Unit 4

Portfolio analysis and financial derivatives

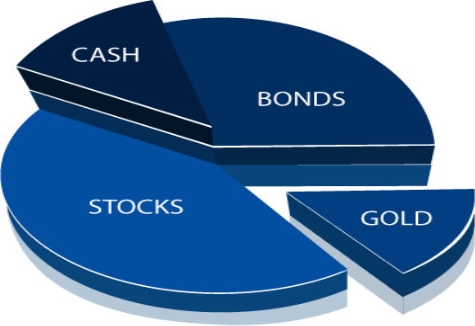

Portfolio is the collection of different types of financial assets like shares, debentures, bonds, precious metal, commodity or combination of open ended and close ended fund or combination of risky and risk free assets to get maximum return with minimum risk. The different types of portfolio investment are as follows:

Advantages of portfolio

The following are the advantages of portfolio investments.

Disadvantages of portfolio

The following are the disadvantages of portfolio investments.

Diversification of Portfolio

Portfolio diversification refers to the process of making investment in different types of to maximise return with minimum risk. It helps the investor to manage the investment by collectively invest in equity and debt fund or securities of different companies, risky or risk free assets to minimise the risk associated with the investment.

Some of the benefits of portfolio diversification are highlighted below-

A diversified portfolio minimizes the overall risk associated with the portfolio. Since investment is made across different asset classes and sectors, the overall impact of market volatility comes down. Owning investments across different funds ensures that industry-specific and enterprise-specific risks are low. Thus, it reduces risks and generates higher returns in the long run.

2. Reduces the time spent in monitoring the portfolio

A diversified portfolio is more stable because not all investments will perform badly at the same time. If investment is made only in equity shares, it is time consuming process in studying the market movement and analyzing the next step. Similarly, investment is solely into low-risk mutual funds, all-time worry will be to find avenues to increase returns. With diversification, you will have to spend lesser time on the same and the portfolio will not require a lot of maintenance.

3. Helps seek advantage of different investment instruments

By selecting mutual funds, investors may gain the benefit of investing in a mix of debt and equity. Similarly, by investing in fixed deposits, investors benefit from a fixed return and a low risk. Hence, diversification of the portfolio will balance the risk and return associated with different funds. Even if one fund does not perform well, the loss may be compensated by the profits made from other funds.

4. Helps achieve long-term investment plans

It is important for the investor to invest indifferent high-performing sectors. If the market volatility has a positive impact on stocks, the investor will be able to generate higher returns on them. If it has a positive impact on debt, the investor will be able to make the most out of mutual funds.

5. Helps avail of benefit of compounding of interest

Selecting a mutual fund as an investment option allows investors to avail of the benefit of compounding interest. This means that every investment made will generate interest on the principal amount as well as on the accumulated interest over the previous invested years. It is important to keep in mind that if you are investing in two different funds, the fund holding for both the schemes should be different; otherwise, diversification does not make any sense.

6. Helps keep the capital safe

Not every investor is ready to play a risky game. Investors who are on the verge of retirement or have just started investing prefer stability in their portfolio and diversification ensures the protection of their savings. Diversification allows investors to achieve their investment plans while maintaining the investment risk at a minimum. It is also a method of playing safe in the volatile market.

7. Shuffle amongst investments

Diversification is a practical approach that every investor should take advantage of. It allows investors to shuffle their investments and take advantage of the market movement. It lets investors spread their investment across different asset classes and increase annual returns.

8. Offers peace of mind

The biggest advantage of diversification is peace of mind. When the total investment is divided amongst a number of asset classes, an investor will not be stressed about the performance of the portfolio.

Key takeaways-

A portfolio is composed of two or more securities. Each portfolio has risk-return characteristics of its own. A portfolio comprising securities that yield a maximum return for given level of risk or minimum risk for given level of return is termed as ‘efficient portfolio’. Portfolio theory originally developed by Harry Markowitz states that portfolio risk, unlike portfolio return, is more than a simple aggregation of the risk, unlike portfolio return, is more than a simple aggregation of the risks of individual assets. This is dependent upon the interplay between the returns on assets comprising the portfolio. Another assumption of the portfolio theory is that the returns of assets are normally distributed which means that the mean (expected value) and variance analysis is the foundation of the portfolio.

