Unit - 2

Methods of economic analysis

Q1) Explain the methods of economic analysis.

A1) Different methods of economic analysis are discussed below-

Figure: Methods of economic analysis

1. Deductive Method

The deductive method involves reasoning from a few fundamental propositions, the truth of which is assumed. For example:

- Let there be 360 degrees in circle – (A general assumption)

- There are four right angles in circle – (A logical argument)

- Therefore this right angle has 90 degrees – (A particular conclusion)

2. Inductive Method

The inductive method involves collection of facts, drawing conclusions from them and testing the conclusions by other facts. For example:

- This apple falls to the ground. (A particular observation)

- All apples fall to the ground. (More observations)

- All objects attract each other. (A general explanation)

The inductive method which is also called empirical method derives economic generalisations on the basis of experience and observations. In this method detailed data are collected with regard to a certain economic phenomenon and effort is then made to arrive at certain generalisations which follow from the observations collected. But, it is worth mentioning that the number of observations has to be large if it can yield a valid economic generalisation. One should not generalise on the basis of a very few observations. There are three ways which can be used for deriving economic principles and theories.

Q2) State the steps involved in deductive methods of economic analysis.

A2) The principal steps in the process of deriving economic generalisations through deductive logic are:

(a) Perception of the Problem:

In any scientific enquiry, the analyst or theorist must have a clear idea of the problem to be enquired into. He must know the significant variables regarding whose behaviour and interrelationship he wants to derive generalisations. The perception of the problem is by no means an easy task.

(b) Definition of Technical Terms and Making of Assumptions:

The next step in the process of deriving economic generalisations is to define precisely and unambiguously the various technical terms to be used in the analysis as well as to state clearly the assumptions he makes to derive generalisations

(c) Deducing Hypotheses through Logical Deduction:

The next step in deriving generalisations through deductive logic is deducing hypotheses from the assumptions or premises taken. A hypothesis describes relationship between factors affecting a phenomenon; it establishes the cause and effect relationship between the variables having a bearing on the phenomenon. Then, through logical process, hypothesis is deduced from the assumptions made. This logical reasoning may be carried out verbally or it may be conducted in symbolic terms using the language of what is known as symbolic logic.

(d) Testing or Verification of Hypotheses:

Hypotheses obtained above have to be verified before they are established as generalisations or principles of economics. For the verification of hypotheses, economists cannot make controlled experiments, because they have to discover uniformities in behaviour patterns of man. We cannot make experiments with man under controlled conditions, such as in laboratories as physical scientists make experiments with inanimate objects of nature and biologists make these with animals and plants. Therefore, economists have to rely on uncontrolled experience and observations. The information regarding uncontrolled experience about the behaviour patterns concerning variables about man and the economy are quite amply available. The reliance by economists on uncontrolled experiences, however, does increase the number of observations required to verify the hypotheses or to establish the generalisations.

Q3) Discuss the Steps in Inductive Method.

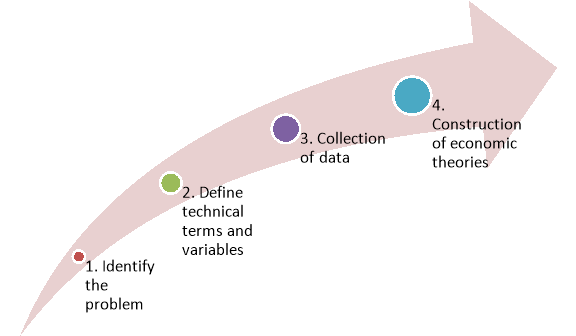

A3) Various steps are gone through in developing economic theories through inductive method.

Figure: Steps in inductive method

- To identify the problem.

- Define technical terms and variables related to the problem.

- The collection of data about the variables related to the problem and doing some preliminary thinking about the possible functional relationships between the relevant variables.

- The construction of economic theories in this method is the processing of data collected and finding out what relations between the variables actually hold good.

Q4) Discuss the effect of borrowing on investment.

