Unit 1

Introduction

Q1) Write a short note on cost accounting?

A1) Modern business needs information about activities to be planned for the future. A major function of management is decision- making. It requires selection of an optimal course of action from among a set of alternatives. Costing techniques play an important role in gathering and analyzing revenue and cost data. It also helps to control business results and to make a proper appraisal of the performance of persons working in an organisation. Cost accounting also helps in acquiring Plant and Machinery, adding or dropping product, make or buy decision, special pricing of products and replacement of assets.

Evolution of Cost Accounting

The widespread interest in the subject of cost accounting could be said to have developed with Industrial Revolution which started in 1760. As mechanization, simplification, standardization and mass production followed in the wake of factory system, costing had to keep pace with these developments. Until the 18th century, cost accounting was in the domain of the engineer. Its integration with financial accounting began when accountants started to audit the cost records. Under the influence of financial accountant, cost accounting came to be viewed almost exclusively as a means of inventory valuation and profit measurement. It has grown only in the 20th century as an independent discipline.

Cost accounting has found to be of assistance to management, in compiling and providing requisite statistical data. It has developed rapidly and assisted management in providing valuable information to take appropriate decision in time. Cost Accounting throws light on the excessive waste of materials, inefficient labour operations, idle machinery and many other similar factors, which are responsible for reduction in the profit of the business activities. Managements found that cost accounting could render valuable assistance in planning, controlling and coordinating the activities.

Definitions

Costing:

The institute of Cost & Management Accountants (ICMA) London has defined costing as the ascertainment of costs, costing includes techniques and processes of ascertaining costs.

Cost Accountancy:

The Institute of Cost and Management Accountants (ICMA) London has defined Cost Accountancy as the “application of costing and cost accounting principles, methods and techniques to the science, art and practice of cost control and ascertainment of profitability as well as presentation of information for the purpose of management decision making”. Accordingly Cost Accountancy includes costing, cost accounting, budgetary control, cost control and cost audit. Cost accounting refers to the process of determining and accounting the cost of some particular product or activity. It also includes classification, analysis and infers production of costs.

Cost Accounting:

The I.C.M.A. London defines Cost Accounting as “the process of accounting for cost from the point at which expenditure is incurred or committed to the establishment of its ultimate relationship with cost centers and cost units”.

In practice, costing, cost accounting and cost accountancy are often used interchangeably. Costing refers to ascertainment of costs, accumulation and measurement of cost of activities, processes, products or services. Cost data are used to prepare the statement of cost or cost sheet. Cost Accounting is a specialized branch of accounting which assists management to control costs and to create an awareness of the importance of cost to wells- being of the business organization. Systematic and useful cost data and reports are required to manage the business to achieve its objectives.

Cost Centre:

Cost Centre is a location, person or an asset for which costs can be ascertained and used for the purpose of cost control. It is an organizational segment or area of activity used to accumulate costs. Different types of cost centers used in a manufacturing organization are personal cost canters, impersonal cost centers, operation cost centers and process centers.

Cost Units:

A cost unit is a unit of quantity of product or service in relation to which cost may be ascertained. There should be a unit of activity for proper ascertainment of cost. Every organization has a unit of its own for measurement of raw materials, and finished products. Once the unit of activity is decided it becomes a cost unit for the cost accountant. The cost units should be suitable to the organization. The following are the examples of cost units in different industries :-

Nature of Industry Cost Unit

Cement Tonne

Cable Metre

Power Kilowatt/ hour

Hospital Per bed

Q2) Explain nature and scope of cost accounting?

A2) Modern business needs information about activities to be planned for the future. A major function of management is decision- making. It requires selection of an optimal course of action from among a set of alternatives. Costing techniques play an important role in gathering and analyzing revenue and cost data. It also helps to control business results and to make a proper appraisal of the performance of persons working in an organisation. Cost accounting also helps in acquiring Plant and Machinery, adding or dropping product, make or buy decision, special pricing of products and replacement of assets.

Evolution of Cost Accounting

The widespread interest in the subject of cost accounting could be said to have developed with Industrial Revolution which started in 1760. As mechanization, simplification, standardization and mass production followed in the wake of factory system, costing had to keep pace with these developments. Until the 18th century, cost accounting was in the domain of the engineer. Its integration with financial accounting began when accountants started to audit the cost records. Under the influence of financial accountant, cost accounting came to be viewed almost exclusively as a means of inventory valuation and profit measurement. It has grown only in the 20th century as an independent discipline.

Cost accounting has found to be of assistance to management, in compiling and providing requisite statistical data. It has developed rapidly and assisted management in providing valuable information to take appropriate decision in time. Cost Accounting throws light on the excessive waste of materials, inefficient labour operations, idle machinery and many other similar factors, which are responsible for reduction in the profit of the business activities. Managements found that cost accounting could render valuable assistance in planning, controlling and coordinating the activities.

Definitions

Costing:

The institute of Cost & Management Accountants (ICMA) London has defined costing as the ascertainment of costs, costing includes techniques and processes of ascertaining costs.

Cost Accountancy:

The Institute of Cost and Management Accountants (ICMA) London has defined Cost Accountancy as the “application of costing and cost accounting principles, methods and techniques to the science, art and practice of cost control and ascertainment of profitability as well as presentation of information for the purpose of management decision making”. Accordingly Cost Accountancy includes costing, cost accounting, budgetary control, cost control and cost audit. Cost accounting refers to the process of determining and accounting the cost of some particular product or activity. It also includes classification, analysis and infers production of costs.

Cost Accounting:

The I.C.M.A. London defines Cost Accounting as “the process of accounting for cost from the point at which expenditure is incurred or committed to the establishment of its ultimate relationship with cost centers and cost units”.

In practice, costing, cost accounting and cost accountancy are often used interchangeably. Costing refers to ascertainment of costs, accumulation and measurement of cost of activities, processes, products or services. Cost data are used to prepare the statement of cost or cost sheet. Cost Accounting is a specialized branch of accounting which assists management to control costs and to create an awareness of the importance of cost to wells- being of the business organization. Systematic and useful cost data and reports are required to manage the business to achieve its objectives.

Cost Centre:

Cost Centre is a location, person or an asset for which costs can be ascertained and used for the purpose of cost control. It is an organizational segment or area of activity used to accumulate costs. Different types of cost centers used in a manufacturing organization are personal cost canters, impersonal cost centers, operation cost centers and process centers.

Cost Units:

A cost unit is a unit of quantity of product or service in relation to which cost may be ascertained. There should be a unit of activity for proper ascertainment of cost. Every organization has a unit of its own for measurement of raw materials, and finished products. Once the unit of activity is decided it becomes a cost unit for the cost accountant. The cost units should be suitable to the organization. The following are the examples of cost units in different industries :-

Nature of Industry Cost Unit

Cement Tonne

Cable Metre

Power Kilowatt/ hour

Hospital Per bed

Nature and Scope of Cost Accounting

Scope

Cost Accounting is very important for a commercial organization. It is also useful for any other organization. It helps management in different fields one of such fields is presentation of information in the most useful manner. Cost Accounting is used to measure, analyze or estimate the costs. Profitability and Performance of individual products, departments and other segments of an organization, for either internal or external or both and to report to the interested parties. Cost Accounting concerns itself with the synthesis and analysis of costs. Its purpose in the modern days is to help management in the twin functions of decision- making and control. Thus, Cost Accounting is not simply cost finding but it is advising management, planning and control of organization and business operations. The Companies Act also provides that certain companies have to maintain cost accounting records and accounts and conduct the audit of cost accounts.

