Unit 4

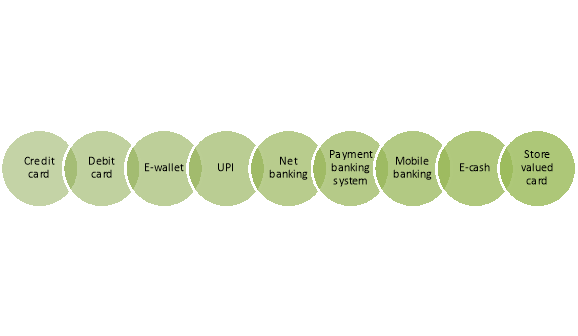

Mechanism of making payment through internet

The online payment mechanism refers to the organised platform for transfer or payment of money using internet. The methods for online payment are-

Figure: Online payment mechanism

- Credit card: The credit card holders able to make online payment to the vendor for purchase of product/services where banks allowed credit to the card holders. The credit card holder will return the amount to the bank later.

- Debit card: The debit card holder makes online payment out of the credit balance of the account for purchase of product or service.

- E-wallet: E-wallet or digital currency is software where the user can add money digitally from his respective bank account. Such digital money is used by the user to make payment electronically for purchase of any product/service. For example, Google wallet, Paytm, Apple pay etc.

- UPI: Unified Payments Interface is a real-time payment system developed by National Payment Corporation of India to facilitate interbank transactions. Under this software multiple bank accounts is added from which financial transactions are made. For example, BHIM UPI, Amazon UPI etc.

- Net banking: Under Net banking/Internet banking/Online banking system, the banker facilitates the bank customers to use the banking services through internet without visiting to the banks in person.

- Payment banking system: It is the application software used in mobile phones which facilitates to deposit, transfer of money digitally by linking the respective bank account of customer. Indian post payment bank, Airtel money, Jio payment bank, Google pay, etc. are some of the examples of payment bank.

- Mobile banking: It is the application software designed for specific banks and installed in mobile phones which facilitates real time payment system and other banking services to bank customers. For example, SBI YONO, U-mobile, PNB ONE etc.

- E-cash: E-cash or electronic cash is the digital money that facilitates to make payment digitally without using hard cash.

- Store valued card: It is a payment system where a specific amount is stored. By using this card one can make payment for the purchases made. For example gift card of online shopping sites.

Key takeaways

- The online payment mechanism refers to the organised platform for transfer or payment of money using internet. It involves payment through credit card, debit card, UPI, net banking, payment paynking, mobile banking etc.

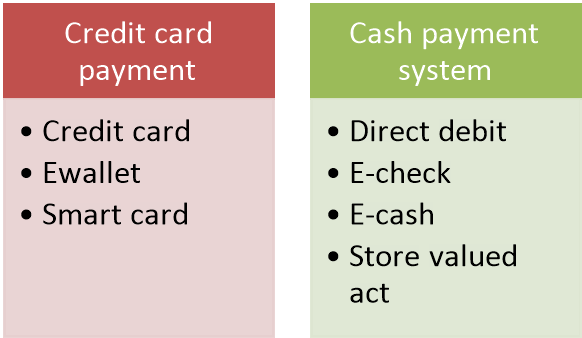

An e-payment system is a way of making transactions or paying for goods and services through an electronic medium, without the use of checks or cash. The electronic payment system has grown increasingly over the last decades due to the growing spread of internet-based banking and shopping. As the world advances more with technology development, we can see the rise of electronic payment systems and payment processing devices. As this increase, improve, and provide ever more secure online payment transactions the percentage of check and cash transactions will decrease. One of the most popular payment forms online are credit and debit cards. Besides them, there are also alternative payment methods, such as bank transfers, electronic wallets, smart cards or bit coin wallet (bit coin is the most popular crypto currency). The classification of Electronic payment system are-

Figure: Electronic payment system

1. Credit Payment System

a) Credit Card — A form of the e-payment system which requires the use of the card issued by a financial institute to the cardholder for making payments online or through an electronic device, without the use of cash.

b) E-wallet — A form of prepaid account that stores user’s financial data, like debit and credit card information to make an online transaction easier.

