Unit - 3

Inflation

Q1) What is inflation? State the features of inflation.

A1) Inflation refers to general increase in price level of commodities and decrease in value of money. In other words, when the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy.

Example

For Rs.100, last week you bought 5 Kg. Of rice. This means that the cost of 1Kg of rice was Rs. 20. This week when you approached the same shop-keeper and paid Rs.100 to get rice, he gave only 4 Kg of rice. He also explained that the price of rice has increased, and now it is Rs.25 per Kg. This example clearly explains the fall in the purchasing power of money. For Rs. 100 you could get 5 Kg rice before, but now only 4 Kg. So purchasing power of money got reduced. This is inflation.

Features of inflation

1. Inflation is always accompanied by a rise in the price level. It is a process of uninterrupted increase in prices.

2. Inflation is a monetary phenomenon and it is generally caused by excessive money supply.

3. Inflation is a dynamic process which can be observed over the long period.

4. Inflation is basically an economic phenomenon. It originates within the economic system and is fostered by interaction of economic forces.

5. Excess of demand over the available supply is the hall mark of inflation. It is a condition of economic disequilibrium.

6. Inflation is generally considered a monetary phenomenon for it is normally characterized by an excessive money supply. Though all increases in the stock of money may not be inflationary yet a persistent rise in prices cannot be sustained unless the quantity of money rises as well.

Q2) How inflation is measured?

A2) The measurement of inflation are-

Figure: Measurement of inflation

- Wholesale Price Index (WPI) – It is estimated by the Ministry of Commerce & Industry and measured on a monthly basis.

- Consumer Price Index (CPI) – It is calculated by taking price changes for each item in the predetermined lot of goods and averaging them.

- Producer Price Index – It is a measure of the average change in the selling prices over time received by domestic producers for their output.

- Commodity Price Indices – It is a fixed-weight index or (weighted) average of selected commodity prices, which may be based on spot or futures price

- Core Price Index – It measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices. It is a way to measure the underlying inflation trends.

- GDP deflator – It is a measure of general price inflation.

Q3) State the effect of inflation in an economy.

A3) The effects of inflation on the economy are:

- It leads to chances of hidden costs for different goods and services in the economy.

- Inflation causes market instability and thereby make it difficult for companies to plan a budget for the long-term.

- Inflation can act as a drag on productivity as companies are forced to mobilize resources away from products and services to handle the situations of profit and losses from inflation.

- Moderate inflation enables labour markets to reach equilibrium at a faster pace

Q4) Discuss the causes of inflation.

A4) The causes of inflation are discussed below-

Figure: Causes of inflation

1. Demand-pull inflation

Demand-pull inflation happens when the demand for certain goods and services is greater than the economy's ability to meet those demands. When this demand outpaces supply, there's an upward pressure on prices - causing inflation.

2. Cost-push inflation

Cost-push inflation is the increase of prices when the cost of wages and materials goes up. These costs are often passed down to consumers in the form of higher prices for those goods and services.

3. Increased money supply

Increased money supply is defined as the total amount of money in circulation, which includes cash, coins, and balances and bank accounts according to the Federal Reserve. If the money supply increases faster than the rate of production, this could result in inflation, particularly demand-pull inflation because there will be too many dollars chasing too few products. An increase in money supply is usually created by the Federal Reserve through a process called Open Market Operations (OMO).

4. Devaluation

Devaluation is downward adjustment in a country's exchange rate, resulting in lower values for a country's currency. The devaluation of a currency makes a country's exports less expensive, encouraging foreign nations to buy more of the devalued goods. Devaluation also makes foreign products for the devaluing country more expensive which encourages citizens of the devaluing country to buy domestic products over foreign imports.

5. Rising wages

Rising wages is exactly what it sounds like - an increase in what's being paid to workers. "Wages are a cost of production," adds Baker. "If wages rise a large amount, businesses will either have to pass the cost on, or live with lower margins. The exception is if they can offset wage growth with higher productivity."

Q5) Discuss the demand pull theory of inflation.

