Unit - 5

Inflation, National Income and Banking

Q1) What is inflation?

A1) Inflation is the rate at which the general price level of goods and services rises, resulting in a decline in the purchasing power of the currency. Central banks are trying to limit inflation and avoid deflation in order to keep the economy running smoothly.

Inflation is the continuous rise in the general price level of goods and services in the economy over a period of time. As price levels rise, less goods and services are purchased by each unit of currency. As a result, inflation reflects a decline in purchasing power per unit amount. This is a loss of real value in exchange media and unit accounts within the economy. The main indicator of price inflation is the inflation rate. This is the annual rate of change of the general price index (usually the consumer price index). The opposite of inflation is deflation.

Inflation affects the economy in a variety of positive and negative ways. The negative effects of inflation include increased opportunity costs for holding money and uncertainty about future inflation that can discourage investment and savings. If inflation is fast enough, consumers are in the future. The positive effects are reducing the real burden of public and private debt, keeping the nominal interest rate above zero so that the central bank can adjust interest rates to stabilize the economy, and unemployment due to nominal wage rigidity. Includes reductions. Economists generally believe that high inflation and hyperinflation are caused by the overgrowth of the money supply. There are more diverse views on the factors that determine low to moderate inflation. Low or moderate inflation can result from fluctuations in the actual demand for goods and services, or changes in available supplies such as shortages. However, the consensus is that the long-term duration of inflation is driven by the money supply, which grows faster than economic growth.

Inflation is a quantitative measure of the speed at which the average price level of a basket of selected goods and services in an economy increases over a period of time. It's the constant rise within the general level of prices where a unit of currency buys but it did in prior periods. Often expressed as a percentage, inflation indicates a decrease within the purchasing power of a nation’s currency.

According to A.C. Pigou (Cambridge University), inflation comes in existence “when money income is expanding more than in proportion to income activity”. An increase in general price level takes place when people have more money income to spend against less goods and services.

G. Crowther (British economists) brings out the meaning precisely when he says, “inflation is a state in which the value of money is falling i.e., prices rising”.

Inflation, according to Harry G. Johnson (Canadian economist), “is a sustained rise in prices”.

Paul Samuelson (American economist) defines inflation as “a rise in the general level of prices”.

According to Milton Friedman (American economists), ‘inflation is taxation without representation’.

Q2) Explain the types of inflation.

A2) Types of Inflation

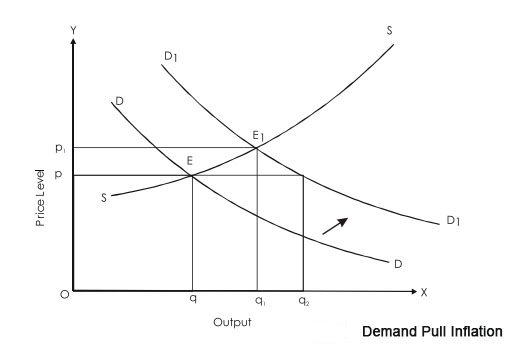

- Demand pull inflation

This is when aggregate demand in the economy exceeds aggregate supply. This increase in aggregate demand can be caused by an increase in the level of money supply or income or public spending.

This concept is related to full employment when it is not possible to change supply. See the graph below.

In the graph above, SS is the aggregate supply curve and DD is the aggregate demand curve. Farther,

Op is an equilibrium price

Oq is the equilibrium output

Due to extrinsic causes, the demand curve shifts to the right to D1D1. Therefore, at the current price (Op), the demand increases by qq2. However, the supply is Oq.

Therefore, excessive demand for qq2 puts pressure on prices and raises them to Op1. Therefore, this price has a new equilibrium where supply and demand are equal. As you can see, excess demand is eliminated as follows:

Prices will rise, demand will fall, and supply will rise.

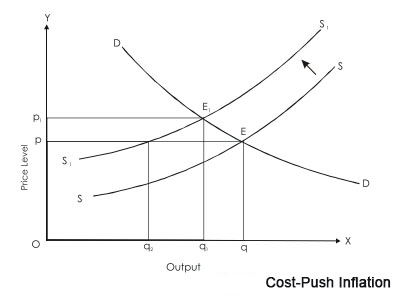

b. Cost push inflation

Supply can also cause inflationary pressure. Aggregate demand remains the same, but price levels rise when aggregate supply declines due to extrinsic causes. See the graph below.

In the graph above, the equilibrium price is Op and the equilibrium output is Oq. When aggregate supply drops, the supply curve SS shifts to the left to reach S1S1.

Currently, at the price Op, the demand is Oq, but the supply is Oq2, which is smaller than Oq. Therefore, prices will be pushed higher until a new equilibrium is reached at Op1.

At this point, there is no excessive demand. Therefore, we can see that inflation is a self-limiting phenomenon.

c. Open inflation

This is the simplest form of inflation visible to people as price levels continue to rise. You can see the annual rate of increase in price level.

d. Suppressed inflation

Let's say the economy is in excessive demand. This usually leads to higher prices.

However, the government can take some repressive measures, such as price controls and rations, to prevent excessive demand from raising prices.

e. Hyperinflation

With hyperinflation, price levels rise rapidly. In fact, prices can be expected to rise every hour. This usually leads to democratization of the economy.

f. Creeping moderate inflation

Creeping – In this case, the price level rises very slowly over a long period of time.

Moderate – In this case, the price level rise is moderate, not too fast or too slow.

g. True inflation

This is done after all the elements of the economy have been fully employed. With full employment, national production becomes completely inelastic. Therefore, more money simply means higher prices, not more production.

h. Semi-inflation

Even before full employment, the economy may face inflationary pressure due to bottlenecks from certain sectors of the economy.

Q3) What are the causes of inflation?

A3) Inflation has several causes. Here are some of them.

