UNIT 4

Market Structure

Q1) Explain market structure and business decisions

A1) In the ordinary sense, the market refers to a place where buyers and sellers meet for the purpose of exchange of goods. However, in economics the term market does not refer to a particular place such. In economics, the term market refers to, ‘An arrangement in which buyers and sellers come in close contact with each other directly or indirectly, to buy or sell goods.’

Following are the features of market-

1) It does not refer to a particular place. It refers to an arrangement which facilitate transaction between buyers and sellers of goods.

2) The supply from sellers and demand from buyers are the two important forces in market.

3) The exchange of a commodity takes place at a particular price in the market.

4) The price is determined by the forces of demand and supply in the market.

5) The market can be small or large. It can be local, national or international.

6) There may be different markets for a specific commodity. Therefore, there may be different prices in different markets for the same commodity.

7) A market brings together potential buyers and potential sellers of a particular commodity.

TYPES OF MARKET:

The market structure is generally classified on the basis of competition among the sellers. Thus, we have the following types of markets:

1) Perfect competition 2) Monopoly 3) Monopolistic competition

4) Oligopoly 5) Duopoly 6) Pure competition

In this chapter we have to learn about perfect competition, monopoly & monopolistic competition.

1)Perfect competition:

Perfect competition refers to ‘A market structure in which there are large number of buyers and sellers with a single uniforms price for the product which is determined by the forces of demand & supply.’ The price prevailing in perfect competition market is equilibrium price.

Features of perfect competition:-

1) Large number of seller / seller are price takers: There are many potential sellers selling their commodity in the market. Their number is so large that a single seller cannot influence the market price because each seller sells a small fraction of total market supply. The price of the product is determined on the basis of market demand and market supply of the commodity, which is accepted by the firms, thus seller is a price taker and not a price maker.

2) Large number of buyers: There are many buyers in the market. A single buyer cannot influence the price of the commodity because individual demand is a small fraction of total market demand.

3) Homogeneous product: The product sold in the market is homogeneous, i.e. identical in quality and size. There is no difference between the products. The products are perfect substitutes for each other.

4) Free entry and exit: There is freedom for new firms or sellers to enter into the market or industry. There is no legal, economic or any type of restrictions. Similarly, the seller is free to leave the market on industry.

5) Perfect knowledge: The seller and buyers have perfect knowledge about the market such as price, demand and supply. This will prevent the buyer from paying higher price than the market price. Similarly, sellers cannot change a different price than the prevailing market price.

6) Perfect mobility of factors of production: Factors of production are freely mobile from one firm to another or from one place to another. This ensures freedom of entry and exit firms. This also ensure that the factors cost are the same for all firms.

7) No transport cost: It is assumed that there are no transport costs. As a result, there is no possibility of changing a higher price on the behalf of transport costs.

8) Non intervention by the government: It is assumed that government does not interfere in the working of the market economy. Price is determined freely according to demand and supply conditions of the market.

9) Single Price: In Perfect Competition all units of a commodity have uniforms or a single price. It is determined by the forces of demand and supply.

2)PURE COMPETITION:

According to Prof. Chamberlin, there is said t be ‘Pure competition’ when the first three condition of perfect competition i.e. large number of buyers and sellers, homogenous product & free entry and exit of firm are fulfilled. When monopoly is absent because the first three conditions are fulfilled but the other conditions like perfect knowledge, perfect mobility, absence of transport cost or no Govt. interference are not fulfilled, then the competition would be ‘PURE’ and not ‘PERFECT’.

Key Points: Large Sellers & Buyers, Same Product Perfect Knowledge, Free entry & exits, mobility, Transport, No Intervention by government, Single Price. |

Price determination under Perfect competition:

The equilibrium price refers to that price at which the demand and supply of a commodity are in equilibrium (equal). In other words Quantity demanded is equal to Quantity supplied. Once equilibrium price is reached there is no tendency for the price to move upward or downwards.

