Unit III

Dividend Policy

Question bank

Q1) What do you mean by dividend policy? What are the different ratios that effect dividend policy?

A1. Dividend policy is a policy adopted by a company to pay dividends to shareholders, and includes the percentage of the amount of dividends paid to shareholders and the frequency with which dividends are paid.

Simply put, a dividend policy is a set of guidelines or rules that a company builds to distribute dividends over years of profitability. In general, listed companies draft dividend policies and store them on their websites for investors. This increases investor confidence in the distribution of dividends.

Dividend policies can be defined as dividend distribution guidelines provided by the company's board of directors. It sets parameters to benefit shareholders based on the capital they have invested in their business.

Consider different ratios that affect our dividend policy.

1. Payment ratio

It is defined as a dividend as a percentage of revenue. It is an important concept of dividend policy. Companies may decide to share almost all of their revenue. Another company may decide to distribute only a portion of its revenue. It may appear at first, but the previous company declares the maximum dividend. But in the long run, the latter company, which declares only a portion of its revenue, could overtake its former high-paying companies.

Looking at the market value, companies that pay less will have higher market stock prices because of their higher revenue growth.

The uncertainties surrounding the future profitability of the company will make certain investors prefer the certainty of current dividends. Investors prefer "large" dividends. Investors do not like to produce "homemade" dividends, but companies prefer to distribute them directly.

Capital gains tax is deferred until the actual sale of shares. This creates a timing option. Capital gains take precedence over dividends, everything else is the same. Therefore, high dividend yield stocks should be sold at a discounted price to generate a higher pre-tax rate of return. Certain institutional investors do not pay taxes.

Dividends are taxed heavier than capital gains, so high-dividend companies should have higher pre-tax returns. Empirical results are mixed-recently, the evidence is in close agreement with dividend neutrality.

2. Retained earnings ratio

If x is the payment ratio, then the retained earnings ratio is 100 minus x. In other words, the retained earnings ratio is the opposite of the payment rate. As we saw above, low payout (and therefore high retention) policies can generate higher dividend announcements to increase profit growth (thus higher stock prices in the secondary market and huge capital gains).

3. Capital gains

Investors in growing companies realize their returns primarily in the form of capital gains. Generally, these growing companies increase their revenue year by year, but their payment ratio may not be very high. Therefore, their retention rate is high. Investors in such companies will earn capital gains in later years. However, the impact of dividend policy (high or low dividends when retained earnings are low or high) is not very simple. Such capital gains will bring distant futures, and therefore many investors may consider them uncertain.

4. Dividend yield

Dividend yield is the dividend per share divided by the market value per share. Dividend yields provide shareholder interests related to the market value of a stock.

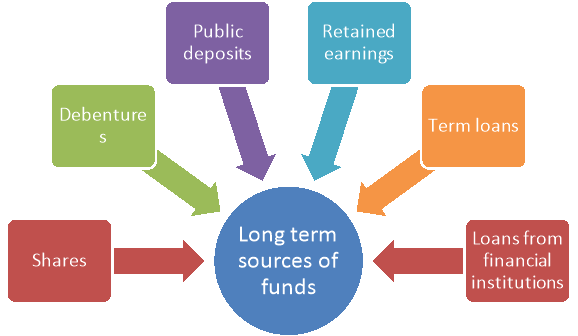

Q2) Discuss the long-term sources of funds. 5

A2. Long term funds are required for purchase of fixed/permanent assets of an organisation. Some of the popular long-term sources of funds are-

The main sources of long-term finance are as follows:

Figure: Sources of long-term funds

- Shares:

These are issued to the general public. These may be of two types: (i) Equity and (ii) Preference. The holders of shares are the owners of the business.

2. Debentures:

These are also issued to the general public. The holders of debentures are the creditors of the company.

3. Public Deposits:

General public also like to deposit their savings with a popular and well-established company which can pay interest periodically and pay-back the deposit when due.

4. Retained earnings:

The company may not distribute the whole of its profits among its shareholders. It may retain a part of the profits and utilize it as capital.

5. Term loans from banks:

Many industrial development banks, cooperative banks and commercial banks grant medium term loans for a period of three to five years.