A5) Demand pull inflation is also known as traditional process. The essence of this theory is that inflation is caused by an excess of demand (spending) relative to the available supply of goods and services at existing prices. According to classical, the key factor is the money supply because in accordance with the quantity theory of money only an increase in the money supply is capable of raising the general price level. In modern income theory, however, demand-pull is interpreted to mean an excess of aggregate money demand relative to the economy’s full employment output level. The theory assumes that prices for goods and services as well as for economic resources are responsive to supply and demand forces, and will, thus, moves readily upward under the pressure of a high level of aggregate demand.

As a result of this excess demand, prices will rise and excess demand inflation or demand-pull inflation comes to exist. Thus, we find that according to this theory of demand-pull inflation, prices rise in response to an excess of aggregate demand over existing supply of goods and services caused by an increase in the quantity of money—resulting in a fall of interest rates—increasing investment expenditures and prices. But demand-pull inflation may also be caused without an increase in money supply—when MEC or MPC goes up causing an increase in expenditures and hence prices. Since inflation is due to excess demand, it is considered controllable by the demand reducing monetary and fiscal policies. Excess demand approach is further developed by Bent Hansen, Keynes, Wicksell and Sweedish economists. Their view is that the general price is determined by the total demand for and total supply of goods just as the price of any good is determined by the forces of demand and supply for it.

According to them inflation is a situation caused by excess demand, in which the total demand for goods as measured by the volume of money offered is in excess of supply of goods at prevailing prices. But a deeper analysis will show that there is very little difference between the two approaches, that is, the approach of quantity theory supported by Milton Friedman that excess demand is caused by excess money supply and Bent Hansen-Keynes approach that excess demand is caused by increased expenditures on C and I, especially when it is realized that excess demand can become effective only by means of an increased supply of money.

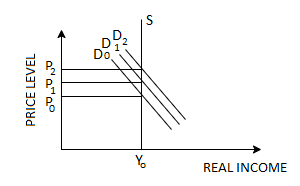

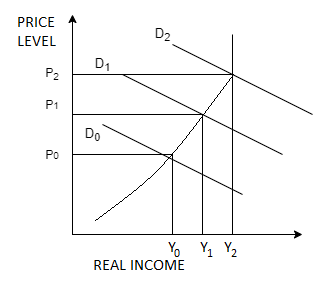

The figure 1 shows that pure-demand-inflation theorists tend to assume that at some income level Y0 in the Figure corresponding to full-employment, the aggregate supply function becomes completely inelastic, as drawn. No income level lower than Y0 is a full-employment one, and increases in demand beyond D0, to D1 and D2 raise the price level from P0 to P1 and P2.

Fig. 1: Pure demand inflation

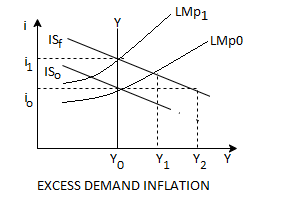

Consider the figure 2, which analyses the working of excess demand inflation irrespective of the fact whether excess demand is caused by increased money supply or by expenditures on C and I.

Let us suppose that the full-employment level of output remains fixed at Y0. General equilibrium is established at Y0 and i0 with price level p0. An increase in the price level may now come about as a result of an increase in aggregate demand, which shifts the IS0 schedule to IS1; the resulting excess demand of Y1 – Y0 leads to a bidding up prices so that the real value of the money supply shrinks and the LMp0 schedule shifts to LMp1, where general equilibrium is again established at the higher interest rate i1 and higher price level p1.

Fig. 2: Working of excess supply in inflation

Q6) Discuss the cost push inflation theory of economics.

A6) The theory of cost-push inflation became popular during and after the Second World War. This theory maintains that prices instead of being pulled-up by excess demand are also pushed-up as a result of a rise in the cost of production. Under cost-push inflation prices rise on account of a rise in the cost of raw materials, especially wages. The theory holds that the basic explanation for inflation is the fact that some producers, group of workers or both, succeed in raising the prices for either their product or services above the levels that would prevail under more competitive conditions.