C Smart card — A plastic card with a microprocessor that can be loaded with funds to make transactions; also known as a chip card.

2. Cash Payment System

a) Direct debit — A financial transaction in which the account holder instructs the bank to collect a specific amount of money from his account electronically to pay for goods or services.

b) E-check — A digital version of an old paper check. It’s an electronic transfer of money from a bank account, usually checking account, without the use of the paper check.

c) E-cash is a form of an electronic payment system, where a certain amount of money is stored on a client’s device and made accessible for online transactions.

d) Stored-value card — A card with a certain amount of money that can be used to perform the transaction in the issuer store. A typical example of stored-value cards are gift cards.

Advantages of electronic payment system

The electronic payment system is growing rapidly due to its convenience of making payment easily without holding hard cash. Some of the advantages of such electronic payment system are discussed below-

1. Instant Payment

Electronic payments are much faster than the traditional methods of payments such as cash or cheques. People can easily make payments at anytime from anywhere across the globe. E-payment systems have eliminated the need for going to the banks to make payments. Now the customers do not have to waste their time standing in the long lines at banks. They can easily pay by using an electronic payment app.

2. Higher payment security

Electronic payment systems offer the multiple ways of securing the payments such as tokenization, encryption, SSL, etc. Now the customers do not have to enter their card details every time as they can save their card details or complete their transactions by using a One Time Password.

3. Customer convenience

Electronic payments can help to provide convenient payment experience to the customers. It allows the customer to purchase goods on credit by offering them with the pay later facility.

4. It saves processing costs

If the banker wants to provide payment services to the customers then they first need to tie up with a card processor. The processor will provide them with a payment gateway for processing and in exchange, it will charge a fixed cost from them. This cost is very high. On the other hand, if they are using an electronic payment system in the business then they do not have to incur such high charges.

5. Lowers risk of theft

The risk of holding cash can be decreased if they are using a secure electronic payment system in their business. By using it, the service provider does not have to worry about the payment record. They can easily get an accurate record of all the transactions at the end of the day.

6. Transparent

Transparency becomes an essential factor when it comes to payments. And when they are using the digital medium for accepting payments, then it becomes essential for them to maintain transparency in their transactions. In the case of electronic payments, they do not have to worry about the record of their payment details. Also, the payment details can be shared to the customers.

7. Promotes contactless transactions

In the times of the COVID-19 pandemic, people have started finding ways of avoiding human touch to save themselves from getting affected by the coronavirus. Due to this, the need for contactless payments has increased. The use of contactless POS terminals in the business to avoid the human touch. In this system, the payee needs to hold his phone near the terminal and his payment will get automatically processed. The customers can also make payments by using QR codes or One Time Passwords (OTP).

Disadvantages of online payments

Online payment methods have several disadvantages. Some of them are:

- Service fees

Payment gateways and third-party payment processors charge service fees.

2. Inconvenient for offline sales

Online payment methods are inconvenient for offline sales.

3. Vulnerability to cybercriminals

Cybercriminals can disable online payment methods or exploit them to steal people’s money or information. Visit the Australian Cybercrime Reporting Network’s Learn about cybercrime page to learn more about cybercrime.

4. Reliance on telecommunication infrastructure

Internet and server problems can disable online payment methods.

5. Technical problems

Online payment methods can go down due to technical problems.

