UNIT III

Funds flow and cash flow analysis

Q1) Define Cash flow.

A1) Cash flows are recorded on the company's cash flow statement. This statement (one of the company's key statements) shows the actual inflows and outflows of cash (or cash-like assets) from its investment activities. This is a mandatory report under generally accepted accounting principles (GAAP)

This is different from the income statement, which records data and transactions that may not be fully realized, such as uncollected income and unpaid income. On the other hand, this information is already entered in the cash flow statement, which gives you a more accurate picture of how much cash your company is generating.

The cash flow statement allows you to classify cash flow sources into three different categories:

Q2) What is Fund Flow statement?

A2) On the accounting side, GAAP required a cash flow statement between 1971 and 1987. 3 If requested, the cash flow statement is primarily an accountant's change in the company's net working capital, or assets and liabilities over a period of time. Much of this information is currently available on the cash flow statement. For investment purposes, the flow of funds does not give the company a cash position. If your company wants to do that, create a cash flow statement.

The flow of money emphasizes the cash-only movement. In other words, it reflects the net movement after investigating the inflows and outflows of monetary funds. It also identifies activities that may deviate from the character of the company, such as irregular expenses.

The use of the income statement in investments is more useful today. Investor sentiment is associated with different asset classes and can be measured. For example, a positive stock flow suggests that investors are generally optimistic about the economy, or at least the short-term profitability of listed companies.

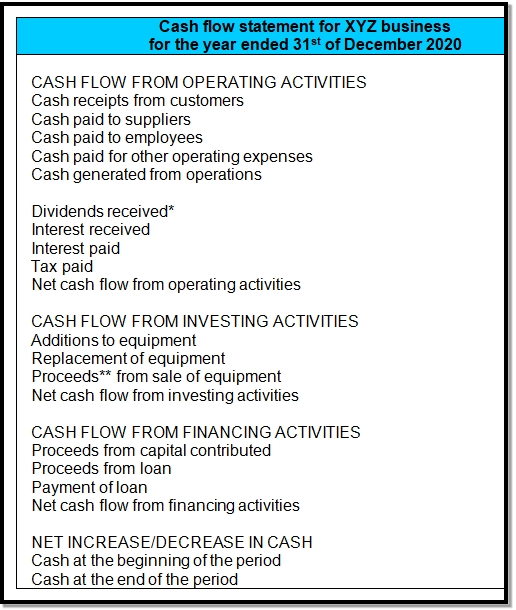

Q3) Draw the specimen of Cash flow.

A3)

Specimen of Cash Flow

A company receives an inflow of cash income from selling goods, providing services, selling assets, earning interest on investments, renting, acquiring loans, or issuing new shares. Cash outflows can result from purchases, loan repayments, business expansions, payroll payments, or dividend distributions.

Investors and lenders have liquidity and cash on hand because the Securities and Exchange Commission (SEC) requires all listed companies to use accrual accounting and largely ignores the actual balance of cash on hand. It relies on cash flow statements to evaluate flow management. It's a more reliable tool than the metrics companies use to dress up their earnings, such as interest, taxes, depreciation, and earned before interest (EBITDA)

Q4) Explain in detail the difference between cash flow analysis and Fund flow analysis.

A4) Here, we will explain in detail the difference between cash flow analysis and Fund flow analysis.

1. The concept of a fund refers to the actual or conceptual "cash" in cash flow analysis. However, it means either all financial resources or net working capital in the cash flow analysis.

2. Cash flow analysis deals with real cash or assumed cash-only movements. However, the flow of funds is related to all the items that make up the funds: net working capital. Cash is one of the elements of working assets

3. The cash flow statement only shows the causes of changes in cash and bank balances: cash receipts and payments. The cash flow statement shows the cause of the change in net working capital. This is a flexible device designed to disclose and highlight all significant changes in a company's current assets and current liabilities during the study period.

4. Cash flow analysis is a short-term financial analysis tool, but cash flow analysis is relatively long-term.

5. The income statement is consistent with the actual accounting standards. However, in the cash flow statement, data obtained on an accrual basis is converted to a cash basis.

6. The Fund Flow Statement aggregates funds generated from different sources for different purposes in which they are used. However, the cash flow statement starts with the cash balance at the start and reaches the cash balance at the end by processing it with various sources and uses.

7. In cash flow analysis, changes in various current assets and current liabilities are displayed in a separate statement or schedule of changes in working capital to see net changes in working capital. However, in fund flow analysis, such changes are adjusted to match the cash from operating activities to confirm cash from operating activities.

