Unit 1

Issue of Shares and Debentures

Q1) Write the journal entries of Forfeiture of Share and reissue of shares.

A1)

Accounting Entries on Forfeiture of Share

When Forfeiture of shares Issued at Par

Share Capital A/c (Called up amount) Dr.

To Share Forfeiture A/c (Paid-up amount) Cr.

To Share Allotment A/c Cr.

To Share Calls A/c (individually) Cr.

Forfeiture of shares issued at Premium

Share Capital A/c Dr.

To Share Allotment A/c Cr.

To Forfeiture Share Allotment A/c Cr.

To First Calls A/c Cr.

b. Securities Premium amount has not been received

Share Capital A/c Dr.

Securities premium account Dr

To Share Allotment A/c Cr.

To Forfeiture call A/c Cr.

To First Calls A/c Cr.

Forfeiture of Shares issued at discount

Share Capital A/c Dr

To Discount on Share Issue A/c

To Share Forfeiture A/c

To Share Allotment/Call A/c

Journal Entries for Re-issue of Forfeited Shares

On re-issue of shares

Bank A/c (Actual amount received) Dr.

Forfeited Shares A/c (loss on re-issue) Dr.

To Share Capital A/c Cr.

On transfer of profit on re-issue

Forfeited Shares A/c Dr.

To Capital Reserve A/c Cr.

Q2) Explain issue of debenture for cash.

A2)

Issue of Debentures for Cash

Debentures are said to be issued at par when their issue price is equal to the face value. The journal entries recorded for such issue are as under:

(a) If whole amount is received in one instalment:

Bank A/c Dr.

To Debenture Application & Allotment A/c

ii. On Allotment of debentures

Debenture Application & Allotment A/c Dr.

To Debentures A/c

(b) If debenture amount is received in two instalments:

Bank A/c Dr.

To Debenture Application A/c

ii. For adjustment of applications money on allotment

Debenture Application A/c Dr.

To Debentures A/c

iii. For allotment money due

Debenture Allotment A/c Dr.

To Debentures A/c

iv. On receipt of allotment money

Bank A/c Dr.

To Debenture Allotment A/c

(c) If debenture money is received in more than two instalments

Additional entries:

Debenture First Call A/c Dr.

To Debentures A/c

ii. On the receipt of the first call

Bank A/c Dr.

To Debenture First Call A/c

Q3) Explain issue of shares and forfeiture of shares.

A3)

Issue of shares

The issue of shares is the procedure in which enterprises allocate new shares to the shareholders. While circulating the shares the enterprise follow the rules stipulated by Companies Act 2013.

Steps in the process of issue of the shares are as follows-

a) Issue of prospectus: Initially the enterprise issues the prospectus to the public generally. The prospectus is an appeal to the public that a new enterprise has come into the presence and it would require funds for operating the trading concern. It contains complete data regarding the enterprise and the way in which the money is to be collected from the prospective investors.

b) Receipt of Applications: When the prospectus is circulated to the public, prospective investors can now apply for shares. As mentioned in the prospectus they must fill out an application and deposit the requisite application money in the schedule bank. The process of application stays open for 120 days. Issue of shares will be cancelled, if in these 120 days minimum subscription has not been reached.

c) Allocation of shares: The shares can be allocated, once the minimum subscription has been done. Normally, there is always oversubscription of shares, so the allocation is done on pro-rata ground. Letters of Allotment are sent out to those people who have been allocated their part of shares. This is a valid contract between company and applicants.

Forfeiture of shares:

Forfeiture of shares is referred to as the situation when the allotted shares are cancelled by the issuing company due to non-payment of the subscription amount as requested by the issuing company from the shareholder.

Forfeiture means cancellation. The shares are forfeited when the shareholder fails to pay any of the calls (one or more) on the authorization of the board of Directors.

Before forfeiture a notice must be given to the shareholder. The notice must provide the shareholder with a minimum of 14 days to make the payment due, or his shares will be forfeited. Even after such notice if the shareholder does not pay, then the shares will be canceled.

Q4) Explain issue of shares.

A4)

Issue of shares

The issue of shares is the procedure in which enterprises allocate new shares to the shareholders. While circulating the shares the enterprise follow the rules stipulated by Companies Act 2013.