Objectives of Cost Accounting

The cost accounting objectives are normally used to denote activities for which costs are required to be determined separately. The activities may be function, organizational sub-division, contract or other work unit for which data are required. There is direct relationship among information needs of management, cost accounting objectives and techniques and tools used for analysis in cost accounting. Thus, cost accounting has the following objectives-

- To determine product costs.

- To facilitate planning and controlling of regular business activities.

- To supply information for short and long run decisions.

Function of cost accounting

- The organization calculates the cost per unit of the different products manufactured by the them

- To provide an accurate analysis of this cost;

- It helps in controlling wastages in each process. To work out the wastage in each process of manufacture and to prepare reports as may be necessary to assist in the control of wastage;

- To provide necessary data for the fixation of selling price of commodities manufactured;

- To compute profits earned on each of the products and to advise management as to how these profits can be improved;

- To help management in control of inventory so that there may be minimum locking up of capital in stocks of raw materials, stores, work-in-process and finished goods

- To install and implement cost control systems like Budgetary Control and Standard Costing for the control of expenditure on materials, labour and overheads;

Q3) Explain management and cost accounting?

A3) Management Accounting is a tool to help the management in securing better planning and control over the organization. Many institutions hire very educated management accountants like ICMA, CIMA, ICWAI, etc. It purely works for internal parties and management. It informs internal decisions, gives feedback on operating presentation of the businesses. It also calculates financial performances. This accounting employs unique approaches like level of costing, budget control, management costing, ratio inspection, responsibility accounting, etc.

Cost accounting is a type of accounting process that aims to apprehend a company’s cost of production by evaluating the input cost of each step of production as well as fixed cost such as the devaluation of capital appliances. Cost accounting is mostly used in an organization or in a company or a firm to aid decision making. Cost accounting can be very favourable and helpful as a piece of equipment for management in setting up budget and cost control programs, which can upgrade total net margins for the company in the future.

Parameter of Comparison | Management Accounting | Cost Accounting |

Objective | The key objective of Management Accounting is to give useful details to management for decision-making. | The key objective of Cost Accounting is to give deduce and control costs. |

Types of Transactions | It deals both with financial and non-financial transactions. | It deals only with financial transactions. |

Basis | This type of accounting purely deals with future transactions. | This type of accounting deals both with present and future transactions. |

Scope | Management accounting has a wider scope as it covers the regions of financial accounts, cost accounts, and tax accounts. | Cost accounting has a confined scope as it covers matters only related to control of cost. |

Utility | Management accounting helps just for the needs of intramural management. | This accounting helps for the needs of both external and internal parties. |

Q4) Explain elements of cost?

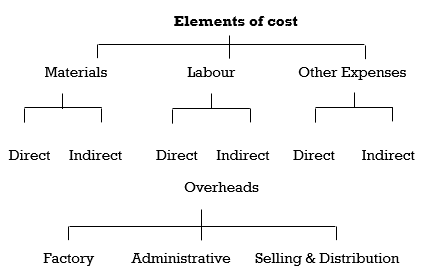

A4) A manufacturing organisation converts raw materials into finished products. For that it employs labour and provides other facilities. While compiling production cost, amount spent on all these are to be ascertained. For this purpose, cost are primarily classified into various elements. This classification is required for accounting and control.

The elements of cost are

(i) Direct material

(ii) Direct labour

(iii) Direct expenses and

(iv) Overhead expenses.

The following chart depicts the broad headings of costs and this acts as the basis for preparing a Cost sheet.

Break up of cost sheet

Classification of Cost

Prime Cost:

The aggregate of Direct material cost, Direct labour and Direct expenses is termed as Prime Cost. Direct costs are traceable to products or jobs.

Direct materials

It includes cost of materials consumed in the production process which can be directly allocated to the cost center. Direct material can be identified and charged to the finished product.

Examples:

- Material specially purchased for a specific job or process.

- Materials passing from one process to another.

- Consumption of materials or components manufactured in the same factory.

- Primary packing materials.

- Freight, insurance and other transport costs, import duty, octroi duty, carriage inward, cost of storage and handling are treated as direct costs of the materials consumed.

In certain cases direct materials are used in small quantities and it will not be feasible to ascertain their costs and allocate them directly. For instance, nails used in the manufacture of chairs and tables, glue used in the manufacture of toys. In such cases cost of the total quantity consumed for the period will be treated as Indirect costs.

Direct Labour

This includes the amount of wages which can be easily identified and directly charged to the product. These are the costs for converting raw material into finished products. Wages paid to workers for operating Lathe machines, Drilling machines etc. in a Tool room are direct wages.

Direct Expenses

This includes expenses other than materials and labour which can be easily identified with a particular product or process. For example: Excise duty expenses. Indirect costs cannot be easily identified with a particular products or process.

Indirect materials

Materials which cannot be traced as part of the finished products are known as Indirect materials.

Examples:

- Consumable stores such as lubricants, cotton wastes, tools etc.

- Materials of insignificant value not worthwhile to ascertain the cost separately, for charging directly such as nails (for making chair) glues (for making toys). These materials can be apportioned to or absorbed by cost centres or cost units arbitrarily.

Indirect labour:

Indirect labour is the cost which cannot be directly charged or identified to the finished product. Indirect labour is apportioned to or absorbed by cost centres or cost units suitably.

Examples:

- Salary to Store- keeper

- Wages to Time – keeper

Indirect Expenses:

These are general expenses not incurred for any particular product or service and not chargeable to the products directly.

Examples:

- Rent, Rates and Insurance of Factory

- Power, lighting, heating, repairs, telephone expense, printing and stationery.

Overheads can be sub-divided into following main groups.

Factory or Works Overheads: Also known as manufacturing or production overheads it consists of all costs of indirect materials, indirect labour and other indirect expenses which are incurred in the factory.

Examples: Factory rent and insurance. Depreciation of Factory building and machinery.

Office or Administration overheads: All indirect costs incurred by the office for administration and management of an enterprise.

Examples: Rent, rates, taxes and insurance of office buildings, audit fees, director’s fees.

Selling and Distribution overheads: These are indirect costs in relation to marketing and sale.

Examples: Advertising, salary and commission of sales agents, travelling expenses of salesmen.

Q5) Explain methods of cost?

A5) Methods of costing

- Job costing – under this costing, costs are collected and accumulated for each job separately. Each job has separate identity; so it becomes essential to analyse the cost according to each job. A job card is prepared for each job for cost accumulation. This method is applicable to printers, machine tool manufacturers, foundries and general engineering workshops.

2. Batch costing - This is an extension of job costing which includes production of large number of parts, in order to make a product undertake the production of each part in batches. Each hatch is treated as a unit of cost and costed separately. The cost per unit is determined by dividing the cost of the batch by the number of units produced in a batch. This method is mainly applicable in biscuits manufacture, garments manufacture and spare parts and components manufacture.

3. Process costing - This is applied in industries where production is continuous, manufacturing is carried on by well defined processes, the finished products of one process becomes the raw material of the subsequent process. Cost of each department is divided by the quantity of production to determine the cost per unit. This method is useful in industries such as paper, soap, textiles, chemicals, sugar and food processing products.

