Unit 1

Indirect Tax

Q1) What is an indirect tax? Discuss the features of indirect tax. 8

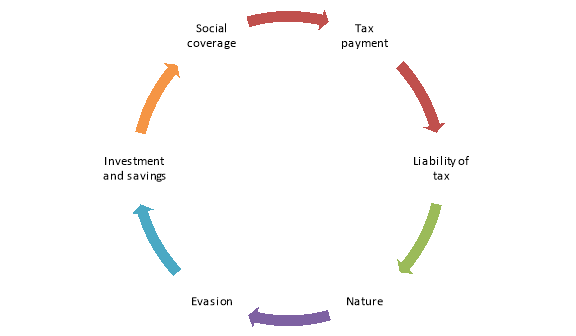

A1) Some of the features of indirect tax are stated below

Figure: Features of indirect tax

- Payment and Tax Load - The service provider makes payment of indirect taxes and this is transferred to a final consumer.

- Liability of Tax – Here the seller or service provider makes payment on indirect taxes which are transferred to final consumer.

- Nature – Initially, indirect taxes used to have a regressive nature. Yet, now with the coming of GST, they have become quite progressive.

- Evasion - Indirect taxes are hard to evade due to direct implementation through goods and services.

- Investment and Saving - Most indirect taxes are largely growth-oriented since they de-motivate the consumer and encourage savings.

- Social Coverage - The indirect tax has a much larger coverage since their charge falls upon each individual buying products or services.

Q2) State the distinctions between direct and indirect tax. 5

A2) The difference between direct and indirect tax are stated below-

Basis of difference | Direct tax | Indirect tax |

| It is levied on income and gains. | It is levied on goods and services. |

2. Payable | It is paid by the individuals and business entity. | It is paid by end consumers. |

3. Transferability | It is non-transferable. | It is transferred by producers to sellers and ultimately to end consumers. |

4. Tax evasion | It is possible. | It is not possible. |

5. Nature | It is progressive in nature. | It is regressive in nature |

6. Examples | Income tax is an example. | GST, VAT etc. are some examples |

Q3) What are the types of indirect tax existed in India before GST. 5

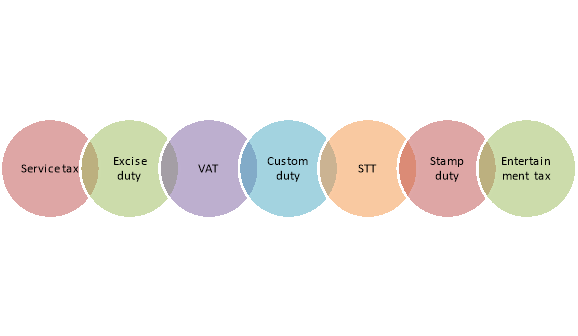

A3) The indirect taxes prevailed in India before GST are discussed below-

Figure: Service tax existed in India before GST

1. Service Tax in India

Service Tax is a tax which is levied on the Services provided by an entity. If an entity is providing any service, they are required to levy Service Tax on the same. This service tax is collected from the recipient of service and deposited with the Central Govt.

2. Excise Duty

Excise Duty is an indirect tax levied on those goods which are manufactured in India. The taxable event in this case is manufacture and the liability of central excise duty arises as soon as the goods are manufactured.

3. Value added tax (VAT)

VAT is a multi-point destination based system of taxation, with tax being levied on value addition at each stage of transaction in the production/ distribution chain. The term ‘value addition’ implies the increase in value of goods and services at each stage of production or transfer of goods.

4. Customs Duty

Customs Duty is a type of Indirect Tax which is levied on goods which are imported into India. In some cases, it is also levied when the goods are exported from India.

5. Securities Transaction Tax (STT)

Securities Transaction Tax or STT is a type of Indirect Tax which is levied at the time of sale/purchase of securities through the Indian Stock Exchanges. These securities include Shares, Mutual Funds, F&O Transactions etc.

