Unit 5

Leasing and Hire–purchase

Consumer finance

Consumer finance refers to granting of credit by banks and financial institutions to customers for purchase of durable and luxuries items like family car, AC, laptop, mobile phones, washing machine etc. Such type of loans is provided to increase the standard of living of people of our country. It is provided to both households and business man. Such loans are repayable within 3 months to 5 years. Some of the examples providing consumer finance in India are commercial banks, Bajaj Finance Ltd., Muthoot Finance Ltd. etc.

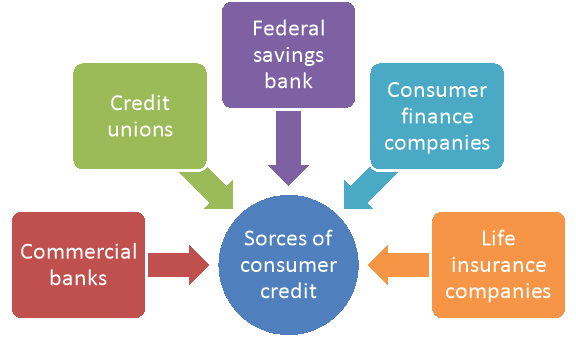

Various sources of consumer credit are mentioned are-

Figure: Sources of consumer credit

- Commercial banks:

• single payment loan

• personal instalment loans

• credit cards

• passbook loans

2. credit unions:

• personal instalment loans

• share-draft credit plans

• second mortgages

3. Federal savings banks:

• personal instalment loans

• home improvement loans

• education loans

• savings account loans

4. Consumer finance companies

- Personal instalment loans

- Second mortgages

5. Life insurance companies:

- Single payment or partial payment loans

Terms and conditions of consumer credit

There are certain terms and conditions of consumer credits from the view point of consumers and provides, namely-

- The providers (banks/financial institutions) must verify the credit worthiness, sources and regularity of income, purpose of loan of customers to reduce the risk of default in payment of loans by borrowers.

- The bankers must follow credit control policy of RBI regarding consumer credit.

- Before taking the loan, the consumer should compare rate of interest, transaction fees, risk of losing asset etc.

- The customers should analyse cost and benefits of different credit institutions.

Pricing of consumer credit

Pricing of consumer credit implies interest paid by consumers for taking consumer credit. The pricing depends on the extent of facility offered by the financer. The elements of pricing of consumer credit are probability of default, administrative expenses etc. The interest rate charged varies depending on the type of credit, duration of credit, amount of credit, nature of institution etc.

Consumer credit scoring

Credit scoring is a statistical analysis performed by lenders to determine the borrower’s creditworthiness which is crucial for lenders before granting any king of credit. It determines the ability of borrower to access loans. Vantage Score, FICO are some of the popular credit scoring models. An individual’s credit score is influenced by his

- Payment history,

- Amount owed,

- Length of credit history,

- New credit, credit mix etc.

The credit score of small business is determined by

- Company information about sales, nature of ownership, number of employees etc.

- Historical business data

- Registration of business

- Public filing

- Payment history and collection

- Accounts reporting etc.

Advantages and disadvantages of consumer finance

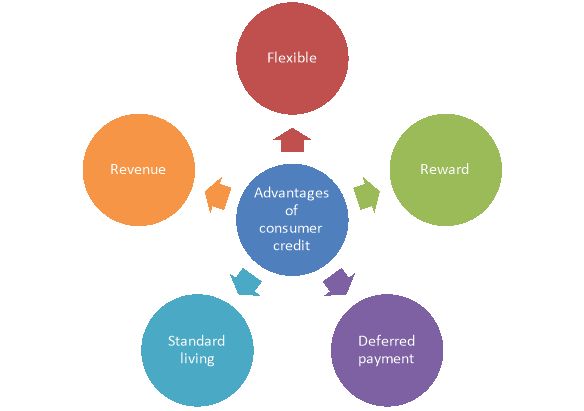

The advantages of consumer finance are mentioned under the following points-

Figure: Advantages consumer credit

- It is a flexible method of credit for consumers because they access to such credits with the help of credit cards to purchase the durable and semi-durable products.

- It provides different types of rewards to the consumers like cash back, discount, coupons, gifts etc. on their credit purchases.

- It allows the consumers to make deferred payments on the purchases. Thus it enables them to purchase products which may not possible for them if payment has to be made at one time.

- It increases standard of living of people of an economy as such loans are provided to purchase luxuries goods and services.

- The banks/ financial institutions able to earn good revenue from such loans because the interest rate charged is higher as compared to other types of loans.

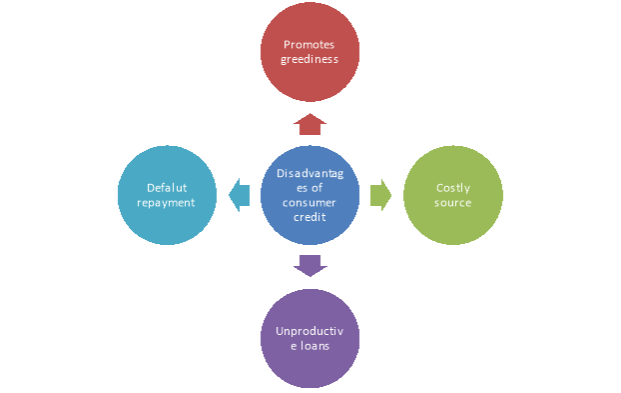

Some of the disadvantages of consumer finance are highlighted under the following points-

Figure: Disadvantages of consumer credit

- It promotes temptation and greediness among the borrowers because it makes credit more affordable for consumers.