4. Operating costing – operation costing is also known as service costing. This is applied in industries which provide service as distinct from those which manufacture goods. This is suitable for hotels, hospital, municipal services, etc. this method is used to ascertain the cost of service rendered.

5. Single costing - where production is uniform and consists of only a single product or two or three types of similar products with variation only in size, shape or quality, this method is applied

6. Multiple costing - where the final product consists of a number of separate parts, e.g., radio set, motor car, bicycle etc. this method is followed. First ascertain the cost of each part and then the cost of assembling the parts will be tabulated. The cost of the final product will consist of the cost all the parts plus the cost of assembling them.

7. Uniform costing - When a number of firms in an industry agree to use the same costing principles, it is known as uniform costing. This method is used for comparison of performance in various undertaking can be made to the common advantage of all the participating units.

8. Farm costing – this method is applicable in calculation of total cost and per unit cost of various activities covered under farming. Farming activities includes agriculture, horticulture, animal husbandry, poultry farming, pisciculture, dairy, sericulture, nurseries for growing and selling of seedlings and plants and rearing of fruits and flowers.

Operation costing – this cost refers to conversion cost i.e., cost of converting the raw materials into finished goods. The cost per unit is determined with reference to final output

Q6) Explain techniques of cost?

A6)

- Uniform Costing: CIMA has defined uniform costing as “the use by several undertakings of the same costing principles and or practices.” Several undertakings uses same costing principles and practice for common control or comparison of costs.

2. Marginal Costing: It is the ascertainment of marginal cost by differentiating between fixed and variable cost. It is used to ascertain the effect of changes in volume or type of output on profit.

3. Standard Costing: the preparation of standard cost and then comparison is made of the actual cost and analyse the deviation (called variances )caused. This permits management to investigate the reasons for these variances and to take suitable corrective action.

4. Historical Costing: It is ascertainment of costs after they have been incurred. It aims at ascertaining costs actually incurred on work done in the past. It has a limited utility, though comparisons of costs over different periods may lead to good results.

5. Direct Costing: It is the involves charging all direct costs, variable and some fixed costs relating to operations, processes or products leaving all other costs to be written off against profits in which they arise.

6. Absorption Costing: it is also called as full costing. It is the practice of charging all costs, both variable and fixed to operations, processes or products. This differs from marginal costing where fixed costs are excluded.

Q7) Explain methods and techniques of cost?

A7) Methods and techniques

Methods of costing

- Job costing – under this costing, costs are collected and accumulated for each job separately. Each job has separate identity; so it becomes essential to analyse the cost according to each job. A job card is prepared for each job for cost accumulation. This method is applicable to printers, machine tool manufacturers, foundries and general engineering workshops.

2. Batch costing - This is an extension of job costing which includes production of large number of parts , in order to make a product undertake the production of each part in batches. Each hatch is treated as a unit of cost and costed separately. The cost per unit is determined by dividing the cost of the batch by the number of units produced in a batch. This method is mainly applicable in biscuits manufacture, garments manufacture and spare parts and components manufacture.

3. Process costing - This is applied in industries where production is continuous, manufacturing is carried on by well defined processes, the finished products of one process becomes the raw material of the subsequent process. Cost of each department is divided by the quantity of production to determine the cost per unit. This method is useful in industries such as paper, soap, textiles, chemicals, sugar and food processing products.

4. Operating costing – operation costing is also known as service costing. This is applied in industries which provide service as distinct from those which manufacture goods. This is suitable for hotels, hospital, municipal services, etc. this method is used to ascertain the cost of service rendered.

5. Single costing - where production is uniform and consists of only a single product or two or three types of similar products with variation only in size, shape or quality, this method is applied

6. Multiple costing - where the final product consists of a number of separate parts, e.g., radio set, motor car, bicycle etc. this method is followed. First ascertain the cost of each part and then the cost of assembling the parts will be tabulated. The cost of the final product will consist of the cost all the parts plus the cost of assembling them.

7. Uniform costing - When a number of firms in an industry agree to use the same costing principles, it is known as uniform costing. This method is used for comparison of performance in various undertaking can be made to the common advantage of all the participating units.

8. Farm costing – this method is applicable in calculation of total cost and per unit cost of various activities covered under farming. Farming activities includes agriculture, horticulture, animal husbandry, poultry farming, pisciculture, dairy, sericulture, nurseries for growing and selling of seedlings and plants and rearing of fruits and flowers.

9. Operation costing – this cost refers to conversion cost i.e., cost of converting the raw materials into finished goods. The cost per unit is determined with reference to final output.

Techniques of costing

- Uniform Costing: CIMA has defined uniform costing as “the use by several undertakings of the same costing principles and or practices.” Several undertakings uses same costing principles and practice for common control or comparison of costs.

b. Marginal Costing: It is the ascertainment of marginal cost by differentiating between fixed and variable cost. It is used to ascertain the effect of changes in volume or type of output on profit.

c. Standard Costing: the preparation of standard cost and then comparison is made of the actual cost and analyse the deviation (called variances )caused. This permits management to investigate the reasons for these variances and to take suitable corrective action.

d. Historical Costing: It is ascertainment of costs after they have been incurred. It aims at ascertaining costs actually incurred on work done in the past. It has a limited utility, though comparisons of costs over different periods may lead to good results.

e. Direct Costing: It is the involves charging all direct costs, variable and some fixed costs relating to operations, processes or products leaving all other costs to be written off against profits in which they arise.

f. Absorption Costing: it is also called as full costing. It is the practice of charging all costs, both variable and fixed to operations, processes or products. This differs from marginal costing where fixed costs are excluded.

Q8) Explain installation of costing system

A8) A costing system is an established set of procedures, rules, cost records, etc., for the purpose of achieving specified objective at minimum cost. It forms the basis for future operations.

Steps for installation of a costing system

Objectives to be achieved:

The first step is to clear the objectives of the costing system so that a thrust is given to that aspect. If the main objective is to improve the marketing then the costing system should give more attention to marketing aspect, if the emphasis is to expand production of products then that area should be cared well. The objective is to get information for decision making, planning and control.

Study the Product:

The study of the product is very essential. The type of costing system to be used is determined by the nature of the product. For example if the product requires high costs on materials then the costing system will give main emphasis on pricing, storing, issuing and controlling of material cost. On the other hand, if the product requires high labour cost then efficient system of time-recording and wage payment will be essential and the same will be true of overhead cost too.

Study the organization

The costing system should be designed to meet the requirements of the organization. It is necessary to study the nature, size and layout of the organization. The factors to be considered are as follows

- Size of the organization and the size of the departments.

- The physical layout of the organization.

- The different levels of management.

- The extent of decentralization of authority.

- The nature of authority relationships.

Deciding the Structure of Cost Accounts:

The next step in the process of installing a costing system is to take decision about the structure of cost accounts. The details of a suitable costing system should be worked out. The structure of cost accounts should be simple and in accordance with the natural production process.

Selecting the Cost Rates:

The next step is to determine the cost rates and the allocation of various expenses among different products. The following points should be considered

- Classification of costs into direct and indirect costs.

- Grouping of indirect costs (overheads) into production, administration, selling and distribution etc.

- Methods of pricing issues.

- Treatment of wastes of all types.

- Absorption of overheads.

- Calculation of overhead rates.

