Unit 3

Development Banks and other Non –Banking Financial Institution

Q1) what is development bank? State the features of development bank. 8

A1) Development Bank is a specialised monetary group. They offer medium- to lengthy-time period investment for the commercial and agricultural sectors. They fund each the non-public and public sectors. Development Bank is a multipurpose monetary group. They are engaged in time period lending, securities funding and different activities. They even sell financial savings and funding conduct in public.

The most important functions of the improvement financial institution are as follows.

1. A specialised monetary institution.

2. Provide medium- to long-time period investment to the commercial enterprise unit.

3. Unlike business banks, we do now no longer receive deposits from the overall public.

4. It isn't always only a time period lending institution. It is a multipurpose monetary institution.

5. It is basically a improvement-orientated financial institution. It’s most important motive is to sell financial improvement through selling funding in growing international locations and entrepreneurial activity. It encourages new and small marketers and seeks balanced nearby growth.

6. We will offer monetary assist now no longer handiest to the personal zone however additionally to the general public zone.

7. It targets to sell network financial savings and funding habits.

8. It does now no longer compete with ordinary monetary channels, that is, finance already to be had through banks and different conventional monetary institutions. Its most important position is the distance filler. e.g , To fill the lack of current monetary facilities.

Q2) Define NBFI. Also discuss the features of NBFI. 8

A2) A non-banking financial Institutions (NBFI) is financial institutions that do not have a full banking license and cannot accept deposits from the general public. However, NBFI promotes alternative financial services such as investment (both collective and individual), risk pooling, financial consulting, intermediaries, remittances and check cashing. NBFI is a source of consumer credit (along with licensed banks). Examples of non-bank financial institutions include insurance companies, venture capitalists, currency exchange offices, some microloan organizations, and pawn shops. These non-bank financial institutions offer services that are not always suitable for banks, act as a competitor to banks, and are sector or group-specific.

Main features of NBFI are discussed below-

1. Financial intermediate:

The maximum vital characteristic of non-financial institution economic intermediaries is the switch of finances from savers to investors.

Financial intermediaries are reasonably priced and less expensive for each SMEs and SMEs.

(A) Fund small and medium-sized corporations which have problem promoting shares and bonds because of excessive transaction costs.

(B) It additionally blessings small savers with the aid of using pooling their finances and diversifying their investments.

2. Economic foundation for economic intermediate:

The coping with of finances with the aid of using economic intermediaries is extra reasonably priced and green than that with the aid of using person asset proprietors because of the reality that economic intermediaries are primarily based totally on.

(A) The regulation of huge numbers, and

(B) Economies of scale in portfolio control.

(i) Law of huge numbers:

Financial intermediaries function at the regulation of huge numbers. According to this regulation, now no longer all lenders withdraw finances from those establishments. In addition, if a few lenders are retreating coins, a few different lenders can be depositing coins. Again, economic intermediaries pay hobby at the loans and investments they make on a normal foundation. All of those elements permit economic intermediaries to preserve handiest a small part of the finances furnished with the aid of using lenders in coins and lend or make investments the rest.

(ii) Economies of scale:

The huge length of the asset portfolio permits economic intermediaries to revel in economies of scale in portfolio control. The principal economies are:

(A) Risk mitigation with the aid of using diversifying portfolios:

(B) Employing green and expert managers.

(C) The control fee of huge loans is low

(D) Low fee of establishment, records and transactions.

3. Incentives to save:

Non-financial institution economic intermediaries play a vital position in selling countrywide financial savings. Savers want treasured garage to preserve their financial savings. These establishments provide a huge variety of economic belongings as a shop of fee and offer savers with expert economic services. As a treasured garage location, economic belongings have sure unique benefits over tangible belongings (bodily capital, stock of goods, etc.). They are less difficult to store, extra fluid, less difficult to cut up and much less risky. In reality, the financial savings-earnings ratio has a fantastic dating to each economic establishments and economic belongings. Financial progress. Induces extra financial savings from the equal degree of actual earnings.

4. Mobilization of financial savings:

Savings mobilization takes place whilst the saver holds the financial savings with inside the shape of currency, financial institution deposits, put up workplace financial savings deposits, lifestyles coverage policies, invoices, bond shares, and so on. NBFI offers a totally green mechanism for mobilizing financial savings. There are kinds of NBFT concerned in saving mobilization.

(A) Deposit intermediaries which include financial savings and mortgage institutions, credit score unions, and mutual financial savings banks. These establishments mobilize small financial savings and offer relatively liquid finances.

(B) Contract intermediaries which include lifestyles coverage businesses, public fund finances, and pension finances. These establishments input into contracts with savers and provide special kinds of blessings over the lengthy term.

