UNIT V

Marginal Costing

Q1) Define Marginal cost. Explain with example.

A1) Marginal costs aren't a costing method like costing jobs, batches, or contracts. It's actually a technology Costing that only considers variable manufacturing costs when determining cost of products sold. It also can be wont to evaluate inventory. In fact, this system is predicated on the subsequent basic principles. The total cost are often divided into fixed and variable. Although total fixed costs remain constant in the least levels In production, variable costs still change counting on the extent of production. Will increase if there's production When production decreases, it increases and reduces incremental cost method helps supply Relevant information to assist management make decisions in several areas ahead folks .Allocate all manufacturing costs to the merchandise , whether the merchandise is fixed or variable. This approach Known as Absorption Costing / Total Costing. However, only variable costs are relevant to deciding .This is referred to as marginal / variable cost.

Marginal cost: The term incremental cost refers to the number at a specific production volume. If the assembly volume is modified by 1 unit, the entire cost are going to be charged. Therefore, it is Additional or additional cost of additional output units. Marginal costs show that there's certainly some change in production wherever there's a change. Changes in total cost. it's associated with fluctuations in variable costs. Fixed costs are treated as a period It costs money and is transferred to the P & L account. This is a costing system that treats only fluctuating manufacturing costs as product costs. Fixed manufacturing overhead is taken into account period cost.

Simple steps to know the above theory:

Example: When a factory produces 1000 units at a complete cost of Rs.3,000 and increases production by one the cost goes up to Rs.3,002, and therefore the incremental cost of additional output is Rs.2. (3002-3000). If there are multiple output increases, dividing the entire rise by the entire output increase Shows the typical incremental cost per unit.

Example: The output has increased from 1000 units to 1020 units, and therefore the total cost to supply these units is Rs.1,045, average incremental cost per unit is Rs.2.25. (That is, additional cost / additional unit = 45/20 = Rs.2.25)

Assumption:

Q2) What are the characteristic features of marginal cost?

A2) Marginal costs are often defined as "confirmation by distinguishing between fixed and variable costs."

Costs, marginal costs, and therefore the impact on profits of changes in production volume or sort of production. "

The costs of the costing procedure are divided into fixed and variable costs. According to J. Batty, the incremental cost is "the costing method is-

Cost behavior thanks to changes in production volume. This definition focuses on confirmation. In addition to marginal costs, the impact of changes in production volume and kinds of production volume on corporate profits.

In other words, incremental cost are often defined as a way for presenting fluctuating cost data. Costs and glued costs are displayed separately for management decisions. got to be clearly understood.

The incremental cost isn't a costing method like process costing or job costing. Rather it's just Methods or techniques for analyzing cost information for management guidance

Example: When a factory produces 1000 units at a complete cost of Rs.3,000 and increases production by one the cost goes up to Rs.3,002, and therefore the incremental cost of additional output is Rs.2. (3002-3000). If there are multiple output increases, dividing the entire rise by the entire output increase Shows the typical incremental cost per unit.

Example: The output has increased from 1000 units to 1020 units, and therefore the total cost to supply these units is Rs.1,045, average incremental cost per unit is Rs.2.25. (That is, additional cost / additional unit = 45/20 = Rs.2.25)

Assumption:

Marginal cost characteristics

(1) All elements of cost are classified into fixed costs and variable costs.

(2) Incremental cost may be a method of cost management and deciding .

(3) Variable costs are billed as manufacturing costs.

(4) Inventories of work-in-process and finished products are evaluated supported variable costs.

(5) Profit is calculated by subtracting fixed costs from contributions. In other words, it's the surplus of the asking price Marginal cost of sales.

(6) Profitability of varied levels of activity is decided by cost volume profit analysis

Q3) Write the Distinction between Absorption Costing and Marginal Costing.

A3) Absorption costing-

Absorption costing is also known as total costing or total costing or traditional costing. It's a technique of cost confirmation. With this method, both fixed and variable costs are charged to the product or process operation. Therefore, the cost of a product is determined by considering both fixed and variable costs.

Distinction between Absorption Costing and Marginal Costing

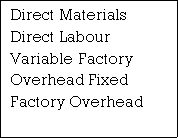

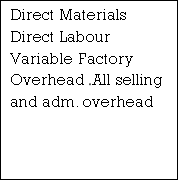

The distinction in these two techniques are illustrated by the following diagrams

The distinction in these two techniques are illustrated by the following diagrams

Fig. 1 Absorption Costing Approach

Fig.

Fig 2 Marginal Costing Approach

Q4) What are the methods of Application of marginal cost?

A4) Marginal cost is a very useful cost calculation method and has great potential for management in various fields. Administrative tasks and decision-making processes. Regarding the application of marginal costs.