Introduction of the system

After completion of the above steps, the costing system may be formally introduced. The success of the costing system will depend upon its proper implementation. Its implementation will be done with the full co-operation of employees in the organization. If required, the system should be gradually introduced instead of implementing it in full.

A Follow-up:

The last step is to take the follow up. A follow-up of the system is essential to make it practicable and useful. The weaknesses and deficiencies may be realized when a system is put into actual practice. While collecting cost information from various sources there may be some delays in supplying information.

Q9) Explain cost audit?

A9) Cost Audit is mainly a preventive measure, a guide for management policy and decisions, in addition to being the barometer of performance.

Cost Audit is an audit of efficiency of minute details of expenditure while the work in progress and not a post mortem examination.

Cost audit can be defined as verification of correctness of cost accounts and a check on adherence to the cost accounting principles, plans and procedures.

According to Institute of Cost Accountants of India cost audit is “ a system of audit introduced by the government of India for the review, examination and appraisal of the cost accounting records and attendant information, required to be maintained by specified industries.”

According to (CIMA) Chartered Institute of Management Accountant, London, “Cost audit is verification of the correctness of cost accounts and cost accounting plans.”

Objectives

- To establish the accuracy of costing data. This is done by verifying the arithmetical accuracy of cost accounting entries in the books of accounts.

- To ensure that cost accounting principles are governed by the management objectives and these are strictly adhered to in preparing cost accounts.

- To ensure that cost accounts are correct and also to detect errors, frauds, and wrong practice in the existing system.

- To check up the general working of the cost department of the organization and to make suggestions for improvement.

- To help the management in taking correct decisions on certain important matters

- To determine the actual cost of production when the goods are ready.

- To reduce the amount of detailed checking by the external auditor, its effective internal cost audit system is in operation.

- To find out whether each item of expenditure involved in the relevant components of the goods manufactured or produced has been properly incurred or not.

Advantages of cost audit

Advantages to management

- It provides necessary information for prompt decision decisions.

- It helps management to regulate production.

- Errors, omission, fraud, and mistakes can be detected and prevented due to the effective auditing of cost accounts.

- It reduces the cost of production through plugging loopholes relating to wastage of material, labor, and overheads.

- It can fix the responsibility of an individual wherever irregularities or wastage are found.

- It improves the efficiency of the organization as a whole and costing system in particular by constant review, revision, and checking or routine procedures and methods.

- It helps in comparing actual results with budgeted results and points out the areas where management action is more needed.

- It also enables comparison among different units of the factory to find out the profitability of the different units.

- It exercises a moral influence on employees, which keeps them efficient and alert.

- It ensures that the cost accounts have been maintained under the principles of costing employed in the industry concerned.

- It ensures effective internal control.

- It helps to increase the overall efficiency of productivity.

- Inefficiency can be eliminated by suitable corrective actions.

- It facilitates cost control and cost reduction.

- It assists in the valuation of stock of materials, works in progress, and finished goods.

- It ensures maximum utilization of available resources,

- It enables the management to choose economic methods of operations and thus earn profits to satisfy the shareholders and the investing public.

- It enables the management to chalk out the future policy based on the report by the cost auditor, especially regarding labor, raw material, plant, etc. to maximize production and reduce the cost of production.

- It tests the effectiveness of cost control techniques and to evaluate their advantages to the enterprise.

Advantages to the shareholders

- It ensures that proper records are maintained as to purchases, utilization of materials, and expenses incurred on various items i.e., wages and overheads, etc. It also makes sure that the industrial unit has been working efficiently and economically.

- It enables shareholders to determine whether or not they are getting a fair return on their investments. It reflects managerial efficiency or inefficiency.

- It ensures a true picture of the company’s state of affairs. It reveals whether resources like plant and machinery are properly utilized or not.

- It creates an image of the creditworthiness of the concern.

Advantages to society

- It tells the true cost of production. From this, the consumer may know whether the market price of the article is fair or not. The consumer is saved from exploitation.

- It improves the efficiency of industrial units and thereby assists in the economic progress of the nation.

- Since the price increase by the industry is not allowed without justification as to an increase in the cost of production, consumers can maintain their standard of living.

Advantages to the customers

- Helps in Fixation of Fair price

- Timely and proper Information

Advantages to the government

- It assists the tariff board in deciding whether tariff protection should be extended to a particular industry or not.

- It helps to ascertain whether any particular industry should be given any subsidy to develop that industry.

- It provides reliable data to the government for fixing up the selling prices of the various commodities.

- It helps in fixing contract prices in a cost-plus contract.

- It determines whether differential pricing within the industry is desirable.

- It helps the government to take necessary measures to improve the efficiency of sick industrial units.

- It can reveal the fraudulent intentions of the management.

- Cost statements may be helpful to authorities in imposing tax or duty at the cost of finished products.

- It facilitates settlement of trade disputes of the companies.

- It imposes an automatic check on inflation.

- It assists the Tariff Board to consider the extension or removal of protection.

Disadvantages of cost audit

- Shortage of cost accountants

- Unrealistic regulations

- Expensive and luxury

- It leads to duplication of work

- Unnecessary interference of government in the working of companies.

Q10) Write about the advantages and disadvantages of cost audit?

A10) Cost Audit is mainly a preventive measure, a guide for management policy and decisions, in addition to being the barometer of performance.

Cost Audit is an audit of efficiency of minute details of expenditure while the work in progress and not a post mortem examination.

Cost audit can be defined as verification of correctness of cost accounts and a check on adherence to the cost accounting principles, plans and procedures.

According to Institute of Cost Accountants of India cost audit is “ a system of audit introduced by the government of India for the review, examination and appraisal of the cost accounting records and attendant information, required to be maintained by specified industries.”

According to (CIMA) Chartered Institute of Management Accountant, London, “Cost audit is verification of the correctness of cost accounts and cost accounting plans.”

Objectives

1) To establish the accuracy of costing data. This is done by verifying the arithmetical accuracy of cost accounting entries in the books of accounts.

2) To ensure that cost accounting principles are governed by the management objectives and these are strictly adhered to in preparing cost accounts.

3) To ensure that cost accounts are correct and also to detect errors, frauds, and wrong practice in the existing system.

4) To check up the general working of the cost department of the organization and to make suggestions for improvement.

5) To help the management in taking correct decisions on certain important matters

6) to determine the actual cost of production when the goods are ready.

7) To reduce the amount of detailed checking by the external auditor, its effective internal cost audit system is in operation.

8) To find out whether each item of expenditure involved in the relevant components of the goods manufactured or produced has been properly incurred or not.

Advantages of cost audit

Advantages to management

1) It provides necessary information for prompt decision decisions.

2) It helps management to regulate production.

3) Errors, omission, fraud, and mistakes can be detected and prevented due to the effective auditing of cost accounts.

4) It reduces the cost of production through plugging loopholes relating to wastage of material, labor, and overheads.

5) It can fix the responsibility of an individual wherever irregularities or wastage are found.

6) It improves the efficiency of the organization as a whole and costing system in particular by constant review, revision, and checking or routine procedures and methods.

7) It helps in comparing actual results with budgeted results and points out the areas where management action is more needed.

8) It also enables comparison among different units of the factory to find out the profitability of the different units.

9) It exercises a moral influence on employees, which keeps them efficient and alert.

