Unit - 5

Tax Planning With Reference To Business Restructuring

Business Restructuring is the corporate management term for the act of reorganizing the legal, ownership, operational or other structures of a company for the purpose of making it more profitable or better organised for its present needs. Different types of business restructuring are-

- Acquisition

- Merger

- Demerger

- Others- capital reduction and buy back

Figure 1: Types of business structure

Tax planning related to amalgamation

Manner of amalgamation

Amalgamation refers to combination of two or more independent companies into a single company. As per section 2(IB) the amalgamation should take place in such a manner that:

(i) All the property of the amalgamating company(s) immediately before the amalgamation becomes the property of the amalgamated company by virtue of the amalgamation.

(ii) All the liabilities of the amalgamating company(s) immediately before the amalgamation become the liabilities of the amalgamated company by virtue of the amalgamation;

(iii) Shareholders (Equity + Preference Shares) holding not less than 75% in value of the shares in the amalgamating company(s) (other than shares already held therein immediately before the amalgamation, or by a nominee for the amalgamated company or its subsidiary) become shareholders of the amalgamated company by virtue of the amalgamation.

WHEN AN AMALGAMA1ION IS NOT TREATED AS AMALGAMATION U/S 2(1B)

1. Where amalgamation is as a result of the acquisition of the property of one company by another company pursuant to the purchase of such property by the other company; or

2. Where amalgamation is as a result of the distribution of such property to the other company after the winding up of the first mentioned company.

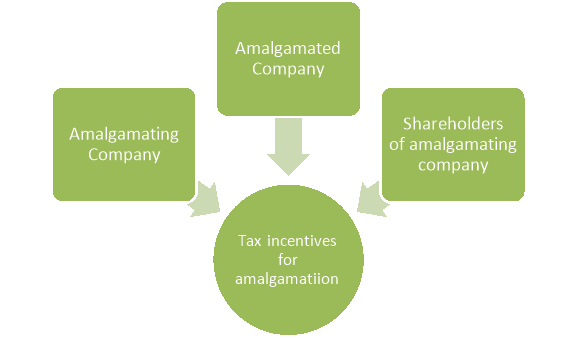

Tax incentives for amalgamation [Section 2(1B)]

Section 2(1B) provided provisions for tax incentives arc available to following assesse:

Figure2: Tax incentives for amalgamation

a) Tax incentives for amalgamating company

- Section 35ABB: There is no tax liability on transfer of a license to operate telecommunication services by amalgamating company to amalgamated company.

- Section 42: There is no lax liability on transfer of a business of prospecting for or extraction or production of petroleum and natural gas by the amalgamating company if the amalgamated company is an Indian company.

- Section 47(vi): There shall be no capital gain arising to amalgamating company consequent to transfer of capital asset to Indian amalgamated company.

- Section 47(via): Any transfer, in a scheme of amalgamation, of a capital asset being a share(s) held in an Indian company, by the amalgamating foreign company to the amalgamated foreign company, if

At least 25% of shareholders of amalgamating company foreign company Continue to remain shareholders of the amalgamated foreign company.

Such transfer does not attract tax on capital gain in the country in which the amalgamating company is incorporated.

In such case capital gain as not chargeable to tax.

b) Tax incentives — for amalgamated company

- Section 35(5): Where, in a scheme of amalgamation, the amalgamating company sells or otherwise transfers to the amalgamated company (being an Indian company) any asset representing expenditure of a capital nature on scientific research, the provisions of this section shall, as far as may be, apply to the amalgamated company as they would have applied to the amalgamating company if the latter had not so sold or otherwise transferred the asset.

- Section 35ABB: The amalgamated Indian company can claim full deduction in respect of remaining instalments of expenditure to obtain license to operate telecommunication services.

- Section 35D(5): The amalgamated Indian company can claim remaining instalments of preliminary expenses.

- Section 35DD: The amalgamated Indian company can claim amalgamation expenses in 5 equal instalments from the year beginning with the previous year in which amalgamation take place.