1) Main causes

There are two main reasons for rising inflation in the economy. When excess demand becomes oversupplied, prices rise as demand increases. At the same time as the price of the factor rises, so does the production cost. That is another reason for rising prices in the economy.

2) Increase in public spending

Non-economic causes

Public spending is the amount of money the government spends on public purposes such as building roads and providing government services. Increasing public spending usually increases the amount of money people have.

Increasing money with people causes increased demand. Inflation occurs when there is excess demand that exceeds supply. This is especially recurring in developing countries and in countries that require the support of many governments.

3) Deficit finance and government spending

Government income may be less than spending. It creates inequality in the economy. To make up for this lack of balance, governments often rely on printing more money-this process is known as deficit finance.

Therefore, inflation in the economy is increasing. This is especially prevalent as the amount of money in circulation increases, but the total amount of commodities available in the economy remains the same.

4) Increased circulation speed

The full use of money in the economy depends on the money supply by the government and the amount of money in circulation.

Inflation often occurs when people in the economy are spending money at a faster rate. This will increase the speed of money circulation in the economy.

5) Hoarding

Saving money

Another reason for inflation could be money savings. People, especially sellers, tend to stockpile available products and not bring them to market. This stacking leads to a shortage of supply, which in turn pushes up the market price of goods.

6) Genuine shortage

Production may decrease. The number of commodities in the economy may witness a decline. Demand remains unchanged and increases over time, but supply is in short supply. This true shortage in the economy leads to inflation.

7) Export

For a stable economy, we need to meet demand both inside and outside the economy. This means that the amount required by foreign economies must also be met. A shortage of exports reduces the money supply in the economy. This brings inflation.

8) Labor union

Union

Trade unions are sometimes the cause of inflation in the economy. The job of trade unions is to seek higher wages for workers. When this is achieved, the amount of money with people will increase, except that production costs will increase. Both of these reasons are responsible for rising inflation.

9) Tax reduction

Tax cuts cause two things-first, it increases the amount of money people have. It also brings about a reduction in money with the government.

As a result, production is reduced. When production decreases and the amount of money with people increases, excess demand becomes oversupplied. This leads to inflation within the economy.

10) Indirect tax

Indirect tax

The government imposes indirect taxes on businesses. There are various forms of tax, such as value-added tax and excise tax.

These indirect taxes result in increased production costs. Producers are not making enough profit from their sales. This leads to a loss of money with people and causes inflation.

11) Price increases in the international market

Many products in the economy are made from goods imported from abroad. If the price of goods rises overseas, the import cost will rise. Rising import costs have two consequences: goodwill is not imported and there is a shortage of products in the economy.

Alternatively, production costs may increase. Both of these phenomena lead to higher prices and cause inflation.

12) Non-economic causes

Non-economical

There may be several non-economic causes that lead to inflation. For example, some natural factors can lead to a shortage of products in the economy.

There may be floods that may destroy crops in one season. When it rains, it can fail, which makes it impossible to produce certain foods. These are all uneconomical reasons, causing supply declines, price increases and inflation.

Q4) How can you control inflation?

A4. Measures to control Inflation

- Repo rate

This is the percentage of RBI or Reserve Bank of India funding commercial banks.

This is a very important percentage of the monetary outflow from the government. Commercial banks can get the help of RBI whenever they face a shortage of funds. Reporate is a tool commonly used by governments to control inflation.

Governments can use this tool to curb the flow of money into the economy. They can simply raise the repo rate to limit the flow of cash.

2. CRR (reserve requirement ratio)

Another very important tool is the reserve requirement ratio. This device is commonly used by RBI. It can control the amount of money that circulates in the economy. The CRR actually reflects the specific amount that commercial banks are allowed to deposit with the Reserve Bank of India.

By increasing the CRR rate, the central government can have a significant impact on inflation levels. This is one of the best government measures to curb inflation.

3. Reverse repo rate

Another way to control inflation is to use reverse reporate. This is the percentage of commercial banks lending to RBI.

Another way to control inflation is to use reverse reporate. This is the percentage of commercial banks lending to RBI.

At any given time, the economy can face inflation and cash shortages. It is at this time that the reverse repo rate, which is part of the liquidity adjustment facility adopted by central banks, will be used.

As a point of credit, it should be noted that reverse repo rates are generally percentile lower than current repo rates. In an attempt to curb inflation, reverse reporate allows the RBI to withdraw money from the economy.

Now let's talk more about it.

- Financial measures:

Monetary measures to curb inflation are attempts to reduce the income that can be made through these steps.

Credit management: This is an important way to control inflation levels. Central banks have adopted several measures to control the quality and quantity of credit.

To reach that goal, it not only raises bank interest rates and reserve requirements, but even sells securities in the open market. It also regulates consumer credit. This has proven useful in the presence of demand inflation factors.

- Democratization: This is an extreme step and is being taken by the government to eliminate the black money in the market. If the government feels that the huge amount of black money in the economy is having an impact, the government can cancel the denomination money.

- New currency issue: This is another extreme step taken by the government. It can launch new currencies that can be exchanged for old banknotes. This is only done if the country has hyperinflation.

2. Financial measures:

Next, I would like to talk about fiscal policy measures to curb inflation. These steps work to manage rising government spending, private investment, public investment, and more.

Reducing Extra Costs: Governments need to take steps to reduce unnecessary costs to reduce inflation. Private expenses should be managed as well. The bill needs to be covered by taxation.

Tax increase: Not only can the government raise taxes, but it can also adopt new taxes to reduce consumer spending. But rising tax levels should not discourage people from saving and investing.

Increased Savings: People should be encouraged to save more. This is expected to reduce the disposable income of the people. Governments need to be proactive in high interest rate public lending, benefit schemes, compulsory pension funds, pension funds and pension schemes.

Surplus Budget: The government may also adopt anti-inflationary budgetary policies. This can be achieved by giving up deficit finance.

Public Debt: You need to manage the repayment of public debt. It will need to be postponed at a later date until inflationary pressures subside.