6. Loan from financial institutions:

There are many specialised financial institutions established by the Central and State governments which give long term loans at reasonable rate of interest. Some of these institutions are: Industrial Finance Corporation of India (IFCI), Industrial Development Bank of India (IDBI), Industrial Credit and Investment Corporation of India (ICICI), Unit Trust of India (UTI), State Finance Corporations etc. These sources of long-term finance will be discussed in the next lesson.

Q3) Explain short term sources of finance. 5

A3. Short-term financing is aimed to meet the demand of current assets and pay the current liabilities of the organization. In other words, it helps in minimizing the gap between current assets and current liabilities. There are different means to raise capital from the market for small duration. Various agencies, such as commercial banks, co-operative banks, financial institutions, and NABARD provide the financial assistance to organizations.

Figure: Sources of short-term finance

1. Trade Credit:

Trade credit refers to the credit extended by the supplier of goods or services to his/her customer in the normal course of business. It occupies a very important position in short-term financing due to the competition. Almost all the traders and manufacturers are required to extend credit facility (a portion), without which there is no business. Trade credit is a spontaneous source of finance that arises in the normal business transactions without specific negotiation, (automatic source of finance).

2. Accruals:

Accrued expenses are those expenses which the company owes to the other, but not yet due and not yet paid the amount. Accruals represent a liability that a firm has to pay for the services or goods, it has received. It is spontaneous and interest-free source of financing. Salaries and wages, interest and taxes are the major constituents of accruals. Salaries and wages are usually paid on monthly and weekly base, respectively. The amounts of salaries and wages are owed but not yet paid and shown them as accrued salaries and wages on the balance sheet at the end of the financial year. The longer the time lag in–payment of these expenses, the greater is the amount of funds provided by the employees. Similarly, interest and tax are accruals, as source of short-term finance. Tax will be paid on earnings.

3. Deferred Income:

Deferred income is income received in advance by the firm for supply of goods or services in future period. This income increases the firm’s liquidity and constitutes an important source of short-term finance. These payments are not showed as revenue till the supply of goods or services, but showed in the balance sheet as income received in advance.

Advance payment can be demanded by firms which are having monopoly power, great demand for its products and services and if the firm is manufacturing a special product on a special order.

4. Commercial Papers (CPs):

Commercial paper represents a short-term unsecured promissory note issued by firms that have a fairly high credit (standing) rating. It was first introduced in the USA and it is an important money market instrument. In India, Reserve Bank of India introduced CP on the recommendations of the Vaghul Working Group on Money Market. CP is a source of short-term finance to only large firms with sound financial position.

5. Public Deposits:

Public deposits or term deposits are in the nature of unsecured deposits, are solicited by the firms (both large and small) from general public primarily for the purpose of financing their working capital requirements.

6. Inter-Corporate Deposits (ICDs):

A deposit made by one firm with another firm is known as Inter-Corporate Deposit (ICD). Generally, these deposits are made for a period up to six months.

Such deposits may be of three types:

(a) Call Deposits:

These deposits are those expected to be payable on call/on just one day notice. But, in actual practice, the lender has to wait for at least 2 or 3 days to get back the amount. Inter-corporate deposits generally have 12 per cent interest per annum.

(b) Three Months Deposits:

These deposits are more popular among companies for investing the surplus funds. The borrower takes this type of deposits for meeting short-term cash inadequacy. The interest rate on these types of deposits is around 14 per cent per annum.

(c) Six months Deposits:

Inter-corporate deposits are made for a maximum period of six months. These types of deposits are usually given to ‘A’ category borrowers only and they carry an interest rate of around 16 per cent per annum.

7. Commercial Banks:

Commercial banks are the major source of working capital finance to industries and commerce. Granting loan to business is one of their primary functions. Getting bank loan is not an easy task since the lending bank may ask a number of questions about the prospective borrower’s financial position and its plans for the future.

At the same time the bank will want to monitor borrower’s business progress. But there is a good side to this that is borrower’s share price tends to rise, because investor knows that convincing banks is very difficult. The different types or forms of loans are:

(i) Loans,

(ii) Overdrafts,

(iii) Cash credits,

(iv) Purchasing or discounting of bills and

(v) Letter of Credit.

