Unit-II

Basics of Material, Labour and Overhead cost

Q1)Define Labour Cost.

A1) Labor is an important element of production. It is a human resource and participates in the process of production. Wages paid for labor are an important cost item. Labor costs need to distinguish between direct and indirect labor. Direct labor costs can be directly identified and billed by product or job, but overhead costs are less identifiable and are included in overhead costs that may be assigned to different products or departments on appropriate criteria. Labor costing has three main purposes.

1. Determining labor costs in terms of product or service costs

2. Report labor costs for planning and management

3. Report labor costs for decision making.

Q2) What is Labor management?

A2) Labor costs are an important part of total production costs. Therefore, labor costs and labor costs need to be managed effectively. Various departments contribute to the efficient use of the workforce and the proper management of costs. The HR department needs to provide an efficient workforce. The engineering department maintains control over the working conditions and production methods of each job and department or process by creating plans and specifications. The time management department keeps an accurate record of the time each employee spends. Payroll preparation from the clock card, job or time ticker, or timesheet is done by the payroll department. The costing department is responsible for accumulating and classifying all data for which labor costs are one of the most important items.

Personnel costs represent human contribution. Labor costs are inherently sensitive. The reason is that labor costs are entirely based on human behavior, labor behavior. To manage labor costs, it is necessary to manage labor behavior. Therefore, managers need to study human behavior, labor performance, time and movement studies, labor turnover, and labor approaches to manage labor costs.

The workforce cannot be saved for future reference. It is very similar to the perishable nature of the material. Some materials are of poor quality and may not be used for manufacturing purposes. Such materials are wasted. Similarly, once the workforce is lost, it cannot be recovered and cannot be used effectively in the next few days.

If the work is kept idle, management will have to pay compensation or wages for such idle time. Therefore, management suffered two losses. They are lost working hours and lost money. Therefore, management is very enthusiastic about managing labor costs.

Classification of labor costs

Labor costs can be categorized as follows.

1. Direct labor costs

Direct labor costs are part of salary or wages and can be identified and billed by a single unit price of production.

Characteristics of direct labor costs:

Direct labor costs have the following characteristics.

2. Indirect labor costs

Even if it occurs directly, it cannot be identified in the production of goods or services. These costs are incurred at the production site. Some cost centers may serve production departments or production activities. These cost centers are responsible for purchasing, engineering, and time management.

3. Manageable labor costs

Labor costs can be managed by managers during production and even when there is no production. Standard hours and hourly rates are fixed and workers can be required to complete a job or order within such time. That way, labor costs can be reduced to some extent.

4. Uncontrollable labor costs

Labor costs that management cannot easily control. Jobs and orders can be completed by a group of workers. The efficiency of such labor groups is inherently different. Workers can maximize their efficiency according to the general environment of the product location. If so, costs cannot be controlled by management.

Q3) How do we calculate Labour Cost?

A3) Techniques for managing labor costs can be effectively used by coordinating the activities of various labor-related departments.

(A) Human Resources Department

(B) Engineering and Operations Research Division

(C) Timekeeping department

(D) Payroll department and

(E) Cost accounting department.

(A) Human Resources Department:

The Board of Directors has policies regarding recruitment, training, placement, transfer and promotion of employees. The Human Resources Manager of the Human Resources Department must implement these policies. The main functions of this department are recruitment, training, and placement of workers in the right jobs.

The Human Resources department recruits workers when it receives employee placement requests from various departments

B) Engineering and Operations Research Division:

Preface:

This department is working to improve working conditions by carrying out the following activities.

(1) Conduct work studies such as method study, exercise study, and time study for each operation.

(2) Maintain the necessary safety standards.

(3) Perform job analysis and job evaluation.

(4) Prepare the specifications and time schedule for each job.

(5) Devise an appropriate wage system and

(6) Implementation of research and experimental work.

The engineering department is basically responsible for work content, standard time, work performance, and so on. These are achieved by performing detailed work studies, including method studies, motion studies, and time studies.