According to Marshall both Demand and Supply are essential in determination equilibrium price. Like the two blades of a scissor that cut piece of paper, demand and supply are important part in determining equilibrium price. Both the blades are useless when they are applied individually. Thus demand and supply are equally important in determining equilibrium price.

This can be explained with the help of following table:

Price (Rs.) | Quantity Demanded (Units) | Quantity Supplied (Units) | Market Condition | Pressure on Price |

5 | 120 | 40 | Shortage | Upward |

10 | 100 | 60 | Shortage | Upward |

15 | 80 | 80 | Equilibrium | Neutral |

20 | 60 | 100 | Surplus | Downward |

25 | 40 | 120 | Surplus | Downward |

In the above table there is Price, Quantity demanded, Quantity supplied, Market condition and change in price. When the price is Rs. 5 Quantity demanded 120 units and quantity supplied 40 units, there is a shortage and pressure on the price is upward (rises). This, conditions same at price of Rs. 10. When price is Rs.20 Quantity demanded is 60 units and Quantity supplied is 100 units, there is surplus in the market and pressure on price is downward (decrease). This condition same at price of Rs.25. When the price is Rs. 15 the quantity demanded is equal to the quantity supplied. It is equilibrium price. At this price the market is cleaned, that is neither surplus nor shortage in the market. At the equilibrium price demanded is equal to supply.

Q2) Explain objectives of a business firm a perfect competition

A2) The main objectives of the firm are as follows

2. Sales maximisation – the firm wants to increase their market share, even if they earn less profit. Increases market share enables the firm to earn high profit in the long run. This enables the firm to provide job with high salary. Increasing market share force rivals out of the business.

3. Growth maximisation – this involves mergers and takeovers. To increase the size and market share the firm is willingly to make lower level of profits. More market share increases its monopoly power and ability to be a price setter.

4. Long run profit maximisation – sometimes firm sacrifice profits in the short term to increase profits in the long run. For ex, investing heavily in new capacity, the firm makes loss in the short run, but make huge profits in the future

5. Social and environmental concern – a firm choose product which do not harm the environment. Some firm adopt environmental concern as a part of their branding which ultimately attract customers and increase profitability.

Q3) Explain Profit maximization and equilibrium of firm and industrial short rum and long rum supply curves

A3) Profit maximisation and equilibrium

Profit refers to the excess receipt from the sale of goods over the expenditure to produce the output. The money received after selling the output is known as revenue. The money required in the process of production is known as cost. The difference between revenue and cost refers to profit.

The producer main motive is to earn maximum profit. The state of equilibrium is when the producer is earning maximum profit. This refers to profit maximisation.

Equilibrium refers to when the firm has no inclination to expand or to contract its output. The producer can attain equilibrium under two situations.

The Marginal Revenue-Marginal Cost Approach

Profit depends on revenue and cost. Thus, equilibrium revolves around revenue and cost. According to the MR-MC approach, a producer is said to be in equilibrium when:

- A Firm can maximise the profit when marginal revenue is equal to marginal cost

- MR is the addition to TR from the sale of one more unit

- MC is the addition to TC when an additional unit is produced.

- Thus, when MR = MC, TR-TC result in maximum profit.

- If MR exceeds MC, then producer will produce more as it adds to the profit

- MC= MR is a necessary condition, but its is not enough to ensure equilibrium. This condition happens more than one output level.

- To ensure equilibrium, it has to be supplemented by the condition that MR should be less than MC after this level

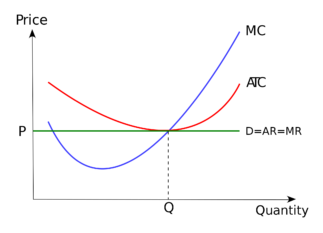

Producer’s Equilibrium when Price remains Constant

Price remains constant under conditions of perfect competition. Here price is equal to AR. When price is constant, revenue from each additional unit is equal to AR. It means AR curve is same as MR curve. The firm attains equilibrium when two condition are fulfilled, that is firm aims at producing that level of output at which MC is equal to MR and MC is greater than MR after MC = MR output level.