8. Factoring:

Factoring is one of the sources of working capital. Banks have been given more freedom of borrowing and lending both internally and externally and facilitated the free functioning in lending and investment operations. From 1994, banks are allowed to enter directly leasing, hire purchasing and factoring services, instead through their subsidiaries. In other words, banks are free to enter or exit in any field depending on their profitability, but subject to some RBI guidelines. Banks provide working capital finance through financing receivables, which is known as “factoring”. A “Factor” is a financial institution, which renders services relating to the management and financing of sundry debtors that arises from credit sales.

Q4) What do you mean by long term and short term finance? 5

A4. Financing is a very important part of every business. Companies often need money to pay for assets, equipment, and other important items. Financing can be either long-term or short-term. Obviously, long-term financing is more expensive than short-term financing.

There are various ways to enable long-term and short-term financing.

A source of funding is the means by which a company raises funds to carry out its activities. Every business always needs a certain amount of money to ensure its continuity. They obtain these funds using the various sources of funding available on the market. Companies choose specific sources of funding according to their needs and capabilities.

Funding sources are categorized based on various criteria such as duration, management, source of origin, and ownership. On a period, basis, these sources are further categorized into long-term and short-term sources.

Short-term funding sources are used for short-term funding of less than a year. Funds raised with short-term funds must be repaid within one year. Long-term funding sources help you get funding for a longer period of one year or more. The funds raised through these can be repaid over the years.

Long-term funding sources: Funds raised through these means can be repaid over the years. It makes it possible to meet the required money requirements for a longer period of time.

Q5) What is working capital? Write its nature. 5

A5. Working Capital is the term used basically to indicate the financial condition of a firm or an organization in the short term. In other words, it can be called a scale to measure the overall efficiency of the business entity.

To obtain the working capital of a specific firm or organisations one is required to subtract the current liabilities from the total current assets of the entity. This ratio suggests whether the particular organization has sufficient assets with it to take care of its short-term debt. To put it the other way, working capital is an indicator of the liquidity levels of an organization for taking care of day-to-day expenditure and cash, accounts payable, inventory, accounts receivable and also due short-term debt.

Working capital is obtained from many company operations like inventory and debt management, revenue collection and supplier payments. Now with the concept of working capital being clear, one needs to know about different types of working capital and the various sources from which it can be derived for the company or the firm.

The amount the company has or will have in a particular year. Working capital is calculated by subtracting current liabilities from current assets. That is, it takes the value of all debt and obligations for the current year and deducts it from the value of all cash and assets that could reasonably be converted to cash in the current year. This is a good measure of shorts and medium-term financial condition of the company. It may indicate how much you can grow your business without resorting to borrowing or other financing tactics. Working capital is also known as operating assets or net current assets.

Nature:

- Operating Expense Management: Working capital management manages all operating expenses of a corporate organization. It regulates all the funds needed to purchase raw materials, spare parts, pay wages and other daily expenses. With proper working capital management, you can frequently purchase all the resources you need according to your business needs.

- Avoiding a financial crisis: Prevents a financial crisis situation within the enterprise. Working capital management focuses on maintaining the optimal level of funding at all times. All business capital is invested in the right assets to strengthen cash management and thereby maintain the right current ratio.

- Keep your business running: Working capital management plays an efficient role in keeping your business circle moving. You always have the right amount of cash available to cover the day-to-day expenses that lead to business continuity. Monitor all accounts payable and accounts receivable in your business and make efficient use of all your funds.

- Fulfilment of short-term obligations: Fulfilling all short-term obligations of the business in a timely manner is an important role of working capital management. With proper management of funds, an organization has sufficient funds available to repay creditors in a timely manner. Sufficient working capital also makes it possible to lend short-term credit lines to clients on a business-by-business basis.

- Cash Discounts Available: Proper management of working capital provides the opportunity to take advantage of the cash discount features offered by suppliers. Companies with sufficient working capital can purchase raw materials in bulk that are available at significant discounts from suppliers when making cash payments.