10) It ensures that the cost accounts have been maintained under the principles of costing employed in the industry concerned.

11) It ensures effective internal control.

12) It helps to increase the overall efficiency of productivity.

13) Inefficiency can be eliminated by suitable corrective actions.

14) It facilitates cost control and cost reduction.

15) It assists in the valuation of stock of materials, works in progress, and finished goods.

16) It ensures maximum utilization of available resources,

17) It enables the management to choose economic methods of operations and thus earn profits to satisfy the shareholders and the investing public.

18) It enables the management to chalk out the future policy based on the report by the cost auditor, especially regarding labor, raw material, plant, etc. to maximize production and reduce the cost of production.

19) It tests the effectiveness of cost control techniques and to evaluate their advantages to the enterprise.

Advantages to the shareholders

1) It ensures that proper records are maintained as to purchases, utilization of materials, and expenses incurred on various items i.e., wages and overheads, etc. It also makes sure that the industrial unit has been working efficiently and economically.

2) It enables shareholders to determine whether or not they are getting a fair return on their investments. It reflects managerial efficiency or inefficiency.

3) It ensures a true picture of the company’s state of affairs. It reveals whether resources like plant and machinery are properly utilized or not.

4) It creates an image of the creditworthiness of the concern.

Advantages to society

1) It tells the true cost of production. From this, the consumer may know whether the market price of the article is fair or not. The consumer is saved from exploitation.

2) It improves the efficiency of industrial units and thereby assists in the economic progress of the nation.

3) Since the price increase by the industry is not allowed without justification as to an increase in the cost of production, consumers can maintain their standard of living.

Advantages to the customers

- Helps in Fixation of Fair price

- Timely and proper Information

Advantages to the government

1) It assists the tariff board in deciding whether tariff protection should be extended to a particular industry or not.

2) It helps to ascertain whether any particular industry should be given any subsidy to develop that industry.

3) It provides reliable data to the government for fixing up the selling prices of the various commodities.

4) It helps in fixing contract prices in a cost-plus contract.

5) It determines whether differential pricing within the industry is desirable.

6) It helps the government to take necessary measures to improve the efficiency of sick industrial units.

7) It can reveal the fraudulent intentions of the management.

8) Cost statements may be helpful to authorities in imposing tax or duty at the cost of finished products.

9) It facilitates settlement of trade disputes of the companies.

10) It imposes an automatic check on inflation.

11) It assists the Tariff Board to consider the extension or removal of protection.

Disadvantages of cost audit

- Shortage of cost accountants

- Unrealistic regulations

- Expensive and luxury

- It leads to duplication of work

- Unnecessary interference of government in the working of companies.

Q11) Write about material control?

A11) Materials constitutes major portion of the total cost of the product. Supplies are also used for the manufacture of product. Both materials and supplies are collectively called as stores. The finished goods are termed as stock.

Materials control refers to managerial activities relating to giving instructions or directions to ensure maintaining adequate quality and quantity of materials for uninterrupted production process with the objective of minimizing material cost per unit. Both materials control and inventory control are not one and the same.

Materials control is a wider term, which includes inventory control. Moreover, cost of production, planning of materials, purchase procedure, transportation and usage control are parts of materials control.

The objectives of a system of material control are as following:-

- To make continuous availability of materials so that there may be uninterrupted flow of materials for production. Production may not be held up for want of materials.

- To purchase requisite quantity of materials to avoid locking up of working capital and to minimise risk of surplus and obsolete stores.

- To make purchase competitively and wisely at the most economical prices so that there may be reduction of material costs.

- To purchase proper quality of materials to have minimum possible wastage of materials.

- To serve as an information centre on the materials knowledge for prices, sources of supply, lead time, quality and specification.

- Study of Material can be better explained as follows:

Material Purchase & ReceiptStorageIssue – Control

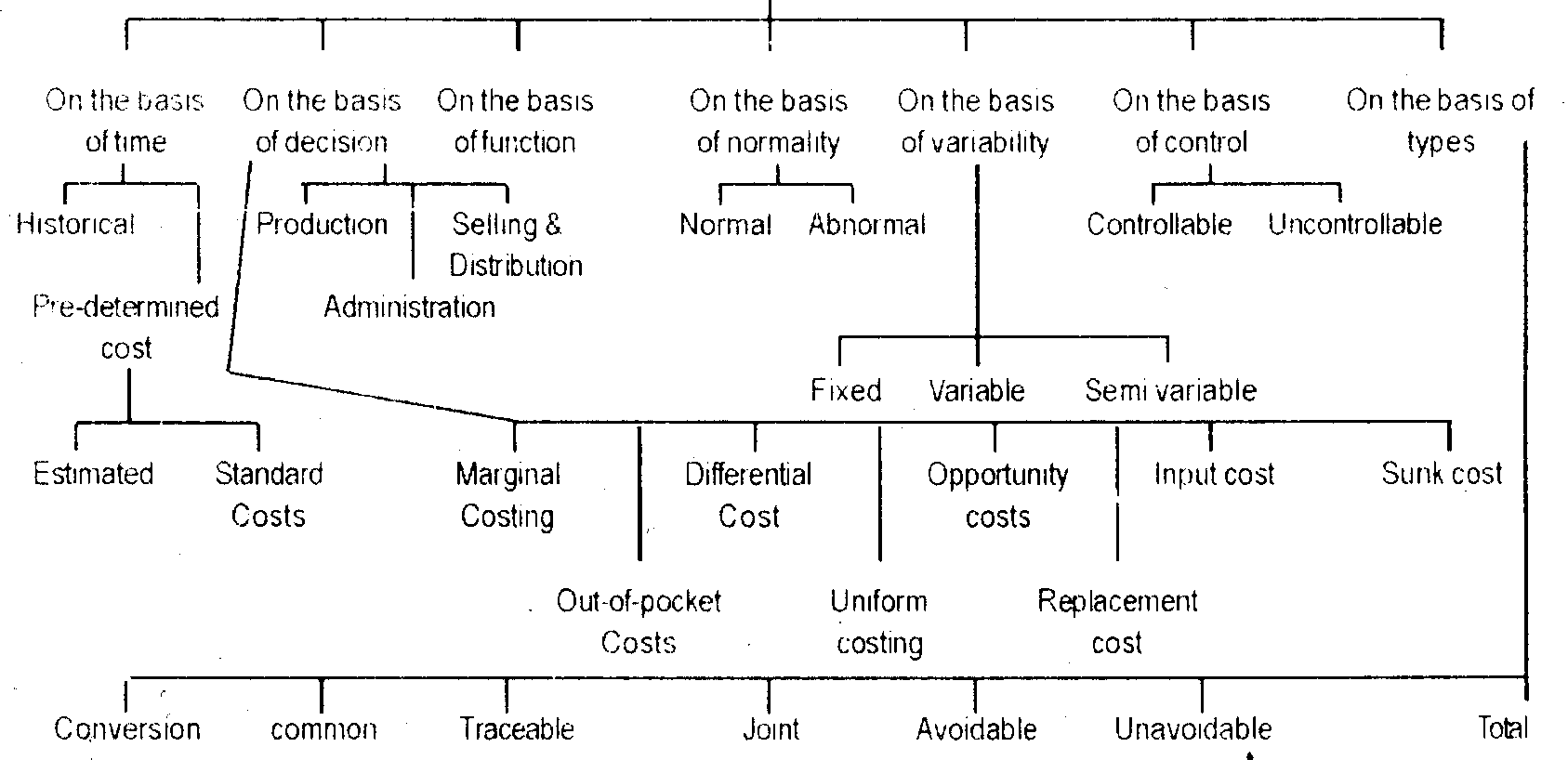

Q12) Explain classification of cost?