- Section 35DDA(2): The amalgamated Indian company can claim remaining deduction on account of expenses incurred in respect of voluntary retirement scheme which is incurred by amalgamating company.

- Section 35E(7): The amalgamated Indian company can claim remaining deduction on account of expenses incurred in respect of prospecting for, or extraction or production of certain minerals and also unabsorbed amount of such a instalments.

- Section 36(I)(ix): The amalgamated Indian company can claim remaining deduction on account of expenses incurred in respect of capital expenditure incurred for the purpose of promoting family planning among its employees.

- Section 42: The amalgamated Indian company can claim remaining deduction on account of expenses incurred in respect of prospecting for, or extraction or production of petroleum and natural gas.

- Bad debts: Where a part of debts taken over by the amalgamated company from the amalgamating company becomes bad subsequenLly, such bad debt is allowed as a deduction in computing the income of the amalgamated company.

- Section 43(1) Explanation 7: Actual cost of the asset to the amalgamated company shall be the same as would have been to the amalgamating company, if it continued to hold it.

- Section 43(6) Explanation 2B: Actual cost of the asset to the amalgamated company WDV (written down value) of the Block of assets to the amalgamating company immediately preceding PY less depreciation actually allowed for such preceding PY.

- Deduction u/s 80IA. 80IB & 80IC is allowed from gross total income to amalgamated company if certain conditions are complied with.

- Exemption u/s 10A & 10B shall be allowed to the amalgamated company for the expired period.

- Section 115VY: Where there is an amalgamation of a qualifying company with another company, the provisions relating to the tonnage tax scheme shall apply to the amalgamated company if it is a qualifying company.

Where the amalgamated company is not a qualifying company, it can exercise an option within 3 months from the date of the approval of the scheme of amalgamation.

c) Tax incentives — for shareholders of amalgamating company

- Section 2(42A)(C): The period of holding of shares shall be from the period the shares were held in amalgamating company.

- Section 47(vii): There shall be no capital gain arising to the shareholders of amalgamating company, where shareholders transfer shares of amalgamating company in lieu of allotment of shares in Indian amalgamated company.

Provisions relating to carry forward and set off of accumulated loss and unabsorbed depreciation allowance in amalgamation, demerger or succession etc. (section 72)

Section- 72 specifies that loss shall be carried forward only by the person who has incurred the loss. But Section 72A specifies an exception to this. Where certain conditions are satisfied accumulated losses and unabsorbed depreciation can be carried forward by amalgamated company also. It is divided in three parts:

- Sec. 72A( I ) to 72A(3) Carry forward and set off of accumulated loss and unabsorbed depreciation in case of amalgamation.

- Sec. 72A(4) & (5) Carry forward and set off of accumulated loss and unabsorbed depreciation in case of demerger.

- Sec 72A(6) Carry forward and set off of accumulated loss and unabsorbed depreciation in case of succession.

Provisions relating to carry forward and set off of accumulated loss and unabsorbed depreciation allowance in case of amalgamation (section 72)

According to section 72A (1), where there has been an amalgamation of a company owning:

A. an industrial undertaking

(i) the manufacture or processing of goods; or

(ii) the manufacture of computer software; or

(iii) the business of generation or distribution of electricity or any other form of power; or

(iiia) the business of providing telecommunication services, whether basic or cellular. Including radio paging, domestic satellite service, network of trunking, broadband network and internet services; or

(iv) mining; or

(v) the construction of ships, aircrafts or rail systems;

B. A Ship or

C. A Hotel

D. An amalgamation of a banking company referred to in section 5(c) of the Banking Regulation Act, 1949 with a Specified Bank.

