Unit 3

Valuation of goodwill and valuation of shares

Q1) The profits of the company for the last three years are as follows-

Year | Profits |

2008 | 20000 |

2009 | 20000 |

2010 | 35000 |

|

|

A1)

The average profits of the company are = (20000+20000+35000)/3 = 25000

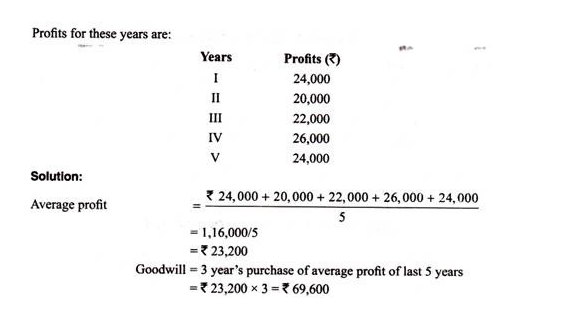

Example 2 – Xltd agreed to purchase a business. For that purchase, goodwill is to be valued at 3 years’ purchase of average profits of last 5 years

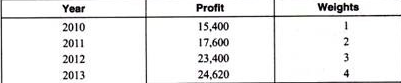

Q2 Calculate weighted average profit.

A2)

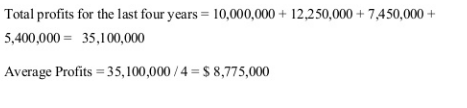

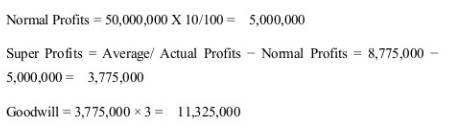

Q3. The capital employed as shown by the books of ABC LTD is 50,000,000. And the normal rate of return is 10%. Goodwill is to be calculated on the basis of three years purchase of super profits of the last four years. Profits of last four years are:

Year | Profit |

2005 | 10,000,000 |

2006 | 12,250,000 |

2007 | 7,450,000 |

2008 | 5,400,000 |

|

|

A3)

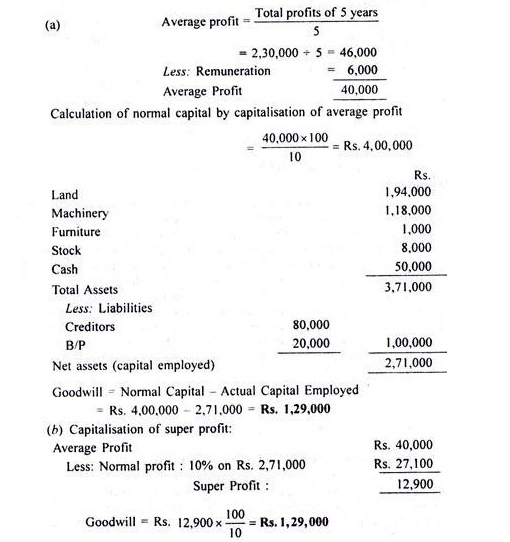

Q4)

A4)

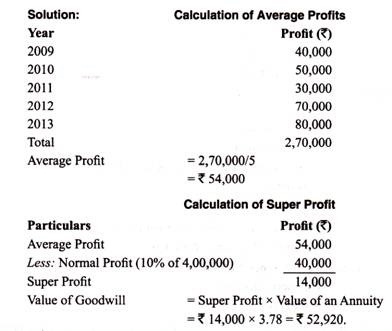

Q5) The net profit of a company after providing for taxation for the past five years is:

The net tangible assets in the business are Rs. 4, 00,000 on which the normal rate of return is expected to be 10%. It is also expected that the company will be able to maintain its super profits for next five years. Calculate the value of goodwill of the business on the basis of an annuity of super profits, taking present value of an annuity of Rs. 1 for five years at 10% interest is Rs. 3.78.

A5)

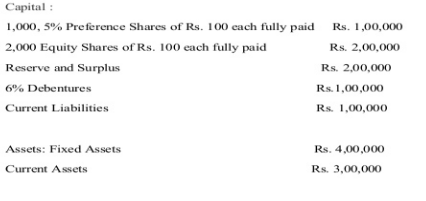

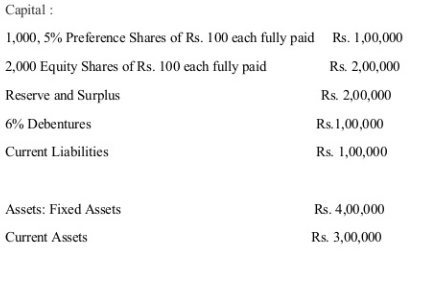

Q6) The following information is available from Tina ltd as on 31st march 2009-

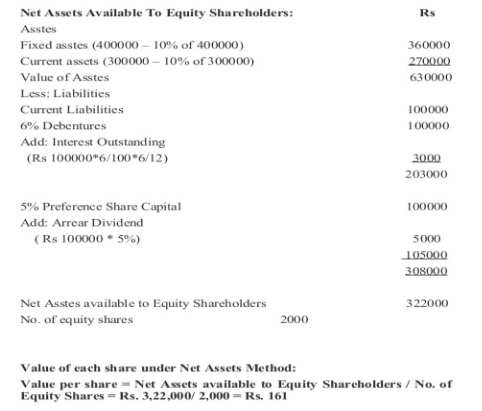

For the purpose of valuation of shares, fixed assets and current assets are to be depreciated by 10%; interest on debentures are due for 6 months; preference dividend is also due for the year. Neither of these have been provided for in the balance sheet. Calculate value of equity under net asset method .