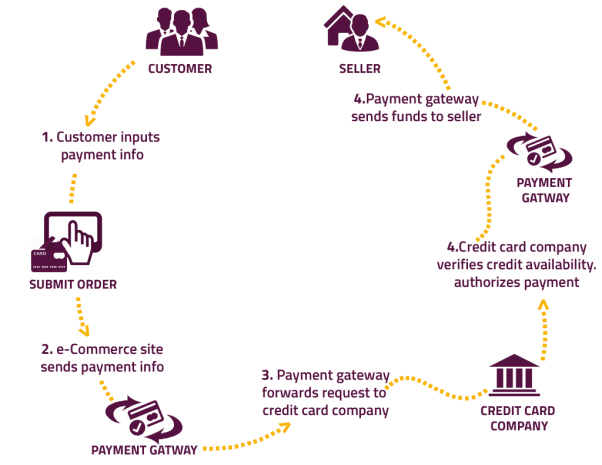

Payment gateway is the technology that enables the merchants to accept safely and securely payment from customers with the help of debit card or credit card or any other online payment method. It facilitates ecommerce applications and other retail stores to accept payments digitally. Amazon payments, Paysimple, Wepay etc. are some of the examples of payment gateway. The figure shows the payment gateway system.

Fig : Payment Gateway system

Source: www.mxicoders.com

The steps involved in payment gateway process are-

- The customer inputs payment details such as bank name, card number, account number, amount, password, pin etc. to the shopping site or retail store.

- The ecommerce website/ device send information to the payment gateway for verification of payment details of the payer.

- On receipt of information, the payment gateway forward request to the credit card company/bank.

- On receipt of request, the credit card company/bank verifies the availability of balance in respective account of the customer and authorises payment to the payment gateway.

- On receipt of authorisation from bank/credit Card Company for payment, the payment gateway finally sends the funds to the respective seller.

The benefits of payment gateway are-

- A payment gateway checks and validates online transactions between merchants and customers.

- It is convenient to use because anyone with basic computer knowledge can perform business transactions using payment gateways.

- It offers lots of customizable features like security features, payment option choices, card features etc. that could greatly benefit merchants and customers.

- It supports ecommerce to grow day by day by facilitating convenient and secured payment system.

- It helps the banking sector to develop online banking services by providing innovative banking services.

Key takeaways

- Payment gateway is the technology that enables the merchants to accept safely and securely payment from customers with the help of debit card or credit card or any other online payment method.

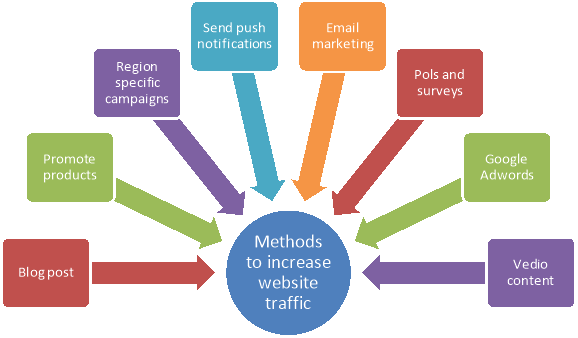

Visitors to website indicate the persons visiting the website daily or from time to time for using the services or for purchasing the products of any company or for getting any material information. Frequent visit to website or huge traffic in website indicates the good brand image of the company. The ecommerce site must put continuous and effective effort to increase the number of visitors to the website. Some of the effective methods to increase website traffic are-

Figure: Methods to increase website traffic

- Blog Posts: It can post blogs about some selected products with their reviews, tutorials, news pieces and other informative articles about these products.

- Promote Products: It must promote products based on the consumer interest. It will attract customers to visit the website for purchase or to get the information.

- Region Specific Campaigns: Region specific campaign allows the ecommerce sites to influence the geographical different customers by influencing their regional sentiments.

- Send Push Notifications: It sends push notifications to their smart phones, laptops etc. to induce them to visit the website.

- Email marketing: It sends notifications through emails about the availability of product/service, discount, rebate etc. over such product/service which induces the customer to visit ecommerce site.

- Polls and Surveys: It can run polls and surveys to ask the visitors which products they like, how was their experiences, would they recommend them to others, and other similar questions. It will increase the interest of customers about the site and motivate them to visit frequently.