5. Investment of finances:

The principal cause of NBFI is to make earnings with the aid of using making an investment mobilized financial savings. To this end, those establishments comply with plenty of funding policies. For example, financial savings and mortgage institutions and mutual financial savings banks put money into mortgages, and coverage businesses put money into bonds and securities.

Q3) Discuss the problems for allocation of Institutional Credit? 5

A3) The main financial considerations that affect the allocation of institutional credit are:

1. Net rate of return

2. Default risk

3. Security (primary and collateral)

4. Margin requirements

5. Credit supply curve

6. Allocation of credits between borrowers.

(I) With default risk

(II) Net rate of return.

Each of these two elements incorporates several other elements. Let's take a brief look at each of the two elements. For simplicity, we use the terms loan and credit interchangeably. If you want, you are free to browse other forms (other than loans) where credits are available. First, and easily dispose of the net rate of return factor. Most of the account of credit allocation as an institutional process is related to the risk factor of default.

1. Net rate of return:

The net rate of return is the interest rate on the loan minus the service costs of the loan. According to the theory received, the loan interest rate is the only credit assigner. This view is very simplistic: in real life, interest rates on institutional loans are controlled prices.

What this rate does is to separate voluntary borrowers from unwilling borrowers at this rate. Those who do not want to borrow at an autonomously given interest rate will be automatically distributed. In this limited sense, interest rates act as a distributor. However, among voluntary borrowers, credit allocation is based on considerations other than interest rates. And it is these considerations or factors that hold the key to the distribution of institutional credit. It is not an interest rate.

Here you can focus on the cost of mortgage services. Services related to the loan business are described below. At this stage, it is sufficient to note that the average cost of a small loan is higher than the average cost of a large loan.

Therefore, if the rate of return is the same, the net interest rate to be repaid from the small loan to the lender is lower than that of the large loan. This in itself discourages financial institution lenders from meeting the borrowing needs of smaller borrowers. There are also reasons heavier than competing with small borrowers.

2. Default risk:

The loan contains two types of promises for the borrower's payment.

(I) With a promise to repay the borrowed amount

(II) A promise to pay interest on a loan, as specified in both the loan agreement and the borrower's promissory note.

Both promises to pay are related to the future. Therefore, there is a risk that one or both payment promises may not be fully fulfilled. This risk is called "default risk" whether the default is related to the loan principal, the loan principal, partial or complete.

In a stable political environment, the risk of default on government debt is usually considered to be zero (or near zero). This is because it has the great power to raise funds by taxing public debt and borrowing more from it. For this reason, government bonds are called gilts, or top quality securities. However, all loans to private sectors (and non-sectoral public sector businesses) carry the risk of default, whether low or high. Therefore, the first concern is for the lender to somehow assess this risk and insure it appropriately and appropriately. The entire concept of borrower creditworthiness is associated with this concern.

Separating the qualified from the ineligible and acceptable borrowing capacity of the qualified borrower is based on this concern. The credit allocation criteria (default risk) derived from this concern are not purely market-determined. In other words, it is not determined by a simple balance of supply and demand forces.

Market power is important, but it is a complex and indirect method. Non-market forces such as contract law, its enforceability in court, legal costs, and time dilation associated with proceedings are of considerable importance. As such, standards may form from one type of financial institution to another, depending on the country and, from time to time, the type of borrower with whom you do business.

3. Security (primary and collateral):

Even sufficient "repayment capacity" experience is sufficient to encourage lenders to lend. This alone does not provide enough handle to collect the loan with interest in the event of an actual default. Therefore, lenders usually insist on proper and specific security for loans. A secured loan is called a secured loan. Loans that are not so secured are called unsecured or clean loans and are generally only available to established prime borrowers in a short period of time with the strength of the promissory note.

Therefore, the basis of securities-oriented credit is the risk of default, which limits the borrower's ability to borrow for the value of the same security directly by claiming it against a valuable tangible security.

There are two types of security itself: primary security and collateral security. Primary collateral is collateral for an asset created or obtained using loan funds and first claimed by the lender through a loan certificate. Collateral security is an additional security that complements the primary security. It may be provided by the Borrower himself or a third party to ensure or guarantee that all terms and conditions of the loan agreement will be respected by the Borrower.

For most personal loans, the above distinction is not very practical, as the lender usually has a firm possession of movables such as ornaments and proper mortgages on the property. However, with durable consumer goods loans, the borrower must be allowed to own and use the consumer, so employment-purchasing finance companies usually claim collateral for the appropriate collateral (from the person by the appropriate means). Even in the form of personal guarantees).

Similarly, a business loan is made to create or acquire a productive business asset, whether it is a factory building, machinery, holdings, or accounts receivable that automatically act as the primary security of the lender. It is considered. However, due to the potential risk of default and the practical difficulty of effectively cracking down on the end use of credit, lenders may also claim collateral as collateral. Does this mean excessive security awareness?

