Unit 1

The Investment Environment

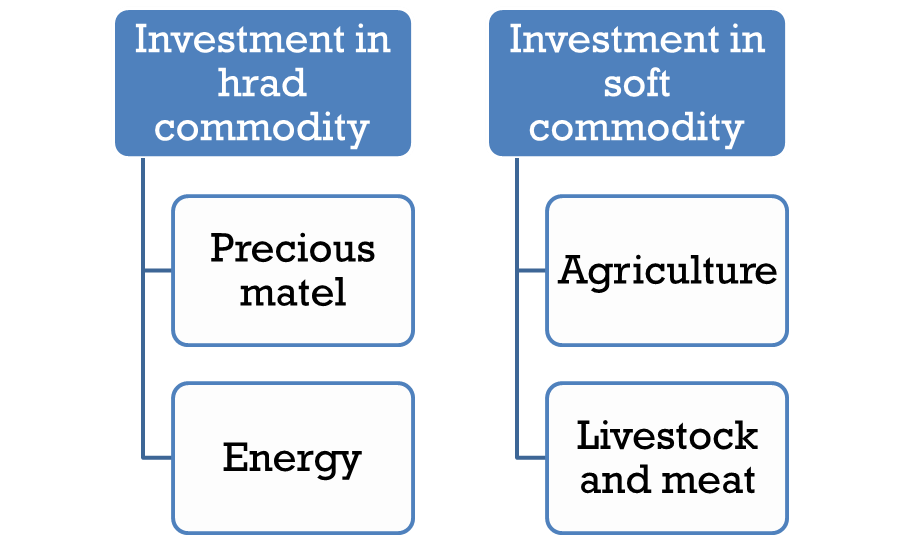

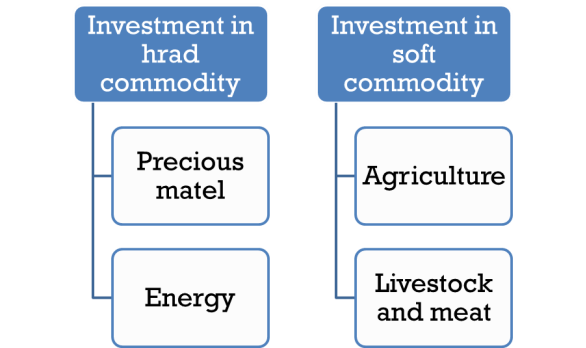

Investment refers to assets that provide long term benefits like capital appreciation/creation of wealth to the investors. The investments are made in real estates, commodities, financial instruments and products like shares, debentures, bonds, mutual funds, insurance and purchase of assets like land and building, machinery, raw materials etc. Depending on the nature of investment in can be broadly divided into two parts- a) Investment in financial assets/financial market b) Investment in business assets. The figure 1 shows the types of investment-

Figure 1: Types of Investment

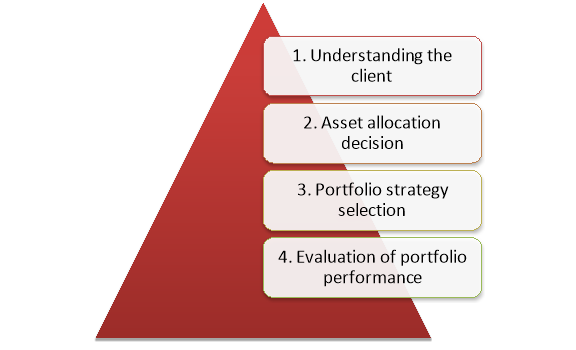

The investment decision process is discussed under the two heads-

a) Decisions of investment in financial assets: The process involved in investment decision process is highlighted in figure 2

Figure 2: Investment decision process in financial assets

1. Understanding the client: In the first step, the investor should understand the client by verifying their nature of business, location, gaols, risk bearing capability, previous year returns, financial statements etc. It helps them to get an insight about the company.

