UNIT IV

Standard costing

Q1) What are the various methods of standard costing?

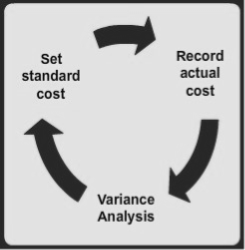

A1) This is a cost accounting technique for cost control, in which standard costs are determined, compared with actual costs, and corrective actions are initiated.

This is a method of control, which involves the creation of detailed costs and sales budgets. A management tool used to facilitate management by exceptions.

Set a standard cost

The standard quantity is predetermined and the standard price per unit is estimated. Budget costs are calculated using standard costs.

Record the actual cost

Calculate the actual quantity and the cost incurred to give the full details.

Analysis of variance

Compare actual and budget costs. Cost variances are used in cost control. Take appropriate corrective action.

Fixed liability compliance (legal compliance) is an effective control system. If necessary, reset the budget.

Types of standards ideal standards:

These are used when the price for materials and labor is most favorable, when the highest output is achieved with the best equipment and layout and when the minimum cost are low.

Normal standard:

Normal activity is defined as the number of Standard Times in which a normal efficiency produces enough goods to meet the average annual sales demand.

Basic or bogey standards:

These criteria are used only if they can remain constant or unchanged for a long time. According to this criterion, the base year is selected for comparative purposes in the same way that statisticians use price indices.

If the basic standard is used, the variance is not calculated as the difference between the standard and actual costs. Instead, the actual cost is represented as a percentage of the base cost.

Current standards:

These criteria reflect management's expectations for the actual costs of the current period. These are the costs incurred by the business owner if the expected price is paid for the goods and services and the use corresponds to what is deemed necessary to generate the planned output.

Dispersion

The difference between the standard cost and the actual cost of the actual output is defined as a variance. Dispersion may be beneficial or unfavorable.

If the actual cost is less than the standard cost, the variance is advantageous; if the actual cost is greater than the standard cost, the variance is unfavorable.

In practice, it is not enough to know the numbers of these differences, and to take the necessary corrective actions to reduce/eliminate them, it is necessary to track their origin and cause of occurrence.

Distributed type

The purpose of the quality costing report is to research the explanations for significant differences so as to spot problems and take corrective action. Dispersion is largely two types, namely, controllable and uncontrollable.

Controllable dispersion

A controllable variance is a variance that can be controlled by the department head, while an uncontrollable variance is a variance that exceeds their control. If the unruly differences are of a material nature and are permanent, then the Standard may require revision.

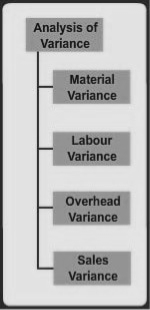

Q2) What is analysis of variance?

A2) Anova is to divide the cost variance into its components and know what is causing it.

Take corrective action for the approach.

Efficiency dispersion:

Variations that arises due to the amount of material, the effectiveness in the use of Labor. Here we compare the actual quantity with the given criteria.

Price rate differences:

Differences that result from changes in unit material prices, Standard Working Hours rates, and standard allowances for overhead costs. Here the actual price is compared with the prescribed one.

Difference by volume:

Variance due to the effect of the difference between the actual activity and the level of activity estimated when the criterion was set.

Reasons for material dispersion

Idle time variance=idle time X Std rate

Q3) What are the steps required to establish a standard costing system in your organization?

A3) The following steps are required to establish a standard costing system in your organization:

1. Determining the cost center

Cost centers are needed to fix costs and responsibilities. For manufacturing, a cost center is created according to the number of products produced, which determines the number of sections, departments, or departments involved in the production process. Cost centers related to people are called personnel cost centers, and cost centers related to products and equipment are called non-personal cost centers.

2. Account classification

Costs are incurred at various stages of the manufacturing process. These costs should be properly recorded in order to accurately calculate the total costs incurred. Therefore, you need to classify your accounts for cost control under the standard costing system.

3. Account coding

You can organize different accounts and use different symbols to facilitate quick collection, communication, and reporting. The following code can be used for the cost factor.