Specified bank means the State Bank of India constituted under the State Bank of India Act, 1955 or a subsidiary bank as defined in the State Bank of India (Subsidiary Banks) Act, 1959 or a corresponding new bank constituted under section 3 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 or under section 3 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980. With another company, then,

Notwithstanding anything contained in any other provision of this Act,

1. The accumulated business loss of the amalgamating company. Accumulated loss means such loss that would have been entitled to carry forward and set off under the provisions of section 72 if the amalgamation had not taken place; and

2. The unabsorbed depreciation of the amalgamating company. Unabsorbed depreciation means so much of the allowance for depreciation of the amalgamating company which remains to be allowed and which would have been allowed to amalgamating company under the provisions of this Act, if the amalgamation had not taken place. Shall be deemed to be the loss (including unabsorbed depreciation), of the amalgamated company for the PY in which the amalgamation was effected. (i.e. The period of 8 years shall be taken from the dare of amalgamation) and other provisions of this Act relating to set off and carry forward of loss and allowance for depreciation shall apply accordingly.

Provisions relating to carry forward and set-off of accumulated loss and unabsorbed depreciation allowance in scheme of amalgamation of banking company in certain cases (Section 72AA)

1. Notwithstanding anything contained in section 2(IB) or section 72A, [ It means conditions of section 2(1 B) or 72A may or may not be satisfied]

2. Where there has been an amalgamation of a banking company with any other banking institution

3. Under a scheme sanctioned and brought into force by the Central Government under section 45(7) of the Banking Regulation Act, 1949,

4. The accumulated loss and the unabsorbed depreciation of such banking company shall be deemed to be the loss or, as the case may be,

5. Allowance for depreciation of such banking institution for the previous year in which the scheme of amalgamation was brought into force and other provisions of this Act relating to set-off and carry forward of Loss and allowance for depreciation shall apply accordingly.

Tax planning in case of demerger

Demerger is an arrangement whereby some part /undertaking of one company is transferred to another company which operates completely separate from the original company. Shareholders of the original company are usually given an equivalent stake of ownership in the new company. Demerger is undertaken basically for two reasons. The first as an exercise in corporate restructuring and the second is to give effect to kind of family partitions in case of family owned enterprises. A demerger is also done to help each of the segments operate more smoothly, as they can now focus on a more specific task.

The demerger under Section 2(19AA) of Income-tax Act, 1961 is defined as follows:

Demerger means the transfer of one or more undertakings to any resulting company pursuant to a scheme of arrangement under Sections 391 to 394 of the Companies Act, 1956 in such a manner that:

- All the property/liability of the undertaking becomes the property/liability of the resulting company.

- All the property/liabilities are transferred at book value (excluding increase in value due to revaluation).

- The resulting company issues shares to the shareholders of demerged company on a proportionate basis, except

where resulting company is a shareholder of the demerged company. - Shareholders holding minimum 75% of the value of shares become shareholders of the resulting company (other than shares already held therein immediately before the demerger by, or by a nominee for, the resulting company or its subsidiary).

- The transfer of an undertaking is on a going concern

basis. - The demerger is in accordance with the conditions notified under Section 72A(5) of IT Act, 1961.

Tax planning in case of slump sale

As per section 2(42C) of Income -tax Act 1961, ‘slump sale’ means the transfer of one or more undertakings as a result of the sale for a lump sum consideration without values being assigned to the individual assets and liabilities in such sales.

Taxability of gains arising on slump sale as per Income Tax Act, 1961

Section 50B of the Income-tax Act, 1961 provides the mechanism for computation of capital gains arising on slump sale. On a plain reading of the Section, some basic points which arise are:

1. Special Provision:

Section 50B reads as ‘Special provision for computation of capital gains in case of slump sale’. Since slump sale is governed by a ‘special provision’, this section overrides all other provisions of the Act.

2. Period of Holding:

Capital gains arising on transfer of an undertaking are deemed to be long-term capital gains. However, if the undertaking is ‘owned and held’ for not more than 36 months immediately before the date of transfer, gains shall be treated as short-term capital gains.

3. Year of Taxability:

Taxability arises in the year of transfer of the undertaking.

4. Formula:

Capital gains arising on slump sale are calculated as the difference between sale consideration and the net worth of the undertaking.