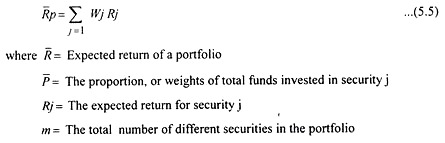

i. Portfolio Return:

The expected return of a portfolio represents weighted average of the expected returns on the securities comprising that portfolio with weights being the proportion of total funds invested in each security (the total of weights must be 100). The following formula can be used to determine expected return of a portfolio-

ii. Portfolio Risk:

Unlike the expected return on a portfolio which is simply the weighted average of the expected returns on the individual assets in the portfolio, the portfolio risk, σp is not the simple, weighted average of the standard deviations of the individual assets in the portfolios. It is for this fact that consideration of a weighted average of individual security deviations amounts to ignoring the relationship, or covariance that exists between the returns on securities. In fact, the overall risk of the portfolio includes the interactive risk of asset in relation to the others, measured by the covariance of returns. Covariance is a statistical measure of the degree to which two variables (securities’ returns) move together. Thus, covariance depends on the correlation between returns on the securities in the portfolio. Covariance between two securities is calculated as below:

1. Find the expected returns on securities.

2. Find the deviation of possible returns from the expected return for each security.

3. Find the sum of the product of each deviation of returns of two securities and respective probability.

The formula for determining the covariance of returns of two securities is:

Key takeaways-

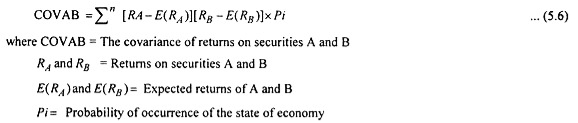

Mutual fund is a non-banking financial company that collects and pool small savings from investors and invest in selected securities of securities market to get maximum return with minimum risk. The profits yielded from mutual fund investment are shared among the investors according to the share of investment. The mutual fund investment is managed by the portfolio manager by carefully selecting the combination of different types of efficient securities. Mutual fund facilitates the potential investors who lack knowledge regarding the financial market to invest in the securities market through some professionally managed specialised institution. It provides different investment opportunities like income fund, growth fund, balanced fund, tax savings fund etc. Some of the examples of mutual fund are SBI mutual fund, ICICI mutual fund, HDFC mutual fund etc.

Figure: Mutual fund process

The characteristics of mutual fund investment are-

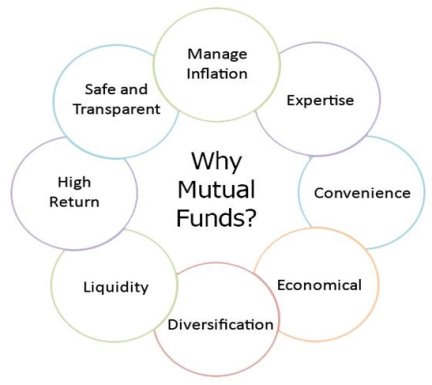

Mutual fund is important because of the following reasons-

Mutual fund provides safety to the investor because it is managed by the professionals who have special knowledge in the field of accounting, industry, taxation, fund management, economics etc. To maintain transparency of fund it provides statement on monthly basis showing their net asset value of investment.

2. Manage inflation:

It manages the inflation in the country by investing excess money to the industrial sector.

3. Convenience:

Mutual fund is convenient for potential investor who lacks knowledge regarding the securities market. It manages the investments of such investors.

4. Expertise:

It provides expertise to investors by introducing different schemes to satisfy their investment needs. Different investment schemes are in the form of income fund, growth fund, balanced fund, tax saving fund, short term fund, long term fund, money market mutual fund etc.

5. Economical:

Mutual fund is an economical investment avenue because it manages bulk funds of different investors. Thus, the portfolio manager charges fees which are shared by all investors.

6. Diversification:

It provides diversified investment avenues to the investors. The portfolio of investment consists of diversified securities or companies or financial instruments to maximise return with minimum risk.