4. Criteria setting

Criteria are ideally expected and can be achieved in future periods, usually in the next fiscal year. The success of standard costing systems is based on the authenticity, reliability, and acceptance of these standards.

There are three types of standards. They are the current standard, the basic standard, and the regular standard. The current standard is divided into two, the ideal standard and the expected or achievable standard.

5. Establishment of standard cost

Standard costs are set individually for each cost element. In general, cost elements are grouped as materials, labor, and overhead costs. In addition, standard costs are set for sales.

6. Preparation of standard cost card or standard cost sheet

Standard cost cards or standard cost sheets are created separately for each product or process.

7. Standard costing organization

A committee is formed to set the standards. If so, the purpose of the standard costing system can be easily achieved.

Q4) Write the advantages and disadvantages of standard cost.

A4) Advantages of Standard Costing

Disadvantages of Standard Costing

Q5) Can we sub-split the usage variance?

A5) When we have multiple raw materials, what is the cause?

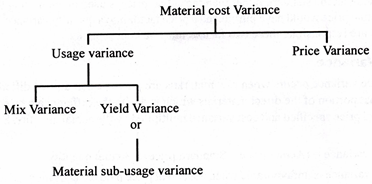

Material difference

Material cost variance material price difference material use variance material yield variance material mixture variance

Material cost variance=(standard quantity X standard price) - (actual quantity X Act Price)material price variance=actual quantity (standard price-actual price)

Material use variance=standard price(standard quantity-actual quantity)material yield variance=(Std input quantity-actual input Qty)*Std price of Std input material mixture variance = standard price(revised standard quantity-actual quantity))

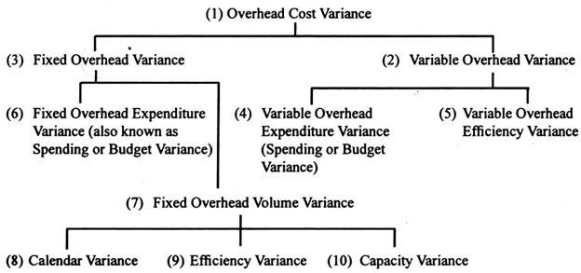

Fixed overhead (Oh) dispersion

Fixed OH cost variance=absorption Oh-actual Oh absorption Oh=actual unit*standard OH rate per unit

We fixed the oh dispersion.

Fixed Oh expenditure variance=budget Oh-actual Oh fixed Oh volume variance=absorption Oh-budget Oh

Q6) What are the reasons for material dispersion?

A6) Reasons for material dispersion

Reasons for overhead distribution

Q7) What are two phases of Anova.

A7) ANOVA has two phases.

(1) Calculation of individual differences and

(2) Identification of the cause of each difference.

I. Material differences:

The following variances make up the material variances:

Material cost variance:

Material cost variance is the difference between the actual cost of the direct material used and the standard cost of the direct material specified for the output achieved. This difference is due to the difference between the amount consumed and the amount of material allowed to be produced, and the difference between the price paid and the pre-determined price.

This can be calculated using the following formula:

Material cost variance = (AQ X AP) – (SQ X SP)

Where AQ = Actual quantity

AP = Actual price

SQ = Standard quantity for the actual output

SP = Standard price

Differences in material usage:

Differences in the amount or amount of material used occur when the actual amount of raw material used for production differs from the standard amount that should have been used to produce the achieved output. It is that part of the direct material cost variance that results from the difference between the quantity actually used and the standard quantity specified.

As an expression, this variance is shown as:

Calculate the difference in material usage from the following information:

Standard material cost per unit Issued material

Material A-2 pcs @Rs. 10 = 20 (Material A 2,050 pieces)

Material B-3 pieces @Rs. 20 = 60 (Material B 2,980 pieces)

Total = 80

Completed units 1,000

Solution:

Material usage variance = (Actual Quantity – Standard Quantity) x Standard Price

Material A = (2,050 – 2,000) x Rs. 10 = Rs. 500 (unfavorable)

Material B = (2980 – 3000) x Rs. 20 = Rs. 400 (favorable)

Total = Rs. 100 (unfavorable)

Note that the standard is used to calculate the usage variance, not the actual price. Using the actual price introduces a price factor into the quantity variance. These two elements should be kept separate as different departments are responsible

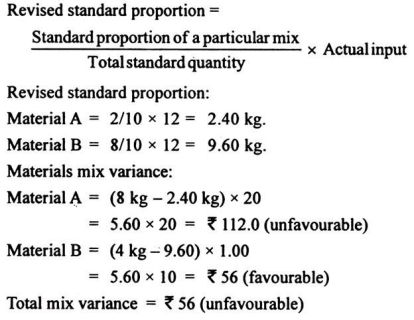

a) Material mixing variances: Material variances or quantity variances can be divided into mixing variances and yield variances.