(C) Time management department:

This department is concerned with maintaining worker attendance and working hours. Attendance time is recorded for wage calculation, and job time or time reservations are spent on each department, job, operation, and process to calculate labor costs for each department, job, and each process and operation. It will be considered to calculate the time taken

(D) Payroll Preparation:

A department salary or wage table is created based on the time card. A full-fledged payroll shows total wages, various deductions, and net wages. Payroll is the basis for checking wages and posting entries to various management accounts. Payroll details depend on your organization's requirements.

(E) Cost accounting department:

The department is responsible for ensuring the correct production costs. Cost verification includes classification, collection, and calculation of output labor costs. In most organizations, cost department representatives

Posted to the manufacturing department to accumulate and categorize costs. The cost calculator oversees the work of the representative and uses the information contained in the timecard and payroll to find the labor costs of manufacturing by manufacturing department, operations, manufacturing instructions, and so on.

The costing department also analyses labor costs in the form of idle time and overtime. A labor cost report is also submitted to management to show the effectiveness of labor use.

Q4) What are the types of incentive wage systems?

A4) There are the following types of incentive wage systems:

1. Halsey Premium Plan

2. Rowan Premium Plan

3. Taylor Differential Peace Rate System

4. Gantt Bonus Plan

5. Emerson Efficiency Plan

6. Bedo Point Premium

7. Merrick Differential Wage Multi-Piece Rate Plan

8. 100% bonus plan.

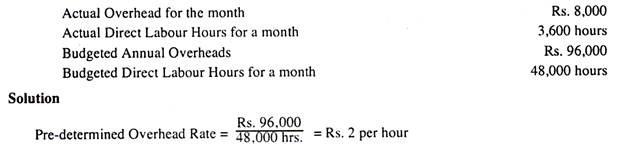

Q5) Calculate the predetermined overhead costs using the direct working hours of the budget period and the overhead charges charged for production for the month from the following details.

The actual time in a month was 3,600 hours, so the overhead charged to production Rs. 7,200 (that is, 3600 x Rs. 2). However, the actual overhead for the month was only Rs. 8,000.

Q6) What are the Methods of Overhead Absorption?

Ans. Methods of Overhead Absorption

• Direct Material Cost Method

• Actual overhead / direct material costs X100

• Direct labor cost method

• Actual overhead / direct labor costs X100

• Prime cost method

• Budget Expenses / Expected Prime Costs

• Direct working hours law

• Overhead / direct working hours

• Rate per unit of production method

• Budget overhead / budget production unit

• Selling price method

• Budget overhead / sales of production units

• Machine hour rate method • Total overhead / total machine Hours

Q7) What is overhead departmentalization?

A7) Organizations include production, finance, human resources, accounting, sales, research, efficient work, collection allocation, development for cost absorption, etc. Therefore, the overhead collected is allocated or allocated to each department on an appropriate basis. This process is called overhead division.

This process assists in managing costs and managing expenses for each department. In addition, the production cost of goods and services is confirmed, the department is passed through, and the services provided by the department are performed.

Q8) Explain overhead classification.

A8) The process of grouping overheads according to common characteristics is known as overhead classification. It provides managers with information that allows them to effectively manage their business. Overhead can be categorized as follows:

a. Elements: indirect materials, labor costs;

b. Function: Expenses for production, management, sales and distribution.

c. Behavior: Fixed, variable, and semi-variable overhead.

1. Fixed overhead remains fixed and is not affected by changes in production levels. For example, rent, fees, salaries, statutory expenses, etc.

2. Variable overhead costs change in direct proportion to changes in production, such as indirect materials, fuel, electricity, stationery, and sales staff commissions.

3. Semi-variable overhead costs are partially fixed and partially variable costs. They remain fixed to production volume and change when production exceeds a certain volume. For example, telephone charges include machine depreciation, repair and maintenance, and supervision costs.

Collection of expenses and codification

Overhead is collected and systematized under the appropriate head. Similar overhead items should be grouped. Overhead grouping is done by a technique called "Codification". This is a way to identify and describe various expenses with numbers, letters, or a combination of both, making it easy to collect cost data. The coding of the entire item is done through a proper coding system. Expenses are collected through store requests, financial accounting, wage tables, registries, and report sources.

Q9) Define Overhead allocation.