Producer’s Equilibrium when Price is not Constant

When there is no fixed price, price falls with an increase in output. The producer sells more units at a lower price. In this case MR slopes downwards. The firm aims at producing that level of output at which MC is equal to MR and MC is greater than MR.

short rum and long rum supply curves

Supply curve shows the relationship between price and quantity supplied. According to Dorfman, “Supply curve is that curve which indicates various quantities supplied by the firm at different prices”.

Supply curve can be divided into two parts as:

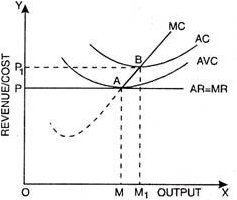

Short run supply curve of a firm

Under Short run, fixed cost remains constant, supply can be changed by changing the only the variable factors. Thus, the firm has to bear fixed cost id it is shut down. Thus, in short run, goods are supplied at price is either greater or equal to average variable cost. Average revenue is equal to marginal revenue under perfect competition. Hence the firm will produce at the point where marginal revenue and marginal cost are equal.

Prof. Bilas has defined it in simple words, “The Firm’s short period supply curve is that portion of its marginal cost curve that lies-above the minimum point of the average variable cost curve.”

From the above figure we can see that the firm will not be covering its average variable cost, at price less than OP. At price OP, OM is the supply. MC and MR cut at point A, OM is equilibrium output. If price rise to OP1, the firm will produce OM1 output. This short run supply curve of a firm starts from A upwards i.e., thick line AB.

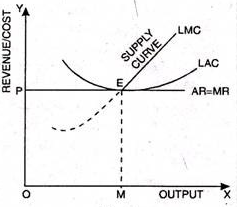

Long run supply curve

Under long run, the supply curve changes by changing all the factors of production. The firm produces only at minimum average cost in long run. In this case, long run marginal cost, marginal revenue, average revenue and long run average cost are equal. The firm enjoys normal profit.

Optimum production is the point where minimum average cost is equal to marginal cost. Long run supply curve is a portion where marginal cost curve that lies above the minimum point of the average cost curve.

Optimum point is the Point E, as at this point MR=LMCAR minimum LAC. The portion of LMC above point E is called long run supply curve

Q4) Explain price and output determination

A4) Price and output determination under perfect competition

On the basis of consumer demand and market supply, the market price and output is determined under perfect competition. The firm should be in equilibrium price which is determined when quantity demand is equal to the quantity supplied. If the firm are in equilibrium, they make maximum profit.

Price determination is shown in the following diagram

price of curd | quantity demanded | quantity supplied | condition |

2 | 90 | 30 | D>S |

3 | 80 | 40 | |

4 | 70 | 50 | |

5 | 60 | 60 | D=S |

6 | 50 | 70 | D<S |

7 | 40 | 80 | |

8 | 30 | 90 |

In the above table we can see when the price is low, the demand is high. The supply side, as the price increases supply also increases. When the price is low, competition between the consumers can raise the price. When the price is high, competition among the seller reduces the price. Thus, the final price is determined where the demand and supply of a commodity are equal to each other. At Rs. 5, the demand of curd is 60 liter and supply is also 60 liters.

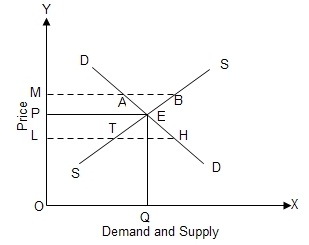

In the above figure, DD is the demand curve, SS is the supply curve. They both intersect at point E. The price is fixed at OP. At OP, the demand and supply are equal to OQ. If price rise to OM, the supply increases. At price OM, the supply exceeds the demand .ie supply of quantity id MB and quantity demanded is less to MA. If price decreases to OL, then demand increases to LH. Here the demand exceeds the supply.

Q5) Define monopoly and its features

A5) The term Monopoly is derived from Greek words, Mono which means Single&Poly which means Selling.