6. Stamp Duty

Stamp Duty is an indirect tax levied by the State Govt’s on the transfer of immovable property located in their state. It is also levied by the Govt. On all Legal Documents. The Stamp Duty Rates vary from State to State.

7. Entertainment Tax

Entertainment Tax is levied on every financial transaction that is related to entertainment and is reserved primarily for the state governments. Some forms of entertainment on which entertainment tax is levied include Amusement Parks, Video Games, Arcades, Exhibitions, Celebrity Stage Shows, sports activities etc.

Q4) State some of the short comings of indirect tax. 5

A4) Some of the short comings of indirect tax systems during pre GST era are-

- Central Sales Tax (CST) is payable for every movement of goods from one State to other.

- Cascading effect of taxes cannot be avoided due to CST and Entry Tax.

- In India, movement of goods from one State to other is not tax free.

- India does not have a national market due to invisible barriers of central sales tax, Entry Tax and State Vat and visible barriers of check posts.

- Central Government cannot impose tax on goods beyond manufacturing level

- State Government cannot impose service tax.

- Same transaction is taxed both by Central and State Government which creates confusion, litigation and double taxation in many cases.

Q5) Write a small note on evolution of GST. 5

A5) GST is known as the Goods and Services Tax. It is an indirect tax which has replaced many indirect taxes in India such as the excise duty, VAT, services tax, etc.

The idea of a Goods and Services Tax (GST) for India was first mooted sixteen years back, during the Prime Ministership of Shri Atal Bihari Vajpayee. In March 2011, Constitution (115th Amendment) Bill, 2011 was introduced in the Lok Sabha to enable levy of GST. On 19th December, 2014, The Constitution (122nd Amendment) Bill 2014 was introduced in the Lok Sabha and was passed by Lok Sabha in May 2015. The Bill was taken up in Rajya Sabha and was referred to the Joint Committee of the Rajya Sabha and the Lok Sabha on 14th May, 2015. The Select Committee submitted its report on 22nd July, 2015. Thereafter, the Constitutional Amendment Bill was moved on 1st August 2016 based on political consensus. The Bill was passed by the Rajya Sabha on 3rd August 2016 and by the Lok Sabha on 8th August 2016. After ratification by required number of State legislatures and assent of the President, the Constitutional amendment was notified as Constitution (101st Amendment) Act 2016 on 8th September, 2016. The Constitutional amendment paved way for introduction of Goods and Services Tax in India. After GST Council approved the Central Goods and Services Tax Bill 2017 (The CGST Bill), the Integrated Goods and Services Tax Bill 2017 (The IGST Bill), the Union Territory Goods and Services Tax Bill 2017 (The UTGST Bill), the Goods and Services Tax (Compensation to the States) Bill 2017 (The Compensation Bill), these Bills were passed by the Lok Sabha on 29th March, 2017. The Rajya Sabha passed these Bills on 6th April, 2017 and were then enacted as Acts on 12th April, 2017. Thereafter, State Legislatures of different States have passed respective State Goods and Services Tax Bills. After the enactment of various GST laws, GST was launched with effect from 1st July 2017 by Shri Narendra Modi, Hon'ble Prime Minister of India in the presence of Shri Pranab Mukherjee, the then President of India in a mid-night function at the Central Hall of Parliament of India.

Q6) Explain the advantages of GST. 8

A6) Some of the advantages of GST are-

- Mitigation of Cascading effect:

Under the GST administration, the final tax would be paid by the consumer for the goods and services purchased. However, there would be an input tax credit structure in place to ensure that there is no slumping of taxes. GST is levied only on the value of the good or service.

2. Abolition of Multiple Layers of Taxation:

One of the advantages of GST is that it integrated different tax lines such as Central Excise, Service Tax, Sales Tax, Luxury Tax, Special Additional Duty of Customs, etc. into one consolidated tax. It prevents multiple tax layers imposed on goods and services.

3. Resourceful Administration by Government:

Previously, the management of indirect taxes was a complicated task for the Government. However, under the GST establishment, the integrated tax rate, simple input of tax credit mechanism and a merged GST Network, where information is available, and administration of resources are well-organised and straightforward for the Government.

