Unit 1

Income Tax

Q1) Define income tax with its features. 5

A1) Income tax refers to direct tax imposed by the government on income of the citizens of India. It is levied on income of individuals from salary, business, business, profession and other income.

Some of the features of income tax are-

- It is a direct tax.

- It is charged on the total income of a person.

- It is charged on the income of the income year at the rate applicable in assessment year.

- It is payable in the year following the income year.

- It is generally charged on revenue income of a person.

- It is a tax charged on a person for income that comes within the preview of relevant income tax law.

- Whether the income is permanent or temporary, it is immaterial from the tax point of view. Even temporary income is taxable.

- If a person receives tax—free income on which tax is paid by the person making payment on behalf of the recipient, it has to be grossed up for inclusion in his total income.

Q2) State the objectives and importance of income tax. 10

A2) Some of the objectives of income tax are highlighted below-

- To reduce inequalities in the distribution of income and wealth.

- To bring out a greater measures of equity between different classes of tax payers.

- To achieve the twin objectives of higher yields with reduction in inequalities.

- To accelerate the temp of economic growth and development of the country.

- To maintain reasonable economic stability in the force of long run inflationary pressure and short run international price movements.

- To make available of funds for economic development.

- To reduce extreme inequalities in wealth, income and consumptions standards with undetermined productive efficiency, offence, justice and political stability.

- To encourage investment in new capital goods.

- To channelize investment into those sectors which contribute the most of economic growth.

Some of the importance of income tax is highlighted below-

- Revenue Collection:

Government collects nearly 18% of revenue from this source of tax. Therefore the most and significant source of revenue is income tax.

2. Redistribution of Income:

An efficient and fair tax system can reduce the inequality of wealth and income. This is possible by imposing tax rich people heavily and to confer a benefit to poorer through progressive income tax.

3. Increase in Savings:

An effective and efficient tax system encourages people to save through providing tax credit facilities on investment allowances.

4. Increasing Capital Investment:

This income tax revenue can be used by the government to ensure the economic development of the country. It can be used to build up the infrastructure to invest in some social security programs in various poverty alleviation programs, like, Social Justice, Economical Control. Increase Public Awareness.

Q3) Define the term income and gross total income under the Income Tax Act. 8

A3) Income Section 2(24)

Income includes—

(i) profits and gains;

(ii) dividend;

(iii) voluntary contributions received by a trust created wholly or partly for charitable or religious purposes or by an institution established wholly or partly for such purposes or by an association or institution referred to in clause (21) or clause (23), or by a fund or trust or institution referred to in sub-clause (iv) or

(iv) the value of any benefit or perquisite, whether convertible into money or not, obtained from a company either by a director or by a person who has a substantial interest in the company, or by a relative of the director or such person, and any sum paid by any such company in respect of any obligation which, but for such payment, would have been payable by the director or other person aforesaid;

(v) any sum chargeable to income-tax under clauses (ii) and (iii) of section 28 or section 41 or section 59;

(vi) any capital gains chargeable under section 45;

(vii) the profits and gains of any business of insurance carried on by a mutual insurance company or by a co-operative society, computed in accordance with section 44 or any surplus taken to be such profits and gains by virtue of provisions contained in the First Schedule;

(viii) any winnings from lotteries, crossword puzzles, races including horse races, card games games and other games of any sort or from gambling or betting of any form or nature whatsoever.

Gross Total Income

Gross Total Income is the aggregate of all the income earned by the individuals during a specified period. According to Section 14 of the Income Tax Act 1961, the income of a person or an assessee can be categorised under these five heads,

- Income from Salaries

- Income from House Property

- Profits and Gains of Business and Profession

- Capital Gains

- Income from Other Sources

Q4) What is total income under the Income Tax Act. 1961. 5

A4) According to section 2(45) total income means the total amount of income referred to in section 5, computed in the manner laid down in this Act. Section 5 of the act provides scope of total Income-

(1) Subject to the provisions of this Act, the total income of any previous year of a person who is a resident includes all income from whatever source derived which-

(a) is received or is deemed to be received in India in such year by or on behalf of such person ; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year ; or

(c) accrues or arises to him outside India during such year:

Provided that, in the case of a person not ordinarily resident in India within the meaning of sub-section (6) of section 6, the income which accrues or arises to him outside India shall not be so included unless it is derived from a business controlled in or a profession set up in India.

(2) Subject to the provisions of this Act, the total income of any previous year of a person who is a non-resident includes all income from whatever source derived which—

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year.