Monopoly refers to a market situation in which there is only a single seller. The firm does not face any competition from any rival. Seller as there is no close substitute for the product. It is opposite of perfect competition. In monopoly the sellers try to control both the price and output. Therefore, In monopoly the seller is price maker. Following are the features of monopoly:

1) Single seller: There are no competitions. Production and supply are controlled by monopolist. He is the Price maker. There is no close substitute for the product of monopolist.

2) No close substitute: There are no close substitutes for the product, so the buyers have no alternative or choice. They have to either buy the product or go without it.

3) No entry: In monopoly there are many restrictions for entry. Thus, other products or firm are not allowed to enter the market. Thus, the monopolist has complete hold over the supply.

4) Price maker: The entire market supply can be controlled by monopolist. He can determine the price of his product. Hence, he is a price maker in the market.

5) No distinction between firm & Industry: Since there is only one seller in monopoly, the firm itself is the industry. There is no distinction between the firm and Industry.

6) Super normal Profit: The monopolist always wants to earn supernormal profit. His decision regarding the price and the level of output are guided by the profit maximization motive. Thus, sometimes at price, he supplies the product as per the demand and sometimes he controls the supply of the product and sells the product at high prices.

7) Price discrimination: This implies charging p different prices for the same product to different buyers. The monopolist succeeds in increasing his profit by adopting the technique of price.

8) Control over the market supply: The monopolist has complete hold over the market supply. He is a sole producer of the commodity. Therefore, entry barriers such as natural, economic, technological or legal do not allow competitors to enter the market.

Q6) Explain types of monopoly

A6) Types of Monopoly:

1) Natural Monopoly: A natural monopoly arises when a particular natural resources is located or available only in particular locality or region. Hence the producers in that region who control the supply of that resources would enjoy a monopoly in the product which requires that natural resources.

2) Legal Monopoly: It arises due to legal protection given to the producer in the form of patents, trademarks, copy rights, etc. The law prevents the potential competitors for producing identical products.

3) Voluntary Monopoly: When number of big business companies acquire monopoly through voluntary agreement, business firms join together through cartels, syndicates etc.. They are called joint monopolies. Merger and amalgamation may also lead to monopoly. E.g. OPEC (Oil Producing and Exporting countries). This is also known as Joint Monopoly.

4) Simple Monopoly: In simple monopoly the firm has monopoly power over a product or service, but it changes a uniform price to all the buyers.

5) Discriminating Monopoly: In discrimination monopoly, the firm change different prices to different buyers or in different markets for the same product. There is no fixed policy for sale of goods. Policies are changes as per the Market conditions, consumers, etc.

6) State or social Monopoly: When the government owns and controls the production of a goods or services it is called state or social monopoly.

7) Private Monopoly: Private monopoly refers to sole ownership of the supply of goods or services by the private firm or individual. The main objective of private monopoly is profit maximization, for e.g. Tata group and Reliance group

Key points: - Natural, Legal, Voluntary, Simple, discriminating, Social Private. |

|

Q7) Explain briefly Determination of price under monopoly

A7) A monopolistic firm is a price-maker, not a price-taker. Therefore, a monopolist can increase or decrease the price. Also, when the price changes, the average revenue, and marginal revenue changes too. Take a look at the table below:

Quantity Sold Price per unit Total Revenue

(TR) Average Revenue

(AR) Marginal revenue

(MR)

1 6 6 6 6

2 5 10 5 4

3 4 12 4 2

4 3 12 3 0

5 2 10 2 -2

6 1 6 1 -4

Let’s look at the revenue curves now:

As you can see in the figure above, both the revenue curves (Average Revenue and Marginal Revenue) are sloping downwards. This is because of the decrease in price. If a monopolist wants to increase his sales, then he must reduce the price of his product to induce:

• The existing buyers to purchase more

• New buyers to enter the market

Hence, the demand conditions for his product are different than those in a competitive market. In fact, the monopolist faces demand conditions similar to the industry as a whole.