3. Other measures:

Some other government measures to control inflation include increased production, reduced demand, and so on.

To increase production: You need to increase production of essentials such as sugar, food and oil. If necessary, you need to import raw materials for production to face the crisis.

Rationalization aimed at improving productivity should be seen as a long-term strategy for controlling inflation.

The consumer goods sector must be supported by financial assistance, subsidies, raw materials and more.

Reasonable wage policy: The government should also impose rational wage and income policy by freezing income, bonuses, dividends, etc. But yes, this is a big step and should only be taken for a short time.

Price Control and Distribution: Price control and distribution are the other two steps in a series of inflation checks.

Distribution is the distribution of essentials to a large number of people. Includes rice, sugar, oil, wheat and more.

Q5) What is national income? Write its features.

A5) In normal language, national income is the sum of goods and services produced in a country in a year. This is the sum of all final goods and services produced each year in a country.

Definitions:

According to Professor Marshall, "A country's workforce and capital, based on its natural resources, produce a specific net total of commodities, material and immaterial, including services of all kinds, every year ... This is the country. Or national dividend. "

According to Marshall's definition, national income is obtained by summing the net output of all production activities. The term "net" means the depreciation of machinery and plants that is deducted from Gross National Product. You need to add the net profit from overseas.

Characteristics of national income:

1) National income is a macroeconomic concept. Macroeconomics deals with totals or the economy as a whole. National income data gives an overview of the performance of a country's economy as a whole over a period of time.

2) National income is a concept of flow. National income is the flow of goods and services produced in a country during the year. Only the goods and services actually produced are included.

3) National income is a monetary evaluation of goods. National income is always expressed financially. It represents only those goods and services that are exchanged for money.

4) National income includes only the value of final goods and services. To avoid double calculations, when estimating national income, only the value of final goods and services is included, not the value of intermediate goods or raw materials. For example, when estimating sugar production, sugar cane is already included in the sugar price, so you don't have to consider the value of sugar cane.

5) National income is net total: National income includes the net value of the goods and services produced and does not include depreciation such as the depletion of capital goods due to use in the production process.

6) Net income from abroad is included in national income: When estimating national income, the net income received from international trade is net export value (X – M) and net income (R – P).

7) Fiscal year: Always referred to the period, that is, the fiscal year in general. In India, it is from April 1st to March 31st every year.

Q6) Explain gross national product.

A6) Gross National Product (GNP) is the sum of all finished products and services produced by national citizens in a particular fiscal year, regardless of location. GNP also measures the output produced by companies in countries that are domestic or foreign. This can be defined as part of an economic statistic consisting of gross domestic product (GDP) and income earned by residents from investments made abroad.

Simply put, GNP is a superset of GDP. GDP limits economic analysis to the geographic boundaries of a country, but GNP extends it to take into account the net foreign economic activities carried out by residents.

Basically, GNP means how the people of a country contribute to its economy. Consider citizenship regardless of the location of ownership. The Grand National Party does not include the income of foreign residents earned domestically. The Grand National Party also does not count the income earned by foreign residents or businesses in India and excludes products manufactured by foreign companies in India.

In the calculation, GNP adds government spending, consumer spending, private domestic investment, net exports, and income earned by foreign nationals, and excludes the income of foreign residents in the domestic economy. In addition, GNP omits the value of intermediate products to avoid double counting because these entries are included in the value of the final product and service.

Q7) What are the different methods to calculate national income?

A7) There are three different approaches to calculate national income. They are–

1) Aggregate Output method 2) Aggregate Income method

3) Aggregate Expenditure method

1)Aggregate output method:

Under this technique country wide profits are calculated with the aid of using aggregating the fee of all very last items and offerings produced in a rustic at some point of a year. Whatever items and offerings are produced in a rustic with the aid of using distinct sectors is expanded with the aid of using their modern-day marketplace charge. The sum overall of all this acquired is simply GNP at marketplace charge. From GNP whilst depreciation fee is deducted, we get NNP at marketplace charge.

In using this method, to avoid double counting, only the value of final goods and services should be taken into account. For this economist have suggested two alternative approaches for measuring national income by output method.

i) Final goods method ii) Value added method

i) Final goods method: Under this method, only the value of final goods and services is taken into account to estimate GNP. The value of intermediate goods and the raw material should not be taken as it would result in double counting. For e.g. – When the value of cloth is taken, value of raw-cotton should not be included because cloth includes the value of raw-cotton.

Ii) Value added method: Under this method, we calculated the value added at each stage of production and total finally sum-up the values to get the total value of the output produced. This is explained with the help of following example:

Stage of Production | Market value of goods (Rs.) | Value added in Production (Rs.) |

Cotton | 40 | 40 |

Yarn (Thread) | 55 | 15 |

Cloth | 75 | 20 |

Shirt [Final goods] | 100 | 25 |

Total Value added | 270 | 100 |

In this table market value of final goods i.e., shirt is Rs. 100. The sum total of value added at each stage of production is also Rs. 100. Thus, GNP by value added approach is equal to the value of final goods approach. Economists consider value added method a better method and it helps to avoid double counting.

Precautions: While estimating national income by output method, the following precautions should be taken:

1) To keep away from double counting, simplest the fee of very last items and offerings should be taken into consideration.

2) Goods used for self intake with the aid of using farmers must be envisioned with the aid of using a bet painting this is imputed fee of products produced for self intake, is protected in country wide profits.

3) Indirect taxes protected with inside the marketplace expenses are to be deducted and subsidies given with the aid of using the authorities to positive merchandise must be brought for correct estimation of country wide profits.

4) While comparing output, adjustments with inside the charge degree among distinct years should be taken into consideration.

5) Value of exports must be brought and fee of imports must be deducted.

6) Depreciation of capital property must be deducted.

7) Sale and buy of 2d hand items must be left out because it isn't always a part of modern-day manufacturing.