- It becomes a costly source of credit for borrowers because the interest rate is high in case of consumer credit.

- It promotes unproductive loans only which unable to contribute to the GDP of an economy.

- There is the risk of default in repayment of loans.

Housing finance

Housing finance refers to extension of loan to consumers for construction of residential house, purchase of house, purchase of flat, repayment of housing loan etc. National Housing Bank is the apex institution in housing finance sector. The housing finance industry is composed of different hosing finance companies and customers. Some of the housing finance companies in India are-

- HDFC ltd.

- LIC Housing finance

- DFHL

- Baja Finance Ltd.

- Indiabulls Housing Finance Ltd.

- Piramal Housing Finance Ltd.

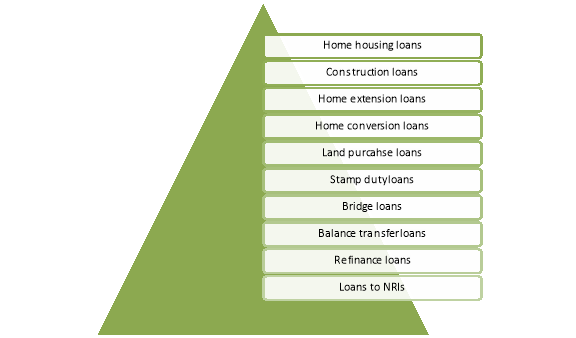

Moreover, commercial banks also provide housing finance facilities to customers. Housing finance involves the following products-

Figure: Housing loan products

- Home purchase loans

- Home construction loans

- Home extension loans

- Home conversion loans

- Land purchase loans

- Stamp duty loans

- Bridge loans

- Balance transfer loans

- Re-finance loans

- Loans to NRIs.

Housing finance policy aspect

The Government of India formulated Housing finance policy with objectives to firstly to provide affordable housing finance system and to accommodate urban dwellers with subsidized rental programmes. Various aspects of housing finance policy are mentioned under the following heads-  Figure: Hosing finance policy

2. It improves demand for houses by

3. It improves supply of housing finance at affordable rates through

|

Sources of funds

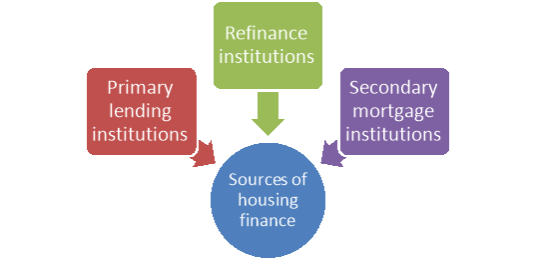

The different sources of fund for housing sector is broadly categorized under three heads-

Figure: Sources of housing finance

- Primary lending institutions:

- Commercial banks

- Regional rural banks

- Co-operative banks

- Micro finance institutions

2. Refinance institutions

- National Housing Bank

- NABARD

- LIC

- GIG

- Government

3. Secondary Mortgage institutions

- Institutional investors

- Households etc.

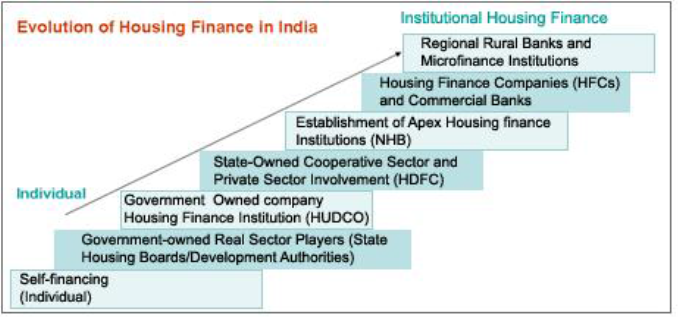

Housing finance in India

India is a developing country and suffers from lack of proper housing facility. To overcome this problem the Government adopted housing finance policy in the five year plan. Government formulated different plans and policies for development of housing sector in India. Housing and Development Corporation provides technical and financial assistance to government regarding housing finance. In 1977 HDFC was established as joint sector leading to establishment of many private sector housing finance companies. In 1988 National Housing Bank was established as the apex institution in housing sector. Gradually commercial banks, co-operative sector and other financial institutions also institutions enter into the housing finance sector.

There are two key regulatory bodies-

|

|

Source: National Housing Bank

National Housing Bank

The National Housing Policy, 1988 envisaged the setting up of NHB as the apex level institution for housing. Accordingly, NHB was established under the NHB Act, 1987. The entire paid up capital is contributed by the RBI. It was established to fulfil the objectives, namely-

- To promote a sound, healthy, viable and cost effective housing finance system to cater to all segments of population and to integrate the housing finance system.

- To promote a network of dedicated housing finance institutions to adequately serve various regions and different income groups.

- To augment resources for the sector and channelize them for housing

- To make housing credit affordable.

- To supervise the activities of housing finance.

- To encourage public agencies to emerge as facilitators and suppliers of serviced land, for housing.

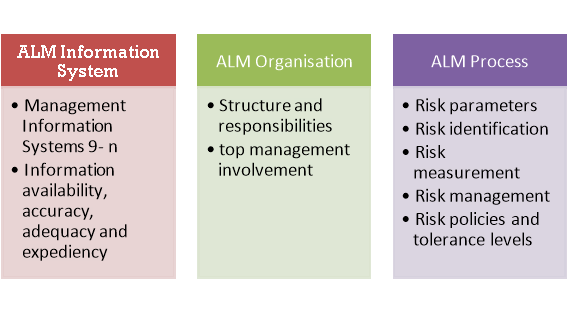

Guidelines for asset liability management system in HFC

It is necessary to provide guidelines for asset liability management system in HFC because during the course of business it exposed to several major risks in like credit risk, interest rate risk, equity/commodity price risk, liquidity risk and operational risk. Asset Liability Management (ALM) is based on three pillars-

- ALM Information Systems: This guideline necessitates the establishment of sound methodology with necessary supporting information system as the central element of the entire ALM exercise is the availability of adequate and accurate information with expedience. In respect of investment portfolio and funds management, it makes arrangement for collection of accurate and adequate information and same is available for stakeholders.

