Unit 3

Securities Contract and Regulations Act

Investors are the pillar of the financial and securities Market. They determine the level of activity in the market. They put the money in funds, stocks, etc. to help grow the market and thus, the Economy. It is thus very important to protect the interests of the investors. Investor protection involves various measures established to protect the interests of investors from malpractices. Securities and Exchange Board of India (SEBI) is responsible for regulations of the Mutual Funds and safeguard the interests of the investors. Investor protection measures by SEBI are in place to safeguard the investors from the malpractices in shares, the stock market, Mutual Fund, etc.

Investor protection legislation is implemented under the Section 11(2) of the SEBI Act. The measures are as follows:

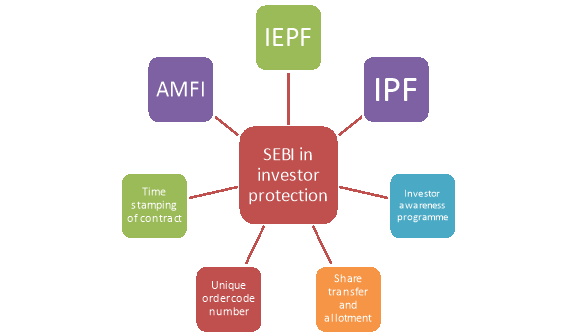

Role of SEBI in investor protection

Protection of investor is one of the objectives of SEBI. It performs the following activities to achieve this objective-

Figure: Role of SEBI in investor protection

Investor protection measures by SEBI also includes the Government of India established a fund called, Investor Education and Protection Fund(IEPF) under the 1956 Company Act. According to the act, the company which has completed seven years in the business should hand over all the unclaimed fund dividends, matured deposits, and debentures, share application money etc. to the Government through IEPF.

2. Investor Protection Fund:

Investor protection Fund (IPF) is set up by Inter-connected Stock Exchange (ISE) in accordance with the guidelines issued by the Ministry of Finance for investor protection, in order to compensate the claims of investors against the members of exchanges (brokers) who have defaulted or failed to pay. The investor can ask for the compensation if a member (broker) of the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE) or any other stock exchange fails to pay the due money for the investments made. The Stock Exchanges have put certain limits on the level of compensation paid to the investors. This limitation has been put according to the discussions and guidance with the IPF Trust. The limit allows that the money to paid as a compensation for a single claim shall not be less than INR 1 lakh - for the case major Stock Exchanges like BSE and NSE - and it should not be less INR 50,000 in case of other Stock Exchanges.

3. Investor Awareness Programme:

Investor protection measures by SEBI follows the slogan ‘An informed investor is a safe investor’. SEBI has thus launched the Securities Market Awareness Campaign in January 2003. Such programmes are now regularly organised by SEBI to educate and create awareness among the investors. The programme covers major subjects like portfolio management, Mutual Funds, tax provisions, Investor Protection Fund, Investors’ Grievance Redressal system of SEBI. It also conducts workshops on derivatives, stock exchange trade, Sensex, etc. SEBI has now conducted over 2000 workshops in more than 500 cities across the country. SEBI has marketed the Investor Awareness Programme across all formats like print media, radio, television, and the internet.

4. Simplification of Share Transfer and Allotment Procedure:

SEBI named a board under the chairmanship of Shri R Chandrasekaran, Managing Director of the Stock Holding Corporation of India Limited, to propose a methodology for speeding up and working on share move and allocation. The board of trustees has presented its draft report which has been flowed to different market go-betweens for their remarks. In view of the criticism, the report will be concluded and vital move will be made to carry out the suggestions. It is normal that execution of the proposals of this panel would impressively facilitate the troubles looked by financial backers by virtue of unreasonable deferrals in share moves and awful conveyances.

5. Unique Order Code Number:

All stock trades have been needed to guarantee that a framework is set up whereby every exchange is allotted a remarkable request code number which is hinted by the merchant to his customer. When the request is executed, this number is to be imprinted on the agreement note, which ensure accuracy and confidentiality.

6. Time Stamping of Contracts:

Stock specialists have been asked to keep a record of time when the customer has submitted the request and mirror something similar in the agreement note alongside the hour of the execution of the request. This is to ensure that the merchant gives due inclination in execution of customer's structure and charges the right cost to his customer without exploiting any intra-day value vacillation for himself.

