Unit - 1

Basic Principle and Methodology of Economics

Q1) Define Economic.

A1) Economic definition: The economy is essentially a study of the use of resources under specific constraints, all linked to the bold hope that the subject under consideration is a rational entity that seeks to improve its overall well-being.

Q2) Explain five basic principles of Economics.

A2) The 5 Basic Principles of Economics:

The world's beef supply is limited. The number of cows that farmers can raise each year is very large, but the destination of the beef is completely floating in the air. It can be replaced with minced beef and sold in large quantities at supermarkets. Can be put in slim gym and other beef jerky products.

You can change it to beef broth and can it for Campbell or send it to a local butcher. Due to the large amount of beef, only many of these products can be produced. So how do you decide how much product to turn into beef jerky poetry and turn into soup? The market system (see Supply and Demand) is a simple answer.

2. Marginal Principal Concept-In short, the definition of Marginal utility is very basic and is what we deal with every day when we run a business. Raise the level of activity as long as the marginal profit exceeds the marginal cost. In other words, spending more money than you are taking is not a very wise business decision without a comprehensive plan for profitability. You may spend three years in the start-up cost hole and rely heavily on investors, but no one is willing to invest if you don't see a way to make a profit. Here is an example of a very basic ordinal utility.

Let's say you run a donut shop. Flour, sugar, eggs and butter in a donut costs about $ .10 per donut. Each donut sells for $ 1.50. It's a huge profit, so it may seem that the marginal profit exceeds the cost.

Unfortunately, Yelp in your store has a low rating and few customers. Even if rents start to skyrocket and the donuts themselves are profitable, the marginal profit does not exceed the cost. You will eventually close your business. This is the definition of the limit principle in its most basic form.

Another example of ordinal utility? Stores can choose to continue expanding their business as long as they see an increase in revenue. For example, when stores like Sears and Toys 'R' Us see that their revenues have begun to decline significantly, they either shrink or shut down altogether.

3. Law Of Diminishing Returns-There are several other names for the law of diminishing returns. You may know it simply as a principle of diminishing returns or reduced marginal productivity. This economic principle shows that if one production is increased while the other production is fixed, the production will increase overall, but the rate of increase will gradually decrease.

Let's take a look at this simple example. A factory with a certain number of workers runs the assembly line most smoothly and finds the best number of workers to produce the most products. This magic number gives you the best returns. Adding more workers to the mix may actually show a decline in long-term profits. Regardless of who is the staff, there are so many products that conveyor belts can achieve. If you don't buy more machines, the cost of hiring these workers is actually your overall income if you are at the highest production level possible with the equipment you already have May be reduced to.

The law of diminishing returns is something that every company should consider when launching and planning expansion. This may still be profitable for the same reasons you hear about layoffs and restructuring within your enterprise, but it's not as profitable as you'd expect. The number of units sold should justify raw materials, salaries, and other manufacturing costs.

4. The Principle of Voluntary Returns- The principle of voluntary returns is a principle of economics that promotes a free exchange of goods and services between buyers and sellers in a marketplace. This particular principle is used highly in international trade.

For example, each country has products they specialize in. Taiwan is a huge manufacturer of microchips. American companies buy these chips to make computers. These computers can then be sold back to Taiwanese consumers.

Basically, we import the products we don't specialize in and sell off the ones we do. Sometimes, those things are deeply intertwined. The key part of this principle is that this exchange is voluntary. You get the best rate and both parties are happy with the exchange.

5. Real /Nominal Principle-The real/nominal principle is one of the fundamentals of economics. Basically, it states that people aren't interested in the face (nominal) value of money. They're interested in the actual (real) value of money. The real value is how much goods money can buy and the key to understanding how much money is actually worth in the scheme of real society. This is specifically important when factoring in exchange rates and inflation or the value in regard to other goods.

Q3) What do you mean by Supply?

A3) Supply is the amount of goods and services that a company can produce using the resources available. Common resources are employees, machinery and raw materials. For example, automaker resources include assembly line workers, the factories they work in, sheet metal, engine parts, and other items used to make cars

Q4) What do you mean by demand?