Steps in the process of issue of the shares are as follows

a) Issue of prospectus: Initially the enterprise issues the prospectus to the public generally. The prospectus is an appeal to the public that a new enterprise has come into the presence and it would require funds for operating the trading concern. It contains complete data regarding the enterprise and the way in which the money is to be collected from the prospective investors.

b) Receipt of Applications: When the prospectus is circulated to the public, prospective investors can now apply for shares. As mentioned in the prospectus they must fill out an application and deposit the requisite application money in the schedule bank. The process of application stays open for 120 days. Issue of shares will be cancelled, if in these 120 days minimum subscription has not been reached.

c) Allocation of shares: The shares can be allocated, once the minimum subscription has been done. Normally, there is always oversubscription of shares, so the allocation is done on pro-rata ground. Letters of Allotment are sent out to those people who have been allocated their part of shares. This is a valid contract between company and applicants.

Q5) Explain forfeiture of shares.

A5)

Forfeiture of shares

Forfeiture of shares is referred to as the situation when the allotted shares are cancelled by the issuing company due to non-payment of the subscription amount as requested by the issuing company from the shareholder.

Forfeiture means cancellation. The shares are forfeited when the shareholder fails to pay any of the calls (one or more) on the authorization of the board of Directors.

Before forfeiture a notice must be given to the shareholder. The notice must provide the shareholder with a minimum of 14 days to make the payment due, or his shares will be forfeited. Even after such notice if the shareholder does not pay, then the shares will be canceled.

Accounting Entries on Forfeiture of Share

When Forfeiture of shares Issued at Par

Share Capital A/c (Called up amount) Dr.

To Share Forfeiture A/c (Paid-up amount) Cr.

To Share Allotment A/c Cr.

To Share Calls A/c (individually) Cr.

Forfeiture of shares issued at Premium

Share Capital A/c Dr.

To Share Allotment A/c Cr.

To Forfeiture Share Allotment A/c Cr.

To First Calls A/c Cr.

b. Securities Premium amount has not been received

Share Capital A/c Dr.

Securities premium account Dr

To Share Allotment A/c Cr.

To Forfeiture call A/c Cr.

To First Calls A/c Cr.

Forfeiture of Shares issued at discount

Share Capital A/c Dr

To Discount on Share Issue A/c

To Share Forfeiture A/c

To Share Allotment/Call A/c

Reissue of forfeited shares:

Forfeited shares are available with the company for sale. The company is under an obligation to dispose off the forfeited shares, after the forfeiture of shares.

The company requires to pass a resolution in its Board Meeting for the re-issue of forfeited shares. Re-issue of forfeited shares is a mere sale of shares for the company. A company does not make allotment of these shares.

Journal Entries for Re-issue of Forfeited Shares

On re-issue of shares

Bank A/c (Actual amount received) Dr.

Forfeited Shares A/c (loss on re-issue) Dr.

To Share Capital A/c Cr.

On transfer of profit on re-issue

Forfeited Shares A/c Dr.

To Capital Reserve A/c Cr.

Q6) Explain redemption of preference shares.

A6)

Preference shares cannot be redeemed unless they are fully paid up. In other words partly paid-up shares cannot be redeemed. Preference shares can be redeemed in two ways- one is profits which would be available for dividend. The other one is out of the proceeds of a fresh issue of shares made with the object of redemption.

When Preference shares are redeemed out of profits available for distribution as dividend, a sum equal to the nominal amount of the shares so redeemed must be transferred out of profits to a reserve account to be called ‘Capital Redemption Reserve Account’. Such reserve can be used for issuing fully paid bonus shares to the shareholders.

Conditions for redemption of preference shares

Before going for redemption, the company must follow the following conditions

The redeemable preference shares can be redeemed by a) the proceeds of a fresh issue of equity shares/ preference shares, b) the capitalization of undistributed profit i.e. creating capital redemption reserve account, or c) a combination of both (a) and (b).

Accounting entries required for redemption of preference shares.

When new shares are issued at par:

Bank A/c …………………Dr.

To Share Capital A/c.

When new shares are issued at premium:

Bank A/c ……………………..Dr.

To Share Capital A/c

To Share Premium A/c

When new shares are issued at a discount:

Bank A/c ………………Dr.

Discount on Issue of Share Capital………..Dr.

To Share Capital A/c.

Conversion of partly paid shares into fully paid shares:

a) Share Call A/c ………..Dr.

To Share Capital A/c

b) Bank A/c ……………..Dr.

To Share Call A/c.

When preference shares are redeemed at par:

Redeemable Preference Share Capital A/c ………………Dr.

To Preference shareholders A/c.

When preference shares are redeemed at a premium:

Redeemable Preference Share Capital A/c ………………Dr

Premium of Redemption Preference Share Capital A/c….Dr.