4. Margin requirements:

How much credit can a borrower have for it, given even acceptable security? Banks typically do not prepay the full amount of banking assets such as machinery, commodities, bills receivable, etc., but are provided by the company as collateral, with a particular minimum percentage of the total value of such assets being pledged by the borrower from his or her resources. Insist on lending.

Technically, this minimum percentage is called the "margin requirement" of the loan, and the difference between the value of the security and the margin is the borrower's "withdrawal power" under the "cash credit system" prevailing in India. Of course, up to a predetermined maximum, called the "credit limit".

In the case of new issuance of shares, the margin requirement is met in the form of promoter equity, which is the first investment in such shares made by the issuer / company promoter. For fixed income issues, proper security of existing and new assets is obtained with the help of bond capital created through a trust deed to handle the repayment of interest-bearing loans.

The main role of the margin requirement is to create a borrower's stock in a business funded by a loan. If the lender lends the entire amount of the business assets held by the borrower, the borrower's investment in the business will be zero and the entire risk of the business will be borne by the lender.

5. Credit supply curve:

Having studied the economic considerations and institutional arrangements that arise from lenders' concerns to counter the risk of a borrower's default, we are ready to incorporate these factors into a standard supply and demand analysis.

6. Credit allocation between borrowers:

Here we can extend the analysis in the previous subsection to explain the allocation of credit between borrowers at an autonomously given interest rate. Our previous discussion is that in traditional security-oriented credit supply, the most important factor for lenders is the equity of competing borrowers, who provide the necessary security and dominate the latter's ability to meet margins. Or net worth) a requirement that indicates a position.

Q4) Discuss the problems between the government and the Commercial Sector regarding institutional credit. 8

A4) There are certain problem exist between government policies and commercial sector for allocating institutional credit. Such problems are discussed below-

(A) Allocation of Credit in Government Sector: The government sector institutions are engaged in delivery of public services like public health, water supply, electricity, transportation and communication, roads and connectivity, education, banking services etc. Thus credit should be allocated to such sectors for providing services to residents of the country.

(B) Allocation of credit in Commercial Sector: Following arguments have been given in the favour of the allocation of more and more credit to commercial or private sector:

(1) Attraction of Higher Profit: Private Sector has the attraction of higher profit. There is more skill and proficiency in the private sector due to the expectation of earning more and more profit. Maximum production at minimum cost can be done in the presence of a balance and optimum capital. This not only reduces the cost of production but also makes the better quality product.

(2) Best Utilisation of Resources: There is best utilisation of resources due to the attraction of profit in the private sector. There is the use of resources in the public sector but there is not the best use. The reason is that in the public sector service is given priority as compared to profit,

(3) Technical Progress: It is the age of competition at present, there is a constant need of technical progress in trade and industries to establish oneself in the world market. The change in technique according to time can be in the private sector only. The process of obtaining order regarding any changes is so lengthy in the public sector that it kills the trade opportunity.

(4) Direct Relation between Ability and Reward: There is better use of credit in the private sector. Its reason is that the remuneration is on the basis of merit in the private sector. The people with better eligibility are appointed in management.

(5) Quick Decision: Generally, such opportunity arises in the field of trades that there is the need of taking quick decisions to get proper advantage. Such quick decisions can be in the private sector only.

(6) Less Interference of the Government: There is limited interference of the government in the private sector. That is why there is better progress of this sector with the help of skilled managerial force. The government also gets increased revenue due to increased production and sale. The government uses this revenue in the public interest.

(7) Risk Bearing: The path of business is not a bed of roses. It is full of thorns at each and every step. So, for getting success in trade sector there is the need of having the capacity of taking risk. The tendency of bearing risk is more in the private sector as compared to the public sector.

Q5) State the issues related to Inter-sectorial and Inter- Regional Problems? 5

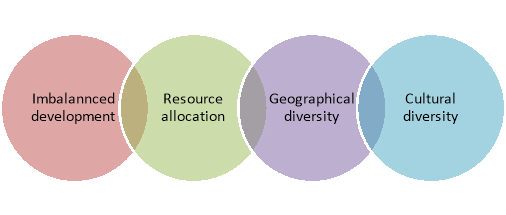

A5) Inter-regional imbalance occurs when there is not an equal development of different status or regions of a country and some regions have high and others have low development, it is called inter-regional imbalance. On the other hand inter-sectorial imbalance occurs when there are many sectors of the economy of any country e.g. Agriculture, trade and business, industries, education, transport etc. When there is imbalance in different sectors within a region only, it is called inter-sectorial imbalance. The issues related to inter-sectorial and inter-regional problems are-

Figure: Inter-sectorial and Inter- Regional Problems

- Imbalanced development

The economy of any country is large in itself. There is not proper development of different regions of the whole country. Some regions are more development and some others are less developed. Similarly all sectors in all regions don’t have equal development. One region may have a good development in agriculture while the other may have such development in the industrial sector. The condition of education may be very good at a place and at the other there may be a good development of transport facilities. It means there is a lack of balance in every region and every sector.