7. The Role of AMFI:

Association of Mutual Funds in India (AMFI) was set up on August 22, 1995, is the association of SEBI registered Mutual Funds in India. It was set up to regulate all those who sell Mutual Fund in India. AMFI registration is required to solicit the Mutual Funds and it regulates the members of the association in order to protect the investor from any kind of mis-selling or unfair investment practices.

Key takeaways

In India investment risks are very high due to dishonest practices, frauds and unethical investment culture. The Government, the Company Law Board and the SEBI, in recent years have made efforts to protect the investors. "Investors protection is a wide term, it encompasses all the measures designed to protect investors from malpractices of brokers, companies managers to issue, merchant bankers, registrar to issues etc. The main complaints are against brokers of stock exchanges, against listed companies and mutual funds.

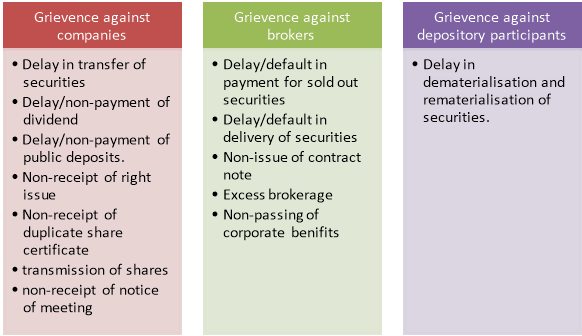

Figure: Grievances of related to stock exchanges

A) Usual grievances against companies

1. Delay in registering transfer of securities:

Registration of transfers should be done by the companies within 30 days of receipt of share transfer instrument but usually it takes many months.

2. Non-payment or delay in payment of dividend:

Dividends should be distributed within 30 days from the date of declaration but by manipulation of procedures dividends may not be received for months.

3. Non-repayment or delayed repayment of public deposits.

Thousands of depositors are involved in litigation to get back their deposits from companies.

4. Non-receipt of rights issue offer:

The letter of offer of rights shares should be sent to all eligible shareholders by registered post and this fact should be prominently advertised in at least two all India newspapers. Shareholders quite often are not informed of rights issue.

5. Non-receipt of duplicate share certificate:

A company is bound to issue duplicate share certificates if the shares are lost or misplaced by the shareholder, after receiving a request along with the requisite fee and on completion of formalities.

6. Transmission of shares:

After the death of a shareholder the ownership of shares passes to his legal heirs which are called transmission of shares. The company is bound to transfer the shares in the name of legal heir of the deceased.

7. Non-receipt of notice of meeting:

Every shareholder whose name appears in the register of members is entitled to receive 21 days advance notice of meeting of shareholders. Non-dispatch of notice of meeting to shareholder is common but serious lapse.

B) Usual grievances against brokers

1. Delay or default in payment for securities sold:

A broker has to make payment to client who has sold securities through him within in 48 hours of payout of funds by clearing house of stock exchange or the Clearing corporation but brokers as a rule, retain the sale proceed as long as they can.

2. Delay or default in delivery of purchased security to the client:

A broker has to deliver the purchased securities to his client within 48 hours of pay-out of securities by the stock exchange. It never happens so, in practice.

3. Non-Issue of contract note:

Brokers have to issue a contract note in in prescribed form to all their clients within 24 hours of the transaction but they avoid doing so to earn secret profits.

4. Charging excess brokerage from clients.

5. Non-passing of corporate benefits

A broker is duty bound to pass all the corporate benefits like rights shares, bonus shares, dividends etc. to the client he is dealing with but, many a times brokers play tricks in this regard. 6. Over charging. he broker should charge or pay only that amount for of sale or purchase of securities at He should not overcharge for purchases or pay less for the sales. In practice most brokers play tricks about it.

C) Grievances against depository participant

Depository Participant is an institution which holds securities either in certificated or uncertificated form, help in dematerialization of securities etc. of the holder. Various banks and other institutions are doing this work. Every depository participant must forward all the dematerialization or materialization requests of his clients to the concerned company within 7 days of the receipt of the request but delays are quite common.