Capital Gain= Sale Consideration-Net Worth

5. Net Worth:

Net worth is deemed to be the cost of acquisition and cost of improvement for section 48 and section 49 of the Act.

Net worth is defined in Explanation 1 to section 50B as the difference between ‘the aggregate value of total assets of the undertaking or division’ and ‘the value of its liabilities as appearing in books of account’. This amendment has made it clear that the slump sale provisions apply to a non-corporate entity also.

The ‘aggregate value of total assets of the undertaking or division’ is the sum total of:

- WDV as determined u/s.43(6)(c)(i)(C) in case of depreciable assets.

- The book value in case of other assets.

For computing the net worth, the assets on which deduction has been allowed under section 35AD and if such assets are transferred under slump sale, the value of such assets shall be taken as NIL.

5. Indexation Benefit:

As per section 50B, no indexation benefit is available on cost of acquisition, i.e., net worth.

7. Case of More than one undertaking:

In case of slump sale of more than one undertaking, the computation should be done separately for each undertaking.

8. Revaluation:

Revaluation of assets shall not be considered while computing the “net worth” i.e. revaluation of assets shall be nullified for computing the “net worth”, irrespective of the fact that revaluation is done in the current year or in past years.

GST Rate on Slump sales

GST has provided many exemption for supply of services i.e. supply of such service will attract NIL rate of GST wide Notification No.12/2017-Central Tax (Rate) dated 28.06.2017, one of the such service is as under, as per serial No. 2 of such notification “Services by way of transfer of a going concern, as a whole or an independent part thereof” will be NIL Rated. Hence supply of Slump sales is exempted from GST without any conditions.

Availability of ITC in case of Slump-Sale

Since the lump sum consideration received for ‘Slump Sale’ of business is exempt from GST, as stated above thus no tax would be charged on the consideration exchanged between the parties. The transferor would be issuing a bill of supply as per section 31(3) (c) of the CGST Act, 2017. Since no tax would be charged on the consideration, therefore the question of availability of input tax credit would not arise at all.

KEY TAKEAWAYS

BUSINESS RESTRUCTURING IS THE CORPORATE MANAGEMENT TERM FOR THE ACT OF REORGANIZING THE LEGAL, OWNERSHIP, OPERATIONAL OR OTHER STRUCTURES OF A COMPANY FOR THE PURPOSE OF MAKING IT MORE PROFITABLE OR BETTER ORGANISED FOR ITS PRESENT NEEDS.\

A. Conversion of partnership firm into company [Section 47 (iii)]

Transfer of a capital asset or intangible asset on conversion of Firm into a Company is not treated as Transfer if following conditions are satisfied and hence not Capital Gain arises. Conditions are:

(a) all the assets and liabilities of the firm [or of the association of persons or body of individuals] relating to the business immediately before the succession become the assets and liabilities of the company;

(b) all the partners of the firm immediately before the succession become the shareholders of the company in the same proportion in which their capital accounts stood in the books of the firm on the date of succession;

(c) the partners of the firm do not receive any consideration or benefit, directly or indirectly, in any form or manner, other than by way of allotment of shares in the company; and

(d) the aggregate of the shareholding in the company of the partners of the firm is not less than 50% , of the total voting power in the company and their shareholding continues to be as such for a period of 5 years from the date of the succession;

B. Conversion of sole proprietary business into company [section 47(xiv)]

Transfer of a capital asset or intangible asset on conversion of sole Proprietorship concern into a Company is not treated as Transfer if following conditions are satisfied and hence not Capital Gain arises. Conditions are:

(a) all the assets and liabilities of the sole proprietary concern relating to the business immediately before the succession become the assets and liabilities of the company;

(b) the shareholding of the sole proprietor in the company is not less than 50% of the total voting power in the company and his shareholding continues to so remain as such for a period of 5 years from the date of the succession; and