A9) Overhead allocation is the allocation of all items of costs to cost centers or costs to units. This refers to the billing of overhead costs to the cost center. This means that overhead was incurred due to the existence of that cost center. If a company offers multiple products, factory overhead is allocated to different production departments or cost centers. Appropriate overhead allocation is very important because incorrect allocations can distort income decisions, asset valuations, and performance valuations. The overhead allocation process is as follows:

I. Accumulate overhead costs based on department or product.

ii. Identify cost targets for assigned costs

iii. Choose how to associate such accumulated costs with cost goals.

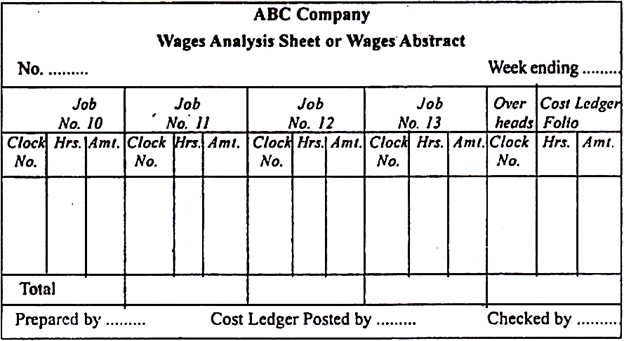

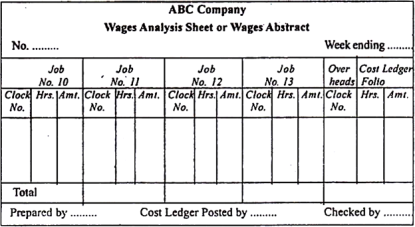

Q10) Explain with the help of diagram the Wage analysis.

A10) The wages charged for various jobs are shown on an analysis sheet called the Wage Analysis Sheet. This is suitable if your company is small and the number of jobs running is small. If you have a lot of work, as in a large company, the timesheet will pre-list the total labor costs and agree with a payroll overview.

The wage summary decisions are as follows:

The analysis sheet shows the labor costs for various jobs and the overhead costs charged as overhead costs.

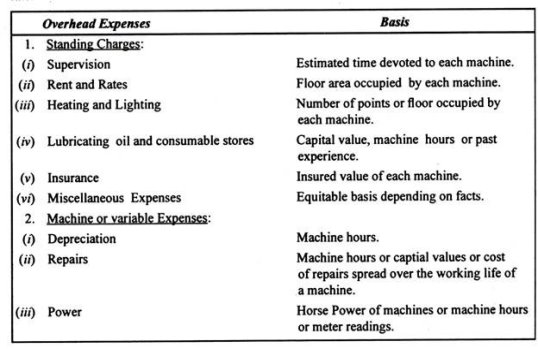

Q11) What are the criteria used to allocate costs for calculating the time rate of a machine?

A11) The following are the criteria used to allocate costs for calculating the time rate of a machine.

Q12) What are the merits and demerits of Peace rate system.

A12) Advantages and disadvantages of peace rate system:

Merit

I. It pays the craftsman according to his efficiency as reflected in the amount of work found by him. It satisfies hard-working and efficient workers, as he thinks his efficiency will be fully rewarded.

ii. Supervision costs are not that heavy. Because workers know that their wages depend on the amount of work they do, they are less likely to waste time.

iii. Direct labor costs per unit of production are constant and constant, making it easier to calculate costs when filling out bids and quotes.

iv. Not only will production and wages increase, but production methods will also improve. This is because workers demand defect-free materials and machines in perfect working conditions.

v. The total unit cost of production is reduced at higher output because the fixed overhead can be distributed to more units.

Demerit:

I. This system is not particularly favored by workers, although it benefits workers as well as business owners. The main reason for this is that the fixed piece rate by the employer is not scientifically based. In most cases, he determines the rate by empirical law and finds that on average workers get higher wages compared to the wages of workers doing the same job on a daily basis. Burden workers to reduce rates.

