Unit-IV

Market Structure

Q1) Explain Market Structure under Perfect Competition.

Sol: Perfect competition refers to a market situation in which there are a large number of buyers and sellers of homogeneous products.

The price of a product is determined by the industry by the forces of supply and demand. For example, if you need a pen, there should be several shops selling pens. Under the conditions of perfect competition, every seller must sell the same quality of the pen at a uniform prevailing price on the market. You can buy a pen from any store at the price Rs. 10. If another shopkeeper charged Rs. 12 for the same quality of the pen, nobody buys from him. But if the shopkeeper charged Rs. 9 all buy pens from that particular store. But both of these situations are unrealistic.

There must be one price dominant throughout the market. Therefore, full competition in the market structure is characterized by a complete lack of competition between individual companies.

Definition:

It is identified by the existence of the many firm; they all sell an identical products an equivalent way. The supplier is the one who accepts the price."- Vilas

Such market gains when the request for product of every producer is totally elastic. Mrs Joan Robinson.

It is a market condition with an outsized number of sellers and buyers, similar products, free entry of enterprises into the industry is ideal knowledge between buyers and sellers of existing market conditions and free mobility of production factors between alternative uses. Lim Chong-ya

Assumption:

The following assumptions for a fully competitive market:

1. A large number of buyers and sellers:

This affects single buyers and sales. When a company enters or leaves the market, there is no impact on the supply. Similarly, if a buyer enters or withdraws from the market, demand will not be affected. Such affects individual buyers and sellers.

2. Homogeneous products:

The second assumption of perfect competition is that all sellers sell homogeneous products. In this situation, the buyer has no reason to prefer the product of one seller to another. This condition exists only if the goods have a clear chemical and physical composition, that is, Substances of the specified grade: salt, tin, wheat, etc.

3. No discrimination:

Under complete competition in the market, sellers and buyers, sellers do freely. It means that buyers and sellers must be willing to deal openly with each other to buy and sell at market prices. This may be true of everything you might want to do so without offering special deals, discounts, or favours to selected individuals.

4. Perfect knowledge:

The competitive market is me (buyers and sellers are in close contact with each other. It means that, on the part of buyers and sellers, there is complete knowledge of the market. This means that many buyers and sellers in the market know exactly how much the price of the goods is in different parts of the market.

In other words, without the knowledge of each buyer and seller of the price at which the transaction is taking place, and the price at which the other buyer and seller are willing to buy or sell.

5. Industry FREE entry and exit:

In the long run, under full competition, the company can enter or exit the enterprise. There is no let or hindrance to the enterprise with regard to its entry into or exit from the market. In other words, the company has no legal or social restrictions. A large number of sellers is possible only if there is a free entry of the enterprise.

6. Perfect mobility:

There must be full mobility of domestic production factors that ensure uniform production costs throughout the economy. That means you are free to seek employment in any industry where different factors in production might like you.

7. Profit maximization:

Under perfect competition, all companies have a common goal of maximizing profits. Thus, there is a lack of social welfare of the general public.

8. No sales cost:

Under perfect competition, there is no sales cost.

9. No transportation costs:

Transportation costs between the sellers should not be. If transportation costs are present buyers are prevented from moving from one seller to another to take advantage of the price difference, which means that transportation costs do not affect the pricing of the product. In other words, these are always prices uniform in the market.

Q2). State the relationship between marginal income and price elasticity.

Sol: Marginal income is related to the price elasticity of demand by the following formula

Total revenue, marginal revenue and price elasticity:

We said that if the demand curve is falling, the TR curve will increase first, reach the maximum value, and then begin to decrease. You can use the previous derived relationships between MR, P, and e to establish the shape of the total revenue curve.

The total revenue curve reaches its maximum level at e=1.

MR = P (1 – 1/1) = 0

If E > 1, the total revenue curve has a positive slope, that is, it is still increasing, so if we consider the following, we have not reached its maximum point

P>0 and (1-1/E)>0; therefore Mr > 0

For E, 1, the total revenue curve has a negative slope, that is, it is falling.

P>0 and (1-1/E)<0; therefore Mr > 0

Then summarize these results as follows:

If the demand is inelastic (e<1), the increase in price leads to an increase in total revenue, and the decrease in price leads to a decrease in total revenue.

If the demand is elastic (e>1), the increase in price leads to a decrease in total revenue, and the decrease in price leads to an increase in total revenue. If the demand has a single elasticity, then for e—1, then MR=0, so the total income is not affected by the change in price.

Q3). What is the position of Equilibrium of the firm in the short run?

Sol: "Short run" means the period when the size of the plant or machine is fixed, and the increase in demand for goods is satisfied only by the intensive use of a given plant, that is, by increasing the amount of fluctuating factors.

Under full competition, companies produce output where marginal costs are equal! Price - - - if the price is higher than the marginal cost, it will pay the company to expand its output so that it is equal to that price. On the other hand, if the price is less than the marginal cost, it is suffering losses and reduces its output until the marginal cost and price are equal. Therefore, the marginal cost curve of an enterprise is the supply curve of a company that is fully competitive in the short term.