7. Liquidity:

Mutual fund provides liquidity to investors as investors have liberty to sale their holdings or transfer their holdings at any time.

8. High return:

It provides high return to investors by managing and diversifying the investment to minimise the risk and maximise return.

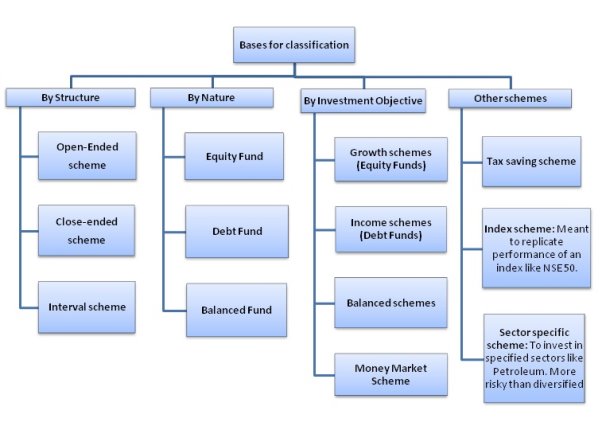

Classification of mutual fund

Figure: Classification of mutual fund

1. Based on Asset Class/nature

a. Equity Funds

Equity funds primarily invest in stocks, and hence go by the name of stock funds as well. They invest the money pooled in from various investors from diverse backgrounds into shares/stocks of different companies. The gains and losses associated with these funds depend solely on how the invested shares perform (price-hikes or price-drops) in the stock market. Also, equity funds have the potential to generate significant returns over a period. Hence, the risk associated with these funds also tends to be comparatively higher.

b. Debt Funds

Debt funds invest primarily in fixed-income securities such as bonds, securities and treasury bills. They invest in various fixed income instruments such as Fixed Maturity Plans (FMPs), Gilt Funds, Liquid Funds, Short-Term Plans, Long-Term Bonds and Monthly Income Plans, among others. Since the investments come with a fixed interest rate and maturity date, it can be a great option for passive investors looking for regular income (interest and capital appreciation) with minimal risks.

c. Money Market Funds

Investors trade stocks in the stock market. In the same way, investors also invest in the money market, also known as capital market or cash market. The government runs it in association with banks, financial institutions and other corporations by issuing money market securities like bonds, T-bills, dated securities and certificates of deposits, among others. The fund manager invests your money and disburses regular dividends in return. Opting for a short-term plan (not more than 13 months) can lower the risk of investment considerably on such funds.

d. Hybrid Funds

As the name suggests, hybrid funds (Balanced Funds) is an optimum mix of bonds and stocks, thereby bridging the gap between equity funds and debt funds. The ratio can either be variable or fixed. In short, it takes the best of two mutual funds by distributing, say, 60% of assets in stocks and the rest in bonds or vice versa. Hybrid funds are suitable for investors looking to take more risks for ‘debt plus returns’ benefit rather than sticking to lower but steady income schemes.

2. Based on Structure

Mutual funds are also categorised based on different attributes (like risk profile, asset class, etc.). The structural classification – open-ended funds, close-ended funds, and interval funds – is quite broad, and the differentiation primarily depends on the flexibility to purchase and sell the individual mutual fund units.

a. Open-Ended Funds

Open-ended funds do not have any particular constraint such as a specific period or the number of units which can be traded. These funds allow investors to trade funds at their convenience and exit when required at the prevailing NAV (Net Asset Value). This is the sole reason why the unit capital continually changes with new entries and exits. An open-ended fund can also decide to stop taking in new investors if they do not want to (or cannot manage significant funds).

b. Closed-Ended Funds

In closed-ended funds, the unit capital to invest is pre-defined. Meaning the fund company cannot sell more than the pre-agreed number of units. Some funds also come with a New Fund Offer (NFO) period; wherein there is a deadline to buy units. NFOs comes with a pre-defined maturity tenure with fund managers open to any fund size. Hence, SEBI has mandated that investors be given the option to either repurchase option or list the funds on stock exchanges to exit the schemes.

c. Interval Funds

Interval funds have traits of both open-ended and closed-ended funds. These funds are open for purchase or redemption only during specific intervals (decided by the fund house) and closed the rest of the time. Also, no transactions will be permitted for at least two years. These funds are suitable for investors looking to save a lump sum amount for a short-term financial goal, say, in 3-12 months.