Nevertheless, the goose must be killed. Without it, the employer is extravagant in his job. Will continue to pay for, so he will curb the growing ambitions of his men. "

ii. Workers want to work at tremendous speeds, so they generally consume more power, overuse machines, and don't try to avoid wasting materials. As a result, production costs are high and profits are low.

iii. Workers' enthusiasm for increased production is likely to reduce the quality of their work. This zeal affects their health and can lead to reduced efficiency.

iv. It encourages soldiers.

v. If you work too fast, your plants and machines can wear out and be replaced frequently.

vi. Trade unions often oppose this system. Because it fosters competition among workers and puts their solidarity in labor disputes at risk.

Q13) How do we calculate Labor turnover rate?

A13) Labor turnover rate:

Labor turnover can be defined as the number of workers replaced during a particular period relative to the average workforce during the period. This is the number of workers who quit their jobs during the period relative to the average workforce during the period. It is a factor that affects labor efficiency and thus labor costs. It means the rate of change in the composition of the workforce.

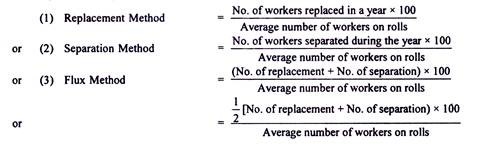

There are three ways to measure it:

B. A high turnover rate is bad because it indicates that the worker will not stay long. When they go, they bring their experience with them. New workers must be engaged and trained. Aside from the cost of hiring and training new workers, their quality is expected to decline. Therefore, the turnover rate of workers is very costly for employers, but when workers take a break from work or get a job that is not suitable for them, they also lose.

C. Both worker turnovers and shifts are costly, but most of the turnover costs usually occur during shifts. Separation is the cause of sales and the exchange continues.

D. There is a certain amount of irreducible turnover due to illness, death, retirement, or marriage of female workers. However, research shows that actual sales are unnecessarily high in most industries.

Causes of turnover:

Some of the causes that contribute to high turnover are the disagreement between work and workers, low wages, bad working conditions, bad treatment on the part of employers, or simply the raging nature of workers. Therefore, the cause may be unavoidable.

The avoidable causes of turnover are:

(1) Redundancy due to seasonal fluctuations, material shortages, project completion, etc. The efficiency and foresight of senior management can eliminate sales from these causes.

(2) Boring work

(3) Bad working conditions

(4) Low wages

(5) Unstable employment

(6) There are few opportunities for promotion

(7) Unfair treatment

(8) Labor dispute.

The unavoidable causes are as follows:

(1) Difficulty of housing

(2) Personal improvement

(3) Domestic responsibility

(4) Illness and accident

(5) Leave the district

(6) Discharged because it was judged to be inappropriate

(7) Discharge due to disciplinary action

(8) Retirement

(9) Death.

Employers can significantly reduce worker turnover, thereby saving labor costs.

Labor turnover cost:

It is a good idea to calculate the labor turnover cost individually.

It consists of:

(A) Recruitment costs for additional men engaged due to excessive turnover.

(B) Training costs for additional men engaged. And

(C) Loss due to reduced production quantity and quality due to sales, represented by lack of recovery of hourly wages and fixed costs.

(D) Costs of lost time, wasted, scrap, defective work and tools, and machine damage due to inefficiencies of new employers.

(E) Cost of products lost due to delayed acquisition of new workforce.

(F) Frequency of accidents due to lack of experience of new employees.

Q14) How can be overhead subdivided into the groups?

A14) Overhead can be subdivided into the following main groups:

Factory or work overhead: Also known as manufacturing or production overhead it consists of all the costs of indirect materials, indirect labor and other overhead incurred in the factory.

Example: Factory rent and insurance. Depreciation of factory buildings and machinery.

Office or management overhead: All indirect costs incurred by the office for the management and management of the enterprise.

Examples: Rent, fees, taxes and insurance for office buildings, audit fees, director fees.

Sales and distribution overhead: These are overhead related to marketing and sales.

Examples: Advertising of distributors, salaries and fees, travel expenses of salesmen.

Q15) Define inventory.

A15) A material is a substance (physical term) that is part of a finished product or is composed of a finished product. In other words, a material is a product that is supplied to a business for the purpose of consuming it in the process of manufacturing or providing services, or for the purpose of converting it into a product. The term "store" is often used as a synonym for material, but store has a broader meaning, not only the raw materials consumed or used in production, but also miscellaneous goods, maintenance stores, processed parts, components. Also includes items such as tools. Jigs, other items, consumables, lubricants, etc. Finished and partially finished products are also often included in the term "store". Materials are also called inventory. The term material / inventory include not only raw materials, but also components; work in process, finished products, and scrap.

