Unit - 5

Project Cost Management

Q1) Explain the terms Budgeting, Cost planning, direct Cost, Indirect cost, Total Cost Curve and Cost Slope?

A1)

1. Budgeting

A budget is an estimation of sales and prices over a designated destiny time period and is used by governments, businesses, and individuals. A finance is essentially an economic plan for a described period, typically 12 months this is recognized to substantially decorate the fulfillment of any economic undertaking.

To manipulate your month-to-month expenses, put together for life's unpredictable events, and be capable of have the funds for big-price price tag objects without going into debt, budgeting is important. Keeping music of the way a great deal, you earn and spend ought not to be drudgery, does not require you to be correct at math, and does not suggest you cannot purchase the stuff you want. It simply way that you will recognize in which your cash goes, you will have extra manipulate over your finances.

Budget is annual financial statement showing the estimated receipts and expenditure in respect of financial year, before commencement of that year.

To enable government to judge the relative urgency of the demands and made against the amounts likely to be available for expenditure on different works head of account during ensuing year, statements of accepted estimates called as budget estimates for next year are prepare and submitted to ministry concerned.

The estimates of expenditure are required to be voted by the legislature.

Late receipts of estimate retard the budget programmed and cause considerable inconveniences.

So, every endeavor should be made to ensure their timely submission.

Originally estimates are prepared from the different division and then submitted to the superintending engineers.

The chief engineer proposes the annual budget estimates after receiving the estimates from superintending engineers under his control.

The budget statement thus, is sent to the secretary of the department who after scrutiny submits to the minister concerned and to the financial department.

2. Cost planning

Cost making plans is a control procedure that seeks to govern design. Improvement in step with the patron's finances. It does this via way of means of supporting the. Patron determine the way it desires to allocate the finances to the diverse elements of the project.

Objectives of Cost Planning

- Origins in control of faculty constructing prices within side the UK

- Similarity within side the distribution of prices some of the diverse elements occurred

- Cost deliberates on the premise of this information

- Became called Elemental Cost Planning

- Cost making plans is a control method that seeks to govern layout improvement consistent with the patron’s finances.

- It does this through assisting the patron determine the way it desires to allocate the finances to the numerous components of the project

Method of figuring out the anticipated fee of a project

Technique through which the finances is allotted to the numerous factors of a supposed constructing project

Advantages of Cost Planning

- To discover fee

- To hold inside finances

- Close hole among finances estimates and Contractor’s tender

- Efficient layout method

- Value for money

- Helping the patron determine the way it desires to allocate the finances to the numerous components of the project.

3. Direct Cost and Indirect cost

1. Direct cost:

The costs and expenses that are accountable directly on a facility, function or product are called as direct costs. In construction projects, the direct costs are the cost incurred on labor, material, equipment etc. These costs for a construction project are developed as estimates by means of detailed analysis of the contract activities, construction method, the site conditions, and resources. Different direct costs in construction projects are material costs, labor costs, subcontractor costs, and equipment costs.

2. Indirect cost:

The unlike direct costs are not directly accountable for a particular facility, product or function. Indirect costs can be either variable or fixed. The main sections coming under indirect costs are personnel costs, security costs, and administration costs. These costs do not have a direct connection with the construction project.

4. Total Cost Curve

TOTAL COST CURVE: A curve that graphically represents the relation among the full cost incurred through a corporation within side the short-run manufacturing of a great or provider and the amount produced.

The overall cost curve is a cornerstone upon which the evaluation of short-run manufacturing is built. It combines all possibility cost of manufacturing right into a single curve, that can then be used with the full sales curve to decide profit. The marginal value curve, the focal factor for the evaluation of short-run manufacturing, is derived without delay from the full cost curve.

The form of the curve displays growing marginal returns at small portions of output and reducing marginal returns at large portions.

The overall fee curve graphically represents the relation among overall cost and the amount of manufacturing.

This curve may be derived in ways. One is to devise an agenda of numbers referring to output amount and overall fee. The different is to vertically upload the full variable cost curve and the full constant cost curve.

The slope of the full cost curve is marginal cost. When building this curve, it's far assumed that overall fee adjustments because of adjustments in the amount of output produced, at the same time as different variables like era and aid costs are held constant.