4. Enhanced Productivity of Logistics:

The restriction on inter statement movement of goods has reduced. Earlier logistic companies had to maintain multiple warehouses across the country to avoid state entry taxed on interstate movements.

5. Creation of a Common National Market:

GST gave a boost to India’s tax to Gross Domestic Product ratio that aids in promoting economic efficiency and sustainable long – term growth. It led to a uniform tax law among different sectors concerning indirect taxes. It facilitates in eliminating economic distortion and forms a common national market.

6. Ease of Doing Business:

With the implementation of GST, the difficulties in indirect tax compliance have been reduced. Earlier companies faced significant problems concerning registration of VAT, excise customs, dealing with tax authorities, etc. The benefits of GST has aided companies to carry out their business with ease.

7. Regulation of the Unorganized Sector under GST:

It has created provisions to bring unregulated and unorganised sectors such as the textile and construction industries to name a few under regulation with continuous accountability.

8. Reduction of Litigation:

GST aids in reducing litigation as it establishes clarity towards the jurisdiction of taxation between the Central and State Governments. GST provides a smooth assessment of tax.

9. Tackling Corruption and Tax Leakages:

With the GST online network portal, the taxpayer can directly register, file returns and make payments of the taxes without having to interact with tax authorities. A mechanism has been devised to match the invoices of the supplier and buyer. This will not only keep a check on tax frauds and evasion but also bring in more businesses into the formal economy.

Q7) Define GST. Also state the disadvantages of GST. 5

A7) GST is known as the Goods and Services Tax. It is an indirect tax which has replaced many indirect taxes in India such as the excise duty, VAT, services tax, etc. In other words, GST is levied on the supply of goods and services. Goods and Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. GST is a single domestic indirect tax law for the entire country.

Disadvantages of Indirect tax are-

1. IT Infrastructure: since GST is an IT-driven law, it cannot be sure whether all the states in India are currently equipped with infrastructure and workforce availability to embrace this law. Only a few states have implemented this E- Governance model. Even today some states use the manual VAT returns system.

2. Higher Tax Burden of SME’s: earlier the small and medium enterprises had to pay excise duty only on a turnover that exceeded Rs. 1.5 crore every financial year. However, under the GST administration, businesses whose turnover exceeds Rs 40 lacs are liable to pay GST.

3. Increase Burden of Compliance: The GST administration states that companies are required to register in all the states they operate in. This increases the burden on the business for excessive paperwork and compliance.

4. Petroleum Products don’t fall under the GST Slab: petrol and petroleum products have not been included in the scope of GST until now. States levy their taxes on this sector. Tax credit for inputs will not be available to these industries or those related industries.

5. Coaching of Tax Officers: there is inadequate training that is provided to the Government officers for practical usage and implementation of such systems since the GST administration heavily banks on information technology.

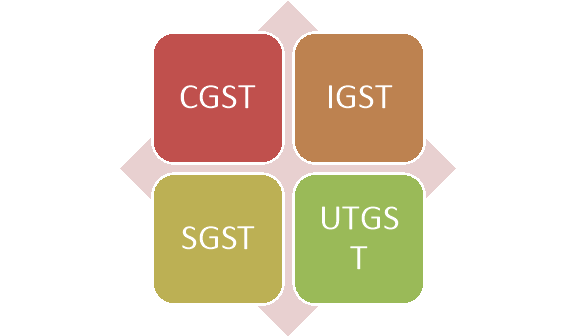

Q8) Discuss the structure of GST. 5

A8) The structure of GST comprises of CGST, IGST, SGST and UTGST. Such types of GST are discussed below-

Figure: Types of GST/Structure of GST

1. Integrated Goods and Services Tax (IGST)

The Integrated Goods and Services Tax or IGST is a tax under the GST regime that is applied on the interstate (between 2 states) supply of goods and/or services as well as on imports and exports. The IGST is governed by the IGST Act. Under IGST, the body responsible for collecting the taxes is the Central Government. After the collection of taxes, it is further divided among the respective states by the Central Government. For instance, if a trader from Assam has sold goods to a customer in Bihar worth Rs.5,000, then IGST will be applicable as the transaction is an interstate transaction. If the rate of GST charged on the goods is 18%, the trader will charge Rs.5,900 for the goods. The IGST collected is Rs.900, which will be going to the Central Government.

