Unit IV

Joint Venture Accounts

Q1) Explain joint venture account

Solution

A joint venture is an association of two or more persons who have combined for the execution of a specific business and divide the profit or loss thereof in the agreed ratio.

Features of Joint Venture

The main features of a joint venture are specifically made clear.

- Two or more person are needed.

- It is an agreement to execute a particular venture or a project.

- The joint venture business may not have a specific name.

- It is of temporary nature. So the agreement regarding the venture automatically stands terminated as soon as the venture is complete.

- The co-ventures share profit and loss in an agreed ratio. The profits and losses are to be shared equally if not agreed otherwise.

- The co-ventures are free to continue with their own business unless agreed otherwise during the life of joint venture

Accounting methods in joint venture transaction

- When separate set of books id kept

Where there are large transactions this method is followed, that is, the venture is a large one and is continued for a comparatively long period. Under double entry principle accounts are prepared.

Under this method the following three accounts are prepared

- Joint venture account - This account represents the results of the business, that is, profit or loss. This account is debited by the cost of goods, expenses; goods supplied by the venturers etc. and are credited by sale proceeds, unsold stock, stock taken by venturers etc.

Profit on joint venture represents if credit side of this account is greater than the debit side and vice versa in the opposite case. The profit or loss so made is transferred to co-venturer’s account.

- Joint bank account - It is like an ordinary Cash Book or Bank Account. On the debit side all incomes including the capital contribution by the ventures appear whereas all expenses of the venture appear on the credit side of this account. It is finally closed by payment to the co-venturers, leaving no balance either side.

- Co venture account - This is the capital account of the venture relating to venture. This account is credited by the capital contributed by the ventures, goods supplied by them from their own stock, expenses made personally by them etc. whereas this account is debited for any withdrawals or any asset taken from the venture.

The profit or loss made on venture is transferred in profit sharing ratio to this account and this account is closed by cash payment from joint bank and vice versa in the opposite case.

b. Where no separate set of book is kept - where the joint venture transactions are limited and the venturers reside at two different places this method is applicable. For instance, there are two venturers, namely, A and B. So, A will prepare a Joint Venture Account and B’s Capital Account in his books while B will also prepare a Joint Venture Account and A’s Capital Account in his book.

- Joint venture account – in this case one’s own share of profit or loss should be transferred to his Profit and Loss Account but co-venturer’s share of profit or loss should be transferred to his personal account.

- Other co venture account - This is a personal account of the co-venturer, and will be debited with the amount of goods purchased, expenses incurred, profit so earned etc. and is credited with the amount of sale proceeds, unsold stock taken etc.

Q2) Explain consignment account

Solution

What is consignment accounting?

Consignment accounting is a type of business arrangement in which one person send goods to another person for sale on his behalf and the person who sends goods is called consignor and another person who receives the goods is called consignee, where consignee sells the goods on behalf of consignor on consideration of certain percentage on sale.

Features

- Two Parties: Consignment accounting mainly involves two party’s consignor and consignee.

- Transfer of Procession: Procession of goods transferred from consignor to consignee.

- Agreement: For terms and conditions of the consignment there is a pre-agreement between the consignor and consignee.

- No Transfer of Ownership: Until the consignee sells it the ownership of goods remains in the hands of the consignor. The only procession of goods is transferred to a consignee.

- Re-Conciliation: Consignor sends Pro-forma invoice while consignee sends account sale details and both reconcile their accounts at the end of the year.

- Separate Accounting: In the books of consignor and consignee there is independent accounting done of consignment account. Both prepare consignment account and record the journal entries of goods through consignment account only.

Terms used in consignment account

- Consignor: It is the person that sends goods.

2. Consignee: The person who receives the goods is called the consignee.

3. Consignment: Consignment is a business arrangement through which the consignor sends goods to the consignee for sale.

4. Consignment Agreement: It is legally written communication which defines the terms and conditions of the consignment between the consignor and consignee.

5. Pro-Forma Invoice: Pro-forma invoice is the statement forwarded when the consignor sends goods to the consignee, showing details of goods such as quantity, price, etc.

6. Non- Recurring Expenses: Expenses that are incurred by the consignor to dispatch the goods from his place to place of the consignee are called non-recurring expenses. These expenses are added to the cost of goods.

7. Recurring Expenses: The consignee incurs these expenses after the goods reached his place. These expenses are of maintenance of goods type’s expenses.

8. Commission: Commission is the reward for the sale of goods on behalf of the consignor. It is as per the consignment agreement.

9. Account Sale: It is the statement forwarded by the consignee to consignor showing details of goods sold, amounts received, expenses incurred, a commission charged, advance payment and balance due and stock in hand, etc.

Accounting entries

Sr.No. | In the Books of Consignor | In the Books of Consignee |

1 | When goods are sent to the consignee Consignment A/cDr To Goods Sent on Consignment A/c (Being Goods Sent on Consignment) | No need to do any Entry in this case |

2 | Expenses Incurred by Consignor Consignment A/cDr To Cash/Bank A/c (Being Expenses incurred on consignment) | Not Applicable |

3 | Advance given by consignee Cash/Bank A/cDr To Consignee’s A/c (Being advance received from consignee) | Consigner A/cDr To Bank/Cash A/c (Being Advance amount paid to Consignor) |

4 | Expenses Incurred by Consignee Consignment A/cDr To Consignee’s A/c (Being Expenses incurred by consignee) | Consigner A/cDr To Bank/Cash A/c (Being Expenses incurred on goods received on consignment) |

5 | Sale by Consignee Consignee’s A/cDr To Consignment A/c (Being Expenses incurred by consignee) | Cash (for cash sale) A/cDr Debtors (for Credit Sale) A/c Dr To Consignor A/c (Being goods sold) |

6 | Commission to Consignee Consignment A/cDr To Consignee’s A/c (Being Commission on sale due to consignee) | Consigner A/cDr To Commission A/c (Being Commission earned) |

7 | Remittance from Consignee Cash/Bank A/cDr To Consignee’s A/c (Being due amount received from consignee) | Consigner A/cDr To Bank/Cash A/c (Being Balance due Payment made to consignor) |

8 | Entry for Profit on Consignment Profit & Loss A/cDr To Consignment A/c (Being Profit earned on consignment) | Not Applicable |

9 | Loss on Consignment Consignment A/cDr To Profit & Loss A/c (Being Loss incurred on Consignment transferred to the profit & Loss Account) | Not Applicable |