Therefore, he faces a negatively sloped demand curve for his product. In the long-run, the demand curve can shift in its slope as well as location. Unfortunately, there is no theoretical basis for determining the direction and extent of this shift.

Talking about the cost of production, a monopolist faces similar conditions that a single firm faces in a competitive market. He is not the sole buyer of the inputs but only one of the many in the market. Therefore, he has no control over the prices of the inputs that he uses.

Role of time element in determination of price are given below:

Time plays an important role in the theory of volume, i.e., price determination because supply and demand conditions are affected by time.

Price during the short-period can be higher or lower than the cost of production, but in the long-period price will have a tendency to be equal to the cost of production.

The relative importance of supply on demand in the determination of price depends upon the time given to supply to adjust itself to demand.

To study the relative importance of supply or demand in price determination, Prof. Marshall has divided time element-into three categories:

(a) Very short period or market period.

(b) Short period.

(c) Long period.

(a) Very short period (determination of market price):

Market period is a time period which is too short to increase production of the commodity in response to an increase in demand. In this period the supply cannot be more than existing stock of the commodity.

The supply of perishable goods is perfectly inelastic during market period. But non-perishable goods (durable goods) can be stored.:

Therefore, the supply curve of non-perishable goods above reserve price has a positive scope at first but becomes perfectly inelastic after some price level.

The reserve price y depends upon-(i) cost of storing, (ii) future expected price, (iii) future cost of production, and (iv) seller’s need for cash we will discuss the determination of market price by taking a perishable commodity and determination of market price is illustrated.

DD is the original demand curve and SS the market period supply curve. The demand curve DD (perfectly inelastic) cuts the supply curve SS at point E. Point E, is the equilibrium point and equilibrium price is determined at OP, level.

Increase in demand shifts the demand curve to D,D and the price also increased to OP,. Decrease in demand shifts the demand curve downward to D2D2 and the price too falls to OP It is, thus, clear that in market period price fluctuates with change in demand conditions.

(b) Price determination is short period:

In the short period fixed factors of production remain unchanged, i.e., productive capacity remains unchanged.

However, in the short period supply can be affected by changing the quantity of variable factors.

In other words, during the short period supply can be increased to some extent only by an intensive use of the existing productive capacity.

Therefore, the supply curve in the short-run slopes positively, but the supply curve is less elastic. Determination of price in the short-run is illustrated.

SS is the market period supply curve and SRS is short-run supply curve. The original demand curve DD cuts both the supply curves at E, point and thus OP, price is determined.

Increase in demand shifts the demand curve upward to the right to D,D,. Now with the increase in demand the market price (in market period) rises at once to OP3 because supply remains fixed. But in the short-run supply increases. Therefore, in the short-run price will cuts the SRS curve. If demand decreases opposite will happen.

(c) Price determination in long period (Normal Price):

In the long period there is enough time for the supply to adjust fully to the changes in demand.

In the long period all factors are variable. Present firms can increase on decrease the size of their plants (productive capacity).

The new firms can enter the industry and old firms can leave the market. Therefore, long-period supply curve has a positive slope and is more elastic than short period supply curve.

The shape of supply curve of the industry depends upon the nature of the laws of returns applicable to the industry. Price determination in the long period is illustrated.

DD is the original demand curve and LS is the long period supply curve of the industry. Demand curve DD and supply curve LS both intersect each other at E point and OP price is determined.

This price will be equal to minimum average cost (AC) of production because in the long period firms under perfect competition can only earn normal profits. Suppose these are permanent increase in demand.

With the increase in demand, the demand curve shifts to D1,D1. As a result of increase in demand the price in the market period and short period will rise.

Due to increase in price present firms will earn above normal profit. Therefore, new firms will enter into market in the long period.

As a result of it supply will increase in the long period. In the long period price will be determined at OP1, level because at this price demand curve D1 D2 cuts the LS curve at E2 point.