2. State Goods and Services Tax or SGST

The State Goods and Services Tax or SGST is a tax under the GST regime that is applicable on intrastate (within the same state) transactions. In the case of an intrastate supply of goods and/or services, both State GST and Central GST are levied. However, the State GST or SGST is levied by the state on the goods and/or services that are purchased or sold within the state. It is governed by the SGST Act. The revenue earned through SGST is solely claimed by the respective state government. For instance, if a trader from West Bengal has sold goods to a customer in West Bengal worth Rs.5,000, then the GST applicable on the transaction will be partly CGST and partly SGST. If the rate of GST charged is 18%, it will be divided equally in the form of 9% CGST and 9% SGST. The total amount to be charged by the trader, in this case, will be Rs.5,900. Out of the revenue earned from GST under the head of SGST, i.e. Rs.450, will go to the West Bengal state government in the form of SGST.

3. Central Goods and Services Tax or CGST

Just like State GST, the Central Goods and Services Tax of CGST is a tax under the GST regime that is applicable on intrastate (within the same state) transactions. The CGST is governed by the CGST Act. The revenue earned from CGST is collected by the Central Government. As mentioned in the above instance, if a trader from West Bengal has sold goods to a customer in West Bengal worth Rs.5,000, then the GST applicable on the transaction will be partly CGST and partly SGST. If the rate of GST charged is 18%, it will be divided equally in the form of 9% CGST and 9% SGST. The total amount to be charged by the trader, in this case, will be Rs.5,900. Out of the revenue earned from GST under the head of CGST, i.e. Rs.450, will go to the Central Government in the form of CGST.

4. Union Territory Goods and Services Tax or UTGST

The Union Territory Goods and Services Tax or UTGST is the counterpart of State Goods and Services Tax (SGST) which is levied on the supply of goods and/or services in the Union Territories (UTs) of India. The UTGST is applicable on the supply of goods and/or services in Andaman and Nicobar Islands, Chandigarh, Daman Diu, Dadra, and Nagar Haveli, and Lakshadweep. The UTGST is governed by the UTGST Act. The revenue earned from UTGST is collected by the Union Territory government. The UTGST is a replacement for the SGST in Union Territories. Thus, the UTGST will be levied in addition to the CGST in Union Territories.

Q9) Write a note on GST council. 8

A9) GST council

As per Article 279A of the amended Constitution, the GST Council is a joint forum of the Centre and the States, and consists of the following members: -

Union Finance Minister | Chairperson |

The Union Minister of State, in-charge of Revenue, Min. Of Finance | Member |

The Minister In-charge of Finance or Taxation or any other Minister nominated by each State Government | Members |

The Council is empowered to make recommendations to the Union and the States on the following:

(a) the taxes, cesses and surcharges levied by the Union, the States and the local bodies which may be subsumed in the goods and services tax;

(b) the goods and services that may be subjected to, or exempted from the goods and services tax;

(c) model Goods and Services Tax Laws, principles of levy, apportionment of Integrated Goods and Services Tax and the principles that govern the place of supply;

(d) the threshold limit of turnover below which goods and services may be exempted from goods and services tax;

(e) the rates including floor rates with bands of goods and services tax;

(f) any special rate or rates for a specified period, to raise additional resources during any natural calamity or disaster;

(g) special provision with respect to the States of Arunachal Pradesh, Assam, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand; and

(h) the date on which GST shall be levied on petroleum crude, high speed diesel, motor spirit (petrol), natural gas and aviation turbine fuel

(i) any other matter relating to the goods and services tax, as the Council may decide.