2)Aggregate income method:

This technique is likewise referred to as issue fee technique. Under this technique, country wide profits are acquired with the aid of using including the earning which include hire, wages, hobby and earnings acquired with the aid of using all men and women and corporations withinside the USA at some point of a year. The overall profits earned with the aid of using all of the elements of manufacturing could be identical to the fee of all form of very last items and offerings produced at some point of a year.

Precautions: While estimating national income by income method, the following precautions should be taken:

1) Transfer earning or switch bills like scholarships, gifts, donations, charity, antique age, pensions, unemployment allowance etc., must be left out.

2) All unpaid offerings like offerings of housewife, instructor coaching her/his child, must be left out.

3) Any profits from sale of 2d hand items like car, house, etc., must be left out.

4) Income from sale of stocks and bonds must be left out, as they do now no longer upload whatever to the actual country wide profits.

5) Revenue acquired with the aid of using the authorities thru direct taxes, must be left out, as it's miles simplest a switch of profits.

6) Undistributed earnings of companies, profits from authorities’ belongings and earnings from public enterprise, which include water supply, must be protected.

7) Imputed fee of manufacturing saved for self intake and imputed hire of proprietor occupied homes must be protected.

3)Aggregate Expenditure method:

Under expenditure technique the country wide profits are regarded as the whole expenditure on items and offerings produced at some point of the year.

Major part of the total goods and services are consumed by households, firms and Government. The unsold goods are held by producer as stock or inventories. Hence, they are assumed to be bought by the producers. The total expenditure incurred by household, Firms and Government are added up to obtain the national income.

To add up total expenditure, we include the following items:

1) Personal consumption expenditure. This is the expenditure on consumer goods and services. (C)

2) Gross domestic private investment (I). This includes the expenditure of business firms on capital goods like building, machinery, equipment etc.

3) Government purchase of goods and services. (G)

4) Net foreign investment – The expenditure on exports is added and expenditure on import is deducted. (E)

E = X – M + (R – P)

Now Gross national expenditure = C + I + G + E

This is called Gross national income. We can obtain Net National Income by deducting depreciation from the Gross National expenditure thus obtained.

Net National Income = Gross National Expenditure – Depreciation

Precautions: While estimating national income by Expenditure method, the following precautions should be taken:

1) Expenditure on all intermediate goods and services should be ignored, in order to avoid double counting.

2) Expenditure on the purchase of second-hand goods should be ignored, as it is not incurred on currently produced goods.

3) Expenditure on transfer payments like scholarships, old age pensions, unemployment allowance etc., should be ignored.

4) Expenditure on purchase of financial assets such as shares, bonds, debentures etc., should not be included, as such transactions do not add to the flow of goods and services.

5) Indirect taxes should be deducted.

6) Expenditure on final goods and services should be included.

7) Subsidies should be included.

Q8) How can you identify that a particular bank is a Commercial bank?

A8) A commercial bank is a bank that performs all kinds of banking functions, such as receiving deposits, prepayment of loans, credit creation, and agency functions. It is also called a joint-stock company because it is organized in the same way as a joint-stock company.

They usually carry out short-term loans to their customers. Recently, we have also started medium- to long-term loans. Twenty major commercial banks are nationalized in India, but in developed countries they operate like private sector corporations. Commercial banks in India include Andorra Bank, Canara Bank, Indian Bank and Punjab National Bank.

A commercial bank is an institution that operates for profit. It accepts deposits from the general public and extends loans to the households, the firms and the Government. The essential characteristics of commercial banking include

(1) Acceptance of deposits from the public.

(2) For the purpose of lending or investment.

(3) Withdrawal by means of an instrument whether a cheque, draft, order, etc.

Definition:

According to Cairns Cross, “A bank is an institution which deals in money and credit.”

According to Sayers, “Banks are institutions whose debts are usually referred to as ‘bank deposits’ and commonly accepted in final settlement of other people debts.”

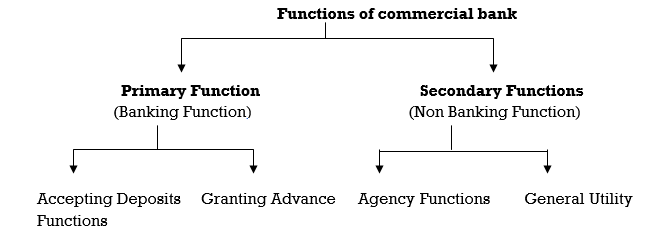

Q9) What are the functions of Commercial bank?

A9) Modern commercial banks perform a variety of functions and help the industrialists, businessmen and traders. They keep the wheels of commerce, trade and industry always revolving. Modern commercial banks perform mainly two types of functions i.e., primary or banking functions and secondary or subsidiary functions.

(A) Primary Functions:

The primary functions of a bank are also known as banking functions. They are the main functions of a bank. They are as follows –

(I) Accepting Deposits: Accepting Deposits from the public is the most important function of a modern commercial bank offering various types of deposit accounts; banks mobilize the savings of the community. People who have surplus money deposit it with a bank for safety. The commercial banks protect the deposits and give interest on such deposits. There are four types of accounts:

(a) Saving Deposits Accounts: It is a deposit account that is operated with the aid of using people for the reason of saving part of their profits. Its major goal is to sell financial savings. It encourages saving conduct the various income earners and others. There isn't any restrict at the range and quantity of deposits. But withdrawals are situation to positive regulations. Banks pay a positive percent of hobby in this deposit. At gift it's miles 4 % p.a. The cash may be withdrawn both with the aid of using cheque or withdrawal slip.

