UNIT-I

Tax Planning

1.1 Tax Planning, Tax Management, Tax Evasion, Tax Avoidance

Preamble

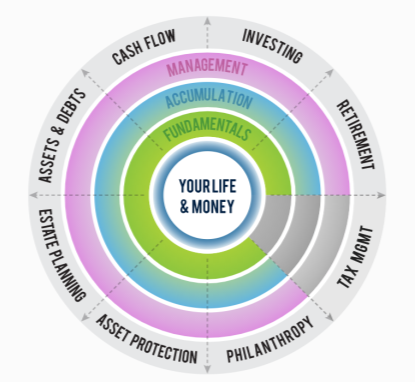

Tax planning is the process of analyzing a financial plan or situation from a tax perspective. The purpose of tax planning is to ensure tax efficiency. With the help of tax planning, you can ensure that all elements of your financial planning work with maximum tax efficiency. Tax planning is an important element of financial planning. Reducing tax obligations and increasing your ability to contribute to retirement plans are key to success.

Tax planning includes a variety of considerations. Considerations such as size, income timing, purchase timing, and planning relate to other types of spending. Also, the investment chosen and the various retirement plans must be closely related to tax filing status and deductions in order to produce the best possible results.

Understand Tax Planning

Tax planning plays an important role in the financial growth story of all individuals, as all individuals in the IT bracket are required to pay taxes. Having a tax plan can streamline your tax payments so that you can make significant profits over a particular period of time with minimal risk. Effective tax planning can also help reduce an individual's tax obligations.

Tax Plans can be categorized as follows:

- Allowable Tax Plan: A tax plan that falls within the legal framework.

- Objective Tax Plan: A tax plan with a specific purpose.

- Long-term / short-term Tax Planning: Plans to be implemented towards the beginning and end of the fiscal year.

Tax Plan Highlights:

- Tax planning is the process of analyzing finance from a tax perspective with the goal of ensuring maximum tax efficiency.

- Tax planning considerations include income timing, purchase timing, spending planning, and size.

- Tax planning is essential for small and medium-sized businesses as well as large businesses because it helps them achieve their business-related goals.

What is a Tax Plan?

In March, I see people desperately stressed about paying taxes. This is when you do tax-related work, such as investing in tax-saving measures, getting the right form from your insurance company, or actually paying taxes.

Not surprisingly, that's the only time we know exactly how much we owe as taxes. Faced with huge tax payments, we are desperately looking for a solution-something to save money! But it would be much better to process the tax long before it was time to pay it. And don't we absolutely like to pay a little less tax than we do?

Suppose you have an annual income of 5 rupees and your income tax debt is 23,690 rupees. It's a lot! Now suppose you want to invest 1.5 rupees. 30% of total income — by tax-saving means. Income tax debt can be reduced to 10,000 rupees. This is a 57.7% reduction. Imagine what you can do with the money you save!

That's why you need a tax plan.

So, what is a Tax Plan?

A tax plan is a logical analysis of income and expenses that helps you make the best investment so that you can save money when paying taxes. Very simply, this process allows you to think about tax payments at the beginning of the year instead of holding for 11 hours. Therefore, the purpose of tax planning is to manage money in a way that reduces the amount you pay as taxes.

The steps in the Tax Planning process are as follows:

- Take your total income into account first. This is just the starting point of the process and you need to calculate your annual and monthly income honestly and accurately.

- Please check the taxable amount accurately. The entire takeaway payment is not taxable. Some salaries, such as rent and travel allowances, are not taxable. On the other hand, the return on investment may be added to taxable income. Therefore, you need to understand the actual taxable income.

- Take advantage of deductions to reduce your total taxable income. This can be achieved by configuring salaries and planning your investment correctly. For example, profits from debt funds held for more than 3 years are taxed at 20% after indexing. On the other hand, interest from fixed deposits is taxed at the same rate as income tax. Therefore, a debt fund may be a tax-friendly option if it falls within the 30% range.

4. Finally, invest some money in tax-saving measures. To do this, you need to read Section 80 of the Income Tax Act. It refers to all tax-related rules. There are many investment options available for effective tax planning, including Provident Public Funding (PPF), Equity Link Savings Scheme (ELSS), and National Savings Certificate (NSC). Even your life insurance, health insurance and mortgage payments can help you take advantage of tax savings.

5. All you need is a quick understanding of your income and some basic tax laws. This little effort can greatly help secure your overall finances security. Unfortunately, given the hustle and bustle of everyday life, there is not enough time to find time to do this. But now that we know how important it is, we hope you find the time.

How to save Taxes?

Taxpayers have several options to reduce their tax obligations. Various sections of India's Income Tax Act provide tax credits and tax exemptions, of which Section 80C is the most popular tax-saving measure. For example, publicly funded deposits, five-year bank depositors, national savings certificates, and investments in ELSS schemes.

The best and best way to save taxes is to make a financial plan and stick to it whenever there is a change in your income. It's also a good practice to make a tax-saving investment at the beginning of the year, rather than rushing to the last moment and often making the wrong investment decision. To do this, it is important to note all available tax exemptions and deductions.

Tax-saving options based on Section 80C

Section 80C, one of the most prevalent sections of the 1961 Income Tax Act, saves up to 46,800 rupees each year (assuming a maximum income tax of @ 30% and an educational tax of 4%). It stipulates regulations. One of the best tax-saving measures under Section 80C is to invest in a stock-linked savings scheme, more commonly known as ELSS. Such tax planning mutual funds offer the dual benefits of potential capital appreciation and tax savings. Apart from the ELSS fund, you can choose to invest in government schemes such as National Savings Certificate (NSC), Public Provident Fund (PPF) and Tax Saving FD. Cumulative investments based on these securities can offer deductions of up to Rs 15,000.

Tax-saving options based on Section 80D

In this section, taxpayers will be provided with a deduction for premiums paid for their health insurance policy. Under Section 80D, taxpayers can claim the following amounts as deductions:

- Up to Rs 25,000 is available for self, child or spouse health insurance

- Up to Rs50,000 is available if your parents are also covered by your health insurance plan

- A maximum deduction of Rs75,000 is allowed if either of your parents belongs to the Elderly Bracket

Tax-saving options based on Section 80E

Section 80E provides tax credits on interest paid on mortgages. These deductions can be claimed for 8 years from the date of repayment. There is no upper limit to the deduction amount. This means that the assessed person can claim the full amount paid as interest from taxable income.

HRA Tax Exemption Application

Under the HRA, taxpayers can take advantage of tax exemptions on the costs of staying in rental housing. Taxpayers are required to submit a receipt for the rent provided by the landlord. The available deduction amount is the smallest of the following amounts.

- The HRA you actually received. Or

- Basic salary of taxpayers living in big cities + 50% of DA (Dear Allowance). & 40% of taxpayers (basic salary + DA) residing in non-major cities. Or

- The total rent paid is 10% of the basic salary + DA minus

Other Tax Exemptions and Deductions

Apart from the above deductions and exemptions, you can save taxes in several different ways. Donations to charities and qualified organizations are also tax exempt.

Under the new tax system announced at Union Budget 2020, individuals can choose to pay taxes at discounted rates and redefine their income tax slabs by waiving various deductions and tax exemptions.

Income tax planning is a perfectly legal and wise decision if implemented under the framework defined by the respective authorities. However, you may be confused about adopting dubious techniques to save taxes. It is the duty and responsibility of all citizens to carry out a prudent tax plan. Based on your tax slab, personal choice, and social responsibility, you can choose from the separate tax-saving mutual funds and investment methods offered to you. Good luck!