2. Resource allocation:

A major problem arises at the time of allocating the limited amount of credit as to which region and which sector should be given priority. There should be more implementation of rationality as compared to rules. The allocation of credit the most backward region should be given so that the people of that region may come in the main stream.

3. Geographical diversity:

Due to geographical diversity, some regions of the country is still not comes under the preview of developmental policies. A North Eastern region, hilly areas are suffers for infrastructural issues, public health, education etc.

4. Cultural diversity:

The diversity in culture among tribes and non-tribes is another region for such disparity. Some tribes of the region are not accepting the developmental policies because of their ignorance and unawareness.

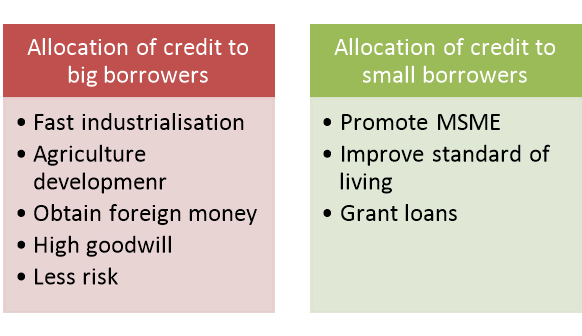

Q6) Discuss the problems between large and small borrowers. 8

A6) There are different arguments in favour of giving priority to big and small borrowers in the allocation of institutional credit. Such issues are discussed below-

Figure: Problem between large and small borrowers

(A) Allocation of Credit to Big Borrowers: Following Arguments can be given in Farmer of granting priority to Big Borrowers in the Allocation of credit:

(1) Fast Industrialisation: The development of industrial sector is essential for the development of economy. Industries have a major contribution in the development of countries like Japan and China. The major borrowers have to be given priority in the credit for the rapid industrialisation of the country because they play an important role in the foundation and development of large scale industries.

(2) Agricultural Development: India is a predominantly agricultural country. Most of its population depends on agriculture. So, large scale farmers have to be given priority in loans for the development of the country, because for a increase in agricultural productivity there is a need of use of scientific implements and technological development. Only large scale farmers can do new experiments in agriculture. Small farmers avoid taking any kind of risk.

(3) Obtaining Foreign Money: The area of big traders is so wide that they export to foreign market also. Due to an increase in export, more amount of foreign money is obtained.

(4) High Goodwill: Big borrowers have higher good will. So, financial institutions take interest in granting loans to them.

(5) Less Risk: There is a negligible risk of non-repayment by big borrowers due to their good reputation. So big borrowers are given priority in the allocation of credit.

(B) Allocation of Credit to Smaller Borrowers: Following arguments can be given in favour of granting priority to smaller borrowers in the allocation of credit:

(1) Mahatma Gandhi had said that it is essential to promote small scale and cottage industries for the development of the country. So, the small borrowers should be given priority in the allocation of credit for promoting small scale and cottage industries.

(2) Small borrowers are generally the people with lower standards of living. An improvement in their standard of living can be brought by giving loans to small borrowers.

(3) Small borrowers are generally scattered in different sectors and regions. By granting loans to them, regional inequalities can be eliminated.

There is generally lack of collateral with small borrowers. Due to it, they are not able to get loan from any other agency. So for the allocation of institutional credit, small borrowers should be given priority.

Q7) Discuss the Operations of conflicting pressure before nationalisation. 8

A7) Before nationalisation of banks, the Indian economy was in the grip of money lenders, indigenous bankers and landlords. Before the nationalisation the conflicting on the operations of banks was as follows:

Figure: Operations of conflicting pressure before nationalisation

(1) Monopoly Tendency: It was expected from banks that their work should be in the interest of the nation and for the public welfare but it could not be so. It was stated in the Monopoly Committee Report, Prof. Mazari’s report on Industrial licensing and the report of Suvilam Dutta Committee that big traders and major bankers are connected with each other through their mutual decision and their collation is harmful for the economy.

(2) Improper Utilisation of Banking Resources: While distributing credit by banks the selection of priority should be done in such a way that it can Toad to a balanced development of the economy. But before nationalisation, the maximum flow of credit was towards the sector of trade and industries due to strong hold of big traders on banks. By the end of March, 1967, the share of banks was about 84 per cent. This is created a situation of imbalance in the economy of the country.

(3) Ignorance of Agriculture Sector: India is pre-dominantly an agricultural country. The majority of its population depends on agriculture. So there cannot be development of the country so long as there is no development of agriculture but the economic condition of Indian farmers is not strong. In this situation, it is expected from banks that they should give sufficient loan to the agricultural sector to strengthen it but before nationalisation the contribution of banks to this sector was next to nothing. For example, credit distributed in the agricultural sector in March 1967 was only 2.1 per cent of total credit.