(b) Fixed Deposits Accounts: Fixed deposits are saved in a financial institution for constant duration various from 30 days to numerous years. A positive amount of cash is deposited for a set duration. A better price of hobby is paid. The price may also range from financial institution to financial institution Withdrawals aren't allowed earlier than the adulthood of duration. In case of emergency, if the depositor desires to withdraw cash earlier than the adulthood date, he's going to ought to lose a few hobbies. The depositor is given a set deposit receipt which he has to supply on the time of adulthood. The deposit may be renewed for in addition duration. Fixed deposit account is likewise called time deposit.

(c) Current Deposits Accounts: These accounts are also known as demand deposits because the amount can be withdrawn on demand. This type of account is opened by businessmen who have a number of regular transactions with the bank, both deposits and withdrawals. There, is no restriction on the number and amount of deposits. There are also no restrictions on the withdrawals. Bank does not pay any rate of interest on such accounts. The bank provides overdraft facility to current account holder. Banks charge incidental commissions on such accounts. It facilitates the industrial progress.

(d) Recurring Deposits Account: Under this account, regular income earners deposit a certain amount of money at regular intervals for a certain period of time. For example, an individual can deposit, say Rs 500 every month for a certain period say, 2 years. Its main objective is to develop regular savings habits among the public. The period of deposit is minimum 6 months and maximum 10 years. The rate of interest is higher. At the end of the maturity period, the account holder can get substantial amount, which can be utilized for the purchase of consumer durables or some other investment such as land, machinery, etc.

(II) Granting Advances (Loans):

The second important function of a commercial bank is to extend loans and advances. The money which is received by banks by way of deposits is utilized for granting loans and advances to worthy borrowers. The profit earning capacity of a bank mainly depends upon the performance of the function. This function is also important in the context of economic development in general and development of trade, industry and commerce.

(a) Overdraft Facility: An overdraft facility is granted with the aid of using the financial institution handiest to the ones humans who've their contemporary-day bills withinside the financial institution. To meet the transient desires of the consumer, the financial institution may also allow the consumer to overdraw the quantity from the financial institution in extra of his balance. The financial institution may also furnish such increase at the private security. The hobby is charged handiest at the real quantity used. The overdraft is granted handiest every so often and for quick durations. A positive quantity is sanctioned as overdrafts which may be withdrawn inside a positive time frame say 3 months or so. It is sanctioned to traders, partnership corporations and joint inventory agencies. The overdraft facility may be renewed from time to time.

(b) Cash Credit: It is a short-term credit given by the bank to any businessman to meet regular working capital needs. The bank opens a separate account in respect of cash credit. The borrower is allowed to draw from that account upto a certain ‘limit against a bond signed by securities or any other eligible securities. Interest is charged only on the actual amount withdrawn by the customer. It can be availed by current account holders as well as other businessmen. Most industrial concerns and business houses borrow money in this form.

(c) Loans: When a banker makes a lump-sum advance to the customers, it is called 'loan'. Interest is charged on the entire amount sanctioned irrespective of whether the complete amount is used or not by the customer. Loans are of various types i.e., Term loans, participation loans, personal loans, call loans, collateral loans etc.

a) Call Loans or Money at call: are loans repayable at short notice. They are called call loans, as they can be called back at any time. These loans are given to for a period of 7 to 15 days for investment in stock market. The rate of interest is the lowest.

b) Short term Loans: are provided by commercial bank for a period not more than two years. The rate of interest is higher. They are given to businessmen to satisfy their working capital requirement.

c) Medium term Loans: The loans are sanctioned for a duration of to 5 years duration. The price of hobby charged for this form of mortgage is extra than the quick time period loans. Such loans are beneficial to industries to introduce improvements or for creation of latest approach of production.

d) Long term Loans: Loans which can be sanctioned for 5 years are called long time loans. The price of hobby charged is better than different loans. Such loans assist businessmen to introduce everlasting modifications with inside the strategies of production.

e) Discounting Bills of exchange: Another important function that the modern banks perform is the discounting of bills of exchange. Advances are made by discounting the bills of exchange. These advances are given for short periods only. When the holder of the bill is not in a position to wait till the maturity of the bill and requires the cash urgently, he sells the bill of exchange to the bank. The bank purchases the instrument at a discount. This type of business is very common in advanced countries.

(B) Secondary Functions:

Secondary functions are also known as non-banking functions or subsidiary functions or subsidiary functions. They are classified into two main categories

(a) Agency functions (b) General utility Functions

(A) Agency Functions: Bank also act as agents for their customers and in that capacity perform certain functions, which are known as agency functions. For these services, the bank charges certain commission from the customers. Some of the agency functions are as follows:

1) Collection: The commercial banks collect cheque, bills, draft interest, dividends on behalf of their customers and credit them into their accounts. This service is provided on the standing instructions from customers.

2) Payments: Banks also pay bills, insurance premium interest, loan installments, electricity bills, telephone bills, etc. on behalf of their customers as per their direction.

3) Purchase and Sale of Securities: Banks purchase or sell shares, bonds and securities of private companies on behalf of their clients.

4) Acts as Trustee: Banks acts as the trustee and the executor of the wills of their customers after their death.

5) E-Banking (Electronic Banking): A customer can operate his bank account through internet. Money can be transferred from one place to another for their customers. E-banking helps businessmen, traders, merchants in transacting business.

6) Dematerialization Account (De-mat Account): Some banks provide De-mat facility. De-mat account is useful to investors who deal in shares. The transactions related to buying and selling of shares are recorded in a separate De-mat account. Periodically statements regarding shares transactions are given to each investor.

B) General Utility Functions:

1) Safe Deposit Vault (Lockers): This facility is available to the general public to enable them to keep their valuables and securities like ornaments, jewels, documents, deeds, etc. There is a separate section in banks where lockers are provided in various sizes on payment of fixed rates.

2) Remittance of Funds: Banks remit money from one place to another or even from one country to another. Remittance of fund is done by telegraphic transfer, mail transfer, demand draft, etc.