- Invest in Google Adwords: Google Adwords is a pay-per-click advertising method designed to attract more people to the ecommerce site. The benefits are-

- Show the ecommerce shop’s ads in Google search results.

- Display text or banner ads in Gmail, on websites, or in apps.

- Showcase video ads on YouTube and target your audience based on their interests or demographics data including age and location.

- Promote your online store’s app across Android and ios devices.

8. Video Content: By publishing video content like product reviews, comparison videos, unboxing, or demonstrating a product, ecommerce site can target and attract a different audience and increase the flow of visitors to the website.

Key takeaways

- Visitors to website indicate the persons visiting the website daily or from time to time for using the services or for purchasing the products of any company or for getting any material information. Frequent visit to website or huge traffic in website indicates the good brand image of the company. The ecommerce site must put continuous and effective effort to increase the number of visitors to the website.

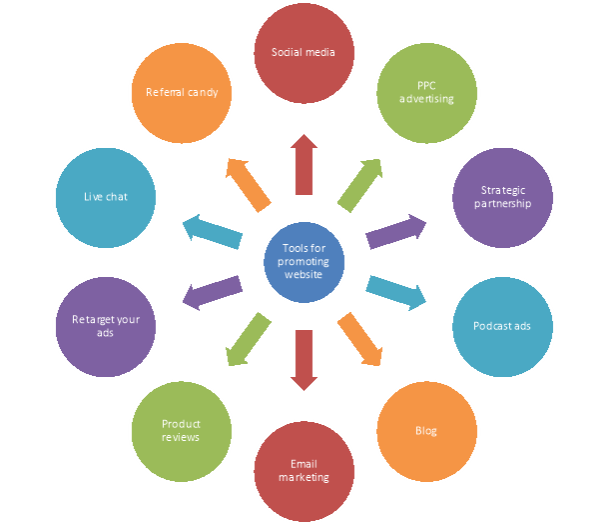

Ecommerce websites adopts certain promotional tools to promote their website in the market. Some of the significant tools are-

Figure: Tools for promoting website

- Social media: It is one of the effective platforms to promote the ecommerce website. Videos, cookies, push notifications etc. about the ecommerce website in social media platforms like facebook, instagram, youtube, linkdin etc. is an effective promotional tool because such social media platforms are used a large number of people.

- PPC (pay per click) advertising: It is a type of marketing where companies pay for every click that their advertisement receives. Google adwords is a type of pay-per-click advertising method designed to attract more people to the ecommerce site.

- Strategic partnerships: Ecommerce websites form partnership with blogs where content writings are posted about the ecommerce websites. By having the website featured in a post on a popular site, the website can drive thousands of targeted visitors to the ecommerce site.

- Podcast ads: Podcast add refers to advertise about brand/company on a podcast i.e., audio show downloaded or streamed for the internet. It provides information about the product, experiences etc. of others users. It helps to promote about the ecommerce website among the target group.

- Blog: Ecommerce websites can launch blogs to provide their buyers with valuable content and build trust in their brand. Promotion via blogging is effective as content can be posted and shared on social media and drive traffic through search engines.

- Email promotions: Promotion via email is an easy way to target buyers with by informing them about the preferred products/services.

- Product reviews: Reviews are helpful for potential buyers to make purchase decision by reading the reviews posted by other users. Positive reviews are helpful for promotion of website.

- Retarget your ads: This method places a cookie from the ecommerce site on visitors’ computers. When they go to another site later, the cookie enables ads to show up for earlier ecommerce products.

- Live chat: Live Chat tool helps businesses to keep a clear line of communication with their customers. With the help of live chat businesses helps customers to find right product, provide technical support and other necessary services.

- Referral Candy: It is the word of mouth promotion of website where reward is provided to the one for referring to his friend about the ecommerce website.

Key takeaways

- Some of the significant tools are social media, PPC, blog, referral candy, live chat, podcast ad, email promotion etc.