(c) the sole proprietor does not receive any consideration or benefit, directly or indirectly, in any form or manner, other than by way of allotment of shares in the company;

(d) all the partners of the firm immediately before the succession become the shareholders of the company in the same proportion in which their capital accounts stood in the books of the firm on the date of succession;

C. Withdrawal of exemption [Section 47a(3)]

The above exemption shall be withdrawn in following case:

- Where any of the conditions laid down in the proviso to clause (xiii) or the proviso to clause (xiv) of section 47 are not complied with, then

- The amount of profits or gains arising from the transfer of such capital asset or intangible asset,

- Shall be deemed to be the profits and gains chargeable to tax of the successor company for the previous year in which the requirements of the proviso to clause (xiii) or the proviso to clause (xiv), as the case may be, are not complied with.

KEY TAKEAWAYS

- TRANSFER OF A CAPITAL ASSET OR INTANGIBLE ASSET ON CONVERSION OF FIRM INTO A COMPANY IS NOT TREATED AS TRANSFER IF FOLLOWING CONDITIONS ARE SATISFIED AND HENCE NOT CAPITAL GAIN ARISES.

- TRANSFER OF A CAPITAL ASSET OR INTANGIBLE ASSET ON CONVERSION OF SOLE PROPRIETORSHIP CONCERN INTO A COMPANY IS NOT TREATED AS TRANSFER IF FOLLOWING CONDITIONS ARE SATISFIED AND HENCE NOT CAPITAL GAIN ARISES.

The LLP Act has provided to convert a private limited company to LLP. The Income tax Act 1961 also has been amended by inserting the provisions related to such conversion. When there is transfer, from one person to another person, the transferor has to pay the capital Gain Tax. The income Tax Act has amended by inserting Section 47(xiiib) which does not amount to transfer. The private limited company which is a transferor and the LLP which is transferee has to comply with the below conditions as per that section.

1. Section 47 (xiiib) – Transactions not regarded as transfer

Following shall not be regarded as “transfer”, therefore, no capital gain shall arise on the following items. Any transfer of a capital asset or intangible asset by a private company or unlisted public company to a limited liability partnership. Any transfer of a share or shares held in the company by a shareholder as a result of conversion of the company into a limited liability partnership in accordance with the provisions of section 56 or section 57 of the Limited Liability Partnership Act, 2008.

Exemption shall be available only if the conversion satisfies all the below mentioned conditions:

According to proviso to section 47(xiiib), the conversion of Private Limited Companies and Unlisted Public Companies into LLP is not taxable subject to following conditions:

(a) all the assets and liabilities of the company immediately before the conversion become the assets and liabilities of the limited liability partnership;

(b) all the shareholders of the company immediately before the conversion become the partners of the limited liability partnership and their capital contribution and profit sharing ratio in the limited liability partnership are in the same proportion as their shareholding in the company on the date of conversion;

(c) the shareholders of the company do not receive any consideration or benefit, directly or indirectly, in any form or manner, other than by way of share in profit and capital contribution in the limited liability partnership;

(d) the aggregate of the profit sharing ratio of the shareholders of the company in the limited liability partnership shall not be less than fifty per cent at any time during the period of five years from the date of conversion; (i.e you can take new partners in the LLP, but all the previous shareholders who became partners in LLP share should remain at least 51% for 5 years from conversion.)

(e) the total sales, turnover or gross receipts in the business of the company in any of the three previous years preceding the previous year in which the conversion takes place does not exceed sixty lakh rupees; and

(f) No amount is paid, either directly or indirectly, to any partner out of balance of accumulated profit standing in the accounts of the company on the date of conversion for a period of three years from the date of conversion.

(g) The total value of the assets as appearing in the books of account of the company in any of the three previous years preceding the previous year in which the conversion takes place does not exceed five crore rupees

2. Some discrepancies related to Conversion of Company into LLP

(e) which says about Total sales, turnover or gross receipts in the business of the Company which means if the company is into textile business, then sales, turnover and receipts of only that business. However if a company is receiving any other income from any other source then it will not be his business income as his business was into textile. As per my understanding if the turnover from textile if 59 lac and is having other miscellaneous income of Rs 5 Lacs, his total receipts would be of 64 lacs, but business receipts of only Rs 59 Lacs. The Exemption is available only to the Capital assets are intangible assets.