A4) Demand is the amount of goods or services that a consumer is willing to buy at a particular price. If all other factors are equal, the buyer buys (demands) more goods at a lower price than at a higher price. Conversely, if consumers buy it at a higher price, the company will produce (supply) more goods. Reason: Greater profit.

Q5) On what basis government policy depend upon?

A5) An important takeaway is that the effects of Government policies depend, in part, on how responsive the quantity demanded or supplied is to changes in price, a concept known as price elasticity.

Q6) What are the Government Policy?

A6) Government Policy

When assessing the impact of price controls on the market, it depends on whether price controls are binding. That is, if the market equilibrium wage is above the minimum wage, it is not binding and the law does not affect the market. The company was already above the minimum wage. Similarly, if the market equilibrium rent is below the upper limit, it is not binding and the law has no effect. The landlord had already charged rent below the statutory rent management price.

However, if price controls are binding, there will be surplus or shortage in the market. A binding minimum wage makes a worker's wage higher than a market equilibrium wage. In other words, supply = demand. In this case, the workers are paid higher wages and they try to give the company more time. Conversely, workers are paid higher wages, so according to the demand curve, companies will demand less working hours. This creates a labor surplus, also known as unemployment. The opposite is true for binding rent management, where the lessor wants more home because it is cheaper than the rent management law, but the landlord does not supply that much. This causes a shortage of markets.

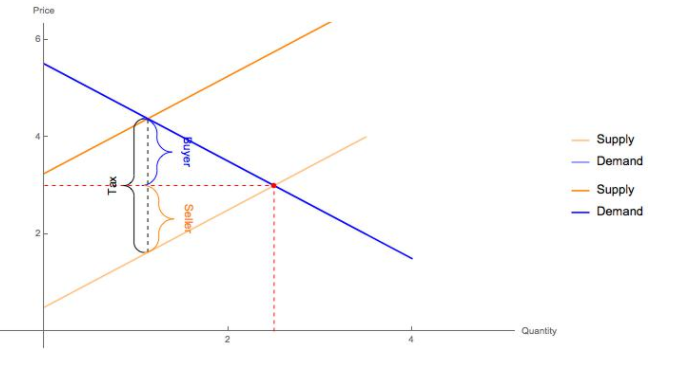

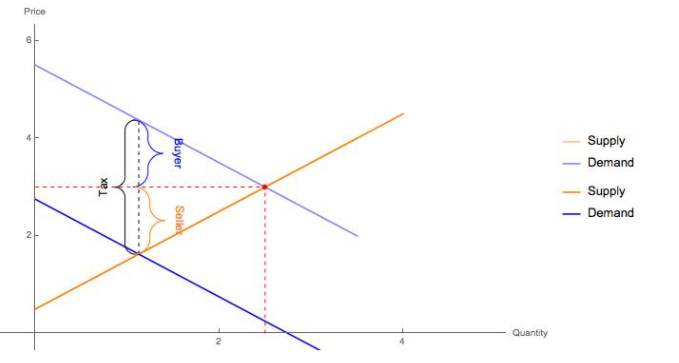

2. Sales Tax-Consumption tax is a tax per unit on goods. Economists distinguish between who literally pays taxes to the government and the financial burden of taxes.

Tax Incident: How is the tax burden shared between buyers and sellers?

The main points from this section of the course are:

The tax return does not depend on who actually pays the tax to the government. Incidence depends on the relative elasticity of demand compared to supply.

The logic for this take-out is:

Therefore, the supply curve shifts up by the tax amount (see graph below). This is because we needed prices and taxes to produce the same amount as before.

The tax return for sellers is the difference between the pre-tax equilibrium price (red dot in the graph below) and the post-tax amount they receive. In the graph, this incidence is marked as a "seller."

For buyers, they are now paying higher prices (if the new supply curve intersects the demand curve). The tax return for a buyer is the difference between the equilibrium price after tax and the equilibrium price before tax. In the graph, this incidence is marked as "buyer”

So, what about when the buyer pays the tax? How does this affect incidence?

The tax return does not depend on whether the buyer or seller physically pays the tax, so when graphing the effect of sales tax, who pays the tax (that is, whether it is a change in demand or supply). Is generally ignored and focused. About tax return.

What determines the tax return if the financial burden of the tax is shared between the buyer and the seller, regardless of who pays the tax? The answer is the relative elasticity of supply and demand, which puts more strain on the market with a less elastic curve.