Price OP1, is greater than previous price OP1, because the industry is an increasing cost industry. This new higher price will also be equal to minimum average cost of production

Q8) Explain equilibrium of a firm

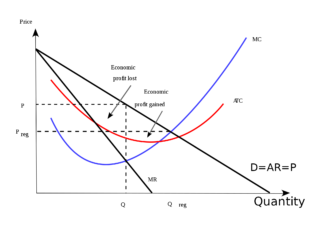

A8) In monopolistic competition, since the merchandise is differentiated between firms, each firm doesn't have a wonderfully elastic demand for its products. In such a market, all firms determine the worth of their own products. Therefore, it faces a downward sloping demand curve. Overall, we will say that the elasticity of demand increases because the differentiation between products decreases.

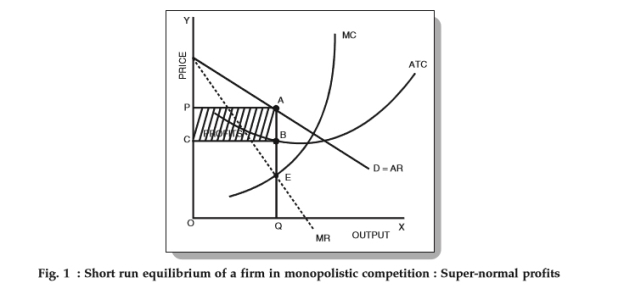

Fig. 1 above depicts a firm facing a downward sloping, but flat demand curve. It also features a U-shaped short-run cost curve.

Conditions for the Equilibrium of a private firm

The conditions for price-output determination and equilibrium of a private firm are as follows:

1. MC = MR

2. The MC curve cuts the MR curve from below.

In Fig. 1, we will see that the MC curve cuts the MR curve at point E. At now ,

• Equilibrium price = OP and

• Equilibrium output = OQ

Now, since the per cost is BQ, we have

• Per unit super-normal profit (price-cost) = AB or PC.

• Total super-normal profit = APCB

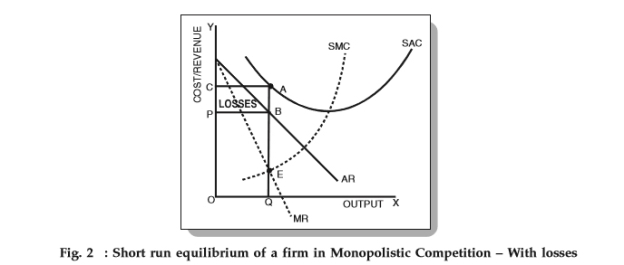

The following figure depicts a firm earning losses within the short-run.

From Fig. 2, we will see that the per cost is above the worth of the firm. Therefore,

• AQ > OP (or BQ)

• Loss per unit = AQ – BQ = AB

• Total losses = ACPB

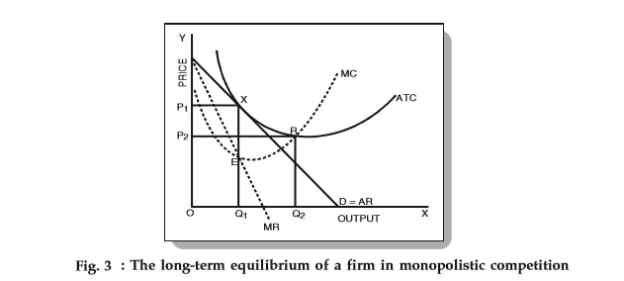

Long-run equilibrium

If firms during a monopolistic competition earn super-normal profits within the short-run, then new firms will have an incentive to enter the industry. As these firms enter, the profits per firm decrease because the total demand gets shared between a bigger number of firms. This continues until all firms earn only normal profits. Therefore, within the long-run, firms, in such a market, earn only normal profits.

As we will see in Fig. 3 above, the typical revenue (AR) curve touches the typical cost (ATC) curve at point X. This corresponds to quantity Q1 and price P1. Now, at equilibrium (MC = MR), all super-normal profits are zero since the typical revenue = average costs. Therefore, all firms earn zero super-normal profits or earn only normal profits.