Q3) Explain journal entries of consignment account

Solution

Sr.No. | In the Books of Consignor | In the Books of Consignee |

1 | When goods are sent to the consignee Consignment A/cDr To Goods Sent on Consignment A/c (Being Goods Sent on Consignment) | No need to do any Entry in this case |

2 | Expenses Incurred by Consignor Consignment A/cDr To Cash/Bank A/c (Being Expenses incurred on consignment) | Not Applicable |

3 | Advance given by consignee Cash/Bank A/cDr To Consignee’s A/c (Being advance received from consignee) | Consigner A/cDr To Bank/Cash A/c (Being Advance amount paid to Consignor) |

4 | Expenses Incurred by Consignee Consignment A/cDr To Consignee’s A/c (Being Expenses incurred by consignee) | Consigner A/cDr To Bank/Cash A/c (Being Expenses incurred on goods received on consignment) |

5 | Sale by Consignee Consignee’s A/cDr To Consignment A/c (Being Expenses incurred by consignee) | Cash (for cash sale) A/cDr Debtors (for Credit Sale) A/c Dr To Consignor A/c (Being goods sold) |

6 | Commission to Consignee Consignment A/cDr To Consignee’s A/c (Being Commission on sale due to consignee) | Consigner A/cDr To Commission A/c (Being Commission earned) |

7 | Remittance from Consignee Cash/Bank A/cDr To Consignee’s A/c (Being due amount received from consignee) | Consigner A/cDr To Bank/Cash A/c (Being Balance due Payment made to consignor) |

8 | Entry for Profit on Consignment Profit & Loss A/cDr To Consignment A/c (Being Profit earned on consignment) | Not Applicable |

9 | Loss on Consignment Consignment A/cDr To Profit & Loss A/c (Being Loss incurred on Consignment transferred to the profit & Loss Account) | Not Applicable |

Q4) Write journal entries for abnormal loss in consignment

Solution

Loss of goods

Normal Loss − Due to inherent characteristics of goods like evaporation, drying up of goods, etc normal loss may occur. It is included in the cost of goods sold and the closing stock by inflating the rate per unit but not separately shown in the consignment account.

Abnormal Loss − An abnormal loss may occur due to any accidental reason. To calculate actual profitability it is creditted to the consignment account.

Abnormal Loss and Insurance

Ffollowing entries will be passed in the books of a consignor, if, there is an insurance policy in respect of the consigned goods −

Sr.No. | In the Books of Consignor | In the Books of Consignee |

1 | Payment of Insurance Premium (a) If insurance premium is paid by the consignor, then cash will be credited. (b) If Insurance premium is paid by the consignee, then consignee’s A/c will be credited. | Consignment A/cDr To Cash A/c Or To Consignee A/c (Being Insurance premium paid) |

2 | At the time of Abnormal Loss | Abnormal Loss A/cDr To Consignment A/c (Being Loss Incurred) |

3 | Acceptance of Claim by Insurance Company | Insurance Company (Name of the insurer) A/cDr To Abnormal Loss A/c (Being claim admitted) |

4 | On receipt of Claim | Bank A/cDr To Insurance Company A/c (Being amount of claim received) |

5 | In Case of Loss | Profit & Loss A/cDr To Abnormal Loss A/c (Being amount of Abnormal Loss transferred) |

Q5) Explain foreign exchange transaction

Solution

Definition

The Foreign Exchange Transactions refers to the sale and purchase of foreign currencies. Simply, the foreign exchange transaction is an agreement of exchange of currencies of one country for another at an agreed exchange rate on a definite date.

Types

- Spot Transaction: The spot transaction is when the buyer and seller of different currencies within the two days of the deal settle their payments. To exchange the currencies it is the fastest way. Here, the currencies are exchanged over a two-day period, which means no contract is signed between the countries. The exchange rate at which the currencies are exchanged is called the Spot Exchange Rate. This rate is often the prevailing exchange rate. The market in which the spot sale and purchase of currencies is facilitated is called as a Spot Market.

2. Forward Transaction: A forward transaction is a future transaction where the buyer and seller enter into an agreement of sale and purchase of currency after 90 days of the deal at a fixed exchange rate on a definite date in the future. The rate at which the currency is exchanged is called a Forward Exchange Rate. The market in which the deals for the sale and purchase of currency at some future date is made is called a Forward Market.

3. Future Transaction: The future transactions are also the forward transactions and deals with the contracts in the same manner as that of normal forward transactions. But however, on the following grounds the transactions made in a future contract differs from the transaction made in the forward contract:

- The forward contracts can be customized on the client’s request, while the future contracts are standardized such as the features, date, and the size of the contracts is standardized.

- The future contracts can only be traded on the organized exchanges, while the forward contracts depending on the client’s convenience can be traded anywhere.

- In case of the forward contracts no margin is required, while to establish the future position the margins are required of all the participants and an initial margin is kept as collateral.

4. Swap Transactions: The Swap Transactions involve a simultaneous borrowing and lending of two different currencies between two investors. Here one investor borrows the currency and lends another currency to the second investor. The obligation to repay the currencies is used as collateral, and the amount is repaid at a forward rate. Without suffering a foreign exchange risk the swap contracts allow the investors to utilize the funds in the currency held by him/her to pay off the obligations denominated in a different currency.

5. Option Transactions: The foreign exchange option gives an investor the right, but not the obligation to exchange the currency in one denomination to another at an agreed exchange rate on a pre-defined date. An option to buy the currency is called as a Call Option, while the option to sell the currency is called as a Put Option.

Q6) Explain investment account

Solution

Definition

Investments are assets held by an enterprise for earning income by way of dividends, interest, and rentals, for capital appreciation, or for other benefits to the investing enterprise. Assets held as stock-in-trade are not ‘investments’.

A current investment is an investment that is by its nature readily realisable and is intended to be held for not more than one year from the date on which such investment is made.

A long term investment is an investment other than a current investment.

An investment property is an investment in land or buildings that are not intended to be occupied substantially for use by, or in the operations of, the investing enterprise.

Classification of investment

A. Current Investments – Current Investments includes investments which by their nature are readily realizable and are intended to be held for less than a year from the date when such investment is done.

B. Long-Term Investments – Long-term investments includes investments other than the current investments, even though they might be freely marketable.

Cost of investment

- Broker, duties, and fees – The cost of investments include charges related to acquisition of brokerage, duties, and fees

- Non-cash consideration – In case investments are acquired, or partly acquired, by issuing shares ,issuing other securities , any other asset. The cost of acquisition is the securities fair value which are issued.

- Interest, dividend or other receivables – Dividends, interest and other receivables that are usually the income from the investment made.