In other words, inflationary pressures originate with supply rather than demand and spread throughout the economy. Inflation of the cost-push type originate in industries which are relatively concentrated and in which sellers can exercise considerable discretion in the formulation of both prices and wages. Cost-push inflation may not be possible in an economy characterized by pure competition.

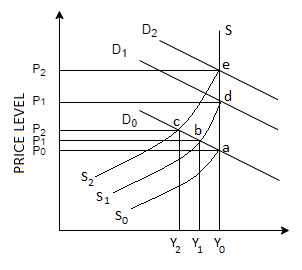

Since this inflation is due to the forces of cost and supply, it is not subject to easy treatment because fiscal and monetary measures may cure a cost inflation only at the expense of increasing unemployment and slower growth. That is why many cost-push inflation experts advocate mitigation rather than elimination of inflation. The image 3 illustrates the pure cost-push inflation phenomenon:

Fig. 3 shows that according to pure supply (cost-push) inflation theorists—in societies of oligopolies, unions and other pressure groups the aggregate supply curve moves upwards from S0 to S1to S2 whatever may happen to aggregate demand. A usual characteristic of such markets is that the money wage rate is inflexible downward, the result of which is an aggregate supply curve of the kind shown by S0S. With the initial SoS and D0 curves in the image 3, we can turn to the process by which increases in the money wage rate push up the price level. We assume that there is an increase in the money wage rate that results entirely from the exploitation of the market strength of labour unions and in no part from increased productivity of labour or increased demand for labour. Increase in wage rate has pushed S0S curve to S1S.

Fig. 3: Cost push inflation

The price level at which each possible level of output will be supplied increases proportionally with the increase in the money wage rate. With aggregate demand of D0, the result of the higher money wage rate and the resultant upward shift in SS function from S0S to S1S is a rise in the price level from P0 to P1 and a fall in the output level from Y0 to Y1 (which results in unemployment).

Q7) Discuss the mixed demand inflation.

A7) The problem of identifying the basic nature-and fundamental source of inflation continues. Does inflation arise from the demand side of the goods, factor and asset markets or from the supply side or from some combination of the two—the so-called mixed inflation. Many economists have come to believe that the actual process of inflation is neither due to demand-pull alone, nor due to cost-push alone, but due to a combination of both the elements of demand-pull and cost-push—called mixed inflation.

The process may be initiated either by demand-pull or by cost-push but it cannot be maintained unless other forces also operate activity. The major difference between the two theories of the inflationary process centres on the responsiveness of both the money wages and prices to change in demand. Those who believe that there is wage and price flexibility in the economy argue in favour of demand- pull inflation; because such flexibility renders it impossible for any cost induced inflationary trend to sustain itself.

On the other hand, those who believe that wages and prices are not flexible emphasize the cost-push theory or inflation. Neither approach taken by itself should be considered a completely satisfactory explanation of the cause and nature of inflation—both the approaches are supplementary rather than competitive (or alternative) as explanations of the cause of inflation. The adjacent Figures show cases of mixed inflation.

One variety of mixed-inflation theory (in image 4) denies for several reasons (one of them money illusion), that aggregate supply is price-inelastic at full employment. In the image 4 (Y0, P0), (Y1, Y1,) and (Y2, P2) are all full- employment positions in that no involuntary unemployment exists. The first corresponds to A.P. Lerner’s “low full employment” with substantial voluntary unemployment, and the last to his “high full employment” with little or none.

The region between low and high full employment was called by Keynes “semi-inflation” in contrast to the true or full inflation. Mixed inflation theorists usually think society prefers the couple (Y2, P2) to other alternatives, even when all three are full-employment positions. In this type mixed inflation does not continue after (Y2, P2) is reached. In this respect, the solutions related more closely to demand than to cost inflation.