3) Letter of credit: Commercial banks also issue letters of credit, to enable the traders to buy goods from foreign countries on credit. Through this letter of credit, the bank in one country authorizes another bank in foreign country to honour the draft or cheque of the person named in the document. The payment is limited to the amount shown in the letter and the amount is chargeable to the bank which issues the letter.

4) Referee: As a referee a bank authenticates the credit worthiness of its customers. This enables the customers to run their business smoothly and also obtain goods and services on credit.

5) Underwriter: Banks provide underwriting facility to the joint stock companies especially new business enterprises and also to the government in order to help them in raising funds. It guarantees the purchase of certain portion of shares if not sold in the market. Later they are free to sell these shares in the market whenever they want to do so. This is all done by the banks on a small commission from the company.

6) Dealings in Foreign Exchange: By keeping separate foreign exchange department, commercial banks offer services for converting one currency into another.

7) ATM facility (Automated Teller machine): Now-a-day banks also provide ATM facility to their customers. As a result, they can withdraw money at any time of the day, at their convenience, whenever they need it.

8) Collects statistics: The modern banks also collect statistics about money, banking, trade, commerce and publish them in form of pamphlets and hand outs. This helps their customers in acquiring knowledge about the latest economic situation.

9) Travellers’ Cheques: Banks help customers by issuing internal or international travellers’ cheques. When people travel within the country or between countries traveller’s cheques are used as most convenient method of carrying funds.

Q10) What are the primary functions of Commercial bank?

A10) Primary Functions:

The primary functions of a bank are also known as banking functions. They are the main functions of a bank. They are as follows –

(I) Accepting Deposits: Accepting Deposits from the public is the most important function of a modern commercial bank offering various types of deposit accounts; banks mobilize the savings of the community. People who have surplus money deposit it with a bank for safety. The commercial banks protect the deposits and give interest on such deposits. There are four types of accounts:

(a) Saving Deposits Accounts: It is a deposit account that is operated with the aid of using people for the reason of saving part of their profits. Its major goal is to sell financial savings. It encourages saving conduct the various income earners and others. There isn't any restrict at the range and quantity of deposits. But withdrawals are situation to positive regulations. Banks pay a positive percent of hobby in this deposit. At gift it's miles 4 % p.a. The cash may be withdrawn both with the aid of using cheque or withdrawal slip.

(b) Fixed Deposits Accounts: Fixed deposits are saved in a financial institution for constant duration various from 30 days to numerous years. A positive amount of cash is deposited for a set duration. A better price of hobby is paid. The price may also range from financial institution to financial institution Withdrawals aren't allowed earlier than the adulthood of duration. In case of emergency, if the depositor desires to withdraw cash earlier than the adulthood date, he's going to ought to lose a few hobbies. The depositor is given a set deposit receipt which he has to supply on the time of adulthood. The deposit may be renewed for in addition duration. Fixed deposit account is likewise called time deposit.

(c) Current Deposits Accounts: These accounts are also known as demand deposits because the amount can be withdrawn on demand. This type of account is opened by businessmen who have a number of regular transactions with the bank, both deposits and withdrawals. There, is no restriction on the number and amount of deposits. There are also no restrictions on the withdrawals. Bank does not pay any rate of interest on such accounts. The bank provides overdraft facility to current account holder. Banks charge incidental commissions on such accounts. It facilitates the industrial progress.

(d) Recurring Deposits Account: Under this account, regular income earners deposit a certain amount of money at regular intervals for a certain period of time. For example, an individual can deposit, say Rs 500 every month for a certain period say, 2 years. Its main objective is to develop regular savings habits among the public. The period of deposit is minimum 6 months and maximum 10 years. The rate of interest is higher. At the end of the maturity period, the account holder can get substantial amount, which can be utilized for the purchase of consumer durables or some other investment such as land, machinery, etc.

(II) Granting Advances (Loans):

The second important function of a commercial bank is to extend loans and advances. The money which is received by banks by way of deposits is utilized for granting loans and advances to worthy borrowers. The profit earning capacity of a bank mainly depends upon the performance of the function. This function is also important in the context of economic development in general and development of trade, industry and commerce.

(a) Overdraft Facility: An overdraft facility is granted with the aid of using the financial institution handiest to the ones humans who've their contemporary-day bills withinside the financial institution. To meet the transient desires of the consumer, the financial institution may also allow the consumer to overdraw the quantity from the financial institution in extra of his balance. The financial institution may also furnish such increase at the private security. The hobby is charged handiest at the real quantity used. The overdraft is granted handiest every so often and for quick durations. A positive quantity is sanctioned as overdrafts which may be withdrawn inside a positive time frame say 3 months or so. It is sanctioned to traders, partnership corporations and joint inventory agencies. The overdraft facility may be renewed from time to time.

(b) Cash Credit: It is a short-term credit given by the bank to any businessman to meet regular working capital needs. The bank opens a separate account in respect of cash credit. The borrower is allowed to draw from that account upto a certain ‘limit against a bond signed by securities or any other eligible securities. Interest is charged only on the actual amount withdrawn by the customer. It can be availed by current account holders as well as other businessmen. Most industrial concerns and business houses borrow money in this form.

(c) Loans: When a banker makes a lump-sum advance to the customers, it is called 'loan'. Interest is charged on the entire amount sanctioned irrespective of whether the complete amount is used or not by the customer. Loans are of various types i.e., Term loans, participation loans, personal loans, call loans, collateral loans etc.

f) Call Loans or Money at call: are loans repayable at short notice. They are called call loans, as they can be called back at any time. These loans are given to for a period of 7 to 15 days for investment in stock market. The rate of interest is the lowest.

g) Short term Loans: are provided by commercial bank for a period not more than two years. The rate of interest is higher. They are given to businessmen to satisfy their working capital requirement.

h) Medium term Loans: The loans are sanctioned for a duration of to 5 years duration. The price of hobby charged for this form of mortgage is extra than the quick time period loans. Such loans are beneficial to industries to introduce improvements or for creation of latest approach of production.

i) Long term Loans: Loans which can be sanctioned for 5 years are called long time loans. The price of hobby charged is better than different loans. Such loans assist businessmen to introduce everlasting modifications with inside the strategies of production.

j) Discounting Bills of exchange: Another important function that the modern banks perform is the discounting of bills of exchange. Advances are made by discounting the bills of exchange. These advances are given for short periods only. When the holder of the bill is not in a position to wait till the maturity of the bill and requires the cash urgently, he sells the bill of exchange to the bank. The bank purchases the instrument at a discount. This type of business is very common in advanced countries.