2. Asset allocation decision: In this step, the investor select the probable assets where the investment to be made in near future. Such assets may be fixed income bearing securities, real estates, domestic or foreign security etc.

3. Portfolio strategy selection: In this step, the investor selects an efficient portfolio which will provide maximum return with minimum risk. Portfolio refers to creation of a group of securities of with different risk and return and from different industry/company.

4. Evaluation of portfolio performance: In this step, the investors regularly evaluate the performance of portfolio by determining its market performance, net asset value, market price of securities. It helps them to decide whether to keep their investment or to withdraw the investment.

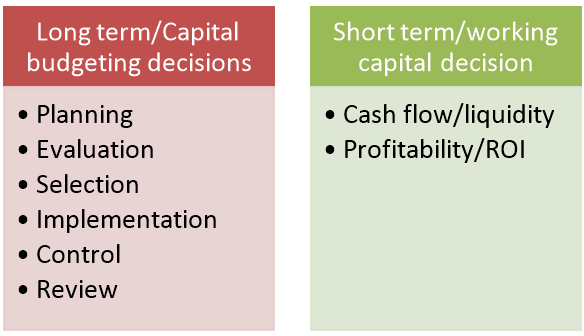

b) Decisions of investment in business assets:

The figure 3 shows the decisions of investment in business assets-

Figure 3: Business assets investment decisions

(Due to limitation of syllabus the business decision process is not discussed further)

Key takeaways-

1) Investment refers to assets that provide long term benefits like capital appreciation/creation of wealth to the investors. The investments are made in real estates, commodities, financial instruments and products like shares, debentures, bonds, mutual funds, insurance and purchase of assets like land and building, machinery, raw materials etc.

Investment in commodities

The investors can make investment in commodities through commodities market. Commodity trading is managed by four major commodity exchanges in India-

Different types of commodities available for investment in the market/commodity exchange are-

a) Hard commodities:

b) Soft commodities:

Figure 4: Investment in commodities

Investment in Real estate

Investment in real estate involves purchase of land, building, management of estate, let out of the estate etc. Investment in real estate is popular trend in recent times due to its growing demand in urban are semi-urban areas due to rapid expansion on business and industry, migration from rural to urban areas for better education, health facility, banking facility, availability of job and livelihood etc. Investment in real estate can be made in following ways-

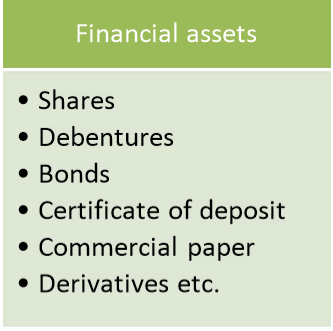

Investment in financial assets

Financial assets are money related assets the value of which is derived from the contract between the parties. Financial assets are traded in the stock exchanges for long term and short term. Different types of financial assets available for investment are-

Figure 5: Investment in financial assets.

Key takeaways-

1) The investors can make investment in commodities through commodities market.

2) Investment in real estate involves purchase of land, building, management of estate, let out of the estate etc.

3) Financial assets are traded in the stock exchanges for long term and short term.

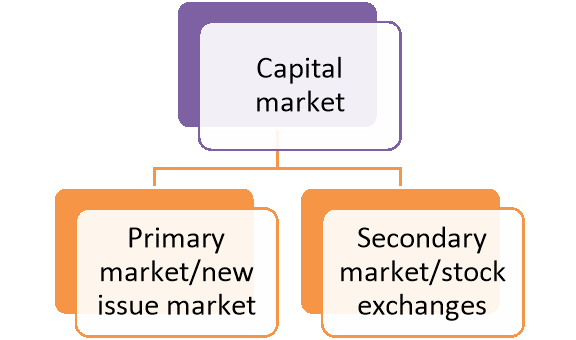

Indian securities market also known as capital market refers to the organised platform for purchase and sale of securities for. It is a long term market where companies and government issues shares, debentures and bonds to the public for arrangement of capital for business and the investors makes investment in such securities. Different stock exchanges like National Stock Exchange, Bombay Stock Exchange, OTCEI, regional stock exchanges, brokers, Merchant bankers’ etc. combinenly represent the capital market. It is strictly regulated by the Securities and Exchange Board of India. Depending on the nature of transactions Indian securities market is divided into two parts-

Figure 6: Classification of securities market

1) Primary market: It is the securities market where securities like shares, debentures and bonds are purchased and sold for the first time.