The overall price curve is often used with a complete sales curve to decide the earnings maximizing stage of manufacturing for a firm.

However, this curve is possibly maximum essential as the idea for deriving the common overall price curve and the marginal price curve. In particular, marginal price is the slope of the full price curve.

5. Cost Slope

Cost Slope Analysis is a price control method beneficial in locating

a) the maximum price green Critical Path Activities to be shortened,

b) the Optimum Cost-Time Point, indicating the perfect factor for a Cost to Time tradeoff, marking a crashing schedule’s factor of most earnings or its factor of diminishing return.

(Larson & Gray, 2011) The method requires:

a) Identifying the Critical Path Activities and their dependencies, and

b) The following four Cost Slope Analysis Index: 1) Indirect Cost and Duration (Normal and Crash Mode) 2) Direct Cost and Duration (Normal and Crash Mode) 3) Maximum crash time allowed in keeping with Critical Path Activity because of technical or assets constraints four) Financial risks, which includes however now no longer confined to: past due transport consequences fees, early transport incentives (quicker time-to-marketplace benefit) etc.

Uses:

Cost Slope Analysis is a fee control approach beneficial in locating

a) The maximum fee green Critical Path Activities to be shortened,

b) The Optimum Cost-Time Point, indicating the best factor for a Cost to Time tradeoff, marking a crashing schedule's factor of most income or its factor of diminishing return.

Cost Slope Formula

Cost Slope’s Formula may be expressed as:

Cost Slope = (Crash Cost – Normal Cost)/ (Normal Time – Crash Time)

Q2) Explain time value of money?

A2)

The time value of cash (TVM) is the idea that cash you've got now could be really well worth greater than the same sum within side the destiny because of its ability incomes capacity. This center precept of finance holds that furnished cash can earn interest, any sum of money is really well worth greater the earlier it's far received. TVM is likewise occasionally called gift discounted fee.

The time value of cash attracts from the concept that rational traders favor to get hold of cash nowadays as opposed to the identical amount of cash within side the destiny due to cash's ability to develop in cost over a given duration of time. For example, cash deposited right into a financial savings account earns a positive hobby fee and is consequently stated to be compounding in value.

Time value of cash is primarily based totally at the concept that human beings could alternatively have cash these days than within side the destiny. Given that cash can earn compound hobby, it's far extra precious within side the gift in preference to the destiny.

The method for computing time fee of cash considers the charge now, the destiny fee, the hobby rate, and the time body. The variety of compounding durations in the course of on every occasion body is a critical determinant within side the time fee of cash formula as well as

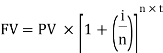

Depending on the precise scenario in question, the time fee of cash system can also additionally extrude slightly. For example, within side the case of annuity or perpetuity payments, the generalized system has extra or much less factors. But in general, the maximum essential TVM system takes into consideration the subsequent variables: FV = Future value of cash PV = Present value of cash i = hobby rate n = wide variety of compounding intervals in step with year t = wide variety of years Based on those variables, the system for TVM is:

Q3) What is mean by present economy studies?

A3)

Present financial system research is engineering financial analyses wherein options for conducting a particular project are being as compared over three hundred and sixty-five days or much less and the have an impact on of time on cash may be ignored.

When options for carrying out a challenge are in comparison for twelve months or less (I.e., have an impact on of time on cash is irrelevant) Rules for Selecting Preferred Alternative

Rule 1 – When sales and different monetary advantages are gift and range amongst options, pick opportunity that maximizes average profitability primarily based totally at the quantity of defect-loose devices of output

Rule 2 – When sales and monetary advantages aren't gift or are regular amongst options, remember handiest prices and pick out opportunity that minimizes general fee in line with defect-loose output

Total Cost in Material Selection

In many cases, choice of amongst substances can't be primarily based totally on expenses of substances.

Frequently, alternate in substances have an effect on design, processing, and delivery expenses.

Q4) Explain equivalence concept?

A4)

When a phrase or word manner precisely the equal element in each language, we name that an equivalence, and it is understandably one of the first matters expert translators’ appearance for These calls for a deep information of each culture, now no longer simply the language.

Economic equivalence is an essential idea upon which engineering financial system computations are based.