The mechanism of GST Council would ensure harmonisation on different aspects of GST between the Centre and the States as well as amongst the States. It has been provided in the Constitution (One Hundred and First Amendment) Act, 2016 that the GST Council, in discharge of various functions, shall be guided by the need for a harmonized structure of GST and for the development of a harmonized national market for goods and services.

The Constitution (One Hundred and First Amendment) Act, 2016 provides that every decision of the GST Council shall be taken at its meeting by a majority of not less than 3/4th of the weighted votes of the Members present and voting. The vote of the Central Government shall have a weightage of 1/3rd of the votes cast and the votes of all the State Governments taken together shall have a weightage of 2/3rd of the total votes cast in that meeting. One half of the total number of members of the GST Council shall constitute the quorum at its meeting.

On 12th September, 2016 the Union Cabinet under the Chairmanship of the Hon'ble Prime Minister approved setting up of GST Council and creation of its Secretariat as follows:

(a) GST Council as per Article 279A of the amended Constitution;

(b) GST Council Secretariat, with its office at New Delhi;

(c) Secretary (Revenue) as the Ex-officio Secretary to the GST Council;

(d) Inclusion of the Chairperson, Central Board of Excise and Customs (CBEC), as a permanent invitee (non-voting) to all proceedings of the GST Council;

(e) One post of Additional Secretary to the GST Council in the GST Council Secretariat (at the level of Additional Secretary to the Government of India), and four posts of Commissioners in the GST Council Secretariat (at the level of Joint Secretary to the Government of India).

The Cabinet also decided to provide for adequate funds for meeting the recurring and non-recurring expenses of the GST Council Secretariat, which shall be borne by the Central Government. The GST Council Secretariat shall be manned by officers taken on deputation from both the Central and State Governments.

Q10) Define GST network. Also discuss the elements of GST network. 5

A10) The Goods and Service Tax Network (or GSTN) is a non-profit, non-government organization. It will manage the entire IT system of the GST portal, which is the mother database for everything GST. This portal will be used by the government to track every financial transaction, and will provide taxpayers with all services – from registration to filing taxes and maintaining all tax details.

The GSTN is a complex IT initiative. It will establish a uniform interface for the taxpayer and also create a common and shared IT infrastructure between the Centre and States.

Figure: GST network

1. Trusted National Information Utility

The GSTN is a trusted National Information Utility (NIU) providing reliable, efficient and robust IT backbone for the smooth functioning of GST in India.

2. Handles Complex Transactions

GST is a destination based tax. The adjustment of IGST (for inter-state trade) at the government level (Centre & various states) will be extremely complex, considering the sheer volume of transactions all over India. A rapid settlement mechanism amongst the States and the Centre will be possible only when there is a strong IT infrastructure and service backbone which captures, processes and exchanges information.

3. All Information Will Be Secure

The government will have strategic control over the GSTN, as it is necessary to keep the information of all taxpayers confidential and secure. The Central Government will have control over the composition of the Board, mechanisms of Special Resolution and Shareholders Agreement, and agreements between the GSTN and other state governments. Also, the shareholding pattern is such that the Government shareholding at 49% is far more than that of any single private institution.

4. Expenses Will Be Shared

The user charges will be paid entirely by the Central Government and the State Governments in equal proportion (i.e. 50:50) on behalf of all users. The state share will be then apportioned to individual states, in proportion to the number of taxpayers in the state.

Q11) State the functions of GSTN. 4

A11) GSTN is the backbone of the Common Portal which is the interface between the taxpayers and the government. The entire process of GST is online starting from registration to the filing of returns.

It has to support about 3 billion invoices per month and the subsequent return filing for 65 to 70 lakh taxpayers.