- Right Shares – the cost of such right shares is then added to carrying the amount of original holding.

Carrying amount of investment

On the basis of category of investment or on an individual investment current investments must be carried in financial statements at lower of cost and fair value, however, not on the overall basis.

Long-term investments must always be carried in financial statements at their cost. But, when there’s a decline, in value the long-term investment, carrying amount is reduced for recognizing such decline.

Investment property

Investments that are made in land or buildings which aren’t imagine to be used significantly for use, or in business operations of, the investing company refers to investment property.

Investment treatment on disposal

On sale or disposal of the investment, the difference between the carrying cost and proceeds from the sales net of any expenses is transferred to P&L.

Reclassification of investments

Where an investment is reclassified from long-term investment to current investment, the transfer is made at carrying amount and lower of cost at the date of such transfer.

Where current investment is reclassified to long-term investment, the transfer is made at the lower of its cost and the fair value of such investment at the date of such transfer.

Disclosure in the financial statement

- For determining carrying amount of investment accounting policies are employed

- The amounts which are included in the profit and loss statement for:

- The income (dividend, interest and rental) from investments such as long-term and current investments separately.

- Profits and losses on the disposal of current investment and the changes in carrying the amount of the investment

- Profits and losses on the disposal of long-term investment and the changes in carrying the amount of the investment

- On the right of ownership substantial limitations, realizability of the investments or remittance of income and proceeds of disposal

- The total amount of both the quoted and unquoted investments, providing the total market value of the quoted investments

- Other disclosures as required by the relevant statute governing the company

Q7) Explain government grants

Solution

Government grants refer to the support given by government either in cash or kind to an enterprise. To meet past or future compliance along with certain conditions such grants are given for an enterprise. The following grants do not include any form of government support

- That cannot be reasonably valued and

- The ones that cannot be separated from the normal trading transactions of an enterprise

While preparing financial statements for an enterprise receipt of government grants is an important issue to be considered.

Accounting Treatment of Government Grants

An enterprise can adopt any two of the accounting approaches to undertake the accounting treatment of government grants. These include:

- Capital Approach - According to the capital approach, the government grants are treated as a part of capital or shareholders’ funds or promoter’s contribution. Such grants are given in an enterprise as a part of the total investment.

In case of such grants, the government does not expect any repayment. Hence, such government grants are credited to the shareholders’ funds.

The second argument in favor of the capital approach towards treating government grants is that it such grants are not earned rather they are considered as an incentive provided by the government without any related costs. Hence it is not justified to recognize government grants in P&L statement

2. Income Approach - As per the income approach, the government grants over one or more periods are treated as income. Following are the arguments that support the income approach for accounting treatment of government grants:

- As per the definition of government grants mentioned above, the government grants are not given without any reason. Therefore, it is logical to consider the government grants as income and match such income with the costs that such a grant tends to compensate.

- Since the grant form part of the fiscal policies of the government , so government grants are similar to the income tax or other taxes charged against the income of the enterprise. Similarly, income tax or other taxes are charged against income in the P&L statement, the government grants should also be treated in the same way.

- In case entities that may follow capital approach and treat grants as part of shareholders’ fund, no relationship exists between the accounting treatment of a grant and accounting treatment of expense to which it associates.

Q7) Explain accounting methods in joint venture account

Solution

- When separate set of books id kept

Where there are large transactions this method is followed, that is, the venture is a large one and is continued for a comparatively long period. Under double entry principle accounts are prepared.

Under this method the following three accounts are prepared

- Joint venture account - This account represents the results of the business, that is, profit or loss. This account is debited by the cost of goods, expenses; goods supplied by the venturers etc. and are credited by sale proceeds, unsold stock, stock taken by venturers etc.

Profit on joint venture represents if credit side of this account is greater than the debit side and vice versa in the opposite case. The profit or loss so made is transferred to co-venturer’s account.

- Joint bank account - It is like an ordinary Cash Book or Bank Account. On the debit side all incomes including the capital contribution by the ventures appear whereas all expenses of the venture appear on the credit side of this account. It is finally closed by payment to the co-venturers, leaving no balance either side.

- Co venture account - This is the capital account of the venture relating to venture. This account is credited by the capital contributed by the ventures, goods supplied by them from their own stock, expenses made personally by them etc. whereas this account is debited for any withdrawals or any asset taken from the venture.

The profit or loss made on venture is transferred in profit sharing ratio to this account and this account is closed by cash payment from joint bank and vice versa in the opposite case.

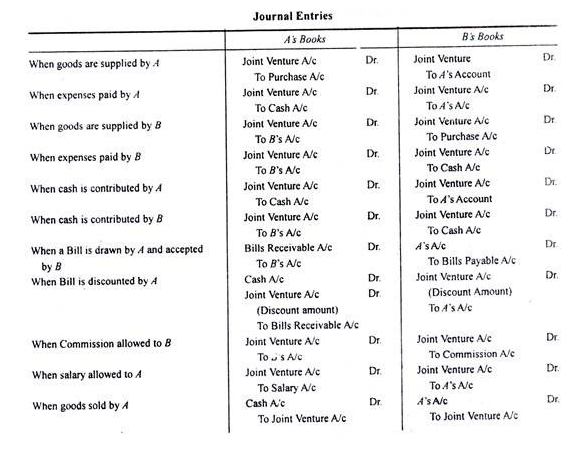

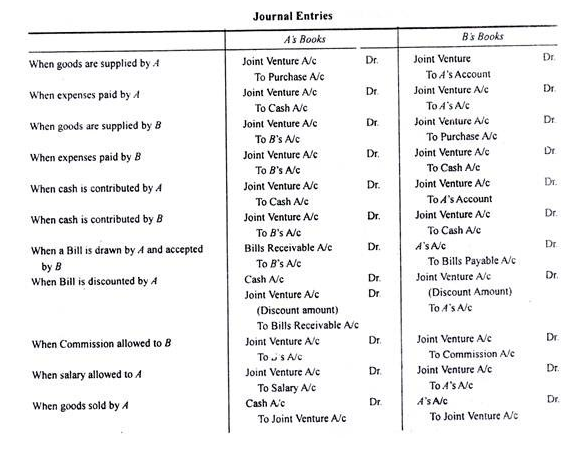

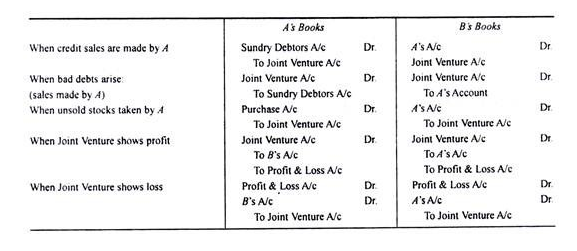

b. Where no separate set of book is kept - where the joint venture transactions are limited and the venturers reside at two different places this method is applicable. For instance, there are two venturers, namely, A and B. So, A will prepare a Joint Venture Account and B’s Capital Account in his books while B will also prepare a Joint Venture Account and A’s Capital Account in his book.