3. Based on Investment Goals

a. Growth Funds

Growth funds usually allocate a considerable portion in shares and growth sectors, suitable for investors (mostly Millennials) who have a surplus of idle money to be distributed in riskier plans (albeit with possibly high returns) or are positive about the scheme.

b. Income Funds

Income funds belong to the family of debt mutual funds that distribute their money in a mix of bonds, certificate of deposits and securities among others. Helmed by skilled fund managers who keep the portfolio in tandem with the rate fluctuations without compromising on the portfolio’s creditworthiness, income funds have historically earned investors better returns than deposits. They are best suited for risk-averse investors with a 2-3 years perspective.

c. Liquid Funds

Like income funds, liquid funds also belong to the debt fund category as they invest in debt instruments and money market with a tenure of up to 91 days. The maximum sum allowed to invest is Rs 10 lakh. A highlighting feature that differentiates liquid funds from other debt funds is the way the Net Asset Value is calculated. The NAV of liquid funds is calculated for 365 days (including Sundays) while for others, only business days are considered.

d. Tax-Saving Funds

ELSS or Equity Linked Saving Scheme, over the years, have climbed up the ranks among all categories of investors. Not only do they offer the benefit of wealth maximisation while allowing you to save on taxes, but they also come with the lowest lock-in period of only three years. Investing predominantly in equity (and related products), they are known to generate non-taxed returns in the range 14-16%. These funds are best-suited for salaried investors with a long-term investment horizon.

e. Aggressive Growth Funds

Slightly on the riskier side when choosing where to invest in, the Aggressive Growth Fund is designed to make steep monetary gains. Though susceptible to market volatility, one can decide on the fund as per the beta (the tool to gauge the fund’s movement in comparison with the market). Example, if the market shows a beta of 1, an aggressive growth fund will reflect a higher beta, say, 1.10 or above.

f. Capital Protection Funds

If protecting the principal is the priority, Capital Protection Funds serves the purpose while earning relatively smaller returns (12% at best). The fund manager invests a portion of the money in bonds or Certificates of Deposits and the rest towards equities. Though the probability of incurring any loss is quite low, it is advised to stay invested for at least three years (closed-ended) to safeguard your money, and also the returns are taxable.

g. Fixed Maturity Funds

Many investors choose to invest towards the of the FY ends to take advantage of triple indexation, thereby bringing down tax burden. If uncomfortable with the debt market trends and related risks, Fixed Maturity Plans (FMP) – which invest in bonds, securities, money market etc. – present a great opportunity. As a close-ended plan, FMP functions on a fixed maturity period, which could range from one month to five years (like FDs). The fund manager ensures that the money is allocated to an investment with the same tenure, to reap accrual interest at the time of FMP maturity.

h. Pension Funds

Putting away a portion of your income in a chosen pension fund to accrue over a long period to secure you and your family’s financial future after retiring from regular employment can take care of most contingencies (like a medical emergency or children’s wedding). Relying solely on savings to get through your golden years is not recommended as savings (no matter how big) get used up. EPF is an example, but there are many lucrative schemes offered by banks, insurance firms etc.

4. Based on Risk

a. Very Low-Risk Funds

Liquid funds and ultra-short-term funds (one month to one year) are known for its low risk, and understandably their returns are also low (6% at best). Investors choose this to fulfil their short-term financial goals and to keep their money safe through these funds.

b. Low-Risk Funds

In the event of rupee depreciation or unexpected national crisis, investors are unsure about investing in riskier funds. In such cases, fund managers recommend putting money in either one or a combination of liquid, ultra short-term or arbitrage funds. Returns could be 6-8%, but the investors are free to switch when valuations become more stable.

c. Medium-risk Funds

Here, the risk factor is of medium level as the fund manager invests a portion in debt and the rest in equity funds. The NAV is not that volatile, and the average returns could be 9-12%.

d. High-Risk Funds

Suitable for investors with no risk aversion and aiming for huge returns in the form of interest and dividends, high-risk mutual funds need active fund management. Regular performance reviews are mandatory as they are susceptible to market volatility. You can expect 15% returns, though most high-risk funds generally provide up to 20% returns.