- ALM Organisation: It consists of board members responsible for management of risks and to decide limits for liquidity, interest rate, exchange rate and equity price risks. The Asset-Liability Committee (ALCO) is formed consisting of the HFC's senior management including the Chief Executive Officer (CEO). He is responsible for ensuring adherence to the limits set by the Board as well as for deciding the business strategy of the HFC (on the assets and liabilities sides) in line with the HFC's budget and decided risk management objectives.

- ALM Process: Measuring and managing liquidity needs are vital for effective operation of HFCs. By assuring an HFC's ability to meet its liabilities as they become due, liquidity management can reduce the probability of an adverse situation. The Gap or Mismatch risk can be measured by calculating Gaps over different time intervals as at a given date. Gap analysis measures mismatches between rate sensitive liabilities and rate sensitive assets including off-balance sheet positions.

Fair trade practice code for HFC’s

The National Housing Bank, has framed the Guidelines on Fair Practices Code for HFCs to serve as a part of best corporate practices and to provide transparency in business practices. The Code has been developed

1) to promote good and fair practices.

2) To increase transparency.

3) To encourage market forces.

4) To promote a fair and cordial relationship.

5) To foster confidence.

HFCs should act fairly and reasonably in all dealings with customers, by ensuring that:

a) They meet the commitments and standards in this Code for the products and services they offer and in the procedures and practices their staff follows.

b) Their products and services meet relevant laws and regulations in letter and spirit.

c) Their dealings with customers rest on ethical principles of integrity and transparency.

Housing finance agencies

- Magma Housing Finance Ltd.

- Prosper Housing Finance Ltd.

- Indiabulls Housing Finance Ltd.

- India Home Loan Ltd.

- Mahindra Rural Housing Ltd.

- Reliance Home Finance Ltd.

- IIFL Home Finance Ltd.

- Tata Capital Housing finance Ltd.

- Muthoot Housing Finance Company

- Sriram Housing Finance Ltd.

Key takeaways

- Consumer finance refers to granting of credit by banks and financial institutions to customers for purchase of durable and luxuries items like family car, AC, laptop, mobile phones, washing machine etc.

- Housing finance refers to extension of loan to consumers for construction of residential house, purchase of house, purchase of flat, repayment of housing loan etc.

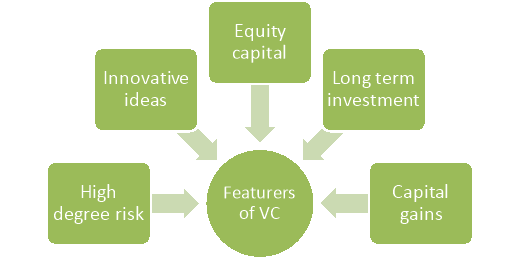

Venture capital is a type financing where the financing company provides equity capital to the highly risky projects related to involvement of sophisticated technology. The Venture Capital Company makes equity participation with the project and provides all technical and financial guidance for the growth of the project. Once the project started earning profit it makes disinvestment from the project. Some examples of venture capital company are-Blume Ventures, IDG Ventures, Accel Partners etc.

Features of venture capital

Some of the essential features of venture capital are-

Figure: Features of venture capital

- It involves high degree of risk as it makes investment in highly risky projects.

- It provides financing facility to the projects that involves sophisticated technology and innovative ideas.

- It provides equity capital to the projects and hence participates in management of the project.

- It is a long term investment because it invests in start-up firms and continues with the project till it starts earning profit.

- It is interested in capital gains because it invests in equity capital of the projects.

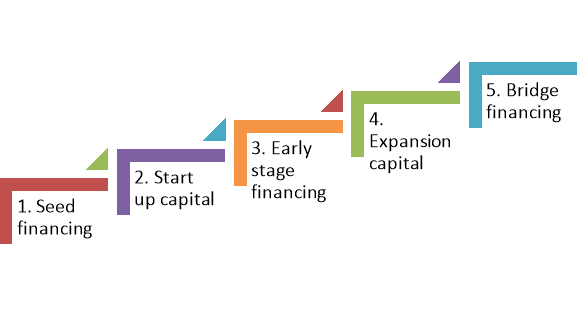

Types/stages of venture capital financing

The venture capitalists supply the funds to projects in every stages of progress instead of one time investment. Different stages of venture capital financing are as follows-

Figure: Venture capital process

- Seed financing/Early stage financing: This is the preliminary stage of venture capital financing. Funds are provided for preliminary activities like research and development, create a sample product, establish an administrative set up etc.

- Start-up capital: In this stage fund is provided to start up the project by recruiting managerial personal, additional market research, promotion of products etc.

- Early stage financing: At this stage, the project the surviving in the market by increasing its sales. The venture capitalist supply fund to increase its productivity, increase market share and increase the efficiency of management.

- Expansion capital: In this stage, the venture capitalist supply fund to expand and diversify its business, enter in the new market and grow rapidly to increase its revenue.

- Bridge financing: In this stage, the venture capitalist helps to find out a partner or acquisition opportunity or attract public financing. In this stage, the project becomes matured and hence the venture capitalist disinvests from the business.