(g) which says total value of assets. The term value is not defined which can be book value or fair market value which will be debateable. However as per my understanding since it is specified as value appearing in books of accounts, it should be taken at book value.

(f) which says non distribution of accumulated profits for 3 years. However, if a company has already distributed bonus shares by capitalising the reserves, then the question won’t arise. Hence there is a loop hole.

Sec 50D was introduced which says that fair market value of assets is to be taken as full value of consideration if capital gain arises on conversion. The capital gains shall be computed as given in section 48 according to which capital gain shall be computed by deducting cost of acquisition and expenditure from full value of consideration There are lot of issues as both the entities are one and the same. However, for transfer there has to be two entities. In this case, only the form of entity is changing i.e from Company t LLP, where there will be no existence in future of Company.

3. Consequences If section 47(xiiib) is violated:

- Transfer of capital Assets:

If the above conditions are violated, the transfer of capital asset is to be done at the market rate and accordingly capital gain is to be calculated. The private limited company which is a transferor has to pay the capital gain tax on such transfer.

- Transfer of Other Assets:

The other assets like, stock in trade, current asset etc is also transferred at the market value and the applicable taxes is to be paid.

- Impact on Share Holders if section 47(xiiib) is violated

The shares in the hands of the shareholders of the private limited company will be converted as capital of the LLP. The shareholder will surrender the shares and acquire capital in the LLP. The shareholder has to pay tax on the capital gain arising from to him from such transfer. The Value of capital is the consideration for the transfer of shares. The cost of share is the amount paid by such share holder at the time of purchase of shares. The receipt of bonus share will not have any cost since it is out of the reserves of the company.

4. Other Interpretation related to Conversion of Company into LLP:

There is one more interpretation that, the transfer of Private Limited Company to LLP is not regarded as transfer. Consequently the shareholders who are transferring the share and the person who is receiving the share are the same. Hence there is no capital gain to be paid by the shareholder because one cannot make profit by selling to himself.

5. Cost of acquisition of the asset related to Conversion of Company into LLP:

Cost of acquisition of the asset shall be deemed to be the cost of acquisition of Predecessor Company.

6. Period of holding of asset related to Conversion of Company into LLP:

As per Section 2(42A)(b), for the purpose of determining period of holding of capital asset for determining nature of capital gain, period for which the asset was held by predecessor company shall be included. Hence long term and short term will depend on the total holding period from the date of buying.

KEY TAKEAWAYS

- THE LLP ACT HAS PROVIDED TO CONVERT A PRIVATE LIMITED COMPANY TO LLP. THE INCOME TAX ACT 1961 ALSO HAS BEEN AMENDED BY INSERTING THE PROVISIONS RELATED TO SUCH CONVERSION.

Under the existing provisions of section 47 of the Income-tax Act, 1961, any transfer of a capital asset from a holding company to its wholly-owned subsidiary company or vice-versa is exempt from the charge of capital gains tax, subject to certain conditions. The exemption is, however, withdrawn under section 47A of the Act, if such capital asset is converted by the transferee company into, or is treated by it as stock-in-trade of its business; or the parent company or its nominee or the holding company ceases to hold the whole of the share capital of the subsidiary company, before expiry of a period of 8 years from the date of transfer.

Transfer of capital asset by a holding company to its 100% subsidiary company

Section 47(iv) provides that any transfer of a capital asset by a company to its subsidiary company shall not be regarded as transfer if—

(a) the parent company or its nominees hold the whole of the share capital of the subsidiary company, and

(b) the subsidiary company is an Indian company;

However, the capital asset must be transferred as a capital asset by the holding company to its wholly owned subsidiary. The capital asset shall not be transferred as stock-in-trade after the 29th day of February, 1988.