A12) Cost items are analysed or grouped according to their common characteristics which is some independent factor. There are many objectives of cost classifications depending on the requirements of management. The different cost classifications are as follows:

Cost Classification by Elements:

The constituent elements of costs are broadly classified into three distinct elements i.e. materials, labour and expenses. These three elements of cost can be further grouped into direct and indirect categories. Direct materials refer to the cost of materials which are conveniently and economically traceable to specific units of output. For example: Raw cotton in textiles, crude oil in making diesel. The indirect materials refer to materials that are needed for the completion of the product but whose consumption with regard to the product is either so small or so complex that it would not be appropriate to treat it as a direct material. For example: stationery lubricants, cotton waste etc.

Cost Classification by Function:

A business organisation has to perform several functions such as Manufacturing, Administration, Selling and Distributing and Research and Development. Functional classification of cost implies that the business performs many functions for which costs are incurred. Expenses or Costs are usually classified by function and grouped under the headings of Manufacturing, Selling and Administrative costs in measuring net income.

Manufacturing costs are all check costs incurred to manufacture the products and to bring them to a saleable condition. This includes direct material, direct labour and indirect manufacturing costs or overheads. Administration costs are incurred for formulation of policy, directing the organisation and controlling the activities excluding the cost of research, development, production, selling and distribution. These costs include salary of executives, office, staff, office rent, stationery, postage etc. Selling costs include the cost of creating and stimulating demand and getting customers. For example: advertisement, salary and commission to salesmen, packing. Distribution costs include the cost of warehouse, freight, cartage etc.

Research and Development costs are incurred in the process of finding out new ideas, new processes by experiments or other means of putting the results of such experiments on a commercial basis. Functional classification of cost is important because it provides an opportunity to the management to evaluate the efficiency of departments performing different functions in an organisation.

Cost Classification by variability:

Cost can be classified as (i) fixed (ii) variable and (iii) semi - fixed or semi variable in terms of their variability or changes in cost behaviour in relation to changes in output or activity or volume of production. Activity may be indicated in any form such as units of output, hours worked, sales, etc. The separation of costs into variable and fixed categories is the most difficult part of the costing operation. Certain costs are easily identifiable as variable or fixed while other costs can be segregated only after careful consideration of their nature and an examination of their behaviour.

Fixed costs:

Fixed cost is a cost which does not change in total for a given time period despite wide fluctuations in output or volume of activity. These costs must be met by the organisation irrespective of the volume level. These costs are also known as capacity costs, period costs or stand - by costs; for example, rent, property taxes, supervisor’s salary, advertising, insurance etc.

Variable costs:

Variable costs are those costs which vary directly and proportionately with the output. There is a constant ratio between the change in the cost and the change in the level of output. Direct materials and labour are the examples of variable costs. Thus, all these costs which tend to vary directly with variations in volume of output are variable costs. However, it must be remembered that variable costs remain the same or approximately the same in amount per unit of production regardless of increase or decrease in volume.

Semi variable or semi fixed costs:

There is another group of costs in between the fixed and variable costs. It is semi variable or semi fixed costs. These costs vary in some degree with volume but not in direct proportion. Such costs are fixed only in relation to specified constant conditions. Semi fixed costs are those costs which remain constant upto a certain level of output after which they become variable. For example: maintenance of building, depreciation of plant, supervisor’s salary, telephone expenses etc.

Q13) Write about classification by function?

A13) Cost Classification by Function:

A business organisation has to perform several functions such as Manufacturing, Administration, Selling and Distributing and Research and Development. Functional classification of cost implies that the business performs many functions for which costs are incurred. Expenses or Costs are usually classified by function and grouped under the headings of Manufacturing, Selling and Administrative costs in measuring net income.

Manufacturing costs are all check costs incurred to manufacture the products and to bring them to a saleable condition. This includes direct material, direct labour and indirect manufacturing costs or overheads. Administration costs are incurred for formulation of policy, directing the organisation and controlling the activities excluding the cost of research, development, production, selling and distribution. These costs include salary of executives, office, staff, office rent, stationery, postage etc. Selling costs include the cost of creating and stimulating demand and getting customers. For example: advertisement, salary and commission to salesmen, packing. Distribution costs include the cost of warehouse, freight, cartage etc.

Research and Development costs are incurred in the process of finding out new ideas, new processes by experiments or other means of putting the results of such experiments on a commercial basis. Functional classification of cost is important because it provides an opportunity to the management to evaluate the efficiency of departments performing different functions in an organisation.

Q14) Write about classification by variability?

A14) Cost can be classified as (i) fixed (ii) variable and (iii) semi - fixed or semi variable in terms of their variability or changes in cost behaviour in relation to changes in output or activity or volume of production. Activity may be indicated in any form such as units of output, hours worked, sales, etc. The separation of costs into variable and fixed categories is the most difficult part of the costing operation. Certain costs are easily identifiable as variable or fixed while other costs can be segregated only after careful consideration of their nature and an examination of their behaviour.

Fixed costs:

Fixed cost is a cost which does not change in total for a given time period despite wide fluctuations in output or volume of activity. These costs must be met by the organisation irrespective of the volume level. These costs are also known as capacity costs, period costs or stand - by costs; for example, rent, property taxes, supervisor’s salary, advertising, insurance etc.

Variable costs:

Variable costs are those costs which vary directly and proportionately with the output. There is a constant ratio between the change in the cost and the change in the level of output. Direct materials and labour are the examples of variable costs. Thus, all these costs which tend to vary directly with variations in volume of output are variable costs. However, it must be remembered that variable costs remain the same or approximately the same in amount per unit of production regardless of increase or decrease in volume.

Semi variable or semi fixed costs:

There is another group of costs in between the fixed and variable costs. It is semi variable or semi fixed costs. These costs vary in some degree with volume but not in direct proportion. Such costs are fixed only in relation to specified constant conditions. Semi fixed costs are those costs which remain constant upto a certain level of output after which they become variable. For example: maintenance of building, depreciation of plant, supervisor’s salary, telephone expenses etc.

Q15) Explain techniques of material control?

A15) The main techniques of material control are as follows

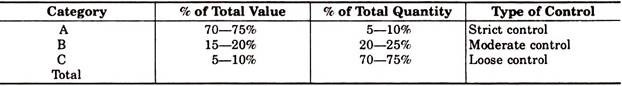

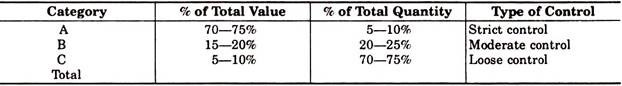

- ABC Analysis

- Determination of stock levels

- Economic Order Quantity (EOQ) Analysis

- Perpetual Inventory System

- Periodic Annual Inventory Control System

- VED Analysis.

- ABC analysis - In the nineteenth century, the concept of ABC Analysis was coined by Pareto, an Indian philosopher. It is a value based system of material control. In this technique materials are analysed according to their value which means greater attention and care are given costly and more valuable materials.