Indian scenario

In India the venture capital financing is started by IFCI in 1975. Later on different commercial banks, specialised institutions and NBFCs started providing venture capital financing. In India, venture capital is regulated by SEBI under the SEBI (Venture Capital Funds) 1996. It is still in its infant stage. It is gaining popularity in India because of the reasons like-

- Growth of new projects related to sophisticated technology.

- Establishment of private sector enterprises in the areas of real estate, marketing, e-commerce etc.

- Growth of capital market.

- Enactment of law to regulate venture capital financing etc.

It mainly covers the areas like technology, consumer goods, pharmaceuticals, agricultural products, speciality chemicals etc. In 2019, VC investment investments activities reached a record of US $ 48 billion.

Key takeaways

- Venture capital is a type financing where the financing company provides equity capital to the highly risky projects related to involvement of sophisticated technology.

Factoring refers to selling of trade receivables (bills of exchange and promissory note) by the owner of business firm (client) to a factor (financial intermediary) to get immediate cash to manage short term finance for his business. Under this method of financing the trade receivables are sold at a discount to the factor. It has essential characteristics of-

- It helps to manage scarcity of short term funds in the business.

- The owner of trade receivables sell it to the factor.

- It is useful both for domestic and international trade.

- It operates under money market.

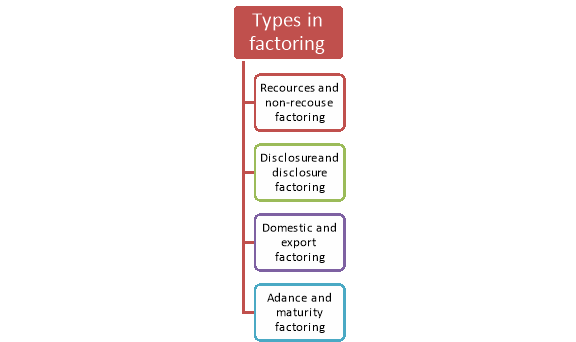

Types of factoring

Depending on the nature of services provided by the factors, it is divides under the following heads-

Figure: Types of factoring

- Recourse and non-recourse factoring:

Under recourse financing, the firm/client who get discounted bill from factor is not discharged from debt until and unless the factor recover the bill amount from the drawee. If the factor unable to recover the bill amount than the firm is liable to discharge the debt.

On the other hand, under non-recourse financing the firm/client is not liable for the debt to the factor if the amount of the trade bill is irrecoverable from the drawee.

2. Disclosed and undisclosed factoring:

Under disclosed factoring, the firm mentions the name of factor in the invoice/bill asking the drawee to pay the debt amount to the factor.

In case of undisclosed factoring the name of the factor is not mentioned in the invoice/trade bill. Here the factor realises the debt from the drawee/debtor in the name of the firm.

3. Domestic and export factoring:

Under domestic factoring, the parties involved in the factoring i.e, customer, client and factor are resident of the same country.

Under export factoring, the drawer and drawee both resided in different country.

4. Advance and maturity factoring:

Under advance factoring, the factor advances money to the firm/client against uncollected trade receivables.

In case of maturity factoring, the banks collects the bills amount on maturity date from the payer and credit the collected amount in the respective account of client.

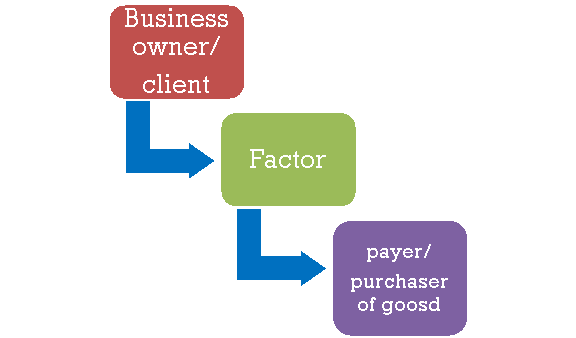

Theoretical framework of factoring/working of factoring

Factoring is an innovative financial service to facilitate domestic and foreign trade to get immediate inflow of short term fund to the client’s business on sale of invoice/trade bill to the factor. It involves three parties, namely the client (business owner/supplier), factor (financial intermediary) and the payer (purchaser of goods). Below figure depicts the factoring process-

Fig: Factoring process

The above depicted factoring process is discussed below under three steps-

Step 1: The supplier/seller/client sells the invoice/trade receivables to a factor to get immediate flow of short term cash to the business. It is sold at a discount to the factor and on due date the amount involved in the trade bill/invoice is recovered by the factor.

Step 2: On payment of advance against the invoice/trade receivables, the factor will hold the same and on maturity or guaranteed date collect the amount from the payer. If the amount is irrecoverable form the payer, than client is liable to the factor for the same until and unless the debts get discharged.

Step 3: The purchaser of goods or payer is liable to discharge the debt of the client to the factor. On failure to make payment on due date, he may be sued by the client or factor for non-payment.

Advantages and disadvantages of factoring

The factoring service is beneficial for traders. Some of the significant benefits of factoring are-

- Factoring service is one of the reliable sources for the business firm to get immediate cash flow of fund by selling the invoices or trade receivables.

- Factoring facilitates the business firm to manage their working capital effectively.

- Non-recourse factoring protects the business firm from risk of bad debt because the client is discharged from liability non-payment by the payer.

- Factoring promotes trade and business in the economy by strengthening their credit capacity. It supplements the bill discounting capacity of commercial banks.

- Growth of factoring business brings price competitiveness in the market. The suppliers get immediate flow of cash and hence they able to increase their production/supply which brings competition in the market.