(4) Ignorance of Social Uplift: It was major problem before the country after independence to bring improvement in the standard of living of the weak and poor people. For the solution of this problem it was expected from financial institutions like banks that it should be a partner in the solution of this national problem. But without caring for it, financial institutions showed interest in providing financial assistance to elite class of the society. Besides, it has also been a charge against banks that they have been using their funds for speculation, hoarding, profiteering etc.

(5) Unbalanced Development: The majority of the population of the country resides in villages but before nationalisation the rural and semi urban areas were neglected and the expansion of branches was done only in cities and metropolies. Consequently, the bigger part of population remained devoid of banking facilities. There was crowding of branches of various banks in some cities. As a result, there was unbalanced development of the economy. So the pressure related to bring change in the policy of banking operation and branch expansion was on the government before the nationalisation.

(6) Managerial Disqualification: Before the nationalisation, the managerial responsibility of bank was mostly in the hands of incapable and inexperienced persons. These managers often had relationships with other companies or institutions. Their main objective was to use banking resources for their own interest even if it violated banking principles. For the lacking of proper training of banking staff they laid stress on experimentation in banking operations. This brought pressure of improvement in job skills on banks.

(7) Insufficient Investment in Government Securities: if the money of the depositors is invested in government securities they often have more faith on banks and they consider their deposit to be safe, but before the nationalisation the investment of banks in government securities decreased continuously. For example: the investment of banks in government securities was 34.5 per cent in 1956 which reduced to be 24.3 per cent in March in 1969. The resources of banks were increasing but the government was not getting sufficient cooperation from banks in fulfilling its programs of economic development. So the banks had the pressure of improving their investment policy.

Q8) Discuss the operations of conflicting pressure after nationalisation. 8

A8) Bank nationalisation improvement in banking system was visible after their nationalisation. There was expansion of branches in rural areas along with the urban areas. Banks were considered very useful with the view of wide ranging improvements in the economy. After this only, 6 more banks were nationalised in the second stage in 1980. The functional pressures rising after the nationalisation of banks are as follows:

Figure: Operations of conflicting pressure after nationalisation

(1) Political Decision: It is said that there had been two sections in the ruling congress party at the time of nationalisation of banks. So, it is supposed that the nationalisation of banks was not an economic decision but a political decision.

(2) Influences of Politicians: It was speculated that the dominance of politicians on the banking system will increase after the nationalisation of banks and consequently the policies of the banks will keep changing according to the whims of ruling party. This will have bad impact on the economy of the country.

(3) Decrease in the Efficiency: It was speculated that banks would develop the feeling of national interest and public betterment but in practice there did not come in the work culture of bank employees. Instead of customer service there was customer harassment and due to it the banking ombudsman had to be appointed. There is pressure of improvement in work culture of bank after the nationalisation.

(4) Loan to Priority Sector: It is a pressure on the banks after nationalisation that it should provide finance to the poor, weak, landless, artisans, small entrepreneurs and marginal farmers timely at subsidize.

(5) Insufficient Fund for Planning: Five Years plans are prepared by the government after every five year for the development of the country. It was expected from the banks after nationalisation that they would provide full cooperation to achieve the objectives of five years plans but such cooperation could not be provided on full scale. It is a pressure of government on banks that they should provide finance to the society according to government schemes.

(6) Regional Inequality: It is true that there has been expansion of branches after the nationalisation but the regional disparities still exists. Inequalities are observed in the distribution of bank branches in various states and population per bank offices in them. Banks have the pressure of eliminating this inequality. Many committees were formed from time to time to suggest the solutions of the pressures related to the improvement in the operations of banks after the nationalisation but these reforms cannot be termed as sufficient. The banks still face the pressure of developing a strong banking system.

Q9) Define the terms development bank and NBFI. 4

A9) Development Bank is a specialised monetary group. They offer medium- to lengthy-time period investment for the commercial and agricultural sectors. They fund each the non-public and public sectors. Development Bank is a multipurpose monetary group. They are engaged in time period lending, securities funding and different activities. They even sell financial savings and funding conduct in public.

A non-banking financial Institutions (NBFI) is financial institutions that do not have a full banking license and cannot accept deposits from the general public. However, NBFI promotes alternative financial services such as investment (both collective and individual), risk pooling, financial consulting, intermediaries, remittances and check cashing. NBFI is a source of consumer credit (along with licensed banks). Examples of non-bank financial institutions include insurance companies, venture capitalists, currency exchange offices, some microloan organizations, and pawn shops. These non-bank financial institutions offer services that are not always suitable for banks, act as a competitor to banks, and are sector or group-specific.