- Drive business growth: Working capital management leads to business growth and growth. The focus is on increasing overall productivity and profitability by ensuring that all business funds are used efficiently. Funds are acquired for the business at economic cost and timely deployed into an efficient set of assets that generate better returns.

- Regulate business reputation: Regulate the overall reputation of a business organization in the market. Proper management of working capital leads to timely payment of all outstanding invoices and short-term debt by the business. Maintaining adequate funds always enhances your overall liquidity position, creditworthiness and builds your company's credit.

Q6) Discuss the importance of working capital. 5

A6. The following is the importance of working capital.

- Liquidity Management: Proper analysis of costs paid or incurred in the near future allows a company's finance team to easily plan funds accordingly.

- Cash shortages: Improperly prepared plans for daily expenses can cause liquidity problems for businesses. They have to postpone or arrange funding from several other sources that give the company a bad impression at the party.

- Helps you make decisions: By properly analysing the funding requirements of your day-to-day operations, your finance team can better manage your funds and determine the available funds and their availability accordingly.

- Add Business Value: Management manages the necessary funds on a daily basis to help authorized personnel pay all outstanding payments in a timely manner, adding value to the market or strengthening goodwill. Bring.

- Assistance in Cash Crunch Situations: Proper management of liquid funds allows organizations to pay their daily costs in a timely manner without affecting the crisis or cash crunch situation.

- Perfect Investment Planning: You can properly manage your funds or working capital, select or plan your investment accordingly, and invest your funds to maximize your return on availability.

- Helps to make short-term profits: It is sometimes seen that companies hold large amounts of working capital that far exceeds the level of working capital required. Therefore, by properly preparing the necessary working capital, these additional funds can be invested in a short period of time to create value in the profits of the company.

- Strengthening the work culture of the entity: Timely payment of daily expenses, mainly focused on employee salaries, creates a good environment and a kind of motivation among employees, works harder and works better strengthen the environment.

- Improve Business Credit: When a company properly plans working capital requirements, timely payments to vendors and other creditors can improve credit and when and when needed. You will be able to easily raise funds.

- Act as a guarantor for another company: If a company creates such a good image in the market, the business can also assist other companies and easily make business profits and contracts.

- Good reputation of an entity: An easy way to create a good reputation in the market. This makes it easy for an organization or entity to sign a contract to achieve a good image and a commitment on time. Today, everyone wants to trade and trade with such parties who have a good market reputation and creditworthiness due to increased fraud and manipulation.

Q7) What are the determinants of working capital? 5

A7. Working capital determinant

Financial management has no fixed formulas or rules for determining working capital requirements in a business. There are many factors that can be a determinant of an organization's working capital. In addition to this, the importance of factors also changes over time for the enterprise. It is very important for a company to perform a proper analysis to find out the factors that influence working capital requirements.

The determinants of a company's working capital are:

1. The nature of the business

The working capital requirements of an organization are also influenced by the nature of the business. For example, trading companies and financial companies do not need a lot of fixed assets. However, they are investing huge working capital to carry out the day-to-day operations of their business. Similarly, retailers and department stores need to own large amounts of merchandise, which requires a large amount of working capital.

Utilities, on the other hand, need more fixed assets. Therefore, the investment in working capital is relatively low compared to other companies. However, manufacturing companies need both, so they are somewhere between trading companies and utilities.

2. Technology and manufacturing policy

The manufacturing process involves procuring raw materials, using raw materials, and converting them into finished products. Therefore, as long as the manufacturing cycle continues, the need for working capital by the organization will increase. However, adding technology to the manufacturing cycle shortens the manufacturing process and thus shortens the conversion period from raw materials to finished products. This reduces working capital requirements. Therefore, it is one of the most important decisions that a company needs to decide whether to add technology to its production process.

3. Credit policy

Credit policy is another important determinant of working capital. If a company adopts a liberal credit policy, it means giving credit to the customer without looking at the customer's creditworthiness. This can delay payments from customers. The collection period will be longer. If the company cannot collect the payment, it can also result in bad debts. Therefore, it is very important for a company to design a credit policy that confirms the customer's creditworthiness, reduces the number of procedures, and grants the customer credit.