The factoring service also suffers from some the following disadvantages-

- The factoring is considered as source of financing because the suppliers/sellers will not get 100 per cent of the invoice/bill amount. They received 70-90 per cent of the invoice/bill amount.

- Lack of secondary market is a hurdle for factoring service. The factor cannot sell the invoices/trade bills in the secondary market which creates difficulty in smooth flow of cash in the economy.

- Sometimes the relation between the customer and company decorates because the factors are provided the responsibility to collect the invoice amount from the customer.

- Use of factoring as a source of financing leads to decline in profit margin of clients because they receive discounted amount from the factor.

- Factoring allows advances against the commercial invoice only. It excludes other sector of the economy which is a big drawback of this service.

Factoring in India

Factoring service is evolved and became popular in western countries due to different services offered by factors.in 1989, Kalyan Sundaram Committee recommended for introduction of factoring services in India. Meanwhile, the Banking Regulation Act, 1949 was amended in 1991 allowing banks to establish factoring services. In 1991, SBI Factors and Commercial Services Pvt. Ltd. Started factoring services for the first time followed by Canara Factors Ltd in the same year. Gradually different NBFCs and commercial banks come forward to provide factoring services in India but it is less popular as compared to developing countries in the world. Some of the financial institutions engaged in factoring business in India are-

- SBI Global Factors

- Canbank Factors

- IFCI factors

- HSBC

- ICICI

- AXIS Bank

- ECGC

Key takeaways

- Factoring refers to selling of trade receivables (bills of exchange and promissory note) by the owner of business firm (client) to a factor (financial intermediary) to get immediate cash to manage short term finance for his business. Under this method of financing the trade receivables are sold at a discount to the factor

Bank Guarantee a promise made by the bank to any third person to undertake the payment risk on behalf of its customers. Bank guarantee is given on a contractual obligation between the bank and its customers. Such guarantees are widely used in business and personal transactions to protect the third party from financial losses. This guarantee helps a company to purchase things that it ordinarily could not, thus helping business grow and promoting entrepreneurial activity. For Example- Xyz company is a newly established textile factory that wants to purchase Rs.1 crore fabric raw materials. The raw material vendor requires Xyz company to provide a bank guarantee to cover payments before they ship the raw material to Xyz company. Xyz company requests and obtains a guarantee from the lending institution keeping its cash accounts. The bank essentially cosigns the purchase contract with the vendor. If Xyz company defaults in payment, the vendor can recover it from the bank.

Advantages and Disadvantages of Bank Guarantees

Bank guarantee has its own advantages and disadvantages. The advantages are:

- Bank guarantee reduces the financial risk involved in the business transaction.

- Due to low risk, it encourages the seller/beneficiaries to expand their business on a credit basis.

- Banks generally charge low fees for guarantees, which is beneficial to even small-scale business.

- When banks analyse and certify the financial stability of the business, its credibility increases and this, in turn, increase business opportunities.

- Mostly, the guarantee requires fewer documents and is processed quickly by the banks (if all the documents are submitted).

On the flip side, there are some disadvantages such as:

- Sometimes, the banks are so rigid in assessing the financial position of the business. This makes the process complicated and time-consuming.

- With the strict assessment of banks, it is very difficult to obtain a bank guarantee by loss-making entities.

- For certain guarantees involving high-value or high-risk transactions, banks will require collateral security to process the guarantee.

Types of Bank Guarantee

There are two major types of bank guarantee used in businesses, which are as follows:

Financial Guarantee

These guarantees are generally issued in lieu of security deposits. Some contracts may require a financial commitment from the buyer such as a security deposit. In such cases, instead of depositing the money, the buyer can provide the seller with a financial bank guarantee using which the seller can be compensated in case of any loss.

Performance Guarantee

These guarantees are issued for the performance of a contract or an obligation. In case, there is a default in the performance, non-performance or short performance of a contract, the beneficiary’s loss will be made good by the bank.

For example, A enters into a contract with B for completion of a certain project and the contract is supported by a bank guarantee. If A does not complete the project on time and does not compensate B for the loss, B can claim the loss from the bank with the bank guarantee provided

Letter of credit

Letter of Credit is issued by the bank to the buyer in order to secure the timely payment by the buyer to the seller. It acts like a guarantee on behalf of the buyer that he/she pays the full amount to the seller, as per defined timeline or on time. If in case the buyer is unable to repay the amount to the seller on time, then the bank will pay on buyer’s behalf to the seller.

Features of Letter of Credit

- Letter of credit is issued against collateral/security that may include buyer’s Fixed Deposits and Bank Deposit, etc.

- Certain fees is charged by the bank depending on the type of Letter of Credit

- Guidelines are issued by International Chambers of Commerce (ICC) for any form of Letter of Credit

- Correctness of Letter of Credit: As only documents are exchanged and no good and services are involved in this process. Therefore, mentioned details in letter should be correct that include name of seller, date, amount, product name and quantity, etc.

- Banks will deny the payment, if they find any slightest mistake in the buyer’s name, product name, shipping date, etc.

- As all parties deals in documents only and not goods and services, so the payment will not depend on the defects in goods and services, if any

Types of Letter of Credit in India

Different types of letter of credit are discussed below-

1. Credit on Sight

In this type of credit, entrepreneur can present a bill of exchange to lender with a sight letter and can take the funds instantly on the basis of letter of sight. Sight letter of credit is considered to be the most instant letter of credit that can be availed immediately.

2. Time Credit

Bill of exchange which is paid after agreed time period between the lender and the borrower is known to be time credit. Certain time period is involved in this type of credit. Letter of Credit defining time credit allows borrower with some days to repay the amount, only after receiving the goods.