It is important to notice that within the long-run, a firm is in an equilibrium position having excess capacity. In simple words, it produces a lower quantity than its full capacity. From Fig. 3 above, we will see that the firm can increase its output from Q1 to Q2 and reduce average costs. However, it doesn't do so because it reduces the typical revenue quite the typical costs. Hence, we will conclude that in monopolistic competition, firms don't operate optimally. There always exists an excess capacity of production with each firm.

In case of losses within the short-run, the firms making a loss will exit from the market. This continues until the remaining firms make normal profits only.

Both Perfect Competition vs Monopolistic Competition are popular choices within the market; allow us to discuss a number of the main Difference Between Perfect Competition and Monopolistic Competition:

1. A market structure, where there are numerous sellers, selling close substitute goods/services to the buyers, is monopolistic competition. A market structure, where there are many sellers selling similar products/services to the buyers, is ideal competition.

2. In perfect competition, the merchandise offered is standardized whereas in monopolistic competition product differentiation is there.

3. In monopolistic competition, every firm offers products at its own price. In perfect competition, the demand and provide forces determine the worth for the entire industry and each firm sells its product at that price.

4. Entry and Exit are comparatively easy in perfect competition than in monopolistic competition.

5. In monopolistic competition, average revenue (AR) is bigger than the marginal revenue (MR), i.e. to extend sales the firm has got to lower down its price. On the opposite hand, average revenue (AR) and marginal revenue (MR) curve coincide with one another in perfect competition.

6. Monopolistic competition, that exists practically. On the opposite hand, perfect competition is an imaginary situation which doesn't exist actually .

7. The demand curve as faced by a monopolistic competitor isn't flat, but rather downward-sloping, which suggests that the monopolistic competitor can raise its price without losing all of its customers or lower the worth and gain more customers.

Since there are substitutes, the demand curve facing a monopolistically competitive firm is more elastic than that of an ideal competition where there are not any substitutes. If a monopolist raises its price, some consumers will choose to not purchase its product—but they're going to then got to buy a totally different product.

However, when a monopolistic competitor raises its price, some consumers will choose to not purchase the merchandise in the least , but others will prefer to buy an identical product from another firm. If a monopolistic competitor raises its price, it'll not lose as many purchasers as would a monopoly competitive firm, but it'll lose more customers than would a monopoly that raised its prices.

Below is that the topmost Comparison between Perfect Competition vs Monopolistic Competition are as follows –

Basic Comparison between Perfect Competition vs Monopolistic Competition Perfect competition

Monopolistic Competition

Number of seller/buyers Many Many

Type of good/services offered Homogeneous Differentiated

Does firm have pricing control over their own prices?

No – Price Takers Yes – some pricing power

Is marketing/branding important? No Yes – Key non-price competition

Are entry barriers zero, low or high? Zero entry Barrier Low entry Barrier

Does this market structure cause allocated efficiency within the long run? Yes, Price = MC Not Quite (P>MC)

Does this market structure cause productive efficiency within the long run? Yes No

Situation Unrealistic Realistic

Demand curve slope Horizontal, perfectly elastic Downward sloping, relatively elastic

A relation between Average Revenue (AR) and Marginal Revenue (MR) Average Revenue = Marginal Revenue Average Revenue > Marginal Revenue.

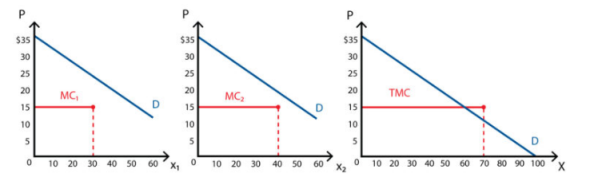

Q9) Explain Multi-plant monopoly

A9) A multiplant monopoly is given in monopolistic firm that have their production divided into more than one plant, each one having its own cost structure. Different cost structures lead to different marginal cost. Thus, each plant has to choose their individual production output level.