Material costs are an important component of the total cost of a product. It accounts for 40% to 80% of the total cost. Percentages may vary from industry to industry. But for the manufacturing sector, material costs are paramount. Inventory is also an important component of working capital. Therefore, it is treated the same as cash. Therefore, analysis and control of material costs is very important.

Q16) What is the purpose of material management system?

A16) Material management: The ability to ensure sufficient inventory of goods to meet all requirements without carrying unnecessarily large amounts of inventory.

The purpose of the material management system is to:

1. Make the material available continuously so that the flow of material for production is uninterrupted. Production cannot be postponed due to lack of materials.

2. Purchase the required amount of materials to avoid working capital locks and minimize the risk of surplus or obsolete stores.

3. Make competitive and wise purchases at the most economical prices so that you can reduce material costs.

4. Purchase the right quality material to minimize the waste of material.

5. Acts as an information centre for material knowledge about prices, suppliers, lead times, quality and specifications.

Q17)Write short notes on Centralized and Decentralized purchases.

A17) Centralized purchase: Centralized purchase means the purchase of materials by one specialized department. The purchasing department has personnel with expertise in all aspects of the material. The purchasing department has the authority to make purchases for the entire organization.

In this system, the requirements of the entire organization are confirmed through the creation of purchasing budget, the purchasing department makes purchases according to the accepted principle, and the materials are distributed to each production department according to the requirements.

In most cases, the purchasing department purchases materials based on the requisition form issued by the store. The supplier delivers the material to the Material Receipt section. Individual departments are not allowed to purchase their own materials when centralized purchases are made.

Decentralized purchase: Decentralized purchases mean that each department can purchase materials according to their needs. Therefore, the authority to make purchases rests with the individual departments.

(A) Advantages of local purchase: If the production unit is far from the body, it is beneficial to have the unit available for purchase locally. You can enjoy the benefits of basic low price and seasonal price, and reduce the cost.

(B) Reduction of transportation costs: By supplying materials locally, transportation costs will be significantly reduced.

(C) Quick resolution of the problem: Disputes caused by refusals, shortages and returns can be resolved easily and quickly.

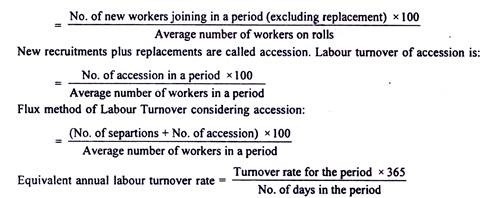

Q18) What do you mean by Purchase requisition?

A18) The decision to purchase the material is made by the purchasing department after receiving the purchase request from the authorized department. A purchase request is made from an approved department to the purchasing department in a prescribed form called a purchase request.

Requisitions provide three basic pieces of information that help buyers perform their purchasing functions efficiently.

The information is as follows:

Purchase requisitions are received by the purchaser from:

(I) Shopkeepers of all standard materials.

(II) Production control department of non-standard materials required for production.

(III) Plant and maintenance engineers for special maintenance and capital investment.

(IV) Head of special items such as office supplies.

The requisition is created three times. Two copies will be sent to the purchasing department, one copy will be retained as proof of approval and the other copy will be returned to the inventor after quoting the order details. Purchasing department. A third copy is kept by the store for office records and future references.

Material specifications or bill of materials:

The requisition contains details and specifications of the materials to purchase. Material specifications are known as bills of material. This starts in the production control department or the plant and maintenance engineer department. The BUI of Material is a complete schedule of materials or parts required for a particular job or work order created by a drafting office. A bill of materials is created for every job and a copy is sent to the storekeeper.

Q19) Define Purchase order.

A19) A purchase order is an agreement between a material buyer and a supplier. It is a requirement from the purchaser to the supplier to supply goods of a specific quantity and quality in accordance with the terms set forth in the contract. It also means the buyer's commitment to deliver and pay for the goods according to the terms and conditions stated on the purchase order.