A4) The borrowing effect on investment is explained with the help of crowding out effect. One of the most common forms of crowding out takes place when a large government, such as that of the U.S., increases its borrowing and sets in motion a chain of events that results in the curtailing of private sector spending. The sheer scale of this type of borrowing can lead to substantial rises in the real interest rate, which has the effect of absorbing the economy's lending capacity and of discouraging businesses from making capital investments. One channel of crowding out is a reduction in private investment that occurs because of an increase in government borrowing. If an increase in government spending and/or a decrease in tax revenues leads to a deficit that is financed by increased borrowing, then the borrowing can increase interest rates, leading to a reduction in private investment. There is some controversy in modern macroeconomics on the subject, as different schools of economic thought differ on how households and financial markets would react to more government borrowing under various circumstances.

Types of Crowding out Effects are discussed below-

1. Economies

Reductions in capital spending can partially offset benefits brought about through government borrowing, such as those of economic stimulus, though this is only likely when the economy is operating at capacity. In this respect, government stimulus is theoretically more effective when the economy is below capacity. If this is the case, however, an economic downswing may occur, reducing revenues the government collects through taxes and spurring it to borrow even more money, which can theoretically lead to a vicious cycle of borrowing and crowding out.

2. Social Welfare

Crowding out may also take place because of social welfare, albeit indirectly. When governments raise taxes in order to introduce or expand welfare programs, individuals and businesses are left with less discretionary income, which can reduce charitable contributions. In this respect, public sector expenditures for social welfare can reduce private-sector giving for social welfare, offsetting the government's spending on those same causes. Similarly, the creation or expansion of public health insurance programs such as Medicaid can prompt those covered by private insurance to switch to the public option. Left with fewer customers and a smaller risk pool, private health insurance companies may have to raise premiums, leading to further reductions in private coverage.

3. Infrastructure

Another form of crowding out can occur because of government-funded infrastructure development projects, which can discourage private enterprise from taking place in the same area of the market by making it undesirable or even unprofitable. This often occurs with bridges and other roads, as government-funded development deters companies from building toll roads or from engaging in other similar projects.

Q5) Define the term national income.

A5) National Income of any country means the complete value of the goods and services produced by any country during its financial year. In other words, the national income of any country is the total amount of income that is accrued by it through various economic activities in one year. It is also helpful in determining the progress of the country. It includes wages, interest, rent, profit, received by factors of production like labour, capital, land and entrepreneurship of a nation. National income is an uncertain term and is often used interchangeably with the national dividend, national output, and national expenditure. It includes payments made to all resources either in the form of wages, interest, rent, and profits. The progress of a country can be determined by the growth of the national income of the country. There are mainly two types of view to define national income.

According to Marshall: “The labour and capital of a country acting on its natural resources produce annually a certain net aggregate of commodities, material and immaterial including services of all kinds. This is the true net annual income or revenue of the country or national dividend.”

Q6) Discuss different concepts of national income.

A6) The concept of national income are discussed below-

Figure: Concepts of National Income

1. GDP at market price: Is money value of all goods and services produced within the domestic domain with the available resources during a year.

GDP = (P*Q)

Where,

GDP = gross domestic product

P = Price of goods and services

Q= Quantity of goods and services

GDP is made up of 4 Components

a) Consumption

b) Investment

c) Government expenditure

d) Net foreign exports of a country

GDP=C+I+G+(X-M)

Where,

C=Consumption

I=Investment

G=Government expenditure

(X-M) =Export minus import

2. Gross National Product (GNP): Is market value of final goods and services produced in a year by the residents of the country within the domestic territory as well as abroad. GNP is the value of goods and services that the country's citizens produce regardless of their location.

GNP=GDP+NFIA or,

GNP=C+I+G+(X-M) +NFIA

Where,

C=Consumption

I=Investment

G=Government expenditure

(X-M) =Export minus import

NFIA= Net factor income from abroad.

3. Net National Product (NNP) at MP: Is market value of net output of final goods and services produced by an economy during a year and net factor income from abroad.

NNP=GNP-Depreciation

Or, NNP=C+I+G+(X-M) +NFIA- IT-Depreciation

Where,

C=Consumption

I=Investment

G=Government expenditure

(X-M) =Export minus import

NFIA= Net factor income from abroad.

IT= Indirect Taxes

4. National Income (NI): Is also known as National Income at factor cost which means total income earned by resources for their contribution of land, labour, capital and organisational ability. Hence, the sum of the income received by factors of production in the form of rent, wages, interest and profit is called National Income.