For example, if demand is not very elastic compared to supply, it means that demand is less responsive to price. Therefore, when taxes are levied, the price paid by the buyer is significantly higher than that of the seller, which increases the tax burden on the buyer.

Conversely, if supply is not very elastic compared to demand, then supply is less responsive to price. Sales tax makes the price received by the seller much lower than that of the buyer. The seller bears a heavy tax burden.

Q7) Define Market.

A7) An arrangement that facilitates the buying and selling of goods, services, factors of production, or future commitments. / A market is a place where buyers and sellers meet and trade.

Q8) Define Market Structure.

A8) Market structure refers to the number of buyers and sellers and the size of distribution in the market for goods and services. The market structure shows the number of buyers and sellers. Their market share; the degree of product standardization and ease of access to the market. Market structure also refers to a company's specific environment, the characteristics of which influence a company's pricing and production decisions.

Q9) What are the types of Market? Explain

A9) There are four types of Market:

Perfect competition refers to a market situation in which there are a large number of buyers and sellers of homogeneous products.

It is identified by the existence of the many firms; they all sell an identical product an equivalent way. The supplier is the one who accepts the price."- Vilas

Such market gains when the request for product of every producer is totally elastic. Mrs Joan Robinson.

It is a market condition with an outsized number of sellers and buyers, similar products, free entry of enterprises into the industry is ideal knowledge between buyers and sellers of existing market conditions and free mobility of production factors between alternative uses. Lim Chong-ya

Assumption:

The following assumptions for a fully competitive market:

1. A large number of buyers and sellers:

This affects single buyers and sales. When a company enters or leaves the market, there is no impact on the supply. Similarly, if a buyer enters or withdraws from the market, demand will not be affected. Such affects individual buyers and sellers.

2. Homogeneous products:

The second assumption of perfect competition is that all sellers sell homogeneous products. In this situation, the buyer has no reason to prefer the product of one seller to another. This condition exists only if the goods have a clear chemical and physical composition, that is, Substances of the specified grade: salt, tin, wheat, etc.

3. No discrimination:

Under complete competition in the market, sellers and buyers, sellers do freely. It means that buyers and sellers must be willing to deal openly with each other to buy and sell at market prices. This may be true of everything you might want to do so without offering special deals, discounts, or favours to selected individuals.

4. Perfect knowledge:

The competitive market is me (buyers and sellers are in close contact with each other. It means that, on the part of buyers and sellers, there is complete knowledge of the market. This means that many buyers and sellers in the market know exactly how much the price of the goods is in different parts of the market.

In other words, without the knowledge of each buyer and seller of the price at which the transaction is taking place, and the price at which the other buyer and seller are willing to buy or sell.

5. Industry FREE entry and exit:

In the long run, under full competition, the company can enter or exit the enterprise. There is no let or hindrance to the enterprise with regard to its entry into or exit from the market. In other words, the company has no legal or social restrictions. A large number of sellers is possible only if there is a free entry of the enterprise.

6. Perfect mobility:

There must be full mobility of domestic production factors that ensure uniform production costs throughout the economy. That means you are free to seek employment in any industry where different factors in production might like you.

7. Profit maximization:

Under perfect competition, all companies have a common goal of maximizing profits. Thus, there is a lack of social welfare of the general public.

8. No sales cost:

Under perfect competition, there is no sales cost.

9. No transportation costs:

Transportation costs between the sellers should not be. If transportation costs are present buyers are prevented from moving from one seller to another to take advantage of the price difference, which means that transportation costs do not affect the pricing of the product. In other words, these are always prices uniform in the market.

Monopolistic Competition An imperfect competition market that has the characteristics of both a monopoly market and a competitive market. Sellers can compete with each other and differentiate their products in terms of quality and branding to change their appearance. In this type of competition, the seller considers the price charged by the competitor and ignores the impact of his price on the competition.

Comparing short-term and long-term monopoly competition, there are two different aspects observed. In the short term, monopolies maximize profits and enjoy all profits as a monopoly.

Due to high demand, the company initially produces many products. Therefore, its marginal revenue (MR) corresponds to its marginal cost (MC). However, MRs will decline over time, and profits will decline as new companies enter the market where differentiated products affect demand.