Q5) Define person under the Income Tax Act. Also explain the residential status of person under the same act. 5

A5) According to section 2(31) of person includes:

- Partnership Firms

- Company

- Association of person or body of individuals whether incorporated or not

- Local authorities

- Any other artificial judicial person not falling under any of the above sub sections.

Residence and Tax Liability

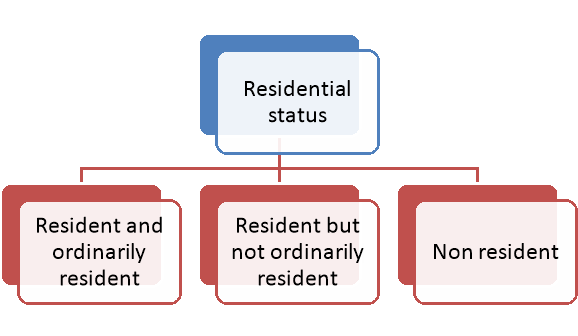

Section 4(6) of the income tax act provides provisions for residential status of person in India. According to the Income Tax Act, 1961, residential status of a person is one of the important criteria in determining the tax implications. The residential status of a person can be categorised into-

a) Resident and Ordinarily Resident (ROR)

b) Resident but Not Ordinarily Resident (RNOR)

c) Non- Resident (NR)

Figure: Residential status

Such types are discussed below-

a) Resident and Ordinarily Resident (ROR)

A resident taxpayer is an individual who satisfies any one of the following conditions:

- Resides in India for a minimum of 182 days in a year, or

- Resided in India for a minimum of 365 days in the immediately preceding four years and for a minimum of 60 days in the current financial year.

b) Resident but Not Ordinarily Resident (RNOR)

If an individual qualifies as a resident, the next step is to determine if he/she is a Resident ordinarily resident (ROR) or an RNOR. He will be a ROR if he meets both of the following conditions:

- Has been a resident of India in at least 2 out of 10 years immediately previous years and

- Has stayed in India for at least 730 days in 7 immediately preceding years

c) Non- Resident (NR)

An individual satisfying neither of the conditions stated above conditions would be a non-resident for the year.

Q6) Define salary and its types as provided under the Income Tax Act 1961. 5

A6) Salary is chargeable to tax either on ‘due’ basis or on ‘receipt’ basis, whichever is earlier. Hence, taxable salary includes:

- Advance salary (on ‘receipt’ basis)

Salary paid in advance is taxable under the head ‘Salaries’ in the year of receipt.

- Outstanding salary (on ‘due’ basis)

Salary falling due is taxable under the head ‘Salaries’ in the year in which it falls due.

- Arrear salary

Any increment in salary with retrospective effect which have not been taxed in the past, such arrears will be taxed in the year in which it is allowed. Arrear salary are taxable on receipt basis

In case Salary is received after deduction of following items... These are added back to get fully Salary:

(i) Own Contribution to Provident Fund.

(ii) Tax Deducted at Source (TDS)

(iii) Repayment of Loan etc.

(iv) LIC Premium, if deducted from salary.

(v) Group Insurance Scheme.

(vi) Rent of House provided by employer.

Salary U/s 17(1):

1.Wages. Fully Taxable.

2.Annuity or Pension. Fully Taxable

3.Gratuity. It has been treated separately.

4. (a) Any Fees -- Fully Taxable

(b) Commission -- Fully Taxable

(c) Bonus -- Fully Taxable

(d) Perquisites -- (Perks) These are treated separately u/s 17(2)

(e) Profit in lieu of Salary -- These are treated separately u/s17(3)

5.Salary in lieu of Leave / Leave Encashment. Fully Taxable.

6.Advance Salary. Fully Taxable

7.Arrears of Salary. Fully Taxable.

8.Refund of Provident Fund (PF)

(a) If SPF -- Fully exempted

(b) If RPF -- Fully exempted if service is more than 5 years.

(c) If URPF -- Taxable portion is added in salary income. Taxable portion is equal to employer’s contribution + interest on this part. Interest on own contribution to URPF is taxable under the head “Income from Other Sources.”

Q7) State about the provisions related to allowances under the head salary under the Income Tax Act. 8

A7)

A. Fully Exempted Allowances:

Foreign Allowance given by Govt. To its employees posted abroad. HRA given to Judges of High Court & Supreme Court.