4. Market and demand conditions

Market demand also plays an important role in determining a company's working capital. For example, low demand during the lean season means that companies do not need more production, which requires less working capital. However, demand will increase during peak seasons. This allows for more production. More production leads to an increased need for working capital.

5. Change price level

Price changes also affect working capital. For example, as the price of raw materials rises, more cash is needed to purchase the raw materials, which requires more working capital. However, companies that raise the price of their products as prices rise do not have to face this problem.

6. Operational efficiency

Operational efficiency refers to the optimal use of resources by a company with minimal spending. Companies need to manage operating costs and strive to make efficient use of fixed and current assets so that they can achieve operational efficiency. This will speed up the cash conversion cycle and improve working capital use.

7. Availability of credits from suppliers

The company's working capital requirements are also influenced by the credit terms provided by the supplier. If the suppliers provide credit to the company on free terms, they need less working capital and vice versa. However, if the supplier does not have credit, the company can borrow money from the bank.

Q8) Explain the scope of working capital. 5

A8. The scope of working capital management is as follows. – –

- Ensuring business continuity: Working capital management allows you to continue your business without interruption. Proper management of working capital always leads to sufficient funding availability. Companies receive a regular supply of raw materials from their suppliers by paying on time to help them continue their production activities on a regular basis.

- Improve your business's solvency: Businesses that manage working capital efficiently can maintain adequate liquidity. It will improve their cash management and reduce their reliance on external funds as large amounts of money are tied to working capital. Working capital management allows them to pay all short-term debt and operating expenses on time.

- Ability to face a crisis: Efficient management of working capital allows businesses to face emergencies such as depression. It always guarantees the proper availability of funds, so businesses can easily face during times of crisis or peak demand when they need to increase their production.

- Improving Credit: Improving business value and market position is another important benefit of working capital management. Companies with sound working capital positions enjoy better liquidity and credit ratings. Helps you easily raise funds on favourable terms from a variety of external sources.

- Better relationships with suppliers and creditors: Working capital management leads to better relationships with suppliers and all creditors. This allows you to pay all membership fees to your suppliers or creditors on time by always maintaining a sufficient amount of funds. This gives creditor’s confidence in their business.

- Helps Expand: Every company wants to expand its activities over a period of time when additional capital is needed. With proper cash management, you can provide the money you need for your business in a timely manner and make your expansion program a success.

- Competitive Advantage: Businesses with money management can reduce costs and avoid wasting resources. By offering products to customers at low prices, you can make a sufficient profit. It helps you gain a competitive advantage in the market and generate significant revenue.

Q9) What is working capital? Explain its concept. 8

A9. Working capital is the amount of rotating capital that circulates in the short term to facilitate the day-to-day operations of a business. It is considered the backbone of all businesses as it plays a very important role in the growth of the business.

As a result, financial managers place the highest priority on working capital management for the sound financial position of the company.

Working capital means a company's investment in raw materials, finished products, cash, and accounts receivable.

For example, if there are manufacturing concerns, the availability of raw materials is important for continuous and non-stop production, and a certain amount of finished products in the warehouse will keep the company unaffected by fluctuations in productivity. It is also important to continue sales. Similarly, the company also needs to invest in credit sales to achieve continuous sales with cash on hand and bank balances to meet daily cash demand.

There are two concepts in working capital.

Total working capital:

Net working capital

- Total working capital

Total working capital is the total investment of a company in current assets. Alternatively, the total amount of short-term capital required for business operations is called total working capital.

For example, the total amount of raw materials, finished products, accounts receivable, and cash. Total working capital has some restrictions, such as not showing the actual position of the business.

When a company borrows a loan or down payment, it increases the balance of the bank, which definitely affects the value of liquid assets and has a positive effect on working capital, but ignores the rise on the other side of the balance sheet.

This concept helps to some extent to calculate the total amount required to invest in liquid assets to keep a business running smoothly.

This concept is usually supported by new businesses that own business ideas but have less investment and need to borrow money from banks and other financial institutions to meet their working capital requirements.

b. Net working capital:

Network capital is the positive or negative balance of a company's current assets against its current liabilities.