Symbolically or as per the formula

NI= NNP +Subsidies-Interest Taxes

Or, GNP-Depreciation +Subsidies-Indirect Taxes

Or, NI=C+G+I+(X-M) +NFIA-Depreciation-Indirect Taxes +Subsidies

5. Personal Income (PI): Is the total money income received by individuals and households of a country from all possible sources before direct taxes. Therefore, personal income can be expressed as follows:

PI=NI-Corporate Income Taxes-Undistributed Corporate Profits

Social Security Contribution +Transfer Payments

6. Disposable Income (DI): It is the income left with the individuals after the payment of direct taxes from personal income. It is the actual income left for disposal or that can be spent for consumption by individuals.

Thus, it can be expressed as:

DI=PI-Direct Taxes

7. Per Capita Income (PCI): It is calculated by dividing the national income of the country by the total population of a country.

Thus, PCI=Total National Income/Total National Population

8. Private income: Private income is income obtained by private individuals from any source, produce or otherwise and retained income of corporations. It can be obtained from NNP at factor cost by making certain additions and deductions.

Private Income = National income (NNP at factor cost) +Transfer Payments + Interest on Public Debt – Social Security – Profits and Surpluses of Public Undertakings.

Q7) Explain the methods of measurement of national income.

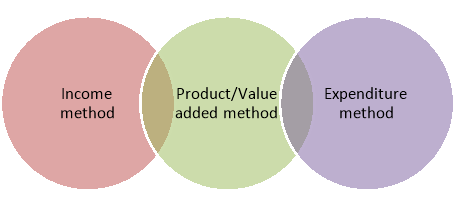

A7) There are three methods to calculate National Income:

- Income Method

- Product/ Value Added Method

- Expenditure Method

Figure: Measurement of national income

- Income Method

In this National Income is measured as flow of income.

It can calculate NI as:

Net National Income = Compensation of Employees+ Operating surplus mixed (w +R +P +I) + Net income + Net factor income from abroad.

Where,

W = Wages and salaries

R = Rental Income

P = Profit

I = Mixed Income

2. Product/ Value Added Method

In this National Income is measured as flow of goods and services.

It can calculate NI as:

NATIONAL INCOME = G.N.P – COST OF CAPITAL – DEPRECIATION – INDIRECT TAXES

3. Expenditure Method

In this National Income is measured as flow of expenditure.

It can calculate NI through Expenditure method as:

National Income=National Product=National Expenditure.

Q8) Explain the importance of national income in an economy.

A8) The significance of national income are discussed below

(a) A reflection of the economic activity:

National income estimates give us detailed data relating to a country’s production, savings, investment, capital formation and various other economic activities in a particular year. All these data give us a comprehensive picture of the economic activities of the people during that year.

(b) Assessment of economic activity:

The national income data relating to the sources of national income give us an idea of the relative importance of the different sectors (namely, agriculture, industry, trade and commerce, services, etc.) in the economy of the country.

(c) Indispensable to government for framing policies and programmes:

The government of a country is to frame its economic policies and programmes on the basis of the estimates of the different components of national income. The importance of these estimates has increased considerably in developing countries in framing their future development plans.

(d) The pivot of economic planning:

National income estimates constitute the pivot of economic planning as the entire machinery of planning is based on “an appraisal of existing resources and an accurate diagnosis of deficiencies” furnished by the national income estimates. These estimates enable the government to determine the allocation of the country’s resources on the different heads of development.

(e) Input-output analysis:

National Income data are also very useful for studying, as done by Prof. W. W. Leontief, the structure of the economy through the input-output analysis.

(f) Measurement of inflationary and deflationary gaps:

Modern economists take the help of the national income data for measuring the inflationary or deflationary gaps found at any time in a country.

(g) Social accounting and the framing of the budget:

National income figures serve as the background of ‘Social Accounting’ and the government’s annual budgets are also framed in the context of the country’s national income estimates.

(h) Measuring the rate of growth and the per capita income:

The annual rate of increase in national income is considered to be the rate of economic growth of a country. Moreover, the per capita income of the people of a country is also calculated dividing the national income by the total population of a country in a particular year.

(i) Comparison of living conditions:

The national income data are also very useful for comparing the overall economic conditions, especially living conditions of the people of the different countries and at different times.

Q9) State the limitations of the national income.