To Preference shareholders A/c.

Adjustment of premium on redemption:

Profit and Loss A/c………………..Dr.

Share Premium A/c ……………….Dr.

To Premium of Redemption Preference Share Capital A/c

Transferring the amount to Capital Redemption Reserve Account:

General Reserve A/c …………….Dr.

Profit and Loss A/c …………….Dr.

To Capital Redemption Reserve A/c

Expenses on issue of shares:

Expenses on Issue of shares A/c…………….Dr.

To Bank A/c.

When payment is made to preference shareholders:

Preference Shareholders A/c ……………Dr.

To Bank A/c.

When the fully paid bonus shares are issued:

Capital Redemption Reserve A/c …………….Dr.

General Reserve A/c …………………………..Dr.

Share Premium A/c ……………………………Dr.

Profit & Loss A/c …………………………….. Dr.

To Bonus to Shareholders A/c

Capitalization of profit:

Bonus to Shareholders A/c ………………Dr.

To Equity share capital A/c

Q7) Explain journal entry of redemption of preference shares.

A7)

Accounting entries required for redemption of preference shares.

When new shares are issued at par:

Bank A/c …………………Dr.

To Share Capital A/c.

When new shares are issued at premium:

Bank A/c ……………………..Dr.

To Share Capital A/c

To Share Premium A/c

When new shares are issued at a discount:

Bank A/c ………………Dr.

Discount on Issue of Share Capital………..Dr.

To Share Capital A/c.

Conversion of partly paid shares into fully paid shares:

a) Share Call A/c ………..Dr.

To Share Capital A/c

b) Bank A/c ……………..Dr.

To Share Call A/c.

When preference shares are redeemed at par:

Redeemable Preference Share Capital A/c ………………Dr.

To Preference shareholders A/c.

When preference shares are redeemed at a premium:

Redeemable Preference Share Capital A/c ………………Dr

Premium of Redemption Preference Share Capital A/c….Dr.

To Preference shareholders A/c.

Adjustment of premium on redemption:

Profit and Loss A/c………………..Dr.

Share Premium A/c ……………….Dr.

To Premium of Redemption Preference Share Capital A/c

Transferring the amount to Capital Redemption Reserve Account:

General Reserve A/c …………….Dr.

Profit and Loss A/c …………….Dr.

To Capital Redemption Reserve A/c

Expenses on issue of shares:

Expenses on Issue of shares A/c…………….Dr.

To Bank A/c.

When payment is made to preference shareholders:

Preference Shareholders A/c ……………Dr.

To Bank A/c.

When the fully paid bonus shares are issued:

Capital Redemption Reserve A/c …………….Dr.

General Reserve A/c …………………………..Dr.

Share Premium A/c ……………………………Dr.

Profit & Loss A/c …………………………….. Dr.

To Bonus to Shareholders A/c

Capitalization of profit:

Bonus to Shareholders A/c ………………Dr.

To Equity share capital A/c

Q8) Explain redemption of debentures.

A8)

Redemption of debentures refers to payment of the amount of debentures by the enterprise. The amount of capital needed for redemption of debentures is large and, therefore, economic enterprises make adequate provision out of gains and accrue capital to reclaim debentures.

It involves repayment of the number of debentures to the debenture holders. Debentures can be redeemed either at par or at a premium.

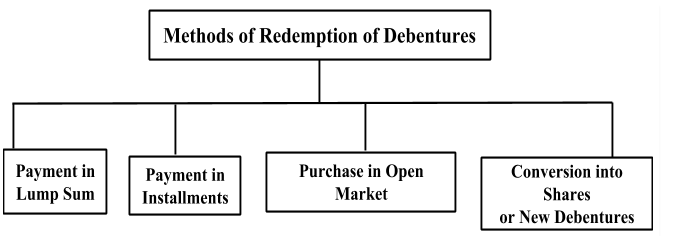

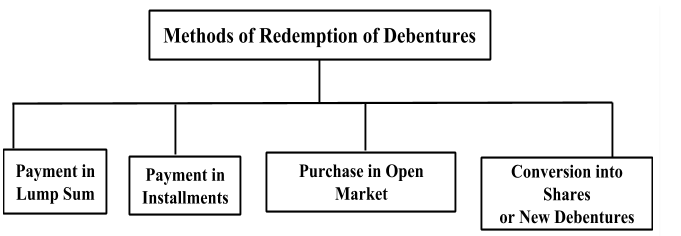

Methods of redemption of debentures

2. Payment in installments: Under this method, usually redemption of debentures is paid in installments on the particular date during the time in the position of the debentures. The total amount of debenture liability is being divided by the total number of years.