- Joint venture account – in this case one’s own share of profit or loss should be transferred to his Profit and Loss Account but co-venturer’s share of profit or loss should be transferred to his personal account.

- Other co venture account - This is a personal account of the co-venturer, and will be debited with the amount of goods purchased, expenses incurred, profit so earned etc. and is credited with the amount of sale proceeds, unsold stock taken etc.

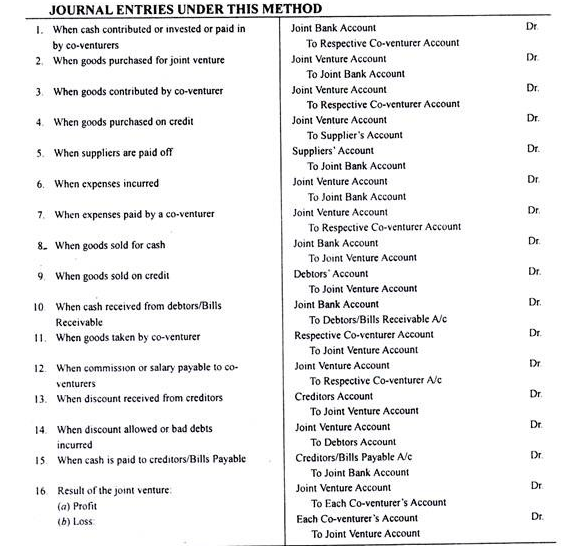

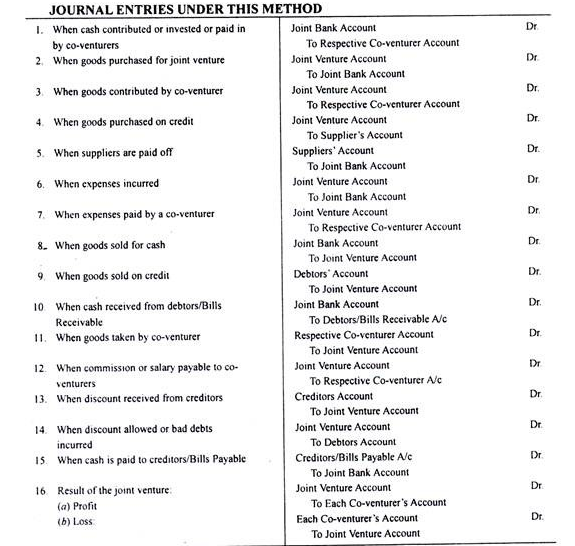

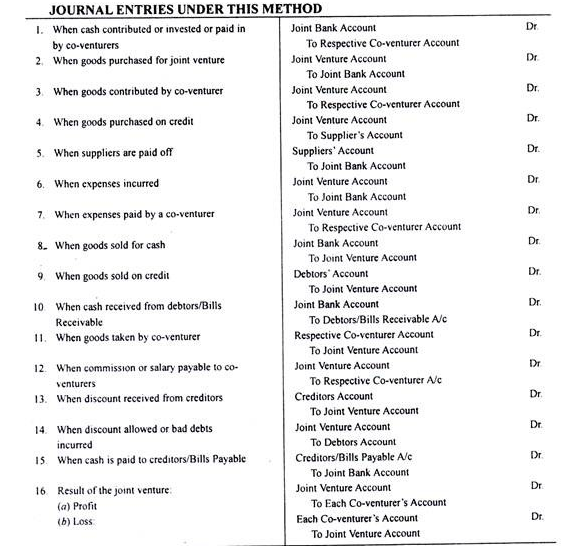

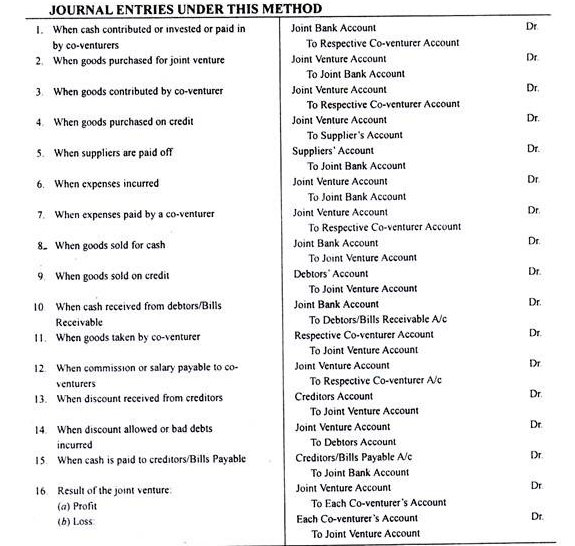

Q8) Write journal entries When separate set of books id kept in joint venture

Solution

When separate set of books id kept

Where there are large transactions this method is followed, that is, the venture is a large one and is continued for a comparatively long period. Under double entry principle accounts are prepared.

Under this method the following three accounts are prepared

- Joint venture account - This account represents the results of the business, that is, profit or loss. This account is debited by the cost of goods, expenses; goods supplied by the venturers etc. and are credited by sale proceeds, unsold stock, stock taken by venturers etc.

Profit on joint venture represents if credit side of this account is greater than the debit side and vice versa in the opposite case. The profit or loss so made is transferred to co-venturer’s account.

- Joint bank account - It is like an ordinary Cash Book or Bank Account. On the debit side all incomes including the capital contribution by the ventures appear whereas all expenses of the venture appear on the credit side of this account. It is finally closed by payment to the co-venturers, leaving no balance either side.

- Co venture account - This is the capital account of the venture relating to venture. This account is credited by the capital contributed by the ventures, goods supplied by them from their own stock, expenses made personally by them etc. whereas this account is debited for any withdrawals or any asset taken from the venture.

The profit or loss made on venture is transferred in profit sharing ratio to this account and this account is closed by cash payment from joint bank and vice versa in the opposite case.