A9) The limitations of national income-

1. First, national in curve figures are not accurate. This is inevitable because measuring the economic activity of an entire country can never be done precisely. People sometimes fail to fill in forms or they complete them inaccurately.

2. The ‘black economy’ distorts the figures. This is the name given to work that is not reported to the authorities.

3. A rise in national income may not mean a rise in living standards. This is because the rise may occur as a result of increased spending on items such as defence, which do not improving living standards. Similarly, an increase in national income may be accompanied by a rise in undesirable externalities, such as pollution, or a fall in the quality of goods.

4. The accounts only measure paid activities. They, therefore, exclude do-it-yourself activities and the work of housewives. If over a period of years there is a rise in such activities, then this will not be shown in the official figures and comparisons over several years will be inaccurate.

In most countries of Africa and Asia, women collect water and wood, people build their own houses and live off food that they have grown. If these unpaid activities are not counted, then the figures will greatly underestimate the level of GNP in these countries.

5. National income often rises in time of war, or the threat of war, because money is spent on weapons. This will push up GNP, but the people may be acutely short of goods to buy.

6. When making comparisons with the past, adjustments have to be made to allow for inflation. Hence it is important when looking at the figures to see whether they are in nominal terms, i.e., the actual figures not adjusted to remove the effects of inflation.

The extent of inflation can be calculated fairly accurately over a short period, such as one year, but it is much more difficult to do so over a long period. One reason is that new products appear and existing ones become obsolete, so it is impossible to measure price rises accurately.

7. Another adjustment that has to be made when making comparisons with the past is that the figures have to be adjusted to allow for population changes. If national income has risen by 10%, but population has also risen by 10%, the average person is no better- off.

8. Many factors affect the quality of life but are excluded from GNP. Over the last few decades, people have come to enjoy more leisure, largely because they work fewer days. The national accounts take no note of this. Similarly, the quality of many products has improved— a modern TV is far superior to one made many years ago.

9. Finally, the figures say nothing about the distribution of income within a country. In some countries a small elite has a large share of the economic cake; in such countries figures showing a high average income per head may give the wrong impression of typical living standards.

Q10) What is GDP at market price?

A10) GDP at market price refers to the money value of all goods and services produced within the domestic domain with the available resources during a year.

GDP = (P*Q)

Where,

GDP = gross domestic product

P = Price of goods and services

Q= Quantity of goods and services

GDP is made up of 4 Components

a) Consumption

b) Investment

c) Government expenditure

d) Net foreign exports of a country

GDP=C+I+G+(X-M)

Where,

C=Consumption

I=Investment

G=Government expenditure

(X-M) =Export minus import

Q11) What is GNP?

A11) GNP refers to the market value of final goods and services produced in a year by the residents of the country within the domestic territory as well as abroad. GNP is the value of goods and services that the country's citizens produce regardless of their location.

GNP=GDP+NFIA or,

GNP=C+I+G+(X-M) +NFIA

Where,

C=Consumption

I=Investment

G=Government expenditure

(X-M) =Export minus import

NFIA= Net factor income from abroad.

Q12) What is NNP at market price?

A12) NNP at market price refers to market value of net output of final goods and services produced by an economy during a year and net factor income from abroad.

NNP=GNP-Depreciation

Or, NNP=C+I+G+(X-M) +NFIA- IT-Depreciation

Where,

C=Consumption

I=Investment

G=Government expenditure

(X-M) =Export minus import

NFIA= Net factor income from abroad.

IT= Indirect Taxes

Q13) What is personal income?

A13) Personal income is the total money income received by individuals and households of a country from all possible sources before direct taxes. Therefore, personal income can be expressed as follows:

PI=NI-Corporate Income Taxes-Undistributed Corporate Profits-

Social Security Contribution +Transfer Payments

Q14) What is the disposal income?

A14) Disposable income is the income left with the individuals after the payment of direct taxes from personal income. It is the actual income left for disposal or that can be spent for consumption by individuals.

Thus, it can be expressed as:

DI=PI-Direct Taxes

Q15) What is private income?

A15) Private income is income obtained by private individuals from any source, produce or otherwise and retained income of corporations. It can be obtained from NNP at factor cost by making certain additions and deductions.

Private Income = National income (NNP at factor cost) +Transfer Payments + Interest on Public Debt – Social Security – Profits and Surpluses of Public Undertakings.