Simply put, network capital is calculated by subtracting current liabilities from current assets.

Current assets include inventories, cash, cash equivalents and accounts receivable, and current liabilities include accounts payable, accrued expenses, or short-term borrowings.

The formula for net working capital can be defined as:

Net Working Capital = Current Assets-Current Liabilities

Network capital can be positive or negative, depending on the values present in the current section of the balance sheet.

The result is positive if the company invests more in current assets backed by a reduction in current liabilities. Also, if the amount of current liabilities exceeds the value of current assets, the result will be negative.

Negative working capital indicates that the risk is high because the company's business has more debt than its own capital. However, according to modern theory, negative working capital is not necessarily a bad thing.

Businessmen have good business plans, but often borrow relatively large amounts from banks and other financial institutions due to lack of funds.

Therefore, this would result in negative network capital, which may not be considered a financial management failure. Because owners use borrowing as a tool to start and grow their business.

And with the passage of time and effort, if the business plan is successfully implemented, the working capital position will begin to shift from negative to positive.

Q10) What are the advantages and disadvantages of working capital? 8

A10. Benefits of working capital management

- Ensure liquidity

Companies are often in trouble because they lack the cash they need to repay their businesses and short-term debt. This happens because the company's working capital management policy is ineffective or not at all. Working capital management ensures liquidity by monitoring accounts receivable, accounts payable, inventory management and debt management. This helps keep your business sufficiently liquid cash at all times to pay operating costs and short-term debt. Therefore, it helps you allocate resources in the best possible way.

b. Avoid operational interruptions

Working capital management involves the use of ratio analysis. Ratios such as working capital ratio, quick ratio, and accounts receivable turnover ratio are calculated and interpreted to provide information to management. Such information helps managers plan and run their businesses in the most efficient way. Optimal use of working capital management avoids future obstacles to business operations. Cases such as delays in payable payments and lack of production are minimized in significant quantities. This gives your business a competitive edge over its competitors.

c. Increased profitability

Proper application of working capital management strategies will improve the profitability of the company in the long run. Policies manage inventory appropriately to avoid operational disruptions. Accounts receivable management is an important part of working capital management, so collection from accounts receivable is on time. With proper management and cash allocation, there are no defaults for payment of transactions that should be paid on time.

d. Improve your financial position

Working capital management basically deals with corporate cash management. Evaluate the source of cash inflows and determine cash outflows in the best possible way. Proper allocation of cash leaves room for investment in the remaining cash or repayment of short-term debt. This will, in most cases, solve your business economically and avoid legal issues that may arise from a lack of working capital. The higher the profitability, the higher the return on capital used. This, in turn, will attract more capital from future investors and unlock more capabilities.

e. Added value

As explained earlier, working capital enhances a company's financial position and operational success. It makes the company stand out among its peers. There is respect for the business market. All this leads to the added value of the entity.

Disadvantages of working capital management

- Financial factors only

Only financial factors are considered in this strategy. Monetary items such as the value of debt receivables and the value of finished products are fundamental determinants in executing a strategy. Non-monetary factors such as recession, dissatisfied workers, and changes in government policy towards the industry are not considered or are unrelated to this policy.

b. Non-situational

Another drawback of working capital management policies is that they are not contextual. This strategy is based on past events and numbers, so it does not allow for rapid changes in market conditions. The time it takes to respond to a particular recent event is important because it impacts business operations and profitability.

c. Based on data

Working capital management works around data. This is an important spirit of working capital management strategy. The data contains details about working capital components every minute. For example, accounts receivable requires a sale date, credit period, allowed grace days, and penalties for non-fulfilment of payments. Without data, this strategy wouldn't make sense in the real world. .

d. Interpretation problem

Working capital management includes a method of ratio analysis. The ratio is just a number that allows the user to interpret the result. In most cases, users do not know if a particular ratio is beneficial to the company. For example, for a liquid asset ratio, a ratio higher than 1: 1 would be desirable. But on the other hand, keeping in mind the economy and business cycle, we also recommend that ratios above 2: 1 are not desirable. Currently, if a company's accounts receivable cycle is greater than the industry average, the company cannot accurately interpret the ratio.