After carefully determining the purchase quantity, the purchasing department should place an order with the supplier of choice. You need to choose a supplier that can deliver the products you need at a competitive price and at the right time. We are looking for a quote from our supplier.

Quotations received from different suppliers are compared and an acceptable supplier is selected. After completing the above procedure, a purchase order will be issued to the supplier to supply the required quantity of goods at the specified time.

Purchase order is issued in the prescribed format, produced in quadruples (4 copies), and sent to the next department for reference and coordination.

(I) the first copy will be sent to the supplier.

(Ii) One copy will be sent to the department that sent the purchase requisition.

(Iii) One copy will be sent to the store or the internal department of the product.

(Iv) One copy will be kept in the purchasing department as a permanent record.

(V) A copy will be sent to your account department.

Q20) What are the important methods to follow in pricing material issuance?

A20) The important methods to follow in pricing material issuance are: -

1. Actual cost method

2. First-in first-out (FIFO) method

3. Last-in first-out (LIFO) method

4. Maximum first-in first-out method (HIFO) method

5. Simple average cost method

6. Weighted average cost method

7. Periodic average cost method

8. Standard Cost method

9. Exchange cost method

10. Last-in first-out (NIFO) method

11. Base stock method.

1. Actual cost method:

If you purchase a material specifically for a particular job, the actual cost of the material will be charged to that job. Such materials are usually kept separately and published only for that particular job.

2. First-in first-out (FIFO) method:

CIMA defines FIFO as "a method of setting the price of material issuance using the purchase price of the oldest unit in stock." With this method, the materials are issued out of stock in the order in which they were first stocked. It is assumed that the material that opens first is the material that is used first.

Advantage:

(A) Easy to understand and easy to price in question.

(B) It is a good store management practice to ensure that raw materials leave stores in chronological order based on age.

(C) This is an easy method with less administrative costs than other pricing methods.

(D) This inventory valuation method is accepted under standard accounting practices.

(E) Consistent and realistic practices in inventory and finished product valuation.

(F) Inventory is valued at the latest market price, close to the value based on replacement costs.

Cons: Disadvantages:

(A) If confused with other materials purchased at a different price at a later date, it is uncertain whether the material with the longest stock will be used.

(B) If the price of the purchased material fluctuates significantly, there will be more clerical work and errors may occur.

(C) Manufacturing costs are modest in situations where prices are rising.

(D) Inflationary markets tend to lower prices for key issues. The deflationary market tends to set higher prices for these issues.

(E) Generally, it is necessary to adopt multiple prices for the publication of a single document.

(F) This method makes it difficult to compare costs for different jobs when billed for the same material at different prices.

3. Last in first out (LIFO) method:

With this method, the latest purchase is issued first. Issues are priced on the latest batch you receive and will continue to be billed until the new batch you receive arrives in stock. This is a way to set the issue price of a material using the purchase price of the latest unit in stock.

Advantage:

(A) Shares issued at more recent prices represent the current market value based on exchange costs.

(B) Easy to understand and apply.

(C) Product costs tend to be more realistic as material costs are billed at more recent prices.

(D) When the price is rising, the issue pricing will be the more recent current market price.

(E) It tends to show modest profit figures by minimizing unrealized inventory gains and valuing inventory at its pre-price value, providing a hedge against inflation.

Cons: Disadvantages:

(A) Valuation of inventory in this way is not accepted in the creation of financial accounting.

(B) This is an assumption of a cash flow pattern and is not intended to represent the actual physical flow of material from the store.

(C) It may be necessary to adopt multiple prices for one problem.

(D) It becomes difficult to compare costs between jobs.

(E) It involves more clerical work and sometimes the evaluation may go wrong.

(F) During inflation, the valuation of inventory in this way does not represent the current market price.

4. Highest in first out (HIFO) method:

With this method, the most expensive material is published first, regardless of the date of purchase. The basic assumption is that in a fluctuating inflation market, material costs are quickly absorbed into product costs, hedging the risk of inflation. This method is used when the material is in short supply and when you are running a contract with costs. This method is uncommon and is not accepted by standard accounting practices.