2) Secondary market: It is the securities market where the second hand securities like shares, debentures and bonds are traded.

Methods of Floatation under new issue market

Functions of a Stock Exchange

1. Providing Liquidity and Marketability to Existing Securities: The basic function of a stock exchange is the creation of a continuous market where securities are bought and sold. It gives investors the chance to disinvest and reinvest. This provides both liquidity and easy marketability to already existing securities in the market.

2. Pricing of Securities: Share prices on a stock exchange are determined by the forces of demand and supply. A stock exchange is a mechanism of constant valuation through which the prices of securities are determined. Such a valuation provides important instant information to both buyers and sellers in the market.

3. Safety of Transaction: The membership of a stock exchange is well regulated and its dealings are well defined according to the existing legal framework. This ensures that the investing public gets a safe and fair deal on the market.

4. Contributes to Economic Growth: A stock exchange is a market in which existing securities are resold or traded. Through this process of disinvestment and reinvestment savings get channelised into their most productive investment avenues. This leads to capital formation and economic growth.

5. Spreading of Equity Cult: The stock exchange can play a vital role in ensuring wider share ownership by regulating new issues, better trading practices and taking effective steps in educating the public about investments.

Trading of securities

Trading in securities is now executed through an on-line, screen-based electronic trading system. Simply put, all buying and selling of shares and debentures are done through a computer terminal. There was a time when in the open outcry system, securities were bought and sold on the floor of the stock exchange. Under this auction system, deals were struck among brokers, prices were shouted out and the shares sold to the highest bidder. However, now almost all exchanges have gone electronic and trading is done in the broker’s office through a computer terminal. A stock exchange has its main computer system with many terminals spread across the country. Trading in securities is done through brokers who are members of the stock exchange. Trading has shifted from the stock market floor to the brokers office. Every broker has to have access to a computer terminal that is connected to the main stock exchange. In this screen-based trading, a member logs on to the site and any information about the shares (company, member, etc.) he wishes to buy or sell and the price is fed into the computer. The software is so designed that the transaction will be executed when a matching order is found from a counter party. The whole transaction is carried on the computer screen with both the parties being able to see the prices of all shares going up and down at all times during the time that business is transacted and during business hours of the stock exchange. The computer in the brokers office is constantly matching the orders at the best bid and offer price. Those that are not matched remain on the screen and are open for future matching during the day. Electronic trading systems or screen-based trading has certain advantages:

1. It ensures transparency as it allows participants to see the prices of all securities in the market while business is being transacted. They are able to see the full market during real time.

2. It increases efficiency of information being passed on, thus helping in fixing prices efficiently. The computer screens display information on prices and also capital market developments that influence share prices.

3. It increases the efficiency of operations, since there is reduction in time, cost and risk of error.

4. People from all over the country and even abroad who wish to participate in the stock market can buy or sell securities through brokers or members without knowing each other. That is, they can sit in the broker’s office, log on to the computer at the same time and buy or sell securities. This system has enabled a large number of participants to trade with each other, thereby improving the liquidity of the market.

5. A single trading platform has been provided as business is transacted at the same time in all the trading centres. Thus, all the trading centres spread all over the country have been brought onto one trading platform, i.e., the stock exchange, on the computer.