The GSTN will handle:

Invoices

Various returns

Registrations

Payments & Refunds

Q12) Write a note on GST authority. 5

A12) GST authority in India is the GST council who is an apex member committee. In order to implement GST, Constitutional (122nd Amendment) Bill (CAB for short) was introduced in the Parliament and passed by Rajya Sabha on 03rd August, 2016 and Lok Sabha on 08th August, 2016. The CAB was passed by more than 15 states and thereafter Hon’ble President gave assent to “The Constitution (One Hundred And First Amendment) Act, 2016” on 8th of September, 2016. Since then the GST council and been notified bringing into existence the Constitutional body to decide issues relating to GST.

On September 16, 2016, Government of India issued notifications bringing into effect all the sections of CAB setting firmly into motion the rolling out of GST. This notification sets out an outer limit of time of one year that is till 15-9-2017 for bringing into effect GST.

As per Article 279A (1) of the amended Constitution, the GST Council has to be constituted by the President within 60 days of the commencement of Article 279A. The notification for bringing into force Article 279A with effect from 12th September, 2016 was issued on 10th September, 2016.

As per Article 279A of the amended Constitution, the GST Council which will be a joint forum of the Centre and the States, shall consist of the following members: -

- Union Finance Minister - Chairperson

- The Union Minister of State, in-charge of Revenue of finance - Member

- The Minister In-charge of finance or taxation or any other Minister nominated by each State Government - Members

As per Article 279A (4), the Council will make recommendations to the Union and the States on important issues related to GST, like the goods and services that may be subjected or exempted from GST, model GST Laws, principles that govern Place of Supply, threshold limits, GST rates including the floor rates with bands, special rates for raising additional resources during natural calamities/disasters, special provisions for certain States, etc.

The Union Cabinet under the Chairmanship of Prime Minister Shri Narendra Modi approved setting up of GST Council on 12th September, 2016 and also setting up its Secretariat as per the following details:

(a) Creation of the GST Council as per Article 279A of the amended Constitution;

b) Creation of the GST Council Secretariat, with its office at New Delhi;

(c) Appointment of the Secretary (Revenue) as the Ex-officio Secretary to the GST Council;

(d) Inclusion of the Chairperson, Central Board of Excise and Customs (CBEC), as a permanent invitee (non-voting) to all proceedings of the GST Council;

(e) Create one post of Additional Secretary to the GST Council in the GST Council Secretariat (at the level of Additional Secretary to the Government of India), and four posts of Commissioner in the GST Council Secretariat (at the level of Joint Secretary to the Government of India). The Cabinet also decided to provide for adequate funds for meeting the recurring and non-recurring expenses of the GST Council Secretariat, the entire cost for which shall be borne by the Central Government. The GST Council Secretariat shall be manned by officers taken on deputation from both the Central and State Governments.

Q13) Explain the provisions related to time of supply of goods under GST. 5

A13) In case of GST, Supply includes sale, transfer, exchange, barter, license, rental, lease and disposal. If a person undertakes either of these transactions during the course or furtherance of business for consideration.

The provisions/features related to supply in GST are-

Time of supply of goods (Section 12)

(1) The liability to pay tax on goods shall arise at the time of supply, as determined in accordance with the provisions of this section

(2) The time of supply of goods shall be the earlier of the following dates, namely:—

a) the date of issue of invoice by the supplier or the last date on which he is required, under sub-section (1) of section 31, to issue the invoice with respect to the supply; or

b) the date on which the supplier receives the payment with respect to the supply:

Provided that where the supplier of taxable goods receives an amount up to one thousand rupees in excess of the amount indicated in the tax invoice, the time of supply to the extent of such excess amount shall, at the option of the said supplier, be the date of issue of invoice in respect of such excess amount.

(3) In case of supplies in respect of which tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earliest of the following dates, namely:—

a) the date of the receipt of goods; or

b) the date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or

c) the date immediately following thirty days from the date of issue of invoice or any other document, by whatever name called, in lieu thereof by the supplier.

(4) In case of supply of vouchers by a supplier, the time of supply shall be—

a) the date of issue of voucher, if the supply is identifiable at that point; or

b) the date of redemption of voucher, in all other cases.