3. Standby Letter of Credit (SBLC)

Standby Letter of Credit (SBLC) is a credit mechanism in which importer can get foreign currency funds internationally by providing the issuance of SBLC from domestic bank that guarantees payment to the international bank, if the borrower fails to repay the amount before on the due date.

4. Revocable Credit

Revocable credit is a type of letter of credit in which the terms and conditions of this type of LC can be amended or cancelled by the issuing bank. It is not important for the issuing bank to tell beneficiaries regarding any change in the letter of credit.

5. Irrevocable Credit

Irrevocable Credit is a type of LC in which the terms and conditions cannot be amended or cancelled by the issuing bank. The bank has to obey the directions or commitments mentioned in the letter of credit.

6. Transferable Credit

Transferable credit, as the name suggests is a type of LC in which the beneficiary can transfer his/her rights to third parties. The terms and conditions may differ as per the trade and industry.

Credit rating simply means rating of the credit worthiness of a company and assessment of the capacity of an issuer for repayment of principal and interest on debt by an independent agency. According to CRISIL, “Credit rating is an unbiased and independent opinion as to issuer’s capacity to meet its financial obligations. It does not constitute a recommendation to buy/ sell or hold a particular security”. Different credit rating agencies like CRISIL, CARE etc. provide ratings for financial institutions, banks, financial products and instruments, financial services etc. depending on which the investors make investment decision.

Features of credit rating

Some of the essential features of credit rating are mentioned below-

- It assesses the credit risk associated with a particular financial instrument, company, service etc.

- It provides rating in symbols like AAA, AA, A+, BBB etc. which implies credit repayment capacity of the company or financial instrument.

- Rating is done after considering the factors like financial and non-financial parameters, past credit etc.

- It provides guidance to investors by informing them about the credit worthiness of the interested investment avenue.

- Credit rating involves in depth study about the company depending on the information supplied by the issuer (of debt security) and also the information collected from various other sources, including personal interactions with various institutions.

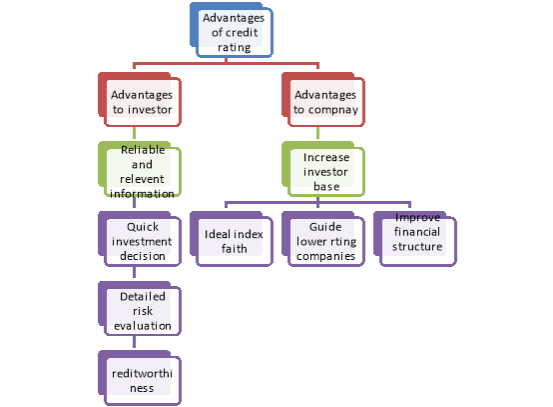

Advantages and disadvantages

Some of the advantages of credit rating are highlighted in the following-

Figure: Advantages of credit rating

A. Advantages to Investors

1. It provides relevant and reliable information to investors at low cost.

2. It enables investors to take quick investment decision on the basis of ratings.

3. It helps the investors to undertake a detailed risk evaluation. It helps the investors to arrive at a meaningful and consistent conclusion regarding the relative credit quality of the security.

4. It suggests the creditworthiness of the instrument and indicates the degree of risk involved in the instrument. Hence the investors can make direct investment decisions.

B. Advantages to Issuers

1. It acts as an ideal index of faith placed by the market in the issuers.

2. It increases the investor base. This enables the rated companies to raise any amount required at lower cost without difficulty.

3. It acts as a guide to companies scoring lower rating. This enables the management to take steps on their operating and marketing risks. This will change the perception against the companies in the market.

4. It encourages discipline among corporate borrowers to improve their financial structure and performance to get better rating.

The disadvantages of credit rating are highlighted below-

- It provides only guidance to investors in determining the level of risk associated with the debt instrument but unable recommended the investors/creditors to buy/sell or hold securities.

- In most of the cases, the rating is done on the basis of the information supplied by the issuer themselves which may not reliable and valid.

- Rating is a static study of present and past data of a company ignoring some dynamic factors. This may lead to changes in the rating.

4. Different agencies provide different rating for the same instrument. In this way the investors may got confused.

5. If the staffs of credit rating agency are inexperienced or less skilled, then the rating may not be perfect.

Regulatory framework of credit rating in India

SEBI Regulations, 2003 require every credit rating agency to follow the code of conduct as given below:

1. A credit rating agency shall make all efforts to protect the interests of investors.

2. A credit rating agency, in the conduct of its business, shall observe high standards of integrity, dignity and fairness in the conduct of its business.

3. A credit rating agency shall fulfil its obligations in a prompt, ethical and professional manner.

4. A credit rating agency shall at all times exercise due diligence, ensure proper care and exercise independent professional judgement in order to achieve and maintain objectivity and independence in the rating process.

5. A credit rating agency shall have a reasonable and adequate basis for performing rating evaluations, with the support of appropriate and in depth rating researches. It shall also maintain records to support its decisions.

6. A credit rating agency shall have in place a rating process that reflects consistent and international rating standards.

7. A credit rating agency shall not indulge in any unfair competition nor shall it wean away the clients of any other rating agency on assurance of higher rating.

8. A credit rating agency shall keep track of all important changes relating to the client companies and shall develop efficient and responsive systems to yield timely and accurate ratings. Further a credit rating agency shall also monitor closely all relevant factors that might affect the creditworthiness of the issuers.

9. A credit rating agency shall disclose its rating methodology to clients, users and the public.

10. A credit rating agency shall not make any exaggerated statement, whether oral or written to the client either about its qualification or its capability to render certain services or its achievements with regard to the services rendered to other clients.