For certain product and processing operations, material mixing is an important instrumental variable, and certain grades of material and quantity are determined prior to production. Mixing differences occur if the ingredients are not actually produced in the same proportions as the standard formulation.

For example, if you add 100 kg of raw material A and 200 kg of raw material B to make a product, the standard material mix ratio is 1: 2.

The raw materials actually used must have this 1: 2 ratio. If not, you will find differences in the mix of materials. Differences in material mix are commonly found in industries such as textiles, rubber and chemicals. Mixing differences can occur when cost savings, effective resource utilization, and the amount of raw materials required are not available at the required time. ..

Material mixing differences are part of the material quantity differences due to differences between the actual composition of the mixture and the standard mixture.

It can be calculated using the following formula.

Material mixing variance = (standard price of actual quantity of actual mixture – standard price of actual quantity of standard mixture)

The revised standard mix or ratio is calculated as follows:

Standard mixture of specific materials / standard total amount x actual input

Example:

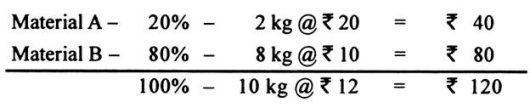

The product is made from two raw materials, Material A and Material B. One unit of finished product requires 10 kg of material.

Calculate the variance of the material mixture.

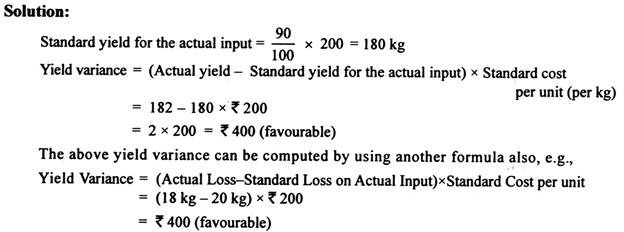

b) Difference in material yield:

Material yield variances account for the rest of the total material variances. The difference between the actual yield obtained and the specified standard yield (in terms of actual input) is due to the difference in material usage. In other words, a yield difference occurs when the output of the final product does not match the output obtained using the actual inputs. In some industries, such as sugar, chemicals, and steel, actual yields may differ from expected yields based on actual inputs, resulting in variable yields.

The sum of the material mix variance and the material yield variance is equal to the material quantity or usage variance. If there is no material mixture variance, the material yield variance is equal to the total material quantity variance. Therefore, the difference between mixing and yield is additive, explaining the different parts of the difference in total material usage.

The formula for calculating the yield variance is:

Yield Variance = (Actual yield – Standard Yield specified) x Standard cost per unit

Example:

Standard input = 100 kg, standard yield = 90 kg, standard cost per kg output = Rs 200

The actual input is 200 kg and the actual yield is 182 kg. Calculate the yield variance.

In this example, the material usage variance is equal to the material yield variance because there is no mixing variance.

The above formula uses output or loss as the basis for calculating the yield variance. Yield variance can also be calculated based solely on the input coefficients. The fact is that the loss of input is equal to the loss of output. Low yield simply means that a large number of inputs are being used and the expected or standard output (based on the actual inputs) has not been achieved.

Q8) Write the various differences between two-way, three way and four way categories .