It has been made compulsory to settle all trades within 2 days of the trade date, i.e., on a T+2 basis, since 2003. Prior to the reforms, securities were bought and sold, i.e., traded and all positions in the stock exchange were settled on a weekly/fortnightly settlement cycle whether it was delivery of securities or payment of cash. This system prevailed for a long time as it increased the volume of trading on the exchange and provided liquidity to the system

Key takeaways-

1) Indian securities market also known as capital market refers to the organised platform for purchase and sale of securities for. It is a long term market where companies and government issues shares, debentures and bonds to the public for arrangement of capital for business and the investors makes investment in such securities.

a) The stock exchange: Stock exchanges are companies registered under the companies Act. 1956 to facilitate buying and selling and trading of securities. The companies can sell their securities through the stock exchanges.

b) Investors: Investors are individuals or institutions who invest in the securities issued by the companies.

c) Issuer of securities: Issuer of securities may be companies/Government who sells securities in this market to raise capital for their business.

d) Banks: Banks facilitates for making financial transactions during trading of securities. The investors must have the demat account with a commercial bank to make buying and selling of securities.

e) Merchant bankers: Merchant bankers are NBFCs involved in issue management of companies. It provides the services like issue management, portfolio management, underwriting of securities, tax consultancy, corporate counselling services etc.

f) Brokers: Brokers are intermediaries registered with SEBI to bring together the buyers and sellers of securities.

g) Depository and custodian: Depositories and custodians help to keep the securities in dematerialised form. It also facilitates digital transfer of securities.

h) Regulatory bodies: Regulatory bodies are institutions that regulate the activities of securities market. Such regulatory institutions are Securities and Exchange Board of India, Reserve Bank of India, Insurance Regulatory Development Authority, Securities Contract Act. etc.

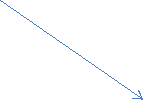

A stock market index is an index number that measures the movement in share prices of stocks under consideration. Different types of security market indices are-

Figure 7: Classification of stock market indices

a) Indices based on size

SENSEX: Constituted of 30 scrips

BSE-100: Constituted of 100 scrips

BSE-500: Constituted of 500 scrips

Nifty: Constituted of 50 scrips

Nikkie: Index Constituted of 225 scrips

S & P 500: Constituted of 500 scrips

NASDAQ: Composite Constituted of around 4700 scrips

b) Indices based on Nature

SENSEX: Broad-based index representing all major industries from the listed universe

BSE IT Sector Index: Index representing the IT sector stocks

BSE TECk Index: Index representing the TMT sector stocks

BSE Healthcare Index: Index representing the Healthcare sector stocks

FTSE-TMT Index: Index based on telecom, media and IT sector stocks

Nasdaq-100 Index: Technology Index

c) Indices based on Calculation Methodology

Some of the security market indices of India

The BSE SENSEX, first compiled in 1986 is a “Market Capitalization-Weighted” index of 30 component stocks representing a sample of large, well-established and financially sound companies. The index is widely reported in both, the domestic and international, print and electronic media and is widely used to measure the performance of the Indian stock markets. The BSE SENSEX is the benchmark index of the Indian capital market and one, which has the longest social memory. In fact the SENSEX is considered to be the pulse of the Indian stock markets. As the oldest index of the Indian Stock market, it provides time series data over a fairly long period of time. The SENSEX has over the years become one of the most prominent Brands in the Country. It can be rightly called the ‘Oldest barometer’ of the Indian equity markets. One can identify the booms and bust of the Indian equities from the SENSEX.

2. BSE-100

The Stock Exchange, Mumbai has been compiling and publishing BSE-100 Index numbers since 3rd January, 1989. BSE-100 index is more broad based than SENSEX as this index has 100 scrips in its basket. This index was earlier called BSE National Index (Natex), when the prices of its constituent scrips were collected from other major exchanges in the country. The base year for BSE-100 Index is 1983-84 and the base value is 100.