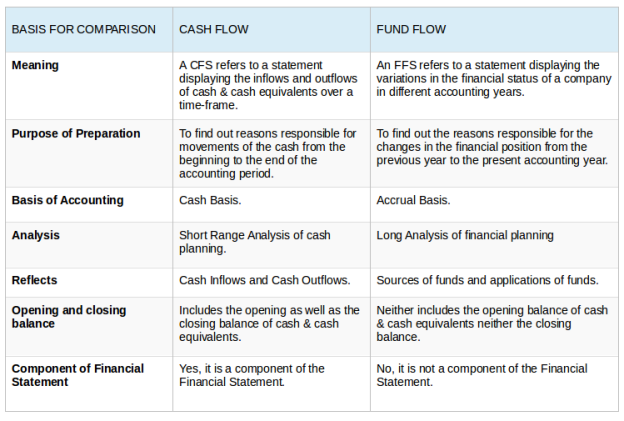

Points of Difference | Cash Flow | Fund Flow |

Meaning

| This represents the inflow and outflow of cash for a specified period of time, and its equivalent. . | It emphasizes the change in the working capital of a company from the end of one period to the end of another. |

Accounting Ways | Cash flows are accounted for only when liquid cash is included in the form of currency or bank transfers. . | The flow of funds is accounted for based on the generation of funds, not the actual payment or collection |

Utility | Cash flows are used to identify the net cash flow of a business over a specific time period. | The use of cash flows extends to an understanding of a company's overall financial situation. |

Business Position | Analysis Cash flow calculations help identify short-term business liquidity positions. | Cash flow calculations help you assess your long-term business position. |

Disclosures Made | All disclosures regarding cash inflows and outflows are made under cash flows. | Funding flows allow disclosure and identification of all sources of funding and their applications. |

Entry in Annual Financial Statements | It is mandatory to include a cash flow statement in the annual financial statements of a particular company. | It is not legally required to include a cash flow statement in the annual financial statements, and companies can do so to build investor confidence or meet investor demands. |

Use in Budgeting | Cash flow statements and analytics help you budget your business cash. | The income statement and analysis are usually useful for a company's regular capital budgeting . |

Q5) Explain the Comparison between Cash and fund flow statement.

A5)

Q6) What is ratio analysis? Mention its Uses.

A6) Ratio analysis refers to the analysis of financial information that is contained in a company's financial statement. These are primarily used by external analysts to determine various aspects of the business, such as profitability, liquidity and solvency.

Ratio analysis

Analysts obtain data to assess a company's financial performance based on current and historical financial statements. They use the data to determine if a company's financial position is on the rise or down and compare it to other competitors.

Use of ratio analysis

1. Comparison

One use of ratio analysis is to compare a company's financial performance to similar companies in the industry to understand its position in the market. By obtaining financial ratios such as price-earnings ratios from known competitors and comparing them to company ratios, management can identify market gaps and explore competitive advantages, strengths and weaknesses. I can do it. Management can then use that information to make decisions aimed at improving the company's position in the market.

2. Trend line

Companies can also use ratios to see if they are prone to financial performance. Established companies collect data from financial statements over a number of reporting periods. The trends obtained can be used to predict the direction of future financial performance. It can also be used to identify financial disruptions that are expected to be impossible to predict using a single reporting period ratio.

3. Operational efficiency

Company owners can also use financial ratio analysis to determine the degree of efficiency in managing assets and liabilities. Inefficient use of assets such as automobiles, land and buildings brings unnecessary costs to be eliminated. The financial ratio also helps determine if the financial resources are overused or underused.

Q7) What are the categories of financial ratio?

A7) There are many financial ratios used in ratio analysis, which fall into the following categories:

1. Current ratio

Quick ratio measures a company's ability to meet its obligations using current assets. If a company is in financial difficulty and unable to pay its debt, it can convert its assets into cash and use that money to settle its pending debt more easily.

Common current ratios include quick ratio, cash ratio, and current ratio. The current ratio is used by banks, creditors, and suppliers to determine if a customer has the ability to meet its financial obligations when it is due.

Current ratio = Current assets / Current liabilities

2. Solvency ratio

The solvency ratio measures a company's long-term financial viability. These ratios compare a company's liability level to its assets, capital, or annual revenue.

The solvency ratio is primarily used by governments, banks, employees and institutional investors.

S. No. | RATIOS | FORMULAS |

1 | Current Ratio | Current Assets/Current Liabilities |

2 | Quick Ratio | Liquid Assets/Current Liabilities |

3 | Absolute Liquid Ratio | Absolute Liquid Assets/Current Liabilities |

3. Profitability ratio

Profitability ratio measures a company's ability to make a profit when compared to the associated costs. A higher rate of return than the previous financial reporting period indicates that the business is improving financially. You can also compare the profitability ratio to the ratio of similar companies to determine the profitability of your business compared to your competitors.