But even in the short term, companies do not supply at a price below their minimum average variable cost. That is, in the short term, companies should at least try to cover their" variable costs." Thus, the short-term supply curve of the enterprise coincides with that portion of the short-term marginal cost curve that is above the minimum point of the short-term average variable cost (SAVC) curve.

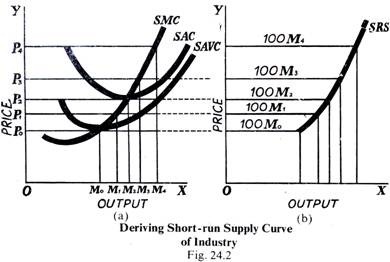

The following figure [Fig. 24.2 (A)) makes it clear:

In this figure, it is a diagram. 24.2(a)is relevant to the enterprise, and 24.2 (b)is the supply curve for the industry. Let's first look at the diagram. 24.2(a) relates to a single company. Along the axis OX represents the output to be supplied, and along oy represents the price. SMC curve is the short-term marginal cost curve, and as mentioned above, it is the short-term supply curve of the company. However, only that part of the SMC curve above the short-range average variable cost (SAVC) means the thicker part above the dotted line.

So for price OP0, OM0 output is supplied, for OP1 price, OM1, quantity is supplied at OP2 price, OM2 is supplied, etc. The price below OP0 corresponds to the dotted part of the SMC below the minimum point of the SAVC (short-run average variable cost) curve, so nothing is supplied below the price OP.

Now, from the supply curve of the enterprise, let us derive the supply curve of the "whole" industry, in which every company is a constituent par) the supply curve of the industry SRS""is derived by the sum of the horizontal (i.e., addition to the horizontal) of that part of the marginal cost curve of all companies that are above the minimum point of their average fragile cost curve. It is believed that this industry consists of 100 identical companies, such as those shown in the figure. 24.2(a).

Q4) Define Constant cost industry supply curve.

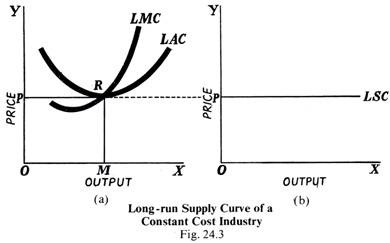

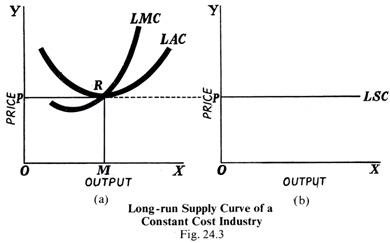

Sol: The supply curve for the constant cost industry is shown in the figure below (Fig. 24.3)

It is characterized in that. 24.3 (a) the LMC associated with the enterprise is a long-term marginal cost curve, and the LAC is a long-term average cost curve. They intersect at R, so at the point R, it means that the marginal cost is equal to the average cost. Here it is also equal to the price OP. So, in the output OM, MC=AC=Price.

Now look at the figure. 24.3(b). Corresponding to the OP price, the long-term supply curve is Lsc, which is a horizontal straight line parallel to The X-axis. This means that whatever the output along the X-axis, the price is the same OP where the marginal cost and the average cost are equal. Because it is a constant cost industry, the cost remains the same.

It is an industry in which the economy and uneconomic are offset so that the cost of production does not change, even if output increases (or decreases). Also, if new companies enter the industry to respond to increasing demand, they will not raise or lower the cost per unit.

Thus, the industry can supply any quantity of goods at a price OP equal to the minimum long-term average cost, which ensures normal profit to all companies engaged in the industry, that is, all companies will be in a long-term equilibrium: price=MC=AC. All companies have the same cost conditions.

Thus, for a continuing cost industry, the long-term supply curve LSC may be a horizontal line (i.e., perfectly elastic) within the price OP adequate to the minimum monetary value. This means that whatever the supplied output, the price will remain the same.

Q5) Explain with the help of diagram Cost-cutting industry supply curve.

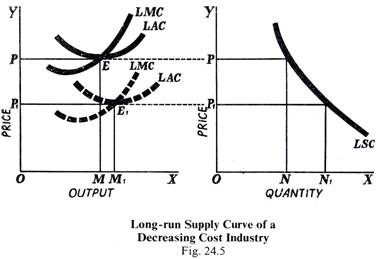

Sol: In industries where costs decrease, costs decrease as production increases due to the expansion of existing companies or the entry of new ones. In this case, the economies of scale outweigh the uneconomic, if any. This happens when young industries grow in new regions, where the supply of productive resources is abundant. The net external economy pushes down the cost curve, allowing additional supply of output to come at a lower price.

The following figure (Fig. 24.5) clarifies the whole:

24.5(A) shows how the new, i.e. dotted LMC and Lac curves are shifting down from their original position when the lmc and LAC curves intersect at the E where all companies were in equilibrium and generating OM. Since the new curve intersects with E1, at this point, companies in the industry have achieved a long-term equilibrium, each producing OM, output, price OP=MC=AC. But look at the diagram. In 24.5 (B), we see that at the OP1 price, the ON is supplied more than or equal to the ON supplied by the original price OP.