Figure 4: Mixed double inflation

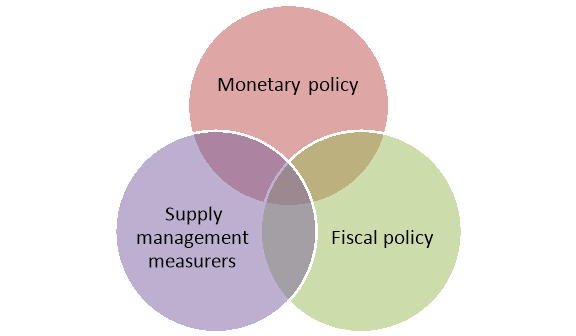

Q8) Explain the measurers to control inflation.

A8) The different remedies to solve issues related to inflation can be stated as:

Figure: Measures to control inflation

- Monetary Policy

The monetary policy of the Reserve Bank of India is aimed at managing the quantity of money in order to meet the requirements of different sectors of the economy and to boost economic growth. This policy is manifested by decreasing bond prices and increasing interest rates. This helps in reducing expenses during inflation which ultimately helps halt economic growth and, in turn, the rate of inflation.

2. Fiscal Policy

- Monetary policy is often seen separate from fiscal policy which deals with taxation, spending by government and borrowing. Monetary policy is either contractionary or expansionary.

- When the total money supply is increased rapidly than normal, it is called an expansionary policy while a slower increase or even a decrease of the same refers to a contractionary policy.

- It deals with the Revenue and Expenditure policy of the government.

Tools of fiscal policy

a) Direct Taxes and Indirect taxes – Direct taxes should be increased and indirect taxes should be reduced.

b) Public Expenditure should be decreased (should borrow less from RBI and more from other financial institutions)

3. Supply Management measures

- Import commodities that are in short supply

- Decrease exports

- Govt may put a check on hoarding and speculation

- Distribution through Public Distribution System (PDS).

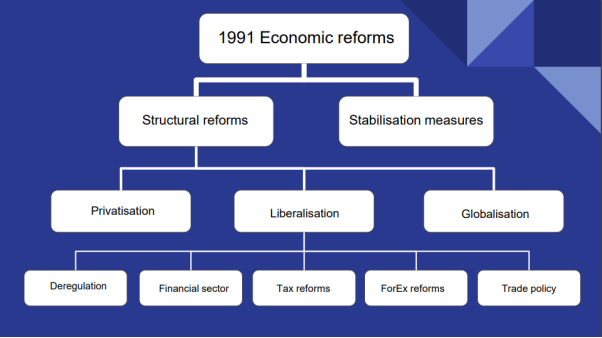

Q9) Write a small note on new economic policy.

A9) The new economic policy was introduced in 1991 by then finance minister Dr. Manmohan Singh under the leadership of P. V. Narasimha Rao. New Economic Policy refers to economic liberalisation or relaxation in the import tariffs, deregulation of markets or opening the markets for private and foreign players, and reduction of taxes to expand the economic wings of the country.

Figure: Economic reforms under new economic policy

Objectives of liberalisation

The main objectives are-

1. The main objective was to plunge Indian Economy in to the arena of ‘Globalization and to give it a new thrust on market orientation.

2. The NEP intended to bring down the rate of inflation

3. It intended to move towards higher economic growth rate and to build sufficient foreign exchange reserves.

4. It wanted to achieve economic stabilization and to convert the economy into a market economy by removing all kinds of un-necessary restrictions.

5. It wanted to permit the international flow of goods, services, capital, human resources and technology, without many restrictions.

6. It wanted to increase the participation of private players in the all sectors of the economy. That is why the reserved numbers of sectors for government were reduced.

Q10) What is privatisation? Explain the privatisation measures of new economic policy.

A10) privatisation means permitting the private sector to set up industries which were previously reserved for the public sector. Under this policy many PSU’s were sold to private sector. Literally speaking, privatisation is the process of involving the private sector-in the ownership of Public Sector Units (PSU’s). The main reason for privatisation was in currency of PSU’s are running in losses due to political interference. The managers cannot work independently. Production capacity remained under-utilized. To increase competition and efficiency privatisation of PSUs was inevitable.