1. Debit card

A debit card is a payment card that promotes electronic or e banking. Under this system, the card holder able to withdraw or make payment up to the debit balance in respective account of the customer. In India ATM card is the debit card. Some of the examples of debit card are rupay, visa debit, mastercard, mastero, mastercard cirruss, mastercard Titanium etc.

How a Debit Card Works

A debit card is usually a rectangular piece of plastic, resembling any charge card. It is linked to the user's checking account at a bank or credit union. The amount of money that can be spent with it is tied to the account size (the amount of funds in the account). In a sense, debit cards work as a cross between ATM cards and credit cards. You can use them to get cash from a bank's automated teller machine, as with the former; or you can make purchases with them, like the latter. In fact, many financial institutions are replacing their plain vanilla, single-purpose ATM cards with debit cards that are issued by major card-payment processors such as Visa or Mastercard. Such debit cards come automatically with your checking account. Whether being used to obtain cash or to buy something, the debit card functions in the same way: It draws the funds immediately from the affiliated account. So, your spending is limited to what’s available in your checking account, and the exact amount of money you have to spend will fluctuate from day to day, along with your account balance. Debit cards usually have daily purchase limits as well, meaning you can't spend more than a certain amount with them in one 24-hour period. Debit card purchases can be made with or without a PIN. If the card has a major payment processor’s logo, it often can be run without one, just as a credit card would be.

2. Credit card

Credit card is a form of plastic money that promotes electronic payments. A credit card is a thin rectangular piece of plastic or metal issued by a bank or financial services company that allows cardholders to borrow funds with which to pay for goods and services with merchants that accept cards for payment. Most major credit cards—which include Visa, Mastercard, Discover and American Express—are issued by banks, credit unions or other financial institutions. Credit cards impose the condition that cardholders pay back the borrowed money, plus any applicable interest, as well as any additional agreed-upon charges, either in full by the billing date or over time. Credit cards typically charge a higher annual percentage rate (APR) versus other forms of consumer loans. Interest charges on any unpaid balances charged to the card are typically imposed approximately one month after a purchase is made (except in cases where there is a 0% APR introductory offer in place for an initial period of time after account opening), unless previous unpaid balances had been carried forward from a previous month—in which case there is no grace period granted for new charges. By law, credit card issuers must offer a grace period of at least 21 days before interest on purchases can begin to accrue. That is why paying off balances before the grace period expires is a good practice when possible. It is also important to understand whether your issuer accrues interest daily or monthly, as the former translates into higher interest charges for as long as the balance is not paid. This is especially important to know if you're looking to transfer your credit card balance to a card with a lower interest rate. Mistakenly switching from a monthly accrual card to a daily one may potentially nullify the savings from a lower rate.

Working process of credit card

The concepts associated with credit card are-

1. Merchant- The merchant or shopkeeper is the one from whose place the purchase is made

2. Acquirer Bank- The merchant’s bank is the acquirer bank

3. Network- This network helps in facilitating the transaction. The common ones are Visa or Mastercard

4. Issuer Bank- It is the bank that will provide you with the credit card

The working process of credit card is

Figure: Working process of credit card

- Authorization

The shopkeeper will swipe the card or insert it into a POS machine. The merchant will be asked to enter a PIN. The network will check whether there is sufficient balance in the account and if yes, the transaction will be authorised.

2. Batching

All the receipts collected by the merchant in the day are sent to the acquirer bank for receiving the payment.

3. Clearing

The acquirer bank via the network sends a request to the respective issuer bank. The issuer bank upon deducting the interchange fees pays the balance amount to the acquirer bank.

4. Funding

After receiving the payment the acquirer bank will deduct the merchant fees and pay to the merchant.

Key takeaways-

- A debit card or credit card is a payment card that promotes electronic or e banking.

References-

- Kotlar, P. (2019). Marketing management (4th edition.). New Delhi, Pearson Education India.

- Securionpay.com

- Www.business.com

- Www.mimeo.com