Transfer of capital asset by a subsidiary company to its 100% holding company

Section 47(v) provides that any transfer of a capital asset by a subsidiary company to the holding company shall not be regarded as transfer, if—

(a) the whole of the share capital of the subsidiary company is held by the holding company, and

(b) the holding company is an Indian company :

However, the capital asset must be transferred as a capital asset by the subsidiary company to its 100% holding company. The capital asset shall not be transferred as stock-in-trade after the 29th day of February, 1988.

Nature of Capital Gains exempt under section 47(iv)/(v)

Any nature of capital gains - long term capital or short term capital gain is exempt under section 47(iv/(v).

Conditions for exemption under section 47(iv) and 47(v)

The exemption under section 47(iv) and 47(v) is subject to certain conditions which are enumerated in section 47A. Section 47A provides for two conditions which must be satisfied for a period of 8 years from the date of transfer of capital assets by a holding company to its wholly owned subsidiary and vice-versa under section 47(iv) and section 47(v)-

Condition 1: The transferee company must hold the capital asset as a capital asset for a period of 8 years from the date of transfer of the capital asset. This does not mean that the subsidiary cannot transfer the capital asset within the lock-in period. This aspect is discussed later. The transferee company is only prohibited from converting the capital asset into stock-in-trade of its business or treat the same as stock-in-trade in its books. The consequences of converting or treating the capital asset so received from the transferor company into stock-in-trade is discussed separately under section 47A.

Condition 2: The parent company or its nominees shall not cease to hold the whole of the share capital of the subsidiary company for a period of 8 years from the date of transfer of the capital asset. The consequences of diluting the shareholding of the subsidiary company is discussed separately under section 47A.

Both the conditions must be satisfied for a period of 8 years from the date of transfer of the capital asset between the holding and wholly owned subsidiary company and vice versa.

Withdrawal of exemption under section 47A

If both the conditions or any one of the condition is violated by the transferee company in any year within the period of 8 years from the date of transfer then the amount of profits or gains arising from the transfer of such capital asset not charged to capital gains under section 45 by virtue of the provisions contained in clause section 47(iv) or section 47(v) of shall be deemed to be income chargeable under the head "Capital gains" of the previous year in which such transfer took place. In order to avail and continue the exemption, both the conditions of section 47A must be adhered to for a lock-in period of 8 years without any fail, else the income on transfer of capital assets which was not taxed in the hands of the transferor company, will be charged to tax under the head capital gains with retrospective effect in the hands of the transferor company. Under clause (iv) of section 47 of the Act, capital gain arising from the transfer of a capital asset by a company to its wholly-owned subsidiary company is exempt from tax. Similarly, under clause (v) of section 47, capital gain arising from the transfer of a capital asset by a subsidiary company to the holding company is also exempt from tax. Exemption under this provision is allowed only if the transferee company is an Indian company.

KEY TAKEAWAYS

- UNDER THE EXISTING PROVISIONS OF SECTION 47 OF THE INCOME-TAX ACT, 1961, ANY TRANSFER OF A CAPITAL ASSET FROM A HOLDING COMPANY TO ITS WHOLLY-OWNED SUBSIDIARY COMPANY OR VICE-VERSA IS EXEMPT FROM THE CHARGE OF CAPITAL GAINS TAX, SUBJECT TO CERTAIN CONDITIONS.

References

- Singhania, Vinod K. And Monica Singhania. Corporate Tax Planning.Taxmann Publications Pvt. Ltd., New Delhi.

- Ahuja, Girish. And Ravi Gupta. Corporate Tax Planning and Management. Bharat Law House, Delhi.

- Acharya, Shuklendra and M.G. Gurha. Tax Planning under Direct Taxes. Modern Law Publication, Allahabad.

- Mittal, D.P. Law of Transfer Pricing. Taxmann Publications Pvt. Ltd., New Delhi