Q11) Define Central bank.

A11) The Central Bank is the most important banking institution in the banking structure of every country. It is the ‘apex’ (highest) banking institution and is rightly treated as the ‘Lender of the money market’. It guides and regular the activities of all the banks in the country. The Central Bank acts as an agent, banker and adviser to the government in economic and financial matters. Their main objective is to regulate currency and credit system and to ensure economic stability and growth in the country. Today almost all the countries of the world have their own Central Banks.

Monetary aggregates are the measures of money stock in a country. Central banks measure money aggregates and present them in the form of end-of-month national currency stock series. In the U.S, monetary aggregates are conventionally labeled as M 0, M 1, M 2, and M 3

The Reserve Bank of India, which is the Central Bank of our country, was established on 1st April, 1935 under the RBI Act, 1934.

Definition:

According to Prof. R. P. Kent, Central Bank is “An institution charged with the responsibility of managing the expansion and contraction of the volume of money in the interest of the general public welfare”.

The central bank is the top financial institution in the country that controls the operation of the banking system. Banks manage and control the expansion and contraction of the money supply in the economy.

Central banks haven't any direct interaction with the overall public. In fact, it acts as a banker for other banks in the country, such as commercial banks, co-operative banks, development banks and regional banks, maintaining deposit accounts and allocating funds as prepayments as needed. In addition, central banks also act as guides to them by providing the guidance they need when they need help.

In addition to this, the central bank is also a government banker, tracking government transactions such as revenues and expenditures under various responsibilities. In addition, the central bank advises the government on various monetary and credit policy issues. It is the only decision maker when it comes to fixing interest rates on bank deposits and loans.

Q12) What are the functions of Central bank?

A12) The functions of Central banks are divided into two parts:

A) Monetary Function B) Non-Monetary Function

A) Monetary Function:

1) Monopoly of notes issue: The main function of the Central Bank is the issue of notes. Central Bank has been authorized to print and issue currency notes. No bank other than the Central Bank enjoys the right of note issue. As the Central Bank is the only authority of note issue, its notes enjoy a distinctive prestige. There is uniformity in the issue of notes and over-issue can avoid. Moreover, it creates confidence among people.

In India, the Reserve Bank of India acts as the Central Bank which enjoys the monopoly of note issue. It has been authorized to print and issue all currency notes except one-rupee notes and coins. The RBI adopts what is known as minimum reserve system to print notes. As per 1957 Reserve Bank of India (amendment) Act, the RBI keeps a minimum reserve of Rs. 200crores in gold and foreign securities. Out of this, Rs. 115 crores must be in gold and Rs. 85 crores in foreign securities. The notes issued in excess of Rs. 200 crores are backed by the government rupee securities.

2) Banker to the Government: It acts as the banker, advisor and agent of the government.

1) As a banker to the government: As a banker of the government, it carries out all banking requirements of the government. It accepts deposits and makes payments of all government workers. It transfers funds from one place to another or from one use to another use for the government. It collects taxes on behalf of the government and advances loans to the government. It manages public debts, interest on loans, repayments of loan from International organizations etc. Central Bank advises the governme1nt on monetary problems and implemented the monetary policy of the nation. In India the Reserve Bank of India performs all these functions. Since, its operation is spread all over India. The RBI has appointed the State Bank of India as its sole agent for transaction government business.

2) As an advisor to the Government: The central bank has complete knowledge about the functioning of the economy and can therefore advice the government on various economic and monetary matters. It advices the government on various financial matters such as framing the budget, controlling inflation, foreign exchange policy, managing fiscal deficit, Monetary policy, etc.

3) Bankers Bank: The Central Bank is the apex body of the banking system. It supervises co-ordinates and controls the operations and activities of the commercial banks. It is the legal tradition that all commercial banks should keep a certain proportion of the demand and time deposits with the Central Bank of the country. This proportion is called cash reserve ratio (CRR).

The Reserve Bank of India also rediscount bill and provides financial assistance to commercial banks. The RBI grants loans to the scheduled banks for a period 90days against eligible bills. The RBI has been empowered to control the activities of all commercial banks under Reserve Bank of India Act 1934 and Banking Regulation Act, 1949.

4) Custodian of Nation’s Foreign Exchange / Determination of Exchange rate:

All foreign exchange reserve of the country is kept by the Central Bank of the country. It enables the Central Bank to exercise control over the foreign exchange. All foreign exchange transaction is done through the Central Bank. The Reserve Bank of India maintains the stability of the rate of exchange, section 40 of the RBI with this function.

It is obligatory for the RBI to buy and sell currencies of the members of the IMF. The Foreign Exchange Regulation Act (FERA) passed in 1947 to give wide powered to RBI to exercise control over foreign exchange. Over the years the act has been amended many times and currently, it is known as Foreign Exchange & Management Act (FEMA).

5) Lender of the last resort: The Central Bank helps the commercial banks when they face a financial crisis. When all the sources are closed, commercial banks can rely (depend) upon the Central Bank as the last resort (option) for securing financial assistance. That is why the Central Bank is called the Lender of the last resort. Sometimes cash reserve of the commercial banks gets exhausted. During such situations, Commercial banks can approach the Central Bank to come to their rescue. The Reserve Bank of India provides the necessary funds and relieves from their burden.