Q10) State the features of development bank. 8

A10) Following are the main characteristic features of a development bank:

- It is a specialised financial institution.

2. It provides medium and long term finance to business units.

3. Unlike commercial banks, it does not accept deposits from the public.

4. It is not just a term-lending institution. It is a multi-purpose financial institution.

5. It is essentially a development-oriented bank. Its primary object is to promote economic development by promoting investment and entrepreneurial activity in a developing economy. It encourages new and small entrepreneurs and seeks balanced regional growth.

6. It provides financial assistance not only to the private sector but also to the public sector undertakings.

7. It aims at promoting the saving and investment habit in the community.

8. It does not compete with the normal channels of finance, i.e., finance already made available by the banks and other conventional financial institutions. Its major role is of a gap-filler, i. e., to fill up the deficiencies of the existing financial facilities.

9. Its motive is to serve public interest rather than to make profits. It works in the general interest of the nation.

Q11) Write a note on development bank. 8

A11) Development Bank is a specialised monetary group. They offer medium- to lengthy-time period investment for the commercial and agricultural sectors. They fund each the non-public and public sectors. Development Bank is a multipurpose monetary group. They are engaged in time period lending, securities funding and different activities. They even sell financial savings and funding conduct in public.

Following are the main characteristic features of a development bank:

- It is a specialised financial institution.

2. It provides medium and long term finance to business units.

3. Unlike commercial banks, it does not accept deposits from the public.

4. It is not just a term-lending institution. It is a multi-purpose financial institution.

5. It is essentially a development-oriented bank. Its primary object is to promote economic development by promoting investment and entrepreneurial activity in a developing economy. It encourages new and small entrepreneurs and seeks balanced regional growth.

6. It provides financial assistance not only to the private sector but also to the public sector undertakings.

7. It aims at promoting the saving and investment habit in the community.

8. It does not compete with the normal channels of finance, i.e., finance already made available by the banks and other conventional financial institutions. Its major role is of a gap-filler, i. e., to fill up the deficiencies of the existing financial facilities.

9. Its motive is to serve public interest rather than to make profits. It works in the general interest of the nation.

Q12) State the functions of development bank. 5

A12) The functions of development bank are-

- Financial Gap Fillers:

Development banks do not provide medium-term and long-term loans only but they help industrial enterprises in many other ways too.

2. Undertake Entrepreneurial Role:

Developing countries lack entrepreneurs who can take up the job of setting up new projects. It may be due to a lack of expertise and managerial ability. Development banks were assigned the job of entrepreneurial gap filling.

3. Commercial Banking Business:

Development banks normally provide medium and long-term funds to industrial enterprises. The working capital needs of the units are met by commercial banks. In developing countries, commercial banks have not been able to take up this job properly. Their traditional approach in dealing with lending proposals and assistance on securities has not helped the industry.

4. Joint Finance:

Another feature of the development bank’s operations is to take up joint financing along with other financial institutions. There may be constraints of financial resources and legal problems (prescribing maximum limits of lending) which may force banks to associate with other institutions for taking up the financing of some projects jointly.

5. Refinance Facility:

Development banks also extend the refinance facility to the lending institutions. In this scheme, there is no direct lending to the enterprise. The lending institutions are provided funds by development banks against loans extended’ to industrial concerns.

Q13) Write a small note on NBFI. 4

A13) A non-banking financial Institutions (NBFI) is financial institutions that do not have a full banking license and cannot accept deposits from the general public. However, NBFI promotes alternative financial services such as investment (both collective and individual), risk pooling, financial consulting, intermediaries, remittances and check cashing. NBFI is a source of consumer credit (along with licensed banks). Examples of non-bank financial institutions include insurance companies, venture capitalists, currency exchange offices, some microloan organizations, and pawn shops. These non-bank financial institutions offer services that are not always suitable for banks, act as a competitor to banks, and are sector or group-specific. A non-bank financial institution (NBFC) is a business establishment that provides financial services and banking facilities without meeting the legal definition of a bank. These are subject to banking regulations set by the Reserve Bank of India and provide banking services such as loans, credit facilities, TFC, retirement planning, investments and stocks in the money market. However, they are restricted from receiving any form of deposit from the general public. These organizations play an important role in the economy, serving in urban and rural areas and primarily providing loans that enable the growth of new ventures.

Q14) Discuss in brief operation of Conflicting pressure before and after bank nationalization in 1969. 10

A14) The bank nationalisation takes place in 1969 and 1980 to expand banks in unbanked areas and also to provide formal institutional credit to the vulnerable section of the society.