5. Specialized Mutual Funds

a. Sector Funds

Sector funds invest solely in one specific sector, theme-based mutual funds. As these funds invest only in specific sectors with only a few stocks, the risk factor is on the higher side. Investors are advised to keep track of the various sector-related trends. Sector funds also deliver great returns. Some areas of banking, IT and pharma have witnessed huge and consistent growth in the recent past and are predicted to be promising in future as well.

b. Index Funds

Suited best for passive investors, index funds put money in an index. A fund manager does not manage it. An index fund identifies stocks and their corresponding ratio in the market index and put the money in similar proportion in similar stocks. Even if they cannot outdo the market (which is the reason why they are not popular in India), they play it safe by mimicking the index performance.

c. Funds of Funds

A diversified mutual fund investment portfolio offers a slew of benefits, and ‘Funds of Funds’ also known as multi-manager mutual funds are made to exploit this to the tilt – by putting their money in diverse fund categories. In short, buying one fund that invests in many funds rather than investing in several achieves diversification while keeping the cost down at the same time.

d. Emerging market Funds

To invest in developing markets is considered a risky bet, and it has undergone negative returns too. India, in itself, is a dynamic and emerging market where investors earn high returns from the domestic stock market. Like all markets, they are also prone to market fluctuations. Also, from a longer-term perspective, emerging economies are expected to contribute to the majority of global growth in the following decades.

e. International/ Foreign Funds

Favoured by investors looking to spread their investment to other countries, foreign mutual funds can get investors good returns even when the Indian Stock Markets perform well. An investor can employ a hybrid approach (say, 60% in domestic equities and the rest in overseas funds) or a feeder approach (getting local funds to place them in foreign stocks) or a theme-based allocation (e.g., gold mining).

f. Global Funds

Aside from the same lexical meaning, global funds are quite different from International Funds. While a global fund chiefly invests in markets worldwide, it also includes investment in your home country. The International Funds concentrate solely on foreign markets. Diverse and universal in approach, global funds can be quite risky to owing to different policies, market and currency variations, though it does work as a break against inflation and long-term returns have been historically high.

g. Real Estate Funds

Despite the real estate boom in India, many investors are still hesitant to invest in such projects due to its multiple risks. Real estate fund can be a perfect alternative as the investor will be an indirect participant by putting their money in established real estate companies/trusts rather than projects. A long-term investment negates risks and legal hassles when it comes to purchasing a property as well as provides liquidity to some extent.

h. Commodity-focused Stock Funds

These funds are ideal for investors with sufficient risk-appetite and looking to diversify their portfolio. Commodity-focused stock funds give a chance to dabble in multiple and diverse trades. Returns, however, may not be periodic and are either based on the performance of the stock company or the commodity itself. Gold is the only commodity in which mutual funds can invest directly in India. The rest purchase fund units or shares from commodity businesses.

i. Market Neutral Funds

For investors seeking protection from unfavourable market tendencies while sustaining good returns, market-neutral funds meet the purpose (like a hedge fund). With better risk-adaptability, these funds give high returns where even small investors can outstrip the market without stretching the portfolio limits.

j. Inverse/Leveraged Funds

While a regular index fund moves in tandem with the benchmark index, the returns of an inverse index fund shift in the opposite direction. It is nothing but selling your shares when the stock goes down, only to repurchase them at an even lesser cost (to hold until the price goes up again).

k. Asset Allocation Funds

Combining debt, equity and even gold in an optimum ratio, this is a greatly flexible fund. Based on a pre-set formula or fund manager’s inferences based on the current market trends, asset allocation funds can regulate the equity-debt distribution. It is almost like hybrid funds but requires great expertise in choosing and allocation of the bonds and stocks from the fund manager.

l. Gift Funds

Yes, you can also gift a mutual fund or a SIP to your loved ones to secure their financial future.

m. Exchange-traded Funds

It belongs to the index funds family and is bought and sold on exchanges. Exchange-traded Funds have unlocked a new world of investment prospects, enabling investors to gain extensive exposure to stock markets abroad as well as specialised sectors. An ETF is like a mutual fund that can be traded in real-time at a price that may rise or fall many times in a day.