11. A credit rating agency shall not make any untrue statements, suppress any material fact or make any misrepresentation in any documents, reports, papers or information furnished to the Board, stock exchange or public at large.

12. A credit rating agency shall maintain an appropriate level of knowledge and competence and abide by the provisions of the Act, regulations and circulars, which may be applicable and relevant to the activities carried on by the credit rating agency. The credit rating agency shall also comply with award of the Ombudsman passed under Securities and Exchange Board of India (Ombudsman) Regulations, 2003.

13. A credit rating agency shall ensure that there is no misuse of any privileged information including prior knowledge of rating decisions or changes.

14. A credit rating agency or any of his employees shall not render, directly or indirectly any investment advice about any security in the publicity accessible media.

15. A credit rating agency shall maintain an arm’s length relationship between its credit rating activity and any other activity.

Credit rating agencies in India

The credit rating agencies operating in India are discussed below

- Credit Rating Information Services of India Ltd. (CRISIL)

CRISIL is the first credit rating agency in India. It is a public limited company established in 1987 in the private sector. It is promoted jointly by ICICI and UTI. It started its operations on 1st January 1988. Its objectives is to accord credit rating to public limited companies which desire to float share capital, debentures, public deposits or commercial paper to raise finance from the public.

Objectives of CRISIL

1. To assist the investors in making investment decisions in fixed interest securities.

2. To guide the investors in understanding the risk associated with a particular debt instrument.

3. To help the companies raise large funds at a lower cost.

4. To create awareness of the concept of credit rating amongst corporations, merchant bankers, brokers, regulatory bodies.

5. To provide regulators with a market driven system in order to ensure discipline and a healthy growth of capital markets.

The services rendered by CRISIL may be summarised as below:

Figure: Services of CRISIL

- Rating services: The main business of CRISIL is rating debentures, deposits, preference shares as well as commercial paper. Rating services is also provided to chit funds, real estate developers, banks etc.

- Information services: CRISIL offers information services also. Its main product ‘CRISIL CARD’ provides corporate and balance sheet data for the sake of analysis. It assesses the outlook and solvency of the concerned companies on the basis of published data. CRISIL 500 Equity Index is an index newly launched on the basis of 500 companies representing 74% of market capitalization of the Mumbai Stock Exchange.

- Advisory services: It also offers services to the Governments, banks, financial institutions etc. It provides advisory services in the areas of energy, transport, urban infrastructure, tourism, economy, corporate, capital markets, and financial services. It also undertakes credit and counter party ratings for corporates.

2. Investment Information of Credit Rating Agency of India Ltd. (ICRA)

It is promoted by IFCI Ltd. It started operations in 1991. It offers credit rating services for rating debentures or bonds, preference shares, medium term debts, including certificates of deposits as well as short term instruments including commercial paper. It has entered into an area called Earning Prospects and Risk Analysis. ICRA also provides credit assessment and general assessment. The primary objective of ICRA is to provide information and guidance to investors/creditors for determining the credit risk associated with a debt instrument/credit obligation. ICRA Limited is a Public Limited Company, with its shares listed on the Bombay Stock Exchange and the national Stock Exchange. Today, ICRA and its subsidiaries together form the ICRA Group of Companies (Group ICRA).

Objectives of ICRA are-

1. To provide information and guidance to investors and creditors.

2. To enhance the ability of the borrower/issuer to enter into financial markets for raising resources from a wide range of investing public.

3. To help the regulators in promoting the transparency in the financial markets.

4. To enable the banks, investment bankers and brokers in placing debt with investors by providing them with a marketing tool.

Services/Functions of ICRA are discussed below-

Figure: Services of ICRA

a. Rating Services

ICRA rates rupee-denominated debt instruments, such as bonds and debentures (long-term), fixed deposit programmes (medium term), commercial paper and certificates of deposit (short-term), and structured obligations and sector-specific debt obligations (issued by Power, Telecom, and Infrastructure companies).

b. Grading Services

ICRA has developed highly specialised evaluation methodologies for grading of construction entities; real estate developers and projects; healthcare entities; maritime training institutes; and initial public offers (IPOs). These grading methodologies have been developed in association with reputable and specialised bodies, associated with the domain.

c. Advisory Services:

ICRA offers a wide range of management advisory services. These include: (a) strategic counselling, (b) risk management, (c) restructuring solutions, (d) inputs for policy formulation, (e) client specific need based studies in the banking and financial services, manufacturing and services sector etc.

d. Outsourcing:

ICRA Online Ltd, a subsidiary of ICRA, provides technology solution, targeted at distributors of third party financial products, insurance brokers, and stock broking houses. The BPO Division of ICRA Online serves financial service companies, financial institutions, investment banks, private equity and venture capital funds, market researchers and the like. The focus is on high and knowledge processing like financial modelling, data analysis valuation etc.

e. Software development:

ICRA Techno Analysis Ltd., a subsidiary of ICRA offers complete portfolio information technology solutions to meet the dynamic needs of present day businesses. The services range from the traditional development of client server, web centric and mobile applications to the generation of cutting edge business analysis.

3. Credit Analysis and Research Ltd. (CARE)

It is promoted by the IDBI. It began its operations from October 1993. It offers a wide range of services. Credit rating is conducted for debentures, fixed deposits, commercial papers etc. CARE ratings are recognised by the Government of India and regulatory agencies in India. It is registered with the Securities and Exchange Board of India (SEBI). The ratings are also recognised by RBI, NABARD, NHB and NSIC. The three largest shareholders of CARE are IDBI Bank, Canara Bank and State Bank of India. CARE is a full service rating company offering a wide range of rating and grading services. These includes rating debt instruments/enterprise ratings of corporates, banks, Financial Institutions (FIs), Public Sector Undertakings (PSUs), state government bodies, municipal corporations, NBFCs, SMEs, microfinance institutions, Structured finance and Securitisation transactions.