Examples of important rates of return include return on equity, return on total assets, rate of return, gross rate of return, and return on capital used.

S. No. | RATIOS | FORMULAS |

1 | Gross Profit Ratio | Gross Profit/Net Sales X 100 |

2 | Operating Cost Ratio | Operating Cost/Net Sales X 100 |

3 | Operating Profit ratio | Operating Profit/Net Sales X 100 |

4 | Net Profit Ratio | Operating Profit/Net Sales X 100 |

5 | Return on Investment Ratio | Net Profit After Interest And Taxes/ Shareholders Funds or Investments X 100 |

6 | Return on Capital Employed Ratio | Net Profit after Taxes/ Gross Capital Employed X 100 |

7 | Earnings Per Share Ratio | Net Profit After Tax & Preference Dividend /No of Equity Shares |

8 | Dividend Pay Out Ratio | Dividend Per Equity Share/Earning Per Equity Share X 100 |

9 | Earning Per Equity Share | Net Profit after Tax & Preference Dividend / No. of Equity Share |

10 | Dividend Yield Ratio | Dividend Per Share/ Market Value Per Share X 100 |

11 | Price Earnings Ratio | Market Price Per Share Equity Share/ Earning Per Share X 100 |

12 | Net Profit to Net Worth Ratio | Net Profit after Taxes / Shareholders Net Worth X 100 |

4. Efficiency ratio

Efficiency ratio measures how well a company uses its assets and liabilities to generate sales and make a profit. They calculate inventory usage, machine usage, debt turnover, and capital usage. These ratios are important. Because when the efficiency ratio improves, the business will generate more revenue and profits.

Key efficiency ratios include asset turnover, inventory turnover, accounts payable turnover, working capital turnover, fixed asset turnover, and receivable turnover.

Typical efficiency ratios are:

Asset turnover = sales / average total assets

2. Inventory turnover measures the number of times a company's inventory is sold and exchanged over a specific time period.

Turnover Stock = cost of sales / average stock

3. Accounts receivable turnover measures the number of times a company can convert accounts receivable into cash over a period of time.

Accounts Receivable Turnover = Net Loan Sales / Average Accounts Receivable

4. Sales days in inventory ratio measure the average number of days a company holds inventory before selling it to its customers.

Number of sales days in inventory ratio = 365 days / inventory turnover

5. Coverage rate

Coverage measures a company's ability to meet its obligations and other obligations. Analysts can use coverage rates over several reporting periods to depict trends in predicting the future financial position of a company. High coverage means that companies can more easily handle debt and related obligations.

Key coverage rates include debt coverage, interest coverage, fixed rate coverage, and EBIDTA coverage.

Coverage Interest ratio = operating income / interest expense

2. Debt repayment coverage reveals how easy it is for a company to pay its debt.

Debt repayment coverage = operating income / total debt repayment

6. Market outlook ratio

Market outlook ratios help investors predict how much they will earn from a particular investment. Revenues can take the form of higher stock prices or future dividends they may expect to earn.

Key market outlook ratios include dividend yield, earnings per share, price earnings ratio, and payout ratio.

Book value ratio per share = (shareholders' equity – preferred stock) / total number of common shares issued

2. Dividend yield is a measure of the amount of dividends attributable to shareholders relative to the market value per share.

Yield Dividend = Dividend per share / stock price

3. Earnings per share ratio measures the amount of net income earned for each issued share.

Earnings per share = Net income / Total number of issued shares

4. Price earnings ratio compares a company's stock price to earnings per share.

Earnings Price ratio = stock price / earnings per share

Q8) Explain Cash flow as per accounting standards.

A8) Cash flow as per accounting standards:

The applicability of the income statement is defined under the businesses Act 2013. As defined by the law, financial statements include:

I. record

ii. Profit and Loss Account / Balance Account

iii. Income statement

iv. Statement of changes in shareholders' equity, etc.

v. Annotation

Therefore, the income statement must be prepared by all companies, but the law also specifies certain categories of companies that are exempt from an equivalent.

For eg: One Person Company (OPC), Small Company, and Dormant Company.

2. Cash and cash equivalents

Cash equivalents are held by a corporation to satisfy its short-term cash commitment on behalf of an investment or other such purpose. For investments that qualify as cash equivalents:

1. The investment must be easily convertible to cash.

2. Must be exposed to a really low level of risk regarding changes in its value.

Therefore, an investment is taken into account a debt instrument as long as such investment features a short maturity within 3 months from the date of acquisition.