Economic equivalence is an aggregate of hobby charge and time price of cash to decide the special quantities of cash at special factors in time which might be same in financial price.

Economic equivalence is an essential idea upon which engineering financial system computations are based.

Before we delve into the monetary aspects, think about the numerous forms of equivalency we can also additionally make use of every day with the aid of using shifting from one scale to another.

Our scales—time in mins, time in hours, period in miles, and period in kilometers—are blended to broaden those equal statements on speed.

Note that during those statements, the essential members of the family of one mile = 1.609 kilometers and 1 hour = 60 mins are applied.

If an essential relation changes, the complete equivalency is in error. Now we consider monetary equivalency.

Economic equivalence is an aggregate of hobby price and time cost of cash to decide the distinctive quantities of cash at distinctive factors in time which might be identical in monetary cost.

As an illustration, if the hobby price is 6% in line with year, $one hundred nowadays (gift time) is equal to $106 12 months from nowadays. Amount accrued = one hundred + one hundred (0.06) = one hundred (1 + 0.06) = $106 If a person supplied you a present of $one hundred nowadays or $106 12 months from nowadays, it might make no distinction which provide you prevalent from a monetary perspective. In both case you have $106 12 months from nowadays.

However, the 2 sums of cash are equal to every other only while the hobby price is 6% in line with year. At a better or decrease hobby price, $one hundred nowadays isn't always equal to $106 12 months from nowadays.

Q5) What is financing of projects?

A5)

Project financing is a mortgage shape that is based mainly at the project's coins glide for repayment, with the project's assets, rights, and pastimes held as secondary collateral.

Project finance is mainly appealing to the personal quarter due to the fact agencies can fund predominant tasks off-stability sheet.

If you're making plans to begin an industrial, infrastructure, or public offerings undertaking and want price range for the same, Project Financing is probably the solution which you are searching for.

The compensation of this mortgage may be finished the use of the coins waft generated as soon as the undertaking is whole rather than the stability sheets of the sponsors.

In case the borrower fails to conform with the phrases of the mortgage, the lender is entitled to take manipulate of the undertaking.

Additionally, economic groups can earn higher margins if an employer avails this scheme at the same time as in part moving the related undertaking dangers. Therefore, this kind mortgage scheme is quite favored through sponsors, groups, and creditors alike. In order to bridge the distance among sponsors and creditors, a middleman is fashioned particularly Special Purpose Vehicle (SPV).

The most important position of the SPV is to oversee the fund procurement and control to make certain that the undertaking property do now no longer succumb to the aftereffects of undertaking failure.

Before a lender makes a decision to finance an undertaking, it's also critical that everyone the dangers that would have an effect on the undertaking are diagnosed and allotted to keep away from any destiny complication

- Pre-Financing Stage

Identification of the Project Plan - This method consists of figuring out the strategic plan of the task and analyzing whether or not its attainable or not. In order to make sure that the task plan is in step with the desires of the monetary offerings company, it's far critical for the lender to carry out this step. Recognizing and Minimizing the Risk - Risk control is one of the key steps that must be targeted on earlier than the task financing assignment begins. Before investing, the lender has each proper to test if the task has sufficient to be had sources to keep away from any destiny risks.

Checking Project Feasibility - Before a lender makes a decision to make investments on a task, it's far essential to test if the involved task is financially and technically viable through analyzing all of the related factors.

2. Financing Stage

Being the maximum critical a part of Project Financing, this step is in addition sub-categorized into the following:

Arrangement of Finances - In order to attend to the budget associated with the task, the sponsor desires to collect fairness or mortgage from a monetary offerings business enterprise whose desires are aligned to that of the task Loan or Equity Negotiation - During this step, the borrower and lender negotiate the mortgage quantity and are available to a unanimous selection concerning the same.

Documentation and Verification - In this step, the phrases of the mortgage are jointly determined and documented preserving the regulations of the task in mind.

Payment - Once the mortgage documentation is done, the borrower gets the budget as agreed formerly to perform the operations of the task.

3. Post-Financing Stage

Timely Project Monitoring - As the task commences, it's far the task of the task supervisor to display the task at everyday intervals.

Project Closure - This step indicates the stop of the task.