B. Fully Taxable Allowances:

(i) Dearness Allowance / Additional D.A. / High Cost of Living Allowance -- Fully Taxable.

(ii) City Compensation Allowances (CCA).

(iii) Capital Compensatory Allowance

(iv) Lunch Allowance

(v) Tiffin Allowance

(vi) Marriage / Family Allowance

(vii) Overtime Allowance

(viii) Fixed Medical Allowance.

(ix) Electricity and Water Allowance

(x) Entertainment Allowance. It is fully added in employee’s Salary.

In case of Government employees a deduction is allowed u/s 16(ii) at the rate of least of following :

(a) Statutory Limit Rs. 5,000 p.a.

(b) 1/5 (20%) th of Basic Salary ; or

(c) Actual Entertainment Allowance received.

Partly Taxable Allowances:

1. House Rent Allowance (HRA)

(a) Fully Exempted, if received by the Judges of High Court and Supreme Court.

(b) Fully Taxable, if received by an employee who is living in his own house or in a house for which no rent is paid.

(c) Exempted upto least of following for those employees who are living in rented houses:

(i) Actual HRA received by the employee.

(ii) Rent paid - 10% of Salary; or

(iii) 40% of Salary in ordinary town; 50% of Salary in Mumbai, Kolkata, Chennai or Delhi.

Ø Taxable HRA = HRA Received - Least of Above.

Ø Salary = Pay + D.A. Which enters into Pay for Service or Retirement Benefits + Commission on Turnover Achieved by Him.

Following Allowances are Exempted upto actual expenditure incurred for employment. Excess, if any, shall be taxable.

2. Uniform Allowance

3. Conveyance Allowance

4. Traveling Allowance

Following Allowance are Exempted up to amount so notified

5. Special Compensatory Allowance

6. Border Area Allowance

7. Tribal Area Allowance -- Exempted upto Rs. 200 p.m. If received in the States of M.P., Tamil Nadu, U.P., Karnataka, Tripura, Assam, West Bengal, Bihar, or Orissa.

8. Children’s Education Allowance -- Exempted up to Rs.100 p.m. Per child for education in India of own two children only.

9. Hostel Expenditure Allowance -- Exempted up to Rs. 300 p.m. Per child for Hostel expenditure on own two children only.

Q8) Highlight the provisions related to perquisites under the head salary of the Income Tax Act. 10

A8) A. Exempted Perquisites:

1. Leave Travel Concession subject to conditions & actual spent only for travels.

2. Computer/ Laptop provided for official / personal use.

3. Initial Fees paid for corporate membership of a club.

4. Refreshment provided by the Employer during working hours in office premises.

5. Payment of annual premium on Personal Accident Policy.

6. Subscription to periodicals and journal required for discharge of work.

7. Provision of Medical Facilities.

8. Gift not exceeding Rs. 5,000 p.a.

9. Use of Health Club, Sports facility.

10. Free telephones whether fixed or mobile phones.

11. Interest Free / concessional loan of an amount not exceeding Rs.20,000 (limit not application in the case of medical treatment)

12. Contribution to recognised Provident Fund / approved super annuation fund, pension or deferred annuity scheme & staff group insurance scheme.

13. Free meal provided during working hours or through paid non transferable vouchers not exceeding Rs. 50 per meal or free meal provided during working hours in a remote area.

The value of any benefit provided free or at a concessional rate (including goods sold at concessional rate) by a company to the Employees by way of allotment of shares etc., under the Employees stock option plan as per Central Government Guidelines.

B. Taxable Perquisites:

1. Rent Free Accommodation

2. Provision of Motor Car or any other Conveyance for personal use of Employee.

3. Provision of Free or Concessional Education Facilities.

4. Reimbursement of Medical Expenditure.

5. Expenditure on Foreign Travel and stay during medical expenditure.

6. Supply of Gas, Electricity & Water.

7. Sale of an Asset to the Employee at concessional price including sale of Share in the Employer Company.

C. Perks Exempted for Employees but Taxable for Employer under Fringe Benefit Tax.

Value of the following benefits is not taxable in the hands of an employee. The employer has to pay tax on deemed income calculated as percentage of expenditure incurred.

- Any free or concessional ticket provided by the employer for private journeys of his employee or their family members

- Any contribution by the employer to an approved superannuation fund for employees;

- Expenditure incurred on entertainment;

- Expenditure incurred on provision of hospitality of every kind by the employer to any person.