Key takeaways

A derivative is a financial contract that derives its value from an underlying asset. The buyer agrees to purchase the asset on a specific date at a specific price. Derivatives are often used for commodities, such as oil, gasoline, or gold. Another asset class is currencies, often the U.S. dollar. There are derivatives based on stocks or bonds. They are complex financial instruments that are used for various purposes, including hedging and getting access to additional assets or markets.

Types of Derivatives

1. Forwards and futures

These are financial contracts that obligate the contracts’ buyers to purchase an asset at a pre-agreed price on a specified future date. Both forwards and futures are essentially the same in their nature. However, forwards are more flexible contracts because the parties can customize the underlying commodity as well as the quantity of the commodity and the date of the transaction. On the other hand, futures are standardized contracts that are traded on the exchanges.

2. Options

Options provide the buyer of the contracts the right, but not the obligation, to purchase or sell the underlying asset at a predetermined price. Based on the option type, the buyer can exercise the option on the maturity date (European options) or on any date before the maturity (American options).

3. Swaps

Swaps are derivative contracts that allow the exchange of cash flows between two parties. The swaps usually involve the exchange of a fixed cash flow for a floating cash flow. The most popular types of swaps are interest rate swaps, commodity swaps, and currency swaps.

Advantages of Derivatives

Unsurprisingly, derivatives exert a significant impact on modern finance because they provide numerous advantages to the financial markets:

1. Hedging risk exposure

Since the value of the derivatives is linked to the value of the underlying asset, the contracts are primarily used for hedging risks. For example, an investor may purchase a derivative contract whose value moves in the opposite direction to the value of an asset the investor owns. In this way, profits in the derivative contract may offset losses in the underlying asset.

2. Underlying asset price determination

Derivatives are frequently used to determine the price of the underlying asset. For example, the spot prices of the futures can serve as an approximation of a commodity price.

3. Market efficiency

It is considered that derivatives increase the efficiency of financial markets. By using derivative contracts, one can replicate the payoff of the assets. Therefore, the prices of the underlying asset and the associated derivative tend to be in equilibrium to avoid arbitrage opportunities.

4. Access to unavailable assets or markets

Derivatives can help organizations get access to otherwise unavailable assets or markets. By employing interest rate swaps, a company may obtain a more favourable interest rate relative to interest rates available from direct borrowing.

Disadvantages of Derivatives

Despite the benefits that derivatives bring to the financial markets, the financial instruments come with some significant drawbacks.

1. High risk

The high volatility of derivatives exposes them to potentially huge losses. The sophisticated design of the contracts makes the valuation extremely complicated or even impossible. Thus, they bear a high inherent risk.

2. Speculative features

Derivatives are widely regarded as a tool of speculation. Due to the extremely risky nature of derivatives and their unpredictable behaviour, unreasonable speculation may lead to huge losses.

3. Counter-party risk

Although derivatives traded on the exchanges generally go through a thorough due diligence process, some of the contracts traded over-the-counter do not include a benchmark for due diligence. Thus, there is a possibility of counter-party default.

In the Indian derivatives market, trade takes place with the help of derivative securities. Such derivative securities or instruments are forward, futures options and swaps. Participants in derivatives securities not only trade in these simple derivative securities but also trade hybrid derivative instrument. Derivatives market in India has a history dating back in 1875. The Bombay Cotton Trading Association started future trading in this year. History suggests that by 1900 India became one of the world’s largest futures trading industry. However after independence, in 1952, the government of India officially put a ban on cash settlement and options trading. This ban on commodities future trading was uplift in the year 2000. The creation of National Electronics Commodity Exchange made it possible. In 1993, the National stocks Exchange, an electronics based trading exchange came into existence. The Bombay stock exchange was already fully functional for over 100 years then. Over the BSE, forward trading was there in the form of Badla trading, but formally derivatives trading kicked started in its present form after 2001 only. The NSE started trading in CNX Nifty index futures on June 12, 2000, based on CNX Nifty 50 index.