Purpose of Tax Planning

- Minimal Proceedings: There is always friction between tax collectors and taxpayers. In these situations, it is important to comply with tax payments and use them properly to minimize friction.

- Productivity: One of the most important purposes of tax planning is to channel taxable income into different investment plans.

- Reducing Tax Obligations: Taxpayers can save up to their tax payments by using the appropriate arrangements to do business in accordance with the required laws.

- Healthy Economic Growth: Economic growth depends heavily on the growth of its citizens. The tax plan estimates the generation of free-flowing white money.

- Economic Stability: Stability is complemented when the tax plan behind the business is in place.

Tax Planning for FY 2021-2022

The first quarter of 2021-22 has ended. If you haven't planned your income tax yet, it's not too late as you still have eight and a half months left. According to tax and investment experts, income tax planning for paid employees is an important financial event, and saved pennies earn pennies and must be taken seriously. Experts also allow income tax planning to first run out of the 1.5 larks per year limit under section 80C and then invest in the national pension system or NPS scheme under section 80 CCD (1B). He added that he would have to run out of the additional £ 50,000 that would be. However, this is not enough because there are many other aspects, such as taxpayer-sensitive Mediclaim benefits and tax efficiency of investments.

Mumbai-based tax and investment expert Balwant Jain said of the income tax plan for paid employees, "Taxpayers must first strive to exhaust the 1.5 racks per year, which is the limit of Section 80C. Then you need to move to the section. With 80 CCD (1B), you will be given an additional £ 50,000 annual profit under investment in the NPS scheme.” Jain, section 80C has a PF deduction. He said it includes options such as life insurance premiums and school fees for children.

Kartik Jhaveri, Transcend Consultant's Wealth Management Director, said: After exhausting the limits of Section 80C and Section 80 CCD (1B), the following: See Section 80D and Section 80G of the Income Tax Act. In Section 80D of the Income Tax Act, income earners are exempt from income tax on additional Mediclaim’s of £ 25,000 for themselves and £ 25,000 for their dependents. Dependents are elderly and income tax exemption for up to £ 50,000 Mediclaim to parents paid by income earners. If the income earner makes a charity or donation, 50% of the donation is an income tax exempt under Section 80G. Only if the recipient has a Section 80G certificate issued by the Government of India. "

Advise taxpayers to check the tax efficiency of their investment during income tax planning. "We need to look at the tax efficiency of investments like FDs (fixed deposits)," said Jitendra Solanki, a SEBI-registered tax and investment expert. A portion of the amount can be transferred to debt. Short-term debt MFs may make concessions with an annual adjustment of 6.0-6.5%, and once the debt mutual fund LTCG is applied, the income will be their own. Only if the Mutual Fund (MF) investment period of 2-3 years added to the net annual income is 3 years or more.

Key takeaways:

- A tax plan is an analysis of your financial situation or plan so that all the elements work together to pay the lowest possible tax.

- Tax planning considerations include income timing, size, purchase timing, and spending planning.

- Tax planning strategies include engaging in retirement savings in an IRA or harvesting tax profits and losses.

- For example, if a single investor with income of $ 80,000 had $ 10,000 in long-term capital gains, he would be subject to a tax obligation of $ 1,500.

- If the same investor sells an unprofitable investment with a long-term capital loss of $ 10,000, the loss offsets the profit and results in zero tax obligations. A minimum of 30 days must elapse if the same loss investment is returned. To avoid the occurrence of wash sales.

Tax Management

As the current tax system is constantly changing and increasing in complexity, clients recognize the important role that income tax planning plays in overall financial planning. A meaningful tax plan can save a fair amount of wealth, but you need to pay attention to all aspects of your financial scope.

This evaluation process involves several areas to evaluate together.

Confirm previous returns

Your tax return is like your financial DNA and gives us valuable insights into what is happening in your financial life. By reviewing the last two tax returns, you can look for past and present tax arbitrage opportunities.

Perform Tax Forecasts

We work closely with your Certified Accountant or one of your Certified Accountants to carry out your tax forecasts throughout the year. These forecasts help you decide which strategy to use to minimize annual and lifetime taxes and avoid penalties.

Tax Strategy Optimization

Helps maintain relevance to current tax law to take advantage of credits, deductions, and the use of pre-tax dollars to minimize today's tax amounts. In many situations, we may need to consider today's strategies for minimizing income and inheritance tax payments throughout your life and the lives of future generations.

Preparing for final Tax Return

If you are using an in-house CPA, create and check your tax return. This allows you to organize your tax information and simplify the tax preparation process by keeping your plans, investments, and taxes under one roof.

Tax Management

- That means planning your business in such a way so that your tax obligations are properly managed.

- The purpose of tax administration is to comply with the provisions of the Income Tax Act and related regulations.

- Tax administration helps you avoid paying interest, fines, prosecutions and more.

Example: -

- Tax administration handles the filing of tax returns on time.

- Audit your account.

- Tax withholding, etc.

Cash Flow and Income Management

No matter who you are in this world, one thing is certain: you need cash flow from the cradle to the graveyard. Managing cash flow is the most important element of your economic life that you need to deal with. For this reason, the first step in a journey with a new client usually involves research in this area.

This evaluation process involves several areas to evaluate together.

- Establish current income flow

Helps you see where and when you are currently receiving money from wages, business, investments, social security and more. You can also predict in your financial plan the sources of income you need to fund your goals.

2. Discuss irregular income and expenses

Sometimes your income doesn't go well. Special planning is required when bonuses, commissions, stock options, etc. are involved. More important than irregular income is planning irregular costs and how to properly allocate funds to meet these needs.

3. Implement first-step cash management

By creating a decision-making process, you will be trained to use a cash flow system that will help you simplify and understand your money. By splitting your expenses into past commitments, current choices, future needs and desires, you can automate spending systems that make healthy choices and give you the peace of mind that you are living within your means.

4. Bank structure optimization

With a few simple banking structures, you can align your bank account with automatic money transfers to suit your needs and goals. Special consideration may be required for business owners and individuals with irregular incomes to facilitate the flow of cash in banks.

Cumulative and Retirement Plans

With a strong cultural foundation in life of "living for today," it's easy to postpone future financial plans. Unfortunately, most people are far less aware of what they need than they really need. Even if you know the need, it's difficult to keep up with all kinds of financial products and tax-effective strategies to get there.

This evaluation process involves several areas to evaluate together.

- Goal setting and confirmation

We will listen to your dreams, explore what you can do, and help you set all your major goals for the next 12 months as major lifetime milestones. Setting goals is only half the battle. We can help you track and track your progress towards your goals.

2. Perform financial forecasts

We utilize advanced financial planning software that brings together your expense needs, sources of income, and assets to predict your chances of success. By constantly updating your plans, we can make some adjustments to see if you are moving towards your goals, or if you are ahead of or behind your goals. Or you can decide if you need to do it.

3. Commit to the plan

We will be your thinking partner, brainstorming and stratifying the best ways to leverage financial products and tax-effective means to reach your goals. Our goal is to help you prioritize your goals and divide them into measurable and achievable steps that you can track over time.

4. Make the most of employee benefits

Review the employee benefits manual to help you consider benefits that will help you plan. This includes big things like retirement plans, pensions and stock options, as well as things that can be overlooked, such as health savings and insurance.

Charity

Time and money are two sources. However, giving them to others is usually thought of later and is fairly scattered and ad hoc when the person is moved. Everyone can be a philanthropist with a strategic plan to give time and money wisely and use tax strategies efficiently to make the most impact on the world.

This evaluation process involves several areas to evaluate together.

- Define values and goals

We can help you see how you are allocating time and money to various philanthropic activities. Our hope is to help you prioritize the ones that will have the greatest impact on your goals.