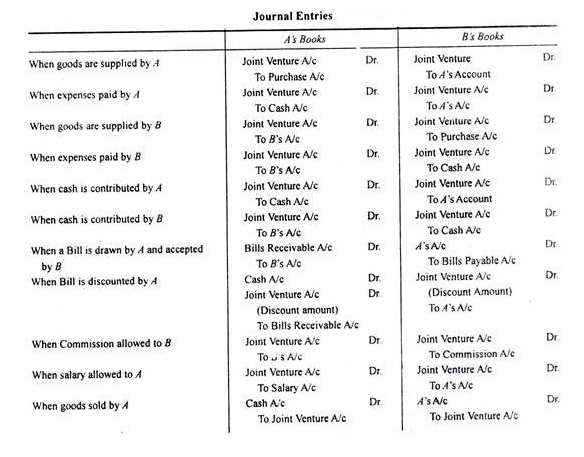

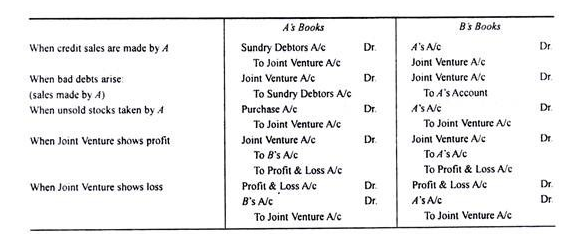

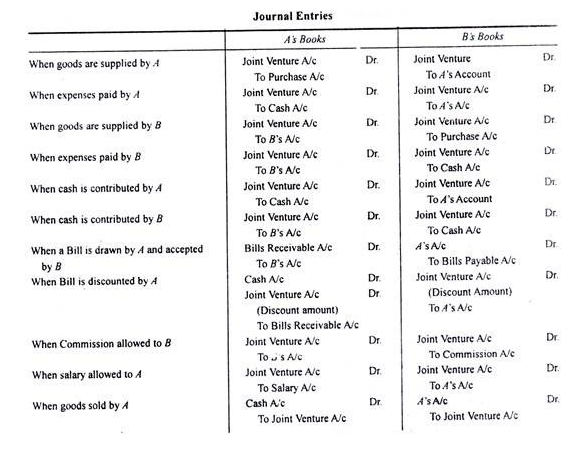

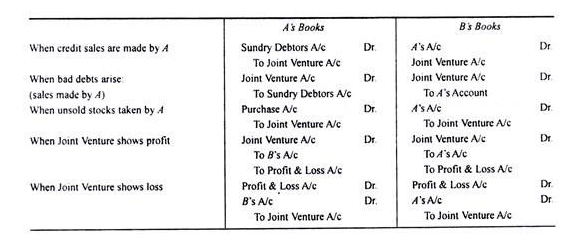

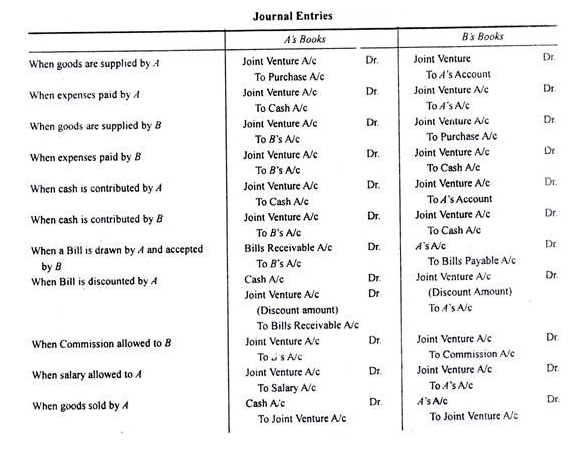

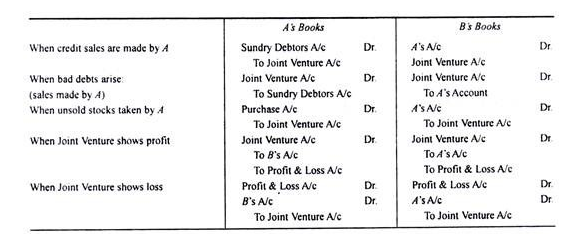

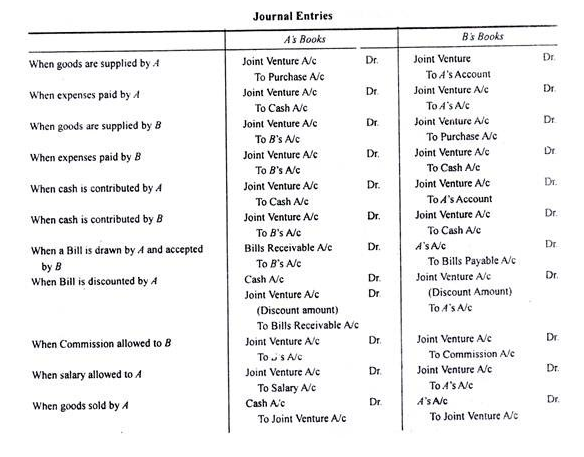

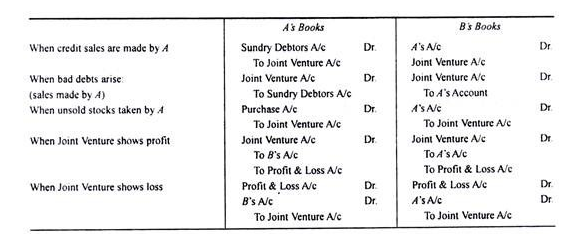

Q9) Write journal entries when no separate set of books id kept in joint venture

Solution

Where no separate set of book is kept - where the joint venture transactions are limited and the venturers reside at two different places this method is applicable. For instance, there are two venturers, namely, A and B. So, A will prepare a Joint Venture Account and B’s Capital Account in his books while B will also prepare a Joint Venture Account and A’s Capital Account in his book.

- Joint venture account – in this case one’s own share of profit or loss should be transferred to his Profit and Loss Account but co-venturer’s share of profit or loss should be transferred to his personal account.

- Other co venture account - This is a personal account of the co-venturer, and will be debited with the amount of goods purchased, expenses incurred, profit so earned etc. and is credited with the amount of sale proceeds, unsold stock taken etc.

Unit IV

Joint Venture Accounts

Q1) Explain joint venture account

Solution

A joint venture is an association of two or more persons who have combined for the execution of a specific business and divide the profit or loss thereof in the agreed ratio.

Features of Joint Venture

The main features of a joint venture are specifically made clear.

- Two or more person are needed.

- It is an agreement to execute a particular venture or a project.

- The joint venture business may not have a specific name.

- It is of temporary nature. So the agreement regarding the venture automatically stands terminated as soon as the venture is complete.