Main Depositories are: • NSDL: National Securities Depositories Limited (1996)

• CDSL: Central Depositories Services Limited (1999)

Key takeaways-

All the recognised stock exchanges have established Investors services cells to redress the grievances of investors. These cells have played an important role in settlement of grievances and have infused confidence among investor. Investors approach these investors’ grievance cells to lodge complaints against companies and members of the stock exchange acting as brokers. Both BSE and NSE too have their grievance cells.

A) Method of redressal of grievance against companies in investor service cell

1. After receiving the complaint from investors, these are forwarded to the concerned company which is directed to solve the matter within 15 days, progress is monitored.

2. If, in spite of reminder, the company fails to resolve the complaints and the total number of pending complaints against the company exceeds 25 and if these complaints are pending for more than 45 days, the cell issues a show cause notice of 7 days to the company.

3. If the company still fails to resolve the complaint within 7 days of issue of show cause notice the scrip of the company is suspended from trading.

4. Investors grievance cell can also transfer scrips of defaulting company to Z category for non-resolution of investors’ complaints

5. Companies which have a long history of not resolving investors’ grievances and have large number of pending complaints are instructed to employ special personnel to clear pending complaints on priority basis.

B) Method of redressal investors’ grievances against stock broker by investor service cell

1. When a complaint is lodged with the stock exchange authorities, they forward it to the investor service cell which refers the complaint to the concerned broker and asks him to settle the complaint and send a reply within 7 days.

2. If no reply is received or the received reply is not satisfactory the matter is placed before the Investors Grievance Redressal Committee (IGRC) of the stock exchange.

3. This committee hears both the complainant, the broker and efforts are made the solve the matter failing which, it is referred for arbitration which is a quasi-judicial process.

4. A sole arbitrator is appointed if the sum is for less than Rs. 25 lakhs, for claims above Rs. 25 lakhs, a penal of 3 arbitrators is appointed.

5. An aggrieved party can file an appeal against the award given by the arbitrator in appropriate court.

C) other measures taken by investor service cell

Other measures taken for Investor protection by stock exchanges and resolve the grievances of the investors and members of the exchange are

1. Calling company representatives to the stock exchange to interaction.

2. Calling registrars and transfer agents to the stock exchange to interact.

3. Issuing monthly press releases.

4. Listing top 25 companies against whom maximum complaints are pending for resolution, this is also released on the website of the exchange.

5. In the case of Bombay Stock Exchange, it can pursue Mumbai based companies to depute their representatives to the exchange to take up the pending list of complaints and resolve them without delay.

Key takeaways-

Investors’ protection is a wide term, it encompasses all the measures designed to protect investors from malpractices of brokers, companies managers to issue, merchant bankers, registrar to issues etc. The main complaints are against brokers of stock exchanges, against listed companies and mutual funds.

a) Usual grievances against companies

1. Delay in registering transfer of securities.

2. Non-payment or delay in payment of dividend.

3. Non-repayment or delayed repayment of public deposits.

4. Non-receipt of rights issue offer.

5. Non-receipt of duplicate share certificate.

6. Transmission of shares.

7. Non-receipt of notice of meeting.

b) Usual grievances against brokers

1. Delay or default in payment for securities sold.

2. Delay or default in delivery of purchased security to the client.

3. Non-Issue of contract note.

4. Charging brokerage from clients.

5. Non-passing of corporate benefits.

c) Grievance against depository participants

Depository Participant is an institution which acts as an agent to hold securities either in certificated or uncertificated form, dematerialization of securities etc. of the holder. Various banks and other institutions are doing this work. Every depository participant must forward all the dematerialization or materialization requests of his clients to the concerned company within 7 days of the receipt of the request but delays are quite common.

An investor can seek redressal of his grievances from, the following agencies:

All the recognised stock exchanges have established Investors services cells to redress the grievances of investors. These cells have played an important role in settlement of grievances and have infused confidence among investor. Investors approach these investors grievance cells to lodge complaints against companies and members of the stock exchange acting as brokers. Both BSE and NSE too have their grievance cells.