Ingredients are an important factor, their availability is limited to a certain quantity, and the company We manufacture three products, A, B and C. In such cases, the marginal cost method helps prepare a statement indicating the amount of contribution per kg of material. Products with the highest yields Contribution per kg of raw material is prioritized and produced as much as possible. After that, other products are picked up in order of priority. Therefore, the resulting product mix is Best profit in a given situation

4. Decision Making: Management decision making is a very important function of any organization decision .The creation should be based on relevant information. Through the marginal cost method Information on cost behavior is provided in the form of fixed and variable costs. The Separation of costs between fixed and variable helps administrators predict cost behavior

Various options. Therefore, it makes decisions easier. Some decisions

In some decisions, the resulting income is the deciding factor, while the basis for comparative cost analysis. Marginal costs help generate both types of information, so the decision is as follows. It's not intuitive, it's rational and factual. Some of the key areas of decision making is listed below:

5. Decision or purchase decision

6. Fluctuations in selling price.

7. Variations in product composition.

8. Changes in sales composition.

9. Key factor analysis.

10. Evaluation of various alternatives for improving profits.

Department closure / continuation.

Q5) Explain the Marginal cost benefits and limits.

A5) The Marginal cost benefits are:

(1) Cost-volume-profit relationship data required for the purpose of profit planning is Normal accounting statement. Therefore, the administrator does not have to work with two separate datasets. To associate one with the other.

(2) Profit for a certain period of time is not affected by changes in absorption of fixed costs due to the building Or reduce inventory. Others remain the same (eg selling price, cost, selling composition), profits move in the Same direction as sales when using direct costing.

(3) Manufacturing costs and income statements in direct cost format follow management's ideas. Strictly more than the absorption cost form of these statements. Because of this, management finds it Easy to understand and use direct cost reports.

(4) The impact of fixed costs on profits is emphasized in the total amount of fixed costs during that period. It will be displayed on the income statement.

5) Marginal income figures are for products, regions, customer classes, and Other segments of the business without obscuring the results due to the allocation of joint fixed costs.

(6) Marginal costs are in effective planning for cost management such as standard costs and flexible budgets.

(7) Marginal costs not only provide a better and more logical basis for fixing selling prices. Bid on contracts when your business is sluggish.

(8) Last but not least, the break-even point can only be determined based on marginal costs.

The marginal cost calculation method has the following restrictions.

(1) In marginal costs, costs are classified into fixed costs and variable costs. Separate costs into fixed and fixed Variables are pretty difficult and can't be done exactly.

(2) Marginal cost is based on the premise that the behavior of cost can be expressed by a straight line. This means Fixed costs remain fully fixed for a period of time at various levels, and variable costs vary linearly. The pattern, or change, is proportional to the change in volume. In real life, fixed costs tend to fluctuate. At various levels of production, especially if additional plants and equipment are introduced, therefore Variable costs may not change at the same rate as volume.

(3) Under the marginal cost method, fixed costs are not included in the value of finished product inventory. And work in process. There are fixed costs, so these also need to be part of the cost of the product. Due to this elimination of fixed costs from finished inventory and work in process, inventory is Modest. This affects the income statement and balance sheet results. Therefore, the profit is contracted unnecessarily.

(4) In the marginal cost system, monthly business reports are not realistic or useful as follows Absorption costing system. This is because this system has different marginal contributions and benefits. With changes in sales. If sales occur occasionally, profits will fluctuate from period to period.

(5) Marginal costs do not provide complete information. For example, it could be due to increased production and sales Extensive use of existing machines or expansion of resources or replacement of labor Mechanical force. The small contribution of the P / V ratio cannot derive this reason.

(6) Under the marginal cost system, the difficulties associated with the allocation and calculation below Over absorption of fixed overhead is eliminated, but the problem remains as long as it is below .There are concerns about absorption or over absorption of fluctuating overhead.

(7) Marginal costs may be useful for short-term evaluation of profitability, but long-term profits. It is determined correctly only on a full cost basis.

(8) Marginal cost does not provide a basis for performance evaluation limit Contribution data do not reveal many of the benefits provided by ANOVA. The difference in efficiency reflects the efficient and inefficient use of plants, machinery and labor and this kind of thing. In the marginal cost analysis, the valuation is insufficient.

(9) Marginal cost analysis assumes that the selling price per unit remains the same at different levels. Production, but these can change in real life and have unrealistic consequences.

(10) What is the impact of fixed costs on products in an era of advances in automation and technology? As a result, fewer systems do not consider fixed costs. It is effective because it does not take into account a significant portion of the cost.

(11) The selling price according to the marginal cost method is fixed based on the contribution. This may not be the case. This is possible in the case of a "cost plus contract". Therefore, the above restrictions have a fixed cost. It is just as important in certain cases.

Q6) What do you mean by Break-even point analysis?

