inventory turnover can help businesses make better decisions on pricing, manufacturing, marketing, and purchasing new inventory.

Source: https://cdn.corporatefinanceinstitute.com

Key takeaways

- The term inventory refers to the stocks of the product a firm is offering for sale and the components that make up the product.

Accounts payable is the amount that a company must pay out over the short term and is a key component of working capital management. Companies endeavour to balance payments with receivables to maintain maximum cash flow. Companies may delay payments as long as is reasonably possible with the goal of maintaining positive credit ratings while sustaining good relationships with suppliers and creditors. Ideally, a company's average time to collect receivables is significantly shorter than its average time to settle payables. Payables management is the handling of a company's unpaid debts to third-party vendors for purchases made on credit. Account payables management involves tasks such as seeking trade credit lines, acquiring favourable terms of purchase, and managing the timing and flow of purchase. Accounts payable management is an essential tool for the proper functioning of the business entity. Let us take note of some common supporting reasons

- It undertakes the responsibility of paying the entity’s bills on time. As this will help in maintaining the so-called strong credit and long-term relationship with the vendors.

- If the payment is made to the vendor on time, the vendor will provide the continuous flow of goods and services for the proper functioning of the entity and also probable trade discounts.

- Accounts Payable management has the responsibility that the payment must be done on time to avoid overdue charges, penalty or late fees.

- It has to make sure that all the invoices can be easily tracked and paid before the due date. The same helps in avoiding the non-payment or payment for the same bill multiple times.

- The process helps in maintaining the proper cash flows such as making payments only when due, by making effective and appropriate use of vendor’s credit facility etc.

- It also helps in refraining from any kind of fraud and theft in the business entity.

Key takeaways

- Accounts payable is the amount that a company must pay out over the short term and is a key component of working capital management. Companies endeavour to balance payments with receivables to maintain maximum cash flow.

References-

1. Bhalla V.K – Financial Management – S.Chand.

2. Horne, J.C. Van and Wackowich. Fundamentals of Financial Management. 9thed. New Delhi Prentice Hall of India.

3. Johnson, R.W. Financial Management. Boston Allyn and Bacon.

4. Joy, O.M. Introduction to Financial Management. Homewood: Irwin.

5. Khan and Jain. Financial Management text and problems. 2nd ed. Tata McGraw Hill New Delhi.

6. Pandey, I.M. Financial Management. Vikas Publications.

7. Chandra, P. Financial Management- Theory and Practice. (Tata McGraw Hill).

8. Rustagi, R.P. Fundamentals of Financial Management. Taxmann Publication Pvt. Ltd.

8. Singh, J.K. Financial Management- text and Problems. 2nd Ed. DhanpatRai and Company, Delhi.

9. Singh, Surender and Kaur, Rajeev. Fundamentals of Financial Management. Book Bank International.

10. Brigham and Houston, Fundamentals of Financial Management, 13th Ed., Cengage Learning.