Loan Repayment - After the task has ended, it's far vital to hold song of the coins go with the drift from its operations as those budgets will be, then, utilized to pay off the mortgage taken to finance the task.

Q6) Explain economic comparison?

A6)

Economic increase may be described because the growth in actual gross home product (GDP) within side the long-run, or as improved productiveness or through a growth within side the herbal resources (inputs) that create output.

It is vital to be aware that actual GDP adjusts for inflation, instead of searching at output in nominal dollars.

Economic increase may also be defined as an outward shift within side the manufacturing-opportunity frontier, bearing in mind the manufacturing of a better amount of goods.

Economic increase may also be defined as an outward shift within side the manufacturing-opportunity frontier, bearing in mind the era of a better amount of products.

While measuring actual GDP is beneficial in a few ways, and taken into consideration a fashionable degree of monetary increase, there may be a splendid deal extra complexity than is being captured (each quantitatively and qualitatively). Classic increase concept makes use of the manufacturing feature to degree monetary increase, which in the long run means that monetary increase continuously compounds.

Growth accounting got here into reputation after the traditional model, figuring out the critical position of generation in monetary increase.

An extra knowledgeable team of workers will bring about will increase in actual output, as will advances in generation and innovation.

Inflation: The upward push within side the well-known degree of charges of products and offerings in an economic system over duration of time.

Gross home product: A degree of the monetary manufacturing of a specific territory in economic capital phrases over a particular time duration.

Q7) What do you mean by present worth method Equivalent annual cost method?

A7)

At a few levels you've got likely sold an asset including a vehicle, a showering device or a laptop and you could have taken into consideration how lengthy you need to preserve that asset previous to changing it.

If the asset is saved for an extended length its preliminary price, much less any residual value, is unfold over extra years that's in all likelihood to lessen your price in step with yr of ownership.

However, because the asset a long time it's far in all likelihood to require increasingly upkeep and might perform much less efficiently with the intention to boom your fees in step with yr.

Determining the greatest time to update the asset (the greatest alternative cycle) is difficult. As a trendy rule you and I don’t fear an excessive amount of approximately this. Indeed, maximum folks will make a selection primarily based totally on our ‘intestine feel’ and different elements including picture for example. Indeed, I generally tend to preserve my vehicle till such time as I actually have misplaced self belief in its capacity to get me reliably from A to B or it has deteriorated a lot I not need to be visible in it!

Companies additionally face precisely the equal asset alternative selections. However, because the quantities concerned can frequently be very significant, making selections primarily based totally on ‘intestine feel’ isn't surely correct enough. The calculation of equal annual fees is a device that may be used to help on this selection-making process.

The equal annual fee approach entails the subsequent steps:

Step 1 – Calculate the internet gift value (NPV) of fee for every capacity alternative cycle.

Step 2 – For every capacity alternative cycle an equal annual fee is calculated.

The decision – The alternative cycle with the bottom equal annual fee may also then be chosen, even though different elements may additionally need to be considered.

The Net Present Value (NPV) Method and the Internal Rate of Return (IRR) Method are sorts of discounted coins go with the drift strategies that are followed to adopt the monetary appraisal of tasks.

In the Discounted Cash go with the drift strategies all of the projected coins inflows and outflows for a capital budgeting venture are discounted to their present price the usage of an approximate hobby charge.

Three discounted coins go with the drift strategies are usually used in capital budgeting

a) Net Present Value (NPV)

b) Internal Rate of Return (IRR)

c) Profitability or Desirability Index

All discounted coins go with the drift strategies are primarily based totally at the time price of cash this means that a sum of money acquired nowadays is really well worth extra than an identical sum of money acquired in future.

To simplify the method of comparing proposals the usage of discounted coins flows, the idea is made that money go with the drift from a venture arise on the give up of accounting period.

Under the NPV approach, all coin’s inflows and outflow are discounted at a minimal suited charge of go back. N normally the companies value of capital.

If the existing price of the coins inflows is extra than the gift price of the coin’s outflows, the venture is appropriate Le NPV>0, take delivery of and NPV <0> must be extra than the NPV of expenses of that venture. The distinction among the 2 NPVs must be positive. In different words, a positive NPV approach the venture ears a charge of go back better than the companies’ value of capital.