6) Clearing house facility: Central Bank provides clearing facility for the smooth functioning of commercial bank. It is a fact that there are large numbers of commercial banks opening in the economy. Each bank will have claims and counter claims over other. This is not possible for all commercial bank to meet personally to settle their claims. Central Bank solves this problem smoothly by debiting and crediting each bank concerned.

B) Non-Monetary Function:

1) Control & supervisory function: The Central Bank of India also takes the responsibility of supervising the activities for all commercial banks. It issues licenses to banking companies. It can take direct action against the erring commercial banks. It can suspend the activities of such commercial banks or may refuse to renew the license. In India the RBI controls, supervises the functions of all commercial banks.

The Reserve Bank of India Act, 1934 & Banking Regulation Act, 1949 have given RBI the power of supervision and control over commercial and co-operative bank.

2) Promotional & Development function:

a) To promote banking habits: The Central Bank has been playing a more responsible role towards the economic development of our country. Its functions are not confirmed to control of money market alone. In India, RBI exercises its power over commercial banks and puts them under pressure to open branches in the rural sector. This has contributed a lot towards rural banking and to cultivate banking habits among the poor people.

b) Agricultural finance: As a significant step towards rural credit, the RBI created various agencies and institutions for weaker sections under the various schemes for rural development. The arrival of NABARD in India has created a history in the field of rural finance.

c) Industrial finance: Central Bank takes several steps to meet the long-term requirements of the industrial finance. The financial institutions like IFCA, SFCA, ICICI, LIC, IDBI, IRCI, SIOBI, etc. play a vital role in boosting the growth in industrial sector in India.

d) Export-Import finance: RBI played a responsible role in the establishment of the Export-Import Bank (EXIM Bank) to provide finance towards export and import activities. The EXIM Bank was establishing in January, 1982 to provide refinance to the commercial banks and financial institutions against their export-import financing activities.

e) Encouraging small savings: To provide opportunities of investment and better returns for small savers, the RBI played an active role in the establishment of UNIT TRUST OF INDIA in 1963.

Q13) What are the Monetary functions of Central bank?

A13) 1) Monopoly of notes issue: The main function of the Central Bank is the issue of notes. Central Bank has been authorized to print and issue currency notes. No bank other than the Central Bank enjoys the right of note issue. As the Central Bank is the only authority of note issue, its notes enjoy a distinctive prestige. There is uniformity in the issue of notes and over-issue can avoid. Moreover, it creates confidence among people.

In India, the Reserve Bank of India acts as the Central Bank which enjoys the monopoly of note issue. It has been authorized to print and issue all currency notes except one-rupee notes and coins. The RBI adopts what is known as minimum reserve system to print notes. As per 1957 Reserve Bank of India (amendment) Act, the RBI keeps a minimum reserve of Rs. 200crores in gold and foreign securities. Out of this, Rs. 115 crores must be in gold and Rs. 85 crores in foreign securities. The notes issued in excess of Rs. 200 crores are backed by the government rupee securities.

2) Banker to the Government: It acts as the banker, advisor and agent of the government.

1) As a banker to the government: As a banker of the government, it carries out all banking requirements of the government. It accepts deposits and makes payments of all government workers. It transfers funds from one place to another or from one use to another use for the government. It collects taxes on behalf of the government and advances loans to the government. It manages public debts, interest on loans, repayments of loan from International organizations etc. Central Bank advises the governme1nt on monetary problems and implemented the monetary policy of the nation. In India the Reserve Bank of India performs all these functions. Since, its operation is spread all over India. The RBI has appointed the State Bank of India as its sole agent for transaction government business.

2) As an advisor to the Government: The central bank has complete knowledge about the functioning of the economy and can therefore advice the government on various economic and monetary matters. It advices the government on various financial matters such as framing the budget, controlling inflation, foreign exchange policy, managing fiscal deficit, Monetary policy, etc.

3) Bankers Bank: The Central Bank is the apex body of the banking system. It supervises co-ordinates and controls the operations and activities of the commercial banks. It is the legal tradition that all commercial banks should keep a certain proportion of the demand and time deposits with the Central Bank of the country. This proportion is called cash reserve ratio (CRR).

The Reserve Bank of India also rediscount bill and provides financial assistance to commercial banks. The RBI grants loans to the scheduled banks for a period 90days against eligible bills. The RBI has been empowered to control the activities of all commercial banks under Reserve Bank of India Act 1934 and Banking Regulation Act, 1949.

4) Custodian of Nation’s Foreign Exchange / Determination of Exchange rate:

All foreign exchange reserve of the country is kept by the Central Bank of the country. It enables the Central Bank to exercise control over the foreign exchange. All foreign exchange transaction is done through the Central Bank. The Reserve Bank of India maintains the stability of the rate of exchange, section 40 of the RBI with this function.

It is obligatory for the RBI to buy and sell currencies of the members of the IMF. The Foreign Exchange Regulation Act (FERA) passed in 1947 to give wide powered to RBI to exercise control over foreign exchange. Over the years the act has been amended many times and currently, it is known as Foreign Exchange & Management Act (FEMA).

5) Lender of the last resort: The Central Bank helps the commercial banks when they face a financial crisis. When all the sources are closed, commercial banks can rely (depend) upon the Central Bank as the last resort (option) for securing financial assistance. That is why the Central Bank is called the Lender of the last resort. Sometimes cash reserve of the commercial banks gets exhausted. During such situations, Commercial banks can approach the Central Bank to come to their rescue. The Reserve Bank of India provides the necessary funds and relieves from their burden.

6) Clearing house facility: Central Bank provides clearing facility for the smooth functioning of commercial bank. It is a fact that there are large numbers of commercial banks opening in the economy. Each bank will have claims and counter claims over other. This is not possible for all commercial bank to meet personally to settle their claims. Central Bank solves this problem smoothly by debiting and crediting each bank concerned.