2. Make a donation plan

We evaluate what donation strategies are available that are in line with your intended goals. Try to coordinate all planning methods by looking at the overall plan

3. Optimize tax efficiency

From donor-advised funds to trusts to foundations, there are some underutilized tools that reduce the tax burden far better than writing a check to a charity. We help you explore ideas to ensure that your money and asset donations are made efficiently.

4. Collaboration with experts

Many philanthropic strategies involve many third parties, including foundations, fiduciaries, lawyers, accountants, fundraiser, and more. We are there to work together to lead the team so you don't have to.

Real Estate Planning

Sadly, many Americans die without a will. It's hard to sit down and think about what happens to your property when you die, trapped in the joy of life. Keeping your loved ones cared for and leaving no confusion or potentially costly mistakes is an important part of your plan.

This evaluation process involves several areas to evaluate together.

Document establishment and review

We help you understand the legal documents and strategies available to protect your personal and business interests in real estate planning, such as wills, POAs, trusts, and sales contracts. We help you plan and review your documents to ensure that your property plan is in line with your wishes.

Confirm recipient designation

We will help you ensure that your retirement account and life insurance beneficiaries are in line with both tax efficiency and special provisions for dependent minors. As life progresses, we want to review your beneficiaries and make sure they explain all the changes in life from marriage, birth, death and divorce.

Asset Title Optimization

Helps you understand the pros and cons of title an individual, joint, trust, or business asset. Our goal is to determine if a title change is necessary and not only have the legal documents prepared, but also ensure that the trust or company is actually funded with the appropriate assets.

Other Real Estate Concerns

We want to help address other concerns such as end-of-life wishes, protection of heirs and children, and development of the roles and responsibilities of executors and trustees. Finally, assess the intended non-charitable gift and how the distribution flows at death for management and taxation.

Key takeaways:

- That means planning your business in such a way so that your tax obligations are properly managed.

- The purpose of tax administration is to comply with the provisions of the Income Tax Act and related regulations.

- Tax administration helps you avoid paying interest, fines, prosecutions and more.

- With a strong cultural foundation in life of "living for today," it's easy to postpone future financial plans.

- A meaningful tax plan can save a fair amount of wealth, but you need to pay attention to all aspects of your financial scope.

Tax Evasion

Indian Tax Evasion

In India, from false tax returns and smuggling to fake documents and bribes, there are many ways people can use to avoid paying taxes. The penalties for this are high, ranging from 100% to 300% of taxes on non-disclosure income.

What is Tax Evasion?

Tax evasion is an illegal act in which an individual or company avoids paying tax obligations. It evokes hidden or false income without evidence of inflating deductions or reporting cash transactions. Tax evasion is a serious crime and imposes criminal liability and considerable penalties.

Supporting taxes is by no means easy, as most people question the concept of donating a portion of their income to the government, but in reality taxes are an important source of income for the government. This is the money invested in various development projects aimed at improving the situation of the company. However, the country faces the big problem of tax evasion. Those who should pay taxes find a way to not pay taxes, and as a result, the country's income is suffering. Now let's look at how people avoid taxes and the penalties for them.

Common methods of Tax Evasion

There are two aspects to not paying taxes when the tax is due. One is tax avoidance and other tax evasion. The difference between the two is that tax avoidance basically finds loopholes that exempt tax payments and is not strictly illegal, but avoidance does not pay taxes at the time of actual tax payment and is absolutely illegal. These are some of the ways people avoid / avoid taxes.

Do not pay due date

This is the easiest way for someone to evade taxes. Even when a membership fee is requested, they will simply not pay it to the government. Persons engaged in this type of tax evasion do not voluntarily or involuntarily pay taxes before or after the due date.

Smuggling:

If a particular item moves from one location across the border to another, you may be charged taxes or fees to move the item. However, some individuals may secretly move these items to avoid paying taxes that completely avoid tax evasion.

Submission of false tax returns

In some cases, when an individual files a tax return, he or she may provide false or incorrect information in order to reduce or not pay the tax that he or she is supposed to pay. This is also tax evasion, as you may not have been provided with complete information and you may have paid less than you actually should have paid.

Inaccurate financial statements

Taxes paid by an individual or organization may be based on financial transactions conducted during the valuation year. Submitting false financial statements or books that earn less than you actually earn can reduce your taxes.

Claim tax exemption using forged documents

Government may have provided certain exemptions and privileges to ensure a little more financial freedom for certain demographics or members of society to progress. In some cases, members who are not actually entitled to such privileges obtain a document created to support their claim that they are part of that group and are therefore exempt if they are not suitable. Insist.

Do not Report Income

This is one of the most common methods of tax evasion. In this case, the individual does not report the income received during the fiscal year. They haven't paid taxes because they haven't reported their income, so they've succeeded in tax evasion together. The simplest example of this is a landlord who keeps a renter but does not notify the authorities that he is renting a house and actually earning income.

Bribery

There may be a certain amount of tax that an individual is not willing to pay. In such cases, he or she may actually bribe the civil servant to prevent them from paying taxes and "disappear" it.

Accumulate Wealth Abroad

We have all heard of Swiss bank accounts. Offshore accounts are foreign-managed accounts and information about transactions in these accounts is not disclosed to the Income Tax Office, thus avoiding all taxes levied on their assets.

Penalties for Tax Evasion

There are various penalties that the Income Tax Department can impose on a person convicted of tax evasion or avoidance. These penalties may also apply to companies that fail to self-report and pay taxes, or to companies that fail to withhold when they are scheduled to withhold.

Some of these are:

- If your income is not disclosed, we will collect 100% to 300% of the tax.

- If you fail to pay the tax, the assessor can impose a penalty, but you cannot exceed the tax amount.

- Rs penalty if an individual does not file a tax return within the allotted time. If you do not submit a statement, you may be charged 200 per day.

- If someone hides their income details or the taxable fringe benefits, the penalty will range from 100% to 300% of the tax paid.

- If an individual or company fails to properly maintain an account as directed in Section 44AA, an Rs penalty will be imposed. 25,000 may be collected.

- If a company fails to audit itself or provide an audit report, it will be penalized for Rs. You may be charged 15,000 rupees or 0.5% of sales, whichever is less.

- If the accountant's report is not provided as instructed, you will be fined Rs. 10,000 rupees may be collected.

- If the tax cannot be deducted where the organization is supposed to make the payment, the penalty may be an unpaid tax payment.

- These are just a few of the penalties that the Income Tax Department can impose, and in some cases large payments may be required, so it is best to ensure that all taxes are paid by the due date is.

Tax Evasion

- Tax evasion uses illegal means to avoid paying taxes.

- Tax evasion usually involves hiding or misrepresenting your income.

- This can be underreporting of income, bulging deductions without evidence, hiding or hiding cash transactions, or hiding money in offshore accounts.

- Tax evasion is part of the overall definition of tax fraud, which is illegal and intentional non-payment of taxes. Fraud can be defined as "the act of deceiving or misrepresenting."

- It is not legally permitted under the tax image.

Example:-

- Fake expenses

- Underreporting of income

- Inflate the deduction without evidence

Key takeaways:

- In India, from false tax returns and smuggling to fake documents and bribes, there are many ways people can use to avoid paying taxes.

- Tax evasion can be either an illegal non-payment or an underpayment of the actual tax obligation.

- Tax evasion can be determined by the IRS regardless of whether the tax form has been submitted to a government agency.

- In order to decide on tax evasion, the agency must be able to show that the tax evasion was intentional on the part of the taxpayer.

- Tax evasion is illegal, but tax avoidance involves finding a legal method (within the law) to reduce the taxpayer's obligations.

