Unit 5

Liquidation of Companies

Winding up is a means to dissolve a company and realize and use its assets in the payments of debt. After satisfaction of the debts, the remaining balance, if any, is paid back to the members in proportion to the contribution made by them to capital of the company. The winding up of a company is the process whereby its life is ended, and its property is administered for the benefit of its creditors and members. An administrator, called a liquidator, is appointed and he takes control of the company, collects its assets, pays its debts and finally distributes any surplus among the members in accordance with their rights.

As per SECTION 2(94A) of the Companies Act,2013, “winding up” means winding up under this Act or liquidation under the Insolvency and Bankruptcy Code, 2016.

Thus, winding up ultimately leads to the dissolution of the company. In between winding up and dissolution, the legal entity of the company remains, and it can be sued in Tribunal of Law.

Winding up V. Liquidation:

Commonly, the expression “winding up” and “liquidation” are used interchangeably; however, there exist a line of difference between the two expressions. Winding up is a process of ending all the business affairs of the company and liquidation refers to selling off the assets of the company.

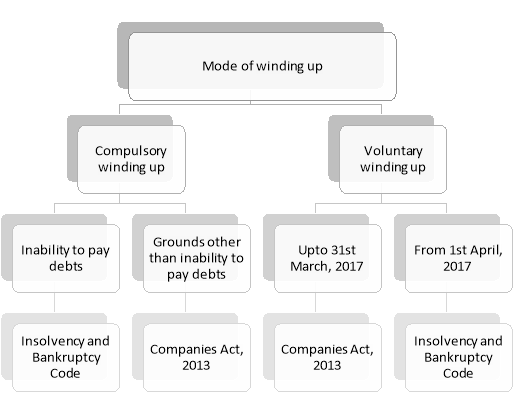

Modes [S.270]

Statement of Affairs [S.274]

Petition by Company:

In case of winding up by Tribunal, Section 272(5) of the Companies Act, 2013 provides that a petition presented by the company for winding up before the Tribunal shall be admitted only if accompanied by a statement of affairs in such form and in such manner as may be prescribed.

Petition by Others:

In accordance with Section 274(1), where a petition for winding up is filed before the Tribunal by any person other than the company, the Tribunal shall, if satisfied that a prima facie case for winding up of the company is made out, by an order direct the company to file its objections along with the statement of its affairs within thirty days of the order in such form and in such manner as may be prescribed. The Tribunal may allow a further period of thirty days in a situation of contingency or special circumstances.

Procedure/Contents:

The broad lines on which the Statement of Affairs is prepared are the following:

If a minus balance emerges, there would be deficiency as regards creditors, otherwise there would be surplus.

e. The amount of total paid-up capital should be added, and the figure emerging will be deficiency as regards members.

Lists:

Statement of Affairs should accompany eight lists:

b. Liabilities:

c. Share Capital:

d. Deficiency/ Surplus:

Deficiency Account

The official liquidator will specify a date for period beginning with the date on which information is supplied for preparation of an account to explain the deficiency or surplus. On that date either assets would exceed capital plus liabilities, that is, there would be a reserve or there would be a deficit or debit balance in the Profit and Loss Account. The deficiency account is divided into two parts:

If the total of the first exceeds that of the second, there would be a deficiency to the extent of the difference, and if the total of the second part exceeds that of the first, there would be a surplus.

Liquidators Final Statement of Account

While preparing the liquidators statement of account, receipts are shown in the following order:

2. Payments:

Payments are made and shown in the following order:

f. Preferential shareholders; and

g. Equity shareholders.

3. Partly paid shares:

In case of partly paid shares, it should be seen whether any amount is to be called up on shares. Firstly, the equity shareholders should be called up to pay necessary amount if creditors claim/claims of preference shareholders cannot be satisfied with the amount. Preference shareholders would be called upon to contribute for paying off creditors.