5. Simple average cost method:

In this way, all the materials received are merged into the inventory of existing materials and their identities are lost. The simple average price is calculated regardless of the quantity involved. The simple average cost is obtained by dividing the number of batches and adding the various prices paid during the period to the batches purchased. For example, three batches of material received in Rs. 10, rupees 12 and Rs. 14 per unit each.

The simple average price is calculated as follows:

Rs. 10+ rupees 12+ rupees 14/3 batch = Rs. 36/3 batch = 12 rupees per unit

This method takes into account the prices of different batches, but is not common because it does not take into account the quantity purchased in different batches. Use this method when the price is less volatile and the stock price is small.

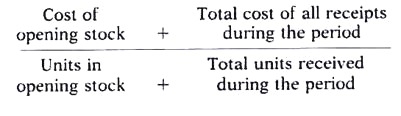

6. Weighted average cost method:

This is a permanent weighted averaging system in which the issue price is recalculated each time after each receipt, taking into account both the total quantity and the total cost when calculating the weighted average price. For example, three batches of material received in a quantity of 1,000 units @ Rs. 15, 1,300 units @ Rupee 16 and 800 units @ Rs. 14.14.

The weighted average price is calculated as follows:

(1,000 units x Rs .15) + (1,300 units x Rs .16) + (800 units x Rs .14) / 1,000 units + 1,300 units + 800 units

= Rs. 15,000+ rupees 20,800 + rupees 11,200 / 3,100 units = rupees 47,000 / 3,100 units = 15.16 per rupee unit

This method tends to smooth out price fluctuations and reduce the number of calculations because each issue is billed at the same price until you receive a new batch of material.

This method is easier than FIFO and LIFO because you do not have to identify each batch individually. However, this method adds more clerical work in calculating the new average price each time you receive a new batch. The calculated issue price rarely represents the actual purchase price.

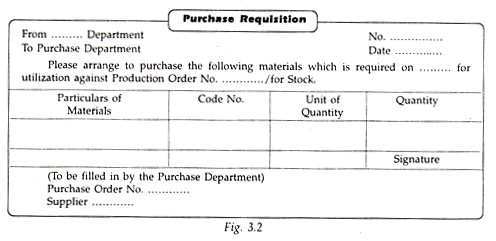

7. Periodic average cost method:

With this method, instead of recalculating the simple or weighted average cost each time you have a receipt, the average for the entire accounting period is calculated.

The average price of all materials published during the period is calculated as follows:

8. Standard cost method:

In this way, important issues are priced at a given standard issue price. The difference between the actual purchase price and the standard issue price is amortized on the income statement. The standard cost is a predetermined cost set by management before the actual material cost is known, and the standard issue price is used for all issuance to production and valuation of final stock.

Careful setting of standard prices first significantly reduces all clerical work and errors and simplifies inventory recording procedures. Eliminating cost fluctuations due to material price fluctuations makes it easier to compare realistic manufacturing costs. This method is not suitable in situations where prices fluctuate.

9. Exchange fee method:

The replacement cost is the cost of replacing the same material by purchasing it on the pricing date of the material issue. It is different from the actual cost on the purchase date. The exchange price is the exchange price of the material at the time the material is issued or on the valuation date of the end-of-term inventory.

This method is unacceptable to standard accounting practices as it reflects costs that are not actually paid. If the shares are held at exchange costs and are purchased at a lower price for balance sheet purposes, an element of profit that has not yet been realized will be included in the income statement.

This method is advocated by charging the job or process for the market price of the material, making it easier to determine the profitability of the job or process. This method is especially suitable for inflationary trends in material market prices. Without the exact market for a particular material, it is difficult to ascertain the replacement price for a material problem.

10. Next Inn First Out (NIFO) Method:

This method is a variant of the exchange cost method. In this way, the price quoted in the latest purchase order or contract is used for all issuance until a new order is placed.

11. Basic stock method:

With this method, the specified quantity of material is always kept in stock and priced as a buffer or base stock at its original cost. In addition, issuance of materials that exceed the basic stock quantity is priced using one of the above methods.

This method shows how prices fluctuate over time. However, this method is uncommon and makes stock valuation completely unrealistic and is not accepted by standard accounting practices.