3. Purchase in open market: For the aim of cancellation when an enterprise buys its own debentures, such an act of buying and cancelling the debentures comprises redemption of debentures by purchase in the open marketplace.

4. Conversion into shares or new debentures: An enterprise can reclaim its debentures by transforming them into a new class of debentures or shares. These new shares or debentures can be either circulated at a premium, at a discount or at par. It may be noted that this method is applicable only to convertible debentures.

Q9. Write journal entry of issue of debentures for cash

Solution

Issue of Debentures for Cash

Debentures are said to be issued at par when their issue price is equal to the face value. The journal entries recorded for such issue are as under:

(a) If whole amount is received in one instalment:

Bank A/c Dr.

To Debenture Application & Allotment A/c

ii. On Allotment of debentures

Debenture Application & Allotment A/c Dr.

To Debentures A/c

(b) If debenture amount is received in two instalments:

iii. On receipt of application money

Bank A/c Dr.

To Debenture Application A/c

iv. For adjustment of applications money on allotment

Debenture Application A/c Dr.

To Debentures A/c

v. For allotment money due

Debenture Allotment A/c Dr.

To Debentures A/c

vi. On receipt of allotment money

Bank A/c Dr.

To Debenture Allotment A/c

(c) If debenture money is received in more than two instalments

Additional entries:

Debenture First Call A/c Dr.

To Debentures A/c

ii. On the receipt of the first call

Bank A/c Dr.

To Debenture First Call A/c

Q10. Explain the issue and redemption of debentures

Solution

Debentures are a document evidencing debt to the debenture holder, generally secured by a fixed or floating charge.

The definition of ‘debentures’ as contained in section 2(12) of the Companies Act does not explain the term. It simply reads “debenture includes debenture stock, bonds and any other securities of a company whether constituting a charge on the assets of the company or not.”

Issue of debentures

The procedure for the issue of debentures is the same as that for the issue of shares. The intending investors apply for debentures on the basis of the prospectus issued by the company. The company may either ask for the entire amount to be paid on application or by means of installments on application, on allotment and on various calls. Debentures can be issued

a) for cash.

b) for consideration other than cash.

c) issued at par, payable at par.

d) issued at discount, payable at par.

e) issued at par, payable at premium.

f) issued at discount, payable at premium.

g) issued at par, payable at discount.

h) issued at discount, payable at discount.

Issue of Debentures for Cash

Debentures are said to be issued at par when their issue price is equal to the face value. The journal entries recorded for such issue are as under:

(a) If whole amount is received in one instalment:

Bank A/c Dr.

To Debenture Application & Allotment A/c

ii. On Allotment of debentures

Debenture Application & Allotment A/c Dr.

To Debentures A/c

(b) If debenture amount is received in two instalments:

iii. On receipt of application money

Bank A/c Dr.

To Debenture Application A/c

iv. For adjustment of applications money on allotment

Debenture Application A/c Dr.

To Debentures A/c

v. For allotment money due

Debenture Allotment A/c Dr.

To Debentures A/c

vi. On receipt of allotment money

Bank A/c Dr.

To Debenture Allotment A/c

(c) If debenture money is received in more than two instalments

Additional entries:

Debenture First Call A/c Dr.

To Debentures A/c

ii. On the receipt of the first call

Bank A/c Dr.

To Debenture First Call A/c

Redemption of debentures

Redemption of debentures refers to payment of the amount of debentures by the enterprise. The amount of capital needed for redemption of debentures is large and, therefore, economic enterprises make adequate provision out of gains and accrue capital to reclaim debentures.

It involves repayment of the number of debentures to the debenture holders. Debentures can be redeemed either at par or at a premium.

Methods of redemption of debentures

2. Payment in installments: Under this method, usually redemption of debentures is paid in installments on the particular date during the time in the position of the debentures. The total amount of debenture liability is being divided by the total number of years.

3. Purchase in open market: For the aim of cancellation when an enterprise buys its own debentures, such an act of buying and cancelling the debentures comprises redemption of debentures by purchase in the open marketplace.

4. Conversion into shares or new debentures: An enterprise can reclaim its debentures by transforming them into a new class of debentures or shares. These new shares or debentures can be either circulated at a premium, at a discount or at par. It may be noted that this method is applicable only to convertible debentures.