4. Loss of Shareholders:

The loss is suffered by each class of shareholders, i.e. the amount that cannot be repaid, should be proportionate to the nominal value of the share. The shares have nominal value of Rs. 80 per share and other set has paid Rs. 60 per share. Suitable adjustment will have to be made in cash in such a case; the latter set must contribute Rs. 20 first; or the first set must be paid Rs. 20 first.

Liquidators Final Statement of Account (Format)

Liquidators Final Statement of Accounts

Receipts | Amount (in Rs.) | Payment | Amount (in Rs.) |

To Assets Realized: | xx | By Legal Charges | xx |

- Land & Building | xx | By Liquidation expenses | xx |

- Plant & Machinery | xx | By Liquidator’s Remuneration | xx |

- Furniture | xx | By Preferential creditors (unsecured) | xx |

- Debtors | xx | By Debenture holders (having a floating charge on assets of the Co.): |

|

- Stock | xx | - Principle | xx |

- Investment | xx | - Outstanding Interest | xx |

- Cash in Hand | xx | By unsecured Creditors | xx |

- Cash at Bank | xx | By Preference Shareholder’s |

|

To Surplus from assets held by secured creditors | xx | - Principle | xx |

To Proceeds on call made on: |

| - Dividend in arrears | xx |

- Equity Shares | xx | By Equity Shareholder’s | xx |

- Preference shares | xx |

|

|

|

|

|

|

| xxx |

| xxx |

|

|

|

|

Key takeaways:

References:

Solved Examples

Q.1

From the following particulars, prepare a Statement of Affairs and the Deficiency of the Equipment Ltd., which went into liquidation on December 31, 2016:

| Rs | Rs | ||||

3,000 equity shares of 100 each, Rs 80 paid-up |

| 2,40,000 | ||||

6% 1,000 preference shares of Rs 100 each fully paid-up | 1,00,000 |

| ||||

Less : Calls in arrear | (5,000) | 95,000 | ||||

5% Debentures having a floating charge on the |

|

| ||||

assets (interest paid upto June 30, 2016) |

| 1,00,000 | ||||

Mortgage on Land & Buildings |

| 80,000 | ||||

Trade Creditors |

| 2,65,500 | ||||

Owing for wages |

| 20,000 | ||||

Secretary’s salary (@ Rs 500 p.m.) owing |

| 3,000 | ||||

Assets | Estimated to produce | Book value | ||||

| Rs | Rs | ||||

Land & Building | 1,30,000 | 1,20,000 | ||||

Plant | 1,30,000 | 2,00,000 | ||||

Tools | 4,000 | 20,000 | ||||

Patents | 30,000 | 50,000 | ||||

Stock | 74,000 | 87,000 | ||||

Investments in the hands of a |

|

| ||||

Bank for an overdraft of Rs 1,90,000 | 1,70,000 | 1,80,000 | ||||

Book Debts | 60,000 | 90,000 | ||||

On 31st December, 2011 the balance sheet of the company showed a general reserve of Rs 40,000 accompanied by a debit balance of Rs 25,000 in the Profit & Loss Account.

In 2012 the company made a profit of Rs 40,000 and declared a dividend of 10% on equity shares. The company suffered a total loss of Rs 1,09,000 besides loss of stock due to fire of Rs 40,000 during 2013, 2014 and 2015. For 2016 accounts were not made.

The cost of winding up is expected to be Rs 15,000.