Tax Avoidance

Distinguish:

Tax avoidance refers to the use of legal means to avoid tax payments. This is primarily dependent on the tax laws of a particular country and the various provisions of that country’s tax law. In such cases, taxpayers can exploit the shortcomings of tax law to find new ways to avoid paying taxes that are within the scope of the law. Most taxpayers avoid taxes by adjusting their books within the legal provisions of the law.

Taxpayers use tax evasion techniques to avoid tax burdens in part or in whole. This is done illegally and is the result of taxpayers adopting unfair trading practices. These practices include false statements, underreporting of income, overvaluation of tax credits, and personal expense claims as a business. Such practices can lead taxpayers to be punished by law and subject to heavy fines.

What are the causes of Tax Evasion and Tax Avoidance?

Tax evasion can be triggered in a variety of ways. Below are some of the causes of tax evasion:

- The country's current tax system plays the most important role in the cause of tax evasion. The more provisions that have specific loopholes, the more likely people are to evade taxes from those loopholes.

- High tax rates in certain countries impose high taxes on taxpayers and encourage taxpayers to reduce their burden by avoiding tax payments.

- Lack of simplicity and accuracy in national tax law. The more complex the law, the more likely it is that people will take advantage of it.

- Citizen's tax integrity and lack of commitment.

- Claim an excess deduction on the taxpayer's tax return for the actual expenditure.

- Underreporting of income from various sources of income. This will reduce your total income and tax burden.

Below are some reasons for tax avoidance.

- The idea of taxpayers who force them to abuse the provisions of tax law.

- Despite their low income, they are always thinking of being charged higher taxes.

- Significant reduction in tax payments.

What is the effect of Tax Avoidance?

- Avoiding taxes has multiple implications. Below are some important effects.

- This leads to lower public revenues, which in turn affects the growth of the country.

- Black money accumulated by tax avoidance has a significant impact and can lead to unnecessary inflation.

- Honest taxpayers begin to have a sense of inequality compared to those who avoid taxes and face no consequences.

- Delays in government projects due to spending restrictions.

Key takeaways:

- Anyone who invests in a retirement fund, takes advantage of a mortgage deduction, or receives a child tax credit practices tax avoidance.

- These are legal tax deductions provided to encourage certain actions, such as retirement savings or home purchases.

- Tax avoidance is different from tax evasion, which relies on illegal methods such as underreporting income.

The deadline for submitting ITRs for 2019-20 (2020-21) will be extended to December 31, 2020. For companies that require tax inspection and for TP, the deadline will be extended to January 31, 2021. To avoid interests under Section 234A, you must pay more than 1 rupee by October 31, 2020. "

Indian taxes can be divided into two types. One is direct tax and the other is indirect tax. When it comes to direct tax, different types of entities are taxed on the income they earn in a fiscal year.

There are different types of taxpayers registered with the Income Tax Office, and they pay taxes at different tax rates.

For example, an individual and a taxpayer company are not taxed at the same tax rate.

Therefore, the direct tax is again subdivided as follows:

Personal Income Tax: The income tax paid by individual taxpayers is personal income tax. Individuals are taxed based on tax slabs at various tax rates.

Corporate tax: The income tax that domestic and foreign companies pay on their income in India is corporate income tax (CIT). CIT is a specific tax rate stipulated by the Income Tax Act, and the tax rate of the union budget changes every year.

Indian Corporate Tax

A company is an organization that has an independent legal entity separate from its shareholders. Domestic and foreign companies are obliged to pay corporate tax under the Income Tax Act. Domestic companies are taxed on basic income, while foreign companies are taxed only on income earned in India. That is, it occurs or is received in India. In the calculation of the tax amount based on the Income Tax Act, the type of company can be defined as follows.

Domestic companies: Domestic companies are companies registered under the Companies Act of India, including companies registered abroad and management is entirely in India. Domestic companies include private companies as well as public companies.

Foreign Companies: Foreign companies are companies that are not registered under the Companies Act of India and are managed and managed outside India.

What does company income mean?

Before we can understand the tax rate and how to calculate taxes on a company's income, we need to learn about the types of income a company earns.

It's here:

- Profit from business

- Capital gain

- Income from rental properties

- Income from other sources such as dividends and interest.

Applicable Tax Rate

Income Tax: The following tax rates will be applied to domestic companies in 2020-21 based on sales.

Sections | Tax rate | Surcharge |

Section 115BA (Companies having turnover up to Rs 400 crore in FY 2017-18) | 25% | 7%/12%* |

Section 115BAA | 22% | 10% |

Section 115BAB | 15% | 10% |

Any other case | 30% | 7%/12%* |

In addition, additional charges if the company is taxed under Section 115BA. If the total income exceeds 1 rupee and up to 10 rupees, the additional charge is 7%. If the total income exceeds 1 billion rupees, the additional charge is 12%. However, if the company chooses to tax under Section 115BAA or Section 115BAB, the surcharge will be 10% regardless of total income.

The following rates apply to foreign companies in 2020-21 based on turnover rates.

Nature of Income | Tax Rate |

Royalty received or fees for technical services from government or any Indian concern under an agreement made before April 1, 1976 and approved by central government | 50% |

Any other income | 40% |

In addition to above rates:

Surcharge rate:

Particulars | Tax Rate |

If total income exceeds Rs. 1 crore but not Rs. 10 Crore | 7% of tax calculated on domestic company/ 2 % of tax calculated on foreign company as per above rates |

If total income exceeds Rs. 10 crores | 12% of tax calculated on domestic company/ 5 % of tax calculated on foreign company as per above rates |

Health and Education Suspension: An additional 4% of the calculated income tax and an applicable surcharge will be added to the amount of the total tax liability prior to this suspension. If the minimum alternative minimum tax (MAT) or the tax calculated at the above tax rates is less than 15% of the book profit, all companies (including foreign companies) will have a minimum alternative minimum tax of 15% on the book profit. You have to pay. This applies if the company does not select Section 115BAA or Section 115BAB.

Everything about filing Income Tax Returns

Deadline for filing income tax returns Companies, including foreign companies, are required to file income tax returns by October 30 every year. Even if the company is established in the same fiscal year, you must file an income tax return for that period before October 31st. In 2019-2020 (2020-21), the due date has been extended to November 30, 2020 due to the pandemic.

Tax returns filed by company ITR6:

All companies, except those claiming deductions under Section 11, are required to file a tax return using form ITR6. Submit your tax return using Form ITR7. Tax Inspection Income Tax Act requires a class of companies to audit their accounts and submit an audit report to the IT department along with their income tax returns. This audit is known as a tax audit. This tax audit report must be compulsorily submitted by a qualified company by September 30th. However, the deadline for submitting the tax audit report for 2019-20 (2020-21) is October 31, 2020. Corporate tax is a sea of regulations that every company must comply with.

Type of Company | New Corporation Tax Rate | Additional Benefit/Requirements |

Corporations not seeking any incentives/exemptions | 22% (earlier 30%) + applicable cess and surcharge. Effective corporate tax rate of 25.17% | No MAT (minimum alternative tax) payable by these companies |

Corporations seeking incentives/exemptions | Unchanged at 30% | MAT rate reduced to 15% from earlier level of 18.5% |

New Manufacturing Companies | 15% (earlier 25%) | New manufacturing co. Must be incorporated on or before October 2019. Must start production before March 2023 |

* The corporate tax rate will not change for all other corporations, including foreign corporations*.

The legal entities that are obliged to pay corporate tax in India are:

- Incorporation of India.

- Companies that earn income from India and do business with those incomes.

- Other foreign companies that are permanently established in India.