A6) Relationship between selling price, sales volume, fixed costs, variable costs, and profits at various levels activity application is explained below:

Break-even point analysis assumptions

Total fixed costs are assumed to be constant in total Variable cost.

Total variable costs increase because the number of units produced increases Sales.

Total revenue increases as the number of units produced increases Safety range.

Q7) What are the decision making steps in marginal costing?

A7) Decision-making steps:

It is appropriate here to describe some of the key important steps that help you make logical decisions.

1. Problem Definition and Clarification: The first step is to define the problem clearly and accurately for decision making so that the quantitative data associated with the solution can be determined. You need to identify possible alternative solutions to your problem. The more alternative solutions you consider, the more complex the problem can be. Then a suitable scanning device will help remove the unattractive choices.

2. Data collection and analysis: If the decision maker feels the need in this regard, he can ask for more information. In fact, many decisions are improvised by obtaining more information, and it is usually possible to obtain such information.

3. Problem analysis: Every option has its own strengths and weaknesses. Decision makers need to make decisions based on the strength of the problem. To determine the maximum net benefit, you need to observe the problem from different perspectives.

4. Confirm alternative actions: The decision maker identifies the course of alternative actions. Select possibilities by calculating different cost structures and revenues under each option

5. Evaluation of each option: There are two types of aspects.

6. Alternative Choices: After defining, collecting, analyzing, checking, and evaluating various alternatives, decision makers can choose alternatives and get started.

7. Evaluation of Results: After making a decision, the decision maker should ask for an evaluation of the results on a regular basis. This will help him correct his mistakes, correct his goals and make better predictions for the future. In this regard, many techniques are used for decision making as follows:

a) Marginal cost

b) Break-even point analysis

c) Difference cost analysis

Management decision-making issues:

Business decisions typically rely on three types of issues:

1. Crisis: Crisis problems are serious problems that require immediate attention.

2. Non-crisis: Non-crisis problems that need to be resolved

At the same time, it has the characteristics of crisis importance and immediacy.

3. Opportunity Issues: Opportunity issues are situations that, if appropriate measures are taken, are likely to bring significant benefits to the organization.

Q8) Explain Marginal Costing Approach.

A8) Application of marginal cost:

Marginal cost is a very useful cost calculation method and has great potential for management in various fields. Administrative tasks and decision-making processes regarding the application of marginal costs.

Ingredients are an important factor, their availability is limited to a certain quantity, and the company We manufacture three products, A, B and C. In such cases, the marginal cost method helps prepare a statement indicating the amount of contribution per kg of material. Products with the highest yields Contribution per kg of raw material is prioritized and produced as much as possible. After that, other products are picked up in order of priority. Therefore, the resulting product mix is Best profit in a given situation

4. Decision Making: Management decision making is a very important function of any organization decision .The creation should be based on relevant information. Through the marginal cost method Information on cost behavior is provided in the form of fixed and variable costs. The Separation of costs between fixed and variable helps administrators predict cost behavior various options. Therefore, it makes decisions easier. Some decisions

In some decisions, the resulting income is the deciding factor, while the basis for comparative cost analysis. Marginal costs help generate both types of information, so the decision is as follows. It's not intuitive, it's rational and factual. Some of the key areas of decision making is listed below:

5. Decision or purchase decision

b. Approval or rejection of export proposal

6. Fluctuations in selling price

7. Variations in product composition

8. Changes in sales composition

9. Key factor analysis

10. Evaluation of various alternatives for improving profits

Department closure / continuation.

Q9) What are the characteristics features of the P / V RATIO?

A9) The characteristics of the P / V ratio are as follows.

(I) Helps administrators see the total amount of contribution to a particular sale.

(II) The selling price and the variable cost per unit are constant or constant as long as they are constant. It fluctuates at the same rate.

(III) Not affected by changes in activity level. In other words, the PV ratio of the product. The amount of activity is the same whether it is 1,000 units or 10,000 units.

(IV) Fixed costs are not considered at all, so the ratio is also unaffected by fluctuations in fixed costs while calculating the PV ratio. For multi-product organizations, PV ratios are very important for management to decide which one to find. The product is more profitable. Management is trying to increase the value of this ratio by reducing variable costs or by raising the selling price.

3. Break-even point: A point that indicates the level of output or sales by dividing the total cost and sales price evenly. There is no profit or loss, it is considered a break-even point. At this point, business income exactly equal to that spending. If production is boosted beyond this level, profits will be generated in the business. And if it decreases from this level, the loss will be incurred by the business. Here it is appropriate to understand the different concepts of marginal costs and break-even points. Go further. This is explained below.

It's neither a profit nor a loss. Therefore, at the break-even point, the contribution is equal to the fixed cost.