3. BSE-200

In order to provide a better representation of the industries in the universe, a more broad-based index- BSE-200 was constructed and launched on 27th May, 1994. The base year for BSE-200 Index is 1989-90 and the base value is 100. The BSE-200 index necessarily includes all BSE-100 companies.

4. DOLLEX-200

While BSE-200 index reflects the growth in market value over the base period 1989-90, with both the current market value and the base value expressed in rupee terms, a need was felt to design a yardstick by which these growth values are measured in dollar terms. Such an index would reflect, in one value, the changes in stock prices and the foreign exchange variation. In order to satisfy this need, The Stock Exchange, Mumbai introduced a new index called DOLLEX-200, i.e. a dollar linked version of BSE-200 index. Here the current and base market values are arrived by dividing the current rupee market value by the current rupee-dollar exchange rate and the base value by a constant average rupee-dollar conversion rate in the base year. Thus, DOLLEX-200 reflects not only the share price movements but also the rupee-dollar movement.

5. BSE-500

Although BSE-200 index is a broad-based index, it represents only 200 companies. Hence, a need was felt to construct BSE-500 index to represent all segments of listed stocks and to give more coverage in terms of number of scrips, market capitalisation and turnover. The BSE-500 Index has a base date of 1st February 1999 and a base value of 1000. The BSE-500 represents around 90% of the total listed market capitalisation of BSE. The selection criteria for the companies include Market capitalisation, Industry representation, Liquidity factors like traded value, trading frequency and average number of trades per day. The BSE-500 index necessarily includes all BSE-200 companies.

6. BSE-PSU INDEX

The Stock Exchange, Mumbai launched “BSE-PSU Index” on Monday, 4th June 2001. The index consists of 34 major Public Sector Undertakings listed on the Exchange. The BSE-PSU Index is displayed on-line on the ‘BOLT’ (BSE On-line Trading Terminal) nationwide. The BSE - Public Sector Undertaking (PSU) Index is a stock index that tracks the performance of the listed PSU stocks on the Exchange. The index constituents (currently 34) are part of the BSE-500 Index. The Base Date for the BSE-PSU Index is 1st February 1999 when the BSE-500 was launched. Being a subset of BSE-500, the BSE-PSU Index ensures a reasonable history of how the Central Government wealth fluctuates on the bourses. The Base Value for the BSE –PSU Index has been set at 1000 to ensure adequacy in terms of Daily Index movement. The BSE-PSU index consists of listed companies \ institutions \ corporations owned or controlled by the central government within the meaning of Section 619-B of the Companies Act, 1956.

7. DOLLEX-30

The Stock Exchange, Mumbai launched a new index ‘DOLLEX-30’ on July 18, 2001 to track the performance of SENSEX scrips in Dollar terms. Like SENSEX, the base-year for DOLLEX-30 is 1978- 79 and base value at 100 points. The exchange has computed historical index values of ‘DOLLEX-30’ since 1979. While SENSEX reflects the growth in market value of constituent stocks over the base period in rupee terms, a need was felt to design a yardstick by which these growth values are measured in dollar terms. Such an index would reflect, in one value, the changes in both the stock prices and the foreign exchange variation. DOLLEX-30 is the second dollar denominated index from The Stock Exchange, Mumbai. Earlier, BSE had launched a dollar version of BSE-200 index called DOLLEX-200 in 1994.

Sources of financial information

Financial information is necessary for stakeholders in decision making process. It is used by existing investors, potential investor, Government, competitors, creditors, suppliers etc. Some of the popular sources of financial information are-

Key takeaways-

1) A stock market index is an index number that measures the movement in share prices of stocks under consideration.