- A corporation that has acquired the title of resident of India for the sole purpose of paying taxes.

Calculation of Corporate Net Profit

Corporate tax is calculated based on the company's net income or net income. The company's net profit / income is the total amount left in the company after various costs have been deducted as needed. There are many costs that a company incurs to sell a product. These costs are as follows:

- Depreciation.

- Total cost of sales.

- Selling costs.

- Expenses incurred for administrative purposes.

- Company income includes net income from the business, rent income, capital gains, or income from other sources of income such as interest or dividend income.

Thus, Net Revenue = Gross Revenue – (Expenses + Depreciation)

Indian corporate tax rate on domestic corporations

A domestic company / company is a company that originated in India and is completely managed in India.

The applicable tax rate of corporate tax for 2019-20 for the following domestic companies:

Gross Turnover | Tax Rate |

Upto Rs. 250 Crore | 25% |

More than Rs. 250 Crore | 30% |

- A domestic business entity with sales up to Rs. We will pay a fixed amount of 250 chlores and 25% corporate tax.

- When the total income earned by the company exceeds Rs in a particular fiscal year. For 100 million rupees, such corporations are subject to an additional corporate tax of 5%.

- Domestic companies are also charged a 4% health education fee.

- If a particular domestic company has a branch office abroad, the same amount of corporate tax is levied on the company's total global revenue. Corporate tax for Indian domestic companies also takes into account the income earned by foreign domestic companies.

Corporate tax of foreign corporations in 2019-20

Foreign companies are defined as companies that do not originate in India. Its management and control take place outside India. These legal entities are not registered under the Companies Act 2013. The rules regarding the taxation process of foreign companies are quite different from those of domestic companies. It all relies on tax agreements between India and other foreign countries. For example, the corporate tax rate for a US-based foreign company depends on the tax agreement that India has with the United States.

Nature of Income | Tax Rate |

Royalty received or fees for technical services received by a foreign corporation from the government or any Indian concern under an agreement made before April 1, 1976 and approved by the central government | 50% |

Any other Income from Indian Operations | 40% |

Corporate Tax Refund

Since companies are subject to several types of corporate tax, there are also certain provisions for corporate tax refunds or deductions. Here are some important points to consider:

In some cases, you can deduct interest income.

- Venture capital gains are not taxed.

- Dividends may also be eligible for tax refunds under applicable conditions.

- The legal entity has the authority to bear the loss incurred in the business for up to 8 years.

- If a company sets up a new power source or new infrastructure, they may be eligible for certain deductions.

- For corporate exports and new businesses, the company is allowed a certain deduction.

- If a company wants venture capital or a fund, various amounts of deduction allowances are allowed.

- If a domestic company receives a certain amount of dividends from another domestic company, there is a provision to deduct dividends such as rebates.

Basics of Corporate Tax Planning

All taxpayers, including business companies, need a tax plan that allows them to maximize their profits by reducing their tax burden. Corporate tax planning involves developing strategies to achieve this goal, so corporations hire professionals who are familiar with all tax-related legal rules and regulations. All businesses carry significant financial risks and require good corporate tax planning.

It is important to remember that corporate tax planning and tax evasion are two completely different concepts. Tax evasion is subject to non-payment of taxes and legal penalties. Tax planning, on the other hand, is a strategy that determines how much tax a company should pay so that it has more net profit to legally pay and less tax. For a successful corporate tax plan in India, a company must be fully aware of all tax laws and financial rules set by the Government of India.

Dividend distribution tax

Dividends refer to the distribution of profits to the shareholders of a company, and the Dividend Distribution Tax (DDT) is levied on the profits distributed by this process.

Corporate tax, on the other hand, is a tax calculated based on the company's net profit deduct the costs they incur. Therefore, dividend distribution tax is a type of tax payable on dividends that a company provides to shareholders, and therefore the higher the dividend, the greater the tax burden on the entity. It can also be said to be the ratio of dividends paid to shareholders by that particular company.

Dividend distribution tax is managed in accordance with the provisions of Section 115-O of the Income Tax Act of 1961. Currently, the dividend distribution tax paid on dividends provided to the shareholders of the company is 15% of the total amount distributed as dividends. This means that you will be effectively taxed at a rate of 17.65%.

Key takeaways:

- Corporate tax is collected by the government as a source of income.

- Taxes are supported taxable income after deducting costs.

- The US corporate tax rate is currently a flat rate of 21%. Prior to the 2017 Trump tax reform, the corporate tax rate was 35%.

- Companies can register as S corporations to avoid double taxation. S corporation does not pay corporate tax because income is passed to the business owner who is taxed by the individual tax return.

- Companies are allowed to reduce their taxable income with certain necessary and regular business expenditures.

- All current costs of running a business are fully tax deductible.

- You can also deduct investments and real estate purchased to generate business income.

- Companies can deduct employee salaries, health insurance, tuition refunds, and bonuses. In addition, companies can reduce their taxable income by deducting premiums, travel expenses, bad debt, interest payments, sales tax, fuel tax, and excise tax.

- Tax preparation costs, legal services, bookkeeping, and advertising costs can also be used to reduce business income.

- Dividend distribution tax is managed in accordance with the provisions of Section 115-O of the Income Tax Act of 1961.

Corporate Tax-Meaning and Definition

Meaning of Company:

The corporate sector is the most widely used business organization, especially for medium and large businesses. In the corporate sector, the business is run by floating a formal registered company with the appropriate privileges.

Corporate tax refers to the taxation of businesses (as defined by the Income Tax Act of 1961) and is the government's primary source of income. Under the Income Tax Act of 1961, businesses are obliged to pay a fixed amount of tax on their income (similar to partnership companies) without the basic tax exemption restrictions that apply to individuals or FIUF.

"Corporate tax" or "corporate tax"

The tax collected from a company (as defined by the Income Tax Act of 1961) is called "corporate tax" or "corporate tax". It is interesting to note that corporate tax revenues are held by the central government and are not shared with the state government.

The type of company under the Income Tax Act.

- Company: According to Section 2 (17), a company means:

- Companies of substantial interest to the public (Section 2 (18):

- Initial public offering:

- Privately held:

- Indian Company [Section 2 (26)]:

- Domestic companies [Section 2 (22A)]:

- Foreign-affiliated companies [Section 2 (23A)]:

- Investment company:

- Company residence [Section 6 (3)]

1. Company: According to Section 2 (17), a company means:

- An Indian company, or a legal entity established by law in a country other than India, or

- An institution, association, or entity that was evaluated as a company in the valuation year under the Income Tax Act of 1922, or as a company in the valuation year beginning before 1.4.1970.

- An institution, association, or entity declared to be a company by CBDT general or special order, whether legal or non-Indian or non-Indian.

2. Companies of substantial interest to the general public (Section 2 (18):

Article 2 (18) of the Income Tax Act defines "a company that the public is of substantial interest in." included:

- A company owned by the Government of India or the Reserve Bank of India.

2. A company that has a government participation, that is, a company in which more than 40% of the shares are owned by the government, RBI, or a company owned by RBI.

3. Companies registered under Article 25 of the Companies Act of 1956:

Companies registered under Article 25 of the Companies Act of 1956 promote commercial, arts, science, charity, religion, or other useful purposes. It is a company that is promoted for special purposes such as doing. And these companies have no motive for profit. However, if these companies declare dividends at any time, they will lose the status of the companies that the general public is substantially interested in.

4. Company Declared by CBDT: A company that has no equity capital and is of substantial interest to the general public given its purpose, the nature and composition of membership, or other relevant consideration. It has been declared by the board.

5. A mutual interest finance company whose main business is the acceptance of deposits from its members and has been declared by the central government to be Nidi or the Mutual Interest Association.