Operations of conflicting pressure before nationalisation

Before nationalisation of banks, the Indian economy was in the grip of money lenders, indigenous bankers and landlords. Before the nationalisation the conflicting on the operations of banks was as follows:

Figure: Operations of conflicting pressure before nationalisation

(1) Monopoly Tendency: It was expected from banks that their work should be in the interest of the nation and for the public welfare but it could not be so. It was stated in the Monopoly Committee Report, Prof. Mazari’s report on Industrial licensing and the report of Suvilam Dutta Committee that big traders and major bankers are connected with each other through their mutual decision and their collation is harmful for the economy.

(2) Improper Utilisation of Banking Resources: While distributing credit by banks the selection of priority should be done in such a way that it can Toad to a balanced development of the economy. But before nationalisation, the maximum flow of credit was towards the sector of trade and industries due to strong hold of big traders on banks. By the end of March, 1967, the share of banks was about 84 per cent. This is created a situation of imbalance in the economy of the country.

(3) Ignorance of Agriculture Sector: India is pre-dominantly an agricultural country. The majority of its population depends on agriculture. So there cannot be development of the country so long as there is no development of agriculture but the economic condition of Indian farmers is not strong. In this situation, it is expected from banks that they should give sufficient loan to the agricultural sector to strengthen it but before nationalisation the contribution of banks to this sector was next to nothing. For example, credit distributed in the agricultural sector in March 1967 was only 2.1 per cent of total credit.

(4) Ignorance of Social Uplift: It was major problem before the country after independence to bring improvement in the standard of living of the weak and poor people. For the solution of this problem it was expected from financial institutions like banks that it should be a partner in the solution of this national problem. But without caring for it, financial institutions showed interest in providing financial assistance to elite class of the society. Besides, it has also been a charge against banks that they have been using their funds for speculation, hoarding, profiteering etc.

(5) Unbalanced Development: The majority of the population of the country resides in villages but before nationalisation the rural and semi urban areas were neglected and the expansion of branches was done only in cities and metropolies. Consequently, the bigger part of population remained devoid of banking facilities. There was crowding of branches of various banks in some cities. As a result, there was unbalanced development of the economy. So the pressure related to bring change in the policy of banking operation and branch expansion was on the government before the nationalisation.

(6) Managerial Disqualification: Before the nationalisation, the managerial responsibility of bank was mostly in the hands of incapable and inexperienced persons. These managers often had relationships with other companies or institutions. Their main objective was to use banking resources for their own interest even if it violated banking principles. For the lacking of proper training of banking staff they laid stress on experimentation in banking operations. This brought pressure of improvement in job skills on banks.

(7) Insufficient Investment in Government Securities: if the money of the depositors is invested in government securities they often have more faith on banks and they consider their deposit to be safe, but before the nationalisation the investment of banks in government securities decreased continuously. For example: the investment of banks in government securities was 34.5 per cent in 1956 which reduced to be 24.3 per cent in March in 1969. The resources of banks were increasing but the government was not getting sufficient cooperation from banks in fulfilling its programs of economic development. So the banks had the pressure of improving their investment policy.

Operations of conflicting pressure after nationalisation

Bank nationalisation improvement in banking system was visible after their nationalisation. There was expansion of branches in rural areas along with the urban areas. Banks were considered very useful with the view of wide ranging improvements in the economy. After this only, 6 more banks were nationalised in the second stage in 1980. The functional pressures rising after the nationalisation of banks are as follows:

Figure: Operations of conflicting pressure after nationalisation

(1) Political Decision: It is said that there had been two sections in the ruling congress party at the time of nationalisation of banks. So, it is supposed that the nationalisation of banks was not an economic decision but a political decision.

(2) Influences of Politicians: It was speculated that the dominance of politicians on the banking system will increase after the nationalisation of banks and consequently the policies of the banks will keep changing according to the whims of ruling party. This will have bad impact on the economy of the country.

(3) Decrease in the Efficiency: It was speculated that banks would develop the feeling of national interest and public betterment but in practice there did not come in the work culture of bank employees. Instead of customer service there was customer harassment and due to it the banking ombudsman had to be appointed. There is pressure of improvement in work culture of bank after the nationalisation.

(4) Loan to Priority Sector: It is a pressure on the banks after nationalisation that it should provide finance to the poor, weak, landless, artisans, small entrepreneurs and marginal farmers timely at subsidize.

(5) Insufficient Fund for Planning: Five Years plans are prepared by the government after every five year for the development of the country. It was expected from the banks after nationalisation that they would provide full cooperation to achieve the objectives of five years plans but such cooperation could not be provided on full scale. It is a pressure of government on banks that they should provide finance to the society according to government schemes.

(6) Regional Inequality: It is true that there has been expansion of branches after the nationalisation but the regional disparities still exists. Inequalities are observed in the distribution of bank branches in various states and population per bank offices in them. Banks have the pressure of eliminating this inequality. Many committees were formed from time to time to suggest the solutions of the pressures related to the improvement in the operations of banks after the nationalisation but these reforms cannot be termed as sufficient. The banks still face the pressure of developing a strong banking system.