(5) Where it is not possible to determine the time of supply under the provisions of sub-section (2) or sub-section (3) or sub-section (4), the time of supply shall––

a) in a case where a periodical return has to be filed, be the date on which such return is to be filed; or

b) in any other case, be the date on which the tax is paid.

Q14) Define inter-state supply and intra-state supply under GST. 5

A14) Inter –state supply

Inter-state supply refers to the place of supply provisions, where the location of the supplier and the place of supply are in:

(a) Two different States;

(b) Two different Union territories; or

(c) A State and a Union Territory. Such supplies shall be treated as the supply of goods or services in the course of inter-State trade or commerce.

Any supply of goods or services in the taxable territory, not being an intra-State supply, shall be deemed to be a supply of goods or services in the course of inter-State trade or commerce. Supplies to or by SEZs are defined as inter-State supply. Further, the supply of goods imported into the territory of India till they cross the customs frontiers of India or the supply of services imported into the territory of India shall be treated as supplies in the course of inter-State trade or commerce. Also, the supplies to international tourists are to be treated as inter-State supplies.

Intra- state supply

Intra-state supply has been defined as any supply where the location of the supplier and the place of supply are in the same State or Union Territory.

Q15) Define exempted supply under GST. 2

A15) “Exempt supply” means supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax under section 11 of CGST Act or under section 6 of the IGST Act, and includes non-taxable supply. No tax on the outward exempted supplies, however, the input supplies used for making exempt supplies to be taxed. Credit of input tax needs to be reversed, if taken; No ITC on the exempted supplies. Value of exempt supplies, for apportionment of ITC, shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building. Any person engaged exclusively in the business of supplying goods or services or both that are not liable to tax or wholly exempt from tax under the CGST or IGST Act shall not be liable to registration. A registered person supplying exempted goods or services or both shall issue, instead of a tax invoice, a bill of supply.

Q16) Define “input tax” under GST.

A16) According to section 2 (g) of the GST act, "input tax" in relation to a taxable person, means,

(i) cess charged on any supply of goods or services or both made to him;

(ii) cess charged on import of goods and includes the cess payable on reverse charge basis.

Q17) Define mixed and composite tax under GST. 2

A17) Mixed supply under GST means a combination of two or more goods or services made together for a single price. Each of these items can be supplied separately and is not dependent on any other.

A supply of goods and/or services will be treated as composite supply if it fulfils the following criteria:

- Supply of 2 or more goods or services together; and

- It is a natural bundle, i.e., goods or services are usually provided together in the normal course of business.

- They cannot be separated.

Q18) State the central state tax. State any three of its features. 4

A18) According to section 2(a) "Central tax" means the central goods and services tax levied and collected under the Central Goods and Services Tax Act.

Some of the short comings of indirect tax systems during pre GST era are-

- Central Sales Tax (CST) is payable for every movement of goods from one State to other.

- Cascading effect of taxes cannot be avoided due to CST and Entry Tax.

- In India, movement of goods from one State to other is not tax free.

Q19) Write a small note on GST. 2

A19) GST is known as the Goods and Services Tax. It is an indirect tax which has replaced many indirect taxes in India such as the excise duty, VAT, services tax, etc. The Goods and Service Tax Act was passed in the Parliament on 29th March 2017 and came into effect on 1st July 2017. In other words, GST is levied on the supply of goods and services. Goods and Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. GST is a single domestic indirect tax law for the entire country.

Q20) Define IGST with example. 2

A20) The Integrated Goods and Services Tax or IGST is a tax under the GST regime that is applied on the interstate (between 2 states) supply of goods and/or services as well as on imports and exports. The IGST is governed by the IGST Act. Under IGST, the body responsible for collecting the taxes is the Central Government. After the collection of taxes, it is further divided among the respective states by the Central Government. For instance, if a trader from Assam has sold goods to a customer in Bihar worth Rs.5,000, then IGST will be applicable as the transaction is an interstate transaction. If the rate of GST charged on the goods is 18%, the trader will charge Rs.5,900 for the goods. The IGST collected is Rs.900, which will be going to the Central Government.