LSC is right for cheaper supply of production resources, which means that additional supply of output is coming at a lower price since both marginal cost and average cost have fallen.

Q6) Is perfect competition good for economic efficiency. Explain.

Sol: Some economists believe that perfect competition isn't an honest market structure for top levels of research and development spending and therefore the resulting product and process innovation. Indeed, monopolistic or oligopolistic markets could also be simpler within the end of the day in creating an environment for research and innovation to flourish. Cost-cutting innovation from one producer is completed immediately, assuming perfect information, without transferring costs to all or any other suppliers.

That said, a competitive market would offer discipline for companies to regulate costs, minimize waste of scarce resources, set high prices and refrain from exploiting consumers by enjoying high profit margins. During this sense, competition can stimulate improvements in static and dynamic efficiency over time.

The future of perfect competition therefore exhibits an optimal level of economic efficiency. However, for this to be achieved, all of the conditions of full competition, including the relevant market must hold.

Q7). What is the position of equilibrium of monopoly firm in short run.

Sol: A monopolist maximizes his short-term profits if the following two conditions are met first, MC equals Mr. Secondly; the slope of MC is larger than that of Mr at the intersection.

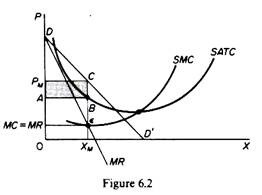

In Figure 6.2, the equilibrium of the monopoly is defined by the point θ at which MC intersects the MR curve from below. Thus, both conditions of equilibrium are met. The price is PM and the quantity is XM. Monopolies realize excess profits equal to shaded areas APM CB. Please note that the price is higher than Mr

In pure competition, the company is the one who receives the price, so it’s only decision is the output decision. The monopolist is faced with two decisions: to set his price and his output. But given the downward trend demand curve, the two decisions are interdependent.

Monopolies set their own prices and sell the amount the market takes on it, or produce an output defined by the intersection of MC and MR and are sold at the corresponding price.

Q8). Explain the Concept of supply curve under monopoly.

Sol: The supply curve under incomplete competition or Monopoly is not unique. This is due to the fact that, unlike full competition, the price is determined simultaneously with the volume of goods produced, and the price is not given to the enterprise under monopoly or Monopoly competition.

Here the company is the price manufacturer of her products. Therefore, the company fixes the price at which it will get the maximum profit. The supply of goods is determined by the market demand for its products. Therefore, it is impossible to talk about the supply curve under monopoly or Monopoly competition.

The output supplied by the producer under such exclusive circumstances depends on the market demand conditions of his product and draws a unique supply curve (and supply schedule).

Therefore, it is not quite applicable to the causes of incomplete competition, monopoly competition, monopolies and oligopolies. This is because the concept of the supply curve refers to questions about the amount of goods a company supplies at various given prices.

Under various sorts of incomplete competition, individual companies don't take the worth as given and aren't mere quantity adjusters. In fact, under various forms of incomplete competition, the company sets its own prices. For companies under incomplete competition, it is not a matter of adjusting output or supply at a given price, but choosing a combination of price output that maximizes profit.

Commenting on the relevance of the supply curve, professor Baumol writes: the supply curve is, strictly speaking, a concept usually relevant only in the case of pure (or complete) competition...The reason for this lies in its definition—the supply curve is designed to answer the form question, “to answer the form question how much would solidify the supply if it encounters a price that is fixed in P dollars. But such questions are most relevant to the behavior of companies that actually deal with prices.”

Q9). Write note on Inefficiency in Monopoly.

Sol: In monopolies, the company sets a certain price for the goods that are available to all consumers. The quantity of good things will be less, and the price will be higher (this is what makes good things a commodity). Monopoly pricing creates a burden loss because companies forgoes transactions with consumers. The burden loss is a potential gain that hasn't gone to producers or consumers. As a result of the loss of burden, the combined surplus (wealth) of monopolies and consumers is less than that obtained by consumers in competitive markets. Monopolies are less effective in total profits from trade than in competitive markets.

Monopolies can become inefficient and less innovative over time, because they do not have to compete with other producers in the market. For private monopolies, complacency can overcome barriers to entry and create room for potential competitors to enter the market. In addition, long-term alternatives in other markets can take control when monopolies become inefficient.

Q10). What are the Causes of loss of dead weight?

Sol: The loss of a dead weight is the result of a market that cannot be cleared naturally and is therefore an indicator of market inefficiency. Supply and demand for goods or services are not balanced. The causes of weight loss are:

- Imperfect market

- Externality

- Taxes or subsides

- Price ceiling

- Price floor

Q11). What are the types of discrimination monopolies?

Sol: Price discrimination is the following three types:

1. Personal price discrimination:

For example, doctors charge different fees for the same surgery from rich and poor patients.

2. Geographical price discrimination:

Under Geographical price discrimination, monopolies charge different prices in different markets for the same product. It also includes dumping, which allows producers to sell the same goods at home at one price, and abroad at another.

3. Price discrimination according to usage:

When monopolies charge different prices for different uses of the same product, it is called price discrimination according to use.