All items of materials are classified according to their value—high, medium and low values, which are known as A, B and C items respectively. ABC technique is some time called as “Always better control” method.

“A” item - These are high value items which may consist of only a small percentage of the total items handled. These materials are kept under the tightest control and the responsibility of the most experienced personnel.

‘B’ Items: These are medium value materials which should be under the normal control procedures.

‘C’ Items: These are low value materials which may represent a very large number of items. These materials are kept under the simple and economic methods of control.

Thus classifying the material in A,B,C category ensures that the management focuses on ‘A’ item where tightest control should be installed. B items may be given less attention and C items least attention.

For example

2. Determination of stock levels - After the material classification and codification is done for all the materials, for each material code we have to fix the Minimum Level, Maximum Level, Re-order Level and Re-order Quantity. It is the storekeeper’s responsibility to ensure inventory of any material is maintained between the Minimum Level and Maximum Level.

Maximum Level:

The Maximum Level indicates the maximum quantity of an item of material that can be held in stock at any time. The stock in hand is regulated in such a manner that normally it does not exceed this level. While fixing the level, the following factors are to be taken into consideration:

- Rate of consumption of material

- Risk of obsolescence and deterioration

- Storage space available

- Cost of storage and insurance

- Availability of funds needed

- Seasonal considerations, e.g. Bulk purchases during seasons at low prices

- Reorder Quantity

Maximum Level = Re-Order Level + Re-Order Qty – (Minimum Rate of Consumption X Minimum Re- Order Period)

Minimum Level:

The Minimum Level indicates the lowest quantitative balance of an item of material which must be maintained at all times so that there is no stoppage of production due to the material being not available.

Minimum Level = Re-Order level – (Normal Rate of Consumption X Normal Re-Order Period)

Re-Order Level:

When the stock in hand reach the ordering or re-ordering level, store keeper has to initiate the action for replenish the material. This level is fixed somewhere between the maximum and minimum levels in such a manner that the difference of quantity of the material between the Re-ordering Level and Minimum Level will be sufficient to meet the requirements of production up to the time the fresh supply of material is received.

Re-Ordering level= Minimum Level + Consumption during lead time

= Minimum Level + (Normal Rate of Consumption × Normal Re-order Period)

Danger Level:

It is the level at which normal issue of raw materials are stopped and only emergency issues are only made. This is a level fixed usually below the Minimum Level. When the stock reaches this level very urgent action for purchases is indicated. This presupposed that the minimum level contains a cushion to cover such contingencies. The normal lead time cannot be afforded at this stage

Danger Level = Normal Rate of Consumption × Maximum Reorder Period for emergency purchases

3. Economic order quantity analysis - Economic order Quantity is also termed as Re-order Quantity. Economic Order Quantity is that size of the order which gives maximum economy in purchasing any material and ultimately contributes towards maintaining the material at the optimum level and at minimum cost.

Two types of cost are taken into consideration while fixing economic order quantity

- Ordering cost – ordering cost refers to the cost of placing on order with the supplier. It includes Cost of staff posted in the purchasing department, inspection section and payment department. Cost of stationery, postage and telephone charges, etc.

- Carrying cost – carrying cost refers to the cost of holding the materials in the store. It includes Cost of storage space which could have been used for some other purpose, Transportation cost in relation to stock, insurance cost, clerical cost, etc.

Formula

Where,

- EOQ = Economic Order Quantity

- 2 = It is a constant figure

- A = Annual consumption of materials in units or rupees

- S = Cost of placing an order

- I = Annual carrying cost of storing one unit.

4. Perpetual inventory system - This is a system of stock control in which continuous record of receipt and issue of materials is maintained by the stores department. It shows the physical movement of stocks and their current balance. It means the system of stock records that will show the receipts, issue and balance of all items in stock at all times.

The Chartered Institute of Management Accountants London defines the perpetual inventory system as, “a system of records maintained by the controlling department, which reflects the physical movements of stocks and their current balance.”

5. Periodic/annual inventory control system – the stock-taking is undertaken at the end of the accounting year, under this system. The stock taking involves verifying the physical quantities of stores in hand. The annual stock- taking should be organized well in advance to minimize production holds up.

The following points are considered while conducting periodic stock verification:

- To control the whole operation a person should be appointed.

- While stock verification is going on, store room should not be opened for issues and receipts.

- All damaged, deteriorated or used items must be recorded separately.

- The stock-taking sheets must be under the control of one individual.

- Materials received should be listed separately but still under inspection.

- Make each person responsible for a particular section.

- Show the method of check i.e. count, weight, measurement on the stock sheet for each item.

6. VED analysis - VED-vital, essential, desirable, analysis. It is used primarily for control of spare parts. Keeping in view the criticality to production, the spare parts can be divided into three categories-vital, essential and desirable.

The spares, the absence of which even for a short time will stop production for quite some time and where the cost of stock out is very high, are known as vital spares.

The spares, the absence of which cannot be tolerated for more than a few hours or a day and the cost of lost production is high and which are essential for the production to continue, are known as essential spares.

The desirable spares are those spares which are needed but their absence for even a week or so will not lead to stoppage of production.

Q16) Write a short note on ABC analysis and EOQ?

A16)

- ABC analysis - In the nineteenth century, the concept of ABC Analysis was coined by Pareto, an Indian philosopher. It is a value based system of material control. In this technique materials are analysed according to their value which means greater attention and care are given costly and more valuable materials.

All items of materials are classified according to their value—high, medium and low values, which are known as A, B and C items respectively. ABC technique is some time called as “Always better control” method.

“A” item - These are high value items which may consist of only a small percentage of the total items handled. These materials are kept under the tightest control and the responsibility of the most experienced personnel.

‘B’ Items: These are medium value materials which should be under the normal control procedures.

‘C’ Items: These are low value materials which may represent a very large number of items. These materials are kept under the simple and economic methods of control.

Thus classifying the material in A,B,C category ensures that the management focuses on ‘A’ item where tightest control should be installed. B items may be given less attention and C items least attention.

For example

2. Economic order quantity analysis - Economic order Quantity is also termed as Re-order Quantity. Economic Order Quantity is that size of the order which gives maximum economy in purchasing any material and ultimately contributes towards maintaining the material at the optimum level and at minimum cost.

Two types of cost are taken into consideration while fixing economic order quantity

- Ordering cost – ordering cost refers to the cost of placing on order with the supplier. It includes Cost of staff posted in the purchasing department, inspection section and payment department. Cost of stationery, postage and telephone charges, etc.

- Carrying cost – carrying cost refers to the cost of holding the materials in the store. It includes Cost of storage space which could have been used for some other purpose, Transportation cost in relation to stock, insurance cost, clerical cost, etc

Formula

Where,

- EOQ = Economic Order Quantity

- 2 = It is a constant figure

- A = Annual consumption of materials in units or rupees

- S = Cost of placing an order

- I = Annual carrying cost of storing one unit.

Q17) What is FIFO?

A17) It is a method of pricing the issue of materials in the order in which they are purchased. In other words the materials are issued in the order in which they arrive in the store. This method is considered suitable in times of falling price because the material cost charged to production will be high while the replacement cost of materials will be low. In case of rising prices this method is not suitable.

Advantages of FIFO:

- It is simple and easy to operate.

- In case of falling prices, this method gives better results.