A8) The various differences between these categories are shown below:

(A) Two-way ANOVA:

Two-way ANOVA calculates two variance budget variances (sometimes called flexible budget or controllable variances) and volume variances. this suggests that:

(I) Budget differences = variable spending differences + fixed spending (budget) differences + fluctuating efficiency differences

(Ii) Volume distribution = Fixed volume distribution

(B) Three-way analysis of variance:

The three-way analysis calculates three variances: spending, efficiency, and volume. Therefore,

(I) Difference in expenditure = Difference in variable expenditure + Difference in fixed expenditure (budget)

(Ii) Efficiency distribution = Variable efficiency distribution

(Iii) Volume distribution = Fixed volume distribution

(C) 4-way analysis of variance:

The four-way analysis includes:

(I) Differences in fluctuating spending

(Ii) Difference in fixed expenditure (budget)

(Iii) Variable efficiency distribution

(Iv) Fixed volume fluctuation.

Q9) Write short note on Difference in fixed overhead capacity.

A9) Difference in fixed overhead capacity:

This is a part of the fixed overhead volume difference thanks to the difference between the particular capacity (in hours) and therefore the budgeted capacity (expressed in hours) that ran during a specific period of time.

Ceremony Capacity variance = (actual capacity time – budget capacity) x standard fixed overhead rate per hour

This difference also represents idle time. If the particular capacity time is bigger than the budget capacity time, the difference is favorable, and if the particular capacity time is a smaller amount than the budget capacity time, the difference is disadvantageous.

If the particular and budgeted days also are specified, the budgeted capacity hours are calculated in actual days and are called the revised budgeted capacity hours, or actual working days budgeted hours.

In this case, the formula for calculating the capacitance difference is:

Capacity variance = (actual capacity time – revised budget capacity time) x standard fixed overhead rate per hour.

In the above formula, if the particular capacity time is bigger than the modified budget time, the difference is going to be advantageous. However, if the particular capacity time is shorter than the modified budget time, the difference is disadvantageous because it means the particular working hours are going to be reduced in consideration of the particular working days.

Two-way, three-way, and four-way ANOVA:

The above overhead variances also are categorized as two-way, three-way, and four-way differences.

Q10) Explain Overhead variances.

A10) Analyzing factory overhead variances is more complex than variance analysis of direct materials and direct labor. There is no standardization of terms or methods used to calculate overhead variances. For this reason, you need to be familiar with the different approaches that can be applied to overhead variances.

In general, the following overhead variance calculations are recommended.

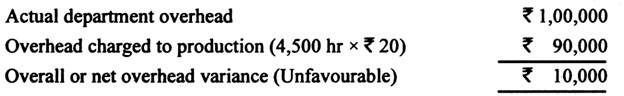

1) Total overhead difference:

Formula:

(Actual overhead incurred) – (Standard time of actual output x Standard overhead rate per hour)

Or

(Actual overhead incurred) – (Actual overhead x standard overhead rate per unit)

To explain the general overhead difference, the department's actual overhead cost was Rs 1, 00,000 in January, and therefore the standard (or allowed) time of the work performed was a complete of 4,500 hours, actually used. Suppose the time spent is 5,000 hours.

With an overhead rate of 20 Renault per hour, the general overhead difference is:

(2) Variable overhead difference:

This is the difference between the particular variable overhead and therefore the standard variable overhead allowed for the output actually achieved.

The formula for calculating this variance is:

(Actual variable overhead) – (Actual output x variable overhead per unit)

Or

(Actual variable overhead) – (Standard time of actual output x standard variable overhead per hour)

(3) Fixed overhead difference:

This difference is calculated using the subsequent formula:

Fixed Overhead Difference = (Actual Overhead – Absorption of Overhead)

Or

(Actual fixed overhead) – (Actual output x fixed overhead per unit)

Or

(Actual fixed overhead) – (Standard time of actual output x Standard fixed overhead per hour)

(4) Difference in variable overhead (expenditure or budget):

This difference shows the difference between actual variable overhead and budget variable overhead supported actual working hours.

This difference is detected using:

(Actual variable overhead – budget variable overhead)

(5) Difference in variable overhead efficiency:

This difference is analogous to the difference parturient efficiency and occurs when the particular working hours differ from the quality time required to supply an honest unit. Thanks to the high or low efficiency of workers engaged within the manufacture of products, actual production and standard fixed quantity may differ.

This difference is calculated using the subsequent formula:

(Actual time – civil time of actual output) x standard variable overhead rate per hour.