Services or Functioning of CARE are-

Figure: Services of CARE

a) Credit rating: It undertakes the credit rating of all types of debt instruments. The rating provides a relative ranking of the credit quality of debt instruments. It also rates quasi-debt obligations such as the ability of insurance companies to meet policy holders’ obligations.

b) Information services: It makes available information on any company, industry, or sector required by a business enterprise. This information will enable the users to make informed decisions regarding investments.

c) Advisory services: It conducts sector studies and provides advisory services in the areas of financial restructuring, valuation and credit appraisal systems.

d) Equity research: It conducts the detailed study of the shares listed in the major stock exchanges. On the basis of this study, it can identify the potential winners and losers on the basis of the fundamentals affecting the industry, economy, market share, management capabilities and other relevant factors.

e) Other services: It undertakes performance rating of parallel marketers of LPG and Superior Kerosene Oil (SKO) as notified by Central Government. It also provides a valuable input in assisting decision making process in banks and Development Financial Institutions. It has a strong structured finance team and has been instrumental in developing rating methodologies for innovative asset backed securities in the Indian capital market.

Credit rating symbols

AAA: highest safety

AA: high safety

A: adequate safety

BBB: inadequate safety

B: high risk

C: substantial risk

D: default.

Key takeaways

- Credit rating simply means rating of the credit worthiness of a company and assessment of the capacity of an issuer for repayment of principal and interest on debt by an independent agency.

The process of counselling begins with establishing relationship between counsellor and counselee and taking into confidence the counselee by the counsellor and allowing him to open his or her heart and after understanding the situation advising him to face the harsh realities of life and society boldly and building his confidence and paving way to make the best use of his strength by overcoming his weaknesses. Financial counselling services are services that are designed to assist individuals or families with their financial needs. There are many different types of financial counselling services. Some of them are discussed below-

Figure: Types of financial counselling

1. Corporate counselling: One of the important functions of a merchant banker is corporate counselling. Corporate counselling refers to a set of activities undertaken to ensure efficient functioning of a corporate enterprise through effective financial management. A merchant banker guides the client on aspects of organizational goals, vocational factors, organization size, choice of product, demand forecasting, cost analysis, allocation of resources, investment decisions, capital and expenditure management, marketing strategy, pricing methods etc.

The following activities are included in corporate counselling:

(a) Providing guidance in areas of diversification based on the Government’s economic and licensing policies.

(b) Undertaking appraisal of product lines, analysing their growth and profitability and forecasting future trends.

(c) Rejuvenating old-line companies and ailing sick units by appraising their technology and process, assessing their requirements and restructuring their capital base.

(d) Assessment of the revival prospects and planning for rehabilitation through modernization and diversification and revamping of the financial and organizational structure.

(e) Arranging for the approval of the financial institutions/banks for schemes of rehabilitation involving financial relief, etc.

(f) Monitoring of rehabilitation schemes.

(g) Exploring possibilities for takeover of sick units and providing assistance in making consequential arrangements and negotiations with financial institutions/banks and other interests/authorities involved.

2. Project counselling: Project counselling relates to project finance. This involves the study of the project, offering advisory services on the viability and procedural steps for its implementation.

Project counselling involves the following activities:

(a) Undertaking the general review of the project ideas/project profile.

(b) Providing advice on procedural aspects of project implementation.

(c) Conducting review of technical feasibility of the project on the basis of the report prepared by own experts or by outside consultants.

(d) Assisting in the preparation of project report from a financial angle, and advising and acting on various procedural steps including obtaining government consents for implementation of the project.

(e) Assisting in obtaining approvals/licenses/permissions/grants, etc. from government agencies in the form of letter of intent, industrial license, DGTD registration, and government approval for foreign collaboration.

(f) Identification of potential investment avenues.

(g) Arranging and negotiating foreign collaborations, amalgamations, mergers, and takeovers.

(h) Undertaking financial study of the project and preparation of viability reports to advise on the framework of institutional guidelines and laws governing corporate finance.

(i) Providing assistance in the preparation of project profiles and feasibility studies based on preliminary project ideas, covering the technical, financial and economic aspects of the project from the point of view of their acceptance by financial institutions and banks.

(j) Advising and assisting clients in preparing applications for financial assistance to various national financial institutions, state level institutions, banks, etc.

3. Credit Counselling

Credit counselling is a useful service in this situation because it is a type of financial counselling geared towards helping individuals or families either escape debt or avoid it. Some of the services that credit counsellors offer may include financial education, budget counselling, and advice on managing money and debt.

4. Bankruptcy Counselling

Bankruptcy counselling refers to counselling and education services provided to those that have fallen into bankruptcy (or are about to). There are two basic types of bankruptcy counselling:

2. Pre-filing bankruptcy counselling and

3. Post-bankruptcy debtor education.

The credit counselling takes place before someone files for bankruptcy, while the debtor education takes place after filing. Both of these services are typically fee-based, though there are cases in which the fees are waived or reduced for consumers who have trouble paying.

Key takeaways

- Financial counselling services are services that are designed to assist individuals or families with their financial needs. There are many different types of financial counselling services.

References

- Bhole, L.M. Financial Markets and Institutions. Tata McGraw-Hill Publishing Company.

- Pandian P. – Financial Service and Markets. Vikas Publishing House.

- Dhanekar. Pricing of Securities. New Delhi: Bharat Publishing House.

- NibasaiyaSapna – Indian Financial System – S.Chand.