- The co-ventures share profit and loss in an agreed ratio. The profits and losses are to be shared equally if not agreed otherwise.

- The co-ventures are free to continue with their own business unless agreed otherwise during the life of joint venture

Accounting methods in joint venture transaction

- When separate set of books id kept

Where there are large transactions this method is followed, that is, the venture is a large one and is continued for a comparatively long period. Under double entry principle accounts are prepared.

Under this method the following three accounts are prepared

- Joint venture account - This account represents the results of the business, that is, profit or loss. This account is debited by the cost of goods, expenses; goods supplied by the venturers etc. and are credited by sale proceeds, unsold stock, stock taken by venturers etc.

Profit on joint venture represents if credit side of this account is greater than the debit side and vice versa in the opposite case. The profit or loss so made is transferred to co-venturer’s account.

- Joint bank account - It is like an ordinary Cash Book or Bank Account. On the debit side all incomes including the capital contribution by the ventures appear whereas all expenses of the venture appear on the credit side of this account. It is finally closed by payment to the co-venturers, leaving no balance either side.

- Co venture account - This is the capital account of the venture relating to venture. This account is credited by the capital contributed by the ventures, goods supplied by them from their own stock, expenses made personally by them etc. whereas this account is debited for any withdrawals or any asset taken from the venture.

The profit or loss made on venture is transferred in profit sharing ratio to this account and this account is closed by cash payment from joint bank and vice versa in the opposite case.

b. Where no separate set of book is kept - where the joint venture transactions are limited and the venturers reside at two different places this method is applicable. For instance, there are two venturers, namely, A and B. So, A will prepare a Joint Venture Account and B’s Capital Account in his books while B will also prepare a Joint Venture Account and A’s Capital Account in his book.

- Joint venture account – in this case one’s own share of profit or loss should be transferred to his Profit and Loss Account but co-venturer’s share of profit or loss should be transferred to his personal account.

- Other co venture account - This is a personal account of the co-venturer, and will be debited with the amount of goods purchased, expenses incurred, profit so earned etc. and is credited with the amount of sale proceeds, unsold stock taken etc.

Q2) Explain consignment account

Solution

What is consignment accounting?

Consignment accounting is a type of business arrangement in which one person send goods to another person for sale on his behalf and the person who sends goods is called consignor and another person who receives the goods is called consignee, where consignee sells the goods on behalf of consignor on consideration of certain percentage on sale.

Features

- Two Parties: Consignment accounting mainly involves two party’s consignor and consignee.

- Transfer of Procession: Procession of goods transferred from consignor to consignee.

- Agreement: For terms and conditions of the consignment there is a pre-agreement between the consignor and consignee.

- No Transfer of Ownership: Until the consignee sells it the ownership of goods remains in the hands of the consignor. The only procession of goods is transferred to a consignee.

- Re-Conciliation: Consignor sends Pro-forma invoice while consignee sends account sale details and both reconcile their accounts at the end of the year.

- Separate Accounting: In the books of consignor and consignee there is independent accounting done of consignment account. Both prepare consignment account and record the journal entries of goods through consignment account only.

Terms used in consignment account

- Consignor: It is the person that sends goods.

2. Consignee: The person who receives the goods is called the consignee.

3. Consignment: Consignment is a business arrangement through which the consignor sends goods to the consignee for sale.

4. Consignment Agreement: It is legally written communication which defines the terms and conditions of the consignment between the consignor and consignee.

5. Pro-Forma Invoice: Pro-forma invoice is the statement forwarded when the consignor sends goods to the consignee, showing details of goods such as quantity, price, etc.

6. Non- Recurring Expenses: Expenses that are incurred by the consignor to dispatch the goods from his place to place of the consignee are called non-recurring expenses. These expenses are added to the cost of goods.

7. Recurring Expenses: The consignee incurs these expenses after the goods reached his place. These expenses are of maintenance of goods type’s expenses.

8. Commission: Commission is the reward for the sale of goods on behalf of the consignor. It is as per the consignment agreement.

9. Account Sale: It is the statement forwarded by the consignee to consignor showing details of goods sold, amounts received, expenses incurred, a commission charged, advance payment and balance due and stock in hand, etc.

Accounting entries

Sr.No. | In the Books of Consignor | In the Books of Consignee |

1 | When goods are sent to the consignee Consignment A/cDr To Goods Sent on Consignment A/c (Being Goods Sent on Consignment) | No need to do any Entry in this case |

2 | Expenses Incurred by Consignor Consignment A/cDr To Cash/Bank A/c (Being Expenses incurred on consignment) | Not Applicable |

3 | Advance given by consignee Cash/Bank A/cDr To Consignee’s A/c (Being advance received from consignee) | Consigner A/cDr To Bank/Cash A/c (Being Advance amount paid to Consignor) |

4 | Expenses Incurred by Consignee Consignment A/cDr To Consignee’s A/c (Being Expenses incurred by consignee) | Consigner A/cDr To Bank/Cash A/c (Being Expenses incurred on goods received on consignment) |

5 | Sale by Consignee Consignee’s A/cDr To Consignment A/c (Being Expenses incurred by consignee) | Cash (for cash sale) A/cDr Debtors (for Credit Sale) A/c Dr To Consignor A/c (Being goods sold) |

6 | Commission to Consignee Consignment A/cDr To Consignee’s A/c (Being Commission on sale due to consignee) | Consigner A/cDr To Commission A/c (Being Commission earned) |

7 | Remittance from Consignee Cash/Bank A/cDr To Consignee’s A/c (Being due amount received from consignee) | Consigner A/cDr To Bank/Cash A/c (Being Balance due Payment made to consignor) |

8 | Entry for Profit on Consignment Profit & Loss A/cDr To Consignment A/c (Being Profit earned on consignment) | Not Applicable |

9 | Loss on Consignment Consignment A/cDr To Profit & Loss A/c (Being Loss incurred on Consignment transferred to the profit & Loss Account) | Not Applicable |

Q3) Explain journal entries of consignment account

Solution

Sr.No. | In the Books of Consignor | In the Books of Consignee |

1 | When goods are sent to the consignee Consignment A/cDr To Goods Sent on Consignment A/c (Being Goods Sent on Consignment) | No need to do any Entry in this case |

2 | Expenses Incurred by Consignor Consignment A/cDr To Cash/Bank A/c (Being Expenses incurred on consignment) | Not Applicable |

3 | Advance given by consignee Cash/Bank A/cDr To Consignee’s A/c (Being advance received from consignee) | Consigner A/cDr To Bank/Cash A/c (Being Advance amount paid to Consignor) |