- Expenditure incurred on conference like conveyance, tour & travel (including foreign travel), on hotel, or boarding and lodging in connection with any conference shall be deemed to be expenditure incurred for the purposes of conference.

- Expenditure incurred on sales promotions including publicity;

- Expenditure incurred on employee’s welfare;

- Expenditure incurred on conveyance

- Expenditure incurred on Hotel, Boarding & Lodging facilities;

- Expenditure incurred on Repair, Maintenance of Motor Cars and the amount of Depreciation there on.

- Expenditure incurred on use of telephone and Mobile Phones.

- Expenditure incurred on maintenance of any accommodation in the nature of Guest House other than used for Training purpose.

- Expenditure incurred on Festival Celebrations.

- Expenditure incurred on use of Health Club and similar facilities.

- Expenditure incurred on gifts;

Fringe Benefit Tax (FBT) is not applicable in case of following type of employers.

- An Individual or a sole Proprietor

- A Hindu Undivided Family

- Government

- A Political Party

- A person whose income is exempt u/s 10(23c)

- A Charitable Institution registered u/s 12AA.

- RBI

- SEBI

Q9) State the provisions related to profit in lieu of salary under the income tax act. 8

A9) Receipts which are included under the head ‘Salary’ but Exempted u/s 10.

1. Leave Travel Concession (LTC) - Exempt upto rules.

2. Any Foreign Allowance or perks - If given by Govt. To its employees posted abroad are fully exempted.

3. Gratuity: A Govt. Employee or semi-Govt. Employee where Govt. Rules are applicable -- Fully Exempted.

A. For employees covered under Payment of Gratuity Act--

Exempt up to least of following:

(a) Notified limit = Rs. 10,00,000

(b) 15 days Average Salary for every one completed year of

service (period exceeding 6 months =1 year)

1/2 month’s salary = (Average monthly salary or wages x 15/26

(c) Actual amount received.

B. Other Employees -- Exempted up to least of following provided service is more than 5 years or employee has not left service of his own:

(a) Notified limit = Rs. 10,00,000

(b) 1/2 month’s average salary for every one year of completed service (months to be ignored.)

(c) Actual amount received

Average Salary = Salary for 10 months preceding the month of retirement divided by 10.

4. Commutation of Pension:

In case commuted value of pension is received --

(a) If Govt. Employee -- is Fully Exempted.

(b) If other employee who receive gratuity also -Lump sum amount is exempted upto commuted value of 1/3rd of Pension.

If other employee who does not get gratuity -- Lump sum amount is exempted upto commuted value of 1/2 of pension.

5. Leave Encashment u/s 10(10AA)

(a) If received at the time of retirement by a Govt. Employee---Fully Exempted

(b) If received during service---Fully taxable for all employees

(c) If received by a private sector employee at the time of retirement exempted upto :

(i) Notified limit Rs. 3,00,000

(ii) Average salary x 10 months

(iii) Actual amount received.

(iv) Average Salary x No. Of months leave due.

6. Any Tax on perks paid by employer. It is fully Exempted.

7. Any payment received out of SPF. Any payment received out of SPF is Fully Exempted.

8. Any payment received out of RPF. Any payment received out of RPF is Fully Exempted, If service exceeds 5 years.

9. Any payment received out of an approved superannuation fund is Fully Exempted

Q10) State the deduction of section 16 and section 80C of the income tax act. 5

A10) Deduction Out of Gross Salary [ Sec. 16]

1. Entertainment Allowance [ U/s 16(ii)]

Deduction u/s 16(ii) admission to govt. Employee shall be an amount equal to least of following:

- Statutory Limit of Rs.5,000 p.a.

- 1/5 th of Basic Salary

- Actual amount of entertainment allowance received during the previous year.

2. Tax on Employment u/s 16(iii

In case any amount of professional tax is paid by the employee or by his employer on his behalf it is fully allowed as deduction.

Deduction U/S 80C Out of Gross Total Income (GTI)

The following are the main provisions of the newly inserted Section 80C.:

- Under Section 80C, deduction would be available from Gross Total Income.

- Deduction under section 80C is available only to individual or HUF.

- Deduction is available on the basis of specified qualifying investments / contributions / deposits / payments made by the taxpayer during the previous year.

- The maximum amount deduction under section 80C, 80CCC, and 80CCD cannot exceed Rs.1 lakh.

Deduction u/s 80C shall be allowed only to the following assessee:

- An Individual

- A Hindu Undivided Family (HUF)