The AS 3 income statement states that movements between items that form a part of cash or cash equivalents should be excluded. Because these are a part of a company's cash management, not business, financing, and investment activities.

Cash management consists of investing surplus take advantage cash equivalents.

3. View income

The income statement must represent the cash flows within the amount during which they're categorized as follows:

A. Sales activities.

B. Investment.

C. Financing activities.

Companies got to prepare and present cash flows from operations, financing, and investment activities during a way that suits their business.

Grouping activities provides information that permits users to assess the impact of such activities on the company's overall financial position and to assess the worth of money and cash equivalents.

A. Sales activities

Cash flow from operating activities comes primarily from activities that generate the company's main revenue. For example:

B. Investment activities

Cash flows from investing activities represent outflows for cash flows and resources aimed toward generating future income. For example:

C. Financing activities

Financing activities are activities that change the composition and size of the owner's capital and therefore the company's debt. For example:

4. Income from operating activities

Companies should report cash flows from operating activities using:

1. Direct method-if all major classes of money receipt and payment are presented. Or

2. Indirect method – If net or loss is adjusted as follows:

a) Impact of non-cash transactions like depreciation, deferred taxes and provisions.

b) Income or deferral of future or past operating cash income or payments

c) Expenses or income related to income financing or investment

5. Income from investment and financing activities

An entity must separately record all major classes of money receipts and payments resulting from financial and investment activities, except people who got to be reported on a net basis.

Cash flows from any of the subsequent operating, financing or investing activities could also be reported in net form.

Cash flows from each of the subsequent activities of a financial company could also be reported in net form.

B. Foreign currency cash flow

Cash flows from transactions in foreign currencies should be recorded in the company's reporting currency using the following methods:

Foreign currency amount * FX rates the exchange rate between the cash flow date report and the foreign currency.

If the result is similar to using the cash flow date rate, you can use a rate that is close to the actual rate.

The impact of exchange rate fluctuations on cash and cash equivalents held in foreign currencies must be reported as a separate and separate part of the adjustment of changes in cash and cash equivalents during the period.

6. Special items, dividends and profits

Cash flows related to special items should be categorized as originating from operating, financing, or investing activities, as appropriate and clearly disclosed.

Cash flows from receiving and paying dividends and interest must be disclosed separately. For financial companies, cash flows from receiving and paying dividends and interest should be categorized as cash flows from operating activities.

For other companies, cash flows from interest expense should be categorized as cash flows from financing activities, while dividends and interest received should be categorized as cash flows from investing activities.

7. Tax on income

Income tax cash flows must be disclosed separately and reported as cash flows from operating activities unless they may be explicitly related to investment and financing activities.

8. Acquisition and disposal of business divisions including subsidiaries

Total cash flows from acquisitions and disposals of business units, including subsidiaries, must be viewed as investment activity and reported separately.

An entity must provide a complete of the subsequent for both acquisitions and disposals of other business units, including subsidiaries, within the subsequent period:

(A) Total purchase or disposal

(B) Purchase or disposal price discharged as cash and cash equivalents

9. Non-cash transaction

Financing and investment transactions that do not require cash or cash equivalents should not be included in the cash flow statement. These transactions must be presented elsewhere in the financial statements in a way that provides relevant information regarding such financing and investment activities.

10. Disclosure

An entity must disclose the amount of substantial unusable cash and cash equivalents it holds, along with management commentary. Commitments that may result from discounted bills of exchange and other similar obligations undertaken by an entity are usually disclosed in the financial statements by note, even if the likelihood of loss is low.

Q9) Differentiate between AS3 and IndAS7

A9) Main differences between AS3 and IndAS7

Details

| AS3 Cash Flow Statement

| Ind AS7 Cash Flow Statement |

Bank Overdrafts

| AS3 does not have such a requirement

| Ind AS 7 explicitly includes bank overdraft as a part of cash and cash equivalents to be repaid for the asking |

Cash Flows from Extracurricular Activities.

| AS3 requires that cash flows related to extracurricular activities be classified as cash flows from operating activities, financing activities, and investing activities. | IndAS7 does not include such a requirement |

changes in ownership of subsidiary | There are no such requirements for cash flows from changes in ownership of subsidiary AS3

| Ind AS 7 requires a classification of cash flows resulting from changes in ownership of subsidiaries. This will not lose your control as cash. Flow from financial activities |

Accounting for investments in subsidiaries or affiliates .

| AS 3 does not have such a requirement | Ind AS 7 requires the use of the cost method or equity method when accounting for investments in subsidiaries or affiliates |

Disclosure Requirements | AS3 requires less disclosure requirements compared to Ind AS 7. | Ind AS 7 requires more disclosure requirements.

|

Q10) Explain Fund Flow statement as per accounting standard.