- Closing stocks represents the market prices.

Disadvantages:

- If the prices fluctuate frequently, this method may lead to clerical errors.

- In case of rising prices this method is not advisable.

- The material costs charged to same job are likely to show different rates.

Q18) What is LIFO?

A18) Under this method most recent purchase will be the first to be issued. It means the most recently items produced are sold first. The issues are priced out at the most recent batch received and continue to be charged until a new batch received is arrived into stock. It is a method of pricing the issue of material using the purchase price of the latest unit in the stock.

Advantages:

- Based on the replacement cost Stocks issued at more recent price represent the current market value

- It is simple to understand and easy to apply.

- Since material cost is charged at more recent price, product cost will tend to be more realistic

- It minimizes unrealized inventory gains and tends to show the conservative profit.

Disadvantages:

- Valuation of inventory under this method is not acceptable in preparation of financial accounts.

- It renders cost comparison between jobs difficult.

- It involves more clerical work and sometimes valuation may go wrong.

Q19) Explain pricing of material issue?

A19) The important methods followed in pricing of issue of materials are as follows

- First in – First Out Method:

It is a method of pricing the issue of materials in the order in which they are purchased. In other words the materials are issued in the order in which they arrive in the store. This method is considered suitable in times of falling price because the material cost charged to production will be high while the replacement cost of materials will be low. In case of rising prices this method is not suitable.

Advantages of FIFO:

d. It is simple and easy to operate.

e. In case of falling prices, this method gives better results.

f. Closing stocks represents the market prices.

Disadvantages:

d. If the prices fluctuate frequently, this method may lead to clerical errors.

e. In case of rising prices this method is not advisable.

f. The material costs charged to same job are likely to show different rates.

2. Weighted Average Price Method:

This method removes the limitation of Simple Average Method in that it also takes into account the quantities which are used as weights in order to find the issue price. This method uses total cost of material available for issue divided by the quantity available for issue.

Issue Price = Total Cost of Materials in stock / Total Quantity of Materials in stock

3. LIFO (Last in first out method):

Under this method most recent purchase will be the first to be issued. It means the most recently items produced are sold first. The issues are priced out at the most recent batch received and continue to be charged until a new batch received is arrived into stock. It is a method of pricing the issue of material using the purchase price of the latest unit in the stock.

Advantages:

- Based on the replacement cost Stocks issued at more recent price represent the current market value

- It is simple to understand and easy to apply.

- Since material cost is charged at more recent price, product cost will tend to be more realistic

- It minimizes unrealized inventory gains and tends to show the conservative profit.

Disadvantages:

- Valuation of inventory under this method is not acceptable in preparation of financial accounts.

- It renders cost comparison between jobs difficult.

- It involves more clerical work and sometimes valuation may go wrong.

4. Simple average cost method- The simple average price is calculated by adding the different prices paid during the period for the batches purchased by dividing the number of batches.

For example, three batches of materials received at Rs. 10, Rs. 12 and Rs. 14 per unit respectively.

The simple average price is calculated as follows:

Rs. 10 + Rs. 12 + Rs. 14/3 batches = Rs. 36/3 batches = Rs 12 per unit

The main disadvantages of this method are it only takes into consideration the prices of different batches but not the quantities purchased in different batches.

Advantages:

- This method is easy to operate.

- It gives reasonably accurate results if prices are stable.

Disadvantage:

- Materials are not priced at actual costs.

- It does not take into account the quantity of materials purchased.

- Verification of closing stock becomes difficult.

- When price and quantity of different lots are widely fluctuates, this method gives incorrect result.

5. Standard cost - Under this method, material issues are priced at a predetermined standard issue price. Any variance between the actual purchase price and standard issue price is written off to the Profit and Loss Account. Standard cost refers to predetermined cost set by the management before the actual material costs being known and the standard issue price is used for valuation of closing stock and all issues to production.

Advantages

- If initially the standard price is set carefully then it reduces all the clerical work and errors tremendously

- The stock recording procedure is simplified.

- By eliminating fluctuations in cost due to material price variance, the realistic production cost comparisons can be made easier.

6. Replacement cost – This method also refers to market price method. The replacement cost is a cost at which identical material can be replaced by purchasing at the date of pricing material issues; as distinct from the actual cost price at the date of purchase. The replacement price is the price of replacing the material at the time of issue of materials or on the date of valuation of closing stock.

The term replacement price has been defined by the Institute of cost and management accountants of England as

“the price at which there could be purchase of an asset identical to that which is being replaced or revalued.

Q20) Explain treatment of material issue?

A20) The requisition received by the storekeeper is serially numbered and the details relating to the quantity issued and number of the stores requisition are entered in the issue column of the bin card. Then the requisitions are sent to the cost office where rate and amount columns are filled and entries are made in the store ledger and job ledger

Sometimes excess material is issued for a particular work to facilitate convenient handling. In such case full quantity is charged to the job or work order and surplus materials of that job may either be returned to stores or transferred to other job.

Return of surplus material

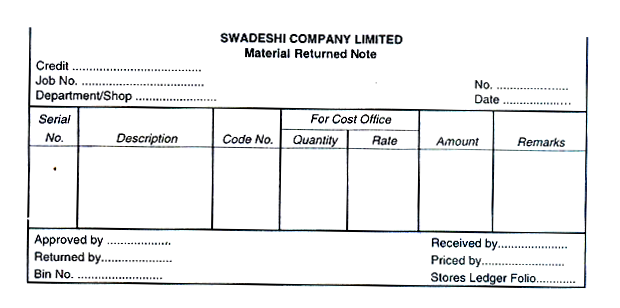

A Material Returned Note or Stores Debit Note or Shop Credit Note is prepared in the department when excess materials are returned to the stores. Three copies are prepared and signed by the storekeeper as a token of receipt of the surplus material and keeps one copy of the same with him for making entries on the receipt side of the bin cards.

The second copy is sent to the cost office for making entries in the stores ledger and for giving credit to the particular job where the materials is in excess and returned.

The third copy is sent to the department which returns the surplus material.

The format is given below

Transfer of surplus materials

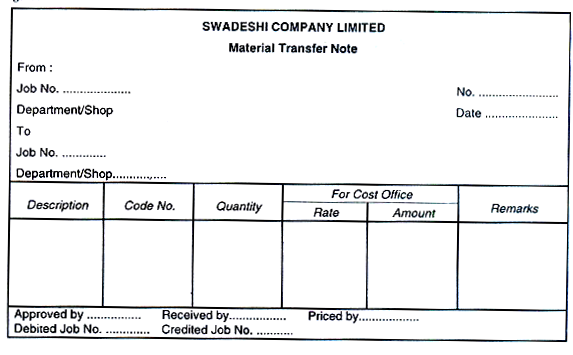

As far as possible Transfer of excess materials from one job to another job should be avoided. The main reason is that record for the transfer may not be made and actual material cost for job may be inaccurate. An exception is given when return of surplus material to the stores may be costly due to the distance or excessive amount of handling charges. Thus materials are transferred to another job which is near the transferring job.

This will result in saving transport cost from the transferring job to the store. Transfer of materials from one job to the other job is to be allowed with the preparation of Material Transfer Note.

In the department Material Transfer Note is prepared where the material is in excess and one copy of the note is sent to the cost office for making necessary records. The job receiving the material is debited and the job transferring the material is credited.