2. Grievance of investors against companies

After receiving the complaint from investors, these are forwarded to the concerned company which is directed to solve the matter within 15 days, progress is monitored. If, in spite of reminder, the company fails to resolve the complaints and the total number of pending complaints against the company exceeds 25 and if these complaints are pending for more than 45 days, the cell issues a show cause notice of 7 days to the company. If the company still fails to resolve the complaint within 7 days of issue of show cause notice the scrip of the company is suspended from trading. Investors grievance cell can also transfer scrips of defaulting company to Z category for non-resolution of investors complaints Companies which have a long history of not resolving investors grievances and have large number of pending complaints are instructed to employ special personnel to clear pending complaints on priority basis.

3. Investors grievances against stock broker

When a complaint is lodged with the stock exchange authorities, they forward it to the investor service cell which refers the complaint to the concerned broker and asks him to settle the complaint and send a reply within 7 days. If no reply is received or the received reply is not satisfactory the matter is placed before the Investors Grievance Redressal Committee (IGRC) of the stock exchange. This committee hears both, the complainant, the broker and efforts are made the solve the matter failing which, it is referred for arbitration which is a quasi judicial process. A sole arbitrator is appointed if the sum is for less than Rs. 25 lakhs, for claims above Rs. 25 lakhs, a penal of 3 arbitrators is appointed. An aggrieved party can file an appeal against the award given by the arbitrator in appropriate court.

4. Redressal of grievances through SEBI

SEBI has a dedicated department viz., Office of Investor Assistance and Education (OIAE) to receive investor grievances and to provide assistance to investors by way of education. Complaints arising out of activities that are covered under SEBI Act, 1992; Securities Contract Regulation Act, 1956; Depositories Act, 1996 and Rules and Regulations made there under and provisions that are covered under Section 55A of Companies Act, 1956 are handled by SEBI. Grievances pertaining to stock brokers and depository participants are taken up with respective stock exchange and depository for redressal and monitored by SEBI through periodic reports obtained from them. Grievances pertaining to other intermediaries are taken up with them directly for redressal and are continuously monitored by SEBI. Grievances against listed company are taken up with the respective listed company and are continuously monitored. The company is required to respond in prescribed format in the form of Action Taken Report (ATR).. Upon the receipt of ATR, the status of grievances is updated.

5. Redressal by Company Law Board

Company law Board which was constituted in May 1991 has been entrusted with many powers which were previously exercised by high courts. Every bench of company Law Board is deemed to be a civil court and every proceeding before it is deemed as judicial proceeding. To protect the interests of investors it has the power of inspection of records and documents and enforcing attendance of witnesses. An aggrieved investor can apply to the Company Law Board (i) To investigate the affairs of the company (ii) For relief in case of oppression of management and/or mismanagement investors can also lodge complaints about delay and non-payment of fixed deposits and interest thereon with the Company Law Board. Representations about desired changes in the Companies Act for investors protection can also be made to the Company Law Board.

When an investor has tried all other ways of getting his grievance settled there is no other way left with him except to proceed against the company or the intermediary by way of civil and criminal proceedings. Suits against companies can be filed in the high courts of the states. Every high court has special designated benches about company affairs and all complaints against companies in breach of Companies Act are heard there. An aggrieved party can file cases in high courts against the companies to get justice but the process of law is quite time consuming and costly and hence beyond the reach of small investors.

2. Redressal of investors grievances through press

If an investor fails to get his grievance remedied from concerned company or authorities, he thinks of bringing bad publicity to the company or to the authorities not listening to him, by reporting the matter to the press. Investors form unfavorable opinion about such company and think that this may happen to them also. So they avoid investing in this company. Such a situation can prove suicidal for the company. To avoid bad publicity the concerned company or the stock exchange management or the government agency like SEBI settles his grievance and report back to the newspaper as to what they have done about the complaint.

Key takeaways-

References:

1. Jones, C.P. Investments Analysis and Management, Wiley, 8th ed.

2. Chandra, Prasanna. Investment Analysis and Portfolio Management. McGraw Hill Education.

3. Rustogi, R.P. Fundamentals of Investment. Sultan Chand & Sons, New Delhi.

4. Vohra N.D. & Bagri B.R., Futures and Options, McGraw Hill Education.