6. Cooperative Companies: Companies in which one or more co-operatives hold 50% or more of the shares.

7. Public Limited Company: A company is considered a public limited company if it is not a private company as defined by the Companies Act of 1956 and meets one of the following two conditions:

- The stock was listed on the approved stock exchange, as was the last day of the relevant previous year. Or

- Its shares, which hold at least 50% of the voting rights (40% limit for industrial companies), are held beneficially throughout the relevant year by governments, statutory companies, and companies of substantial interest to the general public. Was being done or an entirely owned subsidiary of such a corporation.

3. Initial public offering:

It is a company that is of great interest to the public.

4. Private company:

It is a company that is not of much interest to the public.

5. Indian Company [Section 2 (26)]:

"Indian Company" means a company established and registered under the Companies Act of 1956, including:

- A company established and registered under the law relating to a company previously in force in any region of India (excluding Jammu and Kashmir and Union Territory).

- A legal entity established by or under central law, state law, or state law.

- An institution, association, or body declared to be a company by the board of directors.

- In the case of Jammu and Kashmir, for the time being, the company was established and registered under the laws in force in that state.

- In the case of the Union Territory of Dadra and Nagar Haveli, Goa, Daman and Diu, or Pondicherry, the company was established and registered by law for the time being under that Union Territory.

- Provided that the headquarters of a registered or possibly company, company, institution, association or organization is in India in all cases.

6. Domestic companies [Section 2 (22A)]:

Domestic company means an Indian company or other company that has made certain arrangements for filing and paying dividends (including preferred stock dividends) in India with respect to income taxed under the Income Tax Act) Paid from such income.

Therefore, all Indian companies are treated as domestic companies, but not all domestic companies are Indian companies.

If a foreign company makes a prescribed arrangement for the payment of dividends in India, it shall be treated as a domestic company.

7. Foreign companies [Section 2 (23A)]:

A foreign company is a company that is not a domestic company, that is, a company that is registered in another foreign country outside India.

Foreign companies may be treated as domestic companies if they make certain arrangements in India in accordance with Rule 27.

Rule 27: Arrangement of provisions for the declaration and payment of dividends in India.

- The arrangements mentioned in Sections 194 and 236 by the Company for the declaration and payment of dividends (including preferred stock dividends) within India are as follows:

- The registration of shares of the company for all shareholders shall be maintained on a regular basis at major offices in India for the valuation year from the date of April 1 of that year.

- The General Assembly for passing and declaring dividends for previous years related to the valuation year shall be held only in locations within India.

- Declared dividends, if any, shall be paid to all shareholders only within India.

Sec.6 (3), Status of residence of foreign companies

- If the control and control of a foreign company is entirely in India, the foreign company will be treated as a resident of India.

- A foreign company is treated as a non-resident in India if its control and control is wholly / partially outside India.

- The sections that apply to foreign companies are 44BBB, 44D, 115A, 195 and so on.

8. Investment company:

An investment company is a company whose total income consists primarily of income from housing assets, capital gains and income charged under the heading of income from other sources.

9. Company residence [Section 6 (3)]

When is the company said to live in India?

The company is said to have lived in India the previous year if:

- It's an Indian company. Or

- The place of effective management for the year is in India.

When is the company said to be non-resident in India?

Regulations applicable from 2017-18 evaluation

The company will be non-resident in the previous year if:

- It's not an Indian company

- The place of effective management for the year is not India.

Key takeaways:

- The corporate sector is the most widely used business organization, especially for medium and large businesses. In the corporate sector, the business is run by floating a formal registered company with the appropriate privileges.

- Corporate tax refers to the taxation of businesses (as defined by the Income Tax Act of 1961) and is the government's primary source of income.

- A foreign company is a company that is not a domestic company, that is, a company that is registered in another foreign country outside India.

- Article 2 (18) of the Income Tax Act defines "a company that the public is of substantial interest in."

- An investment company is a company whose total income consists primarily of income from housing assets, capital gains and income charged under the heading of income from other sources.

The tax return of the assessed person depends on his status of residence. For example, whether income generated by a person outside India is taxed in India depends on the status of residence of the person in India. Similarly, whether income earned by foreigners in India (or outside India) is taxed in India depends not on citizenship but on the living conditions of the individual. Therefore, determining an individual's status of residence is very important in finding that person's tax obligations.

The status of residence of the person being assessed may vary from year to year and must be determined year on year. Foreign investors may be Indian citizens residing outside India, people from India, and other foreign investors, including businesses.

Under Section 2 (31) of the Income Tax Act, the term individual refers to individuals, Hindu undivided families, partnership companies, companies, individual groups, individual groups, local governments, and all other legal entities it is included. Similarly, under Section 2 (u) of FEMA, an individual includes all of the above categories and any agency, office, or branch owned or controlled by such individual.

The status of residence of a person is handled under the Income Tax Act of 1961, the Federal Emergency Management Agency (FEMA) of 1999, the Companies Act of 1956, and the Direct Tax Bill of 2009.

Company Status of Residence [Section 6 (3)]

The determination of a company's total income depends on the relevant previous year's status of residence. The status of residence of the company is determined by either

- Based on its establishment (registration); or

- Based on the control and management of that business.

Companies can be divided into two categories based on their status of residence.

- Residential company

- Non-resident company.

(A) Residence company [Section 6 (3)]

The company is said to have lived in India the previous year

- It's an Indian company;

- During the relevant previous year, the management and management of its operations is entirely in India.

Observation

- An Indian company is always a resident company for income tax purposes, even if the management and management of its operations is saturated outside India.

- A non-Indian or foreign company will be treated as a resident of India in the previous year only if all control and control of the business of such company during the relevant previous year is in India.

For example:

- The company is founded in India but is headquartered in Dhaka.

- The company is founded in Bangladesh but is headquartered in Kolkata

First, it is incorporated in India and the situation at the headquarters is not important, it is a resident company. In the second case, it is incorporated outside India, but its management and control is entirely in India, so it is a resident company.

(B) Non-resident company [Section 2 (30)]

The company will be non-resident in the previous year if:

- It's not an Indian company

- The place of effective management for the year is not India.

This means that foreign companies whose controls and controls are wholly or partially outside India become non-residents. For example, an American company holds eight meetings in India out of a total of 12 meetings held the previous year. Such companies will be non-resident for the purpose of such previous year's income tax.

Schedule XIII of the Companies Act of 1961 addresses the conditions that must be met in order to appoint a full-time or full-time director or manager (called a "manager") of a company without the approval of the central government.

The description in clause (e) of Part I of the schedule stipulates that resident of India include those who have been in India for at least 12 consecutive months immediately prior to the date of appointment as administrator. I am. I came to stay in India to get a job in India or to carry out a business or profession in India.

Comparison of status of residence under the Income Tax Act, FEMA and Companies Act

An individual may be considered a resident under the Income Tax Act and a non-resident under the FEMA, as the criteria for determining an individual's status of residence differ between FEMA and Income Tax Act.

Under the Income Tax Act, an individual's status of residence is determined for a particular year and is relevant to determine the taxability of the income earned in that year. Under FEMA, status of residence is not only determined at a particular point in time, but is an ongoing process that pertains to the determination of whether an individual can make a particular transaction at that particular point in time.

People who are considered non-resident under the Income Tax Act of 1961 are also considered non-resident for the purposes of FEMA application, but not necessarily those who are considered non-resident under the FEMA. Not limited. Non-resident under the Income Tax Act. For example, a resident Indian will go abroad to do business in December 2008. Under the Income Tax Act, you will be considered a resident during the 2008-09 fiscal year as you will stay in India for more than 182 days. However, under FEMA, he is considered a non-resident the moment he leaves the country for business purposes.