4 | Expenses Incurred by Consignee Consignment A/cDr To Consignee’s A/c (Being Expenses incurred by consignee) | Consigner A/cDr To Bank/Cash A/c (Being Expenses incurred on goods received on consignment) |

5 | Sale by Consignee Consignee’s A/cDr To Consignment A/c (Being Expenses incurred by consignee) | Cash (for cash sale) A/cDr Debtors (for Credit Sale) A/c Dr To Consignor A/c (Being goods sold) |

6 | Commission to Consignee Consignment A/cDr To Consignee’s A/c (Being Commission on sale due to consignee) | Consigner A/cDr To Commission A/c (Being Commission earned) |

7 | Remittance from Consignee Cash/Bank A/cDr To Consignee’s A/c (Being due amount received from consignee) | Consigner A/cDr To Bank/Cash A/c (Being Balance due Payment made to consignor) |

8 | Entry for Profit on Consignment Profit & Loss A/cDr To Consignment A/c (Being Profit earned on consignment) | Not Applicable |

9 | Loss on Consignment Consignment A/cDr To Profit & Loss A/c (Being Loss incurred on Consignment transferred to the profit & Loss Account) | Not Applicable |

Q4) Write journal entries for abnormal loss in consignment

Solution

Loss of goods

Normal Loss − Due to inherent characteristics of goods like evaporation, drying up of goods, etc normal loss may occur. It is included in the cost of goods sold and the closing stock by inflating the rate per unit but not separately shown in the consignment account.

Abnormal Loss − An abnormal loss may occur due to any accidental reason. To calculate actual profitability it is creditted to the consignment account.

Abnormal Loss and Insurance

Ffollowing entries will be passed in the books of a consignor, if, there is an insurance policy in respect of the consigned goods −

Sr.No. | In the Books of Consignor | In the Books of Consignee |

1 | Payment of Insurance Premium (a) If insurance premium is paid by the consignor, then cash will be credited. (b) If Insurance premium is paid by the consignee, then consignee’s A/c will be credited. | Consignment A/cDr To Cash A/c Or To Consignee A/c (Being Insurance premium paid) |

2 | At the time of Abnormal Loss | Abnormal Loss A/cDr To Consignment A/c (Being Loss Incurred) |

3 | Acceptance of Claim by Insurance Company | Insurance Company (Name of the insurer) A/cDr To Abnormal Loss A/c (Being claim admitted) |

4 | On receipt of Claim | Bank A/cDr To Insurance Company A/c (Being amount of claim received) |

5 | In Case of Loss | Profit & Loss A/cDr To Abnormal Loss A/c (Being amount of Abnormal Loss transferred) |

Q5) Explain foreign exchange transaction

Solution

Definition

The Foreign Exchange Transactions refers to the sale and purchase of foreign currencies. Simply, the foreign exchange transaction is an agreement of exchange of currencies of one country for another at an agreed exchange rate on a definite date.

Types

- Spot Transaction: The spot transaction is when the buyer and seller of different currencies within the two days of the deal settle their payments. To exchange the currencies it is the fastest way. Here, the currencies are exchanged over a two-day period, which means no contract is signed between the countries. The exchange rate at which the currencies are exchanged is called the Spot Exchange Rate. This rate is often the prevailing exchange rate. The market in which the spot sale and purchase of currencies is facilitated is called as a Spot Market.

2. Forward Transaction: A forward transaction is a future transaction where the buyer and seller enter into an agreement of sale and purchase of currency after 90 days of the deal at a fixed exchange rate on a definite date in the future. The rate at which the currency is exchanged is called a Forward Exchange Rate. The market in which the deals for the sale and purchase of currency at some future date is made is called a Forward Market.

3. Future Transaction: The future transactions are also the forward transactions and deals with the contracts in the same manner as that of normal forward transactions. But however, on the following grounds the transactions made in a future contract differs from the transaction made in the forward contract:

- The forward contracts can be customized on the client’s request, while the future contracts are standardized such as the features, date, and the size of the contracts is standardized.

- The future contracts can only be traded on the organized exchanges, while the forward contracts depending on the client’s convenience can be traded anywhere.

- In case of the forward contracts no margin is required, while to establish the future position the margins are required of all the participants and an initial margin is kept as collateral.

4. Swap Transactions: The Swap Transactions involve a simultaneous borrowing and lending of two different currencies between two investors. Here one investor borrows the currency and lends another currency to the second investor. The obligation to repay the currencies is used as collateral, and the amount is repaid at a forward rate. Without suffering a foreign exchange risk the swap contracts allow the investors to utilize the funds in the currency held by him/her to pay off the obligations denominated in a different currency.

5. Option Transactions: The foreign exchange option gives an investor the right, but not the obligation to exchange the currency in one denomination to another at an agreed exchange rate on a pre-defined date. An option to buy the currency is called as a Call Option, while the option to sell the currency is called as a Put Option.

Q6) Explain investment account

Solution

Definition

Investments are assets held by an enterprise for earning income by way of dividends, interest, and rentals, for capital appreciation, or for other benefits to the investing enterprise. Assets held as stock-in-trade are not ‘investments’.

A current investment is an investment that is by its nature readily realisable and is intended to be held for not more than one year from the date on which such investment is made.

A long term investment is an investment other than a current investment.

An investment property is an investment in land or buildings that are not intended to be occupied substantially for use by, or in the operations of, the investing enterprise.

Classification of investment

A. Current Investments – Current Investments includes investments which by their nature are readily realizable and are intended to be held for less than a year from the date when such investment is done.

B. Long-Term Investments – Long-term investments includes investments other than the current investments, even though they might be freely marketable.

Cost of investment

- Broker, duties, and fees – The cost of investments include charges related to acquisition of brokerage, duties, and fees

- Non-cash consideration – In case investments are acquired, or partly acquired, by issuing shares ,issuing other securities , any other asset. The cost of acquisition is the securities fair value which are issued.

- Interest, dividend or other receivables – Dividends, interest and other receivables that are usually the income from the investment made.

- Right Shares – the cost of such right shares is then added to carrying the amount of original holding.

Carrying amount of investment

On the basis of category of investment or on an individual investment current investments must be carried in financial statements at lower of cost and fair value, however, not on the overall basis.

Long-term investments must always be carried in financial statements at their cost. But, when there’s a decline, in value the long-term investment, carrying amount is reduced for recognizing such decline.

Investment property

Investments that are made in land or buildings which aren’t imagine to be used significantly for use, or in business operations of, the investing company refers to investment property.