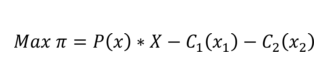

Formula for monopoly with two plants

Where, x1 and x2 are the same product, but produced at different plants.

Multiplant monopoly will maximise its profits when

where MR is the marginal revenue and MC is the marginal cost in each plant.

The multiplant monopolist needs to decide whether to produce in one plant or both the plant. The decision depends on marginal cost of each plants. In case the marginal cost is increasing for one plant, the multiplant monopoly will produce in other plant taking into account the marginal cost.

In case of decreasing marginal cost, it will produce in only one plant than the other plant. In case marginal cost are constant and equal in both the plants, then the firm will produce in either plant as long as capacity allows. If the demand can be meet from one plant, the other plant needs to be closed.

If the marginal cost is constant but different in each plant, production should take place in that plant with lowest marginal cost as soon as maximum limit is not reached. When the capacity is reached for one plant, then production will take place in other plant as shown below

Q10) Explain price discrimination

Q10) Every firm in an oligopoly market is faced with a Kinked Demand Curve, the kink being at that time on the demand curve which corresponds to the prevailing common price accepted by all the firms at which they sell their output. This common price or prevailing market value is such none of the individual oligopolistic firms would make any change in it even when there could be some small variations in their production costs. there's thus a rigidity or stickiness about this price. None of the oligopolistic producers have either the desire or the motivation to vary this price. the most factors which contribute to cost rigidity in an oligopoly market are discussed below:

Firstly, under oligopoly each seller is faced with a Kinked Demand Curve. the purpose of kink divide the demand or AR curve into two distinct parts. The upper part, the part to the proper of the kink is very elastic portion of the demand curve. The lower part or the portion of demand curve to the proper of the kink is a smaller amount elastic. The market value corresponds to the purpose of the kink.

The price that corresponds to the purpose of kink K on the demand curve AKD. This price is accepted by every firm and nobody is willing to vary it. Every firm knows that if it raises the worth above OP, the rival firms won't raise the worth of their product. The firm which raises the worth will thus lose many of its customers to the rivals and it's going to not be ready to make any additions to its revenue; rather its total revenue may become smaller than before. On the opposite hand, if a firm reduces its prices to draw in more customers, the others, faced with the prospects of losing their customers, also make a marketing cut in price. This firm, therefore, doesn't gain much from a discount. Thus, each firm under oligopoly, faced with the Kinked Demand Curve is extremely reluctant to vary the prevailing price. Therefore, there's rigidity or stickiness of the prevailing price under oligopoly.

Secondly, since the oligopolistic firm is maximizing its profits at the prevailing market value, they need no incentive to vary it. The incremental cost curve MC of the oligopolistic firm passes through the gap EF within the marginal revenue curve giving OQ quantity because the profit maximizing level of output. But beyond OQ, MR > MC and hence additional units add more to cost than to revenue and thus not worth producing. Since, profits are being maximized at that level of output and price which corresponds to the kink, the oligopolist isn't curious about changing the worth.

Thirdly, small variations in cost don't disturb oligopoly equilibrium. Even when incremental cost rises from MC to MC’ or falls to MC”, the equilibrium level of output and price remains an equivalent, as of these curves undergo the gap EF within the marginal revenue curve. Thus, the profit maximizing output remains OQ whether the incremental cost increases or decreases by small amounts. However, when the increase in cost is substantial in order that incremental cost curve intersects marginal revenue at some extent above E, there's a case for price rise.

Fourthly, the worth remains same even when there are small changes within the demand curve facing the individual producers. When the demand curve is kinked, an upward or downward shift within the demand curve only affects quantity produced and not the worth level goodbye as incremental cost curve passes through the range of discontinuity or gap within the new marginal revenue curve.

Mostly the firms enjoys non-price competition. it's mainly administered through advertisement, after sale services and other factors. The competition through non-price factors will end in price rigidity within the market. The firms will compete through all the factors aside from price.