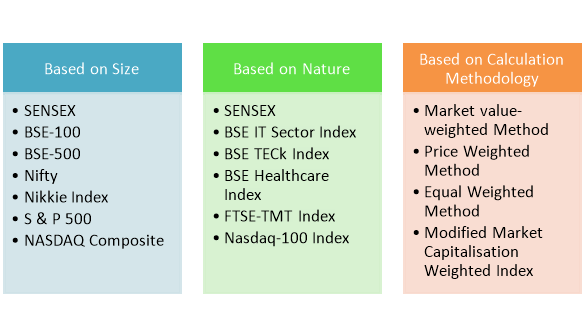

Risk

Risk refers to probability of happening of some uncertain or undesirable situation. In terms of finance, risk is the chance of financial loss. Assets having greater chances of loss are viewed as more risky than those with lesser chances of loss. Risk is always present in business and financial world. Thus a manager should identify the risk and take necessary steps to manage the same. The figure 8 shows different types of risk present in the market-

Figure 8: Types of risk

a) Firm-Specific Risks:

1. Business risk: The chance that the firm will be unable to cover its operating costs. Level is driven by the firm’s revenue stability and the structure of its operating costs (fixed vs. variable).

2. Financial risk: The chance that the firm will be unable to cover its financial obligations. Level is driven by the predictability of the firm’s operating cash flows and its fixed-cost financial obligations.

b) Shareholder-Specific Risks

1. Interest rate risk: The chance that changes in interest rates will adversely affect the value of an investment. Most investments lose value when the interest rate rises and increase in value when it falls.

2. Liquidity risk: The chance that an investment cannot be easily liquidated at a reasonable price. Liquidity is significantly affected by the size and depth of the market in which an investment is customarily traded.

3. Market risk: The chance that the value of an investment will decline because of market factors that are independent of the investment (such as economic, political, and social events). In general, the more a given investment’s value responds to the market, the greater its risk; and the less it responds, the smaller its risk.

c) Firm and Shareholder Risks

1. Event risk: The chance that a totally unexpected event will have a significant effect on the value of the firm or a specific investment. These infrequent events, such as government-mandated withdrawal of a popular prescription drug, typically affect only a small group of firms or investments.

2. Exchange rate risk: The exposure of future expected cash flows to fluctuations in the currency exchange rate. The greater the chance of undesirable exchange rate fluctuations, the greater the risk of the cash flows and therefore the lower the value of the firm or investment.

3. Purchasing-power risk: The chance that changing price levels caused by inflation or deflation in the economy will adversely affect the firm’s or investment’s cash flows and value. Typically, firms or investments with cash flows that move with general price levels have a low purchasing-power risk, and those with cash flows that do not move with general price levels have high purchasing-power risk.

4. Tax risk: The chance that unfavourable changes in tax laws will occur. Firms and investments with values that are sensitive to tax law changes are more risky.

Return

The return is the total gain or loss experienced on an investment over a given period of time. It is the prime objective for making investment. Returns may be in the form of dividend, interest profit etc. It is commonly measured as cash distributions during the period plus the change in value, expressed as a percentage of the beginning-of-period investment value. Return is of two types

It is calculated as-

Return=Income + Change in price of security over a period of time * 100/price paid for security.

Impact of tax on return

Tax is imposed on returns of investment. High tax rate lowers the return on investment because the investors have to pay a portion of their return as tax to Government and low tax rate left a good portion of return with investors as they have to pay a small portion as tax to government.

Impact of inflation on return

Inflation refers to the continuous increase in price of commodities and decrease in money value over a period of time. In investment was made during normal period and return is earned during inflationary period, the returns on investment diminishes due to the adverse impact of rising inflation on returns.

Key takeaways-

1) Risk refers to probability of happening of some uncertain or undesirable situation.

2) The return is the total gain or loss experienced on an investment over a given period of time. It is the prime objective for making investment.

References:

1. Jones, C.P. Investments Analysis and Management, Wiley, 8th ed.

2. Chandra, Prasanna. Investment Analysis and Portfolio Management. McGraw Hill Education.

3. Rustogi, R.P. Fundamentals of Investment. Sultan Chand & Sons, New Delhi.

4. Vohra N.D. & Bagri B.R., Futures and Options, McGraw Hill Education.