Under the Companies Act of 1956, residents of India include those who have been in India for more than 12 months immediately prior to taking office. Therefore, a person who stays in India for employment, business or profession may not be eligible to be appointed as the manager of the company until then without the approval of the central government. Income tax law for uncertain periods and for at least 182 days in India the previous year.

Tax Incident — Total Income Range (Section 5)

The total income of the assessed person cannot be calculated without knowing his status of residence in India the previous year. Depending on the status of residence, the person subject to assessment will be one of the following.

- Lives in India. Or

- I do not live in India.

However, individuals and HUF do not simply live in India. If the individual resides in India, he will be one of the following:

- Residents and regular residents of India. Or

- I am a resident, but usually I do not live in India.

Persons of other categories shall reside in or not reside in India. In their case, there is no further classification as a regular resident or a non-regular resident.

The range of total income according to the status of residence is as follows.

(A). For residents of India (individuals or for HUF, residents and regular residents) [Section 5 (1)]:

If you live / normally live in India, the following incomes form part of your total income.

(a) any income which is received or is deemed to be received in India in the relevant previous year by or on behalf of such person; | (b) any income which accrues or arises or is deemed to accrue or arise in India during the relevant previous year; | (c) any income which accrues or arises outside India during the relevant previous year. |

(B) If you live in India but do not normally live (individuals and HUF only) [Section 5 (1) and its proviso]:

If you live in India but do not normally live, the following income forms part of your total income.

(a) any income which is received or is deemed to be received in India in the relevant previous year by or on behalf of such person; | (b) any income which accrues or arises or is deemed to accrue or arise to him during the relevant previous year; | (c) any income which accrues or arises to him outside India during the relevant previous year if it is derived from a business controlled in or a profession set up in India. |

(C) For non-residents [Section 5 (2)]:

For non-residents of India, the following income forms part of the total income:

(a) any income which is received or is deemed to be received in India during the relevant previous year by or on behalf of such person; | (b) any income which accrues or arises or is deemed to accrue or arise to him in India during the relevant previous year. |

Therefore, please note that the income listed in items (a) and (b) for all three cases above is included in the total income for all three categories of assessors in the same way. The income listed in item (c), that is, the income generated or generated outside India, is as follows.

- If the person being assessed is non-resident in India, it will not be included in the total income at all.

- If you live in India but do not normally live, your total income will only be included if it comes from a business managed in India or a profession established in India.

Therefore, tax deductions are more common for assessors who live and normally reside in India, a little less when they live in India but not normally, and for non-residents in India. May be the least. If the person being assessed has different incomes both inside and outside India.

The above tax return provisions are summarized in the following table.

Particulars of Income | Whether Taxable | ||

| Resident and Ordinarily Resident | Not-Ordinarily Resident | Non-Resident |

1. Income received or deemed to be received in India whether earned in India or elsewhere. | Yes | Yes | Yes |

2. Income which accrues or arises or is deemed to accrue or arise in India during the previous year, whether received in India or elsewhere. | Yes | Yes | Yes |

3. Income which accrues or arises outside India and received outside India from a business controlled from India. | Yes | Yes | No |

4. Income which accrues or arises outside India and received outside India in the previous year from any other source. | Yes | No | No |

5. Income which accrues or arises outside India and received outside India during the years preceding the previous year and remitted to India during the previous year. | No | No | No |

Key takeaways:

- Indian companies always live in India. Even if the Indian company is controlled from a location outside India (or if the shareholders of the Indian company controlling 51% or more of the voting rights are non-residents and / or located outside India), The Indian company lives in India.

- There are three types of status of residence in accordance with government income tax rules. The taxpayer classifications are as follows: Resident. Residents who are not regular residents (RNOR)

- Therefore, taxpayers should carefully check their residence status to avoid legal issues and income tax payments.

- Those who live permanently in their registered domicile have no legal liability and can pay income tax smoothly.

- However, special consideration is given to those who enter and leave the country.

- To avoid double taxation on your income, you should check all terms and qualifications before paying taxes.

- Tax return describes the case where the buyer and seller split the tax burden.

- Tax consequences also indicate who will bear the new tax burden, for example between producers and consumers, or between different class segments of the population.

- The elasticity of demand for goods helps to understand the tax consequences between the parties.

- The tax return represents the distribution of tax obligations that the buyer and seller must cover.

- The level at which each party participates in the compensation of obligations varies based on the relevant price elasticity of the product or service in question and how the product or service is affected by current supply and demand principles.

- The tax return reveals which group (consumer or producer) will pay the new tax price.

- Tax return (or tax return) is an economic term used to understand the division of tax burden between buyers and sellers, or between stakeholders such as producers and consumers.

- The tax return may also be related to the price elasticity of demand.

- If supply is more elastic than demand, the tax burden is on the buyer. If demand is more elastic than supply, the producer bears the cost of taxes.

Tax obligations are the full amount of unpaid taxes within the relevant period and are paid to taxable entities such as the central and state governments, or to local governments such as local governments. Individuals and institutions are obliged to pay taxes on their working income.

In the business, these are recorded on the balance sheet and are considered short-term debt to be settled within a given year. And for individuals, these are payment obligations that must be paid from withholding or self-savings.

Tax Type

India's current tax system has two main tax categories. And these two categories are further subdivided. Here is the type-

Direct Tax

The tax obligation paid directly to the central government is direct tax. Individuals and organizations with taxable income are entitled to pay for it.

Direct Tax Subdivision

- Income Tax

With the exception of businesses, individuals or HUFs are obliged to pay taxes on their income during the fiscal year. The government imposes income tax on salaries, pensions, interest income, and real estate rental income. In addition, the income of freelancers, self-employed or contractors, CAs, lawyers and doctors is also subject to income tax.

2. Corporate Tax

Domestic and foreign companies must liquidate their income tax obligations on gross profits during the period. However, domestic companies pay taxes on basic income and foreign companies are only taxed on Indian income. Corporate tax has the following subcategories-

- Access to Health and Education – In addition, an additional 4% of income tax goes to health and education.

- Dividend Distribution Tax-Companies are obliged to pay dividends circulated among shareholders in each fiscal year and are exempt from tax up to Rs. The Income Tax Act allows 100,000 rupees. This tax is levied on the total or net income of a company's investment.

- Minimum Substitution Tax – Minimum Change Tax is a mandatory tax payable at a rate of 18.45% of book profit under Section 115 JA only if the affiliate is paying income tax below the above rate.

- Fringe Benefit Tax – Fringe Benefit Tax is included in benefits such as accommodation, travel allowances, and employee contributions to the retirement fund.

All of these taxes are subject to Indian corporate tax.

3. Securities Transaction Tax

The Government of India imposes income tax on stock markets and securities transactions on the Indian Stock Exchange.

4. Capital Gains Tax

Capital gains tax is levied on both the return on investment and the profit from the sale of real estate.

5. Prerequisite Tax

Prerequisite taxes are counted on several facilities that the organization provides to its employees.

Indirect Tax

Here, individuals do not pay taxes directly to the government. Instead, taxes are bundled with the price of the product or service. Currently, the only indirect tax in India is the GST or Goods and Services Tax.

Various Income Tax Slabs

Income tax in India works under the Central Direct Tax Commission. The main duty of this sector is to implement some direct taxes to raise the country's real income. It came into effect in 1961.

Income tax debt is structured to fit a variety of income slabs. The income tax slab was updated on February 1st of the 2020 budget.