Solution:

Statement of Affairs on 31 December, 2016, the date of winding up

Estimated realisable value

Assets | Rs |

Assets not specifically pledged (as per list A) |

|

Trade debtors | 60,000 |

Stock in trade | 74,000 |

Plant | 1,30,000 |

Tools | 4,000 |

Patents | 30,000 |

Unpaid calls | 5,000 |

| 3,03,000 |

Assets specifically pledged (as per list B) |

| ||||||

| Estimated Realisation | Due to Secured Creditors | Deficiency Ranking as Unsecured Creditors | Surplus carried to the last column |

| ||

| Rs | Rs | Rs | Rs | |||

Investments | 1,70,000 | 1,90,000 | 20,000 |

50,000 |

| ||

Land & Building | 1,30,000 | 80,000 |

| ||||

| 3,00,000 | 2,70,000 |

|

|

| ||

| Estimated surplus from assets specifically pledged | 50,000 | |||||

| Estimated total assets available for preferential creditors, debenture holders and unsecured creditors | 3,53,000 | |||||

| Summary of Gross Assets: |

| |||||

| Gross realisable value of - assets specifically charged |

|

|

3,00,000 |

| ||

| others assets |

|

|

| 3,03,000 |

| |

|

|

|

|

| 6,03,000 |

| |

| Estimated total assets available for preferential creditors, debenture holders, bank overdraft and unsecured creditors brought forward |

3,53,000 | |||||

Gross Liabilities | Liabilities |

|

| ||||

Rs |

| Rs | Rs | ||||

2,50,000 | Secured creditors (as per List B) to the extent to which claims are estimated to be covered by assets specifically pledge |

|

|

| |||

22,000 | Preferential creditors as per list C (20,000 +2,000) |

| 22,000 | ||||

| Estimated balance of assets available for |

|

| ||||

| Debenture holders, Bank & unsecured |

|

|

| |||

| creditors |

|

|

|

| 3,31,000 | |

1,02,500 | Debenture holders secured by a floating |

|

(1,02,500) |

| charge as per list D |

| |

| Surplus as regards debenture holders |

| 2,28,500 |

| Unsecured creditors as per list E |

|

|

| Estimated unsecured balance of claim of creditors partly secured on |

|

|

| specific assets | 20,000 |

|

| Trade creditors | 2,65,500 |

|

2,92,500 | Outstanding expenses | 7,000 | 2,92,500 |

| Estimated deficiency as regards creditors |

|

|

| being the difference between gross |

|

|

| liabilities and gross assets |

| 64,000 |

6,67,000 |

|

|

|

| Issued & Called up Capital: |

|

|

3,000 Equity shares or Rs 100 each, Rs 80 paid | 2,40,000 |

| |

6% 1,000 preference shares of Rs 100 each fully called |

1,00,000 |

3,40,000 | |

Estimated Deficiency as regards members as per list H |

|

4,04,000 |

Note:

(i) The above is subject to cost to winding up estimated at Rs 15,000 and to any surplus in deficiency on trading realisation of assets.

(ii) There are 3,000 shares unpaid @ Rs 20 per share liable to be called up.

List H - Deficiency Account

- Excess of capital & liabilities over assets on 1-1-2014 Nil

- Net dividend & bonuses during the period Jan.-Dec. 2014 29,700

- Net trading losses after charging depreciation, taxation,

interest on debentures, etc. during the same period

(Rs 1,09,000 + Rs 1,31,300) 2,40,300

4. Losses other than trading losses written off or for which

provision has been made in the books during the same

period - stock loss. 40,000

5. Estimated losses now written off or for which

provision has been made for the purpose of preparing

the statement :

Rs

Plant 70,000

Tools 16,000

Patents 20,000

Stock 13,000

Investments 10,000

Debtors 30,000 1,59,000

6. Other reducing items contributing to deficiency NIL

4,69,000

B. Items reducing Deficiency

7. Excess of assets over capital and liabilities on 1st Jan. 2012 15,000

8. Net trading profit during the period 1st Jan. 2010 to

31st Dec. 2012 40,000

9. Profit & Incomes other than trading profit during the

same period

10. Other items Deficiency - Profit expected on

Land & Building 10,000

65,000

Deficiency as shown by the statement of Affairs (A) - (B) 4,69,000

4,04,000

Working Notes :