Investment treatment on disposal

On sale or disposal of the investment, the difference between the carrying cost and proceeds from the sales net of any expenses is transferred to P&L.

Reclassification of investments

Where an investment is reclassified from long-term investment to current investment, the transfer is made at carrying amount and lower of cost at the date of such transfer.

Where current investment is reclassified to long-term investment, the transfer is made at the lower of its cost and the fair value of such investment at the date of such transfer.

Disclosure in the financial statement

- For determining carrying amount of investment accounting policies are employed

- The amounts which are included in the profit and loss statement for:

- The income (dividend, interest and rental) from investments such as long-term and current investments separately.

- Profits and losses on the disposal of current investment and the changes in carrying the amount of the investment

- Profits and losses on the disposal of long-term investment and the changes in carrying the amount of the investment

- On the right of ownership substantial limitations, realizability of the investments or remittance of income and proceeds of disposal

- The total amount of both the quoted and unquoted investments, providing the total market value of the quoted investments

- Other disclosures as required by the relevant statute governing the company

Q7) Explain government grants

Solution

Government grants refer to the support given by government either in cash or kind to an enterprise. To meet past or future compliance along with certain conditions such grants are given for an enterprise. The following grants do not include any form of government support

- That cannot be reasonably valued and

- The ones that cannot be separated from the normal trading transactions of an enterprise

While preparing financial statements for an enterprise receipt of government grants is an important issue to be considered.

Accounting Treatment of Government Grants

An enterprise can adopt any two of the accounting approaches to undertake the accounting treatment of government grants. These include:

- Capital Approach - According to the capital approach, the government grants are treated as a part of capital or shareholders’ funds or promoter’s contribution. Such grants are given in an enterprise as a part of the total investment.

In case of such grants, the government does not expect any repayment. Hence, such government grants are credited to the shareholders’ funds.

The second argument in favor of the capital approach towards treating government grants is that it such grants are not earned rather they are considered as an incentive provided by the government without any related costs. Hence it is not justified to recognize government grants in P&L statement

2. Income Approach - As per the income approach, the government grants over one or more periods are treated as income. Following are the arguments that support the income approach for accounting treatment of government grants:

- As per the definition of government grants mentioned above, the government grants are not given without any reason. Therefore, it is logical to consider the government grants as income and match such income with the costs that such a grant tends to compensate.

- Since the grant form part of the fiscal policies of the government , so government grants are similar to the income tax or other taxes charged against the income of the enterprise. Similarly, income tax or other taxes are charged against income in the P&L statement, the government grants should also be treated in the same way.

- In case entities that may follow capital approach and treat grants as part of shareholders’ fund, no relationship exists between the accounting treatment of a grant and accounting treatment of expense to which it associates.

Q7) Explain accounting methods in joint venture account

Solution

- When separate set of books id kept

Where there are large transactions this method is followed, that is, the venture is a large one and is continued for a comparatively long period. Under double entry principle accounts are prepared.

Under this method the following three accounts are prepared

- Joint venture account - This account represents the results of the business, that is, profit or loss. This account is debited by the cost of goods, expenses; goods supplied by the venturers etc. and are credited by sale proceeds, unsold stock, stock taken by venturers etc.

Profit on joint venture represents if credit side of this account is greater than the debit side and vice versa in the opposite case. The profit or loss so made is transferred to co-venturer’s account.

- Joint bank account - It is like an ordinary Cash Book or Bank Account. On the debit side all incomes including the capital contribution by the ventures appear whereas all expenses of the venture appear on the credit side of this account. It is finally closed by payment to the co-venturers, leaving no balance either side.

- Co venture account - This is the capital account of the venture relating to venture. This account is credited by the capital contributed by the ventures, goods supplied by them from their own stock, expenses made personally by them etc. whereas this account is debited for any withdrawals or any asset taken from the venture.

The profit or loss made on venture is transferred in profit sharing ratio to this account and this account is closed by cash payment from joint bank and vice versa in the opposite case.

b. Where no separate set of book is kept - where the joint venture transactions are limited and the venturers reside at two different places this method is applicable. For instance, there are two venturers, namely, A and B. So, A will prepare a Joint Venture Account and B’s Capital Account in his books while B will also prepare a Joint Venture Account and A’s Capital Account in his book.

- Joint venture account – in this case one’s own share of profit or loss should be transferred to his Profit and Loss Account but co-venturer’s share of profit or loss should be transferred to his personal account.

- Other co venture account - This is a personal account of the co-venturer, and will be debited with the amount of goods purchased, expenses incurred, profit so earned etc. and is credited with the amount of sale proceeds, unsold stock taken etc.

Q8) Write journal entries When separate set of books id kept in joint venture

Solution

When separate set of books id kept

Where there are large transactions this method is followed, that is, the venture is a large one and is continued for a comparatively long period. Under double entry principle accounts are prepared.

Under this method the following three accounts are prepared

- Joint venture account - This account represents the results of the business, that is, profit or loss. This account is debited by the cost of goods, expenses; goods supplied by the venturers etc. and are credited by sale proceeds, unsold stock, stock taken by venturers etc.

Profit on joint venture represents if credit side of this account is greater than the debit side and vice versa in the opposite case. The profit or loss so made is transferred to co-venturer’s account.

- Joint bank account - It is like an ordinary Cash Book or Bank Account. On the debit side all incomes including the capital contribution by the ventures appear whereas all expenses of the venture appear on the credit side of this account. It is finally closed by payment to the co-venturers, leaving no balance either side.

- Co venture account - This is the capital account of the venture relating to venture. This account is credited by the capital contributed by the ventures, goods supplied by them from their own stock, expenses made personally by them etc. whereas this account is debited for any withdrawals or any asset taken from the venture.

The profit or loss made on venture is transferred in profit sharing ratio to this account and this account is closed by cash payment from joint bank and vice versa in the opposite case.

Q9) Write journal entries when no separate set of books id kept in joint venture

Solution

Where no separate set of book is kept - where the joint venture transactions are limited and the venturers reside at two different places this method is applicable. For instance, there are two venturers, namely, A and B. So, A will prepare a Joint Venture Account and B’s Capital Account in his books while B will also prepare a Joint Venture Account and A’s Capital Account in his book.

- Joint venture account – in this case one’s own share of profit or loss should be transferred to his Profit and Loss Account but co-venturer’s share of profit or loss should be transferred to his personal account.

- Other co venture account - This is a personal account of the co-venturer, and will be debited with the amount of goods purchased, expenses incurred, profit so earned etc. and is credited with the amount of sale proceeds, unsold stock taken etc.