The following steps are taken for privatisation:

1. Sale of shares of PSUs:

Indian Govt. Started selling shares of PSU’s to public and financial institution e.g. Govt. Sold shares of Maruti Udyog Ltd. Now the private sector will acquire ownership of these PSU’s. The share of private sector has increased from 45% to 55%.

2. Disinvestment in PSU’s:

The Govt. Has started the process of disinvestment in those PSU’s which had been running into loss. It means that Govt. Has been selling out these industries to private sector. Govt. Has sold enterprises worth Rs. 30,000 crores to the private sector.

3. Minimisation of Public Sector:

Previously Public sector was given the importance with a view to help in industralisation and removal of poverty. But these PSU’s could not able to achieve this objective and policy of contraction of PSU’s was followed under new economic reforms. Number of industries reserved for public sector was reduces from 17 to 2.

- Railway operations

- Atomic energy

Q11) Write a small note on globalisation.

A11) Literally speaking Globalisation means to make Global or worldwide, otherwise taking into consideration the whole world. Broadly speaking, Globalisation means the interaction of the domestic economy with the rest of the world with regard to foreign investment, trade, production and financial matters.

Following steps are taken for Globalisation:

(i) Reduction in tariffs: Custom duties and tariffs imposed on imports and exports are reduced gradually just to make India economy attractive to the global investors.

(ii) Long term Trade Policy: Forcing trade policy was enforced for longer duration.

Main features of the policy are:

(a) Liberal policy

(b) All controls on foreign trade have been removed

(c) Open competition has been encouraged.

(iii) Partial Convertibility of Indian currency:

Partial convertibility can be defined as to convert Indian currency (up to specific extent) in the currency of other countries. So that the flow of foreign investment in terms of Foreign Institutional Investment (FII) and foreign Direct Investment (FDI).

This convertibility stood valid for following transaction:

(a) Remittances to meet family expenses

(b) Payment of interest

(c) Import and export of goods and services.

(iv) Increase in Equity Limit of Foreign Investment:

Equity limit of foreign capital investment has been raised from 40% to 100% percent. In 47 high priority industries foreign direct investment (FDI) to the extent of 100% will be allowed without any restriction. In this regard Foreign Exchange Management Act (FEMA) will be enforced.

Q12) State the impact of new economic policy.

A12) Some of the significant impact of new economic policy on industry is discussed below-

- It provides budgetary support to central government for financing PSUs of the country.

- It increases competition in industrial sector through liberalised licensing. Many private and foreign countries are entering in the market to increase the competition.

- It promotes Indian companies to enter in the foreign market by exporting goods and services.

- It increases the inflow of foreign exchange by promoting exports among industries.

- It changes the technological environment by innovating sophisticated technology the survival and competes in the market.

- It changes the market concept from production oriented to market oriented concept.

- It also promotes human resource development because changing business environment demands new and updated skill for different job.

Q13) State the objectives of liberalisation.

A13) The main objectives are-

1. The main objective was to plunge Indian Economy in to the arena of ‘Globalization and to give it a new thrust on market orientation.

2. The NEP intended to bring down the rate of inflation

3. It intended to move towards higher economic growth rate and to build sufficient foreign exchange reserves.

4. It wanted to achieve economic stabilization and to convert the economy into a market economy by removing all kinds of un-necessary restrictions.

5. It wanted to permit the international flow of goods, services, capital, human resources and technology, without many restrictions.

6. It wanted to increase the participation of private players in the all sectors of the economy. That is why the reserved numbers of sectors for government were reduced.

Q14) What is monetary policy?

A14) The monetary policy of the Reserve Bank of India is aimed at managing the quantity of money in order to meet the requirements of different sectors of the economy and to boost economic growth. This policy is manifested by decreasing bond prices and increasing interest rates. This helps in reducing expenses during inflation which ultimately helps halt economic growth and, in turn, the rate of inflation. For example, bank rate, open market operation etc.

Q15) State any two tools of fiscal policy.

A15)

a) Direct Taxes and Indirect taxes – Direct taxes should be increased and indirect taxes should be reduced.

b) Public Expenditure should be decreased (should borrow less from RBI and more from other financial institutions)