The Net Present Value is predicated at the time price of cash and the timings of coins flows in comparing tasks. All coin’s flows are discounted on the value of capital and NPV assumes that every one coin inflows from tasks are re-invested on the value of capital.

As a choice criterion, this approach may be used to make a desire among jointly exceptional tasks. The venture with the very best NPV could be assigned the primary rank, observed with the aid of using others within side the descending order

- Merits:

1) NPV recognizes the time price of cash thereby making the approach extra credible.

2) The complete movement of coins flows at some stage in the venture existence is considered.

3) A converting cut price charge may be constructed into the NPV calculations with the aid of using changing the denominator.

4) This approach is beneficial for choice of jointly exceptional tasks.

- Limitations:

1) It is hard to calculate in addition to apprehend and use in contrast with the payback approach.

2) The calculation of cut price charge that's important to the approach gives extreme problems. In fact, there may be distinction of opinion even concerning the precise approach of calculating it.

3) This approach might not provide best outcomes in case of tasks having distinct powerful lives.

Q8) Excel Constructions wants to buy a mixer with a cost of Rs. 35,000 and annual cash savings of Rs. 11,000 for each of 5 years. The cost of capital is 12%.

A8)

With uniform cash flows, the present value (PV) is computed using the present value of and annuity of 5 payments of Rs. 11,000 each at 12 percent; the NPV is calculated as follows:

PV of Cash inflows = 11,000 (PV 1-5 years @ 12%)

= Rs. 39,634

Present Value of Cash outflows 35, 0000 Net sent value of the project 4634

S NPV is positive the project is acceptable since the net - ve of earnings exceed by Rs. 4634 the amount paid for of the funds to finance the investment.

Q9) Explain discounted cash flow method?

A9)

Discounted coins flow (DCF) is a valuation technique used to estimate the cost of a funding primarily based totally on its predicted destiny coins flows.

DCF evaluation tries to determine out the cost of a funding today, primarily based totally on projections of ways a great deal cash it's going to generate within side the destiny.

This applies to the choices of traders in agencies or securities, inclusive of obtaining a company, making an investment in an era startup, or shopping for a stock, and for enterprise proprietors and executives seeking to make capital budgeting or running prices choices inclusive of commencing a brand new manufacturing facility or buying or leasing new equipment.

Discounted coins flow (DCF) facilitates decide the price of a funding primarily based totally on its destiny coins flows.

The gift price of predicted destiny coins flows is arrived at with the aid of using the use of a reduction fee to calculate the DCF. If the DCF is above the modern price of the funding, the possibility should bring about wonderful returns.

Companies commonly use the weighted common price of capital for the cut price fee, as it takes into attention the fee of go back predicted with the aid of using shareholders. The DCF has limitations, mainly in that it is predicated on estimations of destiny coins flows, that could show inaccurate.

A coin’s glide assertion is one of the maximum essential financial statements for a mission or commercial enterprise.

A coin’s glide assertion is a list of the flows of coins into and out of the commercial enterprise or mission.

Think of it as your bank account on the bank. Deposits are the coins influx and withdrawals (checks) are the coins outflows. The stability to your bank account is your internet coins glide at a particular factor in time.

A coin’s glide assertion is a list of coins flows that took place at some stage in the beyond accounting period.

A projection of destiny flows of coins is referred to as a coin’s glide budget.

A coin’s glide assertion isn't always best involved with the amount of the coins flows however additionally the timing of the flows. Many coins flows are built with more than one time periods.

For example, it is able to listing month-to-month coins inflows and outflows over a year’s time. It now no longer bests tasks the coins stability closing on the cease of the 12 months however additionally the coins stability for every month.

Q10) Explain the term depreciation and its type?

A10)

Depreciation

- Its loss in value of property due to it use, life, wear, tear, decay, and obsolescence.

- This is about assessment of physical wear and tear of building or property and it depends upon its original conditions, quality of maintenance and mode of use

- The value of building or property decrease gradually upto utility period due to depreciation.

Depreciation types:

There have three types of method explain as follows: -

a) Straight line method: -

- This method of property is assuming to lease value by constant amount at every year and fixed amount of original cost is written off every year so, that at end at term when asset is worm our, only scrap value removal.