(1) Trial Balance to ascertain the amount of loss for 2016

| Dr. | Cr. |

Rs | Rs | |

Land & Building | 1,20,000 |

|

Plant | 2,00,000 |

|

Tools | 20,000 |

|

Patents | 50,000 |

|

Stock | 87,000 |

|

Investments | 1,80,000 |

|

Debtors | 90,000 |

|

Equity Capital |

| 2,40,000 |

6% Preference share capital |

| 95,000 |

5% Debentures |

| 1,00,000 |

Interest Outstanding |

| 2,500 |

Mortgage on Land & Building |

| 80,000 |

Trade Creditors |

| 2,65,500 |

Owing for Wages |

| 20,000 |

Secretary’s Salary |

| 3,000 |

Managing Director’s Salary |

| 6,000 |

Bank Overdraft |

| 1,90,000 |

Profit & Loss Account on 1-1-2014 | 1,23,700 |

|

| 8,70,700 | 10,02,000 |

Loss for the year (balancing figure) | 1,31,300 | - |

| 10,02,000 | 10,02,000 |

Q.2

X Co. Ltd. went into voluntary liquidation on 1st April, 2017. The following balances are extracted from its books on that date :

|

|

|

|

Capital |

| Machinery | 90,000 |

24,000 Equity Shares of Rs 10 each | 2,40,000 | Leasehold properties | 1,20,000 |

Debentures (Secured by floating charge) | 1,50,000 | Stock | 3,000 |

Bank overdraft | 54,000 | Debtors | 1,50,000 |

Creditors | 60,000 | Investments | 18,000 |

|

| Cash in hand | 3,000 |

|

| Profit and loss account | 1,20,000 |

|

|

|

|

| 5,04,000 |

| 5,04,000 |

The following assets are valued as under:

| Rs |

Machinery | 1,80,000 |

Leasehold properties | 2,18,000 |

Investments | 12,000 |

Stock | 6,000 |

Debtors | 1,40,000 |

The bank overdraft is secured by deposit of title deeds of leasehold properties. There were preferential creditors amounting Rs 3,000 which were not included in creditors

Rs 60,000.

Prepare a statement of affairs to be submitted to the meeting of members/creditors.

Solution:

Statement of Affairs of X Co. Ltd. on the 1st day of April, 2017

Assets not Specifically Pledged: | Estimated realisable values | ||||

Cash in Hand |

|

|

| 3,000 | |

Investments |

|

|

| 12,000 | |

Debtors |

|

|

| 1,40,000 | |

Stock |

|

|

| 6,000 | |

Machinery |

|

|

| 1,80,000 | |

|

|

|

| 3,41,000 | |

Assets specifically pledged : |

|

|

|

| |

| (a) | (b) | (c) | (d) |

|

| Estimated Realisable Value | Due to Secured Creditors | Deficiency ranking as unsecured | Surplus carried to last column |

|

| Rs | Rs | Rs | Rs |

|

Leasehold Property | 2,18,000 | 54,000 | - | 1,64,000 |

|

| Estimated Surplus from Assets Specifically pledged | 1,64,000 | |||

| Estimated total assets available for Preferential creditors, debentures holders secured by floating charge, and unsecured creditors | 5,05,000 | |||

| Summary of Gross assets |

| |||

| Gross realisable value of assets |

| |||

| Specifically Pledged 2,18,000 |

| |||

| Other Assets 3,41,000 |

| |||

| Gross Assets 5,59,000 |

| |||

Rs | Gross Liabilities(to be deducted from surplus or added to deficiency as the case may be) |

| |||

| Secured creditors to the extent to which claims are estimated to be covered by assets |

| |||

54,000 | Specifically pledged |

| |||

3,000 | Preferential creditors | (3,000) | |||

| Balance available for Debenture Holders | 5,02,000 | |||

1,50,000 | Debentures (Payment) | (1,50,000) | |||

| Balance available for Creditors | 3,52,000 | |||

60,000 | Creditors | (60,000) | |||

2,67,000 | Estimated surplus as regards creditors [being difference between gross assets (d) and gross liabilities (e)] | 2,92,000 | |||