Contribution = Fixed cost (1) Break-even point (in units) = Fixed Cost Contribution per unit (2) Break-even point (in amount) = Fixed Cost Contribution per unit x Selling Price per unit Or, = Fixed Cost Total Contribution x Total Sales Or, = Fixed Cost 1− Variable Cost per unit Selling price per unit = Fixed Cost P/V Ratio

Sales at break-even point = break-even point x selling price per unit

At the break-even point, the desired profit is zero. When calculating production or sales

You need to add a fixed amount of "desired profit" or "target profit" "desired profit" or "target profit" The cost of the above formula. For example:

(1) No. of units at Desired Profit = Fixed Cost+Desired Profit Contribution per unit (2) Sales for a Desired Profit = Fixed Cost+Desired Profit P/V Ratio

(2) Sales at break-even point = break-even point x selling price per unit

(3) At the break-even point, the desired profit is zero. When calculating production or sales.

Q10) What types of risk do we incorporate to start our business?

A10) Incorporating risk management into your business is essential to staying in shape.

Common industry mistakes: Many oil and gas companies have been implementing risk management or corporate risk management processes for several years. However, risk management is often misplaced as a compliance function or governance obligation and is seen as a mechanism solely for explaining risks and communicating them to the board of directors. This is not considered a strategic function and is not part of the business planning cycle. Risks are often left in silos and are not organized so that all categories of risk can be viewed in one view.

Risks and threats: Corporate-wide risks, especially emerging threats in new markets, are on the board agenda to understand and manage, but bottom-up assessments are also important. Historically, companies have always invested in risk management activities to address function-specific risks such as exploration risk, production risk, and financial risk, but the current challenge is to bring all these initiatives into a common framework to integrate with and strengthen decision making.

Geopolitical instability: Significant threats to the industry are geopolitical instability and potential risks. In addition to the potential nationalization of assets as recently seen in Argentina, there are also predatory fines by governments in urgent need of money. Reducing geopolitical risk means not only working on the legal and contractual frameworks that underlie a transaction or business, but also understanding the political situation in the region. Predicting changes in political conditions may not be enough to control its impact. Recognizing future political risk factors is one thing, but managing these risks in time to protect assets and people is another issue, especially when: Like Algeria in January 2013, risk is primarily security related.

Cyber security: Recent attacks on the industry show the actual impact that cyber threats can have on the sector through the leakage of commercially sensitive information such as exploration data and malicious interference with industrial control systems. -A tanker course with its proper equipment. Managing cybersecurity as strategic risk rather than operational risk is an important step change needed across the industry to drive long-term risk reduction with quantifiable benefits.

Cyber risks often perform scenario analysis to provide a detailed assessment of their impact on real risk, their greatest vulnerabilities, their exposure quantification, and how companies monitor and address potential cyber attacks. Is not enough to analyze. That is the biggest risk. Collaboration with the UK Government on FTSE350 Cyber Risk Management indicates that we need to rethink how cyber is reported upwards to the Board of Directors using more open and non-technical indicators.

Third party risk: Every company needs to interact with third parties that pose a variety of potential integrity and reputational risks, from customers and suppliers to agents to local or global strategic partners. In particular, increasing attention to regulatory compliance with anti-corruption laws and anti-corruption laws, such as the UK Foreign Corrupt Practices Act and the US Foreign Corrupt Practices Act, is due to a proper understanding of trading partners, their ownership and methods. It means that you can prevent illegal activities. The business may ultimately be responsible. This reduces the risk of public accusations, fines and even imprisonment. Flexible and responsive third-party risk management programs based on the right level of due diligence are essential for managing the widely talked about risk areas.

Operate with risk in mind: You should incorporate risk thinking from the first step to the end of the planning process, such as oilfield life cycle, labor relations, and entry into new markets. Companies often do not fully analyze the practical impact of risk. For example, leave risk described as geopolitical risk or cyber without careful consideration of the true exposure and readiness to prevent or respond in a way that minimizes adverse consequences and optimizes opportunities. I will. Such exposures allow companies to fully assess the scope of their potential, measure their impact from a financial perspective in those scenarios, and incorporate accountability to monitor specific events using defined metrics. We rarely evaluate and report on the effectiveness of our mitigation plans. With this kind of data, you can determine if your company is at sufficient risk or too much. Are competitors of the same size more valued in the equity market because they are making better risk-based decisions? The difference may be due to a cautious and prudent approach to investing in uncertainty.

Required skills: Control functions and risk management need to be coordinated appropriately. Lack of skills and lack of knowledge and experience on how to achieve this form of integration are major obstacles to the convergence or integration of risk and management functions in oil and gas companies. Compliance, corporate governance, assurance, risk finance, etc. need to converge, but managers of these silos are often willing to give up their budget and perceived influence and power within their organization. You need one executive who understands a wide range of governance, risk management, and compliance issues. KPMG recently helped utilities consolidate six risk-related departments into one, standardizing risk-related functions for superior synergies, driving cost savings, and overall risk programs increased effectiveness.