Comparison of the old and new income tax slab of 2020-21 AY

Income Tax Slab | Old Tax Rate | New Tax Rate |

Up to Rs. 2.5 lakh per year | Nil | Nil |

From Rs. 2,50,001 to Rs. 5,00,000 per year | 5% | 5% of the total income + 4% cess |

From Rs. 5,00,001 to Rs. 7,50,000 per year | 20% | 10% of the total income + 4% cess |

From Rs.7,50,001 to Rs. 10,00,000 per year | 20% | 15% of the total income + 4% cess |

From Rs. 10,00,001 to Rs. 12,50,000 per year | 30% | 20% of the total income + 4% cess |

From Rs. 12,50,001 to Rs. 15,00,000 per year | 30% | 25% of the total income + 4% cess |

From Rs. 12,50,001 to Rs. 15,00,000 per year | 30% | 30% of the total income + 4% cess |

In the 2020 budget, the income tax rate has been reduced to provide some relief to the public. However, some tax deductions and tax exemptions for rent deductions, medical insurance premiums, and contributions to the NPS have been omitted from the structure. In addition, taxpayers can choose between old and new structures.

To alleviate all tax turmoil, the Indian Income Tax Department has also introduced a computer to simplify the calculation of tax obligations online.

Types of Tax Obligations

Two types of tax obligations are counted-

- Current Liabilities

Current tax obligations are short-term tax obligations that an individual must pay within a year.

2. Deferred Debt

However, deferred tax obligations are tax obligations that are assessed or due in the current period and are not paid within the cycle.

Corporate tax obligation example

Here is a corporate tax liability example to clear any confusion

Particulars | Amount in crores (Rs) |

Total income of the company | 500 |

Expenses | 100 |

Gross profit before tax | 400 |

Tax rate | 30% |

Gross profit after tax | 400 – 120 = 280 |

Procedure for paying Taxes in India

In India, you can pay taxes both online and offline.

Online Payment Method

Step-

- First, go to the approved website (www.tin-nsdl.com) and log in. Click the Services tab, then click Electronic Payments.

- A screen containing electronic payment of taxes will be displayed. Individuals should choose challan – ITNS280.

- Then enter the required details for this Sharan, along with PAN or TAN.

- After submitting the details with a valid PAN or TAN, the confirmation screen will display the individual's name.

- Posting this confirmation will redirect the taxpayer to the bank's online banking page.

- Then go to the online banking site and enter your payment details.

- If the payment is successful, Sharan's counterpart will be displayed as proof of payment. This completes the tax payment process.

Offline Mode

Individuals can download challan 280 from the internet or collect from banks. They can settle their tax obligations in cash or by check.

What documents do I need for ITR filing?

The following details are required when submitting an ITR:

- Your tax amounts

- Evaluation year

- PAN number

Besides that, you need to know the types of payments, such as self-assessed taxes and prepaid taxes.

What is the difference between tax exemption income and taxable income?

Taxable income is taxable income. Tax exempt income is part of tax-exempt income. For example, if you get Rs. 30,000 rupees a year, then rupees. 25,000 rupees are tax exempt and the remaining rupees. 50,000 is taxable.

Do I need to disclose all means of revenue?

It is mandatory to mention all modes of revenue to avoid penalty charges.

Key takeaways:

- Tax obligations are the total amount of tax obligations that an individual, business, or other entity must pay to a tax authority such as the IRS.

- Income tax, sales tax and capital gains tax are all forms of tax liability.

- Taxes are levied by various tax authorities, including federal, state, and local governments. These tax authorities use the money to pay for services such as road repairs and national defense.

- Both individuals and businesses can reduce their tax obligations by claiming deductions, tax exemptions, and tax credits.

- Tax obligations are the amount of tax that a company or individual incurs under current tax law.

- Taxes are levied by various tax authorities, including federal, state, and local governments. These tax authorities use the money to pay for services such as road repairs and national defense.

- When a taxable event occurs, the taxpayer needs to know the tax base of the event and the tax rate of the tax base.

Minimum Alternate Tax

Companies can reduce their tax obligations through various provisions of the Income Tax Act, including tax exemptions, deductions and depreciation. Some companies make significant profits and pay dividends, but have zero taxable income. For various tax concessions and incentives. A tax policy known as the Minimum Alternative Minimum (MAT) was created to keep these "zero tax payers" within the income tax range and to pay the government a minimum tax amount.

To improve accountability and make sure that no company avoids paying taxes, the govt of India devised the concept of MAT in 1988 to facilitate the taxation of zero-tax companies. Introduced by the Financial Law of 1987, MAT came into effect in the valuation year of 1988-89. According to MAT, such companies are obliged to pay the government by considering a certain percentage of their book profits as taxable income.

How is MAT calculated?

The minimum alternative minimum tax applies if taxable income calculated in accordance with the provisions of the IT Act is found to be less than 15.5% of book profit under the Companies Act 2013 (and additional charges and taxes, if applicable) will be done.

For example, a company with a book profit of 10 billion rupees would have to pay a minimum tax of 1.5 billion rupees (assuming a MAT rate of 15 percent). If your normal tax obligation after requesting a deduction is 10 rupees (less than MAT), you will need to pay the remaining 5 rupees as MAT and use MAT credits equivalent to 5 rupees for future tax payments.

In September 2019, the govt reduced the MAT rate from 18.5% to fifteen and therefore the corporate rate from 30% to 22%. MAT is taxed on book profits, unlike regular corporate tax on taxable income. In addition, MAT will not be levied on new domestic manufacturing companies (established after October 1, 2019).

What are MAT Credits?

MAT credit is the difference between the tax paid by the company under MAT and the regular tax. Carryover of the period of 15 fiscal years is allowed. MAT is similar to prepaid tax. The concept of MAT credit was reintroduced in 2005 with a five-year carry-over mechanism. It was then extended to 10 years and in 2018 to 15 years.

According to the Central Direct Tax Commission (CBDT), companies that choose a lower corporate tax system cannot adjust the cumulative deduction for minimum alternative tax (MAT) to their tax obligations.

Key takeaways:

- MAT guarantees that certain taxpayers will pay a fair distribution or at least a minimum amount.

- It doesn't start until the income reaches a certain level. In 2020, it will be $ 113,400 for a couple submitting jointly.

- In 2015, Congress passed a law that indexes tax exemptions into inflation to prevent middle-income taxpayers from experiencing bracket creep.

- It is designed to prevent taxpayers from evading the fair distribution of tax obligations through tax deductions.

- However, this structure was not an indicator of inflation or tax cuts. This can cause bracket creep.

- This is a condition in which high- and middle-income taxpayers are subject to this tax, as well as the wealthy taxpayers invented by AMT.

- However, in 2015 Congress passed a law that indexes AMT tax exemptions into inflation.

- To determine if you are obligated to pay for MAT, use tax software that calculates automatically for you or fill out the IRS Form 6251.

- This form takes into account medical expenses, mortgage interest, and various other deductions, which tax filers have set by the IRS.

Tax on Distributed Profits

Simply put, dividend profit is the profit shared with shareholders as a dividend. Section 115-O of Income Tax of 1961 mentions dividend distribution tax as an additional income tax. Such taxes are not the nature of tax withholding. This is a tax on the after-tax profit of the company on which the dividend is declared or distributed.

Therefore, it is clear that the dividend distribution tax is an income tax on the distributable profits of domestic companies.

Pre-correction

Section 115-O: -Taxes on distribution profits of domestic companies

Domestic companies are obliged to pay an additional income tax on the amount declared, distributed or paid as a dividend (whether in the middle or not) in addition to the income tax levied on total income. Additional income tax shall be charged at a rate of 15% of current or cumulative profits. This is also known as tax on distributed profits.