| Issued and called up capital 24,000 equity shares of Rs 10 each |

2,40,000 | |||

| Estimated surplus as regard members | 52,000 | |||

Q.3

M. Ltd. resolved on 31st December 2016 that the company be wound up voluntarily. The following was the trial balance extracted from its books as on that date:

| Rs | Rs |

Equity shares of Rs 10 each |

| 2,00,000 |

9% Preference shares of Rs 10 each |

| 1,00,000 |

Plant (less depreciation w/o Rs 85,000) | 2,15,000 |

|

Stock in trade | 2,50,000 |

|

Trade receivables | 55,000 |

|

Trade payables |

| 75,000 |

Bank balance | 74,000 |

|

Preliminary Expenses | 6,000 |

|

Profit & Loss A/c (balance on 1st January, 2016) |

| 30,000 |

Trading loss for the year 2016 | 24,000 |

|

Preference dividend for the year 2016 | 6,000 |

|

Outstanding Expenses (including mortgage interest) |

| 25,000 |

4% Mortgage loan |

| 2,00,000 |

Total | 6,30,000 | 6,30,000 |

On 1st January, 2017 the liquidator sold M. Ltd.’s Plant for Rs 2,05,000 and stock in trade for Rs 2,00,000. The sale was completed in January, 2017 and the consideration satisfied as to Rs 2,62,200 in cash and as to the balance in 6% Debentures of the purchasing company issued to the liquidator at a premium of 2%.

The remaining steps in the liquidation were as follows:

The liquidator realised Rs 52,000 out of the book debts and the cost of collection amounted to Rs 2,000.

The loan mortgage was discharged on 31st January, 2017 along with interest from 31st July, 2016. Creditors were discharged subject to 2% and outstanding expenses excluding mortgage interest were settled for Rs 2,000;

On 30th June 2017 six month’s interest on debentures was received from M. Ltd.

Liquidation expenses amounting to Rs 3,000 and liquidator’s remuneration of 3% on disbursements to members were paid on 30th June, 2017 when:

The preference shareholders were paid out in cash; and

The debentures on M. Ltd. and the balance of cash were distributed ratably among the equity shareholders.

Prepare the Liquidator’s Statement of Account showing the distribution.

Solution:

M. Ltd. (in liquidation)

Liquidator’s Statement of Account from 1st January, 2017 to 30th June, 2017

Reciepts | Rs | Rs | Payments | Rs | Rs |

Balance at Bank Realisation from: |

| 74,000 | Liquidator’s remuneration (3% on Rs 2,43, 398) Liquidation |

| 7302* |

Trade receivables M. Ltd. - |

| 52,000 |

|

|

|

Rs 1,40,000 6% |

|

| Expenses |

| 3,000 |

Debentures | 1,42,800 |

| Loan on mortgage with Accrued interest** |

| 2,04,000 |

Cash | 2,62,200 | 4,05,000 |

|

|

|

6 month’s interest on debentures |

| 4,200 | Creditors including Outstanding |

|

75,500 |

|

|

| Expenses |

|

|

Equity shareholders |

| 5,35,200 | Return contributors : |

|

|

Less: Cost of |

|

| 6% Preference share- |

|

|

Collection of Debts |

|

(2,000) | Holders Rs 10 per share |

| 1,00,000 |

|

|

| 6% Debentures | 1,42,800 |

|

|

|

| Cash (03 P. approx.) per share | 598 | 1,43,398 |

|

|

|

|

|

|

Total |

| 5,33,200 | Total |

| 5,33,200 |

*3/103 × 2,50,700 (i.e. Rs 5,32,000 less payments made to all creditors)