- Annual depreciation = (original cost – scrap value) / life in year.

b) Constant percentage method / declining balance method: -

- In this method the property which can assume to lose value annually at constant percentage of its value.

- By constant percentage method at end of first year the value of property,

= C (1 – P) at end of 2nd year.

= C (1- p) (1- p) = C (1- p) ^2 and so on.

- Hence at end of n year value of property became ultimately scrap value

= C (1 – p) ^ n

- Or

- P = 1- (sc / C) ^ (1/n).

- Above formula does not hold good when scrap value is zero.

c) Quantities survey method: -

In this method, the property is studied in details and extends of physical deterioration work out in endeavors to calculate depreciation.

Q11) What is depletion?

A11)

Depletion is an accrual accounting method used to allocate the fee of extracting herbal sources including timber, minerals, and oil from the earth. Like depreciation and amortization, depletion is a non-coin’s fee that lowers the fee price of an asset incrementally thru scheduled costs to income.

Depletion additionally lowers the fee of an asset incrementally via scheduled expenses to income.

Where it differs is that it refers back to the slow exhaustion of herbal useful resource reserves, in place of the carrying out of depreciable property or the growing old existence of intangibles.

Depletion fee is usually utilized by miners, loggers, oil and fuel line drillers, and different groups engaged in herbal useful resource extraction.

Enterprises with a financial hobby in mineral belongings or status wooden may also apprehend depletion charges in opposition to the ones property as they're used. Depletion may be calculated on a fee or percent basis, and organizations commonly have to use whichever offers the bigger deduction for tax purposes.

In accounting and economic reporting, depletion is supposed to assist efficaciously classify the price of the belongings at the stability sheet and report costs at the earnings assertion inside the precise period.

When the prices related to the exploitation of herbal sources are capitalized, the prices are dispensed systematically over diverse intervals primarily based totally at the sources extracted. The prices are carried at the face of the stability sheet till the fees are recognized.

There are essential varieties of depletion allowance: the share depletion and price depletion. In order to decide which prices want to be dispensed for using herbal sources, account should be taken of every precise step of output. The foundation of depletion is the capitalized prices that have been decreased over numerous accounting intervals. Four key elements are influencing the inspiration of depletion:

- Acquisition: It refers back to the prices related to the acquisition or rent of land possession rights, which the purchaser claims have herbal sources.

- Exploration: Expenses associated with digging be neat the leased or bought belongings.

- Development: These are prices had to put together the land for the exploitation of herbal sources, which includes tunneling or the development of wells.

- Restoration: Costs related to returning the belongings upon finishing touch to its unique state.

Q12) What is arbitration?

A12)

It is settlement of dispute to decision not is taken as regular and ordinary court of law but one or more person chosen by parties themselves called as arbitrator,

This arbitration is domestic court where arbitrator acts as judge.

The arbitrator can either proceed on basis of knowledge or taken evidence or then give his decision on such Incidence.

Need for arbitration: -

The misinterpretation of project plan and contract clauses are closed to come in course of new construction implementation and various other reason enumerators earlier, dispute like to come between two parties.

These types disputes are only solved by through law court or arbitration our complex and based law system make judgment through law court extremely time consuming up to 20 years.

Department officer should themselves make every effort to appoint arbitration for quick disposal of such cases it should understand this progress of important and national development projects are jeopardizing to want timely settlement of such problems.

Power of arbitrator: -

- To administer to any party of arbitration aggression in the option arbitrator.

- To administer pledged to parties and witnesses appearing.

- To state special particular case for opinions of court.

- To correct of mistake in award arise from exception.

- To make the award alternative or qualified.

Qualification of arbitrator: -

- The arbitrator must be judicial and impartial i. e. The arbitrator which not related personally to any parties and he will be free from ill feeling of any parties.

- He can person who has expert knowledge in particular branch of professional and matter of dispute.

- He has undeniable, high integrity, un shaken faith in justice.

- The person who not below the rank superintendent engineer which selected generally arbitrator.

Qualities of arbitrator: -

- Arbitrator which be important and fair to both disputes parties during arbitration process.

- He has to play of role of third party and disinterested judge of process of arbitration

- He must give equal opportunity to both disputes parties which collection evidence.