The Oligopolistic market is made up of a small number of large companies that sell differentiated or identical products. Due to the small number of players in the market, their competitive strategies are dependent on each other.

For example, if one of the actors decides to lower the price of the product, the action will cause the other actors to lower the price as well. On the other hand, price increases may affect others so that consumers take no action in the hope of choosing their product. Therefore, strategic planning with these types of players is essential.

In situations where companies compete with each other, limiting production can create agreements to share the market and bring extraordinary benefits. This is true if either party respects the Nash equilibrium and neither is tempted to engage in the prisoner's dilemma. In such an agreement, they act like a monopoly. Collusion is called a cartel.

Monopoly Market

In a monopoly market, a single company represents the entire industry. There are no competitors and we are the only product seller in the entire market. This type of market is characterized by factors such as the sole claim to ownership of a resource, patents and copyrights, government-issued licenses, or high initial setup costs.

All of the above features related to monopoly limit other companies from entering the market. Therefore, the company remains the single seller as it has the authority to control the market and set prices for goods.

Q10) What are the assumptions of Perfect Competition Market?

A10) The following assumptions for a fully competitive market:

1. A large number of buyers and sellers:

This affects single buyers and sales. When a company enters or leaves the market, there is no impact on the supply. Similarly, if a buyer enters or withdraws from the market, demand will not be affected. Such affects individual buyers and sellers.

2. Homogeneous products:

The second assumption of perfect competition is that all sellers sell homogeneous products. In this situation, the buyer has no reason to prefer the product of one seller to another. This condition exists only if the goods have a clear chemical and physical composition, that is, Substances of the specified grade: salt, tin, wheat, etc.

3. No discrimination:

Under complete competition in the market, sellers and buyers, sellers do freely. It means that buyers and sellers must be willing to deal openly with each other to buy and sell at market prices. This may be true of everything you might want to do so without offering special deals, discounts, or favours to selected individuals.

4. Perfect knowledge:

The competitive market is me (buyers and sellers are in close contact with each other. It means that, on the part of buyers and sellers, there is complete knowledge of the market. This means that many buyers and sellers in the market know exactly how much the price of the goods is in different parts of the market.

In other words, without the knowledge of each buyer and seller of the price at which the transaction is taking place, and the price at which the other buyer and seller are willing to buy or sell.

5. Industry FREE entry and exit:

In the long run, under full competition, the company can enter or exit the enterprise. There is no let or hindrance to the enterprise with regard to its entry into or exit from the market. In other words, the company has no legal or social restrictions. A large number of sellers is possible only if there is a free entry of the enterprise.

6. Perfect mobility:

There must be full mobility of domestic production factors that ensure uniform production costs throughout the economy. That means you are free to seek employment in any industry where different factors in production might like you.

7. Profit maximization:

Under perfect competition, all companies have a common goal of maximizing profits. Thus, there is a lack of social welfare of the general public.

8. No sales cost:

Under perfect competition, there is no sales cost.

9. No transportation costs:

Transportation costs between the sellers should not be. If transportation costs are present buyers are prevented from moving from one seller to another to take advantage of the price difference, which means that transportation costs do not affect the pricing of the product. In other words, these are always prices uniform in the market.

Q11) What is Monopolistic Competition?

A11) Monopolistic Competition An imperfect competition market that has the characteristics of both a monopoly market and a competitive market. Sellers can compete with each other and differentiate their products in terms of quality and branding to change their appearance. In this type of competition, the seller considers the price charged by the competitor and ignores the impact of his price on the competition.

Q12) What is Economics?

A12) Economics is a science that deals with the production, Exchange and consumption of various goods in the economic system. It is a scarce resource that can lessen the abundance of human welfare. The central focus of Economics lies in the choice between resource scarcity and its alternative uses. The word "economics" is derived from two the Greek words oikos (House) and nemein (to manage) mean to manage the household budget "using the limited funds possible.

Q13) What are the difference between microeconomics and macroeconomics?

A13) The differences between microeconomics and macroeconomics can be seen in the following points. Microeconomics is the study of the economic activity of individuals and small groups of individuals. This includes specific households, specific companies, specific industries, specific products, and individual prices.