Q15) What is economic foundation of NBFI. 4

A15) The coping with of finances with the aid of using economic intermediaries is extra reasonably priced and green than that with the aid of using person asset proprietors because of the reality that economic intermediaries are primarily based totally on.

(A) The regulation of huge numbers, and

(B) Economies of scale in portfolio control.

(i) Law of huge numbers:

Financial intermediaries function at the regulation of huge numbers. According to this regulation, now no longer all lenders withdraw finances from those establishments. In addition, if a few lenders are retreating coins, a few different lenders can be depositing coins. Again, economic intermediaries pay hobby at the loans and investments they make on a normal foundation. All of those elements permit economic intermediaries to preserve handiest a small part of the finances furnished with the aid of using lenders in coins and lend or make investments the rest.

(ii) Economies of scale:

The huge length of the asset portfolio permits economic intermediaries to revel in economies of scale in portfolio control. The principal economies are:

(A) Risk mitigation with the aid of using diversifying portfolios:

(B) Employing green and expert managers.

(C) The control fee of huge loans is low

(D) Low fee of establishment, records and transactions.

Q16) What problems are associated with credit to the small scale borrowers? 3

A16) Following arguments can be given in favour of granting priority to smaller borrowers in the allocation of credit:

(1) Mahatma Gandhi had said that it is essential to promote small scale and cottage industries for the development of the country. So, the small borrowers should be given priority in the allocation of credit for promoting small scale and cottage industries.

(2) Small borrowers are generally the people with lower standards of living. An improvement in their standard of living can be brought by giving loans to small borrowers.

(3) Small borrowers are generally scattered in different sectors and regions. By granting loans to them, regional inequalities can be eliminated.

There is generally lack of collateral with small borrowers. Due to it, they are not able to get loan from any other agency. So for the allocation of institutional credit, small borrowers should be given priority.

Q17) What problems are associated with credit to the large scale borrowers? 5

A17) Following Arguments can be given in Farmer of granting priority to Big Borrowers in the Allocation of credit:

(1) Fast Industrialisation: The development of industrial sector is essential for the development of economy. Industries have a major contribution in the development of countries like Japan and China. The major borrowers have to be given priority in the credit for the rapid industrialisation of the country because they play an important role in the foundation and development of large scale industries.

(2) Agricultural Development: India is a predominantly agricultural country. Most of its population depends on agriculture. So, large scale farmers have to be given priority in loans for the development of the country, because for a increase in agricultural productivity there is a need of use of scientific implements and technological development. Only large scale farmers can do new experiments in agriculture. Small farmers avoid taking any kind of risk.

(3) Obtaining Foreign Money: The area of big traders is so wide that they export to foreign market also. Due to an increase in export, more amount of foreign money is obtained.

(4) High Goodwill: Big borrowers have higher good will. So, financial institutions take interest in granting loans to them.

(5) Less Risk: There is a negligible risk of non-repayment by big borrowers due to their good reputation. So big borrowers are given priority in the allocation of credit.

Q18) Write a brief note on development bank. 5

A18) Development Bank is a specialised monetary group. They offer medium- to lengthy-time period investment for the commercial and agricultural sectors. They fund each the non-public and public sectors. Development Bank is a multipurpose monetary group. They are engaged in time period lending, securities funding and different activities. They even sell financial savings and funding conduct in public.

Following are the main characteristic features of a development bank:

- It is a specialised financial institution.

2. It provides medium and long term finance to business units.

3. Unlike commercial banks, it does not accept deposits from the public.

4. It is not just a term-lending institution. It is a multi-purpose financial institution.

5. It is essentially a development-oriented bank. Its primary object is to promote economic development by promoting investment and entrepreneurial activity in a developing economy. It encourages new and small entrepreneurs and seeks balanced regional growth.

6. It provides financial assistance not only to the private sector but also to the public sector undertakings.

7. It aims at promoting the saving and investment habit in the community.

8. It does not compete with the normal channels of finance, i.e., finance already made available by the banks and other conventional financial institutions. Its major role is of a gap-filler, i. e., to fill up the deficiencies of the existing financial facilities.

9. Its motive is to serve public interest rather than to make profits. It works in the general interest of the nation.

Q19) State the features of NBFI. 4

A19) The features of NBFI are-

- It is non-banking in nature.

- It is heterogeneous in nature.

- It does not accept demand deposit.

- It encourages savings and investment in the economy.

Q20) NBFCs are doing functions similar to banks. What is difference between banks & NBFCs? 3

A20) NBFCs lend and make investments and hence their activities are akin to that of banks; however there are a few differences as given below:

i. NBFC cannot accept demand deposits;

Ii. NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself;

Iii. Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of banks.