**It is assumed that loan is secured by a floating charge.

Q.4

Prakash Processors Ltd. went into voluntary liquidation on 31st December, 2016 when their Balance Sheet read as follows:—

Liabilities | Rs |

Issued and subscribed capital : |

|

5,000 10% cumulative preference shares |

|

of Rs 100 each, fully paid | 5,00,000 |

2,500 equity shares of Rs 100 each, Rs 75 paid | 1,87,500 |

7,500 equity shares of Rs 100 each, Rs 60 paid | 4,50,000 |

15% Debentures secured by a floating charge | 2,50,000 |

Interest outstanding on Debentures | 37,500 |

Creditors | 3,18,750 |

| 17,43,750 |

Assets |

|

Land and Building | 2,50,000 |

Machinery and Plant | 6,25,000 |

Patents | 1,00,000 |

Stock | 1,37,500 |

Trade receivables | 2,75,000 |

Cash at Bank | 75,000 |

Profit and Loss A/c | 2,81,250 |

| 17,43,750 |

Preference dividends were in arrears for 2 years and the creditors included Preferential creditors of Rs 38,000.

The assets realised as follows :

Land and Building Rs 3,00,000; Machinery and Plant Rs 5,00,000; Patents Rs 75,000; Stock Rs 1,50,000; Trade receivables Rs 2,00,000.

The expenses of liquidation amounted to Rs 27,250. The liquidator is entitled to a commission of 3% on assets realised except cash. Assuming the final payments including those on debentures is made on 30th June, 2017 show the liquidator’s Statement of Account.

Solution:

Prakash Processors Limited

Liquidator’s Statement of Account

Receipts | Rs | Rs | Payments | Rs | Rs |

To Assets realised - |

|

| By Liquidation expenses |

| 27,250 |

Bank |

| 75,000 | By Preferential creditors |

| 38,000 |

To Other assets: |

|

| By Liquidator’s |

| 36,750 |

Land etc. | 3,00,000 |

| Remuneration (W.N.1) |

|

|

Machinery etc. | 5,00,000 |

| By Debenture holders: |

|

|

Patents | 75,000 |

| Debentures | 2,50,000 |

|

Stock | 1,50,000 |

| Interest accrued | 37,500 |

|

Trade receivables | 2,00,000 | 12,25,000 | Interest 1/1/17-30/6/17 | 18,750 | 3,06,250 |

To Call on equity shareholders (7,500 × Rs 2.65) (1) |

| 19,875 | By Unsecured creditors |

| 2,80,750 |

|

|

|

To Preferential Shareholders : |

|

|

|

|

| Preference capital | 5,00,000 |

|

|

|

| Arrear of Dividend | 1,00,000 | 6,00,000 |

|

|

| By Equity Shareholders |

|

|

|

|

| (Rs 12.35 per share on 2500 shares) |

| 30,875 |

Total |

| 13,19,875 | Total |

| 13,19,875 |

Working Notes:

for the period 1-1-2017 to 30-6-2017 (250000 x 15% x 6/12) = Rs 18,750

3. Total equity capital - paid up Rs 6,37,500

Less : Balance available after payment to unsecured and

preference shares (13,00,000 — 12,89,000) Rs(11,000)

Loss to be borne by 10,000 equity shares Rs6,26,500

Loss per share (626500/10000) Rs 62.65

Hence, amount of call on Rs 60 paid up share (60-62.65) Rs 2.65

Refund to share on Rs 75 paid up share (75-62.65) Rs 12.35

Q.5

The following is the Balance Sheet of Confidence Builders Ltd., as at 30th Sept. 2016:

Liabilities |

| Rs | Asset | Rs |

Share Capital |

|

| Land and Buildings | 1,20,000 |

Issued : 11% Pref. Shares |

| Sundry Current Assets | 3,95,000 | |

of Rs 10 each | 1,00,000 | Profit and Loss Account | 38,500 | |

10,000 equity shares of |

| Debenture Issue |

| |

Rs 10 each, fully paid up | 1,00,000 | expenses not written off | 2,000 | |

5,000 equity shares of |

|

|

| |

Rs 10 each, Rs 7.50 per |

|

|

| |

share paid up | 37,500 |

|

| |

13% Debentures | 1,50,000 |

|

| |

Mortgage Loan |

| 80,000 |

|

|

Bank Overdraft |

| 30,000 |

|

|

Creditors for Trade |

| 32,000 |

|

|

Income-tax arrears : |

|

|

|

|

(assessment concluded |

|

|

|

|

in July 2012) |

|

|

|

|

Assessment year 2014- 2015 | 21,000 |

|

|

|

Assessment year 2015- 2016 | 5,000 | 26,000 |

|

|

|

| 5,55,500 |

| 5,55,500 |

Mortgage loan was secured against land and buildings. Debentures were secured by a floating charge on all the other assets. The company was unable to meet the payments and therefore the debenture holders appointed a Receiver for the Debenture holders brought the land and buildings to auction and realized Rs 1,50,000. He also took charge of Sundry assets of value of Rs 2,40,000 and realized Rs 2,00,000. The Bank Overdraft was secured by a personal guarantee of two of the Directors of the Company and on the Bank raising a demand, the Directors paid off the due from their personal resources. Costs incurred by the Receiver were Rs 2,000 and by the Liquidator Rs 2,800. The Receiver was not entitled to any remuneration but the liquidator was to receive 3% fee on the value of assets realised by him. Preference shareholders had not been paid dividend for period after 30th September 2014 and interest for the last half year was due to the debenture holders. Rest of the assets were realised at Rs 1,00,000.

Prepare the accounts to be submitted by the Receiver and Liquidator.

Solution:

Receiver’s Receipts and Payments Account

|

| Rs |

|

| Rs |

Sundry Assets realised |

1,50,000 | 2,00,000 | Costs of the Receiver |

- | 2,000 |

Surplus received from | Preferential payments |

| |||

mortgage | Creditors paid Taxes |

| |||

Sale Proceeds of land and building | raised within 12 months | 26,000 | |||

Less: Applied to discharge of mortgage loan |

(80,000)

|

70,000

| Debentures holders Principal Interest for half year |

1,50,000 9,750 |

1,59,750 |

|

|

| Surplus transferred to the Liquidator |

|

82,250 |

Total |

| 2,70,000 | Total |

| 2,70,000 |

Liquidator’s Final Statement of Account

| Rs |

| Rs | |

Surplus received from |

| Cost of Liquidation |

| 2,800 |

Receiver | 82,250 | Remuneration to Liquidator (1,00,000 x 3%) | 3,000 | |

Assets Realised | 1,00,000 | Unsecured Creditors : |

| |

Calls on Contributories : |

| for Trade | 32,000 |

|

On holder of 5,000 |

| Directors for payment |

| |

at the rate of |

| of Bank O/D |

|

|

Rs 2.17 per share | 10,850 |

| 30,000 | 62,000 |

|

| Preferential Shareholders: |

| |

|

| Principal | 1,00,000 |

|

|

| Arrears of |

|

|

|

| Dividends | 22,000 | 1,22,000 |

|

| Equity shareholder : |

|

|

|

| Return of money to |

|

|

|

| contributors to holders |

| |

|

| of 10,000 shares at 33 |

| |

|

| paise each |

| 3,300 |

| 1,93,100 |

|

| 1,93,100 |

Working Note:

Call from partly paid shares |

|

Deficit before call from Equity Shares (1,82,250 — 1,89,800) | (7,550) |

Notional call on 5,000 shares @ 2.50 each | 12,500 |

Net balance after notional call | 4,950 |

No. of shares deemed fully paid | 15000 |

Refund on fully paid shares (4950/15000) | 0.33 paise |

Calls on party paid share (2.50 - 0.33) | 2.17 |