- The arbitrator should consciously and always abide by norm of natural justice and equality while carry out arbitration proceedings.

Type of arbitration: -

Following two types of arbitration: -

a) Voluntary arbitration.

b) Compulsory arbitration.

Above type is explain as follows

a) Voluntary arbitration: -

- In this arbitration, is the binding Adversarial Dispute Resolution process in which dispute parties choose one or more arbitrator to hear dispute and to tender a final decision or award after expedition hearing voluntary arbitration implies that two contending parties, unable to compromise their difference by themselves which help of mediator or conciliator, agree to submit dispute bro impartial authority, whose decision they are ready to accept.

- This type reference is called as ‘voluntary reference’ for parties themselves voluntary to come settlement an arbitration machinery.

- The essential elements in voluntary arbitration are, the voluntary submission of dispute to arbitrator.

- The subsequent attendance of witness and investigation, the enforcement of awards is not necessary and binding because there is no compulsive.

- Voluntary arbitration may be special needs for dispute rise under agreement.

b) Compulsory arbitration: -

- In this arbitration, is a non binding, adversaries dispute resolution process which is one or more arbitration hear argument, weigh evidence and issue a non binding judgments on merits after expedited hearing.

- The arbitrator decision address only disputes legal issues and applies legal standards, either party is rejected ruling and request Trial De Novo in court.

- Compulsory arbitration is the parties are required to accept arbitration without any willing ness on this part.

- When one of parties to industry dispute feel aggressive act in other, it may apply to appropriate government to refer to dispute to adjudication machinery.

- This type of reference of dispute is known ‘compulsory or Involuntary’ reference, because reference in such circumstances which not depend on the contending parties.

Q13) Explain Break even cost analysis?

A13)

Break even evaluation is the analytical method used to observe the impact on earnings with adjustments in fee of manufacturing, quantity of manufacturing and charges of very last products.

This analytical method is referred to as CVP evaluation. The spoil even evaluation is maximum typically recognized shape of CVP evaluation. Break even evaluation establishes a courting among fee and sales with recognize to quantity.

Break even evaluation is undertaken to pick out the Break Even Point (BEP) manufacturing BEP fees and revere are identical That is there aren’t any earnings and no loss. It is an equilibrium factor at which the organization does now no longer make any income nor incuse any loses

This manner that if the amount bought is under the BEP the organization will incur a louse and if manages to sell above the BEP it's going to make income. However, if the organization fails to boom the amount that its income it is able to as an alternative make income through reshaping the constant prices.

Reduction of fixed cost

Reduction of variable cost

Increasing the promoting rate in their products

The organization may want to undertake one or all the above alternatives to enhance its backside line. However, through doing so it might be decreasing the breakeven factor The organization might now have a brand new breakeven factor which might be decrease than the only before thereby permitting the organization to make income.

- BEP Calculations:

In the linear CVP (Cost Volume Profit) evaluation model, the spoil-even factor may be measured in phrases of Total Revenue (TR) and Total Costs (TC)

BEP is in which the full sales are precisely identical to total cost

That is total revenue is equal to total costs

TR= TC

Total sales is the quantity of sales generated through the organization and is identical to amount (Q) improved through promoting rate (P)

Total cost is the sum of constant (P) and variable (V)

TR-TC = profit

P x Q – (F+V x Q) = 0

Q= F x (P-V)

BEP = FC/ (P-VC)

- Assumptions of Break Even Analysis:

Break even evaluation is primarily based totally on the subsequent assumptions

- Break-even evaluation assumes that constant prices are steady however in actual conditions that is actual most effective within side the brief length of time. In the long time constant prices go through extrude and have an effect on the BEP.

- Break-even evaluation assumes that common variable prices are steady in step with unit of output at least within side the range of possibly portions of income.

- Break-even evaluation assumes that the amount of products produced is identical to the amount of products bought.

- Applications of Break Even Analysis

Break even evaluation lets in an enterprise company

a) To Measure earnings and losses at diverse degrees of manufacturing

b) To Measure earnings and losses at diverse degrees of income.

c) To are expecting and calculate the impact of adjustments in rate of income.

d) To observe the connection among constant fee and variable fee.

e) To forecast the impact on profitability whilst fee and performance adjustments.