The main instruments for derivatives trading in India are future contracts, options contracts, swaps and etc. These instruments are originally meant for hedging purpose. However, their use for speculation can’t be ruled out.

1. Explaining a forward contract on the Indian derivatives market

Suppose you need to buy some gold ornaments say from a local jewellery manufacturer Gold Inc. Further, assume you need these gold ornaments some 3 months later in the month of October. You agree to buy the gold ornaments at INR 32000 per 10 gram on 15 October 2018. The current price, however, is INR 31800 per gram. This will be the forward rate or the delivery price four months from now on the delivery date from the Gold Inc. This illustrates a forward contract. Please note that during the agreement there is no money transaction between you and Gold Inc. Thus during the time of the creation of the forward contract no monetary transaction takes place. The profit or loss to the Gold Inc. depends rather, on the spot price on the delivery date. Now assume that the spot price on delivery day becomes INR 32100 per 10 gram. In this situation, Gold Inc will lose INR 100 per 10 gram and you will benefit the same on your forward contract. Thus, the difference between the spot and forward prices on the delivery day is the profit/loss to the buyer/seller.

2. How future contracts differs forward contracts on Indian derivative market?

Along with some exception to forward contracts, there are future contracts. What makes future differ forward contracts is that we trade future on stock exchanges while forward on the OTC market. OTC or the over the counter market is a marketplace for typically forward contracts. Another distinction relates to the settlement of the contracts. While futures, in general, settle daily whereas forwards settles on expiration. The daily settlement is technically known as marked-to-market.

3. Basics of options trading in the Indian derivatives market

Consider the same example. Let us now suppose that the seller Gold Inc. believes that the spot price may rise above INR 32000 per 10 gram during the forward contract agreement with you. So to limit loss, Gold Inc. purchases a call option for Rs. 105 at the exercise price of INR 32000 per 10 gram with the three months expiration date. The exercise price is technically known as a strike price. Similarly, the price of the call option is technically known as the option price or the premium. Actually, the call option gives the seller the right to buy the gold at the strike price on the expiration date. However, there is no obligation to buy on the expiration date. He may or may not exercise his right on the expiration date. For instance, if the spot price decline below INR 31800 our Gold Inc will choose not to exercise the option. In this way, his loss would be limited to the premium of INR 105 per 10 gram. In an alternative situation, when you expect the price to fall below the spot price in the future, you have the option to purchase put options. Buying a put option provides you the advantage to sell at the strike price on the expiration date. Here also you have no obligation to exercise your right.

4. What are Swaps?

Swaps are derivatives instruments. The swaps contract involve an exchange of cash flows over time. Swaps are typically done between two parties. One party makes a payment to the other. This depends on whether a price is above or below a reference price. This reference price is the basis of the swap contract and is there is mention regarding it in the contract.

5. What is “Badla” trading?

The “Badla” trading is a mechanism of trade settlement in India. “Badla” is a Hindi term for carryover transactions. This kind of trading facilitates trade shares on the margin on the Bombay Stock Exchange. Further, it also allows to carry forward the positions to the next settlement cycle. There was no fixed expiration date, contract terms for such carryover transactions. Also, no standard margin requirement was there. Moreover, earlier such transactions were carry forward indefinitely. But this was later fixed for a maximum period of 90 days. The SEBI put a complete ban on Badla trading in 2001 with the introduction of futures trading.

Key takeaways-

References:

1. Jones, C.P. Investments Analysis and Management, Wiley, 8th ed.

2. Chandra, Prasanna. Investment Analysis and Portfolio Management. McGraw Hill Education.

3. Rustogi, R.P. Fundamentals of Investment. Sultan Chand & Sons, New Delhi.

4. Vohra N.D. & Bagri B.R., Futures and Options, McGraw Hill Education.