A6)

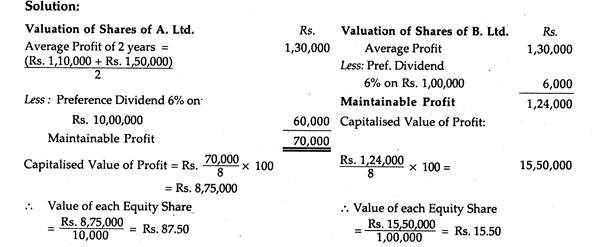

Q7. Two companies, A Ltd. and B. Ltd., are found to be exactly similar as to their assets, reserves and liabilities except that their share capital structures are different:

The share capital of A. Ltd. is Rs. 11,00,000, divided into 1,000, 6% Preference Shares of Rs. 100 each and 1,00,000 Equity Shares of Rs. 10 each.

The share capital of B. Ltd. is also Rs. 11,00,000, divided into 1,000, 6% Preference Shares of Rs. 100 each and 1,00,000 Equity Shares of Rs. 10 each. .

The fair yield in respect of the Equity Shares of this type of companies is ascertained at 8%.

The profits of the two companies for 2009 are found to be Rs. 1, 10,000 and Rs. 1, 50,000, respectively.

Calculate the value of the Equity Shares of each of these two companies on 31.12.2009 on the basis of this information only.

A7)

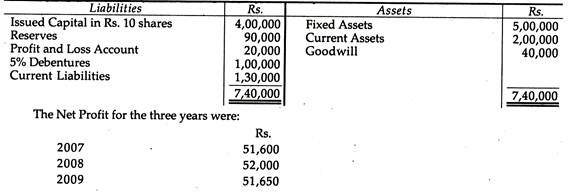

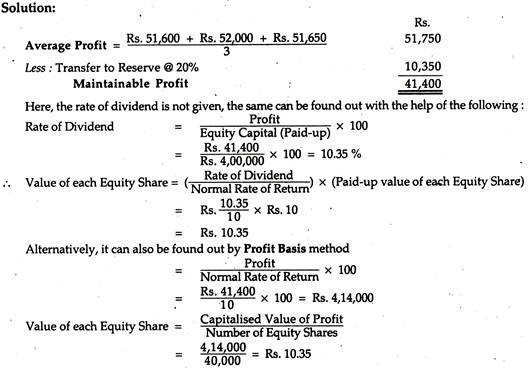

Q8) Calculate the value of each Equity Share from the following information: Of which 20% was placed to Reserve, this proportion being considered reasonable in the industry in which the company is engaged and where a fair investment return may be taken at 10%.

Q9) Explain underwriting of shares.

A9)

The functions of an underwriter refers to underwriting. An under-writer performing the under-writing function may be an individual, firm or a joint stock company.

Definition

Under-writing may be defined as a contract entered into by the company with persons or institutions, called under-writers, who undertake to take up the whole or a portion of such of the offered shares or debentures as may not be subscribed for by the public. Such agreements are called ‘Under-writing agreement’.

Underwriting

STATEMENT SHOWING LIABILITY OF UNDERWRITERS

GROSS LIABILITY BASIS

Particulars | No. of shares |

Gross liability of each underwriters | xxx |

(-) unmarked application in the ratio of gross liability | xxx |

Balance left | xxx |

(-) marked application | xxx |

Net liability of the underwriter | Xxx |

Types of underwriting

2. Partial underwriting – Partial underwriting refers to the part of the issue of shares or debenture of a company is underwritten. Partial underwriting may be done by one underwriter or by a number of underwriters. The company is treated as ‘underwriter’ for the remaining part of the issue, in case of partial underwriting.

3. Firm underwriting - Irrespective of the number of shares or debentures subscribed by the public, it is an underwriting agreement where the underwriter or underwriters agree to buy a certain number of shares or debentures. Thus, in firm underwriting, whether or not the issue is over subscribed, the underwriters agree that a certain number of shares be allotted to them.

Q10) Explain the valuation of shares.

A10)

Valuation of shares is the process of knowing the value of company’s shares. Normally, the value of shares is ascertained from the market price quoted on the stock exchange. Shares of limited company are required to be valued on many occasions such as –

a) Sale or purchase of shares of a private limited company whose shares are not quoted on the stock exchange.

b) Sale or purchase of large number of shares enabling the purchaser to acquire control of management of the company.

c) Sale of entire company on amalgamation with, or absorption by another company

d) Valuation of assets held by investment company.

e) Conversion of one class of shares into another.

f) Ascertaining the value of shares offered as security against loan.

Methods of valuation of shares

According to this method the following points should be considered.

Thus the value of net asset is:

Total of realisable value of assets – Total of external liabilities = Net Assets (Intrinsic value of asset)

Total Value of Equity shares = Net Assets – Preference share capital

Value of one Equity share = Net Assets – Preference share capital/Number of Equity shares

2. Yield method - The emphasis is given to the yield that an investor expects from his investment, under this method. The yield means return that an investor gets out of his holdings—dividend, bonus shares, right issue. Yield is the effective rate of return on investments which is invested by the investors. It is always expressed in terms of percentage.

Under Yield-Basis method, valuation of shares is made on:

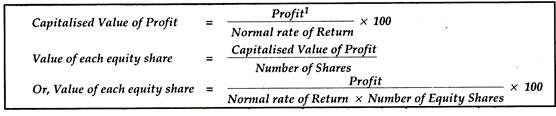

Profit basis - Under this method, firstly, profit are determined on the basis of past average profit; thereafter, capitalized value of profit is to be ascertained on the basis of normal rate of return, and, the same (capitalized value of profit) is divided by the number of shares in order to find out the value of each share.

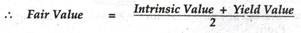

3. Fair value method – The Fair Value Method which is the mean of intrinsic value and Yield Value method and the same provides a better indication about the value of shares than the other methods.