A10) The income statement is a statement created to analyze why a company's financial position changes between two balance sheets. This indicates the inflow and outflow of funds, that is, the source and use of funds for a specific period of time. In other words, the cash flow statement is created to explain changes in the company's working capital position.

There are two types of inflows:-

If a company's long-term funding requirements are met just outside the long-term funding source, the total funding generated from the investment is represented by an increase in working capital. However, working capital will decrease if the funds generated from the investment are not sufficient to close the gap in long-term funding requirements.

Benefits of the income statement-

Funds-Flow Statement-

The cash flow statement is useful for long-term analysis. This is a very useful tool in the hands of management to determine a company's finances and performance. The balance sheet and income statement (income statement) do not provide the information provided by the cash flow statement, that is, changes in a company's financial position. Such analysis is very useful for management, shareholders, creditors, and so on.

2. Analyzing the income statement helps managers test whether working capital is being used effectively and whether working capital levels are appropriate or inadequate for business requirements. I will. Working capital positions help management make decisions such as paying dividends.

3. Fund flow statement analysis helps investors determine if a company has managed its funds properly. It also shows the creditworthiness of the company to help lenders decide whether to lend money to the company. This helps management make policy decisions about future funding policies and capital expenditures.

Q11) What are the steps required to prepare fund flow statement. Explain it with eg.

A11) Preparation of fund flow statement

Step I: Create a working capital fluctuation statement

The first step in creating a cash flow statement is to create a working capital statement. There are several possible reasons for changing a company's working capital position, some of which are explained below.

Example: Create a working capital fluctuation statement from X Ltd's balance sheet for the years ending 2010 and 2011.

Particulars | 2010 | 2011 | Change in Working Capital |

Current Assets |

|

|

|

Inventory | 1524 | 1491 | -33 |

Sundry Debtors | 126 | 183 | +57 |

Cash and Bank | 134 | 166 | +32 |

Other Current Assets | 8 | 9 | +1 |

Loans and Advances | 1176 | 1474 | +298 |

| 2968 | 3323 | +355 |

|

|

|

|

(Less) Current Liabilities |

|

|

|

Liabilities | 1776 | 1483 | -293 |

Provision for Tax | 622 | 745 | +123 |

Proposed Dividend | 65 | 207 | +142 |

| 2463 | 2435 | -28 |

|

|

|

|

Working Capital | 505 | 888 | 383 |

Step II: Prepare funds from operations

The next step is to prepare the funds generated only from the business activities of the business, not from the investment / financial activities of the business. The operating funds shall be prepared as follows:

Particulars | Amount |

Net Income | xxx |

ADD |

|

1. Depreciation on Fixed Assets | xxx |

2. Amortization of Intangible Assets | xxx |

3. Amortisation of Loss on Sale of Investments | xxx |

4. Amortisation of Loss on sale of Fixed Assets | xxx |

5. Losses from Other Non-Operating Incomes | xxx |

6. Tax Provision (Created out of Current Profits) | xxx |

7. Proposed Dividend | xxx |

8. Transfer to Reserve | xxx |

|

|

|

|

(LESS) |

|

1. Deferred credit | xxx |

2. Profit on Sale of Investments | xxx |

3. Profit on Sale of Fixed Assets | xxx |

4. Any written back Reserve & Provision | xxx |

Step III: Prepare the income statement

When preparing a cash flow statement, it is necessary to clearly disclose the source and use of the funds and emphasize the source from which the funds were generated and the uses to which these funds were applied. This statement is sometimes referred to as a source and application statement or a statement of changes in financial position.

Funding source

The items displayed under the Funding Source heading are: ---

b. Mortgage: The amount you receive from mortgage financing is displayed under this heading. Short-term loans are not shown here as they have already been processed during the preparation of the working capital fluctuation statement.

c. Sale of investments and other fixed assets: The total amount received for the sale of investments and other fixed assets is displayed under this heading.

d. Funds from Operations: The funds generated from the operations calculated in Step II should also be displayed here.

e. Working Capital Decrease: This is a statement balance chart and is due to a change in the working capital statement.

Application of funds

The items displayed in the fund application are as follows.

3. Dividend and tax payments: Dividend and tax payments are applied for funds when the allowance is excluded from current liabilities and the current allowance is returned to profits to determine "funds from investment". Is considered.

4. Working Capital Increase: This is a statement balance diagram and results from a change in the working capital statement.

As explained above, the cash flow statement summarizes the resources available to fund a company's activities over a specific period of time and the uses for which such resources were used.