Macroeconomics is also derived from Macross, which means "big" in Greek. The purpose of microeconomics on the demand side is to maximize utility, while on the supply side it is to minimize profits at the lowest cost. On the other hand, the main objectives of macroeconomics are full employment, price stability, economic growth and a good balance of payments.

The basis of microeconomics is a price mechanism that works with the help of the power of supply and demand. These forces help determine the equilibrium price of the market. On the other hand, the basis of macroeconomics is national income, output, and employment, which are determined by aggregate demand and aggregate supply.

Microeconomics is based on various assumptions about the rational behavior of individuals. In addition, the phrase "ceteris paribus" is used to describe economic law. Macroeconomics, on the other hand, makes assumptions based on variables such as the total output of the economy, the extent to which its resources are used, the size of national income, and general price levels.

Microeconomics is based on partial equilibrium analysis that helps explain the equilibrium conditions of individuals, businesses, industries, and factors. Macroeconomics, on the other hand, is based on general equilibrium analysis, which is an extensive study of many economic variables, their interrelationships

and their interdependencies, to understand the workings of the entire economic system.

In microeconomics, equilibrium studies are analyzed at specific times. But it does not explain the time element. Therefore, microeconomics is considered static analysis. Macroeconomics, on the other hand, is based on time lags, rate of change, past and expected values of variables. This rough division between microeconomics and macroeconomics is not rigorous, as parts affect the whole and whole influences the parts.

Q14) What is Disposable Income?

A14) Disposable income, the portion of an individual's income for which the recipient has full discretion. Providing an accurate general definition of income is not easy. Income includes wages and salaries, interest and dividend payments from financial assets, and rent and net income from businesses. Capital gains on real or financial assets should also be counted as income in most cases, at least as long as they increase purchasing power. Such profits can be counted even if the asset has not actually been sold and the increase in purchasing power has not been exercised. In addition, it may include non-cash receipts (in-kind income).

Disposable income excludes mandatory payments in the form of direct taxes, compulsory payments to the social insurance system, and simple remittances from other people, institutions, or governments such as social security benefits and pensions. Includes further adjustments to include, and alimony. In some cases, the line between voluntary and mandatory payments becomes ambiguous, obscuring the meaning of disposable income. It may also be necessary to distinguish between the transfer income that a person is entitled to and the income that is actually received.

By convention, VAT and other taxes, payroll taxes, and indirect taxes such as employer contributions to social insurance are not deducted from the disposable income calculation. These obviously reduce the purchasing power of individuals in general, but it is difficult to attribute their occurrence to a particular person or family. If family members or members of other units share a "pool" of income, there may be a substantial difference between an individual's nominal disposable income (e.g., recorded in salary) and actual discretionary spending. You should also note that there is power. Therefore, a person whose official statistics appear to have very low income after tax may actually be a part-time worker who contributes to and shares the common resources of the family.

Q15) What is a closed economy? Give one example.

A15) A closed economy has no trading activity with the outside economy. Therefore, a closed economy is completely self-sufficient, meaning that imports do not enter the country and exports do not leave the country. The goal of a closed economy is to provide domestic consumers with everything they need from the border.

Why there is no real closed economy

Maintaining a closed economy is difficult in modern society, as raw materials such as crude oil play an important role as inputs to final goods. Many sovereign state do not commonly have raw materials and are forced to import these resources. The closed economy is an instinctive resistance to contemporary liberal economic theory, which promotes the opening of domestic markets to international markets in order to take advantage of comparative advantage and trade.

By focusing on labour and allocating resources to the most productive and efficient work, businesses and individuals can increase their wealth.

Popularization of open trade

Recent globalization means that economies tend to be more open to take advantage of international trade. Petroleum is a good example of a raw material traded worldwide. For example, in 2017, according to World, & quot; sTopExport.com, an independent research and education company, the five largest oil exporters accounted for more than USD $ 841.1 billion in exports. Saudi Arabia for $ 13.36 billion

$ 93.3 billion Russia

$ 61.5 billion in Iraq

$ 5.4 billion in Canada

United Arab Emirates is $ 49.3 billion.

According to the Energy Information Administration, even the United States, the world' largest oil producer, imported about 104,000 barrels / day in 2017, most of it from Canada, Saudi Arabia, Mexico, Venezuela and Iraq.

Example of closed economy

In reality, there is no completely closed economy. Brazil is the world' s most closed economy, importing the world' s lowest quantity of goods when measured as part of its gross domestic product (GDP). Brazilian companies face competitive challenges such as rising exchange rates and defensive trade policies. In Brazil, only the largest and most efficient companies with large economies can overcome export barriers.

How real interest rates balance commodity markets

Y = C + I (r) + G

Model Background

This model is closed in the sense that the model has no exports or imports. This model includes government taxes and government spending.

If the model is out of equilibrium, it is the changing real interest rate that brings the model back into equilibrium. Y> C + I (r) + G => Interest rate decreases => I is y = C + I (r) + Y < C +

I (r) + G => Interest rate increases => I is Y It decreases to = C + I (r) + G.

The left side of the commodity market represents supply

The right side represents demand.

Supply Y = C + I(r) + G Demand

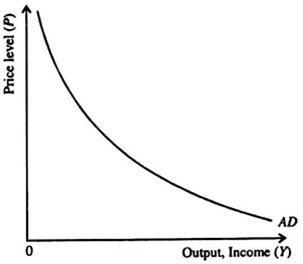

Q16) Define Aggregate Demand. Explain

A16) The term Aggregate Demand (AD) is used to describe the inverse relationship between demand and general price levels. The AD curve shows the amount of goods and services people in the country want at existing price levels.

In Fig. 7.2 the AD curve is drawn for a given value of the money supply M.

The AD curve is downward sloping for two reasons:

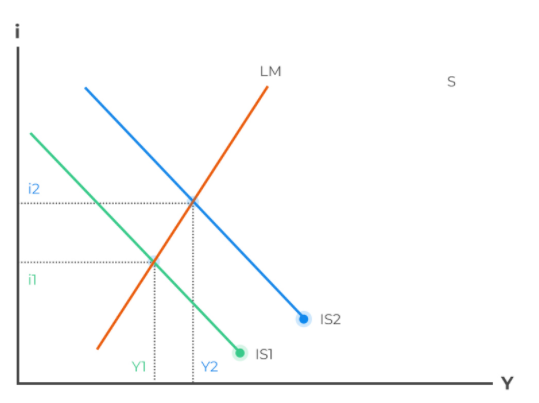

Q17) What is IS/LM model?

A17) The model is represented as a graph consisting of two intersecting lines. On the X-axis we have the real gross domestic product (Y), which is simply the output that the economy produces. On the Y-axis, we have nominal interest rates (i).

The intersection of the IS and LM curves shows the equilibrium point of interest rates and output when money markets and the real economy are in balance. If we move one of the two curves to the right or to the left, the model gives us a new set of economic output and interest rates.

Q18) What is Price Index?

A18) The Price Index (PI) is a measure of how prices change over a period of time. In other words, it's a way to measure inflation. There are multiple ways to calculate inflation (or deflation).

Q19) When will interest rates apply?

A19) Interest rates apply to most loan or borrowing transactions. The college tuition fees for the home where you purchased your personal debt, the start or fund business of a fund business, or the payment of your personal debt are as follows: Companies fund capital projects and obtain loans to expand their business by purchasing fixed and long-term assets such as land, buildings and machinery. Borrowed money will be repaid in one lump sum on a pre-determined date or in regular instalments.

The money repaid is usually more than the amount borrowed, as the lender needs compensation for the loss of money use during the loan period. The lender may be investing money during that period rather than offering a loan that would be generating income from the asset. The difference between the total repayment total and the original loan is of interest to be fulfilled. The interest charged will be applied to the principal amount.

Q20) What are the types of Taxes?

A20) TYPES OF TAXES

Prevalence of a number sorts of taxes is found in India. Taxes in India can be both direct and indirect.

However, the kinds of taxes even depend on whether a precise tax is being levied by the central or the kingdom authorities or any other municipalities.

Following is some of the predominant Indian taxes:

Direct Taxes

It is names so because it is directly paid to the Union Government of India. As per a survey, the Republic of India has witnessed a steady upward jab in the collection of such taxes over a period of previous years. The seen growth in these tax collections as well as the rate of taxes displays a healthful within your budget boom of India. Besides that, it even portrays the compliance of high tax alongside with higher administration of taxation. To title a few of the direct taxes, which are imposed with the aid of the Indian Government are:

• Banking Cash Transaction Tax

• Corporate Tax

• Capital Gains Tax

• Double Tax Avoidance Treaty

• Fringe Benefit Tax

• Securities Transaction Tax

• Personal Income Tax

• Tax Incentives

Indirect Taxes

As hostile to the direct taxes, such a tax in the nation is normally levied on some specific services or some unique goods. An indirect tax is no longer levied on any specific organization or an individual. Almost all the activities, which fall within the periphery of the indirect taxation, are protected in the range beginning from manufacturing items and transport of offerings to those that are supposed for consumption.

Apart from these, the different things to do and services, which are associated to import buying and selling etc. are even covered inside this range.

This large range results in the involvement as well as implementation of some or other oblique tax in all lines of business.

Usually, the oblique taxation in the Indian Republic is a complicated process that involves legal guidelines and regulations, which are interconnected to every other.

These taxation guidelines even consist of some laws that are specific to some of the states of the country.

The regime of indirect taxation encompasses distinctive sorts of taxes.

The groups provide offerings in all or most of the associated fields, some of which are as follows:

• Anti-Dumping Duty

• Custom Duty

• Excise Duty

• Sales Tax

• Service Tax

• Value Added Tax or V. A. T.

Taxation Types:

(i) Proportional taxes,

(ii) Progressive taxes,

(iii) Regressive taxes and

(iv) Digressive taxes.

Proportional Taxes:

Taxes in which the price of tax stays constant, even though the tax base changes, are called proportional taxes.

Here, the tax base may also be income, cash cost of property, wealth, or items etc. Income is, however, viewed as the fundamental tax base, because it is the determinant of taxable capability of a person.

In a proportional tax system, thus, taxes fluctuate in direct share to the change in income. If earnings are doubled, the tax quantity is additionally doubled. Thus, a proportional tax extracts a regular share of rising income.

Progressive Taxes:

Taxes in which the price of tax increases are known as innovative taxes. Thus, in an innovative tax, the quantity of tax paid will increase at a greater price than the amplify in tax base or income, for the taxation quantity is the product of multiplying the base through the charge and both these expand in a revolutionary tax.

Regressive Taxes:

When the charge of tax decreases as the tax base increases, the taxes are known as regressive taxes.

It must be referred to that in regressive taxation, although the whole quantity of tax increase on greater earnings in the absolute sense, in the relative sense, the tax rate declines on a greater income. As such, highly a heavier burden (sacrifice involved) falls upon the negative than on the rich.

Generally, taxes on necessaries are regressive as they take away a higher percentage of lower incomes as compared to greater incomes.

Thus, regressive taxation is unjust and inequitable. It does no longer comply with the canon of equity. It tends to accentuate inequalities of earnings in the community.

Digressive Taxes:

Taxes which are mildly progressive, consequently now not very steep, so that excessive earnings earners do not make a due sacrifice on the foundation of equity, are known as digressive.

In digressive taxation, thus, the tax payable increases solely at a diminishing rate.

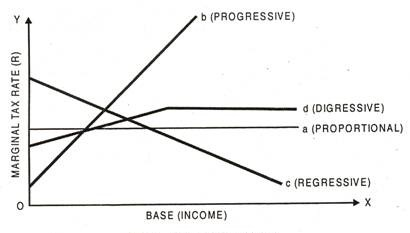

Diagrammatically, differences in progressive, proportional, regressive and digressive taxation are shown in Fig.

Fig. depicts the percentage of profits taken away in taxation under special tax rates. Tax line a represents a revolutionary tax rate, tax line b represents a proportional tax rate, tax line с suggests a regressive tax rate and tax line denotes a digressive tax rate.

The proportional tax charge has a regular slope, graphically, while the revolutionary tax rate has a rising fine slope.

The steeper the slope of the tax line, the modern the tax regime. The regressive tax charge line has a declining negative slope. The steeper the negative slope of the tax line, the more regressive the taxation. The